The impact of green finance on green economy development efficiency: based on panel data of 30 provinces in China

- 1State Grid Shandong Electric Power Research Institute, Jinan, China

- 2State Grid Shandong Electric Power Company, Jinan, Shandong, China

- 3Sino-Danish College, University of Chinese Academy of Sciences, Beijing, China

- 4Research Center on Fictitious Economy and Data Science, Chinese Academy of Science, Beijing, China

Within the framework of China’s socioeconomic transition from a phase of rapid growth to one of high-quality development, it becomes crucial to focus on advancing the green economy to sustain economic progress. Green finance plays a pivotal role in underpinning green industries and fostering the progression of a green economy. Under the auspices of green finance, social capital is increasingly directed towards industries that prioritize energy efficiency, low carbon emissions, and environmental friendliness, thereby spurring technological innovation and industrial metamorphosis in businesses. In this paper, data envelopment approach (DEA) is used to measure the green economic development efficiency of 30 Chinese provinces from 2008 to 2018 in general and by sub-region. The two-way fixed-effects model (Two-way FE) and difference-in-difference (DID) model are established to empirically analyze the effect of green finance on green economy development efficiency and the influence of green polices on these two, with sub-region models examining the heterogeneity of this impact in eastern, western and central regions. The findings suggest that green finance significantly enhances a positive influence on green economic development efficiency, albeit with regional variations. Furthermore, the implementation of green policies facilitates green finance and green economic development.

1 Introduction

Amid escalating impacts of climate change, there is heightened attention to climate change, sustainable development, and green economic development (Lazaro et al., 2023). In response to climate change, the global community aspires to stabilize greenhouse gas concentrations at safe and stable levels collaboratively (Wang et al., 2022). Being the world’s largest carbon emitter, China is at the crossroads of embracing the dual imperative of a low-carbon transition and green growth (Lu et al., 2023). Historically, China’s rapid economic ascent was fueled by a growth model that, while economically advantageous, led to profound environmental degradation, resource depletion, and surges in greenhouse gas emissions such as carbon dioxide (Qin et al., 2021). Confronting this, China has pledged to diminish carbon emissions and combat climate change. The concept of green development, advocating for a balanced coexistence between humanity, society, and the natural world, was first distinctly articulated during the 18th Session of the Fifth Central Committee Meeting. In a landmark announcement at the UN General Assembly in September 2020, China vowed to reach carbon emission peak by 2030 and strive for carbon neutrality by 2060. This commitment was further cemented in March 2021, when the Two Sessions governmental report set forth a low-carbon goal to curtail energy consumption per GDP unit by approximately 3% in 2021, underscoring the national strategy towards a green, low-carbon circular economy. Nonetheless, post-COVID-19 economic revival and supply chain reconstruction present formidable obstacles in progressing towards carbon peak and neutrality. Balancing the curtailment of high-energy-consuming industries with the cultivation of lower-energy sectors, such as services, digital, and high-tech industries, is imperative for industrial upgrading and energy restructuring, representing a novel challenge in China’s environmental policy landscape.

Despite its rapid economic advancement, China is tasked with enhancing resource efficiency and mitigating environmental pollution to realize high-quality green economic growth. As a key indicator to measure the quality of green economy development in different regions, the green economy development efficiency can play its role as a “green yardstick,” which can help the whole country and different regions make sustainable economic structural adjustments. Sustainable economic development is considered as an important prerequisite for the stable and sustainable development of the financial market, and the in-depth development of green finance is an important policy route to promote sustainable economic and social development in China in return. However, to achieve carbon peaking and carbon neutrality, substantial financial investments in energy, energy storage, and end-use electrification are needed at this important stage in the development of the renewable energy sector and sustainable industry (Zhang, 2022). Government subsidies alone are inadequate to bridge the financial chasm necessary for green economic expansion. Thus, the infusion of social capital and market-oriented mechanisms is crucial (Wei and Wu, 2023). A robust and developed capital market benefits corporations by facilitating access to cost-effective financing, garnering long-term investments for green technological innovations, diminishing informational asymmetries in fund allocation, and channeling capital into sustainable development ventures, all of which are instrumental for economic decarbonization (Anton and Afloarei Nucu, 2020; Shahbaz et al., 2021). Green finance plays a dual role in promoting the technological innovation of enterprises’ green transformation through financial support and restricting financing for highly polluting enterprises to encourage emission reduction and green transformation. Consequently, it significantly contributes to reducing pollutant emissions by companies, fostering industry-wide green transformation, and propelling decarbonization in economic development (Xie and Zhang, 2021). By embedding the principle of sustainability in investment decisions, enterprises acknowledge potential environmental hazards. This shared responsibility between the government and businesses catalyzes green economy advancement at both the macro-regional and micro-enterprise levels, culminating in the socialization and marketization of environmental conservation.

The development of green finance in China began later than in many economies, characterized by a dearth of green financial instruments and a nascent market mechanism. Research on green finance in China predominantly bifurcates into two streams. The first stream conducts macro-level qualitative analyses, defining and measuring green finance, assessing its developmental status and challenges, and delineating paths tailored to China’s unique conditions. The second examines the interactions between green finance, economic growth, industrial configuration, and environmental integrity. Yet, empirical inquiries into how green finance influences green economic development efficiency are sparse. The economic development of some provinces in China still suffers from a low conversion rate of input capital, high pollution, and high consumption. The technological innovation capacity of the economy is weak, and the conversion power is low in some regions of China. Bolstering green economic growth efficiency, maximizing resource use, and environmental stewardship are thus imperative. Moreover, the potential for green enterprises to secure augmented financial backing holds substantial promise for boosting corporate innovation, refining China’s economic structure, and elevating its global competitiveness. Moreover, the potential for green enterprises to secure augmented financial backing holds substantial promise for boosting corporate innovation, refining China’s economic structure, and elevating its global competitiveness.

This study augments the existing literature in several ways. Firstly, it addresses the research gap concerning the dynamic interplay among green finance, green economic development efficiency, and policy at China’s provincial and sub-regional tiers. Secondly, this study goes beyond a broad national analysis and conducts further sub-sample tests to investigate potential differences in the impact effects of these variables across the eastern, central, and western regions of China. This regional granularity enriches the analysis. Thirdly, this paper innovatively integrates green finance and economic policy variables to explore the effect of the intensive introduction of relevant policies in 2016 on the green industry and green economy. This approach adds a valuable dimension to the understanding of the specific mechanisms through which policy interventions can influence the development and growth of green sectors.

The rest of the paper is organized as follows. Section 2 consists of literature review. Section 3 introduces the theoretical framework and hypotheses to be tested. Section 4 displays the empirical strategy exploited by this paper and how the data was obtained. Section 5 presents the empirical results and explores the relationship between green finance and green economy development efficiency, followed by the research on regional heterogeneity and the impact of green policies. Section 6 concludes with discussions on implications for policy.

2 Literature review

2.1 Green finance, green economy, and economic growth

Green finance is defined as a financial activity that prefers green enterprises and projects, aiming to direct capital to green industries and carry out financial innovation to promote sustainable economic and financial development (Cowan, 1998). The world’s first eco-green bank was officially incorporated in 1988 in Frankfurt, Germany, with the propose of providing financial support for the development of ecological protection-related work. Under the blueprint of global sustainable development, sustainable finance has become an important issue in the financial development practices of various countries (Barbier, 2011). The development of green finance is significant in promoting technological advancement, environmental protection and economic development (Zhang and Mei, 2022a). Pearce and Turner (1989) are the first to propose the basic concept of a green economy, i.e., an economy that is sustainable between the ecological environment and society, rather than a crude green economy with unsustainable use of resources and severe environmental damage as the cost.

The interaction mechanism between green finance and social economic growth and transformation has been studied by scholars. Green finance can have an impact on social economic development and upgrading. Shaw (1973) analyzes the impact of financial deepening on economic growth and suggests that there is a virtuous two-way promotion cycle between the two. Cilliers et al. (2010) suggest that green credit instruments can provide quantitative tools and support for high-quality urban planning, environmental value enhancement, and sustainable economic development. Menegaki (2011) holds the neutrality hypothesis on the causal relationship between economic and sustainable energy based on evidence from random effect models in 27 European countries from 1997 to 2007. Green finance, by promoting economic growth, technological advancements, and energy transition, facilitates the reduction of carbon intensity of the economy (Lee et al., 2023).

2.2 Green finance, green policy, and green economy development

Green finance provides a boost to sustainable economic development through capital markets. Green finance contributes to green economic development through multiple channels. He et al. (2019) establishes threshold effects models to investigate the effect of renewable energy investment on green economy in China, and acknowledges green credit’s role as threshold variable. Cigu (2020) concludes that green finance could contribute to balance between environment protection and economic growth utilizing public policies. Lee (2020) investigates the promoting effect of green finance on sustainable economy in China. In their study, Zhang and Mei (2022b) establish panel and SDM models to investigate the levels of green finance and industrial pollution across 30 provinces in China. The results show that green finance has a restraining effect and a negative direct effect on industrial pollution. Similarly, Zhang et al. (2022) construct a panel quantile model to explore the relationship between green finance, digital finance, and environmental protection among the G-20 economies. The findings indicate that green finance contributes to emission reduction. Furthermore, Alharbi et al. (2023) analyze a large sample panel model encompassing 44 countries. They focus on the role of green finance, represented by green bonds, in promoting the development of renewable energy. The results demonstrate a significant and positive impact of green finance on renewable energy development, both in the short and long term.

The implementation of green policies has a stimulating effect on the development of green economy. The effect of policy implementation on green economy has been researched theoretically and empirically. Campiglio (2016) recognizes the monetary policies’ positive influence on the low-carbon industries, which might generate more financial support to these green industries through credit creation, and this method would apply well in emerging countries. There exists evidence that sustainable energy production might be correlated with monetary policies according to the empirical evidence in Iran from 1984 to 2016 (Razmi et al., 2021). Wang et al. (2021) indicates that the green finance reform policies facilitate the regional level of green development by industrial structure optimization and technological innovation. Muganyi et al. (2021) utilize text analysis and panel data from 290 cities to construct a Semi-parametric Difference-in-Differences (SDID) model. The study emphasizes the crucial significance of green finance policies in reducing industrial pollution. Li et al. (2022) find that besides green finance, other green policies such as environmental taxes also have a significant promoting effect on renewable energy investment. Additionally, the level of green regulation demonstrates a moderating effect on the relationship between green finance and renewable energy investment. Green finance, along with green financial policies including environmental regulation, green subsidies, and carbon taxes, plays a vital role in driving the decarbonization pathway of economies (Lee et al., 2023).

The existing literature focuses more on the concept, development necessity, and quantitative measurement of green economy and green finance. However, there is less literature that considers the interrelationships between green finance, the efficiency of green economic development, and green policies particularly at China’s provincial and sub-regional tiers. This study makes several contributions to the existing literature. Firstly, while the current literature primarily focuses on the conceptualization, development necessity, and quantitative measurement of green economy and green finance, there is a scarcity of research that examines the interrelationships between green finance, the efficiency of green economic development, and green policies at the provincial and sub-regional levels in China. Therefore, this paper fills this gap by integrating these dimensions and analyzing their interactions. Secondly, this study goes beyond a broad national analysis and conducts further sub-sample tests to investigate potential differences in the impact effects of these variables across the eastern, central, and western regions of China. By considering the specific regional conditions, the study provides a more nuanced perspective on the subject matter. Furthermore, we innovatively integrate green finance with economic policy variables to scrutinize the effects of policy intensification since 2016 on the green sector. This approach sheds light on the precise mechanisms by which policy can steer green industry growth, enriching the discourse on policy-driven economic development.

Consequently, this study synthesizes the interplay among green finance, economic growth, and green economic development. It empirically examines regional disparities in these effects across China’s eastern, central, and western regions, contextualized by actual regional conditions. Moreover, this study innovatively incorporates green finance and economic policy variables, investigating the impacts of the comprehensive policy initiatives enacted in 2016 on the green industry and economy.

3 Theoretical framework and hypotheses

3.1 Green finance and green economy development efficiency

Green finance can provide financial support and guidance for the development of green economy. With the continuous improvement of green financial system, the object of financial support not only covers the clean enterprises at the end of pollution discharge such as sewage treatment and solid waste treatment, but also includes clean energy enterprises, high-tech pollution control equipment producers and other industries, which effectively relieves the problem of environmental pollution from all aspects. The green finance system aims to channel idle social capital and change their investment target from high-pollution industries to low-carbon industries, which could effectively reduce the financing costs and pressure of green enterprises.

Green finance can provide funding for green technology innovation and increase the incentive for green enterprises to develop green technologies. It helps enterprises to establish a complete and mature green technology innovation system. Technology innovation needed to reduce environmental pollution, with an economic slowdown (Song and Wang, 2018). Yin et al. (2015) show a CO2 emission Knznets curve in China and find that technological progress relieves environmental pollution. The technology spillover effect generated by green innovation can bring positive externalities to the economy and promote the green development of the market.

Green finance can promote the development of green economy by promoting the optimization of industrial structure. Industrial structure upgrading is one of the accelerants of green economic development (Zhu et al., 2019). Green finance effectively supports the rapid growth of green industries in low-consumption, low-pollution countries through a variety of direct and indirect financing methods. It helps the development of ecological service industries with low resource consumption, low pollution and high employment capacity. At the same time, the government increases the financing cost of heavy industries by regulating the industries with high pollution and energy consumption. It also imposes certain pollution cost penalties to promote the green transformation of polluting industries. The proportion of green industries such as environmental protection in China will be further increased, and the optimization of industrial structure and green transformation will be gradually realized.

Based on the above analysis, the following hypothesis is formulated.

H1. Green finance contributes positively to green economic development efficiency.

3.2 Heterogeneity in eastern, central, and western regions

Since the actual situation of economic development level and financial market prosperity in China is regionally different, the effect of green finance may be different in different regions. Examining the regional differences will help the government to formulate reasonable green economic and financial policies for different regions.

Based on the above analysis, the following hypothesis is formulated.

H2. The positive contribution of green finance to green economic development efficiency differs in the east, central and west regions.

3.3 Impact of green policy implementation

In September 2015, China’s first top-level design plan to build a “green financial system strategy” was released by the State Council, which elevated the strategic layout of green finance to the national level. 2016 is the opening year for China to accelerate the development of modern green industries and green development economy. In the context of the development and transformation of China’s green economy, a series of green policies were introduced and implemented one after another: In March 2016, the 13th Five-Year Plan proposed the establishment of a green financial system. In August of the same year, the “Guidance on Building a Green Financial System” was signed and issued by seven ministries and commissions, becoming the world’s first basic theoretical framework for green financial policies led by government departments. Subsequently, supporting policies on financial, fiscal, economic and environmental protection reforms were issued one after another to jointly achieve the strategic goal of promoting the internalization of environmental externalities.

Based on the above analysis, the following hypothesis is formulated.

H3. The introduction of a series of green policies in 2016 had a positive impact on the level of green finance and green economic development efficiency.

4 Empirical strategy and data

4.1 Empirical strategy

4.1.1 Data envelopment analysis

This paper uses the data envelopment analysis (DEA) to measure the efficiency of green economic development. Farrell (1957) first proposed the measurement of enterprise productivity. Charnes et al. (1978) proposed a DEA model with constant returns to scale (CRS). The variable scale DEA model (VRS) can be used to calculate the technical efficiency of each decision-making unit (Banker et al., 1984). DEA was widely used to measure the operational efficiency of U.S. banks between 1987 and 1992. The DEA method is suitable for complex systems with multiple inputs and outputs and does not require prior determination of the weights of each indicator. An input-based variable scale DEA model is used to measure the efficiency of green economic development in each province and city. The method is as follows.

where

4.1.2 Panel model

In this paper, a two-way fixed effects model is established to study the relationship between green finance and green economic development efficiency, while five factor indices, namely economic growth, foreign investment, science and technology innovation, industrial structure and urban development level, are selected as the control variables. The model can be expressed as follows.

Where

4.1.3 Difference-in difference method

To investigate the impact of green policies on the efficiency of green finance and green economic development, a Differences-in-Differences model is developed in this paper. Ashenfelter and Card (1985) first introduced the “difference-in-difference” method to estimate the effectiveness of training programs. Athey and Imbens (2006) notes that the Differences-in-Differences model can be used to detect the impact of policy implementation. The expression of the benchmark DID model is as follows.

Where

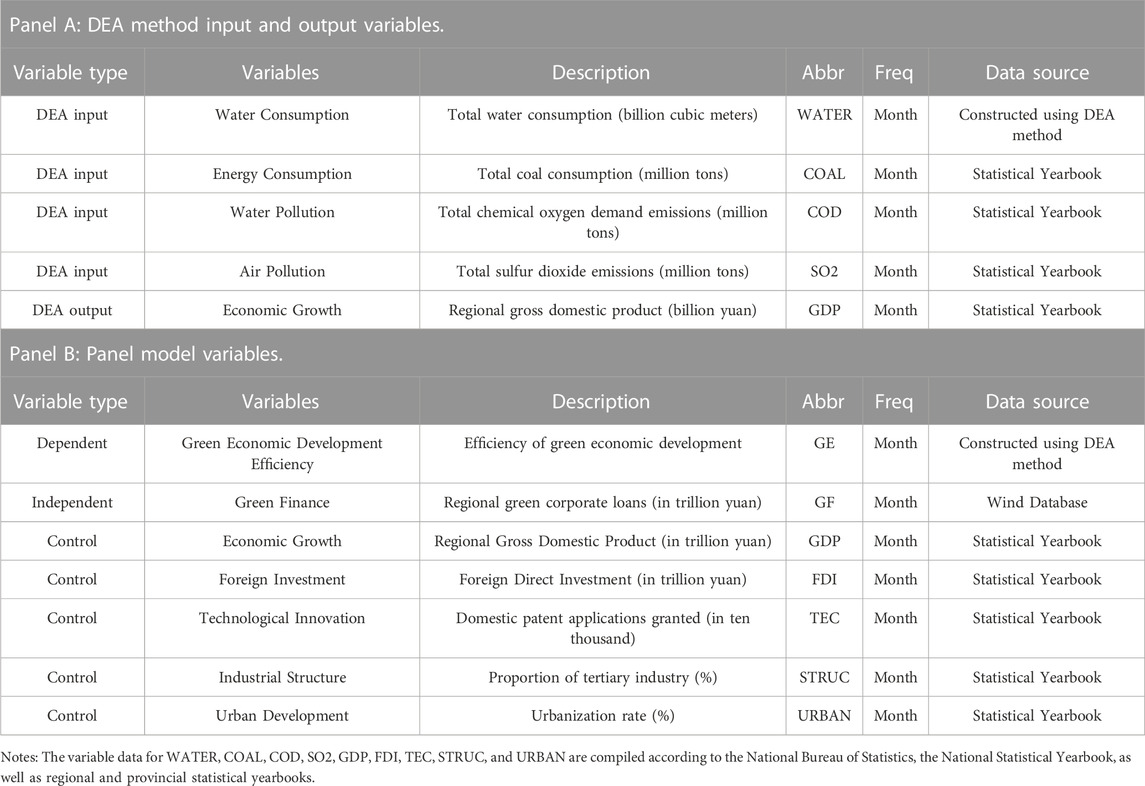

4.2 Data

This paper exploits the monthly panel data of 30 provinces in China (excluding Hong Kong, Macao, Taiwan, and Tibet) from 2008–2018 to deeply analyze the impact of green finance on the development of China’s green economy from the overall and sub-regional perspectives. The sample period covers the year 2016 when a series of green finance, green regulation, and green economy development policies were introduced on a large scale in China. During this sample period, China’s green finance and green level have developed rapidly. The sample period is long enough for panel modeling. Table 1 shows the description of the variables. In the assessment of green finance levels, there is a scarcity of comprehensive data concerning the provincial level, which has been officially published by statistical agencies or business organizations in China. Therefore, according to the Green Industry Guidelines Catalogue (2019 edition), we select representative listed green enterprises, and the total credit of these enterprises is summed up by province and year, which could be regarded as a proxy variable for the level of green finance in each province. In order to adjust for the bias caused by less public data of late-listed enterprises, after excluding the sample of enterprises listed after 2011, a valid sample of 459 enterprises is obtained. The sample of green enterprises can be divided into four categories: energy saving and environmental protection, ecological environment, clean energy, and new energy vehicles.

For the measurement of the level of development of the green economy, total water consumption (billion cubic meters), coal consumption (million tons), chemical oxygen demand emissions (million tons), and sulfur dioxide emissions (million tons) are selected as input variables and regional gross domestic product (billion yuan) as output quantity in the data envelopment analysis. Natural resource consumption and environmental pollutant emissions are considered comprehensively to measure the efficiency of green economy development in each province. In terms of resource consumption, this study focuses on water resource consumption and energy consumption as the primary indicators of resource depletion. Total water usage is selected as an indicator of water resource consumption, while coal consumption is chosen as a proxy variable for energy consumption. Coal production and consumption continue to have a significant weight in China’s energy development and consumption structure. In 2022, coal consumption accounted for 56.2% of the total primary energy consumption, indicating a continued reliance on coal for energy needs. Therefore, this study considers changes in coal consumption as a proxy variable for energy consumption. Additionally, this study considers two main pollution control indicators: chemical oxygen demand (COD) and sulfur dioxide (SO2) emissions, representing the levels of water and air pollution, respectively. COD is a crucial indicator of water pollution in China, reflecting the decrease in organic dissolved oxygen and the increase in inorganic substance content, leading to oxygen depletion or death of aquatic microorganisms. Sulfur dioxide is a primary contributor to air pollution issues such as acid rain and smog, accounting for 10% to 20% of suspended particulate matter. Furthermore, this study includes five index factors, namely economic growth, foreign direct investment, technological innovation, industrial structure, and urban development level, as the main control variables. To measure these factors, indicators such as regional GDP (in trillion yuan), total fixed asset investment by the entire society (in hundred million yuan), foreign direct investment (in trillion yuan), domestic invention patent applications and grants (in ten thousand items), the proportion of the tertiary industry (%), and urbanization rate (%) are comprehensively selected as proxy variables.

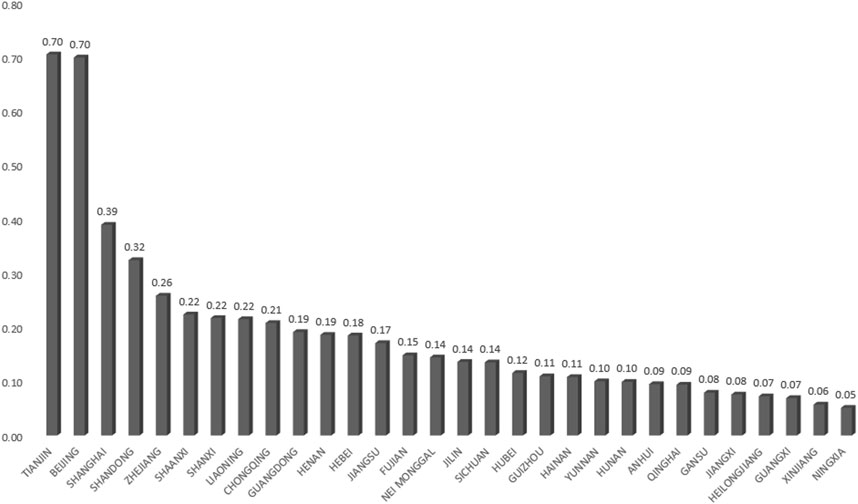

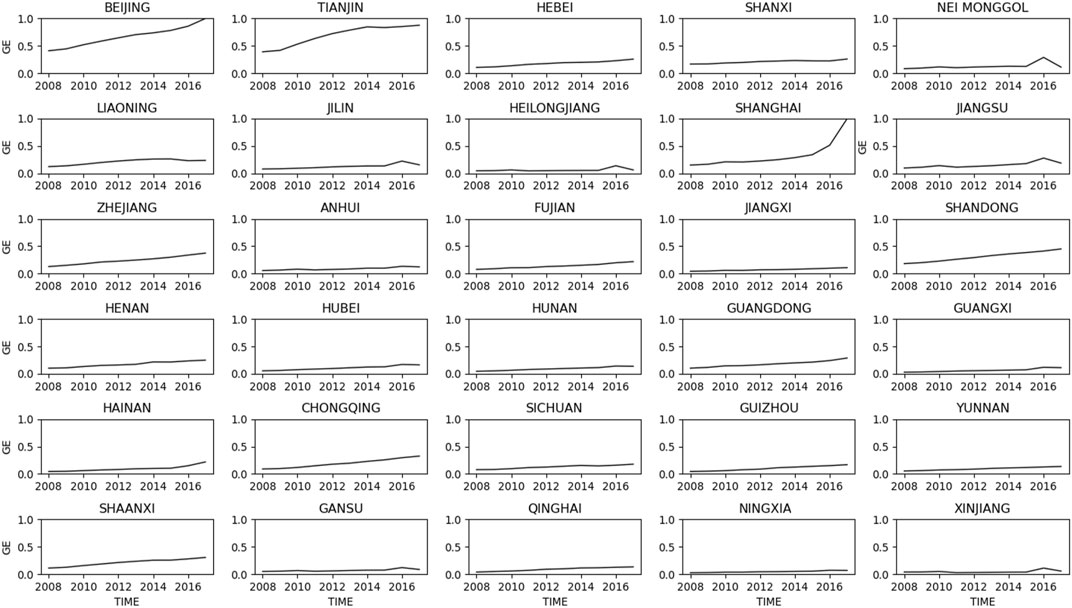

Figure 1 depicts the average level of green development efficiency across provinces from 2008 to 2018. As illustrated in Figure 1, there are regional disparities among the provinces and municipalities. Tianjin, Beijing, and Shanghai exhibited higher average levels of green economic development efficiency compared to other regions, ranking as the top three provinces and municipalities with values of 0.70, 0.70, and 0.39, respectively. Conversely, Guangxi, Xinjiang, and Ningxia demonstrated relatively lower average levels, with values of 0.07, 0.06, and 0.05, respectively. The trend of green economic development efficiency over the period 2008–2018 is presented in Figure 2. It can be observed from Figure 2 that the levels of green economic development efficiency have consistently improved year by year, reflecting the positive trend of green development in China.

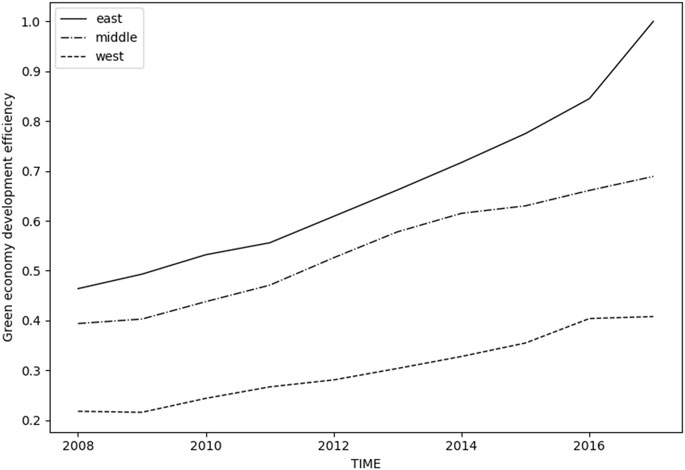

Figure 3 illustrates the regional variations in green economic development efficiency. As depicted in the figure, overall, the provinces experienced an upward trend in green economic development efficiency from 2008 to 2018. Additionally, significant disparities in green economic development efficiency can be observed among the eastern, central, and western regions, with the eastern region having higher efficiency than the central region, which, in turn, is higher than the western region.

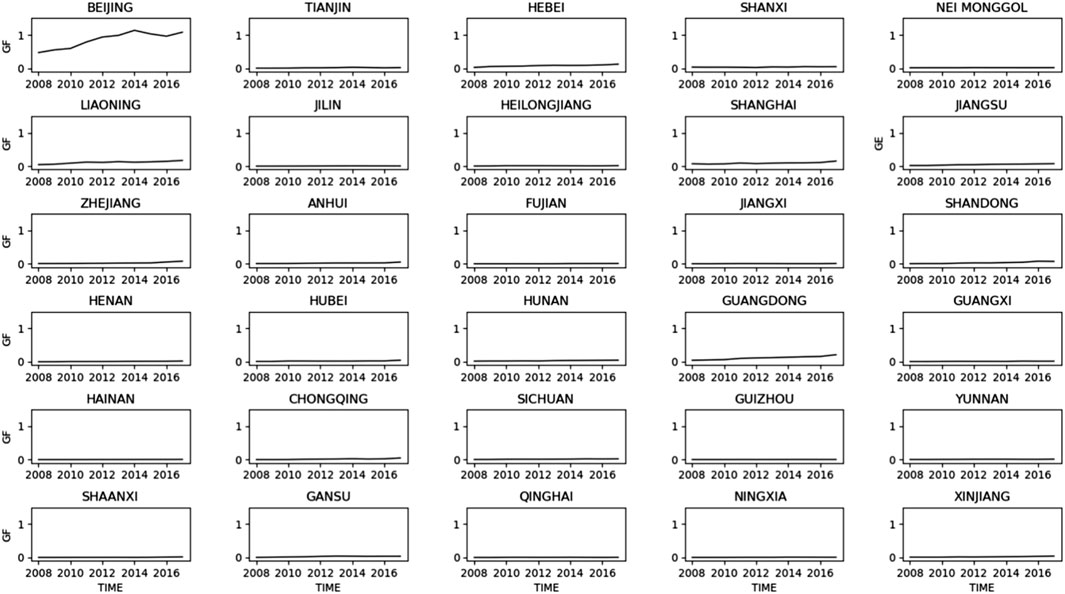

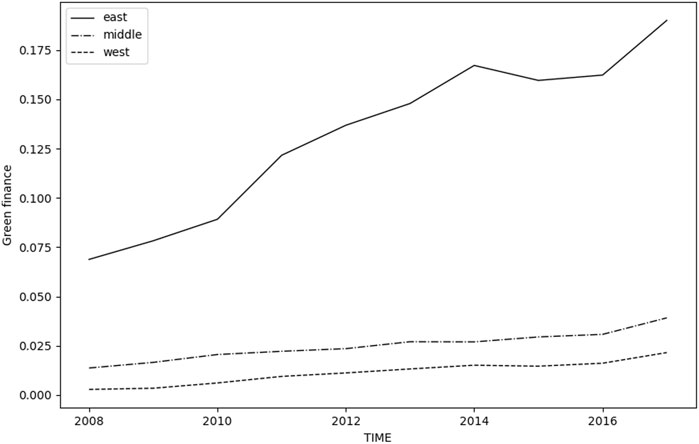

Figures 4, 5, respectively demonstrate the changing trends in green finance levels from 2008 to 2018 at the provincial and regional (eastern, central, and western) levels. As indicated by Figure 4, Beijing exhibited significantly higher levels of green finance compared to other provinces and municipalities. Most regions displayed relatively stable fluctuations in green finance levels over the years, with some provinces, such as Jiangsu, Zhejiang, Anhui, and Guangdong, showing an upward trend after 2015. Figure 5 shows that the eastern region had significantly higher levels of green finance compared to the central and western regions, while the central region slightly surpassed the western region. This pattern aligns with the distribution of green economic development.

To summarize, the final sample includes provincial data on the level of green finance in 30 provinces calculated from the credit data of 459 A-share listed enterprises, the efficiency of green economic development, and other economic indicators1. Table 1 shows the descriptive statistics of the main variables of this article. There are some differences between different provinces, which are related to the economic level, financial market prosperity, and green awareness in different provinces. In terms of green economic development efficiency and the level of green finance, the eastern region performs best, followed by the central region and finally the western region.

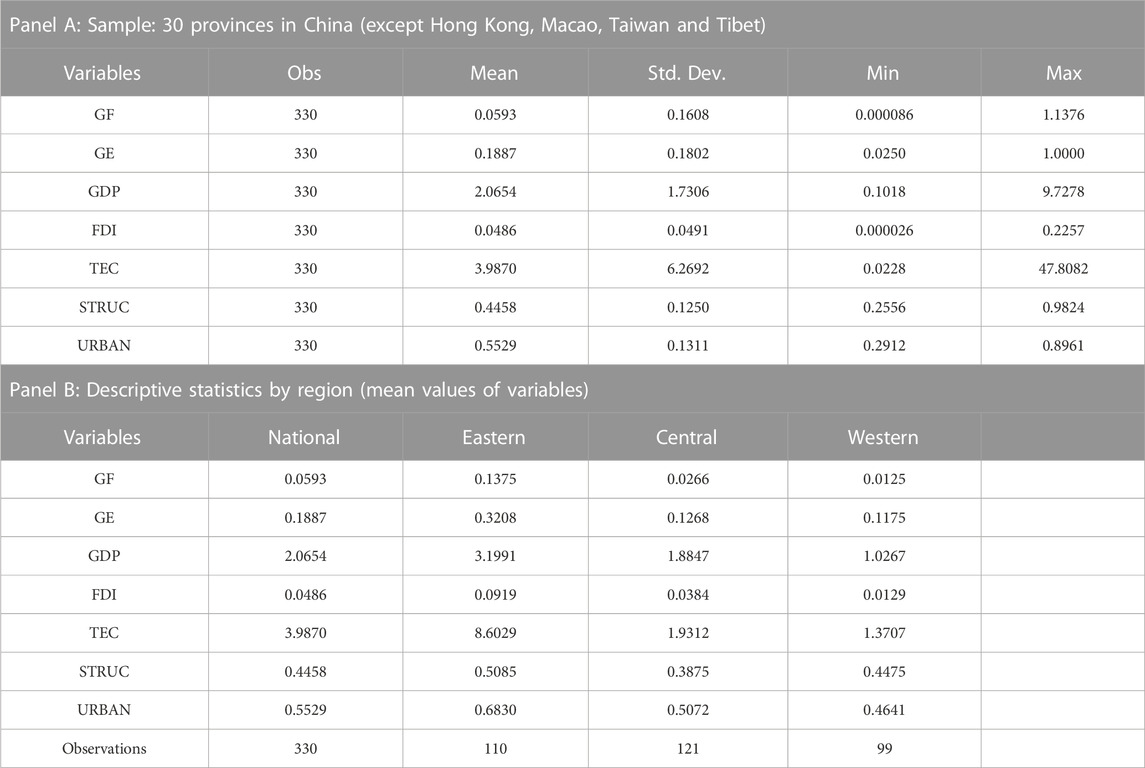

The descriptive statistics of the variables are presented in Table 2. The sample data covers 30 provinces over 11 years from 2008 to 2018, with each variable has 330 observations. Based on the data for each province in Panel A, it can be observed that the variable of green economic development efficiency exhibits ordinal utility, with a minimum value of 0.0250 and a maximum value of 1.0000. There are considerable differences in green economic development efficiency across different regions and years, primarily attributed to variations in economic development levels and the strength of environmental protection awareness in different regions. Additionally, the variable of green finance shows a significant difference between the minimum value of 0.000086 and the maximum value of 1.1376, indicating variations among different provinces. Differences in the average values across regions are related to variations in economic development levels and the prosperity of financial markets in different provinces and municipalities. According to the descriptive statistics in Panel B, the pattern of green economic development efficiency reveals that the eastern region has a higher efficiency compared to the central region, and the central region has a higher efficiency than the western region. Similarly, the level of green finance follows a decreasing trend from the eastern, central, to western regions. The higher level of the tertiary industry in the eastern region compared to the western region, while the western region surpasses the central region, can be attributed to the relatively more developed secondary industry in the central region and its maturity in terms of industrialization.

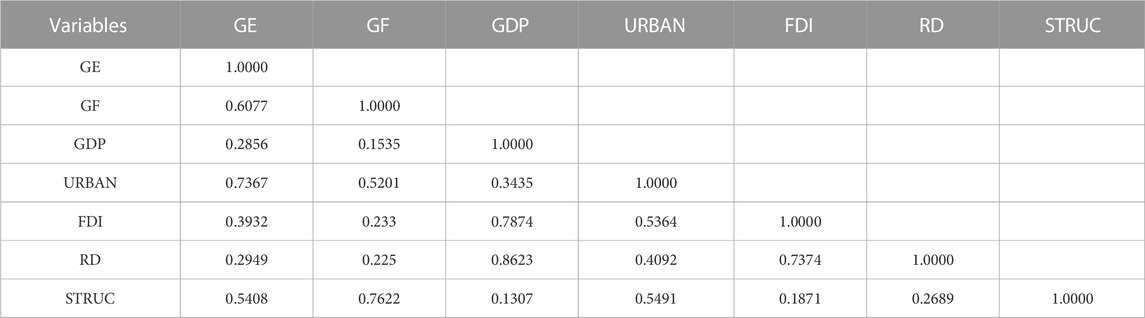

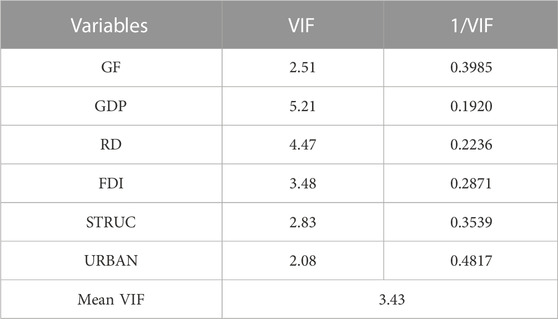

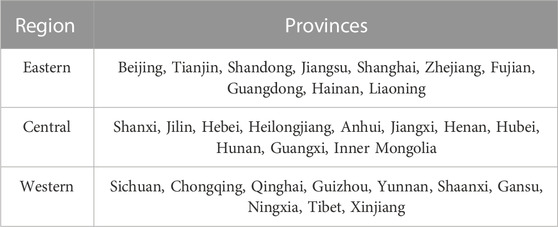

The panel data are short panels, and the data are tested for multicollinearity and robustness. Table 3 presents the levels of correlation among the variables. It can be observed that the highest correlation exists between green economic development efficiency and the level of urbanization (0.7367), followed by the correlation between green finance and green economic development efficiency (0.6077). The VIF test results in Table 4 show that there is no severe multicollinearity problem in the data and there is no unit root in the variables. Therefore, the results of the panel model will be reliable. Table 5 displays the list of provinces and cities included in the eastern, central, and western regions of China, respectively.

5 Empirical results

5.1 Benchmark and sub-regional results

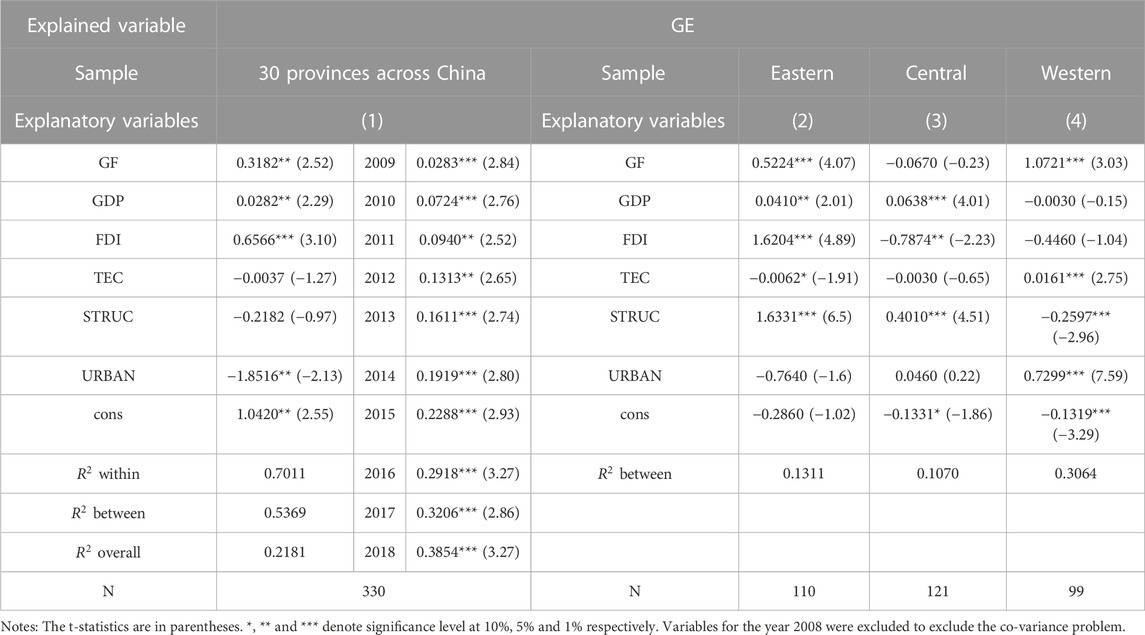

Hypothesis H1 is able to be confirmed by benchmark results. Column (1) of Table 6 shows the effect of green finance on green economy development efficiency as the result of two-way fixed effect model. The results show that the level of green finance has a positive effect on the efficiency of green economic development. The time dummy variable of each year also has a positive effect, and the positive effect gradually increases year by year. The level of economic development (GDP) and the level of foreign openness (FDI) are significantly positive at the 1% level, and both have a positive effect on the efficiency of green economic growth. It is believed that China has passed the inflection point of the environmental Kuznets curve, and the environmental quality will be improved with the further increase of the economic development level. And it reflects the absorption of the mature green development experience and technology of foreign enterprises in the process of introducing foreign investment. The level of urbanization (URBAN) is significantly negative at the 5% level. The increase of urbanization level implies the concentration of population to cities, the expansion of urban construction land scale, and the possible change of industrial structure. This may directly cause the increase in the amount of domestic waste of urban residents, the expansion of resource consumption, and the intensification of industrial environmental pollution in China, leading to a lower level of efficiency of green economic development.

TABLE 6. The influence of green finance on green economy development efficiency and area-level sub-sample tests.

Hypothesis H2 can be confirmed by the results of Sub-regional. Columns (2)–(4) of Table 6 show the differences in the effect of green finance on the efficiency of green economic development in eastern, central and western regions. From the results, we can see that green finance is significantly positive in both eastern and western regions, but insignificant in the central region. It is thought that this difference may be related to the relatively low level of green finance per unit of GDP in the central region and the lower share of tertiary industry compared to the eastern and western regions. Moreover, the more developed economy, stronger public green consciousness and deeper transformation towards green economy in eastern region contributes to the emergence of many green enterprises and better green development efficiency. The western region has a broader geographical area for developing agriculture and fewer heavy pollution industries compared to the central region. At the same time, the western region also contains two provinces with more developed green financial economy, Sichuan and Chongqing.

5.2 Green Policy Test Results

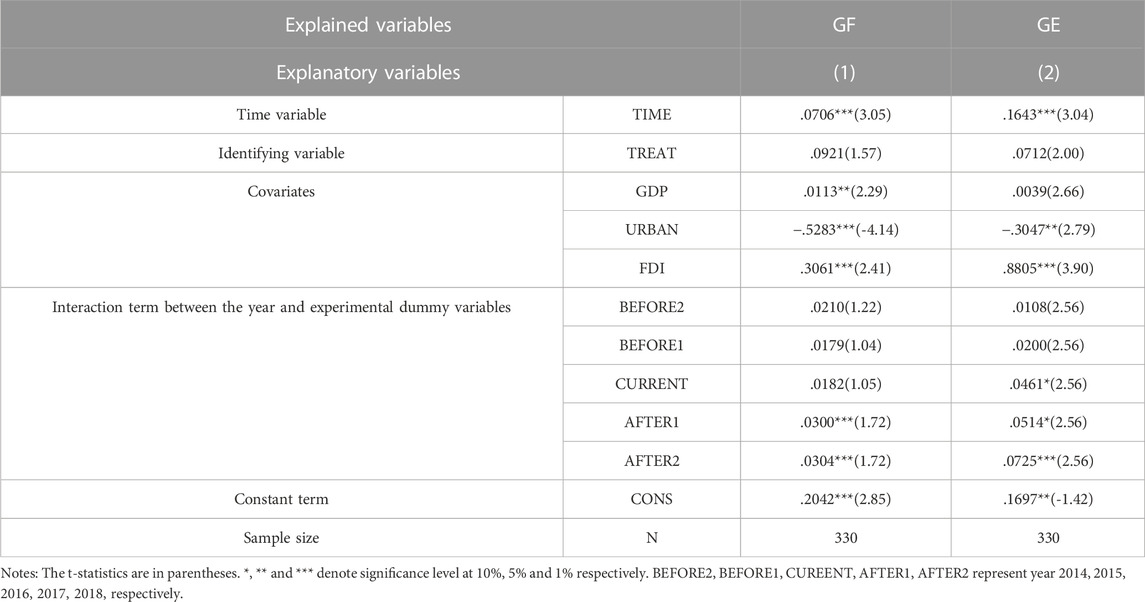

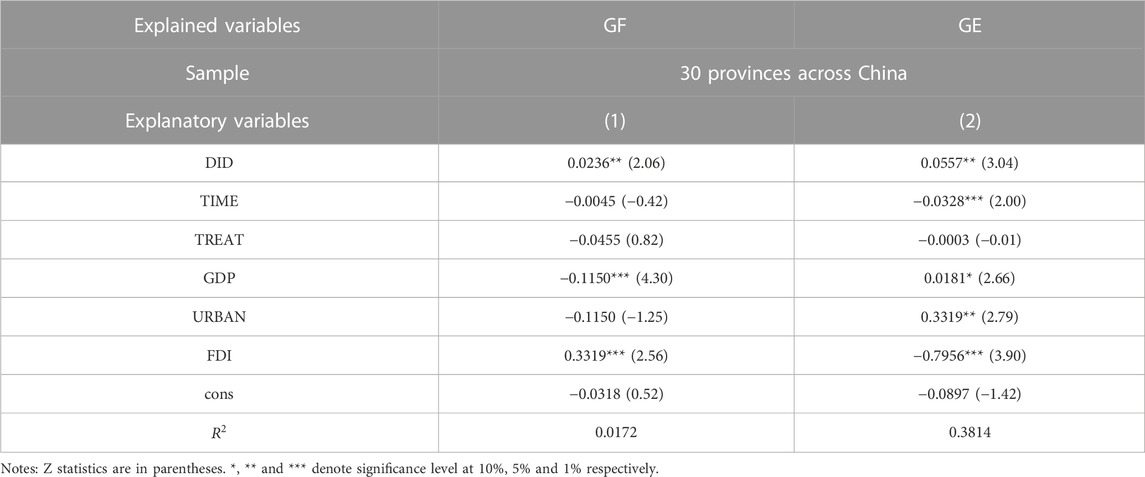

Hypothesis H3 can be confirmed by Green Policy Test Results. Columns (1)–(2) of Table 7 show the effect of green policy dummy variables on the level of green finance and the efficiency of green economic development, respectively. In the table, TREAT is the identifying variable of green finance policy, TIME is the time variable, and DID is the interaction term between the identifying variable and the time variable. Time equals 0 before policy implementation (2016), equals 1 after policy implementation (2016). Treat equals 0 if i is subject to policy implementation, while Treat equals 1 if i is not subject to policy implementation. From the model results. It can be seen that China’s green financial policy has a significant positive effect at the 5% significance level. Specifically, the interaction effect is significantly positive in both models, implying that the implementation of green finance policy helps to improve the level of green finance, and at the same time can promote the efficiency of green economic development. The model also introduces the covariates of economic growth GDP, urbanization level URBAN and foreign investment FDI to control the effects of the three variables on green finance and green economy development. The model satisfies the parallel trend assumption.

TABLE 7. The impact of green policies on green finance and the level of efficiency of green economic development based on a double difference model.

5.3 Robustness test results

The article also selects the variable “total borrowing of green listed enterprises/total borrowing of listed enterprises in A-share market of the province” to replace “total borrowing of green listed enterprises” as a proxy variable for green financial level in each province and city and conducts the robustness test of the model. A fixed-effects model is established to test the robustness of the effect of green financial level on green economic development level, and the robustness test results are shown in Table 8.

TABLE 8. The robustness testing results of influence of green finance on green economy development efficiency and area-level sub-sample tests.

Column (1) of Table 8 shows the robustness test results of the model for the impact of green finance on green economic development. The results of the robustness test are consistent with the results of the two-way fixed effects model of benchmark result. That is, green finance can significantly promote the level of green economy development. The level of economic development (GDP) and foreign openness (FDI) have positive effects on green economic development at 1% significance level. However, an increase in the level of urbanization (URBAN) will lead to a decrease in the level of green economic development. Slightly different from Table 6, the robustness test results show that an increase in the industrial structure optimization, i.e., the share of tertiary sector (STRUC), contributes to the green economy development, while this effect is not significant in the benchmark results. In general, column (1) of Table 8 is consistent with Hypothesis H1: Green finance contributes positively to green economic development efficiency.

Columns (2)–(4) of Table 8 show the results of the robustness testing for East-Central-West heterogeneity, which are generally consistent with the model results in Table 6. And Hypothesis H2 “The positive contribution of green finance to green economic development efficiency differs in the east, central and west regions” is verified. This positive effect is significant in the east and west regions, but not in the central regions.

A robustness test of parallel trends was conducted on the difference-in-difference model to examine the effect of implementing green policies. The results of the robustness test are presented in Table 9. According to columns (1) and (2) of Table 9, the coefficients of BEFORE2 and BEFORE1 in both models are insignificant, while the coefficients of AFTER2 and AFTER1 are significantly positive. This satisfies the assumption of parallel trends. Therefore, it can be assumed that there is no significant difference in the growth trend of green economic development efficiency between the experimental and control group provinces before the policy implementation (CURRENT: 2016). This ensures that the double difference model captures the causal effect of the policy. The test results are consistent with hypothesis 3, which states that “The introduction of a series of green policies in 2016 had a positive impact on the level of green finance and green economic development efficiency.”

6 Conclusion and policy implications

This paper measures and studies the impact of green finance on the development efficiency of China’s green economy by using the data envelopment method with a two-way fixed effects model using sample panel data of 30 regions and provinces in China from 2008 to 2018. The following conclusions are obtained: (1) According to the results of the data envelopment method, the green economic efficiency of all provinces shows an upward trend and significant regional difference. Specifically, the eastern region performs best in green economic efficiency, followed by the central region and finally the western region (2) The results of two-way fixed-effect model show that green finance has a positive effect on green economic development efficiency, which means that with the improvement of green finance level, green economic development efficiency will be improved. Green finance plays an important role in guiding the flow of social capital to the energy-saving, environmental protection and low-carbon product industries, and promoting enterprises to achieve technological upgrading and industrial transformation. (3) The level of economic development and the level of openness to the outside world have a significant positive effect on the efficiency of green economic development, and it is believed that China’s economic development has passed the inflection point of the “inverted U-shaped relationship” of the environmental Kuznets curve. With the improvement of China’s economic development, the severity of environmental pollution has been gradually reduced and environmental quality has been improved. At the same time, in the process of introducing foreign investment, we have learned the experience and technology of overseas enterprises in green development. There is a negative relationship between the level of urbanization and the efficiency of green economic development in China, and the technological progress and the structure of new industries both contribute less to the efficiency of green economic development. (4) Further refinement of the sample test model shows that there is spatial heterogeneity in the effect of green finance on green economic development efficiency, and the coefficient of green finance is significantly positive in the eastern and western regions, but not significant in the central region. This is related to the economic development level of each region, the size of the tertiary industry and the strength of green awareness. (5) A difference-in-difference model is established for the policies of green finance and economy, and the results show that the introduction and implementation of policies have a positive contribution to the development level of green finance and green economy in each region.

According to the empirical results of this article, we can put forward some policy suggestions. Firstly, government departments can continue to vigorously promote the improvement of the green financial market system in the coming years, encourage enterprises to actively conduct research on green innovative technologies, and promote the optimization of industrial structure and green transformation of the economy. Moreover, the promotion of cooperation between the carbon market and the financial system, information-sharing mechanisms, coordinated risk management strategies, and harmonized regulatory frameworks will contribute to the stability of the market during the green transition. Secondly, the government can make reasonable use of green development policies to regulate the resource use and pollutant emissions of enterprises at the production end. At the level of science and technology innovation, these policies could support the research and development of green technology, such as carbon capture and storage, renewable energy generation, storage and transmission, and pollutant treatment technologies, to improve the efficiency of the green economy in the end. In the consumer side, governments could introduce policies like price subsidies and other consumer preferential policies to improve consumers’ awareness of green environmental protection. At the same time, green policies provide financial support to green industries, and helps the development of green enterprises through policies such as subsidies and tax breaks. Thirdly, the green economy should be developed according to local conditions. There exist differences in the effect of green finance on the green economic development efficiency between the eastern, central and western regions. Therefore, when giving full play to the role of green finance in promoting and facilitating the development efficiency of green economy in each region, it is necessary to make green policies for each region in accordance with local conditions and reasonably carry out green financial investment to promote efficient and sustainable development of green economy in each region. Fourthly, the government can draw on the mature experience of foreign countries to promulgate relevant policies and make certain requirements for enterprises to disclose green information. In other words, listed companies should be required to disclose not only business information, but also environmental protection and social responsibility information on a regular basis. For example, government is proposed to increase transparency and disclosure requirements for high-carbon businesses and companies involved in the energy transition. This could ensure that investors and stakeholders are fully aware of the potential risks associated with carbon assets. In addition, to assist investors in understanding the climate risks of relevant entities, the adoption of internationally recognized reporting frameworks, such as the Task Force on Climate-Related Financial Disclosure (TCFD) reports, is encouraged to promote consistency in disclosure practices. In this way, the government can better guide the funds flow to green industries and green projects in the financial market and improve the efficiency of green financial fund allocation. Finally, in developing green finance and green economy under the influence of geopolitical risks and pandemic uncertainties, the government should not neglect the development of contingency plans and adaptation strategies for global uncertainty events to effectively manage the related risks associated with the associated low-carbon transition and energy transition.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: Wind Database, China National Statistical Yearbook, and Chinese Provincial Statistical Yearbook.

Author contributions

DL: Conceptualization, Funding acquisition, Project administration, Resources, Supervision, Writing–original draft. YC: Conceptualization, Data curation, Resources, Supervision, Visualization, Writing–review and editing. HY: Funding acquisition, Project administration, Software, Visualization, Writing–review and editing. YK: Data curation, Formal Analysis, Investigation, Methodology, Validation, Writing–original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was financially supported by the State Grid Corporation of China (No. 520626220103). Project Name: Architecture and Application of Big Data Insight Forecasting Analysis Technology for Power Economy.

Conflict of interest

Author YC was employed by State Grid Shandong Electric Power Company.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Other economic variables include gross domestic product (trillion yuan), foreign direct investment (trillion yuan), number of domestic patent applications granted (million), share of tertiary industry (%), urbanization rate (%).

References

Alharbi, S. S., Al Mamun, M., Boubaker, S., and Rizvi, S. K. A. (2023). Green finance and renewable energy: a worldwide evidence. Energy Econ. 118, 106499. doi:10.1016/j.eneco.2022.106499

Anton, S. G., and Afloarei Nucu, A. E. (2020). The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 147, 330–338. doi:10.1016/j.renene.2019.09.005

Ashenfelter, O., and Card, D. (1985). Using the longitudinal structure of earnings to estimate the effect of training programs. Rev. Econ. Statistics 67, 648–660. doi:10.2307/1924810

Athey, S., and Imbens, G. W. (2006). Identification and inference in nonlinear difference-in-differences models. Econometrica 74, 431–497. doi:10.1111/j.1468-0262.2006.00668.x

Banker, R. D., Charnes, A., and Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 30, 1078–1092. doi:10.1287/mnsc.30.9.1078

Barbier, E. (2011). The policy challenges for green economy and sustainable economic development. Nat. Resour. Forum 35, 233–245. doi:10.1111/j.1477-8947.2011.01397.x

Campiglio, E. (2016). Beyond carbon pricing: the role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 121, 220–230. doi:10.1016/j.ecolecon.2015.03.020

Charnes, A., Cooper, W. W., and Rhodes, E. (1978). Measuring the efficiency of decision making units. Eur. J. Operational Res. 2, 429–444. doi:10.1016/0377-2217(78)90138-8

Cigu, E. (2020). The role of green finance. An overview In: Editors M. Tofan, I. Bilan, and E. Cigu (Iai: Alexandru Ioan Cuza University Publishing House. European Union financial regulation and administrative area– EUFIRE, 657–669.

Cilliers, E. J., Diemont, E., Stobbelaar, D.-J., and Timmermans, W. (2010). Sustainable green urban planning: the green credit tool. J. Place Manag. Dev. 3, 57–66. doi:10.1108/17538331011030275

Cowan, E. (1998). Topical issues in environmental finance. Economy and environment program for southeast asia (EEPSEA). Available at: https://EconPapers.repec.org/RePEc:eep:tpaper:sp199801t2.

Farrell, M. J. (1957). The measurement of productive efficiency. J. R. Stat. Soc. Ser. A Statistics Soc. 120, 253–281. doi:10.2307/2343100

He, L., Zhang, L., Zhong, Z., Wang, D., and Wang, F. (2019). Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J. Clean. Prod. 208, 363–372. doi:10.1016/j.jclepro.2018.10.119

Lazaro, L. L. B., Grangeia, C. S., Santos, L., and Giatti, L. L. (2023). What is green finance, after all? – Exploring definitions and their implications under the Brazilian biofuel policy (RenovaBio). J. Clim. Finance 2, 100009. doi:10.1016/j.jclimf.2023.100009

Lee, C.-C., Wang, F., Lou, R., and Wang, K. (2023). How does green finance drive the decarbonization of the economy? Empirical evidence from China. Renew. Energy 204, 671–684. doi:10.1016/j.renene.2023.01.058

Lee, J. W., School of International Economics and Trade, , and Anhui University of Finance and Economics Aufe, (2020). Green finance and sustainable development goals: the case of China. J. Asian Finance Econ. Bus. 7, 577–586. doi:10.13106/jafeb.2020.vol7.no7.577

Li, Z., Kuo, T.-H., Siao-Yun, W., and The Vinh, L. (2022). Role of green finance, volatility and risk in promoting the investments in Renewable Energy Resources in the post-covid-19. Resour. Policy 76, 102563. doi:10.1016/j.resourpol.2022.102563

Lu, L., Liu, P., Yu, J., and Shi, X. (2023). Digital inclusive finance and energy transition towards carbon neutrality: evidence from Chinese firms. Energy Econ. 127, 107059. doi:10.1016/j.eneco.2023.107059

Menegaki, A. N. (2011). Growth and renewable energy in Europe: a random effect model with evidence for neutrality hypothesis. Energy Econ. 33, 257–263. doi:10.1016/j.eneco.2010.10.004

Muganyi, T., Yan, L., and Sun, H. (2021). Green finance, fintech and environmental protection: evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Pearce, D. W., and Turner, R. K. (1989). Economics of natural resources and the environment. Maryland, United States: Johns Hopkins University Press.

Qin, M., Fan, L., Li, J., and Li, Y. (2021). The income distribution effects of environmental regulation in China: the case of binding SO2 reduction targets. J. Asian Econ. 73, 101272. doi:10.1016/j.asieco.2021.101272

Razmi, S. F., Moghadam, M. H., and Behname, M. (2021). Time-varying effects of monetary policy on Iranian renewable energy generation. Renew. Energy 177, 1161–1169. doi:10.1016/j.renene.2021.06.020

Shahbaz, M., Topcu, B. A., Sarıgül, S. S., and Vo, X. V. (2021). The effect of financial development on renewable energy demand: the case of developing countries. Renew. Energy 178, 1370–1380. doi:10.1016/j.renene.2021.06.121

Song, M., and Wang, S. (2018). Market competition, green technology progress and comparative advantages in China. Manag. Decis. 56, 188–203. doi:10.1108/MD-04-2017-0375

Wang, Y., Zhao, N., Lei, X., and Long, R. (2021). Green finance innovation and regional green development. Sustainability 13, 8230. doi:10.3390/su13158230

Wang, Z., Wei, Y., and Wang, S. (2022). Exploring the research situation of carbon finance: a scientometric analysis on Web of Science database. J. Clim. Finance 1, 100003. doi:10.1016/j.jclimf.2022.100003

Wei, D., and Wu, H. (2023). Impact of financial development on the development of the renewable energy industry of China. J. Clim. Finance 5, 100023. doi:10.1016/j.jclimf.2023.100023

Xie, Q., and Zhang, Y. (2021). Green credit policy, supportive hand and Enterprise innovation and transformation. Sci. Res. Manag. 1, 124–134.

Yin, J., Zheng, M., and Chen, J. (2015). The effects of environmental regulation and technical progress on CO2 Kuznets curve: an evidence from China. Energy Policy 77, 97–108. doi:10.1016/j.enpol.2014.11.008

Zhang, D., Mohsin, M., and Taghizadeh-Hesary, F. (2022). Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Econ. 113, 106183. doi:10.1016/j.eneco.2022.106183

Zhang, L., and Mei, Z. (2022a). Green finance and industrial pollution: empirical research based on spatial perspective. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.1003327

Zhang, L., and Mei, Z. (2022b). Green finance and industrial pollution: empirical research based on spatial perspective. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.1003327

Zhang, Z. (2022). China’s carbon market: development, evaluation, coordination of local and national carbon markets, and common prosperity. J. Clim. Finance 1, 100001. doi:10.1016/j.jclimf.2022.100001

Keywords: green finance, green economic development efficiency, green policy, data envelopment analysis, two-way fixed effects

Citation: Liu D, Chang Y, Yao H and Kang Y (2023) The impact of green finance on green economy development efficiency: based on panel data of 30 provinces in China. Front. Environ. Sci. 11:1328914. doi: 10.3389/fenvs.2023.1328914

Received: 27 October 2023; Accepted: 13 November 2023;

Published: 24 November 2023.

Edited by:

Qiang Ji, Institutes of Science and Development, Chinese Academy of Sciences (CAS), ChinaReviewed by:

Xiaoyun Xing, Beijing Forestry University, ChinaBiao Li, Southwestern University of Finance and Economics, China

Copyright © 2023 Liu, Chang, Yao and Kang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuxin Kang, shannon.kyx@outlook.com

Donglan Liu

Donglan Liu Yingxian Chang2

Yingxian Chang2  Yuxin Kang

Yuxin Kang