A study on the impact of fiscal decentralization on carbon emissions with U-shape and regulatory effect

- 1School of Accounting, Chongqing Technology and Business University, Chongqing, China

- 2Sustainable Real Estate Research Center/Department of Economics and Finance, Hong Kong Shue Yan University, Hong Kong, Hong Kong SAR, China

- 3Chakrabongse Bhuvanarth International Institute for Interdisciplinary Studies, Rajamangala University of Technology Tawan-Ok, Bangkok, Thailand

- 4State Grid Chongqing Electric Power Company Beibei Power Supply Branch, Chongqing, China

The Chinese government set a goal in 2009 to cut carbon emissions by 40–45 percent of 2005 GDP per unit by 2020. The role of fiscal decentralization reform in strengthening environmental governance has gained importance. This paper explored the impact of fiscal decentralization reform from 2010 to 2019 on carbon dioxide emissions in China. We utilized the first-order differential dynamic panel econometrics model to examine the correlation between fiscal decentralization and carbon dioxide emission under fiscal imbalance and transfer indirect effects. The findings revealed that 1) fiscal imbalance reduced CO2 emissions due to the decentralization of revenue, and expenditure asymmetry undermined CO2 emissions control. 2) The central government’s transfer payments offset the negative consequences of a fiscal imbalance. The fiscal decentralization of the government caused a difference between regional income and expenditures in the budget. However, it could affect local government expenditure on carbon emission control through central transfer payments, which could restrain carbon emissions and control environmental pollution. 3) The impact of fiscal decentralization on carbon dioxide emissions was influenced by the industrial structure with the U-Shape effect. This was because the adjustment of the industrial structure was cross-term. In the early stage of the industrial structure adjustment, there was a significant decline in coal consumption demand and carbon emissions reduced. However, as the proportion of the secondary industry increased, there was a significant positive correlation between the secondary sector and carbon dioxide emissions in China. Our findings have important policy implications. First, while the promotion of Chinese officials is based on local GDP performance, locals may introduce green GDP as the criterion for rating governments’ performance. Second, local governments should improve environmental governance by increasing technical, environmental protection, and innovation investment. All in all, the findings provide a theoretical basis for relevant research and policy suggestions for China.

1 Introduction

Climate change and global warming recently emerged as two main concerns worldwide, and there is a growing consensus that countries must find solutions (Boutabba, 2014; Ma et al., 2019; Dong et al., 2020a, 2020b). According to World Bank figures, carbon dioxide (CO2) emissions have drastically expanded during the past 3 decades, rising 64.29% from 1990 to 2018 (World Bank 2020).

China has enjoyed fast economic growth since implementing the Open Door Policy. Nevertheless, it resulted in a significant increase in carbon dioxide emissions. The Chinese government set a goal in 2009 to cut per-GDP carbon emissions from 2005 by 40–45 percent by 2020. China is under enormous pressure to reduce emissions and reduce pollution. According to Cai et al. (2008), China’s environmental difficulties are caused by the “Chinese-style decentralization.” Local governments play a critical role in CO2 emissions under the fiscal decentralization framework. Fiscal decentralization affects carbon dioxide emissions in both direct and indirect means. The direction of the indirect effect is determined by fiscal revenue, governmental fiscal receipts, and expenditure. Fiscal decentralization is impacted by political and economic centralization. Environmental taxes raise local government revenue and reduce pollution, which may harm the economy.

The role of fiscal decentralization reform in strengthening environmental governance has gained importance under China’s national “13th Five-Year Plan” strategy. So, how will the fiscal decentralization reform impact CO2 emissions in China in these 10 years? Does the fiscal decentralization system support or hinder local governments’ efforts in carbon emissions reduction? On the other hand, GDP-based incentives may drive local governments to put more effort into economic growth at the expense of the environment. So, what is the impact of China’s fiscal imbalance and transfer on CO2 emissions?

China’s taxation reform in 1994 allowed fiscal decentralization where the central and local governments’ shared expenditure duties (Zhang, 2020). The federal government receives the most fiscal revenue, and tax collection and administration are the federal government’s responsibility. The central government must achieve two goals during this process: increase fiscal revenue and improve macro-control. Local governments benefit from fiscal decentralization to the best use of limited financial resources, fiscal decentralization and autonomy in expenditure. They may spend more financial resources to reach the central government’s target developments by supporting polluted and/or energy-intensive enterprises, such as petroleum, chemical, steel, and electricity. In addition, the regional market segmentation and repeated construction of local economic growth and revenue immediately affected the short-run (Liu, 2005). Local governments began to compete for resources to meet the goal in the short run. In China’s GDP-oriented appraisal system, local governments often spend money on infrastructure and investment to achieve economic growth requirements (Li and Du, 2021).

Nevertheless, they have few fiscal revenue sources. As a result, uneven revenue devolution and expenditure decentralization exacerbate fiscal imbalance (Jia. et al., 2020). As environmental goals cannot be achieved in a short time, it is often sacrificed (Lin and Du, 2021).

Although existing studies have recognized the existence of fiscal imbalance (Bouton et al., 2008; Meloni, 2016), the research on the impact of fiscal imbalance is rare. As for the relationship between fiscal imbalance and CO2 emissions, previous studies discussed it from the perspective of fiscal decentralization, but there is no consensus on this relationship. Several governments and academics consider fiscal decentralization a viable option to reduce carbon dioxide emissions; they argue that it leads to a “race to the top” among local governments by requiring stricter environmental standards to create environmentally friendly surroundings. As a result, they were reducing contamination in the affected areas (Mu, 2018; Chen and Chang, 2020). Indeed, governments have delegated their environmental policy responsibilities to local governments recently.

Nevertheless, in recent years, a divergent perspective on fiscal decentralization’s impact on carbon dioxide emissions has heightened worries (Zhang K. et al., 2016). The proponents of this point of view think fiscal decentralization might “race to the bottom”: municipal governments neglect environmental standards to entice international firms, increasing CO2 emissions. Due to contradicting findings, scholars have become interested in fiscal decentralization’s impact on carbon dioxide emissions. Despite the long history of fiscal decentralization, the US treasury remains centralized, and few research has studied the effects of fiscal decentralization on CO2 emissions. Furthermore, past research has largely ignored the possibility of panel data cross-sectional dependency and slope variability. Based on Ahmed et al. (2020), the abovementioned contradicting results could be accounted for by human capital and institutions. As a result, it is worth investigating whether fiscal decentralization can indirectly impact carbon dioxide emissions via human capital and institutions, despite the functions of human capital and institutions that have yet to be examined thoroughly.

Furthermore, given the dynamic game and adverse selection between the central and local governments, fiscal decentralization has both positive and negative externalities, and its impact may be nonlinear. Elheddad et al. (2020) studied the provincial panel data from 2006 to 2015 using quantile regression. They discovered a nonlinear relationship between fiscal decentralization and energy consumption. Greater fiscal decentralization could lower carbon emissions, according to Cheng et al. time-series econometric analysis of Chinese data from 2005Q1 to 2018Q (Cheng et al., 2020). Song et al. (2018) came to similar conclusions. Additionally, some researchers found that fiscal decentralization increased investment in environmental protection and had no discernible effect on pollution, which may be explained by Chinese culture and emotion (He, 2015).

This paper examines the impact of fiscal decentralization on CO2 emissions from the perspective of indirect effect. It aims to: 1) Review how fiscal decentralization influences carbon emissions through fiscal imbalance, fiscal transfer, and industrial structure and offer some insights and recommendations for China’s budgetary reform. 2) Conduct a theoretical and empirical investigation of the regulatory effect of fiscal imbalance and transfer on carbon dioxide emissions and make policy recommendations. 3) Research the effect of fiscal decentralization and industrial structure on carbon dioxide emissions.

This paper’s contribution is threefold; first, despite many studies examining the relationship between fiscal decentralization and CO2 emissions. There is no consensus on their relationship because fiscal decentralization frequently involves either expenditure or revenue decentralization. This study reviews the impact of carbon emissions based on environmental regulation factors and more comprehensively analyses fiscal decentralization’s impact on carbon emissions to improve the effectiveness of model regression parameter estimation. We discover that fiscal decentralization can directly reduce carbon dioxide emissions. Second, in the context of fiscal imbalance, this study discusses the role of fiscal imbalance. The lack of literature on the fiscal imbalance in carbon dioxide emissions and fiscal decentralization makes this study particularly noteworthy. Third, while some academics focused on the impact of fiscal decentralization on carbon dioxide emissions, there is a lack of knowledge on fiscal decentralization’s nonlinear impact on environmental quality. This paper examines the nonlinear effect of industrial structure on CO2 emissions. Finally, this research has policy implications. The findings demonstrate a negative connection between fiscal decentralization and carbon emissions. Fiscal imbalances are the main factor in this indirect effect. As a result, refining the tax system can reduce carbon emissions.

The following is the structure of this paper: Section 2 introduces the literature review and theoretical analysis. The three section is the research hypothesis. Section 4 records the data and methodology. Section 5 presents the empirical findings and discussion. Section 6 discusses the findings and policy implications.

2 Literature review and theoretical analysis

2.1 Research into the effect of fiscal decentralization on CO2 emissions

Although academics have begun investigating the carbon dioxide emissions and the impact of fiscal decentralization ((Matheus et al., 2019; Yang et al., 2020), there is no consensus regarding the impact of fiscal decentralization on carbon dioxide emissions.

The first school contends that greater fiscal decentralization better serves pollution control and CO2 emission reduction. Those who believe in this viewpoint argue that in addition to aiding local governments, fiscal decentralization can be beneficial to improving resource-efficient use of resources and comprehension of pollution in the area and residents’ preferences for demand (Millimet, 2003; Mu, 2018). Nevertheless, it can also result in local governments’ competition for resources due to nimbyism which encourages environmental regulations implemented by local governments (Levinson, 2003). On the other hand, local authorities can bring about economic development while improving environmental quality under fiscal decentralization (Yang et al., 2020). For instance, Hao et al. (2020a) found that the impact of fiscal decentralization on CO2 emissions was negative.

Others suggested fiscal decentralization raised carbon dioxide emissions, pinpointing the ‘race to the bottom’ phenomena (Liu et al., 2019). Many academics have backed this claim, claiming that local governments are more likely to “race to the bottom”, reducing local environmental restrictions to allow for more economic development, favoring an increase in CO2 emissions. The impact of fiscal decentralization on the operational processes of environmental policy in China while allowing for spatial correlations in CO2 emissions, resulting in the green paradox. Zhang D. et al. (2016) also came to the same conclusion.

Several governments and academics considered fiscal decentralization a viable option to reduce carbon dioxide emissions (Matheus et al., 2019). They argued that fiscal decentralization could lead to a “race to the top” among local governments. By requiring stricter environmental standards environmentally friendly could reduce contamination in the affected areas (Mu, 2018; Chen and Chang, 2020). Indeed, in recent decades, several global central governments have outsourced their environmental policy responsibilities to local governments. The governments at issue oversee most nations in the Economic Cooperation and Development Organization (OECD).

Nevertheless, a divergent perspective on fiscal decentralization’s impact on carbon dioxide emissions has heightened worries (Zhang D. et al., 2016bib_Zhang_et_al_2016abib_Zhang_et_al_2016abib_Zhang_et_al_2016a). The proponents of this point of view think fiscal decentralization might “race to the bottom” in which municipal governments neglect environmental standards to attract international firms, increasing CO2 emissions. Due to contradictory findings, scholars have become interested in relating fiscal decentralization to carbon dioxide emissions. Despite a long history of fiscal decentralization, the US treasury remains centralized. Research on the effects of fiscal decentralization on CO2 emissions is scarce.

Furthermore, previous research has largely ignored the possibility of panel data cross-sectional dependency and slope variability. Based on Ahmed et al. (2020), the abovementioned contradicting results could be accounted for by human capital and institutions. As a result, it is worth investigating whether fiscal decentralization can indirectly impact carbon dioxide emissions via human capital and institutions, despite the functions of human capital and institutions that have yet been thoroughly examined.

This study collected a well-balanced panel dataset of China’s 31 provinces from 2010 to 2019 to examine the effect of fiscal decentralization on CO2 emissions based on scholarly gaps in prior studies. It also investigated the role of fiscal imbalance in how fiscal decentralization affects greenhouse gas emissions to understand the influencing factors better.

2.2 Studies on fiscal imbalance affecting CO2 emissions

Many emerging and developed countries have gone through fiscal decentralization, and local governments’ fiscal revenue and expenditure are often out of balance (Bhattacharyya. et al., 2017; Bellofatto and Besfamille et al., 2018; Jia et al., 2020). Bellofatto et al. showed that vertical fiscal imbalance was inherent to multi-level governments. Eyraud and Lusinyan (2013) presented stylized facts on vertical fiscal imbalances in OECD countries, which showed a negative empirical relationship between fiscal imbalance and fiscal performance. Jia et al. (2020) found that higher fiscal imbalance induced a form of fiscal indiscipline. According to traditional fiscal federalism, decentralization of fiscal authority would create a competitive advantage in information, encouraging local governments to adjust to their preferences (Tiebout, 1956; Oates and Schwab, 1988). However, decentralization of revenue and expenditures are often not aligned during implementation. As a result of the expanding fiscal deficit, local governments might choose to invest in productive projects and infrastructure, which will generate a significant short-term increase in tax receipts and economic performance. Meanwhile, the promotion of Chinese officials is based on GDP performance to boost economic performance and win political capital (Tang et al., 2012; Yao and Zhang, 2015). Local governments are likely to continue to scale back environmental regulations to entice investment and redirect scarce budgetary resources toward economic development while neglecting the importance of environmental protection and carbon reduction.

The structure of an advanced industrial sector can reduce CO2 emissions. Since different industries have different energy demands, which may directly affect pollution emissions, the change in industrial structure will first result in a change in CO2 emissions. Because steel, cement, and chemicals are energy-intensive and highly polluting, secondary industries tend to reduce CO2 emissions (Zhang D. et al., 2016; Feng. et al., 2020a). On the other hand, the tertiary sector might lower energy use and environmental pollution (Luan et al., 2021). Regression analysis of Chinese provincial data from 1999 to 2016 by Zhu et al. (2019) revealed that the advancement of the industrial structure had a more significant impact than the adjustment of the industrial structure on the green economy efficiency. Local governments may prioritize introducing and developing industries that can generate economic benefits and tax revenue in the short run to relieve fiscal pressure and boost the local economy as the fiscal imbalance grows. As a result, one of the potential pathways for fiscal imbalance will be the industrial structure.

2.3 Literature gap

Although more study was conducted on fiscal decentralization’s environmental impacts, there are still some research gaps. First, even though some academics have begun to examine the effects of fiscal decentralization on CO2 emissions, there is still a lack of knowledge in incorporating nonlinear terms with fiscal decentralization in conjunction with their impact on environmental quality. Second, we believe that apart from the immediate influence. We anticipate the indirect effect of fiscal decentralization on CO2 emissions via various channels, such as fiscal imbalance, fiscal transfer, and industrial structure. To the best of our knowledge, however, relatively little research has carefully examined the functions of these variables which could restrict CO2 emissions. Few research studies have examined indirect roles while nonlinearly investigating fiscal decentralization’s influence on CO2 emissions. Lastly, although prior studies have acknowledged the presence of fiscal imbalance (Bouton L et al., 2008), research on the impact of fiscal imbalance on carbon dioxide emission is scarce.

3 Research hypothesis

China attaches great importance to environmental and ecological protection. It strengthens pollution control, prevention, and ecological improvement and promotes green development. Fiscal departmentsat all levels follow the guidance of ecological progress, optimize the structure of expenditures in the face of apparent conflicts between government revenue and expenditure, and prioritize investment in environmental protection while reducing general expenditures to provide strong support for the tough battle against pollution. From 2016 to 2018, 2.451 billion yuan was allocated, with an annual growth rate of 14.8%, 6.4 percentage points higher than government expenditure in the same period. The proportion of government expenditure increased from 3.7 to 4.2%. Of this total, 1,076.4 billion yuan was allocated by the central government to ecological and environmental protection. In 2019, amid the apparent inconsistency between government revenue and expenditure, governments continued to enhance support for environmental and ecological preservation (China Environmental Statistical Yearbook, China Financial Yearbook).

From 2016 to 2018, the central government allocated 47.4 billion yuan to reduce and regulate air pollution and 57.9 billion yuan for restructuring industrial enterprises to promote structural adjustment in key industries, support steel, reduce coal overcapacity and reduce resource consumption and pollution emissions. With the support of financial funds, the urban air quality has been improving. The fraction of days with favorable air quality in 338 cities in 2018 was 79.3%, up 1.3 percentage points; PM2.5 concentration was 9.3, 22, 22.2, 6.5, 11.8%; and 1899 days, 412 days, pollution intensity, duration, and influence range of heavy pollution weather. Thus, we suggest hypothesis 1.

Hypothesis 1. The higher the fiscal decentralization, the lower the carbon dioxide emissions.China’s market-oriented reform brings fiscal decentralization, which gives local governments significant autonomy in fiscal expenditure. Still, at the same time, local governments should also be responsible for the central government’s assessment mechanism predominately concerned with GDP. Since public spending on education, medical care, and environmental protection is slow and cannot be used as political performance assessed by the central government, the most direct and effective way to promote local economic growth is to increase productive expenditures such as economic construction. Through the construction of infrastructure and investment, capital and labor-intensive industries development are encouraged, thus increasing the local tax revenue. Through empirical research, Lopez et al. (2011) concluded that only boosting the government expenditure without changing the expenditure structure could not improve the environmental quality. When the fiscal expenditure structure is devoted to social public goods, it will effectively reduce environmental pollution. Moreover, these capital and labor-intensive industries are easy to cause environmental pollution. From a carbon dioxide emissions perspective, these “competing for growth” local governments may trade-off environmental benefits for economic gains, resulting in increased carbon emissions. Therefore, the regional fiscal revenue growth is faster than expenditure. The gap widens and hinders carbon emissions reduction. Coupled with the abovementioned mechanism, this proposes two hypotheses to be tested:

Hypothesis 2. the wider the gap between fiscal revenue and expenditure, the higher the carbon dioxide emissions.

Hypothesis 3. the fiscal revenue and expenditure gap of local governments impose a negative role on carbon dioxide control under fiscal decentralizationIn evaluating the implementation effect of transfer payments, previous research mainly focused on countries’ implementation efficiency and ecological benefits (Fiscal Transfers Scheme). Santos et al. (2012) studied the transfer payment system in Portugal and found that the transfer payment funds mainly flew to areas with sizeable ecological protection and relied heavily on fiscal transfer payments. The incentive of transfer payments was enhanced by establishing a suitable information transfer mechanism. Sauquet et al. (2014) and others analyzed the implementation efficiency of ecological VAT with the help of the Bayesian space Tobit model. The study found that there was no cutthroat competition between local governments, but the environmental decisions of various governments had strategic alternatives. Droste et al. (2018a) also evaluated the transfer payment system of Portugal, using the Bayesian time series analysis and simulation of counterfactual time series comparison empirical means found that the system significantly promoted the increase in the number of municipal and national ecological reserves, the implementation of the system and the causal relationship between the rise of the number of reserves. Zhang and Li (2015a) and Zhang and Li (2015b) constructed the mathematical model for analyzing the relationship between the county government and the central government as an example, that is, the dynamic “principal-agent” of the ecological benefit output of the previous phase, and the signal transmission model to consider the heterogeneity of the ecological protection ability of the county-level government. Liu. (2015) built a local government response function and spatial measurement model and identified the eastern six provinces and 46 cities’ transfer payment incentive effect of urban environmental governance. “Punishment” was more helpful in strengthening the environmental regulation, the current system limited the incentive role, target compatibility, and system design was the key conclusion. Kong et al. (2017) constructed a general “principal-agent” model between the central government and county-level government. The mathematical analysis results proved that the introduction of variables such as county-level governments and the relative performance incentive mechanism improved the incentive effect of transfer payments. The research hypothesis is thus proposed:

Hypothesis 4. The higher the proportion of fiscal transfer payments, the lower the carbon dioxide emissions

Hypothesis 5. The more significant the proportion of fiscal transfer payments, the stronger the role of fiscal decentralization’ effect on controlling carbon emissions increases.Carbon concentration is directly determined by the level of economic growth and carbon emissions. Industrial structure changes impact carbon intensity because different industries have distinct energy demands. If the energy demand industry occupies a more significant proportion of the national economy and rises faster, energy consumption and carbon emissions will increase. Guo (2012) believed that changes in industrial structure drive the growth of carbon emissions, but in the grand scheme, changes in carbon dioxide emissions are reduced by industrial structures. Li and Zhou (2012) pointed out that the primary factor is the secondary industry affecting the regional carbon emission intensity. Structural changes exhibited a significant impact on China’s usage of energy: a decline in the percentage of the primary sector significantly reduced the coal consumption demand, the rise of the industrial proportion drove oil consumption demand, and electricity became the immediate energy consumption in China due to the change of structure and the improvement of the overall economic level (Shi, 2009). On the other hand, economic development has always been the central government target. Local officials in the “promotion championship” and “GDP championship” strongly drives regional economic development. To collect more taxes, highly polluted and/or energy consumption enterprises like petroleum, chemical, steel, and electricity become the primary targets. For their immature development and extended profit cycle, high-tech and service industries are unlikely to soon become local governments’ primary taxation source. Local governments lack the motivation to upgrade industries. However, rapid economic growth that relies on highly polluted and high energy consumption industries causes significant environmental damage. Fiscal revenue and official promotion incentives often drove local governments to focus more on capital increment (Fu and Zhang, 2007). To increase fiscal revenue, local governments relax environmental control, lower environmental access threshold, and attract heavy industrial enterprises with good economic benefits and can pay more taxes, resulting in the rapid air quality deterioration. Therefore, when the secondary industry’s added value exceeds a certain threshold, it increases carbon emissions. The research hypothesis is based on the initial analysis:

Hypothesis 6. Industrial structure exhibits a “U-type” role in carbon emissions. Specifically, when the secondary industry’s added value is small, the carbon emission is suppressed; when the secondary industry’s added value increases to a certain extent, the carbon emission will gradually increase.

4 Empirical model and data

4.1 modeling setting

Carbon dioxide emissions are a dynamic process. The carbon emissions of a period could be affected by the current political and economic factors and emissions in the previous period. Because China’s industrial capital adjustment and residents’ energy consumption habits have inertia, the change in carbon emissions has a certain degree of lag. Therefore, this study uses panel data from 31 provinces and cities from 2010 to 2019 to set up a dynamic panel model for empirical tests. The models are listed as follows:

FD, FI, FT, and IND indicate fiscal decentralization, fiscal imbalance, fiscal transfer, and industrial structure. Among them represents 31 provinces and municipalities directly covering China’s central government and autonomous areas, t represents CO2 carbon dioxide emissions from 2010 to 2019, and CO2i,t-1 are emissions of the first phase lag. This paper also introduced the indirect variables of fiscal imbalance, fiscal transfer, and industrial structure to verify whether fiscal decentralization affects carbon emissions through indirect variables. The x represents the control variables, including the degree of economic development (income), Foreign direct investment (Invest), The effect of the opening degree of foreign trade (trade), Regarding population density (pop), Environmental regulation (pol), Government investment in science and technology (tech), Greenland area (GA).

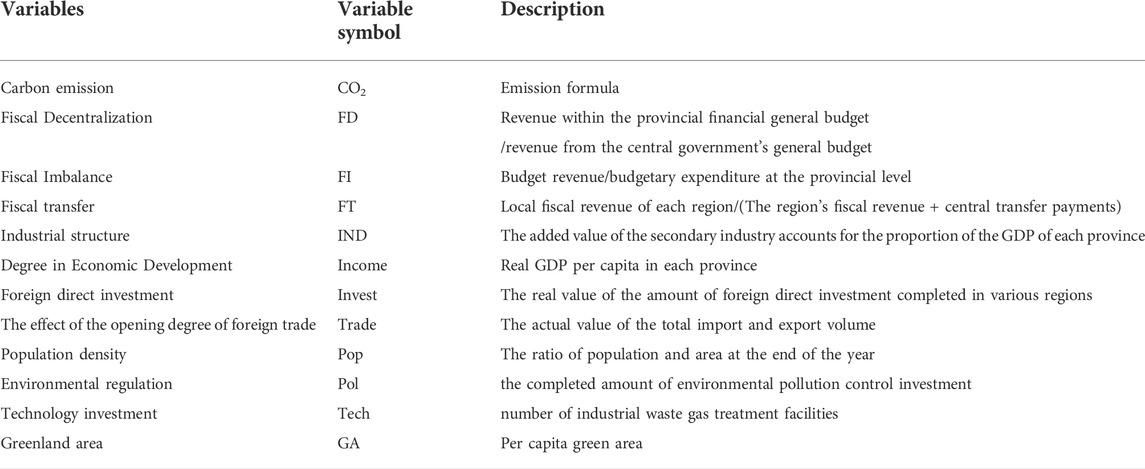

4.2 Variable description

4.2.1 Independent variables

Carbon emission (CO2): the rate at which solid waste is fully utilized was calculated by using typical industrial solid waste in its entirety and general industrial solid waste; the formula of discharge was the total emission of each province. It represented the energy consumption j in the region I during t and the emission coefficient of j energy consumption. The formula for emission coefficient of energy consumption would be: discount carbon dioxide coefficient = average low calorific value ∗ carbon content per unit calorific value ∗ carbon oxidation rate ∗ [10^(-6)] ∗ 44/12. The average low heat generation data was obtained from China’s Statistical Yearbook on Energy, the amount of carbon and how fast carbon burns per unit of calorific value were derived from Table 1.5 and Table 1.7 of the Guide for the Compilation of Provincial Greenhouse Gas List (Trial), respectively. Thus, the coefficients of coal, gasoline, coke, diesel, kerosene, fuel oil, and natural gas were 1.9003, 2.8604, 2.9251, 3.0179, 3.0959, 3.1705, and 2.1605, respectively, so carbon dioxide emissions from fossil natural gas and energy consumption in 31 provinces and cities were estimated.

4.2.2 Dependent variable

Fiscal decentralization (FD): regarding the measurement of fiscal decentralization indicators, scholars mainly discuss it from the perspective of revenue decentralization (He D. and Miao W., 2016) and expenditure decentralization (Lin C. and Yingjie, 2017). If the fiscal decentralization index is measured from a single perspective, it could not reflect its decentralization characteristics well. The fiscal decentralization is reflected in local governments’ fiscal revenue power and expenditure responsibility scope.

Fiscal Imbalance (FI): The essence of FI aims to quantify the disparity under the fiscal decentralization system, the relationship between local fiscal revenue and spending, representing the federal and state governments’ fiscal ties. Referring to Li and Du (2021), the procedure for calculating FI is fiscal revenue decentralization/fiscal expenditure decentralization. As a result, this paper estimated FI from the standpoint of a decentralization system.

Fiscal transfer (FT): To measure the fiscal decentralization of local income by using the self-sufficiency rate of local income, local income self-sufficiency rate = regional own fiscal revenue/(The region’s fiscal revenue + central transfer payments).

The effect of fiscal decentralization on greenhouse gas emissions is mainly reflected in fiscal decentralization revenues from local and national government items are apparent differences, and local governments decide their fiscal expenditure according to their revenue. In theory, local governments can attract targeted investment according to the characteristics of local economic structure and rapidly increase regional fiscal revenue to strengthen environmental governance, such as increasing low-carbon equipment, research and development, and technical personnel training for high-carbon emission enterprises to reduce the regional carbon emission level.

Industrial structure (IND): the percentage of the secondary industry’s added value in the provincial GDP is included. Regional carbon emission is closely related to its industrial structure. To encourage the rapid growth of the local economy, local governments tend to encourage secondary industry development to fasten the pace of regional economic development. However, during the process of industrialization acceleration, the immaturity of technology for utilizing energy and the inefficiency of fossil energy directly lead to increased carbon emissions.

4.2.3 Control variables and moderator variables

Degree of economic development (income): the per capita of each the GDP of a province shows its level of economic growth. To obtain the real per capita GDP, the per capita GDP of all regions from 2010 to 2019, the GDP of each year, and the total population at the end of each region were obtained from the China Statistical Yearbook.

Foreign direct investment (invest): The influence of international investment on regional environmental conditions could generally be classified into two groups. One is based on the hypothesis of a “pollution paradise”, which states that developed countries transfer heavy polluting and high-carbon industries by investing in developing countries. In addition, some scholars believe that there is a more complex mechanism regarding foreign direct investment’s impact on the environmental situation, and the technology spillover effect brought by foreign investment may promote the reduction of the release of carbon (Zhang. et al., 2017b). The level of foreign direct investment in each province was utilized to complete the status of foreign direct investment in this article. It converted the average price of the RMB exchange rate, and finally, the regional GDP index offset the price changes.

The effect of the opening foreign trade (trade): the import and export trade of the high-carbon industry has the most noticeable impact on carbon emissions. Developed countries may transfer carbon emissions to developing countries with a more urgent demand for economic growth through trade. In this paper, the total amount of imports and export of each province provides insight into the degree of opening to the outside world (Zhang et al., 2011). This value is multiplied by the annual average price of the RMB exchange rate throughout the years and converted into RMB, and then the production price index was deduced.

Regarding population density (pop), some scholars believed that energy efficiency exhibited a scale effect. The more dispersed the population, the higher the cost of using energy, and vice versa. It can be inferred that a higher population density in a region may lead to more carbon emissions. The area data of provinces and regions are obtained from the official website of the people’s government. This paper obtained the end-of-year total population data from National Bureau of Statistics website.

Environmental regulation (pol): formulation of national environmental regulation policies directly led to an increase in production costs of enterprises, but it could promote the reduction of carbon emissions. In this study, the completed amount of environmental pollution control investment in each region is used to express the region’s environmental regulation level. The data is selected from the China Environmental Statistical Yearbook over the years, and the regional GDP index processes the value, and the real value is obtained.

Investment by the government in science and technology (tech): Government science and technology investment reflected the level of production technology in the region to some extent. The higher the production technology level in the region, the more advanced the industrial structure, and the higher the energy utilization level, further conducive to reducing regional carbon emissions (Lin and Liu, 2010). This paper used the number index characterization of industrial waste gas treatment facilities invested by the government in science and technology.

Greenland area (GA): On a global scale of ecological civilization, a crucial tool is the carbon trading mechanism for realizing the creation of ecological civilization. Carbon trading lowers carbon emissions from the perspective of carbon sources. On the other hand, green land ecological construction is a carbon sink for carbon absorption. The ecological civilization is measured by per capita green area (Wang. et al., 2022).

The meanings of each variable are shown in Table 1.

4.3 Data and analysis methods

This study utilized the panel data of 31 Chinese provinces (municipalities and autonomous regions) from 2010 to 2019 from the China Statistical Yearbook, China Environmental Statistical Yearbook, China Financial Yearbook, China Energy Statistical Yearbook, and government statistical bulletins and yearbooks.

5 Empirical results and discussion

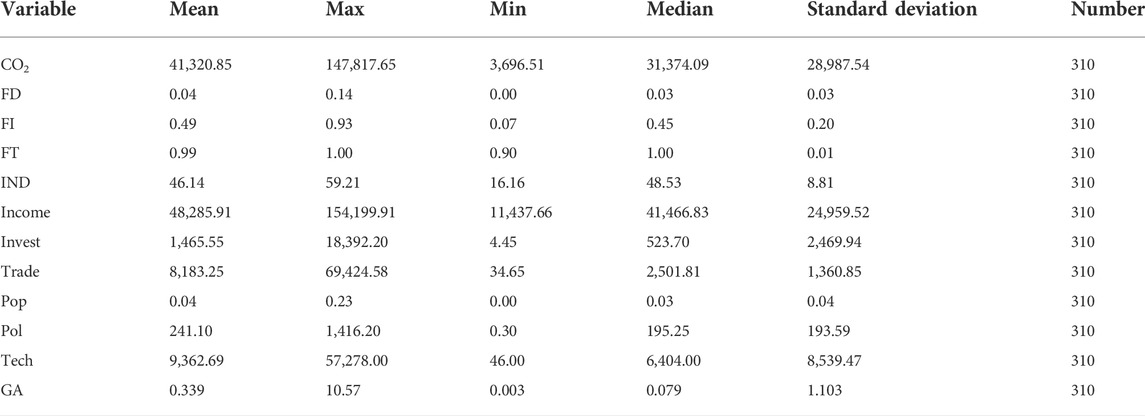

5.1 Descriptive statistics

It used 31 Chinese provinces’ panel data from 2010 to 2019, mainly from the Statistical Yearbook of China over the years and the government unification of various provinces and regions Planning Bulletin and Yearbook. The total number of samples was 310, descriptive statistics were scored for the data analysis, and the detailed results are shown in Table 2. Statistical characteristics of the dependent and independent variables are listed in the table.

5.2 Empirical results

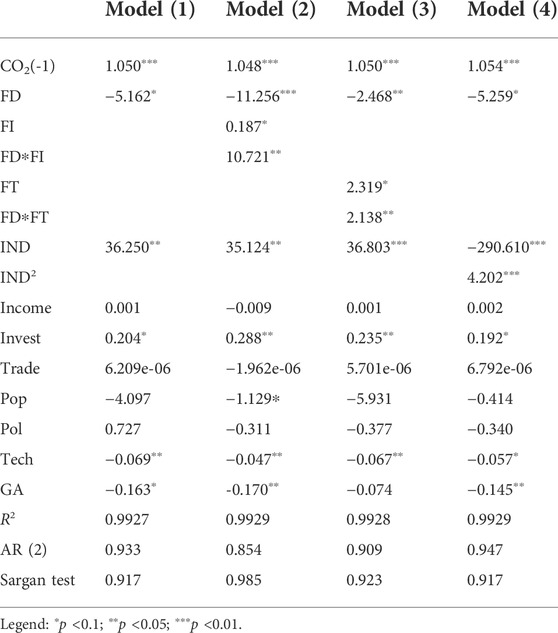

This paper used a robust first-order difference dynamic panel measurement analysis to estimate the impact of fiscal decentralization, fiscal imbalance, fiscal transfer, and industrial structure on carbon dioxide emissions on a national scale. Through the second-order sequence correlation AR test of the three models in Table 3, the results showed that the correlation of second-order sequences did not exist for the error terms receiving the estimated equation. At the same time, the results of the Sargan overidentification test also showed that the null hypothesis of the validity of the instrumental variables could not be rejected (the p-values are all significantly greater than 0.1). This demonstrated the author’s model setting’s logic and the validity of the instrumental variables.

The regression results of Table 3 model 1) showed that the estimated coefficient of carbon emissions in the lagging phase was significant and positive at the 1% level. Carbon dioxide emissions in the previous stage increased by 1% or 1.050% in the current period. The symbol remained significantly positive after other control variables are added later. This showed a positive correlation between the carbon emissions of the last period and the current time frame. China’s carbon dioxide emissions are a continuous and dynamic cumulative adjustment process. Because China’s industrial capital investment, energy consumption habits, and related macro-control have a time lag, the more carbon emissions in the last phase, the increased emissions in this period. The estimated coefficient of fiscal decentralization indicators was negative and significant at the statistical 10% level. Fiscal decentralization increased by 1%, and per capita carbon dioxide emissions decreased by 5.162%, testing the hypothesis of 1. The higher the fiscal decentralization, the smaller the per capita carbon dioxide emissions. The fiscal decentralization’s role reform in strengthening environmental governance gained importance under the national “13th Five-Year Plan” strategy. Financial departments at all levels follow the guidance of ecological progress. Yet, there was an apparent conflict between government revenues and expenditures, means to optimize the spending structure, attach great importance to the environmental protection investment, reduce the general expenditures, and provide strong support for the hard fight against pollution. Fiscal decentralization is critical for reducing carbon dioxide emissions.

Table 3 model 2) showed that fiscal imbalance exhibited a positive and significant calculated coefficient. Increases fiscal imbalance by 10% and carbon dioxide emissions by 0.187%. This verifies the authors’ hypothesis 2 that the higher the government fiscal imbalance, the greater the CO2 emissions. Because local government officials generally have short terms, policymakers invest fiscal spending in economic areas where they can achieve political results as soon as possible. However, environmental protection is often not favored because of its characteristics of significant investment, long effective period, and insignificant short-term political performance. Therefore, many local governments will take economic development as the focus of fiscal expenditure and attract enterprises to invest in local factories by building infrastructure, reducing taxes, and environmental supervision. Local governments’ enthusiastic pursuit of attracting investment weakens local environmental quality standards and indirectly connives at enterprises’ carbon dioxide emissions.

To some extent, fiscal decentralization reflects the government’s ability to control fiscal expenditure. So, the interesting question is, was the impact of fiscal decentralization on CO2 emissions varied at different levels of fiscal expenditure or not? Therefore, the author added the interaction phrase of government fiscal decentralization and fiscal imbalance in the model to explain this problem. The partial impact of fiscal decentralization on carbon emission included the direct effect of fiscal decentralization; the indirect influence was dependent on government fiscal revenue and expenditure. The interaction term coefficient in the model 2) was significantly positive, demonstrating that the effect of fiscal decentralization on CO2 emissions could be realized through government fiscal revenue and expenditure. In areas with considerable government fiscal revenue and expenditure gap, the fiscal decentralization’s role in controlling carbon emissions was gradually weakened and supported hypothesis 3. The interaction term coefficient had a critical value of government fiscal imbalance. When the fiscal imbalance exceeded the threshold, government fiscal decentralization boosted carbon dioxide emissions if the latter would reduce carbon dioxide emissions. In other words, for regions like Guangdong, Shanghai, and Jiangsu with significant fiscal revenue gaps, the increase in fiscal decentralization would not be conducive to improving local carbon emissions. For some areas where fiscal revenue is less than the critical value, the increase in fiscal decentralization will reduce local carbon emissions. This conclusion explains the “double-sided” function of fiscal decentralization in promoting and limiting carbon dioxide emissions. The author compensates for the lack of existing literature. The existing literature rarely examines the “suppression” mechanisms of the effect of fiscal decentralization on carbon dioxide emissions. The author solved this problem by adding the interaction term.

Table 3 model 3) shows that the estimated coefficient of the fiscal transfer degree (central government subsidy provided to close the gap of fiscal imbalance) is positive and significant. That is, the fiscal transfer degree increased by 10%, and the carbon dioxide emissions increased by 2.319%. This also verifies the authors’ hypothesis 4 that the higher the government fiscal transfer degree, the lower the transfer payments, and the greater the CO2 emissions. The restraining influence of the central transfer payments on carbon emissions is verified. The interaction term coefficient in model 3) was significantly positive, implying that the function of fiscal decentralization on CO2 emissions would be realized through government transfer payments. In areas where the central government makes large government transfer payments, the role of fiscal decentralization in controlling carbon emissions gradually increased. Thus, the results supported hypothesis 5. The fiscal decentralization of the government caused the difference between regional fiscal revenue and expenditure. Still, it implied that local government expenditure for carbon emission control through central transfer payments to restrain carbon emissions and control contamination of the environment. This conclusion was in line with the research results of Xu H. and Zhang W (2017), showing that transfer payments significantly enhanced the quality of the ecological environment. It was more efficient to allocate transfer payments to areas with high financial decentralization. At the same time, Miao X. and Zhao Y (2019) found that transfer payment affected fund compensation, improved environmental governance efficiency, increased capital scale, and strengthened institutional constraints helped realize the institutional incentive effect, which is supported.

Table 3 illustrated model 4) results. The coefficient of the square term showed that industrial structure was statistically significant at the level of 1%, indicating a significant “U-shaped” curve in the connection between industrial structure and carbon emissions. This was because the adjustment of the industrial structure was cross-term. In the early stage of industrial structure adjustment, there was a more significant decline in coal consumption demand and reduced carbon emissions. Nevertheless, as the proportion of the secondary industry increases, there was a strong positive association between the secondary industry and carbon dioxide emissions in China, and confirmed hypothesis 6. Currently, the secondary industry is still dominant in the national economy with high energy consumption. As a result, the increase in the share of the secondary industry in GDP increased carbon dioxide emissions. To obtain more fiscal revenue, local governments pay more attention to productive investment in infrastructure construction and economic development, vigorously develop the local economy and introduce industrial enterprises. Influenced by the GDP-oriented promotion championship, the rational government was concerned more with local economic development, environmental protection, and livelihood, resulting in deteriorating air quality.

The long-term development of the Chinese nation requires the construction of an ecological civilization. Control variables were introduced in the model and the estimation results were robust. The estimated Foreign direct investment coefficient was positive. There is a more complex mechanism regarding foreign direct investment’s impact on the environmental situation, and the technology spillover effect brought by foreign investment may promote the reduction of the release of carbon (Zhang. et al., 2017a). The government investment in science and technology was estimated as a negative correlation: Investment in research and technology by the government can represent the level of manufacturing technology in the region to a certain extent, which is further conducive to the reduction of regional carbon emissions (Lin and Liu, 2010). The Greenland area was significantly negative, indicating that the increasing the amount of green space available, thus reducing net carbon emissions, and increasing carbon absorption.

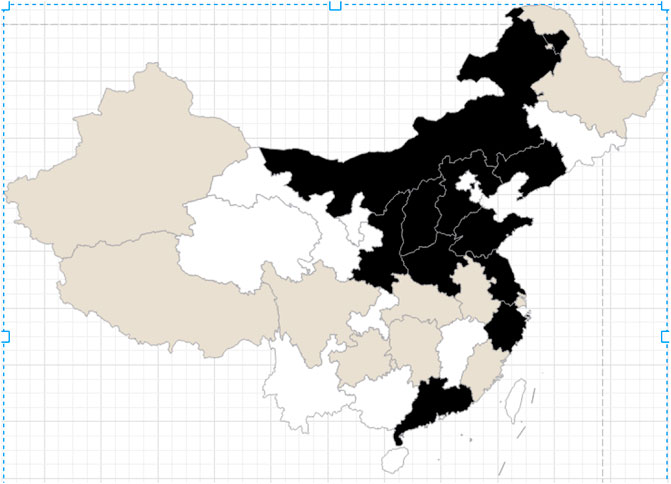

5.3 Analysis of regional differences

The carbon dioxide emissions of different regions in China vary considerably. As per Figure 1, China’s carbon emissions showed an uneven distribution trend. The provinces with relatively large carbon emissions are mainly concentrated in the areas rich in coal resources, with large populations, and developed economies. However, the provinces included in the high-emission zone have a specific regional agglomeration, mainly situated in the middle and north of China and the Bohai Rim region. This is due to the spatial correlation of environmental pollution and the unbalanced distribution in neighboring areas. However, the provinces, including the high-emission areas, have similarities in the local resource endowment and energy consumption structure. Because provinces with medium and high emission areas are mainly rich in coal resources and high levels of industrialization, economically developed areas, such as Shanxi, have many coal resources and are the largest thermal power generation province. Hebei, Shandong, Jiangsu, and other provinces were big steel-producing provinces that would consume much coal. Under the original resource endowment and economic structure conditions, these local governments will naturally vigorously develop the local pillar industries, resulting in increased carbon emissions.

6 Conclusions and policy implications

6.1 Conclusion

There is debate over the connection between fiscal decentralization and carbon dioxide emissions. This research examines the influence of Chinese-style fiscal decentralization on carbon dioxide emissions and control from the standpoint of indirect variables, providing some fresh empirical evidence. We make the following findings utilizing statistics from Chinese provinces from 2010 to 2019. 1) Fiscal imbalance reduces CO2 emissions because the devolution of revenue and expenditure undermines CO2 emissions control. Fiscal decentralization and imbalance in the Chinese model could result in significant incentive distortion. 2) The central government’s transfer payments offset the negative consequences of fiscal imbalance. The fiscal decentralization of the government causes a difference between regional income and expenditures in the budget. Still, title local government expenditure towards carbon emission control through central transfer payments to restrain carbon emissions and control environmental pollution. 3) The effect of fiscal decentralization on CO2 emissions was influenced by the industrial structure with the U-Shape effect. This is because the adjustment of industrial structure is cross-term. In the early stage of industrial structure adjustment, it manifested more in the significant decline in coal consumption demand and reduced carbon emissions. Nevertheless, as the proportion of the secondary industry increases, there was a strong link between the secondary industry and carbon dioxide emissions in China.

6.2 Policy implication

Our findings have significant policy consequences. China experienced increasing resource scarcity and environmental pressure, and building an ecological civilization is vital to achieving high-quality economic development (Du et al., 2021). Environmental governance in China was primarily the responsibility of local governments (Feng T. et al., 2020). In this framework, fostering the development of the green economy requires establishing a fiscal link between the national and local governments that is balanced and coordinated.

For starters, controlling FI is critical for CO2 control. The Chinese government is currently undertaking a fresh wave of fiscal reforms. The fiscal link between the federal and state governments should be improved by a scientific separation of Taxing authority and spending responsibilities for local governments, which may inspire increased spending on the environment and public services by local governments. During this procedure, the central government should increase the control and local government oversight and decentralize revenue authority even more. That local government must balance its revenue and expenditure responsibilities. To summarize, local governments’ fiscal deficits and pressures should be minimized to prevent them from engaging in some economically shortsighted actions.

Second, policymakers should consider the role of various forms of financial compensation. The central government should construct the system of transfer payments properly and increase the efficiency with which fiscal revenues are used. Local governments should also keep an eye on the GDP over environmental issues and prioritize investment. The administration should strengthen its tactics of political promotion, focusing on GDP, and organize local governments’ enthusiasm for energy saving and pollution control.

Third, the Chinese economy is in an advanced stage of development, with essential contents such as modernization of the industrial structure and technology innovation. Our empirical findings demonstrated that changing the traditional fiscal decentralization structure benefited energy conservation and pollution reduction, as well as the modernization of industrial structures and technological innovation. As a result, municipalities should optimize their fiscal expenditure structure, increase spending on technology and sustainable protection, and continuously better environmental management. Local governments should limit their involvement in resource management and environmental governance allocation and encourage development based on the market. Furthermore, FI’s unnecessary administrative interference will degrade the quality of the environment.

Finally, this analysis included policy recommendations for other emerging countries in transition. As part of the global carbon-neutral movement gains traction, countries should restructure and improve their taxation procedures to reflect the economic and political climates in which they live, ensuring institutional support for the growth of the green economy. Most underdeveloped countries also face fiscal decentralization issues, which impede green economic development. On the other hand, complementary efforts based on restoring grass and replanting trees aligned with the realities of establishing a market for carbon trading, which enhanced CO2 sinks and reduced CO2 sources. The constant was significant carbon sequestration, which assured that the net CO2 emissions were controllable under this virtuous loop mechanism.

6.3 Limitations and further research

This study has some limitations, for example, the data could be expanded to other countries. The research strategies presented in this paper could be applied to other nations, regions, pollutants and industries to study the varied effects of fiscal decentralization. For example, how does fiscal decentralization impact environmental laws and regulations compliance (Lai et al., 2007).

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JX: Writing—original draft. RL: Writing—original draft, review and editing. XZ: Supervision. LS: Literature review. WB: Formal analysis, Data curation.

Funding

Please declare all sources of funding received for the research being submitted. This information includes the name of granting agencies and grant numbers, as well as a short description of each funder’s role. You should also mention funds received for open access publication fees, from your institution, library, or other grants. This study is partially supported by Chongqing Social Science Planning Fund (Grant No.2020YBJJ62), Chongqing Municipal Education Commission (Grant No. KJQN202100829), and Chongqing Technology and Business University (Grant No.2151016).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The handling editor ZK declared a past collaboration with the author RL.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.964327/full#supplementary-material

References

Ahmed, Z., Asghar, M. M., Malik, M. N., and Nawaz, K. (2020). Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 67, 101677. doi:10.1016/j.resourpol.2020.101677

Bellofatto, A. A., and Besfamille, M. (2018). Regional state capacity and the optimal degree of fiscal decentralization. J. Public Econ. 159, 225–243. doi:10.1016/j.jpubeco.2017.12.010

Bhattacharyya, S., Conradie, L., and Arezki, R. (2017). Resource discovery and the politics of fiscal decentralization. J. Comp. Econ. 45 (2), 366–382. doi:10.1016/j.jce.2017.02.003

Boutabba, M. (2014). The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 40, 33–41. doi:10.1016/j.econmod.2014.03.005

Bouton, L., Gassner, M., and Verardi, V. (2008). Redistributing income under fiscal vertical imbalance. Eur. J. Political Econ. 24 (2), 317–328. doi:10.1016/j.ejpoleco.2008.01.003

Cai, F., Du, Y., and Wang, M. (2008). Transformation of economic development mode and the internal power of energy conservation and emission reduction. Econ. Res. 6, 4–11.

Chen, X., and Chang, C. (2020). Fiscal decentralization, environmental regulation, and pollution: A spatial investigation. Environ. Sci. Pollut. Res. 27 (25), 31946–31968. doi:10.1007/s11356-020-09522-5

Cheng, S., Fan, W., Chen, J., Meng, F., Liu, G., Song, M., et al. (2020). The impact of fiscal decentralization on CO2 emissions in China. Energy 192, 116685. doi:10.1016/j.energy.2019.116685

Dong, K., Dong, X., and Jiang, Q. (2020b). How does renewable energy consumption lower global CO2 emissions? Evidence from countries with different income levels. World Econ. 43 (6), 1665–1698. doi:10.1111/twec.12898

Dong, K., Hochman, G., and Timilsina, G. R. (2020a). Do drivers of CO2 emission growth alter over time and by the stage of economic development? Energy Policy 140, 111420. doi:10.1016/j.enpol.2020.111420

Droste, N., Becker, C., Ring, I., and Santos, R. (2018a). Decentralization effects in ecological fiscal transfers: A bayesian structural time series analysis for Portugal. Environ. Resour. Econ. (Dordr). 71 (4), 1027–1051. doi:10.1007/s10640-017-0195-7

Du, W., Yan, H., Feng, Z., Yang, Y., and Liu, F. (2021). The supply-consumption relationship of ecological resources under ecological civilization construction in China. Resour. Conservation Recycl. 172, 105679. doi:10.1016/j.resconrec.2021.105679

Elheddad, M., Djellouli, N., Tiwari, A. K., and Hammoudeh, S. (2020). The relationship between energy consumption and fiscal decentralization and the importance of urbanization: Evidence from Chinese provinces. J. Environ. Manage. 264, 110474. doi:10.1016/j.jenvman.2020.110474

Eyraud, L., and Lusinyan, L. (2013). Vertical fiscal imbalances and fiscal performance in advanced economies. J. Monet. Econ. 60 (5), 571–587. doi:10.1016/j.jmoneco.2013.04.012

Fan, Q., and Zhang, T. (2018). Research on Environmental regulation Policy and pollution control Mechanism on China’s economic growth path. World Econ. 8, 171–192.

Feng, S., Sui, B., Liu, H., and Li, G. (2020a). Environmental decentralization and innovation in China. Econ. Model. 93, 660–674. doi:10.1016/j.econmod.2020.02.048

Feng, T., Du, H., Lin, Z., and Zuo, J. (2020b). Spatial spillover effects of environmental regulations on air pollution: Evidence from urban agglomerations in China. J. Environ. Manage. 272, 110998. doi:10.1016/j.jenvman.2020.110998

Fu, Y., and Zhang, Y. (2007). Chinese-Style decentralization and fiscal expenditure structure bias: Managing the world at the cost of competition for growth. Manag. world 3, 46–55.

Guo, Z., Yan, T., Guo, Y., Song, Y. C., Jiao, R. H., Tan, R. X., et al. (2012). p-Terphenyl and diterpenoid metabolites from endophytic Aspergillus sp. YXf3. J. Nat. Prod. 7, 15–21. doi:10.1021/np200321s

Hao, Y., Chen, Y. F., Liao, H., and Wei, Y. (2020a). China’s fiscal decentralization and environmental quality: Theory and an empirical study. Environ. Dev. Econ. 25 (2), 159–181. doi:10.1017/s1355770x19000263

He, Q. (2015). Fiscal decentralization and environmental pollution: Evidence from Chinese panel data. China Econ. Rev. 36, 86–100. doi:10.1016/j.chieco.2015.08.010

Hu, Y., and Guo, X. (2012). Internal growth, government productive expenditure and Chinese resident consumption. Econ. Res. 9, 57–71.

Jia, J., Liu, Y., Martinez-Vazquez, J., and Zhang, K. (2020). Vertical fiscal imbalance and local fiscal indiscipline: Empirical evidence from China. Eur. J. Political Econ. 68, 101992. doi:10.1016/j.ejpoleco.2020.101992

Khan, Z., Ali, S., Dong, K., and Li, R. Y. M. (2021). How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 94, 105060. doi:10.1016/j.eneco.2020.105060

Levinson, A. (2003). Environmental regulatory competition: A status report and some new evidence. Natl. Tax. J. 56 (1), 91–106. doi:10.17310/ntj.2003.1.06

Li, J., and Zhou, H. (2012). Correlation analysis of China's carbon emission intensity and industrial structure. China's Popul. Resour. Environ. 1, 7–14.

Li, T., and Du, T. (2021). Vertical fiscal imbalance, transfer payments, and fiscal sustainability of local governments in China. Int. Rev. Econ. Finance 74, 392–404. doi:10.1016/j.iref.2021.03.019

Lin, B., and Liu, X. (2010). Carbon emissions in China’s urbanization stage: Influencing factors and emission reduction strategies. Econ. Res. 45 (8), 100–110.

Liu, J. (2015). The incentive effect of ecological transfer payments on local government environmental governance —— Is based on empirical evidence from 46 prefecture-level cities in six eastern provinces. Financial Res. 41 (2), 54–65.

Liu, L., Ding, D., and He, J. (2019). Fiscal decentralization, economic growth, and haze pollution decoupling effects: A simple model and evidence from China. Comput. Econ. 54 (4), 1423–1441. doi:10.1007/s10614-017-9700-x

Luan, B., Zou, H., Chen, S., and Huang, J. (2021). The effect of industrial structure adjustment on China’s energy intensity: Evidence from linear and nonlinear analysis. Energy 218, 119517. doi:10.1016/j.energy.2020.119517

Ma, M., Ma, X., Cai, W., and Cai, W. (2019). Carbon-dioxide mitigation in the residential building sector: A household scale-based assessment. Energy Convers. Manag. 198, 111915. doi:10.1016/j.enconman.2019.111915

Matheus, K., José Alberto, F., and António Cardoso, M. (2019). The effect of fiscal and financial incentive policies for renewable energy on CO2 emissions: The case for the Latin American region. Ext. Energy-Growth Nexus-Theory Empir. Appl. 5, 141–172. doi:10.1016/B978-0-12-815719-0.00005-X

Meloni, O. (2016). Electoral opportunism and vertical fiscal imbalance. J. Appl. Econ. 19 (1), 145–167. doi:10.1016/s1514-0326(16)30006-x

Millimet, D. (2003). Assessing the empirical impact of environmental federalism. J. Reg. Sci. 43 (4), 711–733. doi:10.1111/j.0022-4146.2003.00317.x

Mu, R. (2018). Bounded rationality in the developmental trajectory of environmental target policy in China, 1972-2016. Sustainability 10 (1), 199. doi:10.3390/su10010199

Oates, W. E., and Schwab, R. M. (1988). Economic competition among jurisdictions: Efficiency-enhancing or distortion-inducing? J. Public Econ. 35 (3), 333–354. doi:10.1016/0047-2727(88)90036-9

Sanogo, T. (2019). Does fiscal decentralization enhance citizens’ access to public services and reduce poverty? Evidence from Cˆoted’Ivoire municipalities in a conflict setting. World Dev. 113, 204–221. doi:10.1016/j.worlddev.2018.09.008

Santos, R., Ring, I., Antunes, P., and Clemente, P. (2012). Fiscal transfers for biodiversity conservation: The Portuguese local finances law. Land Use Policy 29 (2), 261–273. doi:10.1016/j.landusepol.2011.06.001

Sauquet, A., Marchand, S., and Féres, J. G. (2014). Protected areas, local governments, and strategic interactions: The case of the ICMS-Ecológico in the Brazilian state of Paraná. Ecol. Econ. 107, 249–258. doi:10.1016/j.ecolecon.2014.09.008

Shi, D. (2009). Structural changes are major factors affecting energy consumption in China. China Ind. Econ. 11, 38–43.

Song, M., Du, J., and Tan, K. H. (2018). Impact of fiscal decentralization on green total factor productivity. Int. J. Prod. Econ. 205, 359–367. doi:10.1016/j.ijpe.2018.09.019

Tang, P., Jiang, Q., and Mi, L. (2021). One-vote veto: The threshold effect of environmental pollution in China's economic promotion tournament. Ecol. Econ. 185, 107069. doi:10.1016/j.ecolecon.2021.107069

Tiebout, C. M. (1956). A pure theory of local expenditures. J. Political Econ. 64 (5), 416–424. doi:10.1086/257839

Wang, X., Huang, J., and Liu, H. (2022). Can China’s carbon trading policy help achieve carbon neutrality? — a study of policy effects from the five-sphere integrated plan perspective. J. Environ. Manag. 305, 114357. doi:10.1016/j.jenvman.2021.114357

World Bank, (2020). World development indicators. Available at: http://databank.worldbank.org/data/reports.aspx?source=World%20Development%20Indicators.

Yang, Y., Tang, D., and Zhang, P. (2020). Effects of fiscal decentralization on carbon emissions in China. Int. J. Energy Sect. Manag. 14 (1), 213–228. doi:10.1108/ijesm-03-2019-0001

Yao, Y., and Zhang, M. (2015). Subnational leaders and economic growth: Evidence from Chinese cities. J. Econ. GrowthBost. 20 (4), 405–436. doi:10.1007/s10887-015-9116-1

Zeeshan, K., Ali, Shahid, Dong, Kangyin, and Yi Man Li, Rita (2021b). How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 94, 105060. doi:10.1016/j.eneco.2020.105060

Zeeshan, K., Murshed, M., Dong, K., and Yang, S. (2021a). The roles of export diversification and composite country risks in carbon emissions abatement: Evidence from the signatories of the regional comprehensive economic partnership agreement. Appl. Econ. 53 (41), 4769–4787. doi:10.1080/00036846.2021.1907289

Zhang, D., Cao, H., and Wei, Y-M. (2016a). Identifying the determinants of energy intensity in China: A bayesian averaging approach. Appl. Energy 168, 672–682. doi:10.1016/j.apenergy.2016.01.134

Zhang, H., Feng, C., and Liu, G. (2017a). Chinese style environmental federalism: The impact of environmental separation on carbon emission. Financial Res. 9, 33–49.

Zhang, K., Wang, D. F., and Zhou, H. (2016b). Regional endogenetic strategic interaction of environmental protection investment and emission. China Ind. Econ. 2, 68–82. doi:10.19581/j.cnki.cite.journal.2016.02.006

Zhang, K., Wang, J., and Cui, X. (2011). Fiscal decentralization and environmental pollution: The Perspective of carbon emissions. Industrial Econ. China 10.

Zhang, K., Zhang, Z., and Liang, Q. (2017b). An empirical analysis of the green paradox in China: From the perspective of fiscal decentralization. Energy Policy 103, 203–211. doi:10.1016/j.enpol.2017.01.023

Zhang, W., and Li, G. (2015a). Analysis of the dynamic incentive effect of transfer payment in the national Key Ecological function Zone. China Popul. Resour. Environ. 10, 125–131.

Zhang, W., Li, G., Yu, P., Chen, T., Zhou, W., Zhang, W., et al. (2015b). In vitro release of cupric ion from intrauterine devices: Influence of frame, shape, copper surface area and indomethacin. Biomed. Microdevices 15 (3), 19. doi:10.1007/s10544-014-9924-7

Zhang, W. (2020). Political incentives and local government spending multiplier: Evidence for Chinese provinces (1978–2016). Econ. Model. 87, 59–71. doi:10.1016/j.econmod.2019.07.006

Keywords: fiscal decentralization, carbon emissions, fiscal imbalance, transfer payments, industrial structure, environmental economics, empirical analysis, econometrics

Citation: Xia J, Li RYM, Zhan X, Song L and Bai W (2022) A study on the impact of fiscal decentralization on carbon emissions with U-shape and regulatory effect. Front. Environ. Sci. 10:964327. doi: 10.3389/fenvs.2022.964327

Received: 08 June 2022; Accepted: 29 June 2022;

Published: 22 July 2022.

Edited by:

Zeeshan Khan, Curtin University Sarawak, MalaysiaReviewed by:

Songyu Jiang, Rajamangala University of Technology Rattanakosin, ThailandMatheus Koengkan, University of Aveiro, Portugal

Copyright © 2022 Xia, Li, Zhan, Song and Bai. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xuegang Zhan, lilisan666@ctbu.edu.cn

†These authors have contributed equally to this work and share first authorship

Jing Xia

Jing Xia Rita Yi Man Li

Rita Yi Man Li Xuegang Zhan

Xuegang Zhan Lingxi Song

Lingxi Song Weijia Bai

Weijia Bai