Abstract

This conceptual paper offers a comprehensive exploration of the intricate relationship between audit quality and the efficiency of green investments, placing specific emphasis on the significance of green debt securities. In an era marked by intensified global commitments to sustainability, corporations face multifaceted challenges in optimizing their green investments while ensuring financial stability. The evolving landscape of concepts and practices provide a good shape of sustainable investment. In order to assess investment efficiency within the dynamic green market, the central premise of this research lies in recognizing the substantial role played by audit quality in mitigating inefficiencies within the green investments. Moreover, it equips practitioners with valuable insights for crafting effective green investment strategies in an environment where environmental objectives and financial stability are concurrent priorities. This study provides the importance of adhering to established standards, addressing measurement challenges, and maintaining rigorous monitoring as businesses strategically navigate green investments to achieve ecological and financial success. In doing so, it provides a critical perspective between audit quality and green investment efficiency, offering valuable implications for both academia and practitioners in the realm of sustainability and finance.

Keywords: Audit Quality, Debt Securities, Investment Efficiency, Green Investment

Introduction

In the contemporary landscape, characterized by a heightened consciousness of environmental concerns, businesses grapple with a complex challenge especially the challenge of harmonizing environmentally-conscious investments with the imperative of maintaining financial stability (Inderst et al., 2012; Ning et al., 2022). Apressing inquiry emerges: how can businesses ensure the potency of their eco-fri financial stability (Inderst et al., 2012; Ning et al., 2022).endly investments while safeguarding their fiscal equilibrium? This paper takes on the task of uncovering the connections between how well audits are done and how efficiently these green investments work. A principal focus of green investment centers on the green debt securities – instrumental financial mechanisms underpinning these eco-centric initiatives (Gomariz & Ballesta, 2014; Kaminker & Stewart, 2012). Characterized by an intensified awareness of environmental imperatives, corporations face a formidable conundrum: the imperative to magnify the impact of their green investments while concurrently maintaining financial equilibrium (Wu et al., 2022).

Sustainable investment assets have surged to over $35 trillion globally, a clear testament to the burgeoning significance of environmentally-conscious financial endeavors (Jessop, 2021). Notably, there are many instances of high-profile green investments that underscore both the promise and the challenges involved. For some companies, the commitment to renewable energy projects has witnessed a remarkable increase in stock value following a successful audit attesting to the transparency and efficiency of its green investments. In contrast, some companies might face severe backlash and plummeting investor confidence due to revelations of insufficiently audited environmental claims associated with their sustainable initiatives. As society becomes increasingly attuned to ecological imperatives, businesses navigate a precarious terrain where auditors wield a pivotal role in ensuring the credibility and effectiveness of green investments (Biddle et al., 2009). Consequently, this study's exploration of the symbiotic relationship between audit quality and the efficacy of eco-friendly investments in steering businesses towards a future.

The importance of environmental sustainability and financial performance has ascended to unparalleled prominence within the modern business arena. The imperatives to address climate change and resource scarcity have instigated a surge in green investments, encompassing endeavors that yield favorable environmental outcomes coupled with economic returns (Gilchrist et al., 2021). Yet, optimizing the efficiency of these green investments unfolds as an intricate, multidimensional challenge. It necessitates the delicate alignment of environmental aspirations with financial viability, thereby weaving a cohesive fabric that harmonizes the dual objectives. Core determinants, notably audit quality and the strategic utilization of green debt securities, exert significant sway over corporations as they navigate the intricate tapestry of this dynamic terrain.

The connections between taking care of the environment and keeping finances in check are getting more attention in today's business world. Issues like climate change and fewer resources have led to more investments in projects that are good for the environment and the bottom line (Eccles et al., 2014). But making sure these investments work well is a tough task. It means finding the right balance between environmental goals and financial success (Grewal et al., 2021). And considering the difficulties stated, the paper explores the quality of auditing and the enhancement of the efficiency of investments. The significance of this objective is more highlighted when the transformation pace of the green investment circumstances is considered. This exploration is particularly vital within the rapidly evolving sphere of green investments.

The subsequent sections within this article provide an in-depth analysis of critical factors shaping eco-friendly investments' effectiveness. Section 2 introduces the landscape of green investment, with Section 3 highlighting the pivotal role of audit quality within these efforts. Section 4 discusses on the role in advancing sustainability-focused initiatives. Moving forward, Section 5 presents on the dynamics of efficient green investments and audit quality for establishing sustainable approaches to enhancing green investment efficiency.

The Importance of Green Investment Efficiency

Green investment efficiency stands as a cornerstone in ensuring that resources are channelled into environmentally responsible projects to yield optimal benefits. But. It is crucial for corporations to rightly find the optimal point for green investment. Achieving efficiency in green investments requires a deliberate allocation of resources, meticulous project selection, and vigilant outcome tracking (Ning et al., 2022). Finding the most efficient point for green collectively require to strike a delicate balance between environmental advancements and financial returns. To gauge the efficiency of green investments, a nuanced approach is essential. This comprehensive perspective should take the financial elements, environmental factors, and distinctive nature of these investments into account, simultaneously.

For instance, consider a renewable energy project aimed at constructing a solar farm. Efficient resource allocation in this context would involve judiciously investing in high-quality solar panels, ensuring optimal land use, and utilizing efficient installation methods. Careful project selection might include evaluating the project's potential energy generation, alignment with local climate goals, and socio-economic implications implications (Armenia et al., 2019). Monitoring outcomes would entail tracking energy generation, analyzing the farm's contribution to carbon emissions reduction, and evaluating its financial returns (Kazemian et al., 2022).

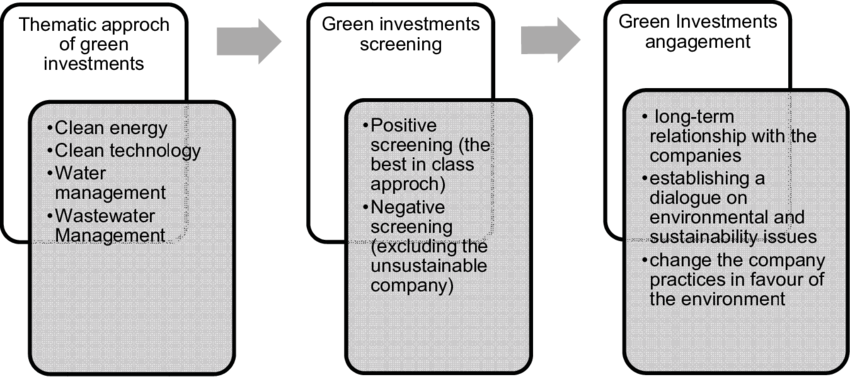

Internationally recognized standards, such as the Green Bond Principles and the Green Loan Principles, provide guidelines to ensure green investment efficiency. These standards outline the criteria for projects to qualify as "green" and offer transparency in reporting and impact assessment. For instance, the Green Bond Principles establish four core components for green bonds: use of proceeds, process for project evaluation and selection, management of proceeds, and reporting. These standards facilitate investor confidence by holding issuers accountable for the environmental benefits they claim to achieve through their green investments. Figure 1 provides Green Investments: approaches, screening and engagement.

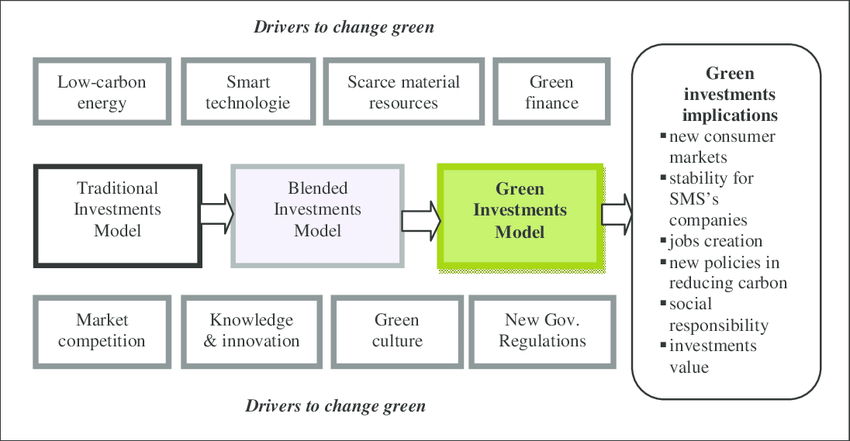

Achieving green investment efficiency benefits are manifold. According to Gilchrist et al. (2021), firstly, it leads to positive environmental impacts, mitigating ecological footprints and contributing to sustainable development. Secondly, it fosters long-term financial stability by ensuring optimal resource allocation and reducing risks associated with environmental liabilities. Moreover, green investment efficiency enhances a company's reputation and attractiveness to environmentally-conscious investors, bolstering access to capital and strengthening stakeholder trust. Furthermore, it stimulates innovation and technological advancements, driving economic growth in industries aligned with sustainable practices. However, challenges persist in measuring and achieving green investment efficiency. Quantifying environmental impacts in financial terms can be intricate, given the diverse nature of projects and their often long-term effects. Furthermore, ensuring that projects meet their intended environmental goals and deliver anticipated financial returns requires ongoing monitoring and adaptation. Figure 2 provides information about green investment model:

One type of significant challenges is in measuring and achieving green investment efficiency. Quantifying environmental impacts in financial terms can be intricate, given the diverse nature of projects and their often long-term effects (Ning et al., 2022). Furthermore, ensuring that projects meet their intended environmental goals and deliver anticipated financial returns requires ongoing monitoring and adaptation. Striking the delicate balance between these two dimensions necessitates a comprehensive understanding of project intricacies and a proactive approach to mitigating potential trade-offs. Green investment efficiency represents the art of maximizing positive environmental outcomes while optimizing financial gains (Zahid et al., 2022). This concept underscores the imperative of responsible resource allocation, strategic project selection, and vigilant outcome assessment. By adhering to established standards, addressing measurement challenges, and pursuing ongoing monitoring, businesses can navigate the intricate landscape of green investments to achieve both ecological and financial success.

Audit Quality in Green Investment

Audit quality, defined by auditors' honesty, competence, and impartiality, assumes a pivotal role in guiding prudent investment choices. This significance is accentuated when it comes to green investments due to several compelling reasons. The intricacies of environmental metrics, the lurking potential for deceptive practices (commonly known as greenwashing), and the overarching demand for transparency render audit quality critical (Zahid et al., 2022). The assurance of accurate financial information concerning green projects instill trust among investors and harmonizes managerial decisions with sustainability objectives. This paper delves into the intricate dynamics of how audits' quality influences investments' efficiency in the context of the emerging green market (Dally et al., 2020).

In the practice of green investments, the role of audits is paramount in validating the credibility of financial information. These investments often involve intricate environmental metrics that necessitate specialized knowledge for accurate assessment. Given these metrics' complexity, competent auditors' presence becomes indispensable. Their understanding of environmental indicators and financial implications safeguards against misrepresentations that could potentially misguide investment decisions (Kim & Li, 2021). A prime example can be seen in renewable energy projects, where the accurate assessment of projected energy yields and associated costs is pivotal for gauging the financial viability of the venture.

The phenomenon of greenwashing adds another layer of significance to audit quality in the green investment arena. Greenwashing refers to instances where entities exaggerate or falsely claim their commitment to environmentally friendly practices. Auditors endowed with integrity and impartiality act as gatekeepers, ensuring that projects labelled as "green" genuinely align with sustainability goals. Their meticulous scrutiny of financial data and project documentation aids in unearthing inconsistencies, safeguarding investor interests, and promoting genuine environmental contributions. Audit quality plays a pivotal role in shaping investment efficiency within the dynamic green market by combating greenwashing, promoting transparency, and facilitating sound managerial decisions.

The influence of audit quality goes beyond financial credibility. It extends to the alignment of managerial decisions with sustainability aspirations. Inaccurate financial reporting could lead to misguided resource allocation, hindering the attainment of environmental targets (Ning et al., 2022). Conversely, audits that uphold quality and transparency provide reliable insights that enable managers to strategically direct investments towards projects that yield tangible ecological benefits. This symbiotic relationship between audit quality and sustainable decision-making contributes to the overall efficiency of green investments. In conclusion, the role of audit quality within the realm of green investments is instrumental. Auditors with integrity, competence, and impartiality ensure the accuracy of financial information in intricate environmental contexts.

Financing Sustainability with Purpose

Green debt securities have emerged as crucial financial tools that are transforming the landscape of sustainable project funding. Notably, this category includes various instruments, with green bonds and green loans being the most prominent among them. These tools are specifically designed to direct capital towards projects that have positive environmental impacts (Gilchrist et al., 2021). As businesses and institutions increasingly realize the interconnected nature of profitability and environmental responsibility, green debt securities are gaining traction as a prudent financial approach (Steuer & Tröger, 2022). Renewable energy projects, infrastructure development with minimal carbon footprints, and initiatives focused on natural resource conservation are a few examples that resonate within this domain. This trend reflects a shift in financial perspectives, emphasizing the alignment of economic growth with ecological well-being and encouraging the adoption of conscientious and impactful investment strategies.

The market for green debt securities has witnessed remarkable growth in recent years, serving as a tangible manifestation of the global consensus on the critical role of sustainable financing. These securities, characterized by their environmentally driven nature, have introduced a novel and purposeful pathway for corporations to engage with capital markets (Gilchrist et al., 2021). With a clear intention of channelling funds towards projects that substantively contribute to the improvement of our environment, green debt securities stand as a testament to the convergence of financial goals and ecological imperatives. By embracing these securities, companies reinforce their commitment to ecological stewardship and tap into a burgeoning investor appetite for ethical and socially responsible investments. This synergistic alignment between sustainable projects and financial instruments not only enhances a corporation's environmental standing but also has the potential to yield favorable financial returns, marking a departure from the traditional notion that profit and the planet are inherently contradictory pursuits.

Renewable energy projects, characterized by their capacity to reduce carbon emissions and contribute to a transition towards cleaner energy sources, are exemplary of the green debt securities' impact (Nustini et al., 2021). Similarly, infrastructure development projects that are conceived with meticulous attention to minimizing their carbon footprints exemplify the sustainable ethos that underscores these financial instruments. Moreover, initiatives dedicated to safeguarding and restoring natural resources, such as reforestation and sustainable land management, find a natural home within green debt securities. In essence, the route of green debt securities exemplifies a pivotal shift in the financial landscape. Given the right mechanisms and motivations, it showcases the growing realization that financial growth and environmental well-being can harmoniously coexist. As corporations increasingly incorporate sustainable practices into their business models, the adoption of green debt securities serves as both a strategic financial maneuver and a tangible step towards a more ecologically balanced future.

The emergence of standards and guidelines has infused structure and transparency into the realm of green debt securities (International Capital Market Association, 2018, 2021). Internationally accepted frameworks such as the Green Bond Principles and the Sustainability-Linked Loan Principles outline stringent criteria that projects must meet to be deemed "green." This assurance ensures that funds raised through green bonds and loans genuinely finance projects with verifiable environmental benefits. The guidelines also mandate thorough reporting and disclosure mechanisms, fostering investor confidence and aligning issuer practices with sustainability objectives. Green debt securities are more than financial instruments; they are conduits of change that bridge economic aspirations with environmental stewardship. The expanding market for these securities bears testament to their resonance in modern finance. Hence, these instruments exemplify how financial innovation can drive sustainable development, enabling companies to embrace eco-conscious projects and investors to contribute to a greener future.

Pioneering Sustainable Transformation

The corporate sector adheres to various frameworks aimed at advancing sustainable transformation and fostering sustainable business development through green financing. An example shown by the Figure 2 is a widely accepted sustainable business approach through green finance that enable sustainable business development policy, designed to cultivate a culture of sustainability within the organization and achieve Sustainable Development Goal (SDG) targets (Kushwaha et al., 2023; Pahlavan et al., 2023). Nonetheless, the extent to which this framework is embraced varies countries including ASEAN region and others, i.e., Taiwan, Thailand, Vietnam, Japan, Laos, the Philippines and the United States. The policy's core objective is to cultivate value across three dimensions: economic growth, social well-being (sometimes referred to as goodness), and environmental stewardship (commonly known as green), all underpinned by the bedrock of effective governance.

A constellation of notable cases highlights the escalating embrace of green investments within corporate agendas. Diverse sectors are now allocating resources towards ventures aligned with ecological responsibility. Enterprises ardently endorse projects such as renewable energy installations, energy-efficient infrastructure upgrades, and innovative waste reduction initiatives. As corporate landscapes reshape, these instances are potent symbols of proactive participation in the transition towards environmentally-conscious business practices. For instance, technology behemoths have undertaken groundbreaking strides by sourcing renewable energy to power their data centers. This departure from conventional energy sources reflects a concerted effort to reduce carbon footprints and align operations with renewable goals. However, these initiatives are not without challenges. Scaling up renewable energy procurement necessitates overcoming infrastructural constraints, negotiating volatile energy markets, and navigating regulatory intricacies. Yet, these technology giants acknowledge the urgency of sustainable transformation, paving the way for others to follow suit (Shuhidan et al., 2016). The impact of green investment strategies and the complex issues provide companies towards a greener and more sustainable future.

The pivotal role of audit quality occupies in navigating this intricate landscape, in which casting light on how reliable financial information shapes the decisions made by managers and the outcomes of projects. With the momentum of sustainability embedding itself within corporate strategies, the understanding of the audit quality, and the efficiency of investments becomes a compass for advancing both environmental aspirations and financial triumphs (Steuer & Tröger, 2022). In this evolving landscape, the symbiotic relationship between responsible investment and financial growth continues our shared future. Through a holistic exploration, it seeks to illuminate the intricate dynamics that underscore the relationship between audit quality and investment efficiency within the context of the green market (Taliento et al., 2019).

High audit quality promotes transparency and accountability in green investments. Audited reports provide a detailed account of how the funds raised through green debt securities are used. This transparency is crucial for investors to track the progress of environmental projects. When investors have confidence in the accountability mechanisms, they are more likely to invest, leading to greater efficiency in raising funds for green initiatives. Also, the green bond market relies on trust and confidence. High audit quality fosters trust among investors, which, in turn, contributes to the growth and development of the green debt securities market. A robust market encourages more issuers to participate, resulting in increased liquidity and efficiency in financing green projects. Stringent regulatory requirements often govern green debt securities. High audit quality ensures that issuers comply with these regulations, reducing the likelihood of legal and reputational risks. Non-compliance can hinder the efficiency of green investments by leading to legal disputes and increased costs.Green investment efficiency is connected towards the art of maximizing positive environmental outcomes while optimizing financial gains. It relates to the imperative of responsible resource allocation, strategic project selection, and vigilant outcome assessment. By adhering to established standards, addressing measurement challenges, and pursuing ongoing monitoring, businesses can navigate the green investments to achieve both ecological and financial success (Kim & Li, 2021). As companies try to balance the need for positive environmental impacts and staying financially sound, they're grappling with a big challenge. Good audits can really make a difference in how well investments perform, especially considering the ever-changing world of green investments. The identification of audit quality as a determinant of green investment efficiency provides its pivotal role in guiding the formulation of sustainable financial strategies.

Acknowledgement

The authors are grateful to the Accounting Research Institute, (ARI- HICoE), Universiti Teknologi MARA, Shah Alam, Malaysia, and the Ministry of Higher Education for providing research funding.

References

Armenia, S., Dangelico, R. M., Nonino, F., & Pompei, A. (2019). Sustainable Project Management: A Conceptualization-Oriented Review and a Framework Proposal for Future Studies. Sustainability, 11(9), 2664.

Biddle, G. C., Hilary, G., & Verdi, R. S. (2009). How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics, 48(2-3), 112-131.

Dally, D., Kurhayadi, K., Rohayati, Y., & Kazemian, S. (2020). Personal carbon trading, carbon-knowledge management and their influence on environmental sustainability in Thailand. International Journal of Energy Economics and Policy, 10(6), 609-616.

Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835-2857. https://doi.org/10.1287/mnsc.2014.1984

Gilchrist, D., Yu, J., & Zhong, R. (2021). The Limits of Green Finance: A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability, 13(2), 478. https://doi.org/10.3390/su13020478

Gomariz, M. F. C., & Ballesta, J. P. S. (2014). Financial reporting quality, debt maturity and investment efficiency. Journal of Banking & Finance, 40, 494–506.

Grewal, J., Hauptmann, C., & Serafeim, G. (2021). Material Sustainability Information and Stock Price Informativeness. Journal of Business Ethics, 171(3), 513-544. https://doi.org/10.1007/s10551-020-04451-2

Inderst, G., Kaminker, C., & Stewart, F. (2012). Defining and Measuring Green Investments. SSRN Electronic Journal.

International Capital Market Association. (2018). Green Bond Principles. https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/June-2018/Green-Bond-Principles---June-2018-140618-WEB.pdf

International Capital Market Association. (2021). Sustainability Bond Guidelines. https://www.icmagroup.org/assets/documents/Sustainable-finance/2021-updates/Sustainability-Bond-Guidelines-June-2021-140621.pdf

Jessop, S. (2021). Sustainable investments account for more than a third of global assets. https://www.reuters.com/business/sustainable-business/sustainable-investments-account-more-than-third-global-assets-2021-07-18/

Kaminker, C., & Stewart, F. (2012). The role of institutional investors in financing clean energy. OECD Working Papers on Finance, Insurance and Private Pensions, No. 23, OECD Publishing.

Kazemian, S., Djajadikerta, H. G., Trireksani, T., Sohag, K., Mohd Sanusi, Z., & Said, J. (2022). Carbon management accounting (CMA) practices in Australia's high carbon-emission industries. Sustainability Accounting, Management and Policy Journal, 13(5), 1132-1168.

Kim, S., & Li, Z. F. (2021). Understanding the Impact of ESG Practices in Corporate Finance. Sustainability, 13(7), 3746.

Kushwaha, D. K., Panchal, D., & Sachdeva, A. (2023). Performance evaluation of bagasse-based cogeneration power generation plant utilizing IFLT, IF-FMEA and IF-TOPSIS approaches. International Journal of Quality & Reliability Management.

Ning, Y., Cherian, J., Sial, M. S., Álvarez-Otero, S., Comite, U., & Zia-Ud-Din, M. (2022). Green bond as a new determinant of sustainable green financing, energy efficiency investment, and economic growth: a global perspective. Environmental Science and Pollution Research, 30(22), 61324-61339. https://doi.org/10.1007/s11356-021-18454-7

Nustini, Y., Mohd Suffian, M. T., Zakaria, N. B., Mohd Sanusi, Z., & Wan Mohd Radzi, W. S. (2021). Do Capital Market Training, Online Facilities and Social Environment Matter in Investment Decision. Asia-Pacific Management Accounting Journal, 16(3), 263-303.

Pahlavan, F., Aldagari, S., Park, K.-B., Kim, J.-S., & Fini, E. H. (2023). Bio-Carbon as a Means of Carbon Management in Roads. Advanced Sustainable Systems, 7(6).

Shuhidan, S. M., Said, J., Mokri, S. H., & Kazemian, S. (2016). Market orientation within technological companies: Risk based approach. 2016 3rd International Conference on Computer and Information Sciences (ICCOINS).

Steuer, S., & Tröger, T. H. (2022). The Role of Disclosure in Green Finance. Journal of Financial Regulation, 8(1), 1-50. https://doi.org/10.1093/jfr/fjac001

Taliento, M., Favino, C., & Netti, A. (2019). Impact of Environmental, Social, and Governance Information on Economic Performance: Evidence of a Corporate 'Sustainability Advantage' from Europe. Sustainability, 11(6), 1738.

Wu, S., Li, X., Du, X., & Li, Z. (2022). The Impact of ESG Performance on Firm Value: The Moderating Role of Ownership Structure. Sustainability, 14(21), 14507.

Zahid, R. M. A., Khan, M. K., Anwar, W., & Maqsood, U. S. (2022). The role of audit quality in the ESG-corporate financial performance nexus: Empirical evidence from Western European companies. Borsa Istanbul Review, 22, S200-S212.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2023

Article Doi

eBook ISBN

978-1-80296-130-0

Publisher

European Publisher

Volume

131

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1281

Subjects

Technology advancement, humanities, management, sustainability, business

Cite this article as:

Sitompul, R., Sanusi, Z. M., Alsayegh, M. F., Erum, N., Kazemian, S., & Hitam, M. (2023). Enhancing Green Investment Efficiency Through Audit Quality. In J. Said, D. Daud, N. Erum, N. B. Zakaria, S. Zolkaflil, & N. Yahya (Eds.), Building a Sustainable Future: Fostering Synergy Between Technology, Business and Humanity, vol 131. European Proceedings of Social and Behavioural Sciences (pp. 1260-1269). European Publisher. https://doi.org/10.15405/epsbs.2023.11.100