Abstract

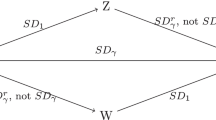

Farinelli and Tibiletti (F–T) ratio, a general risk-reward performance measurement ratio, is popular due to its simplicity and yet generality that both Omega ratio and upside potential ratio are its special cases. The F–T ratios are ratios of average gains to average losses with respect to a target, each raised by a power index, p and q. In this paper, we establish the consistency of F–T ratios with any nonnegative values p and q with respect to first-order stochastic dominance. Second-order stochastic dominance does not lead to F–T ratios with any nonnegative values p and q, but can lead to F–T dominance with any \(p<1\) and \(q\ge 1\). Furthermore, higher-order stochastic dominance (\(n\ge 3\)) leads to F–T dominance with any \(p<1\) and \(q\ge n-1\). We also find that when the variables being compared belong to the same location-scale family or the same linear combination of location-scale families, we can get the necessary relationship between the stochastic dominance with the F–T ratio after imposing some conditions on the means. There are many advantages of using the F–T ratio over other measures, and academics and practitioners can benefit by using the theory we developed in this paper. For example, the F–T ratio can be used to detect whether there is any arbitrage opportunity in the market, whether there is any anomaly in the market, whether the market is efficient, whether there is any preference of any higher-order moment in the market, and whether there is any higher-order stochastic dominance in the market. Thus, our findings enable academics and practitioners to draw better decision in their analysis.

Similar content being viewed by others

Notes

Levy (2015) denotes it as RSSD while we denote it as RSD.

References

Balder, S., and N. Schweizer. 2017. Risk aversion vs. the Omega ratio: Consistency results. Finance Research Letters 21: 78–84.

Bertrand, P., and J.L. Prigent. 2011. Omega performance measure and portfolio insurance. Journal of Banking and Finance 35 (7): 1811–1823.

Caporin, M., M. Costola, G.M. Jannin, and B.B. Maillet. 2018. On the (Ab)Use of Omega? Journal of Empirical Finance 46: 11–33.

Caporin, M., G.M. Jannin, F. Lisi, and B.B. Maillet. 2014. A survey on the four families of performance measures. Journal of Economic Survey 28 (5): 917–942.

Eeckhoudt, L., H. Schlesinger, and I. Tsetlin. 2009. Apportioning of risks via stochastic dominance. Journal of Economic Theory 144 (3): 994–1003.

Eling, M., and F. Schuhmacher. 2007. Does the choice of performance measure influence the evaluation of hedge funds? Journal of Banking & Finance 31 (9): 2632–2647.

Farinelli, S., M. Ferreira, D. Rossello, M. Thoeny, and L. Tibiletti. 2009. Optimal asset allocation aid system: From ‘one-size’ vs ‘taylor-made’ performance ratio. European Journal of Operational Research 192: 209–215.

Farinelli, S., and L. Tibiletti. 2008. Sharpe thinking in asset ranking with onesided measures. European Journal of Operational Research 185 (3): 1542–1547.

Fishburn, P.C. 1977. Mean-risk analysis with risk associated with below target returns. American Economic Review 67: 116–126.

Fong, W.M. 2016. Stochastic dominance and the Omega ratio. Finance Research Letters 17: 7–9.

Gomes, P., and A. Taamouti. 2016. In search of the determinants of international asset market comovements. International Review of Economics and Finance 44: 103–117.

Guo, X., R.H. Chan, W.K. Wong, and L.X. Zhu. 2018. Mean-variance, Mean-VaR, Mean-CVaR models for portfolio selection with background risk. Risk Management. https://doi.org/10.1057/s41283-018-0043-2.

Guo, X., X.J. Jiang, and W.K. Wong. 2017. Stochastic dominance and omega ratio: measures to examine market efficiency and anomaly. Economies 5 (4): 38.

Guo, X., and W.K. Wong. 2016. Multivariate stochastic dominance for risk averters and risk seekers. RAIRO: Operations Research 50 (3): 575–586.

Hanoch, G., and H. Levy. 1969. The efficiency analysis of choices involving risk. Review of Economic Studies 36: 335–346.

Homm, U., and C. Pigorsch. 2012. Beyond the Sharpe ratio: An application of the Aumann–Serrano index to performance measurement. Journal of Banking and Finance 36: 2274–2284.

Kaplan, P.D., and J.A. Knowles. 2004. Kappa: A generalized downside risk-adjusted performance measure. Journal of Performance Measurement 8 (3): 42–54.

Keating, C., and W.F. Shadwick. 2002. A universal performance measure. Journal of Performance Measurement 6 (3): 59–84.

Leitner, J. 2005. A short note on second-order stochastic dominance preserving coherent risk measures. Mathematical Finance 15 (4): 649–651.

Leon, A., and M. Moreno. 2017. One-sided performance measures under Gram-Charlier distributions. Journal of Banking and Finance 74: 38–50.

Leung, P.L., and W.K. Wong. 2008. On testing the equality of the multiple Sharpe Ratios, with application on the evaluation of iShares. Journal of Risk 10 (3): 1–16.

Levy, H. 2015. Stochastic dominance: investment decision making under uncertainty, 3rd ed. New York: Springer.

Li, C.K., and W.K. Wong. 1999. Extension of stochastic dominance theory to random variables. RAIRO: Operations Research 33 (4): 509–524.

Müller, A., and D. Stoyan. 2002. Comparison methods for stochastic models and risks. New York: Wiley.

Ma, C., and W.K. Wong. 2010. Stochastic dominance and risk measure: A decision-theoretic foundation for VaR and C-VaR. European Journal of Operational Research 207 (2): 927–935.

Markowitz, H.M. 1952. The utility of wealth. Journal of Political Economy 60: 151–156.

Markowitz, H.M. 1959. Portfolio Selection. New York: Wiley.

Markowitz, H.M. 1987. Mean-variance analysis in portfolio choice and capital markets. Oxford: Blackwell.

Meyer, T.O., X.M. Li, and L.C. Rose. 2005. Comparing mean variance tests with stochastic dominance tests when assessing international portfolio diversification benefits. Financial Services Review 14 (2): 149–168.

Niu, C.Z., W.K. Wong, and Q.F. Xu. 2017. Kappa ratios and (higher-order) stochastic dominance. Risk Management 19 (3): 245–253.

Niu, C.Z., X. Guo, M. McAleer, and W.K. Wong. 2018. Theory and application of an economic performance measure of risk. International Review of Economics and Finance 56: 383–396.

Ogryczak, W., and R. Ruszczyński. 1999. From stochastic dominance to mean-risk models: semideviations as risk measures. European Journal of Operational Research 116: 33–50.

Ogryczak, W., and R. Ruszczyński. 2001. On consistency of stochastic dominance and mean-semideviation models. Mathematical Programming, Series B 89: 217–232.

Ogryczak, W., and A. Ruszczyński. 2002. Dual stochastic dominance and related mean-risk models. SIAM Journal of Optimization 13: 60–78.

Sharpe, W.F. 1966. Mutual fund performance. Journal of Business 39 (1): 119–138.

Sortino, F., R. Van Der Meer, and A. Plantinga. 1999. Journal of Portfolio Management 26 (I Fall): 50–58.

Sriboonchitta, S., W.K. Wong, D. Dhompongsa, and H.T. Nguyen. 2009. Stochastic dominance and applications to finance, risk and economics. Boca Raton: Chapman and Hall.

Tehranian, H. 1980. Empirical studies in portfolio performance using higher degrees of stochastic dominance. Journal of Finance 35 (1): 159–171.

Wong, W.K. 2007. Stochastic dominance and mean-variance measures of profit and loss for business planning and investment. European Journal of Operational Research 182: 829–843.

Zakamouline, V., and S. Koekebakker. 2009. Portfolio performance evaluation with generalized Sharpe ratios: beyond the mean and variance. Journal of Banking and Finance 33: 1242–1254.

Acknowledgements

The authors are grateful to the Editor-in-Chief, Igor Lončarski, the associate editor, and two anonymous referees for substantive comments that have significantly improved this manuscript. The third author would like to thank Robert B. Miller and Howard E. Thompson for their continuous guidance and encouragement. This research has been partially supported by grants from National Natural Science Foundation of China NSFC (11701034, 11601227, 71602089), National Social Science Fund of China (NSSFC-16BTJ013, NSSFC-16ZDA010), Sichuan Social Science Fund (SC14B091), Sichuan Project of Science and Technology (2016JY0273), the Natural and Social Science Foundation of Jiangsu Province (BK20160785 and 16GLC001), Asia University, China Medical University Hospital, The Hang Seng University of Hong Kong, the Research Grants Council of Hong Kong (Project No. 12500915), and Ministry of Science and Technology (MOST, Project Nos. 106-2410-H-468-002 and 107-2410-H-468-002-MY3), Taiwan.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Guo, X., Niu, C. & Wong, WK. Farinelli and Tibiletti ratio and stochastic dominance. Risk Manag 21, 201–213 (2019). https://doi.org/10.1057/s41283-019-00050-2

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41283-019-00050-2

Keywords

- First-order stochastic dominance

- High-order stochastic dominance

- Upside potential ratio

- Farinelli and Tibiletti ratio

- Risk measures