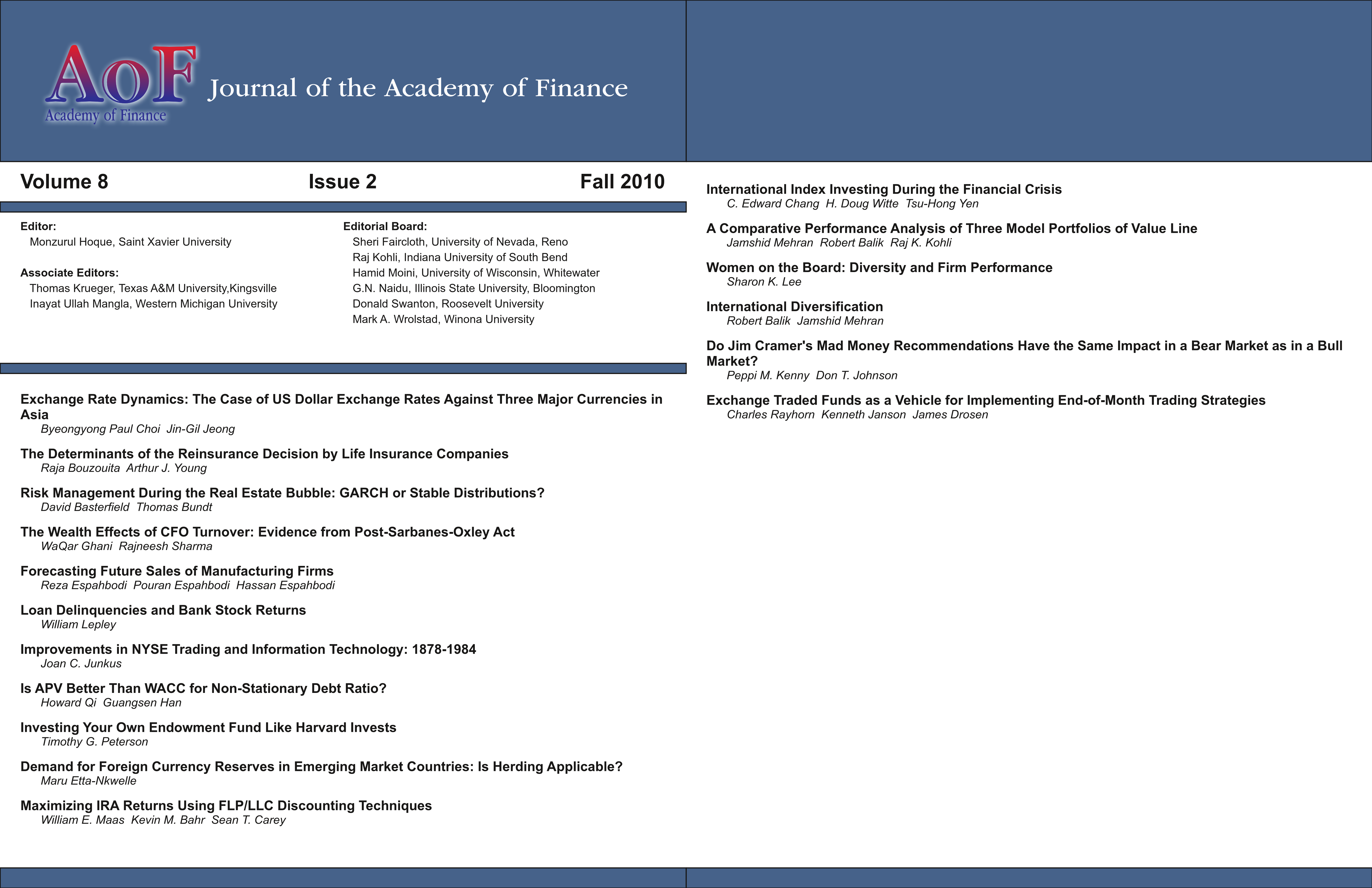

Improvements in NYSE Trading and Information Technology: 1878-1984

DOI:

https://doi.org/10.58886/jfi.v8i2.2338Abstract

Improvements in the technology of information flow and execution/clearing at the New York Stock Exchange between 1878 and 1984 were examined for their effects on price volatility and trading volume. Overall, price volatility was found to decrease after an improvement in trading technology, while both volume and intra-day volatility increased after an improvement in information flow. Noise traders may be attracted by faster information flow, even in the absence of new information, and bring additional volatility to the market. Solutions to the problem of such noise traders might involve increasing the ease of trading, and thus liquidity, to dampen price volatility.

Downloads

Published

2010-12-31

How to Cite

Junkus, Joan. 2010. “Improvements in NYSE Trading and Information Technology: 1878-1984”. Journal of Finance Issues 8 (2):66-78. https://doi.org/10.58886/jfi.v8i2.2338.

Issue

Section

Original Article