Abstract

For the last 500 years, the West has mapped Africa as a source of raw materials, disrupted vibrant African value addition, and arrogated itself as the place where industrial revolutions (value addition) happen. This strategy is clearly traceable from the transatlantic slave trade, continuing through European colonialism, to the current critical raw materials (CRMs) framing necessary for its digital and climate tech dominance. African countries have realized that continuing to export materials raw is an unsustainable path of dependency. Emphasis is now on value addition, which is the norm in everyday life, rendered informal, marginal, even illegal under colonialism and never revisited, recentered, and formalized after independence. This article takes minerals as an example of indigenous value addition and how the transatlantic slave trade and colonial rule destroyed it and inserted in its place extractive infrastructures of CRMs export that have remained intact since independence. The last half of the essay switches to Africa’s pivot to value addition, zeroing in on Zimbabwe and the Democratic Republic of the Congo as case studies, focusing on chrome, cobalt, and lithium. These minerals constitute the basis for the electric vehicle, smartphone, lithium-ion battery, semiconductor, and other electronic manufacturing to supply the newly created African Continental Free Trade Area, an internal market of 1.3 billion people. The article ends with a discussion of four major challenges to value addition—energy, finance, markets, and skills—and how Africa is meeting and could meet them. The reader is invited to consider the implications of a world order in which Africa is no longer exporting its materials raw, but becomes the center of global manufacturing, adding value to its own materials.

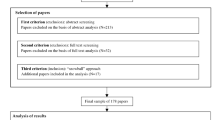

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The article proposes that, from a mineral materials perspective, a shift is underway from a colonial economy where Europe’s African colonies were created and maintained for the sole purpose of extracting and shipping its raw materials to supply an industrializing Europe’s needs. That dependency system begins with the advent of the transatlantic trade in Africans as slaves in 1502 and the European plantation system in the Americas, continues through European colonialism with the Berlin Colonial Conference of 1884–1885, and undergirds Europe’s mapping of Africa as a source of current critical raw materials (CRMs) framing necessary for its digital and climate tech dominance. That dependency framework is the prism within which concepts such as sustainability, sustainable sourcing, decarbonization, and green must be viewed.

Since 2000, African governments have responded with bans on exporting materials raw to reduce the historical dependence on western-controlled markets, and taking concrete steps to add value to mineral, agricultural, and forest resources to develop internally. The late President of Zimbabwe, Robert Mugabe, captured this sentiment well in an address to the Southern Africa Development Community (SADC) in 2015: “If we remain exporters of raw materials we will never go anywhere while other economies flourish. SADC exports 10% to Europe while Asian countries export some 27%,” said Mugabe, adding, “Industrialization is now a must.”1 Five years later when telling the Swiss that Ghana would no longer be exporting its cocoa raw, Ghanaian President Nana Akufo-Addo said, “There can be no future prosperity for the Ghanaian people in the short, medium, or long term if we continue to maintain economic structures that are dependent on the production and export of raw materials.”2

In How Europe Underdeveloped Africa,3 the Guyanese pan-Africanist scholar Walter Rodney traced the origins of dependency from slavery through the colonial moment to its enduring and continuing neocolonial legacies after independence. This article will show equally not only that climate and sustainability (especially the emphasis on “sustainable sourcing”) is its latest iteration, but also that Africa’s moves toward value addition (beneficiation) mark the latest of a continuing struggle toward which anticolonial struggles were waged. In the slave trade, Europe fomented and capitalized on divide and rule to extract and extrude the continent’s raw materials to add value overseas, and whereas efforts at local value addition were stymied by external competition and market dynamics outside Africa’s reach and unfair terms imposed under bilateral treaties or World Trade Organization (WTO) rules, the African Continental Free Trade Area (AfCFTA) creates a free trade area of 1.3 billion people through rules agreed mutually among member states.

From a policy and planning perspective, countries and corporations used to cheap raw materials from Africa will have to deal with a continent adding its own values to its resources not just for export but for its free trade area, principally with Chinese loans and investors. From an African standpoint, this entails taking a long view beyond turning ore into metal or concentrate, or creating parts of things, but designing and making finished goods and the machinery and equipment to manufacture them.

A brief history of African value addition: An indigenous, everyday perspective

Africans are no strangers to value addition; it is the norm in everyday life, creative resilience rendered informal, marginal, even illegal under colonialism and never revisited, recentered, and formalized after independence. Policymakers acknowledge the informal sector’s economic importance, but not its value-adding activities, which the state continues to informalize and even criminalize just as the colonial state did, while corporate mining and foreign direct investment (FDI) are feted as “the formal sector.” Terms such as “artisanal” mining and “panning” (kukorokoza in Zimbabwe) are used to criminalize the practice, thus foreclosing opportunities to productively and intellectually engage with its creative resilience (i.e., creative anchoring practices undertaken against impossible conditions).

Hence, the appeal to history. The beginnings of African value addition to iron, copper, gold, and tin have been dated from 1000 BCE onward.4 Metalworkers made forges and furnaces out of antelope hide, wood, calabashes, bamboos, and clay to turn ore into gold, iron, and copper bars. They worked these bars with anvil, hammer, file, pliers, and goat skin bellows into finished articles, including joining these metallic parts with complementary ones made from wood, leather, clay, etc., to make hoes, axes, spears, arrowheads, musical instruments, etc. (See Figure 1).

The high carbon iron was so strong that it outcompeted the inferior product Europeans were bringing, which had high sulfur content and was brittle. For example, a Portuguese foundry established in the 1750s to transfer European iron-making techniques into the Kongo (specifically present-day Angola) failed and wound up contracting local blacksmiths, who sustained it using indigenous techniques not only of ironmaking, but also making charcoal with just the right carbon content smelting strong metal.5 It was not until after 1700 that Europe transitioned from wood fuel- to coal-processed iron that, except high-grade coking coal, had high sulfur content—a poor substitute for the carbon-steel or pure iron bloom, and certainly no match for iron produced in the African smith’s carefully managed furnaces.6

The gradual decline of African iron mining and smelting industries was not simply a result of cheaper and purer iron bars imported from Europe as some western scholars7 suggested, but the gradual decline of firewood sources for African metallurgy, household energy, and farming-related land clearance. Furnaces were sited based on availability of ore, fuel, water, and suitable materials for constructing the furnace. For instance, the placement of air inlet nozzles in the furnace allowed preheating of the airflow, and “constituted a significant technological innovation unique to African industries, with the smelted product being an intentional steel.” Only in the mid-18th century was the technique of preheating the air blast patented in Britain “as higher temperatures produced more complete combustion, raised the potential furnace temperatures, speeded up and, therefore, increased production,” saving fuel in the process.5,6,8 Africa was already doing that for over two millennia. Did Europe get the technique from African smiths either on the continent or diaspora? Highly likely, if one looks at the Portuguese experience, and considering the process started in Britain after, not before, sustained contact with Africans.

Whereas European and American iron industries transitioned to coal in the mid-18th century, Africa did not. The charring process required not just any charcoal from any tree, but specifically “a slow-burning, dense, hard wood,” that Europeans later found to contain high alkali and silica content and a granular structure ensuring the packed charcoal’s permeability in the charge.6 Selecting such trees, preparing the charcoal, and deploying it as a fuel was a specialized, skillful, spiritual, and intellectual process of deploying energy systems to add value to materials. Charring was carried out in a large cross-shaped trench, with dry twigs, leaves, and palm kernel shells or nuts placed at the bottom, then the green logs, covered with wet soil, then set on fire through the four ends of the trench. After four to eight days, the heap collapsed, signaling the completion of the charring process.6

How the West created Africa’s raw material export dependency

The advent of the transatlantic slave trade from 1502 initiated a trend whereby the West mapped Africa as a source of raw materials to feed its own growth through a monopoly of high-end value addition. Helped by some greedy African rulers that it plied with firearms and its other value-added products, Europe started ripping out African energy and brains (~12 million of them during the trade alone) and exporting them as human machines to the Americas to produce raw materials that fed Europe’s industrial revolution (Figure 2). Africa was divided into spheres of slave raiding and trading between Britain, Portugal, France, Spain, Denmark, and The Netherlands, principally on the western coast of Africa between Senegal in the north and Angola to the south, and on the southeast coast from Zanzibar to Maputo.3,9

Long before Operation Paper ClipFootnote 1 and other subsequent skills transfer through voluntary and forced, covert and overt immigration, there was the transatlantic trade in African experts into slavery to staff areas strategic to Europe’s American empire (see Figure 2). Besides their labor value, Africans were enslaved because of their value addition skill and experience. One of the regions affected was the Kongo region, famed for its ironsmiths, a transnational area that provides the world’s vast array of strategic minerals. Ironsmiths were specifically targeted for enslavement from the Kongo to engineer wood into charcoal to fire sugar mills and to smelt ore into iron, for example at Clifton Forge (Virginia), Winkle Village (Guyana), Morant Bay (Jamaica), and in the Paraíba Valley (southeastern Brazil). Enslaved Africans introduced the hoe, a product of the African mining and metallurgical traditions of the ancestors back in Africa, to the Americas, complete with its cosmologies.5,10,11,12

With the development of the steam engine, Europe switched to enslaving Africans in Africa itself and applying their energy and intellect to mine raw materials to feed the continent’s thirsty emerging industries. The result was the colonial occupation of Africa under rules of territorial partition agreed to among European countries at the Berlin Colonial Conference of 1884–1885. The outward-facing roads, railways, and ports were designed to extrude Africa’s minerals raw to feed Europe’s industrial revolution and bring in the finished products of Europe’s factories (Figure 3a–b).

Europe also built its raw material extraction and local value addition, at least in the settler colonies of the Union of South Africa (South Africa) and the two Rhodesias (Zimbabwe and Zambia), not only on Africans as migrant labor, but principally on unacknowledged African intellect and technology. Virtually all gold, iron, and copper mines in colonial south-central Africa were located in the same areas that Africans were previously or still actively mining. Examples include Kwekwe (Zimbabwe), Musina and Phalaborwa (South Africa), and Katanga (DRC). They also relied largely on firewood and African wood and charcoal-making expertise, even after coal came into use.13,14,15,16

By 1910, Southern Rhodesia had the region’s largest known deposits of high-grade coking coal, in Hwange (Wankie). Under a charter granted by the British monarchy on December 20, 1889, a start-up company called the British South Africa Company (BSAC) colonized a vast territory astride the Zambezi (Northern Rhodesia, Southern Rhodesia). In 1885, King Leopold of Belgium had carved out a personal empire, the Congo Free State (CFS), whose southern province, Katanga, had limitless deposits of copper and cobalt. In 1908, CFS became the Belgian Congo as ownership shifted to the Belgian state. Meanwhile, the Portuguese completed the annexation of Angola and Portuguese East Africa (PEA), on the west and east coasts of southern Africa, respectively. Katanga needed Wankie’s coal; Rhodesia and PEA (under the Companhia de Moçambique) needed Katanga’s copper business on their railroads and ports, respectively).16

The relationship between materials location and extraction (copper, cobalt, in Katanga), energy (coal at Wankie), and transport (railroad owned by Rhodesia, and shipping and ports of Beira, Mozambique), overseas value addition, machinery, and equipment (Europe and the United States) becomes clear. In 1906, BSAC partnered with Belgian capitalists to found Union Minière du Haut Katanga, which obtained a charter from King Leopold II to mine copper and cobalt in Katanga province until 1990. In return for the supply of Wankie coal, BSAC secured rights to ship Katanga’s copper and cobalt on its 1600-mile railway line to Beira, in Portuguese territory).17 Despite having shorter options via Benguela, the 1906 agreement bound Union Minière to the Beira route and Wankie coal throughout the colonial period).18,19 BSAC itself administered two landlocked colonies, and needed the Companhia to find an outlet for its railway traffic to the sea and global markets; Companhia of course needed the rail shipping business).20

Today, Africa continues to export its minerals raw to North America, Europe, Asia, and Australia. From Europe and North America, the position of Africa as a supplier of critical raw materials (CRMs) is codified into policy. CRM is not simply a cliché. It refers to minerals that Europe and the United States deem critical to their national security and economic development that are prone to supply chain disruption. Three of them, chrome, cobalt, and lithium, have been discussed. The European Green Deal for carbon neutrality by 2050 depends on a transition to clean energy; to do so, the EU must secure access to raw materials it does not produce on home soil. Biden’s Build Back Better is premised on similar lines. The raw materials needed for renewable energy (green) technologies are usually extracted and processed using unsustainable coal-fired, hydro-, and solar-powered methods and slave-level labor conditions.21 The EU has scoped out Africa as a source of CRMs and as a market for its climate tech (so-called “breakthrough green technology innovations”) which will, over time, replace natural carbon sinks (trees) and become mechanisms for monopoly capitalist control of the atmosphere, just as outer space. Approximately 35% of the budget of Horizon Europe, the EU’s €95.5 billion (USD$113.5 billion) research and innovation fund (2021–2027), is going into climate research to achieve just that.22

From raw exports to value addition: Zimbabwe and the Democratic Republic of the Congo

Zimbabwe and the Democratic Republic of the Congo (DRC) make sense as case studies because they are the source of some of the major minerals on the EU and US CRM list. Zimbabwe is under de facto sanctions from the United States and its western allies and can only access funding from China, whose role in Africa is most pronounced in Zimbabwe’s steel, lithium, and energy sectors. The irony is that the United States has imposed sanctions on a country rich in minerals it deems critical to its national security and economy, especially in the context of climate and tech industry.

DRC is interesting because it is moving into the manufacture of precursor materials to lithium-ion battery manufacturing, and there is already talk of exceeding that to make the batteries themselves. The discussion in this section scaffolds into a wider one of electric vehicle, smartphone, and lithium-ion battery manufacturing on the continent itself to serve an African Continental Free Trade Area of 1.3 billion people.

Case study #1: Zimbabwe

In 2019, the Government of Zimbabwe set an ambitious target of turning its mining sector into a USD$12 billion industry by 2023. Lithium alone would contribute USD$500 million a year, up from a mere USD$2 million in 2017.23 Gold is projected to contribute USD$4 billion, platinum USD$3 billion, PGMs (platinum group of minerals) USD$3 billion, and chrome, iron, steel, diamonds, and coal USD$1 billion.24 This section discusses chrome, iron, and steel and lithium only.

Chrome, iron, and steel

In 2021, Zimbabwe imposed an immediate ban on exports of raw chrome ore, with a follow-up ban on chrome concentrates to take effect in July 2022 to secure the country’s ferrochrome industry through local value addition. After South Africa, Zimbabwe has the world’s second-largest deposits of high-grade chromium ore at 10 billion tons (or 12% of global total). It produces ~1 million tons per year, 25% of which feeds the domestic ferrochrome industry, the remainder exported mostly to China, where it constitutes 4% of the latter’s imports of 14 million tons per annum. The country has 22 privately owned smelters.

The sector is dominated by Tsingshan Holding Group (China), the world’s biggest stainless-steel company, which also owns the 100,000 ton-per-year (tpy) Afrochine ferrochrome plant at Selous near Chegutu, and a 350,000 tpy coke plant in Hwange. Tsingshan’s subsidiary Zhejiang Dinson Holding Co., Ltd. is building a carbon steel plant, iron ore mine, and 500,000 tpy ferrochrome plant in Kwekwe, Zimbabwe, operated by its subsidiary. This is in addition to Dinson’s existing 150,000 tpy smelters, the 180,000 tpy Zimasco, owned by Sinosteel, a state-owned Chinese comoany, all of which will benefit immensely from the ban.25

Dinson is also building the giant steel manufacturing plant Manhize in Mvuma, second in output size only to ArcelorMittal (South Africa) and Al Ezz Dekheila Steel (Egypt), both 3.2 million tpy, and equal Tembo Steels (Uganda) (see Figure 4). The plant comes decades after the country’s steel plant, ZiscoSteel, stopped production, plunging the country into an importer of all steel and iron products peaking at USD$400 million in 2021. Composed of a carbon and steel plant, an iron ore mine, and a ferrochrome plant, Manhize will open with five furnaces producing ~1.2 million tpy of pig iron and carbon steel, rising to 12 furnaces producing ~2.4 tpy when complete. Initially, Dinson will need 0.5 million tpy of ferrochrome, 1 million of coke from its Hwange coal plant, and 200,000 of nickel (for making stainless steel).26

Lithium

Tsingshan Holding Group is also venturing into lithium value addition, joining three other Shanghai-listed giants, Zhejiang Huayou Cobalt, Sinomine Resource Group, and Chengxin Lithium Group.27 Tsingshan’s agreement commits lithium mining and processing operations.28 Zhejiang Huayou Cobalt’s holding company Prospect Lithium Zimbabwe owns the Arcadia lithium mine in Goromonzi, which has 15.8 million tons worth of measured lithium resources, 11.8 million of them proven. The plant is composed of a 4.5 tpy lithium mine and 400,000 tpy lithium concentrator.23 In December 2022, the government followed up with a ban on the export of unbeneficiated lithium; therefore, only lithium would be allowed.27

Case study #2: The DRC

Cobalt: Precursor material

The moves underway in Zimbabwe’s chrome, steel, and lithium sectors mirror closely developments in the cobalt sector in the DRC, which supplies two-thirds of the world’s cobalt, one of the critical components in rechargeable batteries that power our smartphones, laptops, and electric vehicles.

In 2021, DRC banned the export of copper and cobalt concentrate, from which it gets just 3% from the battery and electric vehicle value chain it feeds. The electric vehicle market will be worth a whopping USD$7 trillion by 2030, and USD$46 trillion by 2050. DRC’s Deputy Prime Minister Eve Bazaiba told delegates at COP26 in Glasgow: “Cobalt cannot be exported, transformed, and manufactured into batteries outside the country, while we are reduced to selling our teeth to afford a green vehicle.” Some 100,000 cobalt miners slave away in small mines in remote parts of DRC in dangerous and toxic conditions and deliver the mineral to one single corporation, Congo DongFang International Mining, a subsidiary of Chinese cobalt giant, Zhejiang Huayou Cobalt, which supplies the globe’s biggest lithium-ion battery makers.29,30,31,32

As a bridging mechanism, a 2021 BloombergNEF report suggested the localization of precursor material—the intermediate material between raw and finished cathode material—manufacturing. Cost-wise it makes sense: a 10,000 metric-ton battery cathode precursor plant can be built for USD$39 million, three times cheaper than in the United States and China, with 30% less carbon footprint. Still, the report’s framework considered only basic value addition in DRC while limiting manufacturing of the more profitable cathode material and cell production to Poland, and battery assembly to Germany.29

Nonetheless, battery precursor materials (a USD$271 billion industry) can potentially become the scaffold toward the USD$1.4 trillion cell production and assembly industry. Even the furnaces, turbines, and photovoltaic cells that turn coal, water, heat, and solar energy into electricity could end up being made in Africa. To this end, the South African businessman Nechan Naicker founded Megamillion Energy Company, the continent’s first large-scale producer of lithium-ion batteries, starting with a 20,000 m2 pilot plant in the Eastern Cape and working toward a ~10 million lithium-ion cells-per-year capacity by 2028 based on nickel-manganese-cobalt (NMC) chemistry.

Where colonial governments had created horizontally integrated cobalt, coking coal, transportation, and market networks for the purpose of exporting Africa’s materials raw, the AfCFTA potentially inverts horizontal integration to stimulate intra-Africa value addition to feed an internal market. For example, lithium-ion battery-making value chains joining cobalt in DRC, manganese in South Africa and Madagascar, copper in Zambia, graphite in Mozambique and Tanzania, phosphate in Morocco, and lithium in Zimbabwe. It can be powered by an equally horizontally integrated power pool bringing together hydroelectricity generated at Grand Inga in DRC (40–70 GW), solar and wind in North Africa, Sahel, and South Africa, and geothermal energy in East Africa.

Value addition beyond concentrates: Toward finished products

Africa is starting to move from processing ore into concentrate to finished products. Although rapid diagnostic (chromatographic immunoassay) medical test kit manufacturing is yet to become more than an interesting research topic, and electric vehicle manufacturing is a longer-term ambition, smartphone and solar panel manufacturing are already being done by Africans abroad or on the continent. In 2019, Jean Mongu Bele, a DRC nation resident in Boston, Mass., created the Okapi Mobile brand of smartphones, drawing inspiration from his African roots (see Figure 5). The Okapi is an animal unique to and a symbol of Congolese heritage. For Bele, the reason for Okapi Mobile was to “bring pride to Africa and further develop the continent’s capabilities in production and technology,” including conducting the design research and user experience (UX) in Africa itself as opposed to doing so only in America, Europe, or China, and then exporting finished products. The emerging product has high dust and water tolerance, facial recognition and fingerprint detection sensitive to black people’s bodily features, and creates more employment in DRC and Africa. Okapi is one of the companies already focusing on assembling and manufacturing Okapi in Congo.33

Source: https://okapimobile.com/shop/okapi-10/. Accessed 25 Jan 2023.

The Okapi Mobile.

To be fair, smartphone manufacturing has been going on in Africa since 2008, when the Chinese technology firm A-Link established a USD$500,000 assembly plant in Rwanda to produce a USD$39 GSM handset with replaceable SIM.34 In 2009, M-mobile Telecommunications Zambia limited (M-Tech) opened a USD$10 million manufacturing plant with a daily output of 1000 handsets.35

However, African-owned and led initiatives like Okapi and similar ones on African soil indicate a new phenomenon that may grow with AfCFTA and better engagement with the diaspora as technology transferers and investors. For example, in 2019, the Ashish Thakkar-owned Dubai-based Mara Group started making its Mara Phone in Kigali, capital of DRC’s eastern neighbor, Rwanda. Unlike previous phones built with imported parts, Mara’s “entire manufacturing process, from the motherboard all the way to the packaging of the phone is done in our newly opened factory,” its country director Eddy Sebera said. Mara has recently been bought by a consortium composed of its local managing director Sylvester Taku, Mabuti Radebe, Lebashe Investment Group, and MPSA Projects. In November 2021, it signed a deal with Angola’s MISALEI- Comércio e Prestação de Serviços, to distribute its phone in that country. There is huge scope for horizontal linkages between coltan in DRC, mica in Madagascar, and platinum, gold, and bauxite in South Africa and Ghana, to mention just a few.21,36,37,38,39,40,41

Two examples of nanotechnology and semiconductor manufacturing are worth mentioning. In 1984, South African firm South African Micro Electronic Systems (SAMES) established a manufacturing plant at Koedoespoort, east of Pretoria in the 1980s, which stopped production in 2009 after 25 years due to Chinese competition.42 In 2021, Kenya launched its first nanotechnology and semiconductor manufacturing plant at the Dedan Kimathi University of Technology’s Science and Technology Park (DoST-Park) in Nyeri County. Called Semiconductor Technologies Limited (STL), this is a public–private partnership to produce integrated circuits, sensors, and related nanotechnology products under its “Buy Kenya, Build Kenya” initiative to turn Kenya into an industrialized nation.43

The final example is solar panel manufacturing and comes from West Africa. In 2016, Francis Boateng established the first solar panel manufacturing factory in Ghana for USD$50 million. It started with a capacity of 32 MW and has been expanding to 150 MW since. Other local manufacturers include ARTsolar of South Africa and Solinc East Africa (Kenya).34 In 2020, Burkina Faso also commissioned its own 30-MW solar panel production and assembly plant, Faso Energy, in the Kossodo industrial zone on the northern outskirts of Ouagadougou.44

Challenges to value addition and how they are being met

This article ends with a discussion of four major challenges to value addition—energy, finance, markets, and skills—and how Africa is meeting and could meet them.

Energy

Zimbabwe best illustrates the tension between value addition and its energy demands in Africa. Similar to almost every country in Africa, it is facing load shedding because demand is far outstripping supply. Breakdowns due to aging, dwindling water levels, a rapid electrification that increased demand without concomitant generating capacity expansion, aging equipment and constant breakdowns, lack of (significant) investment in generating capacity, and overreliance on hydro-monoculture of electrical energy. Current peak demand is ~1700 MW, while at maximum Zimbabwe can only generate 1200 MW at Kariba hydroelectric power station. Upgrades at the coal-fired Hwange Power Station will add 600 MW in the next two years.45,46 The selling price of electricity (2–3 cents per kWH) are lower than the 11 cents per kWH it costs for ZESA to produce it, which subsidizes the consumer and reduces ZESA to a social welfare, loss-making, and loan-dependent organization. It turns off investors. Meanwhile, the power utility is owed USD$1.5 billion in default arrears by consumers.47,48

In response to the national grid supply constraint, mining and processing plants are developing their own independent power supply. These are the major projects:

Company | Location | Capacity (MW) | Cost | Installer |

|---|---|---|---|---|

Zimplats | Ngezi concentrator | 85 | USD$201 million | DPA (Cassava Smartech) |

Karo Mining | Selous | 300 | USD$391 million | Undisclosed |

RioZim | Cam & Motor, Renco, Dalny, Murowa | 180 | Undisclosed | Rio Energy |

Tsingshan | Manhize | 300 | Undisclosed | TBEA |

Environmental

The increasing mining and processing activity produces significant toxic emissions, principally hydrogen sulfide (H2S), sulfur dioxide (SO2), carbon dioxide (CO2), carbon monoxide (CO), radon, and particulate matter (PM) 1, 2.5, and 10. In addition, the tailings, runoff, effluent, and chemicals used in mining and value addition have already caused serious environmental damage in countries such as Zimbabwe. The cyanide, mercury, and toxic wastewater, sludge, and rock in dumps and tailings left on rivers kill aquatic life, livestock, and wild animals and lay to waste the livelihoods of already impoverished communities. Cancers, tuberculosis, and other chemical pollution-related diseases are on the rise.50,51

This is in addition to the massive displacement by governments whenever minerals, oil, and gas have been discovered in an area, raising discontent toward so-called “development.” In Africa, foreign direct investment is a partnership between big corporations and government, at the exclusion of, even against, the people. Especially for strategic and precious minerals, the land designated a mine is cordoned off and operates in a veil of secrecy, completely beyond reach of communities being poisoned by its solid, liquid, and gaseous state emissions. Such companies get away with environmental practices they would never even contemplate back home. Ironically, these same companies post magnificent Climate and Sustainability policies on their websites while using slave and child labor to extract coltan, cobalt, gold, lithium, mica, and silica in DRC and Madagascar.52,53 In dismissing the suit, US District Judge Carl J. Nichols stated that “plaintiffs must have standing to bring their claims, but here they do not: the harm they allege is not traceable to any defendant.”54 In effect, communities have no recourse against the big companies, or the means to hold them accountable. Meanwhile, taking advantage of historic anti-colonial ties, Chinese companies enjoy the patronage of the state, often at the expense of citizens. Governments that take Chinese loans, especially when they have no other options, are either afraid or pay no attention to Chinese companies that violate national environmental laws.55,56

Financing

Because of US sanctions and accumulating debts, Zimbabwe does not have any access to the major lending institutions such as the IMF and World Bank. It has had to short-term finance construction of roads, dam, energy, and other critical infrastructure, and borrow whatever China spares. The 2022 infrastructure allocation, constituting 18% of the budget, shows that Harare is doubling down, not slowing, its commitment to infrastructure. To adequately finance its infrastructure update, Zimbabwe needs USD$40 billion in the next five years.57

Zimbabwe is not among China’s biggest debtors, but it is the biggest source of funding and investment open to Zimbabwe. From 2000 to 2020 alone, China loaned USD$159.9 billion to Africa, ~USD$2.7 billion of it to Zimbabwe, two facilities of USD$997.7 million and USD$390.5 million are the Kariba (hydro) and Hwange (coal-powered) electricity projects funded by China Export–Import Bank.58

Akinwumi Adesina, African Development Bank (AfDB) president, speaking during a visit to Zimbabwe in 2022, advised Zimbabwe and other African countries to tap into pension and the sovereign wealth funds whose assets stand at ~USD$2.1 trillion and could treat infrastructure as an asset class. The only caution he stressed was for governments to read the fine print very closely, negotiate wisely, and utilize the bank’s African Legal Support Facility when negotiating debt, investments, concessions, and interest rates.59

Markets

Up until 2019, foreign competition and the lack of a sizable pan-African market was a huge impediment to local value addition. We saw early on how Africa’s road and rail infrastructure was created to siphon out raw materials to feed Europe’s industries, and not to integrate Africa into a common market. The launch of the African Continental Free Trade Area (AfCFTA) on January 1, 2021, bridges that gap (see Figure 6). Headquartered in Ghana, it is second in size only to the World Trade Organization, the largest in surface area and population (1.3 billion people). It seeks to increase intra-African trade 52% by 2022 and generate USD$450 billion in income by 2035. The free trade area comes at a time of rapid road and rail construction that links Africa internally where colonial infrastructures were raw material syphons.60,61

Tapping into emerging and future road and rail networks, the AfCFTA makes possible horizontal intra-African integration of production centers, value-adding nodes, labor resources, and a vast market. The Trans-Africa Highways system, composed of existing and new stretches of road, often flanked by rail, financed mostly through barter deals with China, the AfDB, World Bank, China Export–Import Bank, European Investment Bank, and other financial institutions (see Figure 7). It is the first serious integration of Africa through physical infrastructures critical to trans-Africa value addition.

Meanwhile, sector specific protocols and structures are being put it place. In 2009, the African Union (AU) Heads of State and Government adopted the African Mining Vision (AMV) to ensure that the continent’s natural resources benefit its citizens through local value addition. The minerals would “serve as a catalyst for accelerated industrialization through mineral value-addition”62 and attract partnerships based on respect and mutual benefits. The African Union with its Africa Mining Vision (AMV): to promote more local processing, value addition, and resource-driven industrialization, which could restrict the export of raw materials.36 In 2014, the African Minerals Development Centre (AMDC) was set up to take action on the AMV objective of value addition at point of production or extraction.63

All these pan-continental bodies position Africa to coordinate action as one formidable bloc, adding value to its resources, bargaining as a single market, production base and political power, among other dividends of unity. Being a fractious continent has allowed both big countries and blocs to bully single African countries into unfair terms of trade, while lending institutions led by the United States (The World Bank) and the EU (International Monetary Fund) dictate loans with heavy conditions. Imagine if Africa spoke as one bloc of 1.2 billion people!

Skills and data

In conversations with African bureaucrats at the IMF and World Bank in 2018, I was told of three areas where skills are needed concerning how Africa negotiates its deals. The first relates to who negotiates. The Asian, Middle Eastern, and European countries send junior officials—technocrats—to negotiate, and they thoroughly scrutinize everything before recommending to the president for signature. African countries by contrast are represented by a head of state or minister negotiating with a low-ranking official of the IMF and The World Bank or investors, conclude deals, and hand over the document for execution to the bureaucrats, who are either too late or too scared to raise red flags.

Second, African countries negotiate poorly (and individually instead of as one big block) and get subprime value for their resources because they lack accurate geodata and that can’t accurately enumerate the value of their minerals, gas, and oil. By contrast, corporations come to the negotiating table armed with the latest data on the geolocation, quantity, and value of the country’s mineral prospects. One side negotiates blindly and accepts peanuts for the price of a fortune, the other walks away with a fortune for the price of peanuts. The Billion Dollar Map project seeks to level the playing field by data standardization and The World Bank Group’s Billion Dollar Map project to help raise USD$1 billion to map out Africa’s subsurface resources for governments to systematize and publicize the data. Another significant project is The Power of the Mine, a 20-year forecast of the mining sector’s energy demands, which aids forward planning.63,64

Finally, even where data are available, there is urgent need for skills development so that Africans can do the mapping and quantifying work themselves and design-build the equipment and software required to do so. Attracting and retaining appropriately skilled, committed, and able people, and access to affordable capital are the major barriers to industrial mineral value addition. Hence, The World Bank is partnering supporting the Association of African Universities’ African Centers of Excellence to train the next generation of scientists and engineers.63 Of course, the challenge remains the purpose and nature of training, which needs to shift from simply meeting the needs of industry but training “value addition entrepreneurs” who will create the battery-, smartphone-, electric car-, chocolate-making, and other industries on home soil.

Conclusions and implications

In conclusion, Africa’s turn to local value addition is likely to have the following implications:

-

1.

The moves toward local value addition locally will only grow, not decrease.

-

2.

The United States and Europe must plan for a near future in which critical components of its manufacturing industries are made in Africa.

-

3.

China has stolen the march with its financing, investment in, and construction of mining, energy, transport infrastructure, and lately concentrators; it is best placed to partner the continent in value addition.

-

4.

With the AfCFTA market and local value addition, Africa will scale down on finished goods imports.

-

5.

In the meantime, African governments and private sector partners are likely to focus on the import of manufacturing equipment, including machining capacity to localize the manufacturing of the equipment itself.

-

6.

While policies (through normal legislative process, executive orders, or statutory instruments) banning raw exports are being gazetted, effectiveness rests principally on implementation and enforcement.

The call to action is toward a futuristic exploration of a world order in which Africa is no longer an object of Western pity and humanitarianism, exporting its minerals raw, or in a position of external dependency, but the center of global manufacturing, adding value to its own materials. In the near future, science, technology, and innovation policy would have to align with demand for value-adding equipment both as a supply opportunity (as seen from outside Africa) and an industrial design imperative (as seen from Africa). The African diaspora will be a key asset in both strategies. At the same time, all this will depend on the state of security to ensure that the AfCFTA’s primary production, manufacturing, transportation, markets, and financial infrastructure are not hampered by armed conflict.

That makes a continental approach to sustainable value addition critical. Sustainability needs to be built up from the realities, conceived not only as a problem, but a reappraisal and audit of Africa’s historical and cultural trajectories and universes of value addition. By which I mean that any conversation on value addition in Africa must deal with everyday forms of value addition, replaced (informalized) by a Western regime of exporting Africa’s minerals raw and then selling finished goods made from them back to Africa. From there it becomes easier to understand where African energy for value addition is emanating from. Several examples of such value addition have been given, complete with the challenges and how Africa is meeting them.

Notes

Operation Paper Clip was a covert US program between 1945 and 1959 to recruit top German scientists, engineers, and technicians (both Nazi and Jewish) from the former Nazi Germany to staff programs that government deemed important to national security and economic development.

References

“Mugabe Calls for Value Add at SADC Summit,” News24.com (April 29, 2015). https://www.news24.com/Fin24/mugabe-calls-for-value-add-at-sadc-summit-20150429. Accessed 16 Dec 2022

N.A.D. Akufo-Addo, Statements by the President of Ghana (YouTube video, posted February 28, 2020). https://www.youtube.com/watch?v=V328GKQfxRU. Accessed 19 Dec 2022

W. Rodney, How Europe Underdeveloped Africa (Tanzania Publishing House, Dar es Salaam, 1972)

S. Chirikure, Metals in Past Societies. A Global Perspective on Indigenous African Metallurgy (Springer, Cham, 2015)

J. Thornton, Afr. Econ. Hist. 19, 1 (1990–1991)

C.L. Goucher, J. Afr. Hist. 22(2), 179 (1981)

J. Flint, in History of West Africa, vol. 2, ed. by J. Ajayi, M. Crowder (Longman, London, 1974), pp. 387–391

M.-C. Dupré, B. Pinçon, Metallurgie et Politique en Afrique Centrale (Editions Karthala, Paris, 1997)

J.E. Inikori, Africans and the Industrial Revolution in England: A Study in International Trade and Economic Development (Cambridge University Press, Cambridge, 2002)

C. Goucher, The Memory of Iron: African Technology in the Americas (NPS, Atlanta, 2004)

J. Ringquist, Afr. Diasp. Arch. Netw. 11, 3 (2008)

L.C.P. Symanski, F. Gomes, J. Afr. Diaspora Archaeol. Herit. 5(2), 174 (2016). https://doi.org/10.1080/21619441.2016.1204794

S.M. Dzivhani, M.F. Mamadi, M.M. Motenda, E. Mudau, The Copper Miners of Musina and the Early History of the Zoutpansberg (Union of South Africa, Department of Native Affairs, Pretoria, 1940)

P.S. Garlake, Great Zimbabwe (Thames and Hudson, London, 1973)

R. Summers, Ancient Mining in Rhodesia (National Museums, Salisbury, 1969)

M. Warthin, Geogr. Rev. 18(2), 307 (1928)

R.E. Birchard, Econ. Geogr. 16(4), 429 (1940)

S. Katzenellenbogen, Afr. Affairs (London) 73(290), 63 (1974)

J. Lunn, J. Afr. Hist. 33(2), 239 (1992)

W.A. Hance, I.S. Van Dongen, Ann. Assoc. Am. Geogr. 47(4), 307 (1957)

G. de Brier, H. Arian, L. Hoex, Reducing the Carbon Footprint at the Expense of a Mineral Footprint? (IPIS Briefing, May 2021). https://ipisresearch.be/weekly-briefing/ipis-briefing-may-2021-reducing-the-carbon-footprint-at-the-expense-of-a-mineral-footprint. Accessed 12 Dec 2022

Z. Usman, O. Abimbola, I. Ituen, What Does the European Green Deal Mean for Africa? (Carnegie Endowment, Washington, DC, 2021). https://carnegieendowment.org/2021/10/18/what-does-european-green-deal-mean-for-africa-pub-85570. Accessed 21 Nov 2022

Huaxia, Huayou Cobalt’s Arcadia Lithium Mine in Zimbabwe to Start Exports Next Year (Xinhua, 2022). https://english.news.cn/20220908/860fb9ba2ff348c6a9ba8cd9fe42a618/c.html

Business Reporter, Zimbabwe, “Zim Halfway Towards US$12bn Mining Target,” The Herald (February 23, 2022). https://www.herald.co.zw/zim-halfway-towards-us12bn-mining-target. Accessed 14 Dec 2022

J. Stibbs, “Zimbabwe Chrome Ore Export Ban Boosts Competitors Amid South Africa’s Tax Uncertainty,” Fastmarkets (August 12, 2021). https://www.fastmarkets.com/insights/zimbabwe-chrome-ore-export-ban-boosts-competitors-amid-south-africas-tax-uncertainty. Accessed 29 Oct 2022

“Fact Box: Tsingshan Is Building a US$1bn Steel Plant in Zimbabwe,” newZWire (October 7, 2022). https://newzwire.live/fact-box-tsingshan-is-building-a-us1bn-steel-plant-in-zimbabwe-here-is-what-we-know-about-the-project. Accessed 21 Nov 2022

N. Banya, “Zimbabwe Signs Agreement with Tsingshan to Set Up Lithium Operations,” Mining.com (November 29, 2022). https://www.mining.com/web/zimbabwe-signs-agreement-with-tsingshan-to-set-up-lithium-operations. Accessed 12 Dec 2022

T. Mukeredzi, “China’s Tsingshan Completes Two Big Zimbabwe Projects,” ChinaDaily.com (May 15, 2021). https://www.chinadaily.com.cn/a/202105/15/WS609f5a2fa31024ad0babe14e.html. Accessed 28 Nov 2022

BloombergNEF, Electric Vehicle Outlook 2021 (BloombergNEF, 2021). https://about.bnef.com/electric-vehicle-outlook. Accessed 19 Dec 2022

A. Hunter, “DRC Bans Export of Cobalt, Copper Concentrate, Cutting off Zambia Trade,” Fastmarkets (March 20, 2019). https://www.fastmarkets.com/insights/exclusive-drc-bans-cobalt-copper-concentrate-exports-cutting-off-zambia-trade. Accessed 15 Nov 2022

“DRC Wants End to Glencore Export of Raw Cobalt,” SwissInfo.ch (November 6, 2021). https://www.swissinfo.ch/eng/business/drc-wants-end-to-glencore-export-of-raw-cobalt/47089566. Accessed 27 Nov 2022

T.C. Frankel, M. Robinson Chávez, J. Ribas, “The Cobalt Pipeline: Tracing the Path from Deadly Hand-Dug Mines in Congo to Consumers’ Phones and Laptops,” Washington Post (September 30, 2016). https://www.washingtonpost.com/graphics/business/batteries/congo-cobalt-mining-for-lithium-ion-battery. Accessed 3 Nov 2022

Okapi Mobile. (okapimobile.com, 2020). https://okapimobile.com/shop/okapi-10/. Accessed 25 Jan 2023

A. Mubarik, “Meet the Founder of Ghana’s First Solar Panel Manufacturing Plant,” Face2Face Africa (March 27, 2021). https://face2faceafrica.com/article/meet-the-founder-of-ghanas-first-solar-panel-manufacturing-plant-improving-lives. Accessed 27 Nov 2022

“Zambia Opens First Ever Cell Phone Manufacturing Company,” Lusakatimes.com (March 11, 2009). https://www.lusakatimes.com/2009/03/11/zambia-opens-first-ever-cell-phone-manufacturing-company. Accessed 10 Sept 2022

“Critical Materials and Sustainable Development in Africa: Antonio M.A. Pedro,” One Earth (2021). https://doi.org/10.1016/j.oneear.2021.02.018

E. Foli, SADC e-Mobility Outlook: Accelerating the Battery Manufacturing Value Chain (South African Institute of International Affairs [SAIIA], 2020), paper no. 316. https://saiia.org.za/research/sadc-e-mobility-outlook-accelerating-the-battery-manufacturing-value-chain/#. Accessed 11 Nov 2022

R. Raji, Electric Vehicles: An Ironic African Opportunity? (Nanyang Technological University, Nanyang Business School, Singapore, 2021). https://www.ntu.edu.sg/docs/librariesprovider100/aci-latest/2021-47.pdf?sfvrsn=7652eb60_2. Accessed 22 Nov 2022

T. Rwanda, “Rwanda’s Phone Manufacturer Signs Deal with Angola Firm,” FurtherAfrica (December 20, 2021). https://furtherafrica.com/2021/12/20/rwandas-phone-manufacturer-signs-deal-with-angola-firm. Accessed 23 Dec 2022

SADT, Mineral Beneficiation: Presentation to Portfolio Committee on Trade and Industry (Department of Trade, Industry and Competition [DTIC], 2020). http://www.thedtic.gov.za/wp-content/uploads/Beneficiation19-June2020.pdf. Accessed 11 Dec 2022

C. Uwiringiyimana, Rwanda Pioneers First ‘Made in Africa’ Smartphones (World Economic Forum, 2019). https://www.weforum.org/agenda/2019/10/rwanda-launches-first-made-in-africa-smartphones. Accessed 8 Dec 2022

“SAMES No Longer Manufacturing in SA,” Dataweek (July 22, 2009). https://www.dataweek.co.za/article.aspx?pklarticleid=5725. Accessed 9 Nov 2022

T. Wanjala, “Kenya First In Africa To Make Electronic Chips, Amid Questions over Relevance of Tech,” Zenger (May 30, 2021). https://www.zenger.news/2021/05/30/kenya-first-in-africa-to-make-electronic-chips-amid-questions-over-relevance-of-tech. Accessed 13 Nov 2022

“First Solar Panel Factory in West Africa Opens in Burkina Faso,” Bat Info (2020). https://batinfo.com/en/actuality/opening-in-burkina-faso-of-the-first-solar-panel-factory-in-west-africa_16426. Accessed 21 Oct 2022

“Factbox: Where Are We with the Hwange Power Projects?” newZWire (April 20, 2021). https://newzwire.live/factbox-where-are-we-with-the-hwange-power-projects. Accessed 8 Dec 2022

“Zim Power Crisis about to Get Worse as Kariba Shuts Down,” newZWire (November 27, 2022). https://newzwire.live/zim-power-crisis-about-to-get-worse-as-kariba-shuts-down. Accessed 20 Nov 2022

“Power Struggle: How Corruption and Poor Planning Left Zimbabwe in the Dark,” newZWire (May 15, 2019). https://newzwire.live/power-struggle-how-corruption-and-poor-planning-left-zimbabwe-in-the-dark. Accessed 17 Dec 2022

“Power Projects Update: ZPC Sets 2023 for Hwange Old Plant Rehab,” newZWire (November 16, 2022). https://newzwire.live/power-projects-update-zpc-sets-2023-for-hwange-old-plant-rehab. Accessed 23 Nov 2022

“As ZESA Fails, These Major Power-Hungry Mining Investments in Zimbabwe Are Bringing Their Own Energy,” newZWire (December 7, 2022). https://newzwire.live/as-zesa-fails-these-major-power-hungry-mining-investments-in-zimbabwe-are-bringing-their-own-energy. Accessed 19 Dec 2022

P. Chitumba, “Cyanide and Mercury Disaster Looms in Shurugwi,” Chronicle (September 29, 2020). https://www.chronicle.co.zw/cyanide-and-mercury-disaster-looms-in-shurugwi.

“Element Africa: Lead Poisoning, Polluted Rivers, and ‘Calamitous’ Mining Regulation,” Mongabay.com (January 31, 2023). https://news.mongabay.com/2023/01/element-africa-lead-poisoning-polluted-rivers-and-calamitous-mining-regulation

B. Jorgensen, “Tech Companies Sued in Child Labor Lawsuit,” EE Times Asia (December 31, 2019). https://www.eetasia.com/tech-companies-sued-in-child-labor-lawsuit

C. McFadden, “Children Labor for Pennies Mining Mica in Madagascar,” Today (November 18, 2019). https://www.youtube.com/watch?v=9BCe3MtO1Oo

D. Toth, “Judge Dismisses Child Labor Class Action Against Apple, Google Alphabet, Microsoft, Dell and Tesla,” Top Class Actions (November 3, 2021). https://topclassactions.com/lawsuit-settlements/employment-labor/judge-dismisses-child-labor-class-action-against-apple-google-alphabet-microsoft-dell-and-tesla

“Chinese Mining Companies Left a Central African River ‘in Ruins,’ ” France 24 (April 11, 2019). https://observers.france24.com/en/20190411-central-african-republic-river-chinese-mining-companies

C. Nyemeck, “Chinese Companies Criticized for Mercury Pollution in Cameroon,” Mongabay.com (September 5, 2022). https://news.mongabay.com/2022/09/chinese-companies-slated-for-mercury-pollution-in-cameroon

“Govt Sees Its Infrastructure Spending as a Source of Pride, ZNCC Sees It as the Main Source of Inflation,” newZWire (May 9, 2022). https://newzwire.live/govt-sees-its-infrastructure-spending-as-a-source-of-pride-zncc-sees-it-as-the-main-source-of-inflation. Accessed 6 Dec 2022

“Zimbabwe’s US$3bn China Loans: Here's What They Were Used for,” newZWire (April 27, 2022). https://newzwire.live/zimbabwes-us3bn-china-loans-heres-what-they-were-used-for. Accessed 21 Nov 2022

Adesina: How Best Can We Fund Infrastructure? newZWire (August 1, 2022). https://newzwire.live/adesina-how-best-can-we-fund-infrastructure. Accessed 19 Dec 2022

E. George, “Why Is So Little Value Added in Africa’s Soft Commodity Value Chain?” Global Trade Review (August 13, 2019). https://www.gtreview.com/supplements/gtr-africa-2019/little-value-added-africas-soft-commodity-value-chain. Accessed 13 Nov 2022

M.O. Tolba, “Processing Agricultural Raw Materials in Africa Reaffirmed as a Priority,” iD4D (June 28, 2016). https://ideas4development.org/en/processing-of-agricultural-raw-materials-in-africa-reaffirmed-as-a-priority. Accessed 24 Nov 2022

S. Shabangu, Address by the Minister of Mineral Resources, 19th Edition of the Mining Indaba, Cape Town International Convention Centre, Western Cape, February 4, 2014. Polity (2014). https://www.polity.org.za/article/sa-susan-shabangu-address-by-the-minister-of-mineral-resources-at-the-19th-edition-of-the-mining-indaba-cape-town-international-convention-centre-western-cape-04022014-2014-02-04. Accessed 15 Dec 2022

P. de Sa, “Can Natural Resources Pave the Road to Africa’s Industrialization?” World Bank Blogs, February 28, 2014. https://blogs.worldbank.org/energy/can-natural-resources-pave-road-africa-s-industrialization. Accessed 27 Nov 2022

S.V. Iyer, “Billion Dollar Map to Help Africa Turn Mining into Prosperity,” World Bank Blogs, February 19, 2014. https://blogs.worldbank.org/energy/billion-dollar-map-help-africa-turn-mining-prosperity. Accessed 12 Dec 2022

Funding

Open access funding provided by the MIT Libraries.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

I, as the single author of this article, confirm that I have no conflict of interest and write this paper purely as academic research work.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mavhunga, C.C. Africa’s move from raw material exports toward mineral value addition: Historical background and implications. MRS Bulletin 48, 395–406 (2023). https://doi.org/10.1557/s43577-023-00534-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1557/s43577-023-00534-3