月刊

ISSN 1000-7229

CN 11-2583/TM

- CSCD核心库收录期刊

- 中文核心期刊

- 中国科技核心期刊

月刊

ISSN 1000-7229

CN 11-2583/TM

电力建设 ›› 2024, Vol. 45 ›› Issue (5): 141-149.doi: 10.12204/j.issn.1000-7229.2024.05.014

收稿日期:2023-11-24

出版日期:2024-05-01

发布日期:2024-04-29

通讯作者:

魏震波(1978),男,博士,副教授,研究方向为复杂系统及其理论、电力系统安全稳定分析与控制及电力市场,E-mail:weizhenbo@scu.edu.cn。作者简介:陶冶(1996),男,硕士研究生,主要研究方向为电力市场;基金资助:

TAO Ye1, WEI Zhenbo1( ), LAN Senlin2, SHI Shuang2, SU Penghuan2

), LAN Senlin2, SHI Shuang2, SU Penghuan2

Received:2023-11-24

Published:2024-05-01

Online:2024-04-29

Supported by:摘要:

期货交易存在保证金和强行平仓制度,全市场背景下电力期货交易制度的特殊性在一定程度上影响着发电企业收益。考虑负荷变化,利用电力期货交易规避电价波动造成的发电侧盈亏风险,构建了一种发电企业全市场收益优化模型。首先,搭建含现货、远期合同和期货合约的电力市场交易架构;其次,以发电企业售电收益最大为目标,逐级搭建含现货、远期合同和期货合约的发电企业收益模型,并给出相应求解算法;最后,采用6个发电企业构成的无阻塞电力市场进行仿真模拟,对收益模型的合理性与有效性进行了验证。结果表明:负荷侧波动导致电价明显波动,电力期货的引入能提高电价稳定性,提高发电企业利润,将发电企业利润损失风险转移到期货市场中,并且边际成本越大的发电企业利润提高越明显;在一定的期货与现货电量配比范围内,配比越大,发电企业利润提高越多,但超过范围后,期货保证金利息亏损变多,发电企业利润反而减少。

中图分类号:

陶冶, 魏震波, 兰森林, 史爽, 苏鹏欢. 考虑电力期货交易的发电企业全市场收益优化模型[J]. 电力建设, 2024, 45(5): 141-149.

TAO Ye, WEI Zhenbo, LAN Senlin, SHI Shuang, SU Penghuan. Market-wide Revenue Optimization Model of Power Generation Company Considering Electricity Futures Trading[J]. ELECTRIC POWER CONSTRUCTION, 2024, 45(5): 141-149.

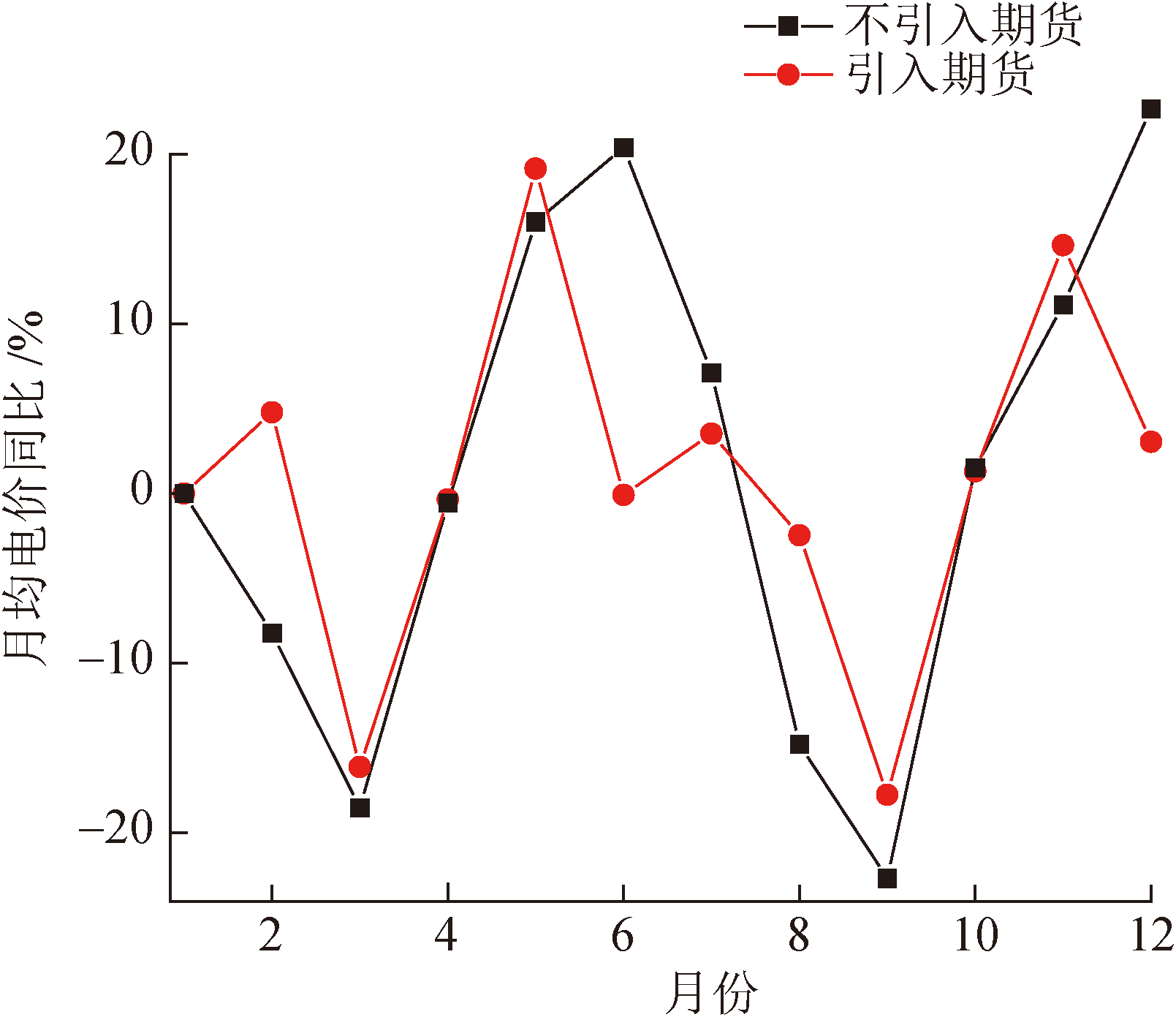

图5 K=20、L(t)取拟合值时月均电价变化百分比

Fig.5 The percentage change in the average monthly electricity price for each month when K=20 and the L(t) is the fitting value

| [1] | 韩瑜. 电力市场化改革中发电企业价格风险规避研究[D]. 济南: 山东大学, 2019. |

| HAN Yu. Research on price risk avoidance of power generation enterprises in power market reform[D]. Jinan: Shandong University, 2019. | |

| [2] | 贺亚慧, 陈国平, 王勇, 等. 新能源发电并网与电网电能质量控制技术应用[J]. 电子技术, 2023, 52(8): 334-335. |

| HE Yahui, CHEN Guoping, WANG Yong, et al. Application of new energy generation grid connection and power quality control technology[J]. Electronic Technology, 2023, 52(8): 334-335. | |

| [3] | 戴秦, 严广乐, 丁会凯. 电力期货电价风险控制机制研究[J]. 华东电力, 2009, 37(5): 731-734. |

| DAI Qin, YAN Guangle, DING Huikai. Research on risk control mechanisms for electricity prices by electricity futures[J]. East China Electric Power, 2009, 37(5): 731-734. | |

| [4] | 程方亮, 杨永利, 龚文军, 等. 考虑电压等级的多维度电力期货交易绩效建模和评估[J]. 微型电脑应用, 2022, 38(5): 76-78. |

| CHENG Fangliang, YANG Yongli, GONG Wenjun, et al. Performance modeling and evaluation of multi-dimensional power futures trading by considering voltage level[J]. Microcomputer Applications, 2022, 38(5): 76-78. | |

| [5] |

LAI S Y, QIU J, TAO Y C. Option-based portfolio risk hedging strategy for gas generator based on mean-variance utility model[J]. Energy Conversion and Economics, 2022, 3(1): 20-30.

doi: 10.1049/enc2.v3.1 URL |

| [6] |

LAI S Y, QIU J, TAO Y C, et al. Risk hedging for gas power generation considering power-to-gas energy storage in three different electricity markets[J]. Applied Energy, 2021, 291: 116822.

doi: 10.1016/j.apenergy.2021.116822 URL |

| [7] |

LAI S Y, QIU J, TAO Y C, et al. Risk hedging strategies for electricity retailers using insurance and strangle weather derivatives[J]. International Journal of Electrical Power & Energy Systems, 2022, 134: 107372.

doi: 10.1016/j.ijepes.2021.107372 URL |

| [8] |

SAVELLI I, GIANNITRAPANI A, PAOLETTI S, et al. An optimization model for the electricity market clearing problem with uniform purchase price and zonal selling prices[J]. IEEE Transactions on Power Systems, 2018, 33(3): 2864-2873.

doi: 10.1109/TPWRS.2017.2751258 URL |

| [9] | 关少杰. 电力期货市场功能研究: 以北欧电力市场为例[D]. 北京: 中国石油大学(北京), 2021. |

| GUAN Shaojie. Research on the function of power futures market[D]. Beijing: China University of Petroleum (Beijing), 2021. | |

| [10] | 刘思东, 贺恩锋, 刘利, 等. 电力期货价格的协整建模与预测[J]. 电力科学与技术学报, 2008, 23(2): 46-50. |

| LIU Sidong, HE Enfeng, LIU Li, et al. Forecasting electricity futures price with cointegration model[J]. Journal of Electric Power Science and Technology, 2008, 23(2): 46-50. | |

| [11] | 朱太辉, 吴忠群. 发电商利用电力期货规避现货交易风险模型[J]. 电网技术, 2008, 32(6): 76-80. |

| ZHU Taihui, WU Zhongqun. A model to prevent spot transaction risk for generation company by use of electricity futures and analysis on calculation example[J]. Power System Technology, 2008, 32(6): 76-80. | |

| [12] | 何永秀, 苏凤宇, 夏雪. PJM电力期货交易经验及对中国电力期货市场建设的启示[J]. 广东电力, 2021, 34(8): 37-42. |

| HE Yongxiu, SU Fengyu, XIA Xue. PJM electric future trading experience and its enlightenment to electric future market construction in China[J]. Guangdong Electric Power, 2021, 34(8): 37-42. | |

| [13] | 朱婕. 电力期货合同研究[D]. 成都: 西南财经大学, 2014. |

| ZHU Jie. The research on electricity futures contract[D]. Chengdu: Southwestern University of Finance and Economics, 2014. | |

| [14] | 陈传彬, 杨首晖, 王良缘, 等. 国外电力期货产品设计逻辑及其对我国启示[J]. 价格理论与实践, 2020(2): 51-54, 174. |

| CHEN Chuanbin, YANG Shouhui, WANG Liangyuan, et al. Logic analysis of foreign power futures product design and its enlightenment to my country[J]. Price (Theory & Practice), 2020(2): 51-54, 174. | |

| [15] | 陆振翔, 黄伟. 全球电力期货市场概况及合约特点分析[J]. 中国证券期货, 2018(5): 23-27. |

| LU Zhenxiang, HUANG Wei. General situation of global power futures market and analysis of contract characteristics[J]. Securities & Futures of China, 2018(5): 23-27. | |

| [16] | 姚星安, 曾智健, 杨威, 等. 广东电力市场结算机制设计与实践[J]. 电力系统保护与控制, 2020, 48(2): 76-85. |

| YAO Xing’an, ZENG Zhijian, YANG Wei, et al. Electricity market settlement mechanism design and practice in Guangdong[J]. Power System Protection and Control, 2020, 48(2): 76-85. | |

| [17] | 翟星, 刘剑清. 电力期货市场对发电企业的影响探讨[J]. 能源技术经济, 2011, 23(10): 24-27. |

| ZHAI Xing, LIU Jianqing. Influence of electricity futures market on power generation companies[J]. Energy Technology and Economics, 2011, 23(10): 24-27. | |

| [18] | 王雪静, 王芳芳. 电力期货市场理论[J]. 中小企业管理与科技(上旬刊), 2014(6): 78-79. |

| WANG Xuejing, WANG Fangfang. Power futures market theory[J]. Management & Technology of SME, 2014(6): 78-79. | |

| [19] | 李赫然. 电力期货价格发现功能与电价形成机制的相关性研究: 基于美国PJM电力市场的实践及对我国的启示[J]. 价格理论与实践, 2014(8): 90-92. |

| LI Heran. Research on the correlation between the price discovery function of electricity futures and the formation mechanism of electricity price: based on the practice of PJM electricity market in the United States and its enlightenment to China[J]. Price (Theory & Practice), 2014(8): 90-92. | |

| [20] | 常素媛. 电力期货的套期保值交易模型与应用研究[D]. 北京: 华北电力大学, 2021. |

| CHANG Suyuan. Research on hedging trading model and application of electricity futures[D]. Beijing: North China Electric Power University, 2021. | |

| [21] | 范凯. 期货合约影响下基于价格分摊的电力现货市场电价出清研究[D]. 南京: 南京邮电大学, 2020. |

| FAN Kai. Research on clearing electricity price in electricity spot market based on price allocation under the influence of futures contract[D]. Nanjing: Nanjing University of Posts and Telecommunications, 2020. | |

| [22] |

冷媛, 辜炜德, 何秉昊, 等. 碳中和背景下电力期货对现货市场影响的仿真分析[J]. 电力建设, 2022, 43(5): 1-8.

doi: 10.12204/j.issn.1000-7229.2022.05.001 |

|

LENG Yuan, GU Weide, HE Binghao, et al. Simulation analysis of the impact of electricity futures on electricity spot market under the background of carbon neutrality[J]. Electric Power Construction, 2022, 43(5): 1-8.

doi: 10.12204/j.issn.1000-7229.2022.05.001 |

|

| [23] | 韦仲康, 朱天博, 邢劲, 等. 区域电力现期混合交易体系及最优交易策略[J]. 湖南科技大学学报(自然科学版), 2021, 36(4): 55-61. |

| WEI Zhongkang, ZHU Tianbo, XING Jin, et al. Optimal electricity trading for mixed spot and futures market in regional power grid[J]. Journal of Hunan University of Science and Technology (Natural Science Edition), 2021, 36(4): 55-61. | |

| [24] | 巢剑雄, 刘登高. 电力期货套期保值功能下发电商电能配置策略的仿真模拟[J]. 湖南大学学报(社会科学版), 2010, 24(1): 34-40. |

| CHAO Jianxiong, LIU Denggao. Analog simulation of generator’s electricity allocation tactics under the condition of electricity futures’ hedging function[J]. Journal of Hunan University (Social Sciences), 2010, 24(1): 34-40. | |

| [25] | 伏开宝. 电力体制改革中市场价格波动管理研究[D]. 上海: 上海社会科学院, 2018. |

| FU Kaibao. Research on market price fluctuation management in power system reform[D]. Shanghai: Shanghai Academy of Social Sciences, 2018. | |

| [26] | 陈清贵, 张茂林, 邢玉辉, 等. 基于SPAN系统的电力期货动态保证金应用研究[J]. 价格理论与实践, 2023(2): 125-129. |

| CHEN Qinggui, ZHANG Maolin, XING Yuhui, et al. Research on the application of dynamic margin for power futures based on SPAN system[J]. Price (Theory & Practice), 2023(2): 125-129. | |

| [27] |

WEN F S, DAVID A K. Optimal bidding strategies and modeling of imperfect information among competitive generators[J]. IEEE Transactions on Power Systems, 2001, 16(1): 15-21.

doi: 10.1109/59.910776 URL |

| [28] |

KALANTZIS F G, MILONAS N T. Analyzing the impact of futures trading on spot price volatility: evidence from the spot electricity market in France and Germany[J]. Energy Economics, 2013, 36: 454-463.

doi: 10.1016/j.eneco.2012.09.017 URL |

| [29] | 李晓龙. 基于市场微观结构理论的我国电力期货市场构建研究[D]. 北京: 华北电力大学, 2019. |

| LI Xiaolong. Research on the construction of China’s electricity futures market based on market microstructure theory[D]. Beijing: North China Electric Power University, 2019. | |

| [30] | 杨涛, 朱琳. 大数据分析技术在电力期货交易市场中的应用研究[J]. 电气技术与经济, 2020(3): 57-61. |

| YANG Tao, ZHU Lin. Research on the application of big data analysis technology in power futures trading market[J]. Electrical Equipment and Economy, 2020(3): 57-61. |

| [1] | 张继国, 任洪民, 刘大勇, 周力威, 邵俊岩, 贾曜诚, 陈厚合. 考虑市场出清的农业园区能量管理策略[J]. 电力建设, 2024, 45(3): 58-68. |

| [2] | 康一鸣, 秦文萍, 姚宏民, 邢亚虹, 胡迎迎, 贾杏平. 电力市场环境下源-网-荷多主体协调互动规划[J]. 电力建设, 2024, 45(2): 147-159. |

| [3] | 孙勇, 李宝聚, 时雨, 杨瑞, 付小标, 王尧. 提升电力保供能力的配电网点对点交易机制[J]. 电力建设, 2024, 45(1): 147-156. |

| [4] | 郭子仪, 韩爽, 刘永前, 阎洁, 闫亚敏. 基于风电场日前交易和日内交易的储能配置方法[J]. 电力建设, 2023, 44(9): 34-42. |

| [5] | 向明旭, 杨高峰, 杨知方, 欧睿, 周宇晴, 许懿. 电力现货市场出清中新能源随机波动特性表征方法及实例探讨[J]. 电力建设, 2023, 44(4): 8-17. |

| [6] | 谢敬东, 刘思旺, 孙欣, 邓化宇, 江海林. 考虑市场力风险防范的电力市场出清机制[J]. 电力建设, 2023, 44(4): 18-28. |

| [7] | 杨玉龙, 矫英鹤, 严干贵, 范立东, 张志伟, 张格琳, 孙伟, 裴鑫岩. 基于改进Shapley值分配的电采暖负荷群交易机制[J]. 电力建设, 2023, 44(4): 37-44. |

| [8] | 张金良, 王玉珠. 多市场情形下燃煤发电企业交易策略分析[J]. 电力建设, 2023, 44(2): 155-162. |

| [9] | 江岳文, 陈巍. 电-碳-配额制耦合交易综述与展望[J]. 电力建设, 2023, 44(12): 1-13. |

| [10] | 任景, 周鑫, 程松, 王茁宇, 张小东, 唐早, 刘继春. 源荷双边参与的高比例新能源电力系统能量与备用市场联合出清方法[J]. 电力建设, 2023, 44(1): 30-38. |

| [11] | 郑浩伟, 闫庆友, 尹哲, 党嘉璐, 林宏宇, 谭忠富. 计及日前-实时交易和共享储能的VPP运行优化及双层效益分配[J]. 电力建设, 2022, 43(9): 34-46. |

| [12] | 詹祥澎, 杨军, 沈一民, 钱晓瑞, 王昕妍, 吴赋章. 基于价值认同的需求侧电能共享分布式交易策略[J]. 电力建设, 2022, 43(8): 141-149. |

| [13] | 丁伟斌, 谭忠富. 考虑不平衡资金处理的电力市场结算机制研究[J]. 电力建设, 2022, 43(7): 13-23. |

| [14] | 冷媛, 辜炜德, 何秉昊, 柳文轩, 赵俊华. 碳中和背景下电力期货对现货市场影响的仿真分析[J]. 电力建设, 2022, 43(5): 1-8. |

| [15] | 张兴平, 何澍, 王泽嘉, 张浩楠, 张又中. 不同新能源渗透率下燃煤机组行为策略分析[J]. 电力建设, 2022, 43(5): 9-17. |

| 阅读次数 | ||||||

|

全文 |

|

|||||

|

摘要 |

|

|||||

版权所有 © 2020 《电力建设》编辑部

地址:北京市昌平区北七家未来科技城北区国家电网公司办公区 邮编:102209 电话:010-66602697

京ICP备18017181号-1 国网安备4511A3CPZ号

本系统由北京玛格泰克科技发展有限公司设计开发