Abstract

This paper analyses how the reconfiguration of power relationships in high-value fresh fruit value chains impacts on upgrading for export performance. The citrus industry in South Africa stands out internationally for its strong export growth and productive capabilities in which collective action by the Citrus Growers Association has played an important role. South Africa is the second largest citrus exporter in the world, after Spain. The industry’s export success has been built on investments and coordination to support shared capabilities and upgrading. The performance relates to improvements from inputs, through to growing, packing and marketing. We find that the upgrading is associated with the relatively powerful position of citrus growers, due to the way they organised themselves through the industry association and their engagement with the state. This has simultaneously supported value creation and inclusion. Through the case study of South Africa’s citrus industry, we demonstrate the potential for growers to organise themselves to reconfigure power relations in the value chain.

Résumé

Cet article analyse l'impact de la reconfiguration des relations de pouvoir dans les chaînes de valeur des fruits frais à forte valeur ajoutée sur l'amélioration des performances à l'exportation. Sur le plan international, l'industrie des agrumes en Afrique du Sud se distingue par sa forte croissance au niveau des exportations et ses capacités productives pour lesquelles l'action collective de la Citrus Growers Association a joué un rôle important. L'Afrique du Sud est le deuxième exportateur d'agrumes au monde, après l'Espagne. Le succès de cette industrie à l'exportation repose sur des investissements et une coordination visant à soutenir les capacités partagées et la mise à niveau. La performance concerne les améliorations depuis les intrants jusqu'à la culture, l'emballage et la commercialisation. Nous constatons que la mise à niveau est associée à la position relativement puissante des producteurs d'agrumes, en raison de la façon dont ils se sont organisés à travers l'association industrielle et de leur engagement avec l'État. La mise à niveau a permis de soutenir simultanément la création de valeur et l'inclusion. À travers l'étude de cas de l'industrie des agrumes en Afrique du Sud, nous démontrons le potentiel que possèdent les producteurs lorsqu’ils s'organisent pour reconfigurer les relations de pouvoir dans la chaîne de valeur.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction: (Re)configurations of Power Relations in Agricultural Value Chains

There has been sustained growth in demand for fresh fruit in global markets which has provided opportunities for exports by developing countries while posing important questions about the organisation of these value chains. We consider the reconfiguration of power relations in a value chain through analysing the citrus industry in South Africa. South Africa stands out as the second largest citrus exporter in the world (after Spain), accounting for 10% of global exports. Two-thirds of the country’s citrus production is exported as fresh fruit, generating 95% of total citrus earnings per annum. It exemplifies an industry oriented to high-value fresh fruit exports employing sophisticated technologies and industrial processes to meet the many and complex sanitary and phytosanitary requirements and to evolve with changing consumer tastes.

The coordination and export-oriented success of South African citrus was a reconfiguration following far-reaching market liberalisation by the South African government in the late 1990s. The first democratic government passed the Marketing of Agricultural Products Act of 1996 which swept aside the single-channel marketing arrangements that had characterised most of South African agriculture under apartheid. In citrus, the single-channel marketing authority had been bestowed on the South African Citrus Exchange co-operative which used Outspan as the overseas marketing and distribution agent (Mather 1999; Mather and Greenberg 2003). The liberalisation was motivated by market efficiency claims made by agricultural economists and the political imperative of reducing support to white farmers (Bayley 2000; Vink and Kirsten 2000; Bernstein 2013; Kirsten et al. 2009).

The case of the citrus industry in South Africa enables us to interrogate how the reconfiguration of power relations supported the upgrading and export growth, to understand the institutions involved, the participation of smaller producers, and the role of government. We analyse how power is attained and exercised by different participants and the links to upgrading and capabilities development.

The export of fresh fruit is a highly governed value chain including with regard to cultivars, phytosanitary standards, traceability, logistics and marketing (Cramer and Chisoro-Dube 2021). South African success in high-value export markets, notably in Europe, has depended on meeting all these requirements and on shifting production to higher value citrus products, notably soft citrus varieties along with lemons and limes, which command higher prices. The key questions are how this has happened, and which interests have taken the lead in the value chain governance, as compared with the previous centralised system. The differences in citrus compared with other areas of agriculture in South Africa which were subject to the same liberalisation (with the exception of sugar) provide important insights into this question. Our analysis identifies the entrepreneurial role of the Citrus Growers Association (CGA), in particular, including its relationship with the South African government. We propose it as an example of a growth coalition with institutional power (Dallas et al. 2019) that has played a market-shaping and inclusion role through organising growers. It is an example of a pocket of efficiency, where growers with agency have built the necessary institutional relations for upgrading (Whitfield et al. 2015).

To explore power relationships and upgrading in the citrus industry, the article relies on semi-structured interviews with some forty producers, industry stakeholders and government officials in fruit-growing regions across South Africa. Upstream in the value chain, we interviewed nine input suppliers, including nurseries, cultivar development and management companies, equipment suppliers and a water board that distributes water for agricultural purposes. Seventeen interviews were conducted with growers through to marketing and these included smaller growers, grower-exporters, packhouses, marketing companies and the growers’ industry association. Five interviews were conducted with national and provincial government departments. Downstream of the value chain, we interviewed nine entities at the fruit processing level. All interviews were conducted by the authors between January 2020 and June 2022.

Power, Governance and Upgrading in Fresh Fruit Value Chains

Building stronger productive capabilities has been described as upgrading in the Global Value Chain (GVC) literature, where upgrading may involve different types of changes that firms or groups of firms undertake to improve their competitive position in global value chains (Gereffi 2019; Gereffi et al. 2001; Humphrey and Schmitz 2000). Through upgrading, firms are able to improve their capacity for value creation and capture. The share of the value created can be described in terms of the distribution of returns, or rents, to firms in different positions in the chain. The governance of the value chain relates to both forms of upgrading for value creation, and the concept of rent capture (Kaplinsky 2019; Havice and Pickles 2019).

Creating and capturing value need not mean moving to higher value goods or services (Gereffi 2019; Ponte and Ewert 2009). Creating and capturing value can equally be about improvements at the same stage of the value chain and relate to improving product development, managerial models, market access, time-to-market, diversified product portfolio and meeting standards (Ponte and Ewert 2009). Upgrading is therefore not linear or unidirectional, it is a dynamic, interlinked and multi-dimensional process and there are a variety of ways in which firms can improve their position in the chain (Gereffi 2019).

It is important to understand the nature of the value chain for assessing value creation and the factors determining rent capture. Value chains in which the primary product is central to the process of value creation and where value addition is sequential and incremental can be understood as additive (Kaplinsky and Morris 2016; Gereffi 2019). These contrast with the structure of vertically specialised GVCs, which involve in-parallel production of various stages of the product’s manufacture. While processing of cocoa into chocolate, or oranges into juice, can be characterised as additive, this is not the same for upgrading and value creation in fresh fruit and vegetables which involve producing different and higher value varieties. As well as the varieties, value comes from the ability to supply high-quality fresh produce into export markets at different times of the year (Dolan and Humphrey 2000; Cramer and Sender 2019). As such, an analysis of economic upgrading in fresh fruit needs to consider producers’ participation in GVCs in terms of the performance of value-added tasks (product diversification, product sophistication, market access and certification), and the influence on improved economic returns or rents (Pasquali et al. 2021a).

The improvements in productive capabilities which generate rents and their capture by different parties interact with power relationships within the value chain and the wider institutional relationships which shape market exchanges (Gereffi 2019; Mondliwa et al. 2020). A focus of GVC research has been on how particular forms of inter-firm relations and value chain organisation influence upgrading. Governance of the relationships includes the role of ‘lead firms’ that are able to shape who does what along the chain, at what price, using what standards and specifications, and delivered in what form and at what point in time (Ponte and Sturgeon 2014; Gereffi et al. 2005; Humphrey and Schmitz 2001). The power of lead firms includes their ability to organise production, the technologies involved, the target markets and the ability to appropriate and distribute the value created (Gibbon et al. 2008). However, lead firm power may be mediated or counterbalanced by collective producer organisation.

Conceptualisations of GVC governance initially focussed on links between suppliers and buyers and identified three key conditions (transactional complexity, codifiability of information and supplier capability) that could explain how lead firms are linked to suppliers in various ways (Gereffi et al. 2005). Understanding of GVC governance subsequently expanded to include the roles of other actors that shape GVC dynamics, such as governments, certification agencies, consumer groups and industry groups, which in turn determine the terms and location of value addition, distribution and capture (Ponte et al. 2019; Dallas et al. 2019).

Standards and certification have been identified as an important factor in value chain governance, power relations and in shaping the international trade regime (Dolan and Humphrey 2000; Pasquali et al. 2021b; Park and Gachukia 2021). The ability to meet these standards is both a threat for producers (excluding them from profitable markets) and an opportunity (providing the potential to enter high-margin markets) (Kaplinsky 2010; Nadvi 2008). The setting of standards and the certification that they have been met is one aspect of power relations in the value chain.

It is therefore essential to analyse the structure of value chains as it relates to power relations and to go beyond a focus on linkages, as per the chain analogy, to take into account different dimensions of power (Bair 2009; Dallas et al. 2019). This includes the role of multiple stakeholders, in what Dallas et al. (2019) call the ‘arena of actors’, and how the different actors transmit or exercise power along the value chains in direct or diffuse mechanisms.

Scholarship points to the potential for collective organisation by industry or businesses as a means of providing crucial shared services such as research and development. Providing these services involves solving collective action problems that hinder upgrading and typically mediating relations with the state (Schneider and Maxfield 1997; Bräutigam et al. 2002; Watkins et al. 2015). Collective organisation by producers can also improve bargaining over the distribution of rents (Sorrentino et al. 2018; Velázquez et al. 2017; Falkowski and Ciaian 2016).

There are important roles for the state in constructing and maintaining GVCs through facilitative, regulatory and distributive interventions (Horner and Alford 2019; Horner 2017; Mayer and Phillips 2017; Park and Gachukia 2021). In particular, government policies influence the opportunities for upgrading not only through their effect on the availability of know-how, inputs and resources required for industrial upgrading but also through their effect on the incentives for upgrading (Brandt and Thun 2016; Bamber and Fernandez-Stark 2019). Government policies and regulations are, in turn, influenced at different levels by interest groups which lobby, organise and shape the agenda through the values and ideas in forms of institutional and constitutive power (Dallas et al. 2019). How the citrus industry in South Africa has shaped—and been shaped by—government policies and regulations is an important question we address.

The Citrus Industry in South Africa—Value Creation, Upgrading and Linkages

Value-Based Export Growth

The most important driver of the citrus industry’s performance in South Africa has been the standards and requirements of export markets, in particular, of European supermarkets (Chisoro-Dube and Roberts 2021). These standards and requirements include ensuring a reliable supply of high-quality, disease-free fruit with a long shelf life, and responding to the changing international preferences and demand patterns. Meeting these requirements creates value through the higher prices realised from the exports.

At the growing level, South Africa’s citrus industry responded to changing international preferences and demand patterns by expanding plantings and production of soft citrus, lemons and limes. The growth in the area planted from 2001 to 2020 was almost entirely due to expanding planting of soft citrus, lemons and limes, which more than quadrupled in area to be 43% of the total area by 2020 (Chisoro-Dube and Roberts 2021). The lag from planting to output is reflected in the trebling of output of soft citrus and lemons and limes from 2010 to 2020 (Fig. 1).

The value of South Africa’s citrus production has increased by a much greater extent than the volumes due to the increasing returns from exports (Fig. 2). Specifically, soft citrus and lemons and limes underpinned the export growth from 2010, nearly quadrupling in value from US$202 million in 2010 to US$730 million in 2020. This shows that what is exported matters; in terms of growing new and improved varieties, and meeting the quality, standards and requirements of export markets.

The price earned on exports of soft citrus, and lemons and limes, as well as for oranges and grapefruit, increased substantially, especially from 2009 onwards (Fig. 3). While export prices of oranges and soft citrus were similar in 2001/2 at around US$200/tonne, the prices of soft citrus quintupled to around US$1000/t in 2018/19 compared with the trebling in orange prices to around US$600/t.

Source Department of Agriculture, Land Reform and Rural Development (DALRRD). Local average prices are based on sales at the 20 major fresh produce markets in the country; Export prices are sourced by DALRRD from Customs and Excise and are Free on Board (FOB) prices

Average export and local South African fresh citrus prices, US$/tonne.

Value Chain Linkages, Investments and Capabilities

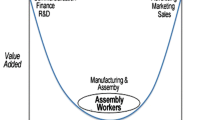

The shifts in production to respond to changes in export markets were the result of the linkages, long-term investments and shared institutional capabilities across key activities in the value chain. The export of fresh fruit involves a range of activities, capabilities and investments including development of cultivars and management of intellectual property rights; propagation of tree seedlings in nurseries; growing of quality fruit and application of crop protection compounds; sorting, grading and packing of fruit; and marketing of fruit in export markets (Fig. 4). It is an increasingly knowledge-intensive, organisationally and technically sophisticated ‘industrial’ activity (Cramer and Sender 2019; Cramer et al. 2022).

Cultivars and Crop Protection Inputs

At the beginning of the value chain, the cultivars determine the product characteristics. These are divided between open varieties on which intellectual property (IP) rights have expired (in most lemons, limes and oranges) and protected newer varieties, mainly ‘soft citrus’ including varieties of mandarins and clementines (Fig. 4).Footnote 1 The access to cultivars and the terms of licencing rights are therefore critical for soft citrus growth (Cramer and Chisoro-Dube 2021; Chisoro-Dube and Roberts 2021).

The capabilities and international links of local cultivar development and management companies are essential for developing and sourcing new cultivars (Fig. 4). A very few local companies in South Africa have developed these capabilities, with the leaders being Citrogold South Africa and Stargrow (Chisoro-Dube and Roberts 2021). Citrogold owns the majority of IP rights to cultivars in South Africa. It built its capabilities from historical linkages with CapeSpan.Footnote 2 Locally, cultivars are developed mainly through natural mutations in the orchards. However, most developments in terms of new cultivars in the South African citrus industry are sourced internationally through the purchase of management rights (Fig. 4).Footnote 3 To track the advances in cultivars around the world, South African cultivar companies have built a network of international relationships through establishing offices in different countries and/or links with international companies with worldwide breeding programmes.Footnote 4

Cultivar companies impose various controls and restrictions on growers to access protected cultivars and growers are typically charged royalties per tree and on export boxes sold. Restrictions include those with regard to marketing and planting and/or a limited number of exporters handling the fruit.Footnote 5 The constraints work through local nurseries (some of which are owned by cultivar companies) and marketing companies with which cultivar companies have degrees of vertical integration (Fig. 4). Planting is restricted to control the supply relative to demand in order to maintain high prices in the market and can also be to ensure that the variety is in the ideal growing environment (Chisoro-Dube and Roberts 2021).

The high levels of concentration coupled with the various costs and restrictions imposed by private cultivar companies on growers led the Citrus Growers’ Association (CGA) to provide a measure of competitive rivalry to the main private cultivar companies through establishing the CGA Cultivar Company (CGACC) in 2011.Footnote 6 The CGACC’s mandate is not to try and discover new varieties but to manage varieties for the industry.Footnote 7 Unlike private cultivar companies which maximise royalty charges to growers and profits from the management of varieties, the CGACC has lower management costs through a model seeking to balance financial benefit for cultivar owners, bringing somewhat cheaper varieties to the market and through increased sales.Footnote 8

After a cultivar is released, nurseries propagate disease- and pest-free trees for supply to farmers (Fig. 4). Some nurseries are fully vertically integrated with the cultivar companies and others are independent. There are around 30 certified citrus nurseries, which are involved in the commercial production of trees and marketing of cultivars in South Africa (Chisoro-Dube and Roberts 2021). To ensure that growers plant trees that comply with phytosanitary standards in export markets, the industry through the CGA manages a centralised system for plant material procurement by certified nurseries. Nurseries can only buy certified rootstock seeds and budwood from a designated location which is secluded from commercial growing areas to guard against any possible contamination.Footnote 9

Closely linked to cultivar development and management companies are companies that manufacture and supply plant protection compounds to nurseries and growers necessary to comply with phytosanitary requirements in export markets (Fig. 4). As with cultivar development and management, the manufacture and supply of crop protection inputs is characterised by high levels of concentration with a very few major multinationals alongside smaller local suppliers.Footnote 10 To provide a measure of competitive rivalry, the CGA established its own commercial subsidiary, River BioScience, in 2004. River BioScience is a bio-technology company manufacturing and commercialising crop protection products and services leveraging CGA’s research through Citrus Research International (CRI).Footnote 11 It develops competing products to the major suppliers for important applications.Footnote 12 For example, River BioScience’s main product and first treatment introduced into the market is Cryptogran, to control larvae of False Codling Moth, which competes with products supplied by multinational corporations. River Bioscience has continued to innovate to build a mixed strategy for crop treatment.Footnote 13 There is widespread use of CGA’s crop protection products and cultivars, which are claimed to be cheaper than competitor products.Footnote 14

In addition to providing a measure of competitive rivalry to the private companies, River BioScience enables the citrus industry to quickly respond to challenges in export markets regarding diseases and pests that may block exports or impose a trade barrier to exports. Cryptogran was specifically developed because the industry foresaw False Codling Moth becoming a markets access issue in the near future.

Growing, Picking and Packing

Growing and picking activities are undertaken by 1400 commercial growers who are members of the CGA, including growers in Eswatini and Zimbabwe (Fig. 4). These are farmers of varying sizes who grow primarily for the fresh export markets.Footnote 15 The growing of fruit involves upfront investment in land preparation, planting material, farm and irrigation infrastructure and systems, chemicals, and continuous improvements in farming methods and technologies to maintain and improve the quality of fruit production. These investments and capabilities enable growers to export by complying with a range of requirements and standards of the importing countries including other export documentation (Chisoro-Dube and Roberts 2021; Cramer and Chisoro-Dube 2021).

After fruit is harvested, it is sent to the packhouses. Packhouses are essential infrastructure for processing fruit grown for export markets (Fig. 4). The packhouse sorts, grades and packs the fruit according to specific market or customer specifications. They monitor specific export requirements and certifications for different markets and buyers. There are economies of scale and major technological changes in these activities which has underpinned the main role of farmer cooperatives in South Africa and other countries. The major technological changes in packhouses include the employment of optical and digital technologies for grading and sorting. Digital technologies improve productivity, accuracy and consistency in the supply of high-quality, defect-free fruit to meet the growing demands of international consumers (Cramer and Chisoro-Dube 2021).Footnote 16

Large farmers can be integrated with own packhouses, and pack for other growers in the same locality (Fig. 4). As farmers have earned good returns, they have invested in their own packhouses which gives them greater autonomy and advanced upgrading (Fig. 4).Footnote 17 Public funding has also been provided to groups of black farmers for packhouse construction.Footnote 18 The industry also has a few co-operatively owned packhouses remaining, which pack for the industry at large (Fig. 4). The choice by farmers to invest in their own packhouses balances lower scale economies against greater autonomy and is one of the interesting aspects in the South African citrus industry that we analyse below.

Export Marketing

Export marketing companies are integrated with packhouse systems and provide a critical link between growers and export markets (Fig. 4). They promote and advertise fruit in different markets, find clients, negotiate price and know where to send how much of fruit based on demand and supply.Footnote 19 Marketing companies’ and packhouses’ long-term personal relationships with international buyers are key to the export performance and responsiveness.Footnote 20 Marketing companies search for new varieties around the world and introduce these to growers. They have relationships with local and international cultivar development and management companies, breeding programmes and institutions. Furthermore, to lengthen their supply windows and diversify their export basket, marketing companies and packhouses have strategic relationships with growers through which they can introduce new varieties and access different growers’ harvest windows, acreage, climates and geographical locations.Footnote 21 New and improved cultivars, and sourcing over wide geographic areas with different climates in Southern Africa, means being able to offer fruit across almost the whole year.

The overall processes for exporting are administratively intensive in terms of the time, investment and expertise required to reach the point of being export-ready. While large grower-exporters have expanded their administration staff dedicated to taking care of all export requirements, smaller growers find it very difficult to do this.Footnote 22 The need for improved processes of capturing, storing and reporting data for compliance with phytosanitary standards in different export markets requires digitalisation of systems. In South Africa, this has driven the adoption of innovative digital platforms, notably Phytclean, for issuing export phytosanitary certification. Phytclean digitises the recording of information and ensures that there is consistency in information for different markets (Cramer and Chisoro-Dube 2021).

The Citrus Growers Association (CGA)

The CGA is central to the functioning of the citrus industry, working with government, various industry organisations and other fruit industries to address key industry challenges and to ensure the industry receives the appropriate support for sustained growth (Fig. 4). As we analyse in “The Citrus Growers Association and the Reconfiguration of Institutional Power” section below, the effectiveness of the CGA is one of the main reasons for the industry’s strong performance. The CGA represents growers and carries out a range of industry functions on behalf of its members. The CGA is funded by a compulsory levy on all citrus exports, as approved by government. The CGA’s main industry functions include research and development and market access (CGA 2020). To execute its different functions, the CGA has been entrepreneurial in establishing subsidiary companies which are either not-for-profit companies that provide shared services and support for growers, or commercial companies that sell products and services to earn returns that are re-invested back into the companies.Footnote 23

The CGA’s main function is market access particularly to the USA, the European Union and the Far East. Market access requires research and development capabilities—which the CGA undertakes through its CRI arm, a non-commercial entity. Research ensures production that complies with food safety and phytosanitary requirements in different markets.Footnote 24 CRI came into being when the CGA took over the Outspan Citrus Centre (then known as Capespan) in April 2002. CRI conducts research, ensures the biosecurity of the industry’s plant material, coordinates the transfer of knowledge to the southern African citrus growers and their service agents, and it operates a Postharvest Technical Forum which deals with technical aspects of the cold chain and logistics (CGA 2007).Footnote 25

Fresh fruit exports rely on government regulatory bodies (PPECB, DALRRD), which are required to approve the sanitary and phytosanitary conditions of products going into fresh fruit export markets (Fig. 4). As part of its key activities, the CGA engages with government to enable various statutory and non-statutory functions to be fulfilled on the growers’ behalf. The CGA works closely with government on issues of market access, logistics, tariffs and trade barriers which are crucial for exporting. Market access involves government-to-government negotiations, with CGA representing growers and providing technical support (Chisoro-Dube and Roberts 2021).

The CGA has increasingly been involved in supporting the inclusion in citrus production of black South African growers who were systematically excluded from commercial agriculture under apartheid. In 2016, the CGA established the CGA Grower Development Company (CGDC) to provide both financial and on-farm support to 145 land reform beneficiaries and individual black farmers, including access to export markets (CGDC 2020a, b). The black grower-members accounted for just under 10% of the total area planted to citrus in 2020, with an average farm size of 56 hectares (CGDC 2020a, b). Around 76 farmers exported and were therefore members of the CGA, accounting for 5% of total members (CGA 2020, p. 48; Chisoro-Dube and Roberts 2021). In 2019, of the 1,854,862 tonnes of citrus exported (CGA 2020), black growers contributed 5% to the total, meaning average export volumes per farm were in line with all CGA members.

Value Chain Governance, Innovation and Upgrading

The South African citrus industry’s performance is due to overall changes in the industry and not a fragmented upgrading in ‘tasks’ by process, product or function at any given level of the value chain. These changes have been driven by the relationships, linkages and collective arrangements which integrate the export market performance with developments from cultivars through to growing, packing and marketing. We argue that the locus of the collective power lying with the growers has been critical to ensure the medium-term investments and the development of necessary institutional capabilities. The reconfiguration of power relations through the role of the industry association is a key factor in the stand-out performance of citrus, including shaping constructive engagement with government.

Systems Upgrading: From Cultivars to Marketing Channels

At the core of the citrus value chain are the relationships between different actors. These relationships and linkages span marketing companies and packhouses, cultivar companies, crop protection companies and nurseries through to growers. The marketing companies are very influential in export market access and returns, however, the success in key markets is dependent on the development of cultivars. Product can obviously only be marketed if it has been grown and, in turn, this requires investments in cultivars, nurseries and plantings by growers.

There are very high levels of concentration at the cultivar, plant protection products and marketing levels which would suggest this is where lead-firm governance lies. However, the drivers of growth have reflected the growers’ relative power.Footnote 26 After the de-regulation of exports, there was a proliferation of agents looking to source fruit for export markets, and growers were aware of the market opportunities. While coordination was required, it was not driven by marketing agents as the routes to export markets.

Growers generally maintained a relatively strong position with regard to marketing companies for two main reasons. First, growers were able to exit from being tied to the packhouses of the former cooperatives and many decided to invest in their own packhouses to ensure greater autonomy and flexibility, even while it meant some scale economies being sacrificed (Chisoro-Dube and Roberts 2021). Indeed, the very first case ruled on by the South African Competition Tribunal of abuse of a dominant position found that a former co-operative packhouse company, Patensie Sitrus, had unfairly exerted its power in the Gamtoos Valley by enforcing exclusive supply agreements over growers (see Roberts 2012).Footnote 27 The ruling enabled farmers to establish their own packhouses, including with other combinations of partners than previously. Public funding has also been provided to groups of black farmers for packhouse construction.Footnote 28 With many growers owning their own packhouses they have greater control and indicated that they can hold marketing agents to account in return for the margins made at this level.Footnote 29

Second, the CGA has been very engaged with logistics and port operations, such that bottleneck facilities have not been controlled by marketing companies on an exclusive basis. Before 1996 the technical aspects of the cold chain and logistics were the responsibility of Outspan. After de-regulation, the CGA through the CRI established the Cold Chain Forum in 2007 to coordinate these activities to support international competitiveness.Footnote 30 The result has been that in South Africa the interactions between packhouses, marketing companies and growers have ensured that the returns to marketing have been based on performance and continuous improvements rather than market power. It also placed the CGA in a strong position to address value chain disruptions during Covid-19 (Meyer et al. 2022).

Access to new and improved cultivars, particularly of soft citrus, has been critical for South Africa’s successful performance in European export markets. With very few South African companies having built capabilities to develop and source cultivars, growers would appear on the face of it to be in a relatively weak position relative to the international cultivar companies with the intellectual property rights. This is especially the case given the levels of concentration and the main developments in cultivars being in the global centres of citrus production and expertise in Spain, California and Morocco. Similarly, manufacturers of crop protection solutions own the registrations to crop chemicals and can charge high prices to growers given the high levels of concentration.

The CGA played an important countervailing role in shaping markets through regulation and in creating competition to large multinationals in key areas. It established businesses to ensure rivalry with the dominant input suppliers, to provide inputs to growers on a reasonable commercial basis and with profits ploughed back into the CGA businesses. The CGACC and River Bioscience have worked to directly improve the competitiveness of growers in Southern Africa through access to better and more keenly priced cultivars and plant treatment inputs (Chisoro-Dube and Roberts 2021).

The entrepreneurial role of the CGA, on behalf of growers, is further evident in the non-profit institutions for research and skills development. The CRI and the Citrus Academy (established in 2005 to provide skills development to the southern African citrus industry) have provided a common base for capabilities development for growers. Unlike other fruit industries, the CGA does not rely on the government-funded Agricultural Research Council (ARC) for its industry research needs.Footnote 31 The CGA conducts its own industry research, which means that the industry is in a better position to quickly respond to changing and expanding standards and requirements in export markets. Other industries which have tended to allocate research funds to the ARC have been subject to a number of challenges of this institution including unfilled posts, poor management and a lack of capacity.Footnote 32

The Citrus Growers Association and the Reconfiguration of Institutional Power

The CGA evolved from the growers’ collective response to the ending of the single-channel marketing system which, under the Citrus Board and Outspan, had been in place since 1940. Outspan was central to initially developing markets in the EU, Japan and other countries. Considerable funds had been invested in the construction of specialised fruit terminals at the major ports. In the 1980s, Outspan was also able to secure bargaining power over shipping schedules and port facilities and negotiate favourable rates with the support of the railways and harbour parastatal (Mather 1999). The Outspan Citrus Centre formed in 1973 undertook extensive research to raise fruit quality, broaden the citrus cultivars being marketed and improve on and off-farm production and processes (Mather and Greenberg 2003).

When all fruit industries in South Africa were de-regulated in terms of the Marketing of Agricultural Products Act (No.47 of 1996) the Citrus Board was abolished and the single-channel marketing arrangements were dissolved (Sandrey et al. 2008; Mather and Greenberg 2003). Grower levies were no longer compulsory and industry structures and services had to be transformed. The Act did provide for the establishment of statutory measures, including levies, however, these had to be applied for.

Just after de-regulation, the citrus growers formed the South African Citrus Growers Association in 1997 to ensure market access to export markets and to carry out certain functions previously carried out by the Citrus Board. These functions included retaining research capacity and market access. The CGA added other grower identified focus areas including logistics, information, transformation and market research—responding to the growers’ priorities.

Coordination through the CGA has ensured that the interests of the most diversified, dispersed value chain participants, the growers, are represented and that the growers direct the range of functions and activities undertaken by the CGA. CGA decisions are through voting which is weighted by the number of export cartons, and decisions require two-thirds of the grower votes. As the industry is not concentrated, at least at the grower level, this requires agreement by a large number of the entities.Footnote 33

Rather than individual lead firms, or a polycentric form of governance of different diffuse and intertwined actors (Pasquali et al. 2021b), the CGA represents a coherent collective private governance which effectively interfaces with public governance through influencing policy and its implementation. The institutional power of the growers via the CGA represents a reconfiguration in a number of important regards as it drew on the roles under the centralised system under apartheid while constituting far-reaching changes in the institutional structure.

We identify the CGA’s critical roles as being to coordinate the value chain in the interests of the growers; to invest in shared capabilities; to be entrepreneurial in ensuring rivalry at key bottlenecks in inputs and markets; and, with government and the National Agricultural Marketing Council (NAMC), to regulate the industry to ensure export market access and success. It has to be responsive to growers’ priorities and this has enabled the industry to anticipate international market developments with strong local linkages, investments in capabilities and continued evolution of the international positioning of South African producers.

Central to these roles and allowing the CGA to plan and carry out the different functions is the funding CGA received from statutory measures for research, market access, training and grower support. The CGA initially had voluntary levies, however, some growers did not pay and could free-ride on the industry support (Chisoro-Dube and Roberts 2021). The CGA was one of the first to apply, in 2001, for statutory levies to be imposed, along with registration of growers and recording of exports. This was approved and implemented from 2001 (CGA 2020). The levies increased from R0.21 per 15 kg carton in 2001, in steps, to R1.64/carton in January 2021, with the motivations for re-approval being required every 4 years (CGA 2020). In US dollar terms the total levies increased substantially from 2006 to 2008 from around US$3 mn to over US$5 mn in 2011/12, and then again to over US$7 mn in 2021 (Fig. 5).

The spending of statutory levies is governed by the NAMC,Footnote 34 with the majority being directed to research. There has been an increase in spending allocated to transformation, which is direct support to black growers, which was set by government at a minimum of 20% from 2018 (NAMC 2015, 2019).Footnote 35 The requirements and budget for transformation have been progressively increased, from requiring 10% of levies going to transformation in 2005, to approximately 20% and then a minimum of 20% from 2018. It is also stipulated that 60% should be on enterprise development (rather than training, as had been the case), with the activities being tracked (NAMC 2015, 2019).Footnote 36 These represent substantial increases in funding from the export levies enforced as a condition for government approval for the statutory levies to the CGA.

The CGA has therefore supported grower development in various ways, and is accountable to both the growers as members, and to the government through the approval process of the levies every 4 years.

Government Policies, Institutions and Industry Engagement

The combination of developments from the cultivar level through to the marketing to achieve high-value exports is based on effective coordination. This has not been state-led, however. Indeed, it was government policy to impose shock liberalisation on agricultural markets in 1996. But the citrus industry’s success in terms of international competitiveness and upgrading is not due to any supposed efficiency of liberalised markets which had motivated the government policies. Instead, the performance reflects the ability of the industry to reconfigure power relations given its strong existing base. This is evident from the difference in performance between citrus and other agricultural products and the initiatives led by the CGA, including in partnership with government (Cramer and Chisoro-Dube 2021; Kaziboni and Roberts 2022). Government, in return, has expected increasing levels of effort and investment by the CGA in incorporating black farmers in export value chains.

The industry has, however, been constrained along with other fruit producers by widespread underinvestment in key infrastructure including ports, along with rural roads, water and telecommunications (Cramer and Chisoro-Dube 2021).Footnote 37 Against this, the CGA has been able to proactively manage the relationship with the government to respond to challenges of market access, phytosanitary standards in export markets, biosecurity of the local industry and addressing logistics at ports.

Government enabled the CGA to play the coordinating role through authorising the levies and supporting its activities in research and international markets. The CGA has been effective in building and maintaining strong links with government to ensure this support, as evidenced in the approval of higher levies and market access support. The government along with the NAMC plays a key role in the signing of trade agreements and the industry relies on the government’s involvement in gaining market access and for it to maintain standards. During the trade negotiations, the industry represents local producers, and it has the technical and skilled people providing feedback on issues such as pests and diseases. Working together with areas within the state with which effective relationships have been developed, the citrus industry therefore represents a ‘pocket of efficiency’ (Whitfield et al. 2015).

The CGA leverages government’s institutional power to regulate certain activities in the value chain in order to protect the industry. For example, to ensure the biosecurity of South African plant material, and to control for pests and diseases in the orchards, there has been the move from a voluntary centralised system of procuring plant material by all nurseries in the country to a mandatory statutory centralised system to be signed off by the Minister of Agriculture in 2022.Footnote 38 Furthermore, the CGA through the CGACC along with other cultivar management companies has coordinated with DALRRD to address the various challenges with the government-owned plant quarantine facility. The facility was underfunded, lacked resources and was poorly managed, resulting in the slow pace of throughput of imported plant material and cultivars through quarantine. DALLRD allowed the industry to elect the CGACC to be the auditor of the plant quarantine facility along with a team of technical persons including scientists, pathologists and biologists. The industry led by the CGA and CRI assist and fund the facility. Through these efforts, the industry has brought down the timelines for cleaning up plant material from 2 to 4 years to about 18 months, from importation to completing quarantine.Footnote 39

The logistics side of the export business has involved very close coordination with government. The citrus industry has brought other fruit industry stakeholders together to continuously engage with government to improve efficiency and logistics systems at the ports. The fruit and export industries and organisations have also devised strategies around common challenges and brought pressure for government to address them.Footnote 40

The CGA relationship with government has also importantly involved land reform. The pace of land reform overall in South Africa has been exceedingly slow on all the targets set. There have been major problems with the granting of title deeds, and with the provision of appropriate support for building capabilities (Presidential Advisory Panel on Land Reform and Agriculture 2019; African National Congress (ANC) 2022).Footnote 41 Key institutions, notably the Land Bank, have not functioned effectively (Land Bank 2021). The expectations which government has placed on the citrus industry have, however, meant that the industry has worked around these challenges and established structures through the Grower Development Company to support black citrus growers who were systematically excluded from commercial agriculture under apartheid. While progress has been much slower than would be desired, in the context of the wider failures of land reform, the performance of black citrus export farmers is notable with volumes on par with the average for all export growers.

The government has pushed the CGA’s efforts for inclusion through setting conditionalities in the levy approval process. This in turn has contributed to political and social sustainability through balancing various interests to broaden the grower-oriented coalition led by the CGA. There has in effect been a political settlement between key groups mediated through the Departments of Agriculture and Land Reform (through various incarnations) and the CGA which has supported productive investments and collective action even while the land reform process in South Africa has been poor overall.

The progress made points to the much greater opportunities which could be realised with more effective government policies and the appropriate support from the relevant institutions. Advancing land reform with value creation requires close networks and links with value chain actors to ensure investment and building of long-term capabilities, as demonstrated by the relative successes in citrus (Chisoro-Dube and Roberts 2021).Footnote 42

Conclusion

The upgrading and capabilities development in the South African citrus industry are explained at one level by the export market orientation, which is important for driving upgrading through the value chain. Our assessment points to the deeper underlying factors in terms of the reconfiguration of power relationships relating to coordination of activities, the control over rents and the composition and roles of the industry association, including engagements with government.

South Africa’s key export markets in the European Union required responsiveness to preferences, quality, and sanitary and phytosanitary standards. This, in turn, promoted technological changes and upgrading—from cultivars and inputs through growing to packing, and marketing. At the inputs level, the development and supply of new and improved cultivars to meet changing international preferences have been critical for the industry’s success in export markets to attain high export prices in value terms. However, citrus stands out within South Africa for the balance of control in favour of growers which has supported coordination, systems upgrading and value creation. There has been a positive interaction between the institutional and bargaining power of growers, built-up over time.

An important part of the differences in power relations is due to the composition and roles of the industry association, as exemplified by the collective ‘grower-power’ exercised through the CGA, and with government support. The CGA coordinates and invests in shared services to support industry capabilities and upgrading over time, necessary to realise export market opportunities. The collective private governance through the CGA and its engagement with public governance has resulted from the reconfiguration of power following the shock liberalisation. Unlike other sectors, the citrus industry has been able to draw on the previous centralised governance to embed the market-shaping roles including research and value chain development in grower-driven coordination.

The CGA has leveraged government’s institutional power, in part by responding to the imperative for greater inclusion of black farmers. The approval process for the statutory levies provides an accountability mechanism through which conditionalities can be set and monitored. However, many challenges remain in terms of inclusivity, given the poor record on land reform (Presidential Advisory Panel on Land Reform and Agriculture 2019), and in wider sharing of the returns through better farm-worker wages and conditions (Alford et al. 2021; Du Toit and Ewert 2002; Mather and Greenberg 2003).

The case study points to the potential for grower organisations to reconfigure power relations in the value chain through collective institutional and bargaining power (Dallas et al. 2019). The CGA demonstrates the potential for growers to organise themselves and to ensure that the interests of the most diversified, dispersed value chain participants are unambiguously represented. This serves to strengthen the grower’s position in relation with government and through which they can influence sectoral industrial policy and its implementation. Most importantly, grower organisations can change the bargaining power of growers, improve growers’ share of rents and shape markets in key levels of the value chain by being entrepreneurial and providing competing rival products to concentrated suppliers.

Notes

Interviews with industry body 17 March 2021; cultivar companies 14 October 2020, 02 December 2020, 10 May 2022.

Interviews with industry body 17 March 2021; cultivar companies 02 December 2020, 10 May 2022.

Interviews with cultivar companies 14 October 2020, 02 December 2020, 10 May 2022; nursery 19 August 2020; fruit marketing companies 04 September 2020, 14 October 2020.

Interviews with cultivar companies 14 October 2020, 02 December 2020, 10 May 2022; fruit marketing companies 04 September 2020, 14 October 2020.

Interviews with industry body 17 March 2021; cultivar companies 14 October 2020, 02 December 2020, 10 May 2022.

Interviews with industry body 17 March 2021; cultivar company 10 May 2022.

Interviews with industry body 17 March 2021; cultivar company 10 May 2022.

Interviews with industry body 17 March 2021; cultivar company 10 May 2022.

http://www.cri.co.za/; Interviews with industry body 17 March 2021; cultivar companies 14 October 2020, 02 December 2020, 10 May 2022; nurseries 19 August 2020, 10 September 2020.

Interviews with crop protection solutions company 20 August 2020; industry body 14May 2021.

https://riverbioscience.co.za/about-us/; Interviews with industry body 17 March 2021; cultivar company 10 May 2022.

Interview with industry body 17 March 2021; cultivar company 10 May 2022.

https://riverbioscience.co.za/about-us/; Interviews with industry body 17 March 2021; cultivar company 10 May 2022.

Interviews with citrus growers, May 2022.

Interview with industry body, 17 March 2021; www.cga.co.za.

Interviews with citrus growers and packhouses, 2020.

Interview with industry body 17 March 2021; grower-owned packhouses, 2020.

Interviews with growers and packhouses, 2020; national development finance institution, 20 November 2019.

Interviews with fruit marketing companies, 04 September 2020, 14 October 2020.

Interview with fruit marketing companies, 04 September 2020, 14 October 2020.

Interviews with fruit marketing companies, 04 September 2020, 14 October 2020.

Interviews with industry body, 17 March 2020, citrus growers in 2020.

See www.cga.co.za.

Interviews with fruit marketing companies, 04 September 2020, 14 October 2020; industry body, 17 March 2020; citrus growers and grower-owned packhouses, 2020.

Case 37/CR/Jun01 Competition Commission v. Patensie Sitrus Beherend Beperk, decision on 4 August 2002.

Interviews with growers and packhouses, 2020; national development finance institution, 20 November 2019; industry body, 17 March 2020.

Interviews with growers and packhouses, 2020; national development finance institution, 20 November 2019; industry body, 17 March 2020.

Interviews with industry body, 17 March 2020; cultivar company, 10 May 2022; NAMC, 29 November 2021.

Interview with NAMC, 29 November 2021.

Interview with industry body, 17 March 2020; NAMC, 29 November 2021.

The National Agricultural Marketing Council (NAMC) was established under the 1996 Marketing of Agricultural Products Act to advise the government on the key areas of market access, efficiency in marketing and optimising export earnings. It is a creature of statute, but not a governmental body, and with substantial resources and expertise to perform a public role.

Interviews with industry body, 17 March 2020; NAMC, 29 November 2021; cultivar company, 10 May 2022.

Interviews with industry body, 17 March 2020; NAMC, 29 November 2021; cultivar company, 10 May 2022.

Interviews with citrus growers in 2020; cultivar company, 10 May 2022; industry body, 17 March 2020; irrigation board, 21 August 2020.

Interviews with cultivar companies, 14 October 2020, 02 December 2020, 10 May 2022.

Interviews with cultivar companies, 14 October 2020, 02 December 2020, 10 May 2022; industry body, 17 March 2020.

Interview with cultivar company, 10 May 2022; industry body, 17 March 2020; citrus growers and packhouses, 2020.

Interview with large producer-exporting company, 18 September 2020; black citrus farmers, 23 March 2020; 30 July 2020; 04 September 2020; 15 September 2020.

Interviews with industry body, 17 March 2020; NAMC, 29 November 2021.

References

African National Congress (ANC). 2022. Policy Conference 2022 Discussion Documents. https://cisp.cachefly.net/assets/articles/attachments/88080_umrabulo-policy-document-18th-may-2022.pdf.

Alford, M., M. Visser, and S. Barrientos. 2021. Southern actors and the governance of labour standards in global production networks: The case of South African fruit and wine. Environment and Planning a: Economy and Space 53 (8): 1915–1934.

Bair, J. 2009. Global commodity chains: genealogy and review. In Frontiers of commodity chain research, ed. J. Bair. Stanford: Stanford University Press.

Bamber, P., and K. Fernandez-Stark. 2019. GVCs and development: policy formulation for economic and social upgrading. In Handbook on global value chains, ed. S. Ponte, G. Gereffi, and G. Raj-Reichert, 466–482. Cheltenham: Edward Elgar Publishing.

Bayley, B. 2000. A revolution in the market: The deregulation of South African agriculture. Oxford: Oxford Policy Management.

Bernstein, H. 2013. Commercial Agriculture in South Africa since 1994: Natural simply capitalism. Journal of Agrarian Change 13 (1): 23–46.

Brandt, L., and E. Thun. 2016. Constructing a ladder for growth: Policy, markets, and industrial upgrading in China. World Development 80: 78–95.

Bräutigam, D., L. Rakner, and S. Taylor. 2002. Business associations and growth coalitions in Sub-Saharan Africa. The Journal of Modern African Studies 40 (4): 519–547.

Chisoro-Dube, S., and S. Roberts. 2021. Innovation and inclusion in South Africa’s citrus value chain. Innovation and Inclusion in Agro-processing Working Paper. https://static1.squarespace.com/static/52246331e4b0a46e5f1b8ce5/t/619b4205fb8ae64b7d5787e5/1637564952393/Final+SA+Citrus+Working+Paper_October+2021.pdf.

Citrus Growers’ Association Grower Development Company. 2020. KwaZulu Natal, South Africa. Presentation. http://cga-gdc.org.za/.

Citrus Growers’ Association of Southern Africa. 2007. Annual Report. KwaZulu Natal, South Africa. https://www.cga.co.za/Page.aspx?ID=3160.

Citrus Growers’ Association of Southern Africa. 2020a. Annual Report. KwaZulu Natal, South Africa. https://www.cga.co.za/Page.aspx?ID=3160.

Citrus Growers’ Association of Southern Africa. 2020b. Key industry statistics for citrus growers 2019 Export Season. KwaZulu Natal, South Africa. http://c1e39d912d21c91dce811d6da9929ae8.cdn.ilink247.com/ClientFiles/cga/CitrusGowersAssociation/Company/Documents/2020%20Citrus%20Industry%20Statistics(2).pdf.

Cramer, C., and S. Chisoro-Dube. 2021. The industrialization of freshness and structural transformation in South African fruit exports. In Structural transformation in South Africa: Sectors, politics and global challenges, ed. A. Andreoni, P. Mondliwa, S. Roberts, and F. Tregenna, 120–142. Oxford: Oxford University Press.

Cramer, C., J. Di John, and J. Sender. 2022. Classification and roundabout production in high-value agriculture: A fresh approach to industrialization. Development and Change 53 (3): 495–524.

Cramer, C., and J. Sender. 2019. Oranges are not only fruit: the industrialization of freshness and the quality of growth. In The quality of growth in Africa, ed. S.M.R. Kanbur, A. Noman, and J.E. Stiglitz. New York: Columbia University Press.

Dallas, M.P., S. Ponte, and T.J. Sturgeon. 2019. Power in global value chains. Review of International Political Economy 26 (4): 666–694.

Dolan, C., and J. Humphrey. 2000. Governance and trade in fresh vegetables: The impact of UK supermarkets on the African horticulture industry. Journal of Development Studies 37 (2): 147–176.

Du Toit, A., and J. Ewert. 2002. Myths of globalisation: Private regulation and farm worker livelihoods on Western Cape farms. Transformation: Critical Perspectives on Southern Africa 50 (1): 77–104.

Fałkowski, J., and P. Ciaian. 2016. Factors Supporting the Development of Producer Organizations and their Impacts in the Light of Ongoing Changes in Food Supply Chains; EUR 27929 EN; https://doi.org/10.2791/21346.

Gereffi, G. 2019. Economic upgrading in global value chains. In Handbook on global value chains, ed. S. Ponte, G. Gereffi, and G. Raj-Reichert, 240–254. Cheltenham: Edward Elgar Publishing.

Gereffi, G., J. Humphrey, R. Kaplinsky, and T.J. Sturgeon. 2001. Introduction: Globalisation, value chains and development. IDS Bulletin 32 (3): 1–8.

Gereffi, G., J. Humphrey, and T. Sturgeon. 2005. The governance of global value chains. Review of International Political Economy 12 (1): 78–104.

Gibbon, P., J. Bair, and S. Ponte. 2008. Governing global value chains: An introduction. Economy and Society 37 (3): 315–338.

Havice, E., and J. Pickles. 2019. On value in value chains. In Handbook on global value chains, ed. S. Ponte, G. Gereffi, and G. Raj-Reichert, 169–182. Cheltenham: Edward Elgar Publishing.

Horner, R. 2017. Beyond facilitator? State roles in global value chains and global production networks. Geography Compass 11 (2): e12307.

Horner, R., and M. Alford. 2019. The roles of the state in global value chains. In Handbook on global value chains, ed. S. Ponte, G. Gereffi, and G. Raj-Reichert, 555–569. Cheltenham: Edward Elgar Publishing.

Humphrey, J., and H. Schmitz. 2000. Governance and upgrading: Linking industrial cluster and global value chain research, vol. 120, 139–170. Brighton: Institute of Development Studies, University of Sussex.

Humphrey, J., and H. Schmitz. 2001. Governance in global value chains. IDS Bulletin 32 (3): 19–29.

Kaplinsky, R. 2010. The role of standards in global value chains. World Bank policy research working paper, 5396.

Kaplinsky, R. 2019. Rents and inequality in global value chains. In Handbook on global value chains, ed. S. Ponte, G. Gereffi, and G. Raj-Reichert, 153–168. Cheltenham: Edward Elgar Publishing.

Kaplinsky, R., and M. Morris. 2016. Thinning and thickening: Productive sector policies in the era of global value chains. The European Journal of Development Research 28: 625–645.

Kaziboni, L., and S. Roberts. 2022. Industrial Policy for a Just Transition to a Green Economy–The Importance of Regional Food Value Chains in Southern Africa. SARChI Industrial Development Working Paper Series WP 2022-01. SARChI Industrial Development, University of Johannesburg.

Kirsten, J., L. Edwards, and N. Vink. 2009. South Africa. In Distortions to agricultural incentives in Africa, ed. K. Anderson and W.A. Masters, 147–174. Washington: World Bank.

Land Bank. 2021. Land Bank Presentation: Standing committee on appropriations. Johannesburg: Land Bank.

Mather, C. 1999. Agro-commodity chains, market power and territory: Re-regulating South African citrus exports in the 1990s. Geoforum 30 (1): 61–70.

Mather, C., and S. Greensberg. 2003. Market liberalisation in post-apartheid South Africa: The restructuring of citrus exports after ‘deregulation.’ Journal of Southern African Studies 29 (2): 393–412.

Mayer, F.W., and N. Phillips. 2017. Outsourcing governance: States and the politics of a ‘global value chain world.’ New Political Economy 22 (2): 134–152.

Meyer, F., T. Reardon, T. Davids, M. van der Merwe, D. Jordaan, M. Delport, and G. Van Den Burgh. 2022. Hotspots of vulnerability and disruption in food value chains during COVID-19 in South Africa: Industry-and firm-level “pivoting” in response. Agrekon 61 (1): 21–41.

Mondliwa, P., S. Roberts, and S. Ponte. 2020. Competition and power in global value chains. Competition and Change 25 (3–4): 328–349.

Nadvi, K. 2008. Global standards, global governance and the organization of global value chains. Journal of Economic Geography 8 (3): 323–343.

NAMC. 2015. Short Report on Statutory Measures implemented in terms of the Marketing of Agricultural Products Act, Act no. 47 of 1996. Pretoria, South Africa. Available at https://www.namc.co.za/.

NAMC. 2019. Status Report on Statutory Measures 2012 Survey. Pretoria, South Africa. https://www.namc.co.za/.

Park, E., and M.K. Gachukia. 2021. The role of the local innovation system for inclusive upgrading in the global value chain: The case of KenyaGAP in the Kenyan horticultural sector. The European Journal of Development Research 33: 578–603.

Pasquali, G., S. Barrientos, and M. Opondo. 2021a. Polycentric governance of global and domestic horticulture value chains: shifting standards in Kenyan fresh fruit and vegetables. GDI Working Paper 2021a-060. Manchester: The University of Manchester.

Pasquali, G., A. Krishnan, and M. Alford. 2021b. Multichain strategies and economic upgrading in global value chains: Evidence from Kenyan horticulture. World Development 146: 105598.

Ponte, S., and J. Ewert. 2009. Which way is “up” in upgrading? Trajectories of change in the value chain for South African wine. World Development 37 (10): 1637–1650.

Ponte, S., and T.J. Sturgeon. 2014. Explaining governance in global value chains: A modular theory-building effort. Review of International Political Economy 21 (1): 195–223.

Ponte, S., T.J. Sturgeon, and M.P. Dallas. 2019. Governance and power in global value chains. In Handbook on global value chains, ed. S. Ponte, G. Gereffi, and G. Raj-Reichert, 120–137. Cheltenham: Edward Elgar Publishing.

Presidential Advisory Panel on Land Reform and Agriculture. 2019. Final report of the Presidential Advisory Panel on Land Reform and Agriculture. South Africa. https://www.gov.za/sites/default/files/gcis_document/201907/panelreportlandreform_0.pdf.

Roberts, S. 2012. Administrability and business certainty in abuse of dominance enforcement: An economist’s review of the South African record. World Competition 35 (2): 269–296.

Sandrey, R., M. Karaan, and N. Vink. 2008. Is there policy space to protect South African agriculture? South African Journal of Economics 76 (1): 89–103.

Schneider, B.R., and S. Maxfield. 1997. Business, the state, and economic performance in developing countries. In Business and the State in developing countries, ed. S. Maxfield and B.R. Schneider, 3–35. Ithaca and London: Cornell University Press.

Sorrentino, A., C. Russo, and L. Cacchiarelli. 2018. Market power and bargaining power in the EU food supply chain: The role of Producer Organizations. New Medit 17 (4).

Velázquez, B., B. Buffaria, and European Commission. 2017. About farmers’ bargaining power within the new CAP. Agricultural and Food Economics 5: 1–13.

Vink, N., and J. Kirsten. 2000. Deregulation of agricultural marketing in South Africa: lessons learned. Briefing Paper prepared for the Free Market Foundation. Johannesburg, South Africa.

Watkins, A., T. Papaioannou, J. Mugwagwa, and D. Kale. 2015. National innovation systems and the intermediary role of industry associations in building institutional capacities for innovation in developing countries: A critical review of the literature. Research Policy 44 (8): 1407–1418.

Whitfield, L., O. Therkildsen, L. Buur, and A. Kjaer. 2015. The politics of African Industrial Policy. Cambridge: Cambridge University Press.

Acknowledgements

Some of the material included is developed from the working paper (Innovation and inclusion in South Africa’s citrus value chain, Shingie Chisoro-Dube and Simon Roberts, 2021). The working paper is listed in the reference section of the manuscript, and a URL provided. Nomination of referees: Aarti Krishnan and Valentina De Marchi.

Funding

Open access funding provided by University of Johannesburg. This research was funded in whole, or in part, by [ESRC GCRF] [Grant number - ES/S0001352/1]. For the purpose of open access, the author has applied a creative commons attribution (CC BY) licence to any author accepted manuscript version arising.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chisoro, S., Roberts, S. Grower Power for Value Creation in High-Value Horticulture? The Case of Citrus in South Africa. Eur J Dev Res 36, 1–24 (2024). https://doi.org/10.1057/s41287-023-00591-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41287-023-00591-z