Abstract

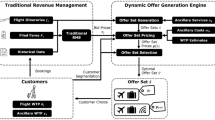

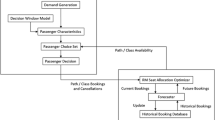

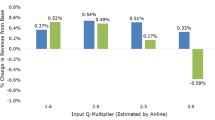

As enhancements in airline IT begin to expand pricing and revenue management (RM) capabilities, airlines are starting to develop dynamic pricing engines (DPEs) to dynamically adjust the fares that would normally be offered by existing pricing and RM systems. In past work, simulations have found that DPEs can lead to revenue gains for airlines over traditional pricing and RM. However, these algorithms typically price each itinerary independently without directly considering the attributes and availability of other alternatives. In this paper, we introduce a dynamic pricing engine that simultaneously prices multiple substitutable itineraries that depart at different times. Using a Hotelling line (also called a locational choice model) to represent customer tradeoffs between departure times and price, the DPE dynamically suggests increments or decrements to the prices of pre-determined fare products as a function of booking request characteristics, departure time preferences, and the airline’s estimates of customer willingness-to-pay. Simulations in the Passenger Origin–Destination Simulator (PODS) show that simultaneous dynamic pricing can result in revenue gains of between 5 and 7% over traditional RM when used in a simple network with one airline and two flights. The heuristic produces revenue gains by stimulating new bookings, encouraging business passenger buy-up, and leading to spiral-up of forecast demand. However, simultaneous dynamic pricing produces marginal gains of less than 1% over a DPE that prices each itinerary independently. Given the complexity of specifying and implementing a simultaneous pricing model in practice, practitioners may prefer to use a flight-by-flight approach when developing DPEs.

Similar content being viewed by others

Notes

Different coefficients of variations were tested with little change to experimental outcomes.

References

Akçay, Y., H.P. Natarajan, and S.H. Xu. 2010. Joint Dynamic Pricing of Multiple Perishable Products Under Consumer Choice. Management Science 56 (8): 1345–1361.

Aydin, G. and J.K. Ryan. 2000. Product Line Selection and Pricing Under the Multinomial Logit Model. In Proceedings of the 2000 MSOM Conference, Ann Arbor, MI, 1–49.

Belobaba, P.P. 1992. Optimal Vs. Heuristic Methods for Nested Seat Allocation. Presentation to AGIFORS Reservations Control Study Group Meeting, Brussels, Belgium.

Belobaba, P.P. 2016. Optimization Models in RM Systems: Optimality Versus Revenue Gains. Journal of Revenue and Pricing Management 15 (3): 229–235.

Bockelie, A. and P.P. Belobaba. 2017. Incorporating Ancillary Services in Airline Passenger Choice Models. Journal of Revenue and Pricing Management 16 (6): 553–568.

Boeing. 1996. The Decision Window Path Preference Model: Summary Discussion. Marketing and Business Strategy, Boeing Commercial Airplanes

Bratu, S. 1998. Network Value Concept in Airline Revenue Management. Unpublished Master’s Thesis, Massachusetts Institute of Technology, Cambridge, MA.

Burger, B., and M. Fuchs. 2005. Dynamic Pricing—A Future Airline Business Model. Journal of Revenue and Pricing Management 4 (1): 39–53.

Chen, S., G. Gallego, M.Z.F. Li, and B. Lin. 2010. Optimal Seat Allocation for Two-Flight Problems with a Flexible Demand Segment. European Journal of Operations Research 201: 897–908.

D’Huart, O., and P. Belobaba. 2012. A Model of Competitive Airline Revenue Management Interactions. Journal of Revenue and Pricing Management 11 (1): 109–124.

Dong, L., P. Kouvelis, and Z. Tian. 2009. Dynamic Pricing and Inventory Control of Substitute Products. Manufacturing and Service Operations Management 11 (2): 317–339.

Fiig, T., K. Isler, C. Hopperstad, and P.P. Belobaba. 2010. Optimization of Mixed Fare Structures: Theory and Applications. Journal of Revenue and Pricing Management 9 (1–2): 152–170.

Fiig, T., U. Cholak, M. Gauchet, and B. Cany. 2015. What is the Role of Distribution in Revenue Management?—Past and Future. Journal of Revenue and Pricing Management 14 (2): 127–133.

Fiig, T., O. Goyons, R. Adelving, and B. Smith. 2016. Dynamic Pricing—The Next Revolution in RM? Journal of Revenue and Pricing Management 15 (5): 360–379.

Gallego, G., and R. Wang. 2014. Multiproduct Price Optimization and Competition Under the Nested Logit Model with Product-Differentiated Price Sensitivities. Operations Research 62 (2): 450–461.

Garrow, L., S.P. Jones, and R.A. Parker. 2007. How much Airline Customers are Willing to Pay: An Analysis of Price Sensitivity in Online Distribution Channels. Journal of Revenue and Pricing Management 5 (4): 271–290.

Gaur, V., and D. Honhon. 2006. Assortment Planning and Inventory Decisions Under a Locational Choice Model. Management Science 52 (10): 1528–1543.

Mumbower, S., L.A. Garrow, and M.J. Higgins. 2014. Estimating Flight-Level Price Elasticities Using Online Airline Data: A First Step Toward Integrating Pricing, Demand, and Revenue Optimization. Transportation Research Part A: Policy and Practice 66: 196–212.

Ratliff, R. 2017. Industry-Standard Specifications for Air Dynamic Pricing Engines: Progress Update. In Proceedings of the 2017 AGIFORS Revenue Management Study Group Meeting, San Francisco, CA.

Seelhorst, M., and Y. Liu. 2015. Latent Air Travel Preferences: Understanding the Role of Frequent Flyer Programs on Itinerary Choice. Transportation Research Part A: Policy and Practice 80: 49–61.

Smith, B.C. and C.W. Penn. 1988. Analysis of Alternative Origin-Destination Control Strategies. In AGIFORS Symposium Proceedings, vol. 28, New Seabury, MA.

Suh, M., and G. Aydin. 2011. Dynamic Pricing of Substitutable Products with Limited Inventories Under Logit Demand. IIE Transactions 43: 323–331.

U.S. Department of Transportation. 2016. The Value of Travel Time Savings: Departmental Guidance for Conducting Economic Evaluations Revision 2 (2016 Update). 27 September 2016.

Westermann, D. 2013. The Potential Impact of IATAs New Distribution Capability (NDC) on Revenue Management and Pricing. Journal of Revenue and Pricing Management 12 (6): 565–568.

Wittman, M.D. and P.P. Belobaba. 2017. Customized Dynamic Pricing of Airline Fare Products. Journal of Revenue and Pricing Management. https://doi.org/10.1057/s41272-017-0119-8.

Zhang, D., and W.L. Cooper. 2009. Pricing Substitutable Flights in Airline Revenue Management. European Journal of Operations Research 197: 848–861.

Zhang, D., and Z. Lu. 2013. Assessing the Value of Dynamic Pricing in Network Revenue Management. INFORMS Journal on Computing 25 (1): 102–115.

Acknowledgements

Michael Wittman would like to thank Craig Hopperstad for excellent development assistance with PODS; members of the MIT PODS Consortium for funding and helpful suggestions; participants of the 2017 AGIFORS RM Study Group Meeting; and Jan Vilhelmsen, Robin Adelving, and Jean-Michel Sauvage for their hospitality during the author’s research visit at Amadeus in August 2016.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wittman, M.D., Fiig, T. & Belobaba, P.P. A dynamic pricing engine for multiple substitutable flights. J Revenue Pricing Manag 17, 420–435 (2018). https://doi.org/10.1057/s41272-018-0149-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41272-018-0149-x