Abstract

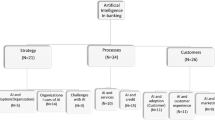

This paper addresses the use of a customer character model as a determinant of used auto loan churn among a unique population of subprime borrowers. The customer character model (i.e restricted model) is compared to a full model consisting of the 4 Cs of capacity, collateral, credit, and character of churn prediction. The results reveal that there is a difference between the full model and the customer character model. Additionally, different supervised classification methods, such as logistic regression (LR), linear discriminant analysis (LDA), decision trees (DTs), and random forests (RFs), are applied and compared in terms of multiple predictive performance measures. The RF classification measures report the strongest performance. Additionally, different classification methods suggest the importance of different customer character variables. Therefore, from a practical perspective, effective borrower character screening is recommended to determine customer profiles more accurately for the purposes of target marketing and customer retention. This study also deepens understanding of subprime credit markets and reveals additional insights to credit screening using machine learning techniques.

Similar content being viewed by others

References

Abu-Nimeh, S., D. Nappa, X. Wang, and S. Nair. 2007, October. A comparison of machine learning techniques for phishing detection. In Proceedings of the anti-phishing working groups 2nd annual eCrime researchers summit, 60–69. New York: ACM.

Agarwal, S., B.W. Ambrose, and S. Chomsisengphet. 2008. Determinants of automobile loan default and prepayment. Economic Perspectives 32 (3): 17–27.

Ahn, Y., D. Kim, and D.-J. Lee. 2019. Customer attrition analysis in the securities industry: A large-scale field study in Korea. International Journal of Bank Marketing 38 (3): 561–577.

Ali, Ö.G., and U. Arıtürk. 2014. Dynamic churn prediction framework with more effective use of rare event data: The case of private banking. Expert Systems with Applications 41 (17): 7889–7903.

Assis, C. 2016. Subprime car loans aren’t subprime mortgages yet still worry Jamie Dimon and now, John Oliver. https://www.marketwatch.com/story/could-subprime-auto-loans-lead-to-same-economic-catastrophe-as-risky-mortgages-2016-07-27.

Axelton, K. 2020, July 19. How to Get a Used Car Loan. Experian. https://www.experian.com/blogs/ask-experian/how-to-get-a-used-car-loan/.

Barboza, F., H. Kimura, and E. Altman. 2017. Machine learning models and bankruptcy prediction. Expert Systems with Applications 83: 405–417.

Braun, M., and D.A. Schweidel. 2011. Modeling customer lifetimes with multiple causes of churn. Marketing Science 30 (5): 881–902.

Breiman, L. 2001. Random forests. Machine Learning 45 (1): 5–32.

Buckinx, W., and D. Van den Poel. 2005. Customer base analysis: Partial defection of behaviorally loyal clients in a non-contractual FMCG retail setting. European Journal of Operational Research 164 (1): 252–268.

Butler, A.W., E.J. Mayer, and J. Weston. 2020. Racial discrimination in the auto loan market. SSRN 3301009.

Chawla, N.V. 2009. Data mining for imbalanced datasets: An overview. In Data mining and knowledge discovery handbook, 875–886. Boston: Springer.

Chen, K., Y. Hu, and Y. Hsieh. 2015. Predicting customer churn from valuable B2B customers in the logistics industry: A case study. Information Systems and E-Business Management 13 (3): 475–494.

Chiang, D.A., Y.F. Wang, S.L. Lee, and C.J. Lin. 2003. Goal-oriented sequential pattern for network banking churn analysis. Expert Systems with Applications 25 (3): 293–302.

Clarke, K.A. 2005. The phantom menace: Omitted variable bias in econometric research. Conflict Management and Peace Science 22 (4): 341–352.

Courchane, M.J., B.J. Surette, and P.M. Zorn. 2004. Subprime borrowers: Mortgage transitions and outcomes. The Journal of Real Estate Finance and Economics 29 (4): 365–392.

Coussement, K., and K.W. De Bock. 2013. Customer churn prediction in the online gambling industry: The beneficial effect of ensemble learning. Journal of Business Research 66 (9): 1629–1636.

Coussement, K., S. Lessmann, and G. Verstraeten. 2017. A comparative analysis of data preparation algorithms for customer churn prediction: A case study in the telecommunication industry. Decision Support Systems 95: 27–36.

Coussement, K., and D. Van den Poel. 2008. Churn prediction in subscription services: An application of support vector machines while comparing two parameter-selection techniques. Expert Systems with Applications 34 (1): 313–327.

Cox Automotive 2018 Used Car Market Report & Outlook Forecast Higher Used-Vehicle Sales for 2018 and a Decline in New-Car Sales. 2018. https://www.coxautoinc.com/news/cox-automotive-2018-used-car-market-report-outlook-forecast-higher-used-vehicle-sales-for-2018-and-a-decline-in-new-car-sales/.

De Caigny, A., K. Coussement, and K.W. De Bock. 2018. A new hybrid classification algorithm for customer churn prediction based on logistic regression and decision trees. European Journal of Operational Research 269 (2): 760–772.

Delen, D. 2010. A comparative analysis of machine learning techniques for student retention management. Decision Support Systems 49 (4): 498–506.

Denison, D.G., B.K. Mallick, and A.F. Smith. 1998. A Bayesian CART algorithm. Biometrika 85 (2): 363–377.

Dogru, N., and A. Subasi. 2018, February. Traffic accident detection using random forest classifier. In 2018 15th learning and technology conference (L&T), 40–45. IEEE.

Fader, P.S., and B.G. Hardie. 2010. Customer-base valuation in a contractual setting: The perils of ignoring heterogeneity. Marketing Science 29 (1): 85–93.

Field, A., J. Miles, and Z. Field. 2012. Discovering Statistics Using R. Thousand Oaks, CA: SAGE.

Ghulam, Y., and S. Hill. 2017. Distinguishing between good and bad subprime auto loans borrowers: The role of demographic, region and loan characteristics. Review of Economics and Finance 10 (4): 49–62.

Hand, D.J. 2006. Classifier technology and the illusion of progress. Statistical Science 21 (1): 15.

Haron, S., and B. Shanmugam. 1994. Lending to small business in Malaysia. Journal of Small Business Management 32 (4): 88.

Heitfield, E., and T. Sabarwal. 2004. What drives default and prepayment on subprime auto loans? The Journal of Real Estate Finance and Economics 29 (4): 457–477.

Höppner, S., E. Stripling, B. Baesens, and T. Verdonck. 2017. Profit driven decision trees for churn prediction. arXiv preprint. https://arxiv.org/abs/1712.08101.

Huffman, M. 2018. Subprime auto loan defaults hit 20-year high in March Consumers with poor credit may find it harder to buy a car. https://www.consumeraffairs.com/news/subprime-auto-loan-defaults-hit-20-year-high-in-march-051618.html.

Innovative Funding Services. 2019. The four C’s of credit. https://www.ifsautoloans.com/the-four-cs-of-credit/.

James, G., D. Witten, T. Hastie, and R. Tibshirani. 2013. An introduction to statistical learning, vol. 112. New York: Springer.

Jankowicz, A.D., and R.D. Hisrich. 1987. Intuition in small business lending decisions. Journal of Small Business Management 25 (3): 4.

Jiménez, G., and J. Saurina. 2004. Collateral, type of lender and relationship banking as determinants of credit risk. Journal of Banking & Finance 28 (9): 2191–2212.

Keramati, A., H. Ghaneei, and S.M. Mirmohammadi. 2016. Developing a prediction model for customer churn from electronic banking services using data mining. Financial Innovation 2 (1): 1–13.

Khan, M.R., J. Manoj, A. Singh, and J. Blumenstock. 2015. Behavioral modeling for churn prediction: Early indicators and accurate predictors of custom defection and loyalty. In Big data congress, 677–608. IEEE International Congress.

Khan, A.A., S. Jamwal, and M.M. Sepehri. 2010. Applying data mining to customer churn prediction in an internet service provider. International Journal of Computer Applications 9 (7): 8–14.

Kiisel, T. 2013. The Five ‘C’s of Small Business Lending. http://www.easybib.com/guides/citation-guides/apa-format/how-to-cite-a-website-apa/.

Koturwar, P., S. Girase, and D. Mukhopadhyay. 2015. A survey of classification techniques in the area of big data. arXiv preprint. https://arxiv.org/abs/1503.07477.

Kuhn, M., and K. Johnson. 2013. Applied predictive modeling, vol. 26. New York: Springer.

Ledolter, J. 2013. Data mining and business analytics with R. Hoboken: Wiley.

López-Díaz, M.C., M. López-Díaz, and S. Martínez-Fernández. 2017. A stochastic comparison of customer classifiers with an application to customer attrition in commercial banking. Scandinavian Actuarial Journal 2017 (7): 606–627.

Martens, D., J. Vanthienen, W. Verbeke, and B. Baesens. 2011. Performance of classification models from a user perspective. Decision Support Systems 51 (4): 782–793.

Mendez, G., T.D. Buskirk, S. Lohr, and S. Haag. 2008. Factors associated with persistence in science and engineering majors: An exploratory study using classification trees and random forests. Journal of Engineering Education 97 (1): 57–70.

Milanović, S., N. Marković, D. Pamučar, L. Gigović, P. Kostić, and S.D. Milanović. 2021. Forest fire probability mapping in eastern Serbia: Logistic regression versus random forest method. Forests 12 (1): 5.

Moti, H.O., J.S. Masinde, N.G. Mugenda, and M.N. Sindani. 2012. Effectiveness of credit management system on loan performance: Empirical evidence from micro finance sector in Kenya. International Journal of Business, Humanities and Technology 2 (6): 99–108.

Neslin, S.A., S. Gupta, W. Kamakura, J. Lu, and C.H. Mason. 2006. Defection detection: Measuring and understanding the predictive accuracy of customer churn models. Journal of Marketing Research 43 (2): 204–221.

Nie, G., W. Rowe, L. Zhang, Y. Tian, and Y. Shi. 2011. Credit card churn forecasting by logistic regression and decision tree. Expert Systems with Applications 38 (12): 15273–15285.

Noshad, Z., N. Javaid, T. Saba, Z. Wadud, M.Q. Saleem, M.E. Alzahrani, and O.E. Sheta. 2019. Fault detection in wireless sensor networks through the random forest classifier. Sensors 19 (7): 1568.

Ohsaki, M., P. Wang, K. Matsuda, S. Katagiri, H. Watanabe, and A. Ralescu. 2017. Confusion- matrix-based kernel logistic regression for imbalanced data classification. IEEE Transactions on Knowledge and Data Engineering 29 (9): 1806–1819.

Owczarczuk, M. 2010. Churn models for prepaid customers in the cellular telecommunication industry using large data marts. Expert Systems with Applications 37 (6): 4710–4712.

Pohar, M., M. Blas, and S. Turk. 2004. Comparison of logistic regression and linear discriminant analysis: A simulation study. Metodoloski Zvezki 1 (1): 143.

Rajamohamed, R., and J. Manokaran. 2018. Improved credit card churn prediction based on rough clustering and supervised learning techniques. Cluster Computing 21 (1): 65–77.

Risselada, H., P.C. Verhoef, and T.H. Bijmolt. 2010. Staying power of churn prediction models. Journal of Interactive Marketing 24 (3): 198–208.

Roszbach, K. 2004. Bank lending policy, credit scoring, and the survival of loans. Review of Economics and Statistics 86 (4): 946–958.

Scully, M. 2017. Deep Subprime’ auto loans are surging. https://www.bloomberg.com/news/articles/2017-03-28/-deep-subprime-becomes-norm-in-car-loan-market-analysts-say.

Seide, C.K. 2012. Consumer financial protection post Dodd-Frank: Solutions to protect consumers against wrongful foreclosure practices and predatory subprime auto lending. The University of Puerto Rico Business Law Journal 3: 219–233.

Sengupta, R., and G. Bhardwaj. 2015. Credit scoring and loan default. International Review of Finance 15 (2): 139–167.

Sharma, A., and P.K. Panigrahi. 2011. A neural network based approach for predicting customer churn in cellular network services. International Journal of Computer Applications 27 (11): 26–31.

Sokolova, M., N. Japkowicz, and S. Szpakowicz. 2006, December. Beyond accuracy, F-score and ROC: a family of discriminant measures for performance evaluation. In Australasian joint conference on artificial intelligence, 1015–1021. Berlin: Springer.

Stahlecker, P., and G. Trenkler. 1993. Some further results on the use of proxy variables in prediction. The Review of Economics and Statistics 75 (4): 707–711.

Stolba, S. 2021, June 7. Fewer subprime consumers across U.S. in 2021. Experian. https://www.experian.com/blogs/ask-experian/research/subprime-study/.

Subudhi, A., M. Dash, and S. Sabut. 2020. Automated segmentation and classification of brain stroke using expectation-maximization and random forest classifier. Biocybernetics and Biomedical Engineering 40 (1): 277–289.

Tashman, H.M. 2007. Subprime lending industry: An industry in crisis. Banking LJ 124: 407.

Van Haver, J. 2017. Benchmarking analytical techniques for churn modelling in a B2B context.

Verbeke, W., K. Dejaeger, D. Martens, J. Hur, and B. Baesens. 2012. New insights into churn prediction in the telecommunication sector: A profit driven data mining approach. European Journal of Operational Research 218 (1): 211–229.

Verbeke, W., D. Martens, C. Mues, and B. Baesens. 2011. Building comprehensible customer churn prediction models with advanced rule induction techniques. Expert Systems with Applications 38 (3): 2354–2364.

Vuk, M., and T. Curk. 2006. ROC curve, lift chart and calibration plot. Metodoloski Zvezki 3 (1): 89.

What are the 4Cs of Credit? 2019. Retrieved from https://www.creditguru.com/index.php/credit-management/commercial-credit-management-articles/79-what-are-the-4-cs-of-credit.

Wu, B., T. Abbott, D. Fishman, W. McMurray, G. Mor, K. Stone, and H. Zhao. 2003. Comparison of statistical methods for classification of ovarian cancer using mass spectrometry data. Bioinformatics 19 (13): 1636–1643.

Zhang, Y., J. Qi, H. Shu, and J. Cao. 2007, October. A hybrid KNN-LR classifier and its application in customer churn prediction. In IEEE international conference on Systems, man and cybernetics, 2007 (ISIC), 3265–3269. IEEE.

Zoric, A. 2016. Predicting customer churn in banking industry using neural networks. Interdisciplinary Description of Complex Systems: INDECS 14 (2): 116–124.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors of this manuscript declare that they have no financial or non-financial interest with any organization cited in this manuscript and the subject matter discussed. On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Valluri, C., Raju, S. & Patil, V.H. Customer determinants of used auto loan churn: comparing predictive performance using machine learning techniques. J Market Anal 10, 279–296 (2022). https://doi.org/10.1057/s41270-021-00135-6

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41270-021-00135-6