Abstract

Although the International Monetary Fund (IMF) claims that poverty reduction is one of its objectives, some studies show that IMF borrower countries experience higher rates of poverty. This paper investigates the effects of IMF loan conditions on poverty. Using a sample of 81 developing countries from 1986 to 2016, we find that IMF loan arrangements containing structural reforms contribute to more people getting trapped in the poverty cycle, as the reforms involve deep and comprehensive changes that tend to raise unemployment, lower government revenue, increase costs of basic services, and restructure tax collection, pensions, and social security programmes. Conversely, we observe that loan arrangements promoting stabilisation reforms have less impact on the poor because borrower states hold more discretion over their macroeconomic targets. Further, we disaggregate structural reforms to identify the particular policies that increase poverty. Our findings are robust to different specifications and indicate how IMF loan arrangements affect poverty in the developing world.

Similar content being viewed by others

Introduction

Over the past few decades, the International Monetary Fund (IMF) has maintained that it is committed to lessening poverty in the developing world. The IMF’s provision of concessional financial support through the Poverty Reduction and Growth Trust for low-income countries is evidence of the Fund’s interest in lowering poverty (IMF 2021). The Fund’s recent endorsement of fiscal stimulus measures to protect lives and livelihoods against COVID-19 further suggests its concern about people most at risk of economic hardship (Fiscal Monitor 2020). Although the IMF is not a unitary actor, and its management, research department, and staff may have different views on how to design lending programmes to best address poverty, the IMF claims that its programmes seek to achieve poverty reduction and growth (IMF 2021).

Some studies also seem to back the IMF’s position, noting that since the Great Recession the Fund has given borrowers added discretionary fiscal stimulus and put less emphasis on financial austerity (Ban 2015; Ostry, Lounganiand Furceri 2016). Conversely, other scholarship finds that when countries participate in IMF arrangements, poverty increases and income distribution worsens (Easterly 2003; Forster et al. 2019; Garuda 2000; Oberdabernig 2013: 123; Vreeland 2002). Still, others indicate that while the Fund’s poverty reduction programmes have no adverse effects on the poor in borrower countries, they have limited impact on lessening poverty (Hajro and Joyce 2009; Lang 2021).

This paper adds to the IMF and poverty literature by disaggregating loan arrangement conditions. Employing instrumental modelling to account for non-random IMF selection for 81 developing countries from 1986 to 2016, and consistent with the literature (Garuda 2000; Oberdabernig 2013; Pastor 1987; Vreeland 2002), we find that developing countries operating under IMF loans experience higher poverty rates in general. However, and building on previous research (Easterly 2003; Krueger et al. 2003; Reinsberg et al. 2019a), we also report that IMF conditions have different effects on poverty. The IMF codes loan conditions as structural (i.e. structural performance criteria or structural benchmark) or stabilisation reforms (i.e. quantitative performance criteria or indicative benchmark) (Reinsberg et al. 2019a). We find that loans with structural conditions tend to increase poverty, while loans with stabilisation conditions usually have little measurable impact. Our results are consistent over the short and medium term and robust to different model specifications.

We contend that structural reforms involve deep and comprehensive market-oriented changes to the economy that tend to raise unemployment, lower government revenue, increase costs of basic services, and restructure tax collection, pensions, and social security programmes, leading to worsened poverty. Additionally, when we disaggregate structural reforms to their specific conditions, we find that nearly all have statistically significant and harmful effects, providing further evidence that structural reforms raise rates of poverty.

Conversely, stabilisation reforms and their disaggregated conditions appear to have limited impact on poverty. Although stabilisation policies including cutting government spending, raising interest rates, and repaying debts cause economic pain, the IMF sets broad targets on macroeconomic indicators linked to stabilisation reforms, providing the borrower more policy discretion relative to structural reforms (Grabel 2017; Reinsberg et al. 2019a). As recent work has shown (Ban 2015; Clift 2018; Ostry et al. 2016), the IMF has experienced an evolution of ideas toward more discretionary fiscal stimulus and gradual fiscal austerity. Moreover, given that the poor represent a large share of the electorate in developing countries (Geddes 1994), governments with greater policy discretion hold political incentives to cut government spending, as part of fiscal consolidation policies, that fall less heavily on those near the poverty line, and especially during election years (Hübscher 2016; Hübscher et al. 2020). Further, and contrary to structural policies, studies have found that stabilisation reforms may not be that contractionary over the medium term (Alesina and Perotti 1995) and the higher borrowing costs associated with debt issues may be small and temporary (Panizza et al. 2009), or short-lived (Borensztein and Panizza 2009), potentially limiting the impact of stabilisation measures on poverty.

Our findings hold implications for policymakers. First, based on our sample of countries and years, approximately 1.28 billion people are categorised as impoverishedFootnote 1 on average per year, reflecting about 32.7% of the cases. The large number of poor people suggests the importance of IMF-poverty research. Second, the fact that no empirical work has fully tested the influence of all different conditional arrangements on poverty reinforces the benefits of disaggregating fund programmes to show the adverse consequences of structural conditions and the limited impact of stabilisation policies. Third, our research contributes to the globalisation and the poor debate. Although the IMF claims that it supports poverty reduction (IMF 2021), much globalisation work stresses the challenges faced by the poor because of open-market programmes (Ha 2012; Huber et al. 2006; Reuveny and Li 2003; Rudra 2002). Building on previous studies indicating that international pressures hurt the poor (e.g. Oberdabernig 2013), and that stabilisation and structural reforms play varying roles (Reinsberg et al. 2019a, b), our results show how international pressures, as reflected by IMF conditions, can hurt the poor but that what matters most for addressing poverty is whether countries initiate structural reforms.

The IMF and poverty

The impact of the IMF on development in the developing world has drawn significant attention, with much of the interest deriving from the fact that, since the 1980s, debt crises and capital shortages have increased demand for IMF services (Vreeland 2003a: 12‒16). The growing demand for IMF resources has also sparked debate about the conditions borrowing countries agree to in their Letters of Intent (Babb 2003: 10‒11; Babb and Buira 2005: 64; Vreeland 2003b: 338). While some argue that loan conditionality programmes improve economic growth and income standards for borrowers (Atoyan and Conway 2006; Killick 1995), or promote economic benefits for the poorest countries (Bird and Rowlands 2016) or for long-term users of the fund (Bas and Stone 2014), opponents charge that IMF programmes reduce growth rates (Dreher 2006) and delay recovery for years (Blyth 2013; Stiglitz 2002).

Several studies also show that politics affect IMF loan conditions (Babb 2003; Copelovitch 2010; Stone 2008; Dreher et al. 2015). Although the IMF appeared to respond to the criticisms and began borrower ‘ownership’ programmes in the 2000s (Bird and Rowlands 2016: 12), many studies indicate that IMF loans continue to harm borrower states (Kentikelenis et al. 2016; Nelson 2014b; Stubbs and Kentikelenis 2018; Vetterlein 2015). Given the controversies surrounding the fund, and the economic results in borrower states, the question we ask is what are the effects of the IMF on poverty in the developing world?

In the literature, previous research has reached varying conclusions about the impact of IMF programmes on poverty. Some studies find that IMF loan arrangements contribute to increased poverty. Pastor (1987) and Vreeland (2002), for example, show that participation in IMF programmes worsens income distributions, especially for the poor and the labour class, which can increase rates of poverty. Similarly, Garuda (2000) reports a deterioration in income distribution but only in countries where external imbalances were severe prior to IMF programmes. Others note more mixed results for the IMF and poverty. While Oberdabernig (2013) finds that IMF loans lead to a rise in poverty but only during the first 2 years of a fund programme,Footnote 2 Easterly (2003: 362) shows that IMF programmes lower the growth elasticity of poverty, meaning that ‘economic expansions benefit the poor less under structural adjustment, but at the same time economic contractions hurt the poor less’. By contrast, Lang (2021) observes that IMF concessional arrangements have no substantial effects on poverty rate, a finding also supported by Hajro and Joyce (2009) who show that fund programmes have no significant direct impact on poverty.Footnote 3

Other studies consider how IMF loan arrangements affect policy areas that indirectly impact poverty rates. Rickard and Caraway (2019), for example, observe that public sector reforms in a fund arrangement significantly reduce government spending on public sector wages. Similarly, Stubbs and Kentikelenis (2018) maintain that the practice of conditionality affords international financial institutions including the IMF and World Bank with substantial policy influence on borrower governments’ social expenditures. Relatedly, Forster et al. (2019) report that fiscal policy reforms that limit government expenditure, mandate trade and capital account liberalisation as well as financial sector reforms, and constrain external debt have adverse distributional consequences. They reveal that increases for the top income decile drive the distributional consequences, whereas debt-related issues lower the income share of the bottom quintile. Lastly, Forster et al. (2020) find that structural adjustment policies tied to labour market reforms lower health system access and increase neonatal mortality.

Although prior research that directly (or indirectly) investigated the IMF’s effects on poverty provided many useful insights, none directly and fully considered the numerous conditions contained within IMF loan arrangements that could impact poverty rates in borrower states. Specifically, we argue that IMF loans containing structural conditions support increased poverty while loans with stabilisation conditions are less likely to affect poverty.

Before comparing the specific policy prescriptions within any arrangement, we first distinguish between condition types. The IMF identifies loan conditions as under structural or stabilisation terms. Structural arrangements include structural performance criteria or structural benchmarks, while stabilisation conditions contain quantitative performance criteria or indicative benchmarks (Reinsberg et al. 2019a). The explicit structural factors normally include trade, financial, capital account, tax, and labour reforms, institutional restructurings, as well as privatising state-owned enterprises (SOEs) (Hakro and Ahmed 2006; Lora 2012; Morley et al. 1999). In contrast, the IMF (2018) identifies stabilisation reforms as ‘macroeconomic variables under the control of the authorities, such as monetary and credit aggregates, international reserves, fiscal balances, and external borrowing’, a classification also applied in political economy research (Easterly 2003; Kentikelenis et al. 2016; Krueger et al. 2003).

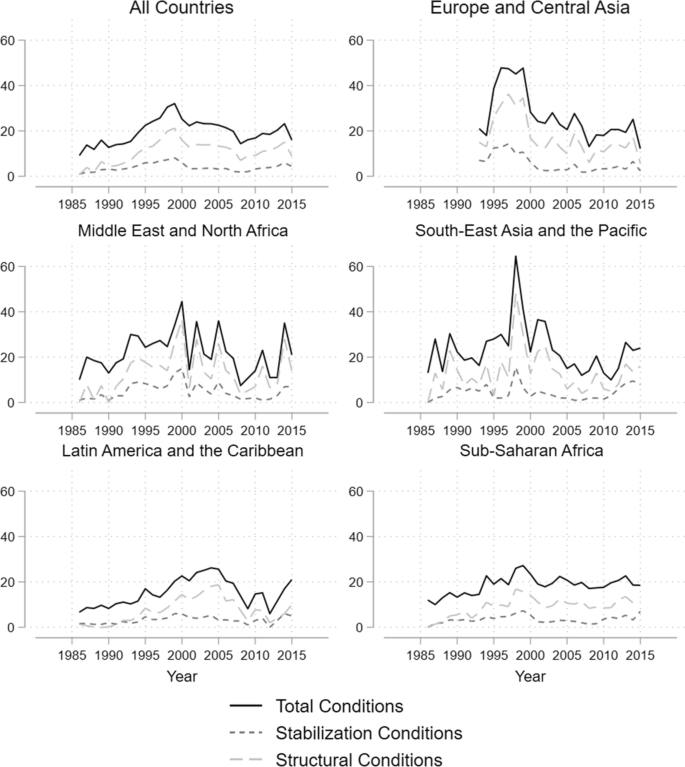

Differentiating between structural and stabilisation conditions, as the IMF and literature do, is critical because of the varying effects the conditions have on borrower states. Building on earlier work (e.g. Easterly 2003; Krueger et al. 2003; Lora 2012), we maintain that structural reforms contain deep and comprehensive changes involving trade and exchange policies, labour reforms, privatisation, financial/fiscal sector issues, revenue and tax policies, and/or institutional reforms. These reforms advance free market commitments to limit the role of the state, and favour government structures that uphold the rule of law and property rights (de Soto 2000). According to Reinsberg et al. (2019a: 1224), structural conditions ‘seek to transform countries’ political economies via deregulation, liberalization, and privatization’. Because they are comprehensive, the reforms contain intrusive conditions that inhibit borrowers from modifying them to mitigate their negative effects on poverty. Indeed, such insights build on Easterly (2005), who argues that structural reforms encroach on borrower sovereignty. We present the evolution of structural and stabilisation loan conditions across time and disaggregated by regions in Fig. 1.

Our theoretical mechanism linking structural policies and poverty relies on the reforms’ effects on raising unemployment, lowering government revenue (and, by extension, social spending), increasing costs of basic services, and restructuring of tax collection, pensions, and social security. Looking first at privatisation, the sale of SOEs to private firms leads to the sacking of redundant state workers, contributing to higher unemployment, raising poverty rates (Beinen and Waterbury 1989). Privatisation also leads to much higher prices for public services (e.g. water, electricity, etc.), as private firms seek to earn monopoly rents in sectors that have barriers to entry, driving more people into poverty (Kurtz and Brooks 2008).Footnote 4

Similarly, equalising income tax rates under regressive tax reforms and a more flexible labour market are also likely to increase poverty (Morley et al. 1999; Rudra 2002). The ‘Washington Consensus’ has long championed lower tax rates for entrepreneurs and higher consumption-based taxes (e.g. value-added taxes) to promote job creation and boost revenues (Williamson 1990). Consumption taxes take a much higher share of the poor’s disposable income. Likewise, the IMF has promoted abolishing taxes on the repatriation of foreign profits to attract capital from abroad. Such policies reduce government revenues, potentially lowering social spending resources for the poor.

Labour reforms are also likely to increase poverty. Previous research has shown that creating a more flexible labour market facilitates the hiring and firing of workers and the lowering of wages for lower-skilled employees (Rudra 2002). Unemployment plays a role in increasing poverty but the fall in wages for less-skilled employees is also critical for people living on the margins. Our labour reforms’ expectation coincides with Rickard and Caraway (2019), who find that IMF public sector conditions lower government spending on public sector wages, contributing to higher poverty rates. Further, pension and social security reforms also tend to follow with a more flexible labour force, again placing the more marginalised workers at risk of falling into the poor ranks.

Trade and institutional changes also affect poverty. Trade receives much attention, as the change from manufacturing for domestic consumers to the global market, and competition for subsistence farmers, contributes to job losses especially for the poor (Frieden 1991).Footnote 5 Contrary to the Heckscher–Ohlin model that developing countries well-endowed with unskilled labour benefit from freer trade, opening markets favours the wealthy at the expense of the poor (Reuveny and Li 2003). Additionally, the promotion of free trade zones, and reduction in tariffs and import duties decreases government revenues available for aiding the poor. The lifting of government-subsidised price controls, also tied to freer trade, raises costs for all consumers but the price hikes again fall disproportionately on the poor (Manzetti 1999). The enforcement of property rights also tends to preserve the interests of an influential minority (Amendola et al. 2013). In Chiapas, Mexico, for example, property rights enforcement, as part of the free trade pact, required common land decampment, forcing many to turn to the informal economy (Kus 2010), increasing their risk of exploitation (Prahalad and Hammond 2002) and raising the specter of higher poverty rates (de Soto 2000). Informal sector workers also have less access to government social spending and retirement funds, increasing their likelihood for poverty.

Financial and fiscal reforms connected to structuralism, which under some circumstances the IMF codes as stabilisation reforms,Footnote 6 are generally associated with the creation of institutions and rules. Financial reforms typically enforce compliance and appoint international auditors to restrict lending from banks with a high percentage of bad loans, promote international practices, and support central bank independence. Fiscal reforms tend to endorse fiscal responsibility laws, establish treasury department functions, certify monthly payrolls, and monitor spending by local governments. Unlike other structural policies, these reforms do not appear to have a direct effect on poverty. In fact, the policies may help reduce corruption, which could indirectly help the poor as government resources go where they are intended and not to serve political cronies.

In contrast to structural reforms, stabilisation policies typically include measures that cut government spending, reduce the money supply, and decrease domestic and external debt to achieve macroeconomic stabilisation (Bird and Rowlands 2016: 40; IMF 2016). Unlike structural reforms, governments under stabilisation reforms can generally pursue a range of alternatives to meet the conditions set by the IMF that are less likely to impinge on borrower sovereignty (Easterly 2005; Reinsberg et al. 2019a).

Beginning with government spending cuts (i.e. fiscal issues), such reductions could increase poverty, as developing countries adopt austerity policies to address inflation, debt arrears, and fiscal imbalances (Végh and Vuletin 2015). Lower expenditure on social programmes is most painful for poorer households (Stubbs and Kentikelenis 2018). However, social spending does not have to contract to the point that it pushes many more people into poverty. As Reinsberg et al. (2019a: 1232) note, ‘stabilization conditions do not oblige governments to enact specific reforms but leave them with some discretion in how to achieve economic policy objectives’. Borrower countries also have political incentives not to implement fiscal consolidation policies that substantially increase poverty, and especially during election years (Hübscher 2016; Hübscher et al. 2020), as the poor comprise a sizable portion of the electorate (Geddes 1994).

Stabilisation measures also include monetary and debt policies to address financial difficulties. Among the monetary policies (i.e. financial reforms), the IMF favours currency boards to restrict currency manipulation by monetary authorities and raise foreign net reserves (IMF 2004). Related to tying monetary authorities’ hands, the IMF also backs policies to reduce external and internal debt arrears, imposing curbs on available credit sources. These monetary and debt measures typically raise interest rates, increasing the cost of borrowing, and making it more expensive for businesses to expand. However, the government has some flexibility in how it addresses financial matters and ‘may renegotiate the terms of existing debt contracts to ease debt service … [or] take measures to promote economic growth, which reduces the debt-to-GDP ratio’, lessening the financial burden on those near the poverty line (Reinsberg et al. 2019a: 1232). Moreover, although the rate hikes could lead to higher unemployment, the rising borrowing costs associated with debt issues may be small and temporary (Panizza et al. 2009), or short-lived (Borensztein and Panizza 2009), limiting their effects on poverty.

Additionally, it is not clear that households near the poverty line will acquire new debt. Big ticket purchases are likely out of the reach of the near-poor, negating increased interest rates. Of course, if they are already borrowers and the higher interest rates are applied retroactively on the existing loans, poverty rates could rise. But higher interest rates may not have the same impact for those near the poverty line as they would incur with structural changes to the economy. Some studies also find that stabilisation policies that reduce budget deficits and domestic credit, and increase the real interest rate, produce higher GDP, lower inflation, and improve the current account balance (Doroodian 1994). Economic growth is key here as ‘most authors agree that economic growth is fundamental for poverty reduction’ (Oberdabernig 2013: 115).

Moreover, the evolution of ideas held by IMF staff members indicates the greater flexibility for borrowers particularly with stabilisation policies. From the 1980s to early 2000s, IMF staff members who supported shock therapy appeared to hold the most influence on loan arrangements (Chwieroth 2008). Chwieroth (2014) argues that the staff’s normative orientations and its common academic training favoured conditionality, with stricter terms for borrowers whose policymakers (or officials) appeared indifferent to the staff’s orientations or who held different professional ties. Likewise, Nelson (2014a) showed that shared economic beliefs between the IMF staff and management and top policymakers in borrower countries affected loan size, conditionality, and enforcement, with market-oriented reforms carrying the day.

However, in the early 2000s and into the Great Recession, a backlash erupted against the IMF, with some arguing that the staff had changed its perspectives regarding strict adherence to fiscal austerity (Ban 2015; Barta 2018; Clift 2018). Gradualism, policy flexibility, and discretionary fiscal stimulus that related to stabilisation seemed to take hold as the IMF’s mantra (Ban 2015: 179; Johnson, and Barnes 2015; Ostry et al. 2016: 41). The IMF even began to incorporate social benchmarks into funding guidelines (Vetterlein 2015). Although some scholars contend that IMF programmes still contain procyclical macroeconomic policies that enforce austerity (Grabel 2017: 113; Nelson 2014a, b: 163; Weisbrot et al. 2009), indicating that there is a mismatch of communication and practice for IMF policies (Grabel 2017: 123; Kentikelenis et al. 2016; Mariotti et al. 2017), others remark that the IMF shows ‘greater acceptance of discretionary fiscal stimulus programs’ (Ban 2015: 179), views fiscal consolidation as ‘not a fiscal noose today’ (Ostry et al. 2016: 41), and sees spending-based adjustments as posing limited effects on households below the poverty line (Blyth 2013). Such programme discretion appears to apply mainly to stabilisation policies and not structural reforms (Grabel 2017; Reinsberg et al. 2019a).

Lastly, stabilisation programmes can include measures that boost social spending and social justice, and provide financial benefits to those below the poverty line (Chu and Gupta 1998: 19; Collier and Gunning 1999; Polak 1991: 36).Footnote 7 As Grabel (2017: 128) notes, the IMF places more attention to social spending targets, the poor, and the vulnerable in its support packages, increasing social spending as a percentage of total public spending for all borrowers. Spending cuts also may not be that contractionary, particularly over the medium term (Alesina and Perotti 1995). As Alesina and Ardagna (2013: 20) observe, ‘in some cases spending-based adjustments have been associated with no recession at all, even in the short run, thus producing an expansionary fiscal adjustment.’

Based on the preceding discussion, we propose two hypotheses.

H1

Structural loan conditions imposed by the IMF are likely to increase poverty rates.

H2

Stabilisation loan conditions imposed by the IMF are not significantly related to poverty.

Research design

We collect data for 81 developing countries from 1986 to 2016 to determine the effects of different IMF loan conditions on poverty. We use all developing countries and years for which data are available for the IMF conditionality measures and our key control variables.Footnote 8

Dependent variables

To assess the impact that IMF conditionality has on the poor in developing countries, we use the World Bank’s (2018) poverty headcount ratio, or the percentage of the population living below the national poverty line, logged as our primary dependent variable.We log poverty due to the high level of positive skew in the data. This measure is computed from household survey data collected from nationally representative samples of households in each country. National poverty lines are country-specific benchmarks for estimating poverty based on specific economic and social contexts. As these lines reflect local perceptions of the level of income needed to be non-poor, they are not appropriate for comparison across countries. However, as we are interested in changes in poverty levels within countries, the data are appropriate for our analysis.Footnote 9

Independent variables

For our independent variables of interest, we identify which types of conditions have been imposed on a country under an IMF arrangement. Our primary independent variables of interest are the logged count of the number of specific IMF arrangement conditions a country is under for at least 6 months in a calendar year. We use the natural log of condition counts to account for the high level of skewedness in conditions (+2.29). We are particularly interested in the effect of structural conditions on poverty. For this reason, we focus on seven condition types, trade and exchange issues, labour issues, privatisation, financial sector issues, revenue and tax issues, institutional reform, and fiscal issues. We include the remainder of the condition types as other, including land and environment, redistribution, social policy, and the other category from the original dataset, because they are included in a very small proportion of all arrangements. We obtain loan data from the IMF, and data on specific conditionality from Kentikelenis et al. (2016).Footnote 10 We provide descriptive statistics on the distribution of conditions in Table 1. Of all the IMF arrangements included in our sample, 66% had structural conditions, 88% had stabilisation conditions, and 56% had both stabilisation and structural conditions. We employ a strategy consistent with Oberdabernig (2013), and assess the effects of condition type 2 years after implementation. We also employ different lags to validate that the results are not dependent on a specific lag structure.Footnote 11

We include a dummy variable for IMF participation in addition to the condition variables to ensure that our estimates are capturing the effects of conditionality and not some other components of IMF intervention (moral hazard, policy advice, technical assistance, etc.). We also include several economic, political, and social controls commonly used in the poverty literature (Dabla-Norris et al. 2015; Giddens 2013; Oberdabernig 2013). Among the economic controls, we enlist logged GDP and measures for deflation and hyperinflation. The expectation is that challenging economic circumstances harm the poor more than other groups. We also control for levels of natural resources, trade, and capital inflows which may impact poverty and access to funding through financial markets. Economic circumstances are precarious for individuals just above the poverty line, and changes in GDP, inflation, natural resource stocks, and trade are likely to increase the number of impoverished people. We obtain economic measures from the World Bank (2018).

Among the political and social covariates, we control for democracy, left government, urban population, population growth, and life expectancy. While democracy should contribute to lower poverty because of the need to cater to constituents, the low turnout from the poor often leads to politicians introducing policies that benefit only the wealthiest voters (Lee 2005; Bonica et al. 2013), ignoring the plight of poor voters. Executive ideology also is expected to affect poverty since a larger share of poor constituents support leftist governments, who likely will invoke pro-poor policies. We measure executive ideology by recording 1 for leftist leaders and 0 for executives from all other parties. Similarly, urban population growth may support poverty reduction because it enhances rates of national saving (Kentor 2001), providing a safety net for the poor. However, overall population growth could lead to increased poverty, as a rising population (ceteris paribus) puts pressures on wages and jobs. Increased life expectancy can also exacerbate poverty, as the elderly and retired with minimal pensions represent a larger portion of the population. We measure level of democracy using the Polity score from Polity 5 (2020) and executive ideology data is from Beck et al. (2001), which we updated to the more current period. The social measure data are from the World Bank (2018).Footnote 12

Method

The decision to enter an IMF agreement is not random, and neither is the type of loan conditions imposed by the IMF. This produces the potential for endogeneity in loan condition models, which has been previously indicated (Caraway et al. 2012; Rickard and Caraway 2014). Recent studies on the effect of IMF agreements (Lang 2021; Nelson and Wallace 2017; Stubbs et al. 2020) maintain that the compound instrumental variable approach (Nunn and Qian 2013) yields more credible statistical results than Heckman-type selection models.Footnote 13 To account for the possible endogeneity between loan conditionality and poverty we follow prior studies and utilise a two-stage least squares (2SLS) instrumental variable approach, which allows us to identify both the direction of the bias related to the allocation of countries under specific arrangements, and from where the bias stems (Jensen 2004; Lang 2021).

The selection of instrumental variables requires identifying factors that are correlated to changes in the endogenous independent variable while not correlated (exogenous) to changes in the primary dependent variable. Fortunately, previous research (Lang 2021) provides an instrument based on a compound instrumental variable approach which utilises exogenous variation in IMF liquidity. Our instrument is the interaction of a time-variant variable, log of IMF’s liquidity ratio,Footnote 14 and a country specific variable, the probability of receiving a specific condition type.Footnote 15 The interacted instrument varies both across countries as well as over time introducing exogenous variation to the extent that the isolated interaction effect is excludable from alternative channels (Lang 2021). Thus, even if there was endogeneity between the time-variant level variable and the outcome, the exclusion restriction would only be violated if the unobserved variables driving this endogeneity were correlated with the country-specific likelihood (for econometric details see Nizalova and Murtazashvili 2016).

In the first-stage equation the condition variable is regressed on the interaction term and on all second-stage variables. The addition of year fixed effects control for the level effect of the global financial trends. The identification can therefore be interpreted as a difference-in-difference approach: after controlling for the levels, the IV’s coefficient indicates how global financial trends affects the likelihood of receiving a specific condition type year t differently in countries with different participation probabilities. Similar to the above approach, we employ a partial first differenced model in the second stage.

Some readers, however, might worry that condition probability, as measured by the number of years since the beginning of the sample that any country has received a condition of a specific type, threatens the excludability of the instrument. In fact, research has shown that the IMF experiences much ‘recidivism’, as the country ends up dealing with the IMF repeatedly (Bird et al. 2004; Conway 2007). It could be the case that poverty outcomes in a country have a relationship to the recurrent economic problems that give rise to repeated interactions with the IMF. However, due to the interactive nature of our instruments, even if there was a correlation it would have to be conditional on the IMF liquidity ratio, because of the difference-in-difference style model the interacted IV estimates. Other readers may have concerns about the excludability of the IMF’s liquid liability ratio. Lang (2021) provides two additional justifications for why this measure meets this restriction. First, the majority of IMF monetary flows from any specific country are not sizable enough to significantly affect the liquidity ratio, given that most monies purchased or repurchased rarely represent more than 1% of total IMF quotas. As such, any concern regarding excludability would relate to very few observations. Second, the timing of such transactions is agreed upon years in advance. Given also that explanatory variables are lagged it is unlikely that the schedule of large transactions developed with economically large countries is correlated with future levels of poverty in specific countries.

While the ‘excludability’ of instruments must be justified theoretically, the ‘relevance’ can be tested empirically. We provide evidence that the instrument significantly predicts the presence of conditions once other exogenous variables have been partialled out in the paper. The results presented in Tables 2 and 3 demonstrate the relevance of the instruments. We would expect the coefficient for the instrument in the first stage regression to be positive since similar conditions in the past, and a higher liquidity of the IMF, should increase the probability of entering an agreement and having similar conditions in the current programme. As expected, the coefficient is both statistically significant and positive in all models. Furthermore, the Kleibergen–Paap LM statistic rejects the null hypothesis that the equation is underidentified at the 0.1% level. The F-statistics is well above the threshold of ten, as indicated by Stock and Yogo (2005) as necessary to indicate that the instruments are not weakly identified. The significance in both the F-statistic and the under identification test statistics provide us with some justification that our instruments meet the relevance criterion.

There are limitations to this method. While it would be beneficial to account for all sources of potential endogeneity between specific conditions and poverty, even among countries with IMF arrangements, we lack sufficient instruments to do so. The problem stems from an inability to identify instruments for specific condition types that do not also predict IMF programmes more generally, as any type of condition necessitates the presence of an IMF programme, causing them to be highly correlated. However, following Stubbs et al. (2020), a compound instrumental variable approach remains the best available to address potential endogeneity of specific types of conditions. We also cluster by country and employ bootstrapped standard errors to correct for inconsistencies created by uneven cluster size in the two-stage modelling procedure.

Results

We start by examining how IMF arrangements affect poverty without additional covariates. We include multiple covariates because of the likelihood that our exclusion restriction holds may be conditional on them. However, the inclusion of potential post-treatment controls increases the likelihood that we induce post-treatment bias into our models if the variables are themselves endogenous (Montgomery et al. 2018). We present the results of our fixed effects regression with non-selection hazard correction and synthetic instruments for endogeneity in Table 2.Footnote 16 The synthetic instruments are reasonably strong, as suggested by their respective F-statistics, which are above 10 for all models (Stock and Yogo 2005). In Model 1, the undifferentiated specification indicates that all IMF arrangements have a positive effect on poverty, a finding that is consistent with Easterly (2003) and Oberdabernig (2013). On average, countries that enter into an IMF arrangement with a mean level of conditionality, will have about 1.3% higher poverty 2 years after implementation than countries whose number of conditions are in the 25th percentile. In Models 2‒4, we test the effects of conditionality on countries whose agreements only include stabilisation conditions, only include structural conditions, or include both, respectively. When we model the effects of agreements that have only stabilisation conditions (Model 2) and those that have only structural conditions (Model 3), we find that only the arrangements that contain structural conditions affect poverty, and the effect is positive and significant. For countries whose agreements only include structural conditions, a one standard deviation increase in the number of conditions would lead to an expected increase in poverty of about 1%.Footnote 17 We include arrangements that have both structural and stabilisation conditions in Model 4, and find that poverty is only related to the number of structural conditions.Footnote 18 The results from agreements including both structural and stabilisation conditions (about 56% of the sample) indicate that a one standard deviation increase in the number of structural conditions would lead to an expected increase in poverty of about 1.5% 2 years after implementation.

For ease of interpretation of the coefficients of interest, due to the lagged independent and dependent variables, we also present the results for Models 1 and 4 graphically in Fig. 2. Figure 2 illustrates the expected change in poverty produced by differing number of conditions. A country entering into an agreement with the median in the number of total conditions should expect an increase in poverty of about 2.0%, 2 years after programme implementation. A country entering into an agreement with a number of conditions in the 75th percentile should expect an increase in poverty of about 3.5%. This indicates that countries that enter into IMF arrangements with more conditions should expect greater increases in poverty than countries who enter into arrangements with less conditions. While the results for stabilisation conditions are insignificant, we show that a country entering into an agreement with the median, or 75th percentile, of structural conditions should expect an increase in poverty of about 2.4% and 4.7% respectively, 2 years after programme implementation.Footnote 19 This suggests that there is something unique about structural conditionality, as it is associated with increasing poverty in developing countries.Footnote 20

One possible limitation of our finding is that we are primarily looking at the number of arrangement conditions and unable to fully account for programme compliance. Although many studies underscore the IMF’s enforcement challenges (see Boockmann and Dreher 2003: 101; Vreeland 2006: 374), and the difficulties borrowers face with implementing structural conditions (e.g. Mercer-Blackman and Unigovskaya 2004; Reinsberg et al. 2021; Stone 2002), leading to programme interruptions which could affect poverty, several studies show high compliance rates with fund programmes (see Collier and Gunning 1999; Krueger 1997). We estimate models that exclude countries that have less than 25% of their available monies undrawn, a strategy used by Dreher (2003) to indicate country compliance.Footnote 21 The results indicate that non-compliance does not seem to significantly affect our results which are consistent with the primary findings presented in the paper, suggesting that structural conditions have an adverse impact on poverty irrespective of compliance. Further, we find evidence that stabilisation conditions may also be affecting poverty, but only for countries whose agreements include both structural and stabilisation conditions.

We next turn our attention to determining which, if any, of the structural conditions are leading to increased poverty.Footnote 22 Table 3 shows the result of the disaggregated analysis. We find that trade and exchange conditions, labour conditions, privatisation, revenue and tax conditions, and institutional reforms are all positively correlated to an increase in poverty, and financial sector reforms and fiscal issues do not reach statistical significance. While we are not sure why changes to interest rates and greater fiscal discipline do not have a significant effect on poverty, in the case of financial reforms, it is possible that the poor are not eligible for loans or credit, and the tighter credit markets and higher interest rates brought on by financial reforms have limited effect on them. Regarding fiscal issues, most changes to government spending are short term and often overturned by the current or future administrations, lessening their impact on poverty (Biglaiser and DeRouen 2007).

In terms of substantive effects, we find that between two countries under IMF agreements, countries should expect a 0.75% increase in people living below the poverty line for every two additional trade and exchange conditions on average, 2 years after implementation. Additionally, a country under IMF agreement with an average number of trade and exchange conditions will have a poverty rate 3.5% higher than countries without arrangements, all else equal.Footnote 23 We contend that trade and exchange conditions, which reflect the shift from serving domestic consumers to manufacturing for the global market, as well as competition for subsistence farmers, contribute to worker and farmer economic dislocation, producing higher poverty levels (Frieden 1991; Reuveny and Li 2003).

The largest substantive effect we find is from increases in the number of institutional reform conditions. Countries facing IMF arrangements with two additional institutional reform conditions should expect an increase in poverty of 1.2% versus similar countries with less conditions. Countries with an average number of institutional reform conditions are expected to have poverty rates about 5% higher than countries without IMF agreements. While this finding may be somewhat unintuitive, as these policies often seek to bring people in from the informal economy, the implementation of institutional reforms can drive people into the informal economy (Kus 2010) based on the loss of common lands. The increased reliance of poorer households on informal economies, which can often be exploitive (Prahalad and Hammond 2002), reduces the availability of government benefits, increasing those in poverty.

We find that labour conditions also have a large substantive effect on poverty, where the average increase for countries facing arrangement with two additional labour conditions should expect an increase in poverty of about 0.9%, and 3.4% higher than similar countries not under agreement. This is expected since labour conditions that facilitate a more flexible labour market lead to reduced wages, especially for abundant lower-skilled workers, contributing to increased poverty (Rudra 2002). Countries that face IMF arrangements with two additional privatisation reforms have an average expected increase in poverty of about 1% 2 years after implementation, and 2.8% higher than countries not under IMF agreement. Two additional revenue and tax reforms conditions produce an average expected effect of about 0.85%, and countries with an average number of revenue and tax reform conditions are expected to have poverty rates 2.3% higher than countries not under agreement. Privatisation is often associated with job losses and an increase in commodity prices, which can decrease the earnings of poorer workers and increase consumption costs, both of which lead to increased poverty. Revenue and tax reforms often include the implementation of higher consumption-based taxes, which take a higher share of the poor’s disposable income, leading to higher poverty rates.

In sum, the results appear to bolster our two hypotheses. First, as predicted by Hypothesis 1, we find that structural loan conditions tend to increase poverty rates. Countries operating under nearly all types of structural conditions are likely to experience higher poverty rates. Second, as expected by Hypothesis 2, stabilisation loan conditions are generally not significantly related to poverty. The results suggest that there is something special about structural loans conditions that contribute to higher poverty rates in borrower countries.

Conclusion

Although studies have investigated the impact of IMF loans on poverty in borrower states, no works have attempted to unpack the multiple different conditions of Fund arrangements on poverty in debtor countries. In this paper, we have developed the first study to distinguish between the effects of structural and stabilisation conditionality on poverty and found that countries under IMF structural conditions tend to experience increases in poverty while countries under stabilisation conditions tend to see fairly minimal changes in poverty. Consistent with much of the literature (Easterly 2003; Garuda 2000; Oberdabernig 2013; Pastor 1987; Vreeland 2002), we also note that countries under IMF arrangements are more prone to observe an increase in poverty. However, this study moves beyond earlier research (e.g. Oberdabernig 2013) by showing the IMF conditions that are most likely to produce increased poverty.

All told, the findings presented here hold important policy implications and substantive meaning, given that 1.28 billion people (or 32.7% of the cases in our sample) live in poverty. First, most studies in the IMF literature have lumped together loans with all types of conditions, and treated them equally, as if fund programmes are all the same. By showing that variations exist among programmes in terms of the conditions imposed upon borrower countries, our study helps explain differences in poverty outcomes among borrower countries. Focusing on the specific IMF conditions and how they fit under structuralism or stabilisation also provides possible clues as to why scholars in the literature have reached disparate conclusions regarding the impact of the fund on economic development in the developing world.

Second, the findings advance theoretical debates in the globalisation literature. Many studies inform us that globalisation, as measured by trade (Ha 2012; Reuveny and Li 2003; Rudra 2002) and foreign direct investment (Ha 2012; Huber et al. 2006; Reuveny and Li 2003), worsens poverty. Scholars long have argued that economic integration and increased foreign competition causes domestic job losses especially in developing countries who tend to provide inadequate social safety nets (Kaufman and Segura-Ubiergo 2001). The globalisation debate also has targeted the IMF for its one-size-fits-all approach to conditionality and policies that favour the interests of its wealthiest donor countries (Stiglitz 2002). Our research suggests that specific fund conditions affect poverty in borrower countries.

Third, the work also offers more information about the politics of IMF lending. There is a large body of literature that considers how powerful member-states and politics influence conditionality (e.g. Thacker 1999; Copelovitch 2010). The IMF and its staff are aware that many developing countries hold negative perceptions about the fund’s policy recommendations. In response, the IMF and its staff have tried to improve their reputation by providing concessional financial support through the Poverty Reduction and Growth Trust (IMF 2021), supporting fiscal stimulus measures during COVID-19 (Fiscal Monitor 2020), and placing less emphasis on financial austerity since the Great Recession (Ban 2015; Ostry et al. 2016), giving borrowers added policy discretion. However, as long as the IMF and its staff continue to require structural conditions, the likelihood is that borrower countries will see increased poverty, regardless of whether the fund and its staff imposed the policies to further the interests of powerful member-states or they are truly unintended effects of the policies.

More work is needed to understand how international financial institutions influence poverty. Specifically, the impact of politics on IMF conditionality programmes merits scrutiny. IMF programmes differ in their design and borrowers vary in their willingness and ability to implement adjustment programmes. How these factors affect the link between conditionality and poverty rates in borrowing countries and how governments distribute the pain of IMF-led adjustment programmes is an area for future research. Our study represents a first step for uncovering how the fund shapes policy choices by borrower countries. The main takeaway is that borrower states need to consider the loan conditions available when they sign an IMF arrangement and should attempt to avoid structural reforms if they hope to reduce poverty.

Notes

Values based on percentage of the population living on less than $3.20 a day (World Bank 2018).

Oberdabernig (2013: 123) also finds that concessional loans are ‘generally connected to rising poverty rates’.

Lang (2021) further shows that the IMF contributes to income inequality and this effect is driven by absolute income losses for the poor. Hajro and Joyce (2009) find that fund programmes have an indirect effect on poverty, as the IMF’s concessionary programmes increase the impact of growth on lowering infant mortality, while the non-concessionary programmes lower the effect of growth on human development.

We include reforming SOEs with privatisation because it impacts pricing and jobs. Like privatisation, SOE reforms require the elimination of government-subsidised prices, raising poverty rates for those who cannot afford the higher costs (Manzetti 1999: 61, 67), and laying off excess workers, which increases poverty.

The IMF also discusses trade and exchange rate as stabilisation policies. However, the stabilisation reforms are related to gross net or international reserves, currency boards, and real effective exchange rates and not deep and comprehensive changes such as a shift to freer trade.

We discuss financial and fiscal reforms under stabilisation below.

One might argue that IMF-approved safety nets could be coded separately, outside of stabilisation programmes. However, the category social policies, which contains some safety net elements, are sometimes neutral in terms of lowering poverty. Social policies as a category also appear less frequently than the main five categories we present when we disaggregate stabilisation programmes in Online Appendix C. We thus choose to include the social policy category in the aggregate version of stabilisation policies.

Due to data limitations, we estimate our results on unbalanced panels. A list of the countries included and years covered, as well as variable descriptions, appear in Online Appendix A.

As robustness checks, we employ multiple measures of poverty and find similar results. We also disaggregate our poverty measure between urban poverty (public sector workers) and rural poverty (smallholders), and report that this distinction does not produce a meaningful difference to our findings (see results in Online Appendix B).

For IMF loan data, see http://www.imf.org/external/np/tre/tad/extarr1.cfm. For loan conditions data, see http://www.kentikelenis.net/data.html.

Our analysis of different lag structures, available in the Online Appendix, yield interesting results. Previous research has shown that IMF agreement implementation can show contemporaneous effects (Oberdabernig 2013), as governments often make changes even before formal agreements begin. Our analysis does not provide evidence of such an effect. Although our coefficients are in the correct direction, they fail to meet statistical significance. More importantly, our findings show a longer lasting effect of IMF conditionality than previously identified (see e.g. Easterly 2000). We find significant effects of IMF structural conditionality four years after implementation, which indicates that the effect of IMF loan conditionality may have both short-term and long-term effects on poverty.

For an overview of previous studies that have employed similar variables, see Oberdabernig (2013).

As a check on our analysis we perform Heckman-type selection models. We find similar results, which are available from the authors.

IMF liquidity ratio is the IMF’s total liquid resources, including drawing rights, divided by their liquid liabilities, including total reserve tranche positions plus outstanding IMF borrowing. Data calculated by Lang (2021) based on the IMF’s Annual Reports and the IMF International Financial Statistics.

Programme condition probability is defined as the fraction of years the country has been under a programme between when they enter the sample and year t. As such, we generate three instrumental variables. One for participation in any IMF agreement, one for participation in IMF agreements that contain stabilisation conditions, and one for participation in IMF agreements that contain structural conditions.

We present results from Naïve models in the Online Appendix.

Our models including different lag structures (available in the Online Appendix) indicate that a one standard deviation increase in the number of structural conditions could lead to an increase in poverty of about 3 percent, four years after implementation.

The number of stabilisation and structural conditions in our sample is moderately correlated (0.612) indicating that this model could be biased by multicollinear predictor variables. However, the level of collinearity does not exceed 0.7, the conventional level of high collinearity (Neter et al. 1996), and the results from the models are consistent with other models that do not include both condition types.

Previous research has shown different effects depending on the particular region, with Kentikelenis et al. (2015) reporting that the very poor countries of sub-Saharan Africa differ from other locales. We desegregate by region to show that our results are not driven by any one particular area. Further, other researchers have indicated a potential period effect, where the effect of IMF programmes may be period-specific (see e.g. Oberdabernig 2013). Consistent with other researchers, the effect of structural conditions is significant prior to 2000 and after 2009, but loses significance at traditional confidence levels between 2000 and 2008. Results available in Online Appendix B.

Prior research has indicated that IMF programmes may have differing effects for developing and emerging economies (Easterly 2003; Mercer-Blackman and Unigovskaya 2004). Employing IMF classification, we split the sample between developing and emerging economies and find a statistically significant and positive relationship between structural conditions and poverty for both groups. Results available in Online Appendix B.

Results available in Online Appendix B.

We also tested the effect that different stabilisation conditions have on poverty and report the results in Online Appendix C. Among the stabilisation conditions, only external debt has a significant effect on poverty.

All predicted effects are calculated at the mean number of conditions.

References

Alesina, Alberto and Silvia Ardagna (2013) ‘Tax policy and the economy’, published by University of Chicago Press on behalf of National Bureau of Economic Research 27(1): 19‒68.

Alesina, Alberto and Roberto Perotti (1995) ‘Fiscal expansions and fiscal adjustments in OECD countries’, Economic Policy 21(3): 205‒48.

Amendola, Adalgiso, Joshy Easaw and Antonio Savoia (2013) ‘Inequality in developing economies: The role of institutional development’, Public Choice 155(1/2): 43‒60.

Atoyan, Ruben and Patrick Conway (2006) ‘Evaluating the impact of IMF programs: A comparison of matching and instrumental-variable estimators’, Review of International Organizations 1(2): 99‒124.

Babb, Sarah (2003) ‘The IMF in sociological perspective: A tale of organizational slippage’, Studies in Comparative International Development 38(1): 3‒27.

Babb, Sarah and Ariel Buira (2005) ‘Mission creep, mission push and discretion: The case of IMF conditionality’, in A. Buira, ed., The IMF and the World Bank at sixty, 59‒83, London: Anthem Press.

Ban, Cornel (2015) ‘Austerity versus stimulus? Understanding fiscal policy change at the International Monetary Fund since the great recession’, Governance 28(2): 167‒83.

Barta, Zsófia (2018) In the red: The politics of public debt accumulation in developed countries, Ann Arbor: University of Michigan Press.

Bas, Muhammet A. and Randall W. Stone (2014) ‘Adverse selection and growth under IMF programs’, Review of International Organizations 9(1): 1‒28.

Beck, Thorsten, George Clarke, Alberto Groff, Philip Keefer, and Patrick Walsh (2001) ‘New tools in comparative political economy: The database of political institutions.’ The world bank economic review 15(1): 165–176.

Bienen, Henry and John Waterbury (1989) ‘The political economy of privatization in developing countries’, World Development 17: 617‒32.

Biglaiser, Glen and Karl DeRouen Jr. (2007) ‘Sovereign bond ratings and neoliberalism in Latin America’, International Studies Quarterly 51(1): 121‒38.

Bird, Graham and D. Rowlands (2016) The International Monetary Fund: Distinguishing reality from rhetoric, Cheltenham: Edward Elgar.

Bird, Graham, Mumtaz Hussain, and Joseph P. Joyce (2004) ‘Many happy returns? Recidivism and the IMF.’ Journal of International Money and Finance 23(2): 231–251.

Blyth, Mark (2013) Austerity: The history of a dangerous idea, Oxford: Oxford University Press.

Bonica, Adam, Nolan McCarty, Keith T. Poole and Howard Rosenthal (2013) ‘Why hasn’t democracy slowed rising inequality?’, Journal of Economic Perspectives 27(3): 103‒23.

Boockmann, Bernhard and Axel Dreher (2003) ‘The contribution of the IMF and the World Bank to economic freedom’, European Journal of Political Economy 19(3): 633–49.

Borensztein, Eduardo and Ugo Panizza (2009) ‘The costs of sovereign default’, IMF Staff Papers 56(4): 683‒741.

Caraway, Teri L., Stephanie J. Rickard and Mark S. Anner (2012) ‘International negotiations and domestic politics: The case of IMF labor market conditionality’, International Organization 66(1): 27‒61.

Chu, Ke-young and Sanjeev Gupta (1998) Social safety nets: Issues and recent experiences, Washington: IMF Publication Services.

Chwieroth, Jeffrey M. (2008) ‘Normative change from within: The International Monetary Fund’s approach to capital account liberalization’, International Studies Quarterly 52(1): 129‒58.

Chwieroth, Jeffrey M. (2014) ‘Professional ties that bind: How normative orientations shape IMF conditionality’, Review of International Political Economy 22(4): 757‒87.

Clift, Ben (2018) The IMF and the politics of austerity in the wake of the global financial crisis, Oxford: Oxford University Press.

Collier, Paul and Jan Willem Gunning (1999) ‘The IMF’s role in structural adjustment’, Economic Journal 109: F634‒51.

Conway, Patrick (2007) ‘The revolving door: Duration and recidivism in IMF programs.’ The Review of Economics and Statistics 89(2): 205–220.

Copelovitch, Mark S. (2010) ‘Master or servant? Common agency and the political economy of IMF lending’, International Studies Quarterly 54: 49‒77.

Dabla-Norris, Era, Kalpana Kochhar, Nujin Suphaphiphat, Frantisek Ricka and Evridiki Tsount (2015) Causes and consequences of income inequality: a global perspective, Washington: International Monetary Fund.

Doroodian, Khosrow (1994) ‘IMF stabilization policies in developing countries: A disaggregated quantitative analysis’, International Economic Journal 8(4): 41‒55.

Dreher, Axel (2003) ‘The influence of elections on IMF programme interruptions’, Journal of Development Studies 39(6): 101–20.

Dreher, Axel (2006) ‘IMF and economic growth: The effects of programs, loans, and compliance with conditionality’, World Development 34(5): 769‒88.

Dreher, Axel, Jan-Egbert Sturm, and James Raymond Vreeland (2015) ‘Politics and IMF conditionality’. Journal of Conflict Resolution 59(1): 120–148.

Easterly, William (2003) ‘IMF and World Bank structural adjustment programs and poverty’, in M. P. Dooley and J. A. Frankel, eds, Managing Currency Crises in Emerging Markets, 361‒92, Chicago: University of Chicago Press.

Easterly, William (2005) ‘What did structural adjustment adjust?’, Journal of Development Economics 76(1): 1–22.

Fiscal Monitor (2020) Fiscal policies to address the Covid-19 pandemic, Washington: International Monetary Fund, available at https://www.imf.org/en/Publications/FM/Issues/2020/09/30/october-2020-fiscal-monitor (last accessed on 12 March 2022).

Forster, Timon, Alexander E. Kentikelenis, Bernhard Reinsberg, Thomas H. Stubbs and Lawrence P. King (2019) ‘How structural adjustment programs affect inequality: A disaggregated analysis of IMF conditionality, 1980–2014’, Social Science Research 80: 83‒113.

Forster, Timon, Alexander E. Kentikelenis, Thomas H. Stubbs, and Lawrence P. King (2020) ‘Globalization and health equity: The impact of structural adjustment programs in developing countries’, Social Science and Medicine Volume 267, Article 112496. https://doi.org/10.1016/j.socscimed.2019.112496.

Frieden, Jeffry A. (1991) Debt, development, and democracy: Modern political economy in Latin America, Princeton: Princeton University Press.

Garuda, Gopal (2000) ‘The distributional effects of IMF programs: A cross-country analysis’, World Development 28(6): 1031‒51.

Geddes, Barbara (1994) Politician’s dilemma: Building state capacity in Latin America, Berkeley: California Series on Social Choice and Political Economy.

Giddens, Anthony (2013) The consequences of modernity, Hoboken, NJ: John Wiley and Sons.

Grabel, Ilene (2017) When things don’t fall apart: Global financial governance and developmental finance in an age of productive incoherence, Cambridge, MA: MIT Press.

Ha, Eunyoung (2012) ‘Globalization, government ideology, and income inequality in developing countries’, Journal of Politics 74(2): 541‒57.

Hajro, Zlata and Joseph P. Joyce (2009) ‘A true test: Do IMF programs hurt the poor?’, Applied Economics 41(3): 295‒306.

Hakro, Nawaz A. and Wadho Waqar Ahmed (2006) ‘IMF stabilization: Programs, policy conduct and macroeconomic outcomes: A case study of Pakistan’, Lahore Journal of Economics 11(1): 35‒62.

Huber, Evelyne, Francois Nielsen, Jenny Pribble and John D. Stephens (2006) ‘Politics and inequality in Latin America and the Caribbean’, American Sociological Review 71(6): 943–63.

Hübscher, Evelyne (2016) ‘The politics of fiscal consolidation revisited’, Journal of Public Policy 36(4): 573‒601.

Hübscher, Evelyne, Thomas Sattler and Markus Wagner (2020) ‘Voter responses to fiscal austerity’, British Journal of Political Science: 1‒10. doi:https://doi.org/10.1017/S0007123420000320

IMF (2004) Classification of exchange rate arrangements and monetary policy frameworks, Washington: International Monetary Fund, available at https://www.imf.org/external/np/mfd/er/2004/eng/0604.htm (last accessed on 12 March, 2022).

IMF (2016) IMF lending, October 3, Washington: International Monetary Fund, available at http://www.imf.org/en/About/Factsheets/IMF-Lending (last accessed on 12 March, 2022).

IMF (2018) IMF conditionality, March 6, Washington: International Monetary Fund, available at https://www.imf.org/en/About/Factsheets/Sheets/2016/08/02/21/28/IMF-Conditionality (last accessed on 12 March, 2022).

IMF (2021) IMF support for low-income countries, February 16, Washington: International Monetary Fund, available at https://www.imf.org/en/About/Factsheets/IMF-Support-for-Low-Income-Countries (last accessed on 12 March, 2022).

Jensen, Nathan M. (2004) ‘Crisis, conditions, and capital: The effects of International Monetary Fund agreements on foreign direct investment flows’, Journal of Conflict Resolution 48(1): 194‒210.

Johnson, Juliet, and Andrew Barnes (2015) ‘Financial nationalism and its international enablers: The Hungarian experience’, Review of International Political Economy 22(3): 535‒69.

Kaufman, Robert R., and Alex Segura-Ubiergo (2001) ‘Globalization, domestic politics, and social spending in Latin America: a time-series cross-section analysis, 1973–97.’ World politics 53(4): 553–587.

Kentikelenis, A. E., T. H. Stubbs, and L. P. King (2015) ‘Structural adjustment and public spending on health: Evidence from IMF programs in low-income countries’, Social Science and Medicine 126: 169‒76.

Kentikelenis, Alexander E., Thomas H. Stubbs and Lawrence P. King (2016) ‘IMF conditionality and development policy space, 1985‒2014’, Review of International Political Economy 23(4): 543‒82.

Kentor, Jeffrey (2001) ‘The long term effects of globalization on income inequality, population growth, and economic development’, Social Problems 48(4): 435‒55.

Killick, Tony (1995) ‘Structural adjustment and poverty alleviation: an interpretative survey’, Development and Change 26(2): 305‒30.

Krueger, Anne O. (1997) ‘Whither the World Bank and the IMF?’, NBER Working Paper No. W6327, available at http://ssrn.com/abstract=226081 (last accessed on 12 March, 2022).

Krueger, Anne O., Stanley Fischer and Jeffrey D. Sachs (2003) ‘IMF stabilization programs’, in M. Feldstein, ed., Economic and financial crises in emerging market economies, 297‒361, Chicago: National Bureau of Economic Research.

Kurtz, Marcus J., and Sarah M. Brook. (2008) ‘Embedding neoliberal reform in Latin America’, World Politics 60(6): 231‒80.

Kus, Basak (2010) ‘Regulatory governance and the informal economy: cross-national comparisons’, Socio-Economic Review 8(3): 487‒510.

Lang, Valentin (2021) ‘The economics of the democratic deficit: The effect of IMF programs on inequality’, Review of International Organizations 16(3): 599‒623.

Lee, Cheol-Sung (2005) ‘Income inequality, democracy, and public sector size’, American Sociological Review 70(1): 158‒81.

Lora, Eduardo A. (2012) What has been reformed and how to measure it (updated version), Washington: Inter-American Development Bank.

Manzetti, Luigi (1999) Privatization South American style, New York: Oxford University Press.

Mariotti, Chiara, Nick Galasso and Nadia Daar (2017) ‘Great Expectations: Is the IMF turning words into action on inequality?’, Oxford: Oxfam Briefing Paper, available at https://www-cdn.oxfam.org/s3fs-public/file_attachments/bp-great-expectations-imf-inequality-101017-en.pdf (last accessed on 12 March, 2022).

Mercer-Blackman, Valerie and Anna Unigovskaya (2004) ‘Compliance with IMF program indicators and growth in transition economies’, Emerging Markets Finance and Trade 40(3): 55‒83.

Montgomery, Jacob M., Brendan Nyhan, and Michelle Torres (2018) ‘How conditioning on posttreatment variables can ruin your experiment and what to do about it.’ American Journal of Political Science 62(3): 760–775.

Morley, Samuel A., Roberto Machado and Stefano Pettinato (1999) Indexes of structural reform in Latin America, Santiago: ECLAC.

Nelson, Stephen C. (2014a) ‘Playing favorites: How shared beliefs shape the IMF’s lending decisions’, International Organization 68(2): 297‒328.

Nelson, Stephen C. (2014b) ‘The International Monetary Fund’s evolving role in global economic governance’, in M. Moschella and C. Weaver, eds, Handbook of Global Economic Governance, 156–70, London: Routledge.

Nelson, Stephen C., and Geoffrey P.R. Wallace (2017) ‘Are IMF lending programs good or bad for democracy?’, Review of International Organizations 12(4): 523‒58.

Neter, John, Michael H. Kutner, Christopher J. Nachtsheim and William Wasserman (1996) Applied linear statistical models, Chicago: Irwin.

Nizalova, Olena Y. and Irina Murtazashvili (2016) ‘Exogenous treatment and endogenous factors: Vanishing of omitted variable bias on the interaction term’, Journal of Econometric Methods 5(1): 71–77.

Nunn, Nathan and Nancy Qian (2013) ‘U.S. food aid and civil conflict’, American Economic Review 103(3): 86–92.

Oberdabernig, Doris A. (2013) ‘Revisiting the effects of IMF programs on poverty and inequality’, World Development 46(1): 113-42.

Ostry, Jonathan D., Prakash Loungani, and Davide Furceri (2016) ‘Neoliberalism: Oversold?-Instead of delivering growth, some neoliberal policies have increased inequality, in turn jeopardizing durable expansion’. Finance & development 53.002.

Panizza, Ugo, Federico Sturzenegger and Jeromin Zettelmeyer (2009) ‘The economics and law of sovereign debt and default’, Journal of Economic Literature 47(3): 1–47.

Pastor, Jr. Manuel (1987) ‘The effects of IMF programs in the third world: Debate and evidence from Latin America’, World Development 15(2): 249‒62.

Polak, Jacques J. (1991) ‘The changing nature of IMF conditionality’, Working Paper 41, Paris: OECD Development Centre.

Polity 5 Project (2020) Political regime characteristics and transitions, 1800‒2018, College Park: University of Maryland, available at https://www.systemicpeace.org/inscrdata.html.

Prahalad, Coimbatore K., and Allen Hammond (2002) ‘Serving the world's poor, profitably.’ Harvard business review 80(9): 48-59.

Reinsberg, Bernhard, Alexander Kentikelenis, Thomas Stubbs and Lawrence King (2019a) ‘The world system and the hollowing-out of state capacity: How structural adjustment programs impact bureaucratic quality in developing countries’, American Journal of Sociology 124(4): 1222‒57.

Reinsberg, Bernhard, Thomas Stubbs, Alexander Kentikelenis and Lawrence King (2019b) ‘The political economy of labor market deregulation during IMF interventions’, International Interactions, doi: https://doi.org/10.1080/03050629.2019.1582531.

Reinsberg, Bernhard, Alexander Kentikelenis, and Thomas Stubbs (2021) ‘Unimplementable by design? Understanding (non-)compliance with International Monetary Fund policy conditionality’, Governance (forthcoming).

Reuveny, Rafael, and Quan Li (2003) ‘Economic openness, democracy, and income inequality: An empirical analysis’, Comparative Political Studies 36(5): 575‒601.

Rickard, Stephanie J. and Teri L. Caraway (2014) ‘International negotiations in the shadow of national elections’, International Organization 68(13): 701‒20.

Rickard, Stephanie J. and Teri L. Caraway (2019) ‘International demands for austerity: Examining the impact of the IMF on the public sector’, Review of International Organizations 14(1): 35‒57.

Rudra, Nita (2002) ‘Globalization and the decline of the welfare state in less-developed countries’, International Organization 56(2): 411‒45.

Soto, Hernando de (2000) The mystery of capital: why capitalism triumphs in the West and fails everywhere else, New York: Basic Books.

Stiglitz, Joseph E. (2002) Globalization and its discontents, New York: Norton.

Stone, Randall W. (2002) Lending credibility: The International Monetary Fund and the post-communist transition, Princeton: Princeton University Press.

Stone, Randall W. (2008) ‘The scope of IMF conditionality’, International Organization 62(4): 589‒620.

Stock, James, and Motohiro Yogo (2005) Asymptotic distributions of instrumental variables statistics with many instruments, Vol. 6, Ch. 6.

Stubbs, Thomas and Alexander Kentikelenis (2018) ‘Conditionality and sovereign debt: An overview of human rights implications’, in I. Bantekas and C. Lumina, eds, Sovereign Debt and Human Rights, 359‒80, Oxford: Oxford University Press.

Stubbs, Thomas, Bernhard Reinsberg, Alexander Kentikelenis and Lawrence King (2020) ‘How to evaluate the effects of IMF conditionality: An extension of quantitative approaches and an empirical application to public education spending’, Review of International Organizations 15: 29‒73.

Thacker, Strom C. (1999) ‘The high politics of IMF lending’, World Politics 52(1): 38‒75.

Vegh, Carlos A. and Guillermo Vuletin (2015) ‘How is tax policy conducted over the business cycle?’, American Economic Journal: Economic Policy 7: 327‒70.

Vetterlein, Antje (2015) ‘Paradigm maintenance: The IMF and social policies after the financial crisis’, Global Social Policy 15(1): 85–88.

Vreeland, James R. (2002) ‘The effect of IMF programs on labor’, World Development 30(1): 121‒39.

Vreeland, James R. (2003a) The IMF and economic development, Cambridge: Cambridge University Press.

Vreeland, James R. (2003b) ‘Why do governments and the IMF enter into agreements? Statistically selected cases’, International Political Science Review 24(3): 321–43.

Vreeland, James R. (2006) ‘IMF program compliance: Aggregate index versus policy specific research strategies’, Review of International Organizations 1(4): 359‒78.

Weisbrot, Mark, Rebecca Ray, Jake Johnston, Jose Antonio Cordero, and Juan Antonio Montecino (2009) ‘IMF-supported macroeconomic policies and the world recession: a look at forty-one borrowing countries.’ Center for Economic and Policy Research 1611.

Williamson, John (1990) Latin American adjustment: How much has happened?, Washington: Institute for International Economics.

World Bank (2018) World development indicators. Washington: World Bank, available at http://databank.worldbank.org/data/reports.aspx?source=WDI-Archives (last accessed on 12 March, 2022).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Biglaiser, G., McGauvran, R.J. The effects of IMF loan conditions on poverty in the developing world. J Int Relat Dev 25, 806–833 (2022). https://doi.org/10.1057/s41268-022-00263-1

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41268-022-00263-1