Abstract

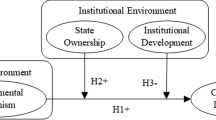

Can state governance spur firm innovation in an emerging economy and transform state-owned enterprises (SOEs) from “dying dinosaurs” to “dynamic dynamos”? We seek an answer to this question by investigating the innovative performance of restructured SOEs in China’s high-speed train sector. We expect that SOE restructuration will improve firm innovation, but that the degree of improvement will depend on how the state conducts firm governance. Building on institutional theory, we distinguish state governance via equity ownership and administrative affiliation in an emerging economy with market-hierarchy institutional conflicts. Under such conflicts, restructured SOEs experience institutional logic dissonance, which hinders organizational change for technological innovation. We hypothesize that state ownership exacerbates institutional logic dissonance at a restructured SOE, thus limiting innovation improvement from restructuration; in contrast, state affiliation mitigates firm dissonance and hence augments such improvement. We find empirical evidence for these hypotheses in a comprehensive panel of high-speed train manufacturers in China between 1989 and 2015. This study contributes to the institution-based theory of technological innovation in emerging economies. On the practical front, our findings suggest that emerging states may adopt arms-length governance to spur SOE innovation and unleash these dynamic dynamos to fuel sustainable economic growth.

Résumé

La gouvernance de l’État peut-elle stimuler l’innovation dans une économie émergente et transformer les entreprises publiques (EP) de « dinosaures mourants » en « dynamos dynamiques » ? Nous cherchons une réponse à cette question en étudiant les performances innovantes des EP restructurées dans le secteur des trains à grande vitesse en Chine. Nous prévoyons que la restructuration des EP améliorera l’innovation des entreprises, mais que le degré d’amélioration dépendra de la manière dont l’État conduit la gouvernance des entreprises. Sur la base de la théorie institutionnelle, nous distinguons la gouvernance de l’État via la propriété des actions et l’affiliation administrative dans une économie émergente avec des conflits institutionnels de type hiérarchie-marché. Dans de tels conflits, les EP restructurées connaissent une dissonance logique institutionnelle, ce qui entrave le changement organisationnel pour l’innovation technologique. Nous faisons l’hypothèse que la propriété de l’État exacerbe la dissonance de la logique institutionnelle dans une EP restructurée, limitant ainsi l’amélioration de l’innovation par la restructuration; en revanche, l’affiliation à l’État atténue la dissonance de la firme et augmente donc cette amélioration. Nous validons ces hypothèses par des preuves empiriques fondées sur un panel complet de fabricants de trains à grande vitesse en Chine entre 1989 et 2015. Cette étude contribue à la théorie institutionnelle de l’innovation technologique dans les économies émergentes. Sur le plan pratique, nos résultats suggèrent que les États émergents pourraient adopter une gouvernance indépendante pour stimuler l’innovation des EP et déclencher ces dynamos dynamiques pour alimenter une croissance économique durable.

Resumen

¿Puede la gobernanza estatal estimular la innovación de las empresas en una economía emergente y transformar las empresas de propiedad estatal de “dinosaurios agonizantes a “dínamos dinámicos”? Buscamos una respuesta a esta pregunta investigando los resultados innovadores de las empresas estatales en el sector de los trenes de alta velocidad de China. Esperamos que la restructuración de las empresas de propiedad estatal mejore la innovación de las empresas, pero que el grado de mejora dependerá de cómo el Estado lleve a cabo la gobernanza de la empresa. Basándose en la teoría institucional, distinguimos la gobernanza estatal a través de la propiedad de capital y la afiliación administrativa en una economía emergente con conflictos institucionales de jerarquía de mercado. Bajo esos conflictos, las empresas de empresas de empresas de servicios personales reestructuradas experimentan disonancia lógica institucional, lo que dificulta el cambio organizativo para la innovación tecnológica. Lanzamos las hipótesis que la propiedad estatal exacerba la disonancia de la lógica institucional en una empresa de propiedad estatal reestructurada, limitando así la mejora de la innovación de la reestructuración; en cambio, la afiliación estatal mitiga la disonancia de la empresa y, por lo tanto, aumenta dicha mejora. Encontramos evidencia empírica de estas hipótesis en un amplio panel de fabricantes de trenes de alta velocidad en China entre 1989 y 2015. Este estudio contribuye a la teoría de la innovación tecnológica basada en instituciones en las economías emergentes. En el frente práctico, nuestros hallazgos sugieren que los Estados emergentes pueden adoptar una gobernanza en condición de igualdad para estimular la innovación de las empresas de propiedad estatal y dar rienda suelta a estos dinamos dinámicos para impulsar el crecimiento económico sostenible.

Resumo

Pode a governança estatal estimular inovação de empresas em uma economia emergente e transformar empresas estatais (SOEs) de “dinossauros moribundos” em “dínamos dinâmicos”? Buscamos uma resposta para essa pergunta investigando o desempenho inovador de empresas estatais reestruturadas no setor de trens de alta velocidade da China. Esperamos que a reestruturação de SOE melhore a inovação da empresa, mas que o grau de melhoria dependa de como o estado conduz a governança da empresa. Com base na teoria institucional, distinguimos governança estatal por meio de propriedade acionária e afiliação administrativa em uma economia emergente com conflitos institucionais em hierarquia de mercado. Sob tais conflitos, SOEs reestruturadas são acometidas de dissonância na lógica institucional, o que dificulta mudança organizacional visando inovação tecnológica. Hipotetizamos que a propriedade estatal aumente a dissonância na lógica institucional em uma SOE reestruturada, limitando assim a melhoria na inovação advinda da reestruturação; por outro lado, afiliação estatal atenua a dissonância da empresa e, portanto, amplia essa melhoria. Encontramos evidências empíricas para essas hipóteses em um painel abrangente de fabricantes de trens de alta velocidade na China entre 1989 e 2015. Este estudo contribui para a teoria baseada em instituições da inovação tecnológica em economias emergentes. Em termos práticos, nossas descobertas sugerem que países emergentes podem adotar uma governança independente para estimular inovação de SOE e desencadear esses dínamos dinâmicos para fomentar crescimento econômico sustentável.

抽象

新兴经济体中, 国家治理能激发企业创新, 并将国有企业从 “垂死挣扎的恐龙” 转变为 “充满动能的发电机”吗 ? 我们通过研究中国高速列车行业国企改制后的创新绩效, 来寻求这—问题的答案. 我们认为, 国企改制将促进企业创新, 但创新改进的程度取决于国家的公司治理水平. 在制度理论基础上, 我们将新兴经济体 (存在市场等级制度冲突) 的国家治理分成: 所有制和行政隶属两个不同维度. 在市场等级制度冲突下, 改制后的国企会面临制度逻辑不协调, 这将阻碍技术创新所需的组织变革进程. 我们假设, 国家所有制将加剧改制国企的制度逻辑不协调, 从而降低改制对创新的促进作用; 与之相反, 国家隶属却能缓解这种不协调, 进而提高改制对企业创新的促进作用. 通过对中国高速列车制造行业 1989–2015 年的面板数据分析, 以上假设得到证实. 这项研究为基于制度理论的新兴经济体技术创新理论做出了贡献. 在实践方面, 我们的研究表明, 新兴国家可以采取适当的 “长臂” 治理, 以更好激发国企创新, 进而释放国企动能以推动经济可持续增长.

Similar content being viewed by others

References

Aftab, S., & Shaikh, A. S. 2013. Reforming state-owned enterprises, Pakistan policy note. no. 4 ed. Washington D.C.: World Bank.

Bhagavatula, S., Mudambi, R., & Murmann, J. P. 2019. Innovation and entrepreneurship in India: An overview. Management and Organization Review, 15(3): 467–493.

Bin, G. 2008. Technology acquisition channels and industry performance: An industry-level analysis of Chinese large- and medium-size manufacturing enterprises. Research Policy, 37(2): 194–209.

Bloom, N., Romer, P. M., Terry, S. J., & Van Reenen, J. 2013. A trapped-factors model of innovation. American Economic Review, 103(3): 208–213.

Bruton, G. D., Peng, M. W., Ahlstrom, D., Stan, C., & Xu, K. 2015. State-owned enterprises around the world as hybrid organizations. Academy of Management Perspectives, 29(1): 92–114.

Buckley, P. J., Clegg, L. J., Voss, H., Cross, A. R., Liu, X., & Zheng, P. 2018. A retrospective and agenda for future research on Chinese outward foreign direct investment. Journal of International Business Studies, 49(1): 4–23.

Burt, R. 1992. Structural holes: The social structure of competition. Cambridge: Harvard University Press.

Chang, H. J. 2007. State-owned enterprise reform. New York: United Nation Department for Economic and Social Affairs (UNDESA).

Chen, M. J., & Miller, D. 2010. West meets east: Toward an ambicultural approach to management. Academy of Management Perspectives, 24(4): 17–24.

D’Aunno, T., Succi, M., & Alexander, J. A. 2000. The role of institutional and market forces in divergent organizational change. Administrative Science Quarterly, 45(4): 679–703.

DiMaggio, P. J., & Powell, W. W. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2): 147–160.

Drucker, P. 1985. Innovation and entrepreneurship. New York: Routledge.

Elango, B., & Pattnaik, C. 2007. Building capabilities for international operations through networks: A study of Indian firms. Journal of International Business Studies, 38(4): 541–555.

Filatotchev, I., Liu, X., Buck, T., & Wright, M. 2009. The export orientation and export performance of high-technology SMEs in emerging markets: The effects of knowledge transfer by returnee entrepreneurs. Journal of International Business Studies, 40(6): 1005–1021.

Friedland, R., & Alford, R. R. 1991. Bringing society back in: Symbols, practices, and institutional contradictions. In W. W. In Powell & P. J. DiMaggio (Eds.), The New institutionalism in organizational analysis (pp. 232–263). Chicago: University of Chicago Press.

Gorodnichenko, Y., & Roland, G. 2011. Individualism, innovation, and long-run growth. Proceedings of the National Academy of Science, 108,: 21316–21319.

Greenwood, R., & Hinings, C. 1996. Understanding radical organizational change: Bringing together the old and the new institutionalism. Academy of Management Review, 21(4): 1022–1054.

Griffith, D. A., & Harvey, M. G. 2001. A resource perspective of global dynamic capabilities. Journal of International Business Studies, 32(3): 597–606.

Grigoriou, K., & Rothaermel, F. T. 2017. Organizing for knowledge generation: Internal knowledge networks and the contingent effect of external knowledge sourcing. Strategic Management Journal, 38(2): 395–414.

Groves, T., Hong, Y., McMillan, J., & Naughton, B. 1994. Autonomy and incentives in Chinese state enterprises. Quarterly Journal of Economics, 109(1): 183–209.

Guan, J., & Yam, R. C. M. 2015. Effects of government financial incentives on firms’ innovation performance in China: Evidences from Beijing in the 1990s. Research Policy, 44(1): 273–282.

Harrison, A., Meyer, M., Wang, P., Zhao, L., & Zhao, M. 2019. Can a tiger change its stripes? Reform of Chinese state-owned enterprises in the penumbra of the state, NBER Working Papers 25475. Cambridge, MA: National Bureau of Economic Research, Inc.

Hassard, J., Rees, C. J., Morris, J., Sheehan, J., & Xiao, Y. X. 2010. China’s state-owned enterprises: Economic reform and organizational restructuring. Journal of Organizational Change Management, 23(5): 500–516.

Hassard, J., Sheehan, J., Zhou, M., Terpstra-Tong, J., & Morris, J. 2007. China’s state-enterprise reform: From Marx to the market. London: Routledge.

Hofstede, G. 2001. Culture’s consequences: Comparing values, behaviors, institutions and organizations across nations. Thousand Oaks: Sage Publications.

Hu, A. G. Z., Jefferson, G. H., & Qian, J. C. 2005. R&D and technology transfer: Firm-level evidence from Chinese industry. Review of Economics and Statistics, 87(4): 780–786.

Hu, H. W., Cui, L., & Aulakh, P. S. 2019. State capitalism and performance persistence of business group-affiliated firms: A comparative study of China and India. Journal of International Business Studies, 50(2): 193–222.

Huang, L. F. J., & Snell, R. S. 2003. Turnaround, corruption and mediocrity: Leadership and governance in three state-owned enterprises in Mainland China. Journal of Business Ethics, 43(1–2): 111–124.

Jensen, M. C., & Meckling, W. H. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4): 305–360.

Jia, N., Huang, K. G., & Zhang, C. M. 2019. Public governance, corporate governance, and firm innovation: An examination of state-owned enterprises. Academy of Management Journal, 62(1): 220–247.

Kozminski, A. K. 1993. Catching up? Organizational and management change in the ex-socialist block. Albany: State University of New York Press.

Kraatz, M. S., & Block, E. S. 2008. Organizational implications of institutional pluralism. In R. Greenwood, C. Oliver, R. Suddaby, & K. Sahlin-Andersson (Eds.), The Sage handbook of organizational institutionalism (pp. 243–275). London: Sage.

Krishnan, R. T., & Prashantham, S. 2019. Innovation in and from India: The who, where, what, and when. Global Strategy Journal, 9(3): 357–377.

Li, J., Xia, J., & Zajac, E. J. 2018. On the duality of political and economic stakeholder influence on firm innovation performance: Theory and evidence from Chinese firms. Strategic Management Journal, 39(1): 193–216.

Liang, H., Ren, B., & Sun, S. L. 2015. An anatomy of state control in the globalization of state-owned enterprises. Journal of International Business Studies, 46(2): 223–240.

Liegsalz, J., & Wagner, S. 2013. Patent examination at the State Intellectual Property Office in China. Research Policy, 42(2): 552–563.

Liu, X., Lu, J., Filatotchev, I., Buck, T., & Wright, M. 2010. Returnee entrepreneurs, knowledge spillovers and innovation in high-tech firms in emerging economies. Journal of International Business Studies, 41(7): 1183–1197.

Mahmood, I. P., & Rufin, C. 2005. Government’s dilemma: The role of government in imitation and innovation. Academy of Management Review, 30(2): 338–360.

March, J. 1991. Exploration and exploitation in organizational learning. Organization Science, 2(1): 71–87.

Mariotti, S., & Marzano, R. 2019. Varieties of capitalism and the internationalization of state-owned enterprises. Journal of International Business Studies, 50(5): 669–691.

Megginson, W. L., & Netter, J. R. 2001. From state to market: A survey of empirical studies on privatization. Journal of Economic Literature, 39(2): 321–389.

Meyer, K. E., & Peng, M. W. 2016. Theoretical foundations of emerging economy business research. Journal of International Business Studies, 47(1): 3–22.

Mudambi, R. 2011. Hierarchy, coordination, and innovation in the multinational enterprise. Global Strategy Journal, 1(3–4): 317–323.

Musacchio, A., Lazzarini, S. G., & Aguilera, R. V. 2015. New varieties of state capitalism: Strategic and governance implications. Academy of Management Perspectives, 29(1): 115–131.

Nee, V. 1989. A theory of market transition: From redistribution to markets in state socialism. American Sociological Review, 54(5): 663–681.

Oliver, C. 1991. Strategic responses to institutional processes. Academy of Management Review, 16(1): 145–179.

Oliver, C. 1997. Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18(9): 697–713.

Orr, G., & Roth, E. 2012. A CEO’s guide to innovation in China. McKinsey Quarterly, 1: 74–83.

Pache, A. C., & Santos, F. 2010. When worlds collide: The internal dynamics of organizational responses to conflicting institutional demands. Academy of Management Review, 35(3): 455–476.

Pache, A. C., & Santos, F. 2013. Inside the hybrid organization: Selective coupling as a response to competing institutional logics. Academy of Management Journal, 56(4): 972–1001.

Peng, M. W., Ahlstrom, D., Carraher, S. M., & Shi, W. 2017. An institution-based view of global IPR history. Journal of International Business Studies, 48(7): 893–907.

Pollitt, C., & Bouckaert, G. 2004. Public management reform: A comparative analysis (2nd ed.). Oxford: Oxford University Press.

Porter, M. 1991. Toward a dynamic theory of strategy. Strategic Management Journal, 12(S2): 95–117.

Ralston, D. A., Terpstra-Tong, J., Terpstra, R. H., Wang, X., & Egri, C. 2006. Today’s state-owned enterprises of China: Are they dying dinosaurs or dynamic dynamos? Strategic Management Journal, 27(9): 825–843.

Ramamurti, R., & Hillemann, J. 2018. What is “Chinese’’ about Chinese multinationals? Journal of International Business Studies, 49(1): 34–48.

Ryan, T. P. 2008. Modern regression methods (2nd ed.). New York: Wiley.

Schilling, M. A. 2015. Technology shocks, technological collaboration, and innovation outcomes. Organization Science, 26(3): 668–686.

Schmidt, K. 1997. Managerial incentives and product market competition. The Review of Economic Studies, 64(2): 191–213.

Schumpeter, J. A. 1942. Capitalism, socialism, and democracy (3rd ed.). New York: Harper and Brothers.

Schwartz, S. H. 1994. Cross-cultural research and methodology series. Individualism and collectivism: Theory, method, and applications (Vol. 18). Thousand Oaks: Sage Publications Inc.

Stiglitz, J. E. 1991. The invisible hand and modern welfare economics, NBER working papers 3641. Cambridge: National Bureau of Economic Research, Inc.

Sun, Z. 2015. Technology innovation and entrepreneurial state: The development of China’s high-speed rail industry. Technology Analysis & Strategic Management, 27(6): 646–659.

Sytch, M., & Tatarynowicz, A. 2014. Exploring the locus of invention: The dynamics of network communities and firms’ invention productivity. Academy of Management Journal, 57(1): 249–279.

Tan, D., & Tan, J. 2017. Far from the tree? Do private entrepreneurs agglomerate around public sector incumbents during economic transition? Organization Science, 28(1): 113–132.

Tan, J. 2002. Impact of ownership type on environment, strategy, and performance: Evidence from China. Journal of Management Studies, 39(3): 333–354.

Tan, J., Li, S., & Xia, J. 2007. When iron fist, visible hand, and invisible hand meet: Firm-level effects of varying institutional environments in China. Journal of Business Research, 60(7): 786–794.

Tan, J., & Litschert, R. J. 1994. Environment-strategy relationship and its performance implications: An empirical study of the Chinese electronics industry. Strategic Management Journal, 15(1): 1–20.

Tan, J., & Peng, M. 2003. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strategic Management Journal, 24(13): 1249–1263.

Tan, J., & Tan, D. 2005. Environment – Strategy coevolution and coalignment: A staged-model of Chinese SOEs under transition. Strategic Management Journal, 26(2): 141–157.

Taylor, M. Z., & Wilson, S. 2012. Does culture still matter? The effects of individualism on national innovation rates. Journal of Business Venturing, 27(2): 234–247.

Thornton, P. H., Ocasio, W., & Lounsbury, M. 2012. The institutional logics perspective: A new approach to culture, structure, and process. Oxford: Oxford University Press.

Walsh, J. P., & Kosnik, R. D. 1993. Corporate raiders and their disciplinary role in the market for corporate control. Academy of Management Journal, 36(4): 671–700.

Wang, C., Rodan, S., Fruin, M., & Xu, X. 2014. Knowledge networks, collaboration networks, and exploratory innovation. Academy of Management Journal, 57(2): 484–514.

Xu, D., Lu, J. W., & Gu, Q. 2014. Organizational forms and multi-population dynamics: Economic transition in China. Administrative Science Quarterly, 59(3): 517–547.

Zhou, K. Z., Gao, G. Y., & Zhao, H. 2017. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Administrative Science Quarterly, 62(2): 375–404.

Zhou, K. Z., Tse, D. K., & Li, J. J. 2006. Organizational changes in emerging economies: Drivers and consequences. Journal of International Business Studies, 37(2): 248–263.

ACKNOWLEDGEMENTS

This research is in part supported by Grants from Social Science and Humanities Research Council of Canada and National Natural Science Foundation of China (71472131, 71732005, and 71401183).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Accepted by Jaideep Anand, Guest Editor, 5 May 2020. This article has been with the authors for four revisions.

Appendices

Appendix 1: Conceptual Supplement

See Table 5.

Appendix 2: Additional Analysis

Rights and permissions

About this article

Cite this article

Genin, A.L., Tan, J. & Song, J. State governance and technological innovation in emerging economies: State-owned enterprise restructuration and institutional logic dissonance in China’s high-speed train sector. J Int Bus Stud 52, 621–645 (2021). https://doi.org/10.1057/s41267-020-00342-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41267-020-00342-w