Abstract

This article argues that major post-crisis regulatory initiatives like the Dodd-Frank Act, the Vickers Report, the Liikanen Review and Basel III capital adequacy and liquidity rules that are shaping the banking industry globally are not likely to be successful in de-risking the banks because they do not explicitly engage with the consequences of shareholder value-driven business models that drive management behaviour in banking. Banks operate in a financialized economy where firms compete in the stock market to deliver unrealistic returns to shareholders. The business models of such financialized banks re-locate risks according to conjunctural market and regulatory arbitrage conditions to achieve the unchallenged return targets and therefore thwart the ideal outcomes aimed at by regulatory initiatives. The section ‘Introduction: Post-crisis regulatory reform initiatives to de-risk and re-capitalise banks’ of this article will describe the de-risking and re-capitalisation measures that were introduced by the post-crisis regulatory initiatives in the United States and Europe. The section ‘Financialized bank business models’ will discuss bank business models in a financialised economy and how the post-crisis regulatory initiatives have failed to address the risks in banking that are associated with maximising shareholder value. The section ‘Post-crisis examples of relocated risks in shareholder value-driven banks’ will examine two post-crisis case studies where JP Morgan Chase and the UK retail banks like Lloyds Group, in pursuit of shareholder value creation, suffered losses from activities that the new regulatory initiatives have failed to identify and regulate.

Similar content being viewed by others

References and Notes

U.S.A. Congress (2010) Dodd-Frank wall street reform and consumer protection act, http://housedocs.house.gov/rules/finserv/111_hr4173_finsrvcr.pdf, accessed 15 March 2013.

The Independent Commission on Banking (2011) Final report: Recommendations, http://webarchive.nationalarchives.gov.uk, accessed 20 March 2013; House of Commons (2013) Financial Services (Banking Reform) Act 2013, http://www.legislation.gov.uk/ukpga/2013/33/contents/enacted, accessed 10 January 2014.

Liikanen, E. (2012) High-level expert group on reforming the structure of the EU banking sector – final report, p. i, http://ec.europa.eu/internal_market/bank/docs/high-level_expert_group/report_en.pdf, accessed 10 March 2013.

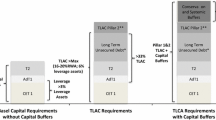

BCBS (Basel Committee on Banking Supervision) (2011) Basel III: A global regulatory framework for more resilient banks and banking systems, June, http://www.bis.org/publ/bcbs189.pdf, accessed 16 March 2013.

BCBS (Basel Committee on Banking Supervision) (2013) Basel III: The liquidity coverage ratio and liquidity risk monitoring tools, January, http://www.bis.org/publ/bcbs238.pdf, accessed 19 March 2013.

See Milbourn, T.T., Boot, A.W. and Thakor, A.V. (1999) Megamergers and expanded scope: Theories of bank size and activity diversity. Journal of Banking and Finance 23 (2): 195–214, Casu, B. and Girardone, C. (2004) Financial conglomeration: Efficiency, productivity and strategic drive. Applied Financial Economics 14(10): 687–696; Campa, J.MC. and Hernando, I.H. (2006) M&A performance in the European financial industry. Journal of Banking and Finance 30(12): 3367–3392.

See Van der Zwan, N. (2014) State of the art: Making sense of financialization. Socio-Economic Review 12 (1): 99–129, Engelen, E. and Konings, M. (2010) Financial capitalism resurgent: Comparative institutionalism and the challenges of financialization. In: G. Morgan, J. Campbell, C. Crouch, O.K. Pedersen and R. Whitley (eds.) The Oxford Handbook of Comparative Institutional Analysis. Oxford: Oxford University Press, pp. 601–624; van Treeck, T. (2009) The political economy debate on ‘financialization’ – A macroeconomic perspective. Review of International Political Economy 16(5): 907–944; Erturk, I., Froud, J., Johal, S., Leaver, A. and Williams, K. (2008) Financialization at Work: Key Texts and Commentary. London: Routledge.

Froud, J., Johal, S., Leaver, A. and Williams, K. (2006) Financialization and Strategy: Narrative and Numbers. London: Routledge, Ertürk et al7; Engelen, E. et al (2011) After the Great Complacence: Financial Crisis and the Politics of Reform. Oxford: Oxford University Press.

Froud et al8.

Lazonick, W. and O’Sullivan, M. (2010) Maximizing shareholder value: A new ideology for corporate governance. Economy and Society 29 (1): 13–35.

Citigroup (2007) Annual Report 2006. p. 5, http://www.citigroup.com/citi/fin/data/ar06c_en.pdf, accessed 16 January 2015.

Deutsche Bank (2007) Annual Review 2006. p. 2, https://annualreport.deutsche-bank.com/2006/ar/servicepages/downloads/files/dbfy2006_entire.pdf, accessed 17 January 2015.

Deutsche Bank (2013) Annual Review 2012. p. 3, https://annualreport.deutsche-bank.com/2012/ar/servicepages/downloads/files/dbfy2012_entire.pdf, accessed 17 January 2015.

BBC News (2009) RBS boss set for £9.6m pay deal, http://news.bbc.co.uk/go/pr/fr/-/1/hi/business/8112199.stm, accessed 22 June 2009.

See Crouch, C. and Streeck, W. (1997) Political Economy of Modern Capitalism: Mapping Convergence and Diversity. London: Sage, Schmidt, V.A. (2003) French capitalism transformed, yet still a third variety of capitalism. Economy and Society 32(4): 526–554; Vitols, S. (2005) German corporate governance in transition: Implications of bank exit from monitoring and control. International Journal of Disclosure and Governance 2(4): 357–367; Wood, G. and Lane, C. (2011) Capitalist Diversity and Diversity within Capitalism. New York: Routledge; Grittersová, J. (2014) Non-market cooperation and the variety of finance capitalism in advanced democracies. Review of International Political Economy 21(2): 339–371.

Haldane, A. (2009) Small lessons from big crisis, p. 3, http://www.bankofengland.co.uk/publications/speeches/2009/speech397.pdf, accessed 25 January 2010.

Wilson, J. (2012) Deutsche to break with Ackermann target. Financial Times 9 September.

http://www.northernrock.co.uk, http://www.n-ram.co.uk/~/media/Files/N/N-RAM/content/results-presentations/stockex070124.pdf, accessed 9 February 2010.

Sarangi, A. (2006) Northern rock: This train has left the station. ING Equity Markets, September 2.

Bebchuk, L.A. and Spamann, H. (2009) Regulating bankers’ pay. Harvard John M. Olin Center for Law, Economics, and Business. Discussion Paper No. 641, Cambridge, MA, http://www.law.harvard.edu/programs/olin_center/, accessed 8 May 2010.

Blundell-Wignal, A. and Atkinson, P. (2010) Thinking beyond Basel III: Necessary solutions for capital and liquidity. OECD Journal: Financial Market Trends (1): 1–23.

Macartney, H. (2014) From Merlin to Oz: The strange case of failed lending targets in the UK. Review of International Political Economy 21 (4): 820–846.

Ridley, A. (2013) Blame bank regulation for Britain’s stagnation. Financial Times 12 August.

Blundell-Wignall, A., Atkinson, P. and Roulet, C. (2013) Bank business models and the Basel system: Complexity and interconnectedness. OECD: Financial Market Trends (2): 1.

Ayadi, R. and De Groen, W.P. (2014) Banking Business Models Monitor 2014 – Europe. Brussels, Belgium: Centre for European Policy Studies and International Observatory on Financial Services Cooperatives.

Roengpitya, R., Tarashev, N. and Tsatsaronis, K. (2014) Bank business models. BIS Quarterly Review, December 55–67.

Alexander, P. (2014) Banks try to stay ahead of regulatory tide. The Banker Special Report – Transforming the Bank: Regulation and strategy, January, p. 2.

United States Senate (2013) JP Morgan chase whale trades: A case history of derivatives risks and abuses, http://www.gpo.gov/fdsys/pkg/CHRG…/pdf/CHRG-113shrg85162.pdf, accessed 12 February 2014.

Makan, A. (2012) JPMorgan takes more risk than rivals. Financial Times 23 May.

JP Morgan Chase & Co (2013) The 2012 Annual Report. p. 10, http://investor.shareholder.com/jpmorganchase/annual.cfm, accessed 18 January 2015.

Zuckerman, G. and Burne, K. (2012) London whale’ rattles debt market. The Wall Street Journal 6 April.

Benoit, D. (2012) J.P. Morgan: A London whale? He is more of a shrubbery. The Wall Street Journal 13 April.

See JPMorgan Chase annual reports.

Ertürk, I., Froud, J., Leaver, A., Johal, S. and Williams, K. (2013) (How) do devices matter in finance? Journal of Cultural Economy 6 (3): 336–352.

Economist (2015) British banks: The $43 billion-dollar bill. 7 February.

In its 2000 Annual Report Bank of America, which is primarily a retail bank, reported that ‘Shifting the focus from loans to fee-based products and services, leveraging the balance sheet and honing the client base make us more value-added to corporations and institutions – and more profitable.’ (Bank of America Annual Report 2000, p. 28).

Lloyds Banking Group (2014) Annual Report and Accounts 2013. p.49, http://www.lloydsbankinggroup.com/globalassets/documents/investors/2014/2013_lbg_interactive_annual_report.pdf, accessed 18 January 2015.

Bank of England (2014) Stress Testing the UK Banking System: 2014 Results, December, p. 7, http://www.bankofengland.co.uk/financialstability/Documents/fpc/results161214.pdf, accessed 7 January 2015.

Financial Conduct Authority (2013) Final Notice to Lloyds TSB Bank plc and Bank of Scotland plc, 10 December, p. 6, https://www.fca.org.uk/your-fca/documents/final-notices/2015/lloyds-banking-group, accessed 25 January 2016.

Financial Services Authority (2013) Final Guidance: Risks to Customers from Financial Incentives, January, p. 6, http://www.fca.org.uk/your-fca/documents/finalised-guidance/fsa-fg131, accessed 3 February 2014.

Financial Conduct Authority (2013) 10 December, p. 3, https://www.fca.org.uk/your-fca/documents/final-notices/2015/lloyds-banking-group, accessed 25 January 2016.

Ertürk, I. and Solari, S. (2007) Banks as continuous reinvention. New Political Economy 12 (3): 369–388.

Deutsche Bank (2006) Lloyds TSB: Dial T, for Turnaround, 19 June, p. 4, Deutsche Bank, London.

Glazer, E. (2015) J.P. Morgan’s Dimon says big is beautiful. The Wall Street Journal 14 January.

Acknowledgements

The author would like to thank Shawn Donnelly and Zdenek Kudrna for their comments on the earlier versions of this article at the European Consortium for Political Research Annual Conference in Salamanca in 2014 and at the University of Denver workshop on ‘National versus Supranational Banking Regulation after the Crisis: Dilemmas for States’ in February 2015 respectively. He also thank Huw Macartney for his comments on the final version of the article.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ertürk, I. Financialization, bank business models and the limits of post-crisis bank regulation. J Bank Regul 17, 60–72 (2016). https://doi.org/10.1057/jbr.2015.23

Published:

Issue Date:

DOI: https://doi.org/10.1057/jbr.2015.23