Abstract

This paper investigates the effect of the Affordable Care Act’s Medicaid expansion on the retirement decision of low-educated adults aged 55–64. I employ a difference-in-differences strategy that exploits the timing and expansion decisions of states for adults without dependent children. I find that the expansions increase Medicaid enrollment for both men and women. The estimates also suggest that the expansions result in women retiring early, whereas there is no significant change in the retirement behavior of men. These findings imply that the effect of health insurance on women’s retirement decisions may depend on men’s labor market responses to health insurance.

Similar content being viewed by others

Notes

As of January 2018, there are 33 expansion states and 18 non-expansion states.

See Figure 11.1, 2017 Employer Health Benefits Annual Survey, Kaiser Family Foundation and Health Research and Educational Trust, retrieved May 1, 2017 from: https://www.kff.org/health-costs/report/2017-employer-health-benefits-survey/.

For example, Bailey and Chorniy (2016) investigate the job lock effect using the dependent coverage mandate as a natural experiment.

These estimates are similar to those found in the literature (see, for example, Kaestner et al. 2017).

Using the 2006 Massachusetts health reform as a natural experiment, Heim and Lin (2017) find an increase in women’s early retirement from full-time employment by 1.1 percentage points and no effect on men’s retirement behavior.

These two modules of SIPP are on education, work history, and job characteristics.

The paper addresses censoring problems related to the outcome variable, as well as selection into jobs.

The authors are conservative with respect to the causal interpretation of their estimates.

Retirement is defined as a transition from full-time employment in the baseline year to retirement at the next survey date.

The effect on self-employment is negative, but it is not statistically different from zero.

One limitation of the study is with regards to external validity because the author drops public schools in large cities.

As discussed by Aslim (2016), large and heterogeneous treatment groups may jeopardize the estimates for labor market outcomes.

For adults aged 51–56 years, some of the effective provisions of the ACA within those periods are the changes to private health insurance with respect to preexisting conditions, the introduction of health insurance exchanges, and some early expansions.

In addition, some of the studies that look at the relationship between RHI and retirement have confounded the estimates by not controlling for defined benefit pensions. Note that defined pension plans, which are correlated with the availability of RHI, may increase the probability of early retirement (Gustman and Steinmeier 1994).

Using a dynamic model, they also simulate the effect of employer-provided health insurance on labor force participation rates.

Since marginal medical care received decreases as health worsens, it is reasonable that M is nonlinear in H.

In a dynamic framework, however, it would be interesting to investigate the employment outcomes of individuals who choose between RHI and Medicaid.

See full list of mandatory benefits at http://www.Medicaid.gov.

Health variables are mainly related to disabilities, including self-care difficulty, hearing difficulty, vision difficulty, independent living difficulty, ambulatory difficulty, and cognitive difficulty.

Note that the publicly available HRS does not include geographic identifiers.

A minor limitation is the absence of survey months that could be used to capture the monthly variation in policy variables. Note that March CPS does not also vary by months.

This restriction is consistent with the literature; for example, Kaestner et al. (2017) restrict the sample to low-educated adults to explore the effect of Medicaid expansions on labor supply.

Note that the availability of Medicare may confound the estimates on Medicaid. Thus, I exclude adults above the age of 64. In addition, some studies denote stronger retirement incentives for adults who are closer to the 64 age cutoff; I also test this by restricting the age to 59–64.

Note that retirement income is highly correlated with the probability of leaving the labor force. An alternative definition could be the probability of leaving the labor force conditional on working full time in the past 12 months (Heim and Lin 2017). The findings of the IV model are robust to the changes in the definition of the outcome variable and are available upon request.

When early and late expansion states are included in the analysis, the timing of expansion changes, and Post also changes accordingly.

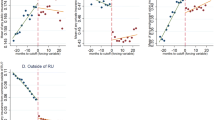

The findings for the 2009–2013 pre-policy period are in “Appendix”.

The estimates for private health insurance are available upon request.

The OLS estimates are available upon request.

The findings are, however, robust to changes in the sample period to 2010–2016.

The benchmark sample includes childless adults aged 55–64 years. This age restriction for the lower boundary is the same as the previous studies that investigate the effect of RHI on early retirement (Gruber and Madrian 1996; Rogowski and Karoly 2000; Boyle and Lahey 2010; Shoven and Slavov 2014; Fitzpatrick 2014). On the other hand, there are some retirement studies that use either 50 or 51 as the lower boundary for age (Strumpf 2010; Robinson and Clark 2010; Levy et al. 2018).

Note that these individuals do not have dependent children under the age of 18.

References

Alker, Joan, Samantha Artiga, Tricia Brooks, Martha Heberlein, and Jessica Stephens. 2013. Getting into Gear for 2014: Findings from a 50-State Survey of Eligibility, Enrollment, Renewal, and Cost-Sharing Policies in Medicaid and CHIP, 2012–2013. Washington: Kaiser Family Foundation.

Aslim, Erkmen Giray. 2016. Does Medicaid Expansion Affect Employment Transitions? Working Paper, SSRN.

Aslim, Erkmen Giray. 2018. Woodwork Effects and Medicaid Enrollment: Evidence from the Affordable Care Act. Working Paper, Private Enterprise Research Center, Texas A&M University.

Ayyagari, Padmaja. 2017. Health Insurance and Early Retirement Plans: Evidence from the Affordable Care Act. Working Paper, Department of Health Management and Policy, University of Iowa.

Bailey, James, and Anna Chorniy. 2016. Employer-Provided Health Insurance and Job Mobility: Did the Affordable Care Act Reduce Job Lock? Contemporary Economic Policy 34(1): 173–183.

Baughman, Reagan A. 2018. The Affordable Care Act and Retirement: Effects of Changes in Medicaid and Non-group Coverage. Working Paper, Department of Economics, University of New Hampshire.

Blau, David M., and Donna B. Gilleskie. 2001. Retiree Health Insurance and the Labor Force Behavior of Older Men in the 1990s. Review of Economics and Statistics 83(1): 64–80.

Blau, David M., and Donna B. Gilleskie. 2006. Health Insurance and Retirement of Married Couples. Journal of Applied Econometrics 21(7): 935–953.

Blau, David M., and Donna B. Gilleskie. 2008. The Role of Retiree Health Insurance in the Employment Behavior of Older Men. International Economic Review 49(2): 475–514.

Boudreaux, Michel H., Kathleen Thiede Call, Joanna Turner, Brett Fried, and Brett O’hara. 2015. Measurement Error in Public Health Insurance Reporting in the American Community Survey: Evidence from Record Linkage. Health Services Research 50(6): 1973–1995.

Boyle, Melissa A., and Joanna N. Lahey. 2010. Health Insurance and the Labor Supply Decisions of Older Workers: Evidence from a US Department of Veterans Affairs expansion. Journal of Public Economics 94(7): 467–478.

Boyle, Melissa A., and Joanna N. Lahey. 2016. Spousal Labor Market Effects from Government Health Insurance: Evidence from a Veterans Affairs Expansion. Journal of health economics 45: 63–76.

Cohen, Robin A., Michael E. Martinez, and Emily P. Zammitti. 2016. Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-March 2016. Centers for Disease Control and Prevention.

Dague, Laura, Thomas DeLeire, and Lindsey Leininger. 2017. The Effect of Public Insurance Coverage for Childless Adults on Labor Supply. American Economic Journal: Economic Policy 9(2): 124–54.

Duggan, Mark, Gopi Shah Goda, and Emilie Jackson. 2017. The Effects of the Affordable Care Act on Health Insurance Coverage and Labor Market Outcomes. NBER Working Paper No. 23607.

Fitzpatrick, Maria D. 2014. Retiree Health Insurance for Public School Employees: Does it Affect Retirement? Journal of Health Economics 38: 88–98.

Frean, Molly, Jonathan Gruber, and Benjamin D. Sommers. 2017. Premium Subsidies, the Mandate, and Medicaid Expansion: Coverage Effects of the Affordable Care Act. Journal of Health Economics 53: 72–86.

French, Eric, and John Bailey Jones. 2011. The Effects of Health Insurance and Self-Insurance on Retirement Behavior. Econometrica 79(3): 693–732.

Garthwaite, Craig, Tal Gross, and Matthew J. Notowidigdo. 2014. Public Health Insurance, Labor Supply, and Employment Lock. Quarterly Journal of Economics 129(2): 653–696.

Gooptu, Angshuman, Asako S. Moriya, Kosali I. Simon, and Benjamin D. Sommers. 2016. Medicaid Expansion Did not Result in Significant Employment Changes or Job Reductions in 2014. Health Affairs 35(1): 111–118.

Gruber, Jonathan, and Brigitte C. Madrian. 1995. Health-Insurance Availability and the Retirement Decision. American Economic Review 85(4): 938–948.

Gruber, Jonathan, and Brigitte C. Madrian. 1996. Health Insurance and Early Retirement: Evidence from the Availability of Continuation Coverage. In Advances in the Economics of Aging, ed. D.A. Wise, 115–146. Chicago: University of Chicago Press.

Gustman, Alan L., and Thomas L. Steinmeier. 1994. Employer-Provided Health Insurance and Retirement Behavior. ILR Review 48(1): 124–140.

Gustman, Alan L., Thomas L. Steinmeier, and Nahid Tabatabai. 2018. The Affordable Care Act as Retiree Health Insurance: Implications for Retirement and Social Security Claiming. NBER Working Paper No. 22815.

Heim, Bradley T., and LeeKai Lin. 2017. Does Health Reform Lead to an Increase in Early Retirement? Evidence from Massachusetts. ILR Review 70(3): 704–732.

Kaestner, Robert, Bowen Garrett, Jiajia Chen, Anuj Gangopadhyaya, and Caitlyn Fleming. 2017. Effects of ACA Medicaid Expansions on Health Insurance Coverage and Labor Supply. Journal of Policy Analysis and Management 36(3): 1–35.

Kapur, Kanika, and Jeannette Rogowski. 2011. How Does Health Insurance Affect the Retirement Behavior of Women? INQUIRY: The Journal of Health Care Organization, Provision, and Financing 48(1): 51–67.

Karoly, Lynn A., and Jeannette A. Rogowski. 1994. The Effect of Access to Post-retirement Health Insurance on the Decision to Retire Early. ILR Review 48(1): 103–123.

Kim, Daeho. 2016. Health Insurance and Labor Supply: Evidence from the Affordable Care Act Early Medicaid Expansion in Connecticut. Working Paper, SSRN.

Leung, Pauline, and Alexandre Mas. 2016. Employment Effects of the ACA Medicaid Expansions. Princeton University, Department of Economics, Industrial Relations Section.

Levy, Helen, Thomas C. Buchmueller, and Sayeh Nikpay. 2018. Health Reform and Retirement. Journals of Gerontology Series B: Psychological Sciences and Social Sciences 73(4): 713–722.

Madrian, Brigitte C. 1994. The Effect of Health Insurance on Retirement. Brookings Papers on Economic Activity 1994(1): 181–252.

Marton, James, and Stephen A. Woodbury. 2013. Retiree Health Benefits as Deferred Compensation: Evidence from the Health and Retirement Study. Public Finance Review 41(1): 64–91.

Marton, James, Stephen A. Woodbury, and Barbara Wolfe. 2007. Retiree Health Benefit Coverage and Retirement. In Government Spending on the Elderly, ed. D.B. Papadimitriou, 222–242. New York: Palgrave Macmillan.

Nyce, Steven, Sylvester J. Schieber, John B. Shoven, Sita Nataraj Slavov, and David A. Wise. 2013. Does Retiree Health Insurance Encourage Early Retirement? Journal of Public Economics 104: 40–51.

Robinson, Christina, and Robert Clark. 2010. Retiree Health Insurance and Disengagement from a Career Job. Journal of Labor Research 31(3): 247–262.

Rogowski, Jeannette, and Lynn Karoly. 2000. Health Insurance and Retirement Behavior: Evidence from the Health and Retirement Survey. Journal of Health Economics 19(4): 529–539.

Shoven, John B., and Sita Nataraj Slavov. 2014. The Role of Retiree Health Insurance in the Early Retirement of Public Sector Employees. Journal of Health Economics 38: 99–108.

Sommers, Benjamin D., Genevieve M. Kenney, and Arnold M. Epstein. 2014. New Evidence on the Affordable Care Act: Coverage Impacts of Early Medicaid Expansions. Health Affairs 33(1): 78–87.

Sonier, Julie, Michel H. Boudreaux, and Lynn A. Blewett. 2013. Medicaid ‘Welcome-Mat’ Effect of Affordable Care Act Implementation Could be Substantial. Health Affairs 32(7): 1319–1325.

Strumpf, Erin. 2010. Employer-Sponsored Health Insurance for Early Retirees: Impacts on Retirement, Health, and Health Care. International Journal of Health Care Finance and Economics 10(2): 105–147.

Yelowitz, Aaron S. 1995. The Medicaid Notch, Labor Supply, and Welfare Participation: Evidence from Eligibility Expansions. Quarterly Journal of Economics 110(4): 909–939.

Acknowledgements

I would like to thank Dhaval Dave (editor) and two anonymous referees for their very helpful suggestions. I would also like to thank Shin-Yi Chou, Muzhe Yang, Seth Richards-Shubik, Karen S. Conway, Naim Chy, Liqun Liu, Ashley Bullock, Chelsea Temple, and the participants at the 2018 Eastern Economic Association meeting. All errors are mine.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Aslim, E.G. The Relationship Between Health Insurance and Early Retirement: Evidence from the Affordable Care Act. Eastern Econ J 45, 112–140 (2019). https://doi.org/10.1057/s41302-018-0115-8

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41302-018-0115-8