Abstract

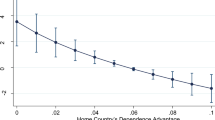

In this study, we theorize that preferential trade agreements (PTAs) send two distinct signals to foreign direct investors. At the first tier, a PTA signals that member states will maintain stable and peaceful relations with one another, making overt host-state hostility toward investors headquartered in member countries unlikely. At the second tier, a PTA can signal that investments will be safe from subtler meddling that infringes on property rights. While any PTA sends the first-tier signal, only deep PTAs with provisions such as investor-state dispute settlement mechanisms and property rights protections provide this second-tier signal. The second-tier signal is especially important to investors in countries where property rights are weak, as the extra protections provided by a deeper agreement can substitute for those that are missing at the domestic level. We find empirical support for our argument: PTA depth is positively associated with FDI between member countries, but the association weakens as property rights laws in host countries increase in strength. These findings suggest that governments can attract higher levels of FDI through comprehensive trade agreements, as opposed to shallow PTAs, when domestic policies are not sufficient. However, shallow agreements suffice where domestic policy already protects property rights.

Similar content being viewed by others

REFERENCES

Acharya, R., Crawford, J., Maliszewska, M., & Renard, C. 2011. Landscape. In J. Chauffour & J. Maur (Eds), Preferential trade agreement policies for development: A handbook: 37–68. Washington, DC: The World Bank.

Adams, R., Dee, P., Gali, J., & McGuire, G. 2003. The trade and investment effects of preferential trading arrangements—Old and new evidence. Staff Working Paper. Productivity Commission, Canberra.

Addo, K. 2014. Core labour standards and international trade: Lessons from the regional context. Heidelberg: Springer.

Ahcar, J., & Siroën, J. 2017. Deep integration: Considering the heterogeneity of free trade agreements. Journal of Economic Integration, 32(3): 615–659.

Allee, T., & Peinhardt, C. 2010. Delegating differences: Bilateral investment treaties and bargaining over dispute resolution provisions. International Studies Quarterly, 54(1): 1–26.

Asoni, A. 2008. Protection of property rights and growth as political equilibria. Journal of Economic Surveys, 22(5): 953–987.

Baccini, L. 2019. The economics and politics of preferential trade agreements. Annual Review of Political Science, 22: 75–92.

Baccini, L., & Dür, A. 2015. Investment discrimination and the proliferation of preferential trade agreements. Journal of Conflict Resolution, 59(4): 617–644.

Baccini, L., Pinto, P. M., & Weymouth, S. 2017. The distributional consequences of preferential trade liberalization: Firm-level evidence. International Organization, 72(1): 373–395.

Barry, C. M., & DiGiuseppe, M. 2019. Transparency, risk, and FDI. Political Research Quarterly, 72(1): 132–146.

Barthel, F., Busse, M., & Neumayer, E. 2010. The impact of double taxation treaties on foreign direct investment: Evidence from large dyadic panel data. Contemporary Economic Policy, 29(3): 366–377.

Bearce, D. H., & Omori, S. 2005. How do commercial institutions promote peace? Journal of Peace Research, 42(6): 659–678.

Berger, A., Busse, M., Nunnenkamp, M., & Martin, R. 2013. Do trade and investment agreements lead to more FDI? Accounting for key provisions inside the black box. International Economics and Economic Policy, 10(2): 247–275.

Bergstrand, J., & Egger, P. 2007. A knowledge-and-physical-capital model of international trade flows, foreign direct investment, and multinational enterprises. Journal of International Economics, 73(2): 278–308.

Berkowitz, D., Lin, C., & Ma, Y. 2015. Do property rights matter? Evidence from a property law enactment. Journal of Financial Economics, 116(3): 583–593.

Blinder, A. S. 2019. The free-trade paradox: The bad politics of a good idea. Foreign Affairs, 98(1): 119–128.

Blonigen, B. A. & Piger, J. 2014. Determinants of foreign direct investment. Canadian Journal of Economics, 47(3): 775–812.

Branstetter, L. 2017. Intellectual property rights, innovation and development: Is Asia different? Millennial Asia, 8(1): 5–25.

Busse, M., Königer, J., & Nunnenkamp, P. 2010. FDI promotion through bilateral investment treaties: More than a bit? Review of World Economics, 146(1): 147–177.

Bussmann, M. 2010. Foreign direct investment and militarized international conflict. Journal of Peace Research, 47(2): 143–153.

Büthe, T., & Milner, H. V. 2008. The politics of foreign direct investment into developing countries: Increasing FDI through international trade agreements? American Journal of Political Science, 52(4): 741–762.

Büthe, T., &. Milner, H. V. 2014. Foreign direct investment and institutional diversity in trade agreements: Credibility, commitment, and economic flows in the Developing World, 1971–2007. World Politics, 66(1): 88–122.

Campos, N. F. 2004. What does WTO membership kindle in transition economies? An empirical investigation. Journal of Economic Integration, 19(2): 395–415.

Chakrabarti, A. 2001. The determinants of foreign direct investments: Sensitivity analyses of cross‐country regressions. Kyklos, 54(1): 89–114.

Cherif, M., & Dreger, C. 2018. Do regional trade agreements stimulate FDI? Evidence for the Agadir, MERCOSUR and AFTA regions. Review of Development Economics, 22(3): 1263–1277.

Chowdhury, A., & Mavrotas, G. 2006. FDI and growth: What causes what? The World Economy, 29(1): 9–19.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. 2011. Signaling theory: A review and assessment. Journal of Management, 37(1): 39–67.

Correia, S. 2017. Linear models with high-dimensional fixed effects: An efficient and feasible estimator. Working Paper. http://scorreia.com/research/hdfe.pdf

Crawford, J., & Laird, S. 2001. Regional trade agreements and the WTO. The North American Journal of Economics and Finance, 12(2): 193–211.

Dawar, K., & Holmes, P. 2011. Competition policy. In J. Chauffour & J. Maur (Eds), Preferential trade agreement policies for development: A handbook: 347–366. Washington, DC: The World Bank.

Desbordes, R., & Vicard, V. 2009. Foreign direct investment and bilateral investment treaties: An international political perspective. Journal of Comparative Economics, 37(3): 372–386.

Dincer, O. 2007. The effects of property rights on economic performance. Applied Economics, 39(7): 825–837.

Dong, B., & Torgler, B. 2011. Democracy, property rights, income equality, and corruption. FEEM Working Paper No. 8. Milan: Fondazione Eni Enrico Mattei.

Drabek, Z., & Payne, W. 2002. The impact of transparency on foreign direct investment. Journal of Economic Integration, 17(4): 777–810.

Dreher, A., Mikosch, H., & Voigt, S. 2015. Membership has its privileges—The effect of membership in international organizations on FDI. World Development, 66: 346–358.

Duanmu, J. 2014. State-owned MNCs and host country expropriation risk: The role of home state soft power and economic gunboat diplomacy. Journal of International Business Studies, 45(8): 1044–1060.

Dür, A., Baccini, L., & Elsig, M. 2014. The design of international trade agreements: Introducing a new dataset. Review of International Organizations, 9(3): 353–375.

Flores, R. G., & Aguilera, R. V. 2007. Globalization and location choice: An analysis of US multinational firms in 1980 and 2000. Journal of International Business Studies, 38(7): 1187–1210.

Frankel, J. A., & Romer, D. H. 1999. Does trade cause growth? American Economic Review, 89(3): 379–399.

Frenkel, M., & Walter, B. 2019. Do bilateral investment treaties attract foreign direct investment? The role of international dispute settlement provisions. The World Economy, 42(5): 1316–1342.

Gamso, J., & Grosse, R. 2019. NAFTA 2.0: What should be next? Harvard International Review, 40(1): 29–37.

Giambona, E., Graham, J. R., & Harvey, C. R. 2017. The management of political risk. Journal of International Business Studies, 48(4): 523–533.

Golub, S. S. 2009. Openness to foreign direct investment in services: An international comparative analysis. The World Economy, 32(8): 1245–1268.

Gopinath, M., Pick, D., & Vasavada, U. 1999. The economics of foreign direct investment and trade with an application to the U.S. food processing industry. American Journal of Agricultural Economics, 81(2): 442–452.

Gounder, A., Falvey, R., & Rajaguru, G. 2019. The effects of preferential trade agreements on foreign direct investment: Evidence from the African Caribbean Pacific region. Open Economies Review, 30(4): 695–717.

Graham, B. A.T. & Tucker, J. R. 2017. The international political economy data resource. Review of International Organizations, 14(1): 149–161.

Graham, B. A. T., Johnston, N. P., & Kingsley, A. F. 2018. Even constrained governments take: The domestic politics of transfer and expropriation risks. Journal of Conflict Resolution, 62(8): 1784–1813.

Graham, B. A.T., Hicks, R., Milner, H., & Bougher, L. D. 2018. World Economics and Politics Dataverse.

Hafner-Burton, E. M. 2005. Trading human rights: How preferential trade agreements influence government repression. International Organization, 59(3): 593–629.

Hamilton, C. B., Winters, L. A., Hughes, G., & Smith, A. 1992. Opening up international trade with Eastern Europe. Economic Policy, 7(14): 77–116.

Hanh, P. T. H. 2011. Does WTO accession matter for the dynamics of foreign direct investment and trade? Economics of Transition and Institutional Change, 19(2): 255–285.

Hayo, B., & Voigt, S. 2007. Explaining de facto judicial independence. International Review of Law and Economics, 27(3): 269–290.

Hicks, R., & Johnson, K. 2011. The politics of globalizing production: Why we see investment chapters in preferential trade agreements. Paper presented at the conference on The Politics of Foreign Direct Investment, Princeton University.

Hofmann, C., Osnago, A., & Ruta, M. 2019. The content of preferential trade agreements. World Trade Review, 18(3): 365–398.

Horn, H., Mavroidis, P. C., & Sapir, A. 2010. Beyond the WTO? An anatomy of EU and US preferential trade agreements. The World Economy, 33(11): 1565–1588.

Josling, T. 2011. Agriculture. In J. Chauffour and J. Maur (Eds), Preferential trade agreement policies for development: A handbook: 143–161. Washington DC: The World Bank.

Kerner, A. 2009. Why should I believe you? The costs and consequences of bilateral investment treaties. International Studies Quarterly, 53(1): 73–102.

Kohl, T., & Trojanowska, S. 2015. Heterogeneous trade agreements, WTO membership and international trade: An analysis using matching econometrics. Applied Economics, 47(33): 3499–3509.

Kohl, T., Brakman, S., & Garretsen, H. 2016. Do trade agreements stimulate international trade differently? Evidence from 296 trade agreements. The World Economy, 39(1): 97–131.

Kox, H. L. M., & Rojas-Romagosa, H. 2019. Gravity estimations with FDI bilateral data: Potential FDI effects of deep preferential trade agreements. EIU Working Paper ESCAS 2019/70.

Laget, E., Rocha, N., & Varela, G. 2018. FDI and deep preferential trade agreements: An empirical investigation. Unpublished, World Bank, Washington, DC.

Lanyi, P., & Steinbach, A. 2017. Promoting coherence between PTAs and the WTO through systemic integration. Journal of International Economic Law, 20(1): 61–85.

Lechner, L. 2018. Good for some, bad for others: US investors and non-trade issues in preferential trade agreements. Review of International Organizations, 13(2): 163–187.

Lee, J., & Mansfield, E. 1996. Intellectual property protection and U.S. foreign direct investment. Review of Economics and Statistics, 78(2): 181–186.

Li, Q., & Vashchilko, T. 2010. Dyadic military conflict, security alliances, and bilateral FDI flows. Journal of International Business Studies, 46(1): 765–782.

Limão, N. 2006. Preferential trade agreements as stumbling blocks for multilateral trade liberalization: Evidence for the United States. American Economic Review, 96(3): 896–914.

Limão, N. 2007. Are preferential trade agreements with non-trade objectives a stumbling block for multilateral liberalization? The Review of Economic Studies, 74(3): 821–855.

Lin, M., Lucas, H. C., & Shmueli, G. 2013. Too big to fail: Large samples and the p-value problem. Information Systems Research, 24(4): 906–917.

Liu, X., Wang, C., & Wei, Y. 2001. Causal links between foreign direct investment and trade in China. China Economic Review, 12(2-3): 190–202.

Liu, X. 2016. Trade agreements and economic growth. Southern Economic Journal, 82(4): 1374–1401.

Loree, D. W., & Guisinger, S. E. 1995. Policy and non-policy determinants of U.S. equity foreign direct investment. Journal of International Business Studies, 26(2): 281–299.

Manfred, E., & Dupont, C. 2012. Persistent deadlock in multilateral trade negotiations: The case of Doha. In A. Narlikar, M. Daunton, & R. M. Stern (Eds), The Oxford handbook on the World Trade Organization: 587–606. Oxford: Oxford University Press.

Manger, M. S. 2009. Investing in protection: The politics of preferential trade agreements between North and South. Cambridge, UK: Cambridge University Press.

Manger, M. S., & Pickup, M. A. 2016. The coevolution of trade agreement networks and democracy. Journal of Conflict Resolution, 60(1): 164–191.

Mansfield, E. D. 1998. The proliferation of preferential trading arrangements. Journal of Conflict Resolution, 42(5): 523–543.

Mansfield, E. D., & Milner, H. V. 2012. Votes, vetoes, and the political economy of international trade agreements. Princeton, NJ: Princeton University Press.

Mansfield, E. D., & Pevehouse, J. C. 2000. Trade blocs, trade flows, and international conflict. International Organization, 54(4): 775–808.

Marchant, M. A., Cornell, D. N., & Koo, W. (2002). International trade and foreign direct investment: Substitutes or complements? Journal of Agriculture and Applied Economics, 34(2), 289–302.

Maur, J., & Shepherd, B. 2011. Agriculture. In J. Chauffour & J. Maur (Eds), Preferential trade agreement policies for development: A handbook: 197–216. Washington, DC: The World Bank.

Medvedev, D. 2010. Preferential trade agreements and their role in world trade. Review of World Economics, 146(2): 199–222.

Medvedev, D. 2012. Beyond trade: The impacts of preferential trade agreements on FDI inflows. World Development, 40(1): 49–61.

Miller, T., Kim, A. B, & Roberts, J. M. 2019. 2019 index of economic freedom. Washington DC: The Heritage Foundation.

Moser, C., & Rose, A. K. 2012. Why do trade negotiations take so long? Journal of Economic Integration, 27(2): 280–290.

Neumayer, E., & Spess, L. 2005. Do bilateral investment treaties increase foreign direct investment to developing countries? World Development, 33(10): 1567–1585.

Nunnenkamp, P., & Spatz, J. 2004. Intellectual property rights and foreign direct investment: A disaggregated analysis. Review of World Economics, 140(3): 393–414.

Osnago, A., Rocha, N., & Ruta, M. 2017. Do deep trade agreements boost vertical FDI? The World Bank Economic Review, 30(Supplement_1): S119–S125.

Osnago, A., Rocha, N., & Ruta, M. 2019. Deep trade agreements and vertical FDI: The devil is in the details. Canadian Journal of Economics, 52(4): 1558–1599.

Pandya, S. S. 2016. Political economy of foreign direct investment: Globalized production in the twenty-first century. Annual Review of Political Science, 19: 455–475.

Reid, A. S. 2003. Enforcement of intellectual property rights in developing countries: China as a case study. DePaul Journal of Art, Technology & Intellectual Property Law, 13(1): 63–99.

Roberts, T. 2018. Economic policy, political constraints, and foreign direct investment in developing countries. International Interactions, 44(3): 582–602.

Rose-Ackerman, S., & Tobin, J. 2005. Foreign direct investment and the business environment in developing countries: The impact of bilateral investment treaties. Yale Law & Economics Research Paper No. 293.

Seuba, X. 2013. Intellectual property in preferential trade agreements: What treaties, what content? The Journal of World Intellectual Property, 16(5–6): 240–261.

Seyoum, B. 1996. The impact of intellectual property rights on foreign direct investment. The Columbia Journal of World Business, 31(1): 50–59.

Stiglitz, J. E. 2000. The contributions of the economics of information to twentieth century economics. Quarterly Journal of Economics, 115(4): 1441–1478.

Tobin, J. L., & Rose-Ackerman, S. 2011. When BITs have some bite: The political-economic environment for bilateral investment treaties. Review of International Organizations, 6(1): 1–32.

Ullah, M. S., & Inaba, K. 2014. Liberalization and FDI performance: Evidence from ASEAN and SAFTA member countries. Journal of Economic Structures, 3: 6.

Vicard, V. 2012. Trade, conflict, and political integration: Explaining the heterogeneity of regional trade agreements. European Economic Review, 56(1): 54–71.

Wüthrich, S. 2020. Seeking domestic approval: Determinants of ratification duration in international trade. Swiss Political Science Review. Published online before print.

Yackee, J. W. 2008. Bilateral investment treaties, credible commitment, and the rule of (international) law: Do BITs promote foreign direct investment? Law & Society Review, 42(4): 805–832.

Author information

Authors and Affiliations

Corresponding author

Additional information

Accepted by Walid Hejazi, Guest Editor, 12 June 2020. This article has been with the authors for two revisions.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Gamso, J., Grosse, R. Trade agreement depth, foreign direct investment, and the moderating role of property rights. J Int Bus Policy 4, 308–325 (2021). https://doi.org/10.1057/s42214-020-00061-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s42214-020-00061-x