Abstract

I undertake a comparative study assessing the North–South divide in Italian tax compliance, employing the largest behavioral tax compliance experiment to date. Contrary to a large body of literature, I argue that willingness to pay taxes is constructed within a specific institutional environment and reflects the country’s quality of institutions. To test this hypothesis, I use controlled tax compliance experiments from four laboratories in Capua, Rome, Bologna, and Milan. By employing the experimental method, I am able to hold institutions constant allowing me to isolate cultural variation. Contrary to cultural explanations for tax compliance, when controlling the institutional environment, there is no difference in tax compliance. Furthermore, using social value orientation to compare prosociality, I also find no differences between the two regions. I therefore conclude that individuals’ relationship to their states shapes these behavioral differences in tax compliance.

Source Santoro (2010)

Source Murphy et al. (2011, Fig. 1, p. 772)

Source Murphy et al. (2011, Fig. 1, p. 773)

Source Chiarini and Marzano (2007)

Similar content being viewed by others

Notes

The experiments were carried out by a group of researchers at the European University Institute. When describing the experiments I will use the plural we or our, but when describing the results I will use the first person singular.

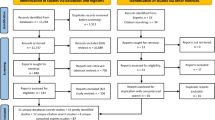

The experimental sites included Bologna Laboratory for Experiments in Social Sciences, Centro d’Economia Sperimentale A Roma Est, Experimental Economics Lab of the University of Milano Bicocca in Italy, and the Experimental Laboratory at Seconda Università degli Studi di Napoli in Capua. All data can be downloaded from www.willingtopay.eu.

For more details on the online recruitment system (ORSEE), see Greiner (2004).

Because round nine is a donation round, we have left it out of the analysis.

References

Allingham, M., and A. Sandmo. 1972. Income tax evasion: A theoretical analysis. Journal of Public Economics 1 (3): 323–338.

Alm, J., and B. Torgler. 2006. Culture Differences and Tax Morale in the United States and in Europe. Journal of Economic Psychology 27 (2): 224–246.

Almond, G.A., and S. Verba. 1963. The Civic Culture. Political Attitudes and Democracy in Five Nations. Princeton: Princeton University Press.

Andreoni, J., B. Erard, and J. Feinstein. 1998. Tax Compliance. Journal of Economic Literature 36 (2): 818–860.

Andrighetto, G., N. Zhang, S. Ottone, F. Ponzano, J. D’Attoma, and S. Steinmo. 2016. Are Some Countries More Honest than Others? Evidence from a Tax Compliance Experiment in Sweden and Italy. Frontiers in Psychology 7: 472.

Banfield, E. 1967. The Moral Basis of a Backward Society. Glencoe: Free Press.

Barone, G., and S. Mocetti. 2011. Tax Morale and Public Spending Inefficiency. International Tax and Public Finance 18 (6): 724–749.

Bergman, M. 2009. Tax Evasion and the Rule of Law in Latin America: The Political Culture of Cheating and Compliance in Argentina and Chile. University Park, PA: Pennsylvania State University Press.

Boyne, G.A., O. James, P. John, and N. Petrovsky. 2012. Party Control, Party Competition and Public Service Performance. British Journal of Political Science 42 (3): 641–660.

Braithwaite, V. 2003. Dancing with Tax Authorities: Motivational Postures and Non-compliant Actions. In Taxing Democracy, ed. V. Braithwaite, 15–39. Aldershot: Ashgate.

Bruner, D.M., J. D’Attoma, and S. Steinmo. 2017. Going Dutch? The Role of Gender in the Provision of Public Goods through Tax Compliance. Working Paper.

Cadsby, C.B., E. Maynes, and V.U. Trivedi. 2006. Tax Compliance and Obedience to Authority at Home and in the Lab: A New Experimental Approach. Experimental Economics 9 (4): 343–359.

Chiarini, B., and F. Marzano. 2007. Structural and Cyclical Patterns of Underground Labour Input in Italy from 1980 to 2004. SSRN Electronic Journal 1–9.

Chung, J., and V.U. Trivedi. 2003. The Effect of Friendly Persuasion and Gender on Tax Compliance Behavior. Journal of Business Ethics 47 (2): 133–145.

Cummings, R., J. Martinez-Vazquez, M. McKee, and B. Torgler. 2009. Tax Morale Affects Tax Compliance: Evidence from Surveys and an Artefactual Field Experiment. Journal of Economic Behavior & Organization 70 (3): 447–457.

D’Attoma, J. 2017. Divided Nation: The North–South Cleavage in Italian Tax Compliance. Polity 49 (1): 69–99.

D’Attoma, J., C. Volintiru, and S. Steinmo. 2017. Willing to Share? Tax Compliance and Gender in Europe and America. Research & Politics 4 (2): 2053168017707151.

Dubin, J.A., and L.L. Wilde. 1988. An Empirical Analysis of Federal Income Tax Auditing and Compliance. National Tax Journal 41 (1): 61–64.

Erard, B., and J.S. Feinstein. 1994. The Role of Moral Sentiments and Audit Perceptions in Tax Compliance. Public Finance 49: 70–89.

Feld, L., and B. Frey. 2007. Tax Compliance as the Result of a Psychological Tax Contract: The Role of Incentives and Responsive Regulation. Law & Policy 29 (1): 102–120.

Ferrer-i Carbonell, A., and K. Gërxhani. 2016. ‘Tax Evasion and Well-Being: A Study of the Social and Institutional Context in Central and Eastern Europe. European Journal of Political Economy 45 (Suppl): 149–159.

Filippin, A., C.V. Fiorio, and E. Viviano. 2013. The Effect of Tax Enforcement on Tax Morale. European Journal of Political Economy 32: 320–331.

Fiorio, C.V., and A. Zanardi. 2008. ‘It’s a Lot, But Let It Stay’: How Tax Evasion is Perceived Across Italy. In The Shadow Economy Corruption and Governance, ed. M. Pickhardt, and E. Shinnick. Cheltenham: Edward Elgar.

Frey, B., and L. Feld. 2002. Deterrence and Morale in Taxation: An Empirical Analysis. Tech. Rep. CESifo Working Paper No. 760.

Frey, B., and B. Torgler. 2007. Tax Morale and Conditional Cooperation. Journal of Comparative Economics 35 (1): 136–159.

Friedland, N., S. Maital, and A. Rutenberg. 1978. A Simulation Study of Income Tax Evasion. Journal of Public Economics 10 (1): 107–116.

Gërxhani, K. 2007. Explaining Gender Differences in Tax Evasion: The Case of Tirana, Albania. Feminist Economics 13 (2): 119–155.

Giese, S., and A. Hoffmann. 2000. Tax Evasion and Risky Investments in an Intertemporal Context: An Experimental Study. Discussion Papers. Interdisciplinary Research Project 373: Quantification and Simulation of Economic Processes.

Graetz, M., and L. Wilde. 1985. The Economics of Tax Compliance: Fact and Fantasy. National Tax Journal 38 (3): 355–363.

Greenspan, A. 2011. Europe’s Crisis is All About the North–South Split. https://www.ft.com/content/678b163a-ef68-11e0-bc88-00144feab49a.

Greiner, B. 2004. The Online Recruitment System ORSEE 2.0—A Guide for the Organization of Experiments in Economics. University of Cologne, Working Paper Series in Economics 10 (23): 63–104.

Gylfason, H.F., A.A. Arnardottir, and K. Kristinsson. 2013. More on Gender Differences in Lying. Economics Letters 119 (1): 94–96.

Hasseldine, J., and P.A. Hite. 2002. Framing, Gender and Tax Compliance. Journal of Economic Psychology 24 (4): 517–533.

Kastlunger, B., E. Lozza, E. Kirchler, and A. Schabmann. 2013. Powerful Authorities and Trusting Citizens: The Slippery Slope Framework and Tax Compliance in Italy. Journal of Economic Psychology 34: 36–45.

Kirchler, E., E. Hoelzl, and I. Wahl. 2008. Enforced Versus Voluntary Tax Compliance: The “Slippery Slope” Framework. Journal of Economic Psychology 29 (2): 210–225.

Kleven, H.J., M.B. Knudsen, C.T. Kreiner, S. Pedersen, and E. Saez. 2011. Unwilling or Unable to Cheat? Evidence From a Tax Audit Experiment in Denmark. Econometrica 79 (3): 651–692.

Kornhauser, M.E. 2006. A Tax Morale Approach to Compliance: Recommendations for the IRS. Florida Tax Review 8: 599.

Levi, M. 1989. Of Rule and Revenue. Berkeley: University of California Press.

Levi, M., A. Sacks, and T. Tyler. 2009. Conceptualizing Legitimacy, Measuring Legitimating Beliefs. American Behavioral Scientist 53 (3): 354–375.

Luigi Cannari, G.D. 2007. Le opinioni degli italiani sull’evasione fiscale. Rome: Banca D’Italia.

Milliron, V.C. 1985. A Behavioral Study of the Meaning and Influence of Tax complexity. Journal of Accounting Research 23 (2): 794–816.

Murphy, K. 2004. The Role of Trust in Nurturing Compliance: A Study of Accused Tax Avoiders. Law and Human Behavior 28 (2): 187.

Murphy, R., K. Ackermann, and M. Handgraaf. 2011. Measuring Social Value Orientation. Judgment and Decision Making 6 (8): 771–781.

OECD. 2014. OECD Factbook 2014: Economic, Environmental and Social Statistics. OECD Publishing, Paris. https://doi.org/10.1787/factbook-2014-en.

Putnam, R.D., R. Leonardi, and R.Y. Nanetti. 1994. Making Democracy Work: Civic Traditions in Modern Italy. Princeton: Princeton University Press.

Ross, A.M., and R.W. McGee. 2011. A Demographic Study of Polish Attitudes Toward Tax Evasion. Academy of Accounting and Financial Studies 16 (1): 23.

Ross, M.L. 2004. Does Taxation Lead to Representation? British Journal of Political Science 34 (02): 229–249.

Santoro, A. 2008. Taxpayers’ Choices Under Studi Di Settore—What Do We Know and How Can We Interpret It. Giornale degli economisti e annali di economia 67 (2): 161–184.

Santoro, A. 2010. L’evasione Fiscale. Bologna: Mulino.

Steinmo, S., K. Thelen, and F. Longstreth (eds.). 1992. Structuring Politics: Historical Institutionalism in Comparative Analysis. Cambridge: Cambridge University Press.

Teorell, J., N. Charron, M. Samanni, S. Holmberg, and B. Rothstein. 2011. The Quality of Government Dataset. Göteborg: The Quality of Government Institute, University of Göteborg.

Torgler, B. 2002. Direct Democracy Matters: Tax Morale and Political Participation. In Annual Conference on Taxation and Minutes of the Annual Meeting of the National Tax Association. National Tax Association.

Torgler, B. 2003a. Does Culture Matter? Tax Morale in an East-West-German Comparison. FinanzArchiv: Public Finance Analysis 59 (4): 504–528.

Torgler, B. 2003b. Tax Morale, Rule-Governed Behaviour and Trust. Constitutional Political Economy 14 (2): 119–140.

Torgler, B. 2005. Tax Morale and Direct Democracy. European Journal of Political Economy 21 (2): 525–531.

Wahl, I., B. Kastlunger, and E. Kirchler. 2010. Trust in Authorities and Power to Enforce Tax Compliance: An Empirical Analysis of the “Slippery Slope Framework”. Law & Policy 32 (4): 383–406.

World Bank. 2014. World Development Indicators. Tech. Rep. Washington, DC: World Bank.

Acknowledgements

I would like to thank Sven Steinmo, Giulia Andrighetto, Sanne Noyon, Stefania Ottone, Ferruccio Ponzano, Nan Zhang, Arturo Palomba, Patrizia Sbriglia, and the lab personnel at Bologna Laboratory for Experiments in Social Sciences, Centro d’Economia Sperimentale A Roma Est, Experimental Economics Lab of the University of Milano Bicocca in Italy, and the Experimental Laboratory at Seconda Università degli Studi di Napoli in Capua. Funds for this research were provided by the European Research Council (Grant Agreement No. 295675 ).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

D’Attoma, J. What explains the North–South divide in Italian tax compliance? An experimental analysis. Acta Polit 54, 104–123 (2019). https://doi.org/10.1057/s41269-018-0077-1

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41269-018-0077-1