Abstract

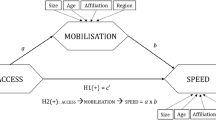

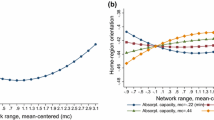

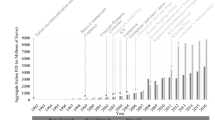

Prior international business research recognizes that networks can affect internationalization decisions, yet our understanding of how networks in the host country do so, especially with respect to establishment mode choices between greenfield and acquisition, remains nascent. Host-country networks become particularly salient after initial entry as the multinational enterprise (MNE) more directly engages with local actors and develops embeddedness in the host country. We draw from network theory to argue that establishment modes of post-entry foreign direct investments into a host country are shaped by the MNE’s position within local alliance networks. We posit that local network centrality increases the likelihood of choosing greenfield because it provides access to broad knowledge flows and higher social status that reduce the MNE’s need to pursue acquisitions of local firms. Conversely, local network brokerage increases opportunities for knowledge recombination, making greenfield a less likely choice vis-à-vis acquisition. Using data on automotive MNEs entering the U.S. over 22 years, we find support for our predictions. Demonstrating that distinct aspects of the MNE’s local network alliance position can operate in different ways to effectuate establishment mode choices, this study advances a more nuanced understanding of how networks shape internationalization into a host country.

Resume

Des recherches antérieures en affaires internationales reconnaissent que les réseaux peuvent influencer les décisions d'internationalisation. Or reste encore au stade embryonnaire notre connaissance de la façon dont les réseaux du pays d’accueil exercent de telles influences, notamment en ce qui concerne les choix de mode d'établissement entre la construction d’une nouvelle filiale autonome et l’acquisition. Les réseaux du pays d'accueil deviennent particulièrement importants après l'entrée initiale, car l'entreprise multinationale (MNE - Multinational Enterprise) s'engage plus directement avec des acteurs locaux et développe son encastrement dans le pays d'accueil. Nous appuyant sur la théorie des réseaux, nous argumentons que les modes d’établissement des investissements directs étrangers post-entrée dans un pays d’accueil soient façonnés par la position de la MNE au sein des réseaux d’alliances locales. Nous estimons qu’une position centrale au sein du réseau local augmente la possibilité de choisir la construction d’une nouvelle filiale, car elle donne accès à de larges flux de connaissances et à un statut social plus élevé, lesquels réduisent la nécessité pour la MNE de poursuivre des acquisitions d’entreprises locales. Inversement, une position courtier augmente les opportunités de recombinaison des connaissances, ce qui rend le choix de la construction d’une nouvelle filiale moins plausible que l'acquisition. Nos résultats, appuyés sur les données des MNEs du secteur de l'automobile entrant aux États-Unis sur une période de 22 ans, confirment nos prédictions. En démontrant que les aspects distincts de la position au sein des réseaux d’alliances locaux de la MNE peuvent fonctionner de différentes manières pour forger les choix de mode d'établissement, cette recherche propose une compréhension plus nuancée de la manière dont les réseaux façonnent l'internationalisation dans un pays d'accueil.

Resumen

La investigación anterior en negocios internacionales reconoce las redes pueden afectar las decisiones de internacionalización, sin embargo, nuestro entendimiento sobre cómo las redes en el país anfitrión lo hacen, especialmente con relación a la elección del modo de establecimiento entre la adquisición y las inversiones nuevas (greenfield), sigue siendo incipiente. Las redes del país anfitrión adquieren especial relevancia después de la entrada inicial, cuando la empresa multinacional (EMN) participa más directamente con los actores locales y desarrolla su arraigo en el país anfitrión. Nos basamos en la teoría de las redes para argumentar que los modos de establecimiento de las inversiones extranjeras directas tras la entrada en un país anfitrión están condicionados por la posición de la EMN dentro de las redes de alianzas locales. Planteamos que la centralidad de la red local aumenta la probabilidad de optar por greenfield dado que proporciona acceso a amplios flujos de conocimiento y a un mayor estatus social que reduce la necesidad de la EMN de buscar adquisiciones de empresas locales. A la inversa, la intermediación de la red local aumenta las oportunidades de recombinación de conocimientos, lo que hace que la elección de greenfield sea menos probable frente a la adquisición. Utilizando datos sobre las EMN del sector automotriz que han entrado en los Estados Unidos durante 22 años, encontramos apoyo a nuestras predicciones. Demostrando que distintos aspectos de la posición de la alianza de la red local de la EMN pueden operar de diferentes maneras para efectuar la elección del modo de establecimiento, este estudio avanza una comprensión más matizada de cómo las redes determinan la internacionalización en in país anfitrión.

Resumo

Pesquisas anteriores sobre negócios internacionais reconhecem que redes podem afetar decisões de internacionalização, mas nossa compreensão de como as redes no país anfitrião o fazem, especialmente com respeito a escolhas sobre o modo de estabelecimento entre greenfield e aquisição, permanece incipiente. Redes do país anfitrião tornam-se particularmente importantes após a entrada inicial, à medida que a empresa multinacional (MNE) se envolve mais diretamente com atores locais e desenvolve raízes no país anfitrião. Baseamo-nos na teoria de redes para argumentar que modos de estabelecimento de investimentos diretos estrangeiros pós-entrada em um país anfitrião são moldados pela posição da MNE dentro das redes de alianças locais. Postulamos que a centralidade da rede local aumenta a probabilidade da escolha de greenfield porque fornece acesso a amplos fluxos de conhecimento e status social mais elevado, que reduzem a necessidade da MNE de buscar aquisições de empresas locais. Por outro lado, intermediação da rede local aumenta as oportunidades de recombinação de conhecimento, tornando greenfield uma escolha menos provável em relação à aquisição. Usando dados sobre MNEs automotivas entrando nos EUA ao longo de 22 anos, encontramos suporte para nossas previsões. Demonstrando que aspectos distintos da posição da aliança de rede local da MNE podem operar de maneiras diferentes para efetuar escolhas de modo de estabelecimento, este estudo avança uma compreensão mais matizada de como redes moldam a internacionalização em um país anfitrião.

摘要

先前的国际商务研究已认识到网络可以影响国际化决策, 然而我们对东道国网络如是何做到这一点的, 尤其是对绿地开发和收购之间的建立模式选择方面的理解, 仍是初步的. 随着在最初进入之后跨国企业 (MNE) 更直接地与当地参与者互动并在东道国嵌入式发展, 东道国网络变得尤为突出. 我们从网络理论出发, 论证了外国直接投资进入东道国后的建立模式被MNE在当地联盟网络中的地位所塑造. 我们认为, 本地网络的中心性增加了选择绿地开发的可能性, 因为它可以提供广泛的知识流和更高的社会地位, 从而减少了MNE对本地公司收购的需求. 相反, 本地网络经纪人增加了知识重组的机会, 这使得绿地开发相对于收购而言不太可能. 利用22年来进入美国的汽车MNE的数据, 我们为我们的预测提供了支持. 通过展示MNE在本地网络联盟中位置的不同方面可以通过不同的运营方法来实现建模选择, 本研究推进了对网络如何将国际化塑入东道国的更细微的了解.

Similar content being viewed by others

REFERENCES

Audretsch, D. B., & Belitski, M. 2019. The limits to collaboration across four of the most innovative UK industries. British Journal of Management, 31(4): 830–855.

Balachandran, S., & Hernandez, E. 2018. Networks and innovation: Accounting for structural and institutional sources of recombination in brokerage triads. Organization Science, 29(1): 80–99.

Bonacich, P. 1987. Power and centrality: A family of measures. American Journal of Sociology, 92(5): 1170–1182.

Borgatti, S. P., Everett, M. G., & Freeman, L. C. 2002. Ucinet for Windows: Software for social network analysis. Analytic Technologies.

Brouthers, K. D., & Brouthers, L. E. 2000. Acquisition or greenfield start-up? Institutional, cultural and transaction cost influences. Strategic Management Journal, 21(1): 89–97.

Brouthers, K. D., Brouthers, L. E., & Werner, S. 2008. Real options, international entry mode choice and performance. Journal of Management Studies, 45(5): 936–960.

Brouthers, K. D., & Hennart, J. F. 2007. Boundaries of the firm: Insights from international entry mode research. Journal of Management, 33(3): 395–425.

Burt, R. S. 1992. Structural holes: The social structure of competition. Harvard University Press.

Burt, R. S. 2007. Secondhand brokerage: Evidence on the importance of local structure for managers, bankers, and analysts. Academy of Management Journal, 50(1): 119–148.

Chang, S. J., & Rosenzweig, P. M. 2001. The choice of entry mode in sequential foreign direct investment. Strategic Management Journal, 22(8): 747–776.

Chen, R., Cui, L., Li, S., & Rolfe, R. 2017. Acquisition or greenfield entry into Africa? Responding to institutional dynamics in an emerging continent. Global Strategy Journal, 7(2): 212–230.

Chi, T. 2000. Option to acquire or divest a joint venture. Strategic Management Journal, 21(6): 665–687.

Chi, T., Li, J., Trigeorgis, L. G., & Tsekrekos, A. E. 2019. Real options theory in international business. Journal of International Business Studies, 50(4): 525–553.

Cohen, W. M., & Levinthal, D. A. 1989. Innovation and learning: The two faces of R & D. Economic Journal, 99(397): 569–596.

Cohen, W. M., & Levinthal, D. A. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1): 128–152.

Cuypers, I., Ertug, G., Kilduff, M., Zaheer, A., & Cantwell, J. 2020. Making connections: Social networks in international business. Journal of International Business Studies.. https://doi.org/10.1057/s41267-020-00319-9.

Dikova, D., & Brouthers, K. 2016. International establishment mode choice: Past, present and future. Management International Review, 56(4): 489–530.

Dussauge, P., Garrette, B., & Mitchell, W. 2004. Asymmetric performance: The market share impact of scale and link alliances in the global auto industry. Strategic Management Journal, 25(7): 701–711.

Dutta, S., Narasimhan, O. M., & Rajiv, S. 2005. Conceptualizing and measuring capabilities: Methodology and empirical application. Strategic Management Journal, 26(3): 277–285.

Estrin, S., Baghdasaryan, D., & Meyer, K. E. 2009. The impact of institutional and human resource distance on international entry strategies. Journal of Management Studies, 46(7): 1171–1196.

Funk, R. J. 2014. Making the most of where you are: Geography, networks, and innovation in organizations. Academy of Management Journal, 57(1): 193–222.

Gao, G. Y., & Pan, Y. 2010. The pace of MNEs’ sequential entries: Cumulative entry experience and the dynamic process. Journal of International Business Studies, 41(9): 1572–1580.

Gilsing, V., Nooteboom, B., Vanhaverbeke, W., Duysters, G., & van den Oord, A. 2008. Network embeddedness and the exploration of novel technologies: Technological distance, betweenness centrality and density. Research Policy, 37(10): 1717–1731.

Guan, J., & Liu, N. 2016. Exploitative and exploratory innovations in knowledge network and collaboration network: A patent analysis in the technological field of nano-energy. Research Policy, 45(1): 97–112.

Guldiken, O., Mallon, M. R., Fainshmidt, S., Judge, W. Q., & Clark, C. E. 2019. Beyond tokenism: How strategic leaders influence more meaningful gender diversity on boards of directors. Strategic Management Journal, 40(12): 2024–2046.

Guler, I., & Guillén, M. F. 2010. Home country networks and foreign expansion: Evidence from the venture capital industry. Academy of Management Journal, 53(2): 390–410.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. 1998. Multivariate data analysis. Prentice Hall.

Hennart, J. F. 2009. Down with MNE-centric theories! Market entry and expansion as the bundling of MNE and local assets. Journal of International Business Studies, 40(9): 1432–1454.

Hoetker, G. 2007. The use of logit and probit models in strategic management research: Critical issues. Strategic Management Journal, 28(4): 331–343.

Iurkov, V., & Benito, G. R. 2018. Domestic alliance networks and regional strategies of MNEs: A structural embeddedness perspective. Journal of International Business Studies, 49(8): 1033–1059.

Jiang, R. J., Tao, Q. T., & Santoro, M. D. 2010. Alliance portfolio diversity and firm performance. Strategic Management Journal, 31(10): 1136–1144.

Johanson, J., & Vahlne, J. E. 2009. The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership. Journal of International Business Studies, 40(9): 1411–1431.

Klier, H., Schwens, C., Zapkau, F. B., & Dikova, D. 2017. Which resources matter how and where? A meta-analysis on firms’ foreign establishment mode choice. Journal of Management Studies, 54(3): 304–339.

Kogut, B. 1983. Foreign direct investment as a sequential process. In C. Kindelberger, & D. Audretsch (Eds.), The multinational corporations in the 1980s. MIT Press.

Kogut, B. 2000. The network as knowledge: Generative rules and the emergence of structure. Strategic Management Journal, 21(3): 405–425.

Kogut, B., & Singh, H. 1988. The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19(3): 411–432.

Koka, B. R., & Prescott, J. E. 2008. Designing alliance networks: The influence of network position, environmental change, and strategy on firm performance. Strategic Management Journal, 29(6): 639–661.

Kwon, S. W., Rondi, E., Levin, D., De Massis, A., & Brass, D. 2020. Network brokerage: An integrative review and future research agenda. Journal of Management. https://doi.org/10.1177/0149206320914694.

Lee, J. W., Abosag, I., & Kwak, J. 2012. The role of networking and commitment in foreign market entry process: Multinational corporations in the Chinese automobile industry. International Business Review, 21(1): 27–39.

Li, J., & Fleury, M. T. L. 2020. Overcoming the liability of outsidership for emerging market MNEs: A capability-building perspective. Journal of International Business Studies, 51(1): 23–37.

McEvily, B., & Zaheer, A. 1999. Bridging ties: A source of firm heterogeneity in competitive capabilities. Strategic Management Journal, 20(12): 1133–1156.

Meyer, K. E., van Witteloostuijn, A., & Beugelsdijk, S. 2017. What’s in a p? Reassessing best practices for conducting and reporting hypothesis-testing research. Journal of International Business Studies, 48(5): 535–551.

Mingo, S., Morales, F., & Dau, L. A. 2018. The interplay of national distances and regional networks: Private equity investments in emerging markets. Journal of International Business Studies, 49(3): 371–386.

Mueller, M., Hendriks, G., & Slangen, A. H. L. 2017. How the direction of institutional distance influences foreign entry mode choices: an information economics perspective. In A. Verbeke, J. Puck, & R. van Tulder (Eds.), Progress in international business research (pp. 271–296. Emerald Group Publishing Limited.

Parente, R., Melo, M., Andrews, D., Kumaraswamy, A., & Vasconcelos, F. 2020. Public sector organizations and agricultural catch-up dilemma in emerging markets: The orchestrating role of Embrapa in Brazil. Journal of International Business Studies.. https://doi.org/10.1057/s41267-020-00325-x.

Parente, R., Rong, K., Geleilate, J. M., & Misati, E. 2019. Adapting and sustaining operations in weak institutional environments: A business ecosystem assessment of a Chinese MNE in Central Africa. Journal of International Business Studies, 50: 275–291.

Pehrsson, A. 2020. An acquisition or a greenfield subsidiary? The impact of knowledge on sequential establishments in a host country. International Marketing Review, 37(2): 377–396.

Phelps, C. C. 2010. A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Academy of Management Journal, 53(4): 890–913.

Podolny, J. M. 1993. A status-based model of market competition. American Journal of Sociology, 98(4): 829–872.

Powell, W. W., Koput, K. W., & Smith-Doerr, L. 1996. Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Administrative Science Quarterly, 41(1): 116–145.

Puck, J. F., Holtbrügge, D., & Mohr, A. T. 2009. Beyond entry mode choice: Explaining the conversion of joint ventures into wholly owned subsidiaries in the People’s Republic of China. Journal of International Business Studies, 40(3): 388–404.

Putzhammer, M., Fainshmidt, S., Puck, J., & Slangen, A. 2018. To elevate or to duplicate? Experiential learning, host-country institutions, and MNE post-entry commitment increase. Journal of World Business, 53(4): 568–580.

Putzhammer, M., Slangen, A., Puck, J., & Lindner, T. 2020. Multinational firms’ pace of expansion within host countries: How high rates of pro-market reform hamper the local exploitation of foreign expansion knowledge. Journal of International Management, 26(1): 100703.

Quintane, E., & Carnabuci, G. 2016. How do brokers broker? Tertius gaudens, tertius iungens, and the temporality of structural holes. Organization Science, 27(6): 1343–1360.

Rosenkopf, L., Metiu, A., & George, V. P. 2001. From the bottom up? Technical committee activity and alliance formation. Administrative Science Quarterly, 46(4): 748–772.

Schilling, M. A., & Phelps, C. C. 2007. Interfirm collaboration networks: The impact of large-scale network structure on firm innovation. Management Science, 53(7): 1113–1126.

Sharma, A., Kumar, V., Yan, J., Borah, S. B., & Adhikary, A. 2019. Understanding the structural characteristics of a firm’s whole buyer–supplier network and its impact on international business performance. Journal of International Business Studies, 50(3): 365–392.

Shi, W. S., Sun, S. L., Pinkham, B. C., & Peng, M. W. 2014. Domestic alliance network to attract foreign partners: Evidence from international joint ventures in China. Journal of International Business Studies, 45(3): 338–362.

Shipilov, A. V. 2009. Firm scope experience, historic multimarket contact with partners, centrality, and the relationship between structural holes and performance. Organization Science, 20(1): 85–106.

Shipilov, A. V., Li, S. X., & Greve, H. R. 2011. The prince and the pauper: Search and brokerage in the initiation of status-heterophilous ties. Organization Science, 22(6): 1418–1434.

Slangen, A., & Hennart, J. F. 2007. Greenfield or acquisition entry: A review of the empirical foreign establishment mode literature. Journal of International Management, 13(4): 403–429.

Song, S. 2017. Host market uncertainty, subsidiary characteristics, and growth option exercise. Long Range Planning, 50(1): 63–73.

Sorenson, O., & Stuart, T. E. 2008. Bringing the context back in: Settings and the search for syndicate partners in venture capital investment networks. Administrative Science Quarterly, 53(2): 266–294.

Stallkamp, M., Pinkham, B. C., Schotter, A. P., & Buchel, O. 2018. Core or periphery? The effects of country-of-origin agglomerations on the within-country expansion of MNEs. Journal of International Business Studies, 49(8): 942–966.

Tsai, W. 2001. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44(5): 996–1004.

Valentino, A., Caroli, M., & Mayrhofer, U. 2018. Establishment modes and network relationships of foreign subsidiaries. International Business Review, 27(6): 1250–1258.

Verbeke, A., & Hillemann, J. 2013. Internalization theory as the general theory of international strategic management: Jean-Francois Hennart’s contributions. Advances in International Management, 26(1): 35–52.

Yeniyurt, S., & Carnovale, S. 2017. Global supply network embeddedness and power: An analysis of international joint venture formations. International Business Review, 26(2): 203–213.

Zelner, B. A. 2009. Using simulation to interpret results from logit, probit, and other nonlinear models. Strategic Management Journal, 30(12): 1335–1348.

Zhang, J., & Pezeshkan, A. 2016. Host country network, industry experience, and international alliance formation: Evidence from the venture capital industry. Journal of World Business, 51(2): 264–277.

Zhao, X. 2009. Technological innovation and acquisitions. Management Science, 55(7): 1170–1183.

ACKNOWLEDGEMENTS

We thank JIBS Area Editor Ilan Vertinsky and three anonymous reviewers for their constructive comments and valuable input that have helped shape the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Accepted by Ilan Vertinsky, Area Editor, 1 February 2021. This article has been with the authors for three revisions.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Zhao, Y., Parente, R., Fainshmidt, S. et al. MNE host-country alliance network position and post-entry establishment mode choice. J Int Bus Stud 52, 1350–1364 (2021). https://doi.org/10.1057/s41267-021-00414-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41267-021-00414-5