Abstract

IFRS requires that for purchase accounting purposes, insurance liabilities are measured at their “fair value”. Purchase accounting for insurance contracts proves to be a challenging topic for standard setters, preparers, and users, given the absence of specific guidance in IFRS for this particular case. Recent developments, in particular the 2010 IFRS Insurance Contract Exposure Draft, the 2010 Solvency II QIS 5 Technical Specifications and the 2009 Market Consistent Embedded Value (MCEV) Principles, may be seen as providing relevant techniques in this context but do not present clear guidance specifically for fair values as required for purchase accounting purposes. This paper compares fair value as required for purchase accounting within the current IFRS Phase II process, the proposed Solvency II regulations and the practical actuarial concept of MCEV. Potential investors may benefit from this as discretionary elements in M&A transaction accounting, and their implications should be taken into account early in the transaction process of insurance companies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Following the 2008 financial market crisis, the European market for mergers and acquisitions (M&A) in the insurance industry picked up significantly—however remaining juvenile compared to the U.S.Footnote 1 Dominant drivers of recent M&A insurance transactions in Europe have been global growth strategies by multinational groups, low interest rates, upcoming increased capital requirements under the new regulatory Solvency II regime and forced sales by large groups providing compensation for assumed state aid. In 2011–2012, a number of insurance groups initiated or exercised disposal processes in relation to foreign European subsidiaries outside their home geographies, including Ageas, Delta Lloyd, Groupama, KBC, Old Mutual and Uniqa. Almost simultaneously, financial investors with a financial services focus have become increasingly interested in the insurance industry, a prominent example being the 2012 closed acquisition of Ageas’ German life entities by Augur, the private equity fund, which gave evidence that BaFin, the German regulator, did indeed approve the purchase of a German life insurer by a financial investor for the first time.

Despite the increasing relevance of financial investors as purchasers of European insurances companies—some of them domiciled offshore outside the European Union (EU) and therefore not subject to EU accounting legislation, but possibly nevertheless applying IFRS for their financial reports—the vast majority of purchasers of insurance companies continue to be strategic investors domiciled and listed in the EU and therefore reporting under EU regulations.Footnote 2

The 2008 revised IFRS 3 “Business combinations” specifies the financial reporting by an entity (acquirer) when it acquires another company (acquiree). Under the “acquisition method” of IFRS 3, the acquirer recognises the acquiree's identifiable assets (including intangible assets) and liabilities at their fair value at acquisition date, also recognising goodwill, which is subject to subsequent impairment tests. To apply the IFRS 3 acquisition method, the consideration transferred shall be measured at fair value, calculated as the sum of the acquisition-date fair values of the assets transferred by the acquirer, the liabilities incurred by the acquirer to former owners of the acquiree and the equity interests issued by the acquirer (IFRS 3.37).

These accounting rules for business combinations also apply for insurance liabilities (IFRS 4.31), despite the continued absence of specific IFRS guidance for insurance contract accounting. Even more, insurance companies are, until IFRS 4 Phase II is finalised, temporarily allowed to use their pre-existing local Generally Accepted Accounting Principles (GAAP) for insurance contract liabilities (“grandfathering”).

Compliant with IFRS 4.25, European insurers continue to use the local GAAP of their respective geography, which leads to a plethora of measurement models (see Table 1). This concept was followed in the 2011 group financial report by most leading European insurance groups. Table 1 illustrates that a number of European insurance groups applied local GAAP to report their insurance liabilities but used U.S. GAAP or other local GAAP for their foreign subsidiaries. In contrast, German insurers Allianz, Munich Re and Talanx (including Hannover Re) as well as Austrian Uniqa (including its former listed German subsidiary Mannheimer), in accordance with the rules of IFRS, recognise and measure all underwriting liabilities on the basis of U.S. GAAP. The same applies for listed Generali Deutschland, which follows other rules for insurance accounting than its majority shareholder, the Italian company Generali.

Historically, German public companies were allowed to prepare an international group financial report pre-IAS regulation (2005) if the specific accounting rules were globally recognised (Art. 292a German Commercial Code). Those German insurers that elected IFRS chose U.S. GAAP rules in relation to insurance contracts, especially SFAS 60, SFAS 97 and SFAS 120, despite the fact that these had been developed in the context of U.S. insurance products.Footnote 3 In the case of Gothaer, the non-listed German mutual, a voluntary (Art. 315a para. 3 German Commercial Code) IFRS group financial report with insurance contracts measured according to U.S. GAAP is presented. In this paper, we focus on specific U.S. GAAP accounting rules for insurance contracts as used in IFRS group financial reporting (which we refer to as “duplex” IFRS/U.S. GAAP purchase accounting).

The purpose of this paper is to identify and analyse key questions with respect to a “fair value” of insurance contracts in an M&A transaction context, in the absence of specific IFRS guidance. Further, this paper aims to compare this fair value with value categories as discussed in the current IFRS Phase II process, the proposed Solvency II regulations and the practical actuarial concept of Market Consistent Embedded Value (MCEV). Finally, the paper discusses practical implications for an IFRS 3 purchase price allocation (PPA) and subsequent U.S. GAAP reporting, especially in the light of discretionary elements due to the lack of specific guidance on fair value measurement of insurance liabilities. A question addressed in this paper is to which degree the acquirer's choice of one of the actuarial concepts mentioned above may impact financial reporting. Potential investors and advisors may benefit from this, as the implications from M&A transaction accounting should be taken into account early in the transaction process of insurance companies.

The remainder of this paper is organised as follows. The next section presents the concept of the “fair value” of an insurance contract and the approximative application of IFRS Phase II, Solvency II, MCEV and appraisal value. The subsequent section discusses the accounting for acquired insurance contracts within the PPA according to IFRS 3, focusing on the application of U.S. GAAP reporting as applied by German multinational insurers. Finally, a case study to illustrate potential effects from purchase accounting is included in the penultimate section. This paper takes into account developments occurring up to 30 June 2012.

Fair value of insurance liabilities

General fair value discussion

IFRS 3 requires the use of fair value for business combination purposes. Independent of a concrete fair value definition, there are three generally accepted approaches to (fair) valuation techniques, also referred to as a fair-value “hierarchy”Footnote 4: (i) Under the Market Approach, the value of the liability is determined by comparison with prices paid for similar liabilities (the preferred approach according to IFRS 3). Even though there are cases where comparability between transactions of insurance liabilities exists due to reference to a recent similar transaction (e.g. transactions of closed blocks of business, reinsurance contracts), the market activity with respect to insurance liabilities is rather low and hence the use of market comparables is not available in practice: “Fair values of insurance contracts are normally not observable in markets”.Footnote 5 (ii) The Cost Approach reflects the idea of rebuilding or reconstructing an equivalent liability (replacement value). While there are some applications especially on tangible assets, this approach is not applicable to insurance liabilities since many of the features of insurance contracts cannot be reconstructed. (iii) Finally, the Income Approach includes a projection of future cash flows to be paid on a contractual insurance obligation (netted by future premium cash inflow) that are discounted back to present value, considering the risk-adjusted discount rate (considering either the inherent risk with an adjustment to the discount rate or an explicit risk adjustment) associated with in-force insurance contracts. Embedded value (EV) and appraisal value represent two actuarial methods based on the discounted cash flow method of the Income Approach. IFRS 4 Phase II and Solvency II offer examples of approaches with explicit risk adjustments.

The valuation technique generally chosen to model under the Income Approach is the present mean value of future cash flows, consistent with the economic model of the discounted cash flow approach.Footnote 6 The riskiness of future cash flows needs to be considered, either by using risk-weighted cash flows or by adjusting the discounting rate, which is calculated from the risk-free market interest rate for equivalent cash flow durations (reflecting risk averseness). In the case of the regulated insurance industry, any (potential) burdens from regulatory requirements (e.g. solvency capital requirements, policyholder participation) are to be modelled in.5

From the theoretical perspective of a business valuation to support an acquirer's investment decision, the Income Approach represents the best practice method because it potentially reflects the acquirer's future income stream, determined under his specific, “subjective” assumptions and related to his individual decision-making process—rather than representing the case of an “objective” market participant.Footnote 7 Nevertheless, under current IFRS and U.S. GAAP accounting rules, this is different, as these incorporate assumptions which market participants would use in making estimates of fair value. However, under previous U.S. GAAP guidance (APB 16), an acquiring entity's intended use (buyer-specific assumptions) was considered. Today, especially under FAS 157, U.S. GAAP and IFRS accounting rules have converged to the non-specific assumptions of an “objective” market participant.

According to IFRS 13 (effective 1 January 2013), the fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”, that is, an exit price. A fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants to sell the asset or transfer the liability at the measurement date under current market conditions. The hypothetical transaction is considered from the perspective of a market participant that holds the asset or owes the liability, that is, it does not consider entity-specific factors that might influence an actual transaction. This is consistent with U.S. GAAP, where the Financial Accounting Standards Board (FASB) defined “fair value” in 2006 as “the price that would be received … to transfer a liability in an orderly transaction between market participants at the measurement date” (SFAS 157/ASC 820). Based on this standard, any fair value measurement has to be market-based, reflecting the assumptions that market participants would use in pricing the liability, emphasising the necessity of market data obtained from sources independent of the reporting entity.

In the end, the purpose of the valuation determines whether the assumptions of an “objective” market participant should be used rather than entity-specific factors (e.g. intended use, individual averseness). Pre-acquiring an insurance company, it is common practice to determine potential adjustments to net asset value as part of financial due diligence. Such pre-acquisition adjustments take into account the individual buyer's perspective and estimate an entity-specific purchase price based on a fair value of assets and liabilities. In this pre-acquisition situation, the “subjective” assumptions of the potential buyer need to be considered and hence, the assumptions for fair value determination of insurance liabilities may be different from the ones used in purchase accounting.Footnote 8 For the purpose of a PPA according to IFRS 3, the fair value has to fulfil the criteria of IFRS 13, whereas for pre-acquisition valuation, the subjective value from a buyer's perspective might be a more useful indicator of the fair value.

The acquiring entity, having just completed the transaction, is likely to have analysed cash flows and the capital requirements of the insurance liabilities and made a determination of the value of the acquiree. Actuarial analyses performed during the acquisition process are part of the financial due diligence of the target entity and may take the form of actuarial appraisals or EV calculations to determine the value in-force. This information should be available for fair value calculation and purchase accounting purposes.Footnote 9

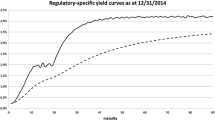

As it is wide actuarial practice across Europe today that any determination of a fair value of insurance contracts reflects the ideas and proposals of IFRS 4 Phase II, Solvency II and MCEV, we will derive fair value measurements for insurance liabilities from those concepts, compare them and assess their compliance with general fair value principles defined in IFRS 13. Such an exercise has to be seen against the background of relevant developments (Figure 1).

Fair value of insurance liabilities in the IFRS context

In the current discussion of IFRS 4 Phase II (in contrast to a previous 2007 discussion paper that was based on a “current exit value”), one comprehensive measurement model for all types of insurance contracts issued by insurers, with a premium-allocation approach for some short-duration contracts, was proposed by the IASB in 2010 (ED/2010/8). According to this Exposure Draft, the measurement model is based on a “fulfilment” objective that reflects the fact that an insurer generally expects to fulfil its liabilities over time by paying benefits and claims to policyholders as they become due, rather than transferring the liabilities to a third party, that is, the current fulfilment value.Footnote 10 The insurer will therefore consider its entity-specific assumptions in the measurement, except for those based on markets, for example, the time value of money.

At initial recognition, an insurer would measure a contract as the sum of the present value of the fulfilment cash flows and a residual margin that eliminates any gain at inception of the contract. The sum of the present value of the fulfilment cash flows would be made up of an explicit, unbiased and probability-weighted estimate (i.e. expected value of the future cash outflows, less the future cash inflows that will arise as the insurer fulfils the insurance contract), a discount rate that adjusts those cash flows for the time value of money, and a risk adjustment, being an explicit estimate of the effects of uncertainty about the amount and timing of those future cash flows. If the initial measurement of an insurance contract results in a day one loss, then the insurer would recognise that day one loss in profit or loss (i.e. no residual margin would be included).

For purposes of determining the amount of insurance liabilities in a PPA context, conceptionally only discounted cash flows and a risk margin would be considered. The residual margin only calibrates the liability to eliminate day 1 gains. All calculations are done on a gross basis leading to a separate reinsurance asset. Non-life business is treated in the same way as life business, that is, discounted. In the current discussion, only one exception from discounting is considered for short-tail liabilities, when the effect is immaterial. The reinsurance would be considered on a gross basis, meaning that the cedant would have to measure the present value of the fulfilment cash flows, including a risk margin and a residual margin.

There are significant differences between the measurement model in the currently discussed IFRS 4 Phase II Exposure Draft and the measurement model based on general fair value considerations according to IFRS 13. For example, the credit risk and a service margin should be considered in the fair value, but are not incorporated in the fulfilment value, whereas the residual margin, included in the fulfilment value, is not in accordance with the fair value model. In addition, there are valuation differences in the determination of the risk margin and the non-financial market parameters.Footnote 11

Fair value of insurance liabilities in the Solvency II context

The idea of a comprehensive “economic balance sheet” is embedded in the regulatory development around Solvency II. Under the Solvency II Framework Directive, liabilities shall be valued at the amount for which they could be transferred, or settled, between knowledgeable willing parties in an arm's length transaction (2009/138/EC, Article 75). The value of insurance liabilities shall be equal to the sum of a best estimate of cash flows and a risk margin:

The Framework Directive defines the best estimate as “the probability-weighted average of future cash-flows, taking account of the time value of money (expected present value of future cash-flows), using the relevant risk-free interest rate term structure. The calculation of the best estimate shall be based upon up-to-date and credible information and on realistic assumptions and be performed using adequate, applicable, and relevant actuarial and statistical methods”, while the risk margin is “calculated by determining the cost of providing an amount of eligible own funds equal to the Solvency Capital Requirement necessary to support the insurance and reinsurance obligations over the lifetime thereof” (2009/138/EC, Article 77). The details on the parameters are defined in the quantitative impact studies (QIS), of which five have been conducted throughout Europe so far.

Conceptually, the valuation can be divided into two parts, with one part relating to hedgeable risks, that is, based on observable market parameters and another part referring to non-hedgeable risks, calculated as best estimate plus the risk margin. The best estimate of cash flows uses probability-weighted average future cash flows including contractual future premiums, cash flows resulting from options and guarantees within contracts, expenses (including general overhead expenses, not in line with general fair value methodology), and cash flows resulting from policyholder behaviour. As a practical expedient, entity-specific best estimates should be used and updated regularly for unavoidably entity-specific assumptions as, for example, administrative costs. For financial input factors market prices should be used as far as available. For discounting, the risk-free interest rate should be used. In the 2010 QIS 5 study, the relevant swap curves including adjustments for illiquidity premium were provided for major currencies.

The risk margin can be seen as compensation for bearing the risk, that is, a proxy for the market price of risk. The underlying idea for the risk margin is that, based on the going-concern assumption, any insurer will have to hold certain solvency requirements as defined by the regulator as well as economically. In order to calculate the risk premium, Solvency II requires the use of a cost-of-capital approach per business level (including diversification between business lines) with a specified interest rate, which is determined at 6 per cent in QIS 5 (QIS 5 Technical Specifications 5.25).

All calculations are done on a gross basis leading to a separate reinsurance asset, which needs to be discounted and adjusted in the fair value valuation for expected losses due to default of the counterparty. In general, not only life but also non-life reserves have to be discounted.

Although it is the intention of Solvency II that valuation standards for supervisory purposes should to the extent possible be compatible with international accounting rules, in order to limit the administrative burden (2009/138/EC, Article 46), there are significant differences, partially due to the fact that solvency guidance is based on the 2007 discussion paper of IFRS 4. Compared with the more recent Exposure Draft, the measurement attribute differs (fulfilment value rather than current exit value) and the residual margin does not exist. Owing to the different scopes, the valuation of liabilities from investment contracts will diverge, as IFRS valuation is based on IAS 39. Additionally, the implementation of the residual margin in IFRS 4 leads to generally higher values of liabilities compared with Solvency II.Footnote 12

Assessing the Solvency II model against the general fair value principles outlined in IFRS 13, it has to be noticed that Solvency II calculates exit value from a third-party perspective. Therefore, from a conceptual view, it tends to best fit the IFRS general definition of fair value. However, as it was developed for regulatory reporting purposes, some of the input factors are defined centrally by the regulator and therefore do not reflect market conditions. The most obvious assumption is the determination of the cost-of-capital rate with not less than 6 per cent.

Fair value of insurance liabilities in the context of embedded value

The MCEV Principles were developed by the Chief Financial Officers’ (CFO) Forum in 2008 with the intention of increasing standardisation and to bring consistency to the European industry's disclosure of EV. The MCEV of an insurance company represents the present value of future cash flows available to the shareholders, adjusted for the risks of those cash flows.Footnote 13 MCEV does not include any values attributable to future sales (closed book approach). The MCEV measures the value of the insurer by adding today's value of the existing business (i.e. future profits) to the net of market value of assets and value of insurance liabilities (i.e. accumulated past profits), expressed in a formula:

The value of an in-force covered business is defined as the certainty equivalent value of future profits (CEV) minus the time value of financial options and guarantees (TVOG) including the cost of credit risks minus the cost of residual non-hedgeable risks (CNHR) minus the frictional costs of required capital (FC).

Based on the MCEV Principles, the value of in-force business can be derived from the best estimate of cash flows plus those adjustments:

For the estimation of future cash flows, the CFO Forum required stochastic models with the following requirements for the assumptions, which are separated into an economic and a non-economic part. The non-economic assumptions, such as demographics, expenses or taxation, have to consider past, current and expected future experience and any other relevant data.Footnote 14

Economic assumptions, such as inflation or investment return, must be internally consistent and should be determined in a way that projected cash flows are valued in line with the prices of similar cash flows that are traded on the capital market.Footnote 15 No smoothing of market or account balance values or unrealised gains is permitted, and they need to be updated for each reported calculation of MCEV.

For discounting, the “reference rate” has to be used, which is a proxy for a risk-free rate appropriate to the currency, term and liquidity of the liability cash flows. For the participating business, the assumptions should be made on a basis consistent with the projection assumptions, established company practice and local market practice.Footnote 16 The calculation is made on a net basis; therefore, reinsurance effects have to be considered in the calculation. A risk adjustment is explicitly considered in the CNHR.

When comparing the valuation of liabilities with the requirements set in IFRS 13, a distinction needs to be made between financial risks and operational/insurance risks. On the one hand, MCEV is a proper method for determining the fair value of financial risk, especially due to the fact that market consistent assumptions are used. However, due to the fact that some market participants criticised the volatility of MCEV calculations during the 2008 financial crisis, some changes were made by the CFO Forum which diverge from the theoretical “clean” fair value concept. This divergence was also expressed in the CFO Forum's December 2011 press release, responding to the then-current market conditions. Especially taking into account an illiquidity premium is seen critical in the literature.Footnote 17 On the other hand, the MCEV methodology is very limited with respect to considering operational/insurance risks.

Since the MCEV covers long-term insurance (life and health business) only, a principle-based methodology for short-term insurance contracts does not exist so far.Footnote 18 As a practical approximation, the 2009 amendment to the MCEV Principles requires the combination of MCEV results from the covered life business with the IFRS results of the non-life business to provide a complete picture of an insurer's business—an inconsistent approach widely criticised.Footnote 19

Fair value of insurance liabilities in the context of appraisal value

An approach related to the concept of EV/MCEV is the actuarial appraisal value. The appraisal value can be seen as an extended EV, as it is the sum of the net asset value, VIF and the value of future business:

It is the only concept that considers cash flows from future operations in the determination of the current fair value (open book approach). As insurance liabilities may not include this future business value, this is not a separate approach for determining the fair value of insurance liabilities, but needs to be considered when determining the fair value of other intangibles in business combination, such as customer relationship.

Comparison of discussed concepts and comparison with general fair value definition

Comparing the four discussed methodologies, it can be noticed that none of the concepts is, conceptually-speaking, fully compliant with the requirements of IFRS 13 on fair values. Table 2 compares relevant assumptions and criteria of the proposed IFRS 4 (Phase II), proposed Solvency II (QIS 5) and MCEV in the context of fair value determination.

Our preliminary conclusion is as follows: Current IFRS 4 does not provide specific guidance on the fair value measurement of insurance liabilities. All concepts discussed, with the exception of the appraisal value, can be seen as a basis for fair value determination for the purpose of purchase accounting. Necessary adjustments include the residual margin of IFRS 4 Phase II and the cost-of-capital rate in Solvency II. Based on such adjustments and in line with current industry practice,9 these approaches, reflecting methods and assumptions used by market participants in the industry, may be appropriately used to estimate fair value in the purchase accounting context.

However, the absence of specific guidance on fair value measurement introduces a considerable discretionary element into accounting for business combinations. By choosing a certain actuarial concept (considering the consistency of accounting policies, IAS 8), the acquirer may impact the initial recognition on the initial balance sheet as well as future net income. For example, compared with interest rates chosen in MCEV calculations, an application of the 6 per cent risk-free interest rate specified by QIS 5 may ceteris paribus lead to a lower initial recognition of insurance liabilities, resulting in a lower future net income stream. For an illustration of such sensitivities, refer to the brief case study included in the penultimate section of this paper.

Accounting for insurance contracts within a PPA

According to general IFRS guidance (IFRS 3), the acquirer has to measure the identifiable assets acquired and liabilities assumed at their fair value. In addition, acquired intangible assets have to be recorded as long as they are identifiable and can be measured reliably. The following discussion is based on the assumption that the acquirer applies U.S. GAAP accounting rules for insurance contracts, as this is commonly done among some leading insurers in German-speaking countries (refer to the first section). However, most of the issues subsequently raised arise under most other local GAAPs.

PVFP asset arising from the expanded presentation

With respect to insurance contracts, IFRS 4.31 states that insurance liabilities assumed and insurance assets acquired are to be measured at their fair value but allows to split the fair value of the acquired insurance contracts into the two components (i) a liability measured in accordance with insurer's accounting policy and (ii) an intangible asset, representing the difference between the fair value and the amount in (i), that is, the present value of future profits (PVFP). This asset is consistent with U.S. GAAP business combination accountingFootnote 20 and has also been given other names, including “value of business acquired” (VOBA) or “value of business in-force” (VBI). Economically, this asset represents the profit on long-duration insurance contracts which have been written before the date of acquisition and will emerge thereafter.

With respect to the insurance assets mentioned in IFRS 4.31, the value of in-force contracts, resulting from the expanded presentation permitted by IFRS 4, has to be distinguished from other intangible assets, such as customer relationships. Typically, the first step in a business combination is to identify all assets and liabilities which are recognisable for PPA. As a consequence, possible items recorded in the acquiree's previous local GAAP balance sheet, such as equalisation reserves or deferred acquisition costs (DAC), must be eliminated. Reinsurance-related items, such as contra-liabilities, need to be recognised based on accounting principles of the acquirer and measured at fair value.

As it is common in recent transactions to apply the expanded presentation, the insurance liabilities of the acquired business have to be measured based on the existing accounting rules of the purchaser in order to determine the first part (i) of the expanded presentation for insurance liabilities. As discussed in the first section, European insurers continue to use their pre-existing accounting rules, in the case of some leading German/Austrian insurers U.S. GAAP. Changes might arise from different levels of prudence or discounting under the accounting methodologies. For example, claims reserves may not be discounted under U.S. GAAP except in the case of claims with fixed and reliably determinable payments made at known time intervals on an individual claim basis.Footnote 21 In a further step, the fair value of those insurance liabilities has to be determined (optionally, the fair value adjustment is calculated directly).

However, there is no concrete IFRS or U.S. GAAP guidance for the initial measurement of the PVFP. According to accounting literature,Footnote 22 the initial PVFP is derived from all contractual cash flows that are projected for proper policy groups, including premiums, charges, claims, expenses and investment earnings. Regarding the interest rate, it is currently discussed if the discount rate, which is based on general market conditions, should reflect both the time value and the inherent risk in the transaction, or only the time value with an explicit estimation of the risk.22 The PFVP asset does not include the value of future business and is hence consistent with the idea of a closed book approach.

Regarding subsequent measurement, IFRS 4 states that the PVFP has to be amortised over the estimated life of the contract (IFRS 4.BC149), and the subsequent measurement is outside the scope of IAS 38 “Intangible Assets”. The subsequent measurement should be consistent with the measurement of related insurance liabilities (IFRS 4.31b) and is covered by the liability adequacy test (IFRS 4.15–19). Therefore, the PVFP is not subject to IAS 36 “Impairment of assets”.

Owing to lack of guidance for the direct initial measurement of the PVFP asset, in practice the following methods were developed based on the U.S. GAAP accounting regime:

Traditional long duration insurance contracts (ASC 944-40, former FAS 60): PVFP can be calculated as the present value of gross premiums minus net level premiums, which is the future profit, expected from the insurance contract. The input parameters need to be determined using the current availing best estimate assumption, including provisions of adverse deviation (PAD). The calculation can alternatively be performed using the actuarial K-factor (ratio of deferrable expenses to estimated gross profits).

Participating insurance contracts (ASC 944, former FAS 120): PVFP is calculated as the present value of estimated gross margins (EGM) based on estimations as of the acquisition date. At purchase date, the insurer prepares projections of EGM based upon best estimate assumptions without the risk for adverse deviation for each book of contracts. In contrast to regular EGM calculation, the participating feature has to be considered in future cash flows. Usually the present value of EGMs is calculated based on the expected investment yield. However, for purposes of PVFP calculation, a risk rate has to be used that considers the cost of capital, yields generated on similar currently issued business, the discount rate implicit in the seller's offering price, and the general interest rate environment.

Limited payment contracts (FAS 97): PVFP can be calculated as the present value of gross premiums minus net level premiums, which is the future profit expected from the insurance contract. All assumptions must be based on current estimations.

Universal life contracts (FAS 97): PVFP is the present value of estimated gross profits (EGP) based on estimations as of the purchase date. Usually, the present value of EGM is calculated using the expected investment yield. However, for purposes of PVFP calculation, a risk rate has to be used that considers the cost of capital, yields generated on similar currently issued business, the discount rate implicit in the seller's offering price and the general interest rate environment.

Investment contracts with discretionary participating features: As investment contracts that do not earn significant investment revenues other than investment returns are measured at fair value at the time of their acquisition, the inherent PVFP, that is, future investment spreads (earned rate less credited rate), is incorporated into this fair value measure, rather than separately recorded as a PVFP asset.

It should be noted that, when comparing these PVFP practical measuring methods with the fair value definition outlined above under “General fair value discussion”, some differences arise especially due to the use of entity-specific assumptions in U.S. GAAP. However, U.S. GAAP methods provide a reasonable estimate for fair value in practice.

Intangible assets relating to customer relationships

As noted above, there are a number of other possible intangible assets besides the PVFP.Footnote 23 Unlike those arising from the expanded presentation allowed under IFRS 4, these assets are within the scope of IAS 36 and 38. Hence, the subsequent measurement is based on general accounting guidance. In general, it needs to be determined if such an intangible asset has a finite or infinite life and if, based on the acquirer's accounting policy, the cost model or the revaluation model is to be used for subsequent measurement.

As mentioned above, PVFP excludes the value of future business and therefore follows the closed book approach. Hence, the value of the expected future business from existing customer relationships, which can apply to both life and non-life business, is commonly considered to be an intangible asset resulting from an insurance business combination. To the extent that considerations paid exceed the net of assets and liabilities and do not meet the recognition criteria in IAS 38, it will be recognised in goodwill.

Regarding customer relationships it can be distinguished between direct relationships with policyholders, distribution channels and customer lists: With an asset representing the direct relationship, the value of the future business with existing customers is valued. It typically would be based on projected cash flows discounted at a market discount rate including a risk adjustment. As for the valuation, the probability of contract renewals including forecasted premium volumes, premium rates, projected surrenders, proportion of business ceded to reinsurers, loss ratios and other expenses would need to be considered, the involvement of actuaries for the estimation of the cash flows is usually necessary. In addition, the impact of reinsurance needs to be considered, as the acquirer's decision to continue the current reinsurance programme has significant influence on the cash flow. If a reliable measure is possible, cross-selling may also be considered, that is, the possibility to sell insurance contracts typically offered by the acquired insurer to the customers of the purchasing insurer and vice versa. Hereby the differentiation between synergies, shown in goodwill, and a separate intangible asset is important.Footnote 24

The valuation of intangible assets regarding distribution channels needs to consider the future business with existing customers and new customers due to greater accessibility to a certain marketplace, for example, bank distribution. The valuation is typically either based on future cash flows (refer to comments above), comparable market transactions or multiples of the value of new business arising from distribution contracts. Any such intangible asset must meet the identifiability criterion, that is, be separable and arising from contractual or other legal rights.

The value of customer lists results from the possibility to sell unrelated contracts to existing customers.9 Depending on local legislation, these customer lists can be sold separately. Their valuation is typically either based on comparable market transactions or on future cash flows. Care should be taken not to double count the asset related to a customer relationship as in certain cases the distinction of cash flows related with customer relationships might be difficult.

Regarding subsequent measurement, it has to be decided whether the intangible has indefinite life or a finite life, whereby finite life also includes intangibles whose life cannot be determined (and therefore must be estimated). Usually the life of a distribution channel can be considered as finite, as it is either based on contractual terms or, in the case of customer lists, the life of the customers is finite. Depending on the valuation model chosen (cost or revaluation method), the amortisation is either based on depreciable amounts (which are allocated on a systematic basis over the useful life) together with an annual impairment test, or only based on a regular impairment test (IAS 38).

Other intangible assets and goodwill

Besides the intangibles related to customer relationships, other intangible assets might be recognised in a business acquisition, such as brand names, trademarks, copyrights, licenses, product approvals or service agreements. Identification and first-time valuation of these assets in the insurance industry do not significantly diverge from transactions in other industries.

Based on IFRS 3, the excess of the consideration transferred over the net of the identifiable assets and liabilities acquired as of the acquisition date must be recognised as goodwill. Therefore goodwill implicitly includes intangible assets that do not satisfy the criteria for recognition (IFRS 3.32) and represents the payment made by the acquirer in anticipation of future economic benefits from assets that are not capable of being individually identified, recognised or reliably measured.

Case study and impacts on subsequent financial performance

We have chosen a brief case study (simplified) to illustrate the effects under IFRS as described above. The acquirer purchases 100 per cent of shares of a target insurance company (with life and non-life business) for total consideration of €200 million. The acquired entity reports under a European local GAAP, while the acquirer, subject to a mandatory IFRS group report, has chosen U.S. GAAP to recognise insurance liabilities. Figure 2 shows the allocation of the price premium (purchase price less acquiree's reported equity) to various intangibles, other assets and liabilities, and to goodwill. Total fair value adjustments of €65 million at acquisition date consist of general IFRS 3 and of insurance contract-related IFSR 4 components (insurance liabilities and PVFP). Based on a 25 per cent corporate tax rate, €16 million deferred tax liabilities offset the total fair value adjustment, resulting in a residual goodwill of €51 million (for which a recognition of a deferred tax liability is not permitted, IAS 12.21).

Figure 3 compares the acquiree's financial position pre-acquisition (local GAAP, amortised cost basis) with the balance sheet based on IFRS 3 purchase accounting (fair value basis). The total additional €30 million in intangible assets and the €51 million goodwill complement the balance sheet. The fair value of insurance liabilities has been determined €25 million below the amount reported under the acquirer's local GAAP in use. In the IFRS 3 balance sheet post-acquisition, the acquirer's U.S. GAAP accounting rules are applied, which are by €10 million less prudent than the acquiree's historical accounting (e.g. no equalisation provisions as permitted under various local GAAP, IFRS 4.14). The remaining amount of €15 million is recognised as a PVFP asset. In the resulting balance sheet, the acquiree's net asset value is equal to the purchase price.

Table 3 provides an overview on potential future impacts from the PPA over a three-year period, that is, from subsequent measurements under IFRS. The acquiree's brand is an indefinite life intangible and will therefore not amortise but will be subject to impairment tests (IAS 38.108). Intangible assets referring to customer relationships will—under the cost model—amortise over their finite useful life (IFRS 4.33; IAS 38.97) and will, as a consequence, impact future net income stream. Future net income effects from the €10 million fair value adjustment on financial instruments (available for sale) depend on financial market development and are basically not foreseeable. The PVFP asset will amortise over the estimated life of the contracts (IFRS 4.31b), while goodwill will only be subject to IAS 36 impairment tests.

Given the absence of specific guidance on fair value measurement of insurance liabilities, the acquirer may, as a discretionary element, choose another actuarial concept to determine the initial IFRS 3 balance sheet recognition (see “Comparison of discussed concepts and comparison with general fair value definition” above). For example, compared with the €10 million adjustment of insurance liabilities depicted in Table 3, a total insurance liabilities adjustment of €20 million leads to lower net income in subsequent periods—for example, an additional €1.2 million expense in Year 1 (before deferred tax adjustment). While this illustrates the impact a choice of one of the actuarial concepts may have, general practical experience in the European M&A transaction market suggests that potential future adverse impacts arising from intangible assets, especially goodwill, are of much higher concern.

Based on a sample of 21 European insurers, a recent study found that of the insurers in the sample, nine reported a goodwill impairment and ten reported a loss on other intangible assets in 2009. The same study determined the average ratio of goodwill to cost of acquisition at 28 per cent in 2009, with a total goodwill representing 18 per cent of reported equity.Footnote 25 Whereas these ratios are relatively low compared with other industries, a potential impact on group performance is evident also in the insurance industry.

Figure 4 illustrates some potential implications from an allocation to goodwill as compared with an allocation to other assets. While the PPA does not impact a company's future cash flow, it usually has an adverse effect on the acquirer's future profit and loss accounts (future net income stream). Impacted key performance measures include combined ratio, net income and earnings per share, which are some of the financial performance indicators widely used in the European insurance industry.Footnote 26 An acquirer, applying purchase accounting under IFRS, needs to be well aware of the impacts arising from purchase accounting procedures and should therefore consider a pre-PPA analysis,Footnote 27 performed prior to signing, that is, during the financial due diligence phase of the M&A transaction process.

Conclusion

This paper aims to shed some light on the requirements stemming from the fair value measurement of insurance contracts in an M&A transaction context. The starting point is the IFRS requirement of fair value without providing specific guidance. It is general industry practice to use existing actuarial approaches, which may, if appropriately applied, lead to the required fair value in the purchase accounting context.

The IFRS 4 Exposure Draft, the Solvency II QIS 5 Technical Specifications and the MCEV Principles are recent developments that include assumptions and methodologies of significant differences. Of these approaches, only Solvency II QIS 5 provides a methodology that computes an “exit value” as required by IFRS for purchase accounting purposes. However, QIS 5 uses input factors centrally defined by the regulator, for example, a cost-of-capital rate of 6 per cent (above the risk-free rate). Various other assumptions differ between methodologies, while MCEV remains a concept for life/health insurance only and therefore is of limited practicability. Further, the appraisal value is based on an open book approach and therefore only relevant for the fair value calculation of the intangible assets. On this background, all relevant parties involved in an insurance M&A transaction—whether they be potential investors, M&A transaction advisors, actuaries or accountants—need to develop a joint practical approach based on the acquaintance of given theoretical requirements and of the concepts’ various characteristics. Therefore, cross-functional collaboration is key.

The absence of specific guidance on fair value measurement of insurance liabilities introduces a considerable discretionary element into purchase accounting. In fact, the acquirer may impact both the initial recognition of insurance liabilities and subsequent future net income by choosing a certain concept, applied consistently across M&A transactions. This paper provides an overview on the conceptual choices an acquirer has in the course of a PPA and the potential impacts on initial and subsequent financial reporting. However, general practical experience suggests that potential future adverse impacts arising especially from goodwill impairment are of much higher concern to acquirers.

In the end, the total impact on subsequent financial performance arising from PPA appears rather modest in the insurance industry compared with other sectors. The average goodwill relative to total equity of European insurers of 18 per cent indicates their past reluctance to pay high purchase prices as well as remote overall M&A activity so far—this is in stark contrast to, for example, entertainment and media (101 per cent) or telecommunications (77 per cent) following significant M&A activity in these sectors in previous years.25 This fairly comfortable position of the European insurance industry may persist in the future even if a wave of M&A activity occurs in the sector (as expected by market participants), provided that European insurers continue to apply adequate due diligence and insurance contract valuation methodologies throughout the M&A transaction process.

Notes

2 Regulation 1606/2002 of the European Parliament and of the Council of 19 July 2002.

4 IDW (2005).

9 IAA (2008).

CFO Forum 2009, principle 11.

CFO Forum 2009, principle 12.

CFO Forum 2009, principle 14.

E.g. Eling and Kraus 2012.

E.g. DAV (2000).

For an overview refer to e.g. WGARIA (2005).

References

Castedello, M., Klingbeil, C. and Schröder, J. (2006) ‘Abbildung von Unternehmenserwerben und Werthaltigkeitsprüfungen nach IFRS’, Die Wirtschaftsprüfung 59 (16): 1028–1036.

CFO Forum (2009) Market Consistent Embedded Value: Basis for Conclusions. http://www/cfoforum.eu/index.html.

Cummins, J.D., Weiss, M.A. and Klumpes, P.J.M. (2008) Mergers and acquisitions (M&A) in the European and U.S. Insurance Industries: Information Asymmetry and Valuation Effects, working paper, Temple University Philadelphia and Imperial College London.

Deutsche Aktuarvereinigung (DAV) (2000) Rechnungslegung nach IAS/US-GAAP: Aktuarielle Praxis in der Deutschen Lebensversicherung, Cologne: Deutsche Aktuarvereinigung (DAV).

Eling, M. and Kraus, C. (2012) ‘Marktkonsistente Ermittlung des Unternehmenswerts in der Kritik’, Versicherungswirtschaft 67 (2): 110–112.

Engeländer, S. and Kölschbach, J. (2006) ‘A Reliable Fair Value for Insurance Contracts’, The Geneva Papers on Risk and Insurance—Issues and Practice 31 (3): 512–527.

Ellenbürger, F. and Kölschbach, J. (2010) Vor einem großen Schritt hin zu neuen Bilanzierungsstandards, Versicherungswirtschaft 65 (17/18): 1230–1232 and 1303–1308.

Glaum, M. and Wyrwa, S. (2011) Making Acquisitions Transparent: Goodwill Accounting in Times of Crisis, Frankfurt: Moderne Wirtschaft.

Heep-Altiner, M. and Krause, T. (2012) Der Embedded Value im Vergleich zum ökonomischen Kapital in der Schadenversicherung. Cologne University of Applied Sciences.

Institut der Wirtschaftsprüfer (IDW) (2005) ‘IDW Stellungnahme zu Rechnungs legung: Bewertungen bei der Abbildung von Unternehmenserwerben und bei Werthaltigkeitsprüfungen nach IFRS RS HFA 16’, Die Wirtschaftsprüfung 58 (3): 1415–1426.

International Actuarial Association (IAA) (2008) International Actuarial Note 11: Business Combinations under International Financial Reporting Standards IFRS, Ottawa: International Actuarial Association (IAA).

Kanngiesser, S. (2011) ‘Bilanzierung von Versicherungsverträgen’, in N. Lüdenbach and W.-D. Hoffmann (eds.) Haufe IFRS-Kommentar, 8th edn, Freiburg: Haufe.

Koller, T., Murrin, J. and Wessels, D. (2010) Valuation: Measuring and Managing the Value of Companies, 5th edn. New York: Wiley.

Kölschbach, J. and Engeländer, S. (2009) ‘Der Market consistent embedded value als Bewertungsmethode in einer IFRS-Bilanz?’, in Société Générale (ed.) Das Ende der neuen Ideen, Frankfurt, pp. 26–28.

KPMG (2002) US GAAP for Foreign Insurers, 2nd edn, New York: KPMG.

KPMG (2011) Insurance Reporting Round-Up: Based on the 2010 year end results of European insurers, London: KPMG.

KPMG (2012) ‘Moving towards global insurance accounting’, IRFS Insurance Newsletter 25, 24 April.

Morgan, J.P. (2010) European Insurance: Solvency II: A potential game changer, Europe Equity Research, 19 January.

Nguyen, T. and Grosche, S. (2012) ‘Bewertungskonzept zur IFRS-Bilanzierung von versicherungstechnischen Verpflichtungen’, Zeitschrift für Internationale Rechnungslegung 1: 29–34.

Nguyen, T. and Molinari, P. (2009) Jahresabschluss von Versicherungsunternehmen nach internationalen Rechnungslegungsstandards, WHL Graduate School Business and Economics, Lahr.

Nguyen, T. and Molinari, P. (2012) ‘Accounting of “insurance contracts” according to IASB Exposure Draft: Is the Information Useful?’, The Geneva Papers on Risk and Insurance—Issues and Practice, advance online publication, May 2, 2012; doi:10.1057/gpp.2012.11.

Patel, C.C. and Marlo, L.R. (2001) ‘Conversion of European reporting systems to U.S. generally accepted accounting principles: A claims reserve perspective’, In Casualty Actuarial Society 2001 Discussion Papers on Financial and Accounting Systems and Issues Associated with the Globalization of Insurance, Arlington, VA: CAS, pp. 53–73.

PricewaterhouseCoopers (PwC) (2007) Accounting for M&A in the insurance sector: A practical guide to IFRS and US GAAP implications, BusCom issues for insurers.

Rockel, W., Helten, E., Ott, P. and Sauer, R. (2012) Versicherungsbilanzen: Rechnungslegung nach HGB und IFRS, 3rd edn, Stuttgart: Schaeffer-Poeschel.

Sauer, R. (2012) ‘Bilanzierung von Versicherungsverträgen’, in Haufe IFRS-Kommentar, 10th edn, Freiburg: Haufe.

Schertzinger, A.A. and Schiereck, D. (2011) ‘Value creation by M&A transactions in the European insurance market’, Global Journal of Management and Business Research 11 (11): 25–41.

Sieben, G. (1994) ‘Zur Ermittlung des Gesamtwertes von Lebensversicherungsgesellschaften: eine Analyse aus Sicht der Unternehmensbewertungstheorie’, in R. Schwebler (ed.) Dieter Farny und die Versicherungswirtschaft, Karlsruhe: VVW, pp. 479–506.

Working Group “Accounting and Reporting of Intangible Assets” (WGARIA) of the Schmalenbach Gesellschaft (2005) ‘Corporate Reporting on Intangibles: A Proposal from a German Background’, Schmalenbach Business Review (sbr), 57 (2): 65–100.

Zülch, H. and Wünsch, M. (2008) Aufgaben und Methoden der indikativen Kaufpreisallokation (Pre-Deal-Purchase Price Allocation) bei der Bilanzierung von Business Combinations nach IFRS 3, KoR: internationale und kapitalmarktorientierte Rechnungslegung 8 (7/8): 466–474.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Paetzmann, K., Lippl, C. Accounting for European Insurance M&A Transactions: Fair Value of Insurance Contracts and Duplex IFRS/U.S. GAAP Purchase Accounting. Geneva Pap Risk Insur Issues Pract 38, 332–353 (2013). https://doi.org/10.1057/gpp.2012.48

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/gpp.2012.48