Abstract

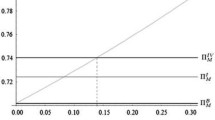

In this paper, we show that under certain conditions, strategic decentralization through the addition of a retailer in the distribution channel can increase a manufacturer's profits. The specific case on which we focus is the quantity coordination (double marginalization) problem for a manufacturer selling durable goods in a two-period setting. We show that the standard solution that coordinates a channel for non-durables does not coordinate the channel for durables. In particular, even though a manufacturer can achieve channel coordination by offering per-period, two-part fees, the equilibrium wholesale price in the first period is strictly above the manufacturer's marginal cost. This is in stark contrast to the two-part solution for non-durables where the equilibrium wholesale price is equal to marginal cost. We also identify a strategy that solves both the channel coordination and the Coase problem associated with durable goods. In this strategy, at the beginning of period 1, the manufacturer writes a contract with the retailer specifying a fixed fee and wholesale prices covering both periods. We show that by adding a retailer and using this contract, the manufacturer makes higher profits than it could if it were to sell directly to consumers.

Similar content being viewed by others

References

Ausubel, L. and R. Deneckere. (1989). “Reputation in Bargaining and Durable Goods Monopoly”, Econometrica 57, 511-531.

Bagnoli, M., S. Salant, and J. Swierzbinski. (1989). “Durable-Goods Monopoly with Discrete Demand”, Journal of Political Economy 97(12), 1459-1478.

Barzel, Y. (1982). “Measurement Cost and the Organization of Markets”, Journal of Law and Economics 25(1), 27-48.

Bond, E. and L. Samuelson. (1984). “Durable Good Monopolies with Rational Expectations and Replacement Sales”, RAND Journal of Economics 15(3), 336-345.

Bulow, J. (1982). “Durable-Goods Monopolist”, Journal of Political Economy 90(2), 314-332.

Bulow, J. (1986). “An Economic Theory of Planned Obsolescence”, Quarterly Journal of Economics 101(4), 729-779.

Butz, D. (1990). “Durable-Good Monopoly and Best Price Provisions”, American Economic Review 80, 729-749.

Coase, R. (1972). “Durability and Monopoly”, Journal of Law and Economics 15(April), 143-149.

Conlisk, J., E. Gerstner, and J. Sobel. (1984). “Cyclic Pricing by a Durable Goods Monopolist”, Quarterly Journal of Economics 99, 489-505.

Desai, P. and D. Purohit. (1998). “Leasing and Selling: Optimal Strategies for a Durable Goods Firm”, Management Science 44(11), S19-S34.

Desai, P. and D. Purohit. (1999). “Competition in Durable Goods Markets: The Strategic Consequences of Leasing and Selling”, Marketing Science 18(1), 42-58.

Fehr, N. and K. Kuhn. (1995). “Coase Versus Pacman: Who Eats Whom in the Durable Goods Monopoly”, Journal of Political Economy 103(4), 785-812.

Fudenberg, D. and J. Tirole. (1998). “Upgrades, Trade-Ins, and Buybacks”, RAND Journal of Economics 29, 235-258.

Huang, S., Y. Yang, and K. Anderson. (2001). “A Theory of Finitely Durable Goods Monopoly with Used-Goods Market and Transaction Costs”, Management Science 47(11), 1515-1532.

Jeuland, A.P. and S.M. Shugan. (1983). “Managing Channel Profits”, Marketing Science 2(3), 239-272.

Kahn, C. (1986). “The Durable Goods Monopolist and Consistency with Increasing Costs”, Econometrica 54(2), 275-294.

Lal, R. (1990). “Improving Channel Coordination Through Franchising”, Marketing Science 9(4), 299-318.

Lal, R., J.D.C. Little, and Miguel Villas-Boas. (1996). “A Theory of Forward Buying, Merchandising and Trade Deals”, Marketing Science 15(1), 21-37.

Moorthy, K. (1987). “Managing Channel Profits: Comment”, Marketing Science 6(4), 375-379.

McGuire, T. and R. Staelin. (1983). “An Industry Equilibrium Analysis of Downstream Vertical Integration”, Marketing Science 2(2), 239-272.

Rao, R. and S. Srinivasan. (1995). “Why Are Royalty Rates Higher in Service Type Franchises?”, Journal of Economics and Management Strategy 4(1), 7-31.

Spengler, J. (1950). “Vertical Integration and Anti-Trust Policy”, Journal of Political Economy 58, 347-352.

Stokey, N. (1981). “Rational Expectations and Durable Goods Pricing”, Bell Journal of Economics 12(Spring), 112-128.

Tirole, J. (1988). The Theory of Industrial Organization. Cambridge, MA: MIT Press.

Villas-Boas, M. (1998). “Product Line Design for a Distribution Channel”, Marketing Science 17(2), 156-169.

Wernerfelt, B. (1994). “On the Function of Sales Assistance”, Marketing Science 13(1), 68-82.

Williamson, Oliver E. (1975). Markets and Hierarchies: Analysis and Antitrust Implications. New York: Free Press.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Desai, P., Koenigsberg, O. & Purohit, D. Strategic Decentralization and Channel Coordination. Quantitative Marketing and Economics 2, 5–22 (2004). https://doi.org/10.1023/B:QMEC.0000017033.09155.12

Issue Date:

DOI: https://doi.org/10.1023/B:QMEC.0000017033.09155.12