Abstract

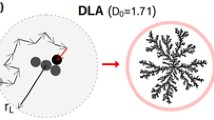

The paper is divided into two parts. We first extend the Boldrin and Montrucchio theorem[5] on the inverse control problem to the Markovian stochastic setting. Given a dynamicalsystem x t+1 = g(x t , z t ), we find a discount factor β* such that for each 0 < β < β* a concaveproblem exists for which the dynamical system is an optimal solution. In the second part,we use the previous result for constructing stochastic optimal control systems having fractalattractors. In order to do this, we rely on some results by Hutchinson on fractals and self‐similarities.A neo‐classical three‐sector stochastic optimal growth exhibiting the Sierpinskicarpet as the unique attractor is provided as an example.

Similar content being viewed by others

References

M.F. Barnsley, Fractals Everywhere, Academic Press, New York, 1988.

M.F. Barnsley and S. Demko, Iterated function systems and the global construction of fractals, Proceedings Royal Society London Series A 399(1985)243-275.

R.N. Bhattacharya and R. Rao, Normal Approximation and Asymptotic Expansion, Wiley, New York, 1976.

J. Benhabib and K. Nishimura, Stochastic equilibrium oscillations, International Economic Review 30(1989)85-101.

M. Boldrin and L. Montrucchio, On the indeterminacy of capital accumulation paths, Journal of Economic Theory 40(1986)26-39.

W.A. Brock and M. Majumdar, Global asymptotic stability results for multisector models of optimal growth under uncertainty when future utilities are discounted, Journal of Economic Theory 18(1978)225-243.

W.A. Brock and L.J. Mirman, Optimal economic growth and uncertainty: The discounted case, Journal of Economic Theory 4(1972)479-513.

J. Dieudonné, Eléments d'Analyse, Vol. 1, Gauthier-Villars, Paris, 1969.

J.B. Donaldson and R. Mehra, Stochastic growth with correlated production shocks, Journal of Economic Theory 29(1983)282-312.

R.M. Dudley, Convergence of Baire measures, Studia Mathematica 28(1966)251-268.

K.J. Falconer, The Geometry of Fractal Sets, Cambridge University Press, Cambridge, 1985.

K.J. Falconer, Dimensions — their determination and properties, in: Fractal Geometry and Analysis, eds. J. Bélair and S. Dubuc, Kluwer Academic, Dordrecht, 1991, pp. 405-468.

C.A. Futia, Invariant distributions and the limiting behavior of Markovian economic models, Econometrica 50(1982)377-408.

M. Hata, Topological aspects of self-similar sets and singular functions, in: Fractal Geometry and Analysis, eds. J. Bélair and S. Dubuc, Kluwer Academic, Dordrecht, 1991, pp. 405-468.

H.A. Hopenhayn and E.C. Prescott, Stochastic monotonicity and stationary distributions for dynamic economies, Econometrica 60(1992)1387-1406.

J. Hutchinson, Fractals and self-similarity, Indiana University Mathematics Journal 30(1981)713-747.

A. Lasota and M.C. Mackey, Chaos, Fractals, and Noise, Springer, New York, 1994.

R.E. Lucas and E.C. Prescott, Investment under uncertainty, Econometrica 5(1971)659-681.

L.J. Mirman, On the existence of steady state measures for one sector growth models with uncertain technology, International Economic Review 13(1972)271-286.

L.J. Mirman, The steady state behavior of a class of one sector growth models with uncertain technology, Journal of Economic Theory 6(1973)219-242.

K. Mitra, On the indeterminacy of capital accumulation paths in a neoclassical stochastic growth model, Cornell University, CAE Working Paper Series 96-05, 1996.

L. Montrucchio, Dynamic complexity of optimal paths and discount factors for strongly concave problems, Journal of Optimization Theory and Applications 80(1994)385-406.

K. Nishimura and G. Sorger, Optimal cycles and chaos: A survey, Studies in Nonlinear Dynamics and Econometrics 1(1996)11-28.

J.M. Ortega and W.C. Rheinboldt, Iterative Solutions of Nonlinear Equations in Several Variables, Academic Press, New York, 1970.

F. Privileggi, Metodi ricorsivi per l'ottimizzazione dinamica stocastica, Ph.D. Dissertation, University of Trieste, 1995.

N.L. Stokey and R.E. Lucas, Recursive Methods in Economic Dynamics, Harvard University Press, Cambridge, MA, 1989.

E.R. Vrscay, Iterated function systems: Theory, applications and the inverse problem, in: Fractal Geometry and Analysis, eds. J. Bélair and S. Dubuc, Kluwer Academic, Dordrecht, 1991.

Rights and permissions

About this article

Cite this article

Montrucchio, L., Privileggi, F. Fractal steady states instochastic optimal control models. Annals of Operations Research 88, 183–197 (1999). https://doi.org/10.1023/A:1018978213041

Issue Date:

DOI: https://doi.org/10.1023/A:1018978213041