Abstract

The management of solid waste has become an urgent problem in nations with a great population density. Accordingly, waste reduction through source reduction and recycling has become increasingly important. Our purpose is to show how prevention, recycling and disposal of waste could be part of a theory of the firm. We first derive efficient production functions from production processes with waste as a by-product. Waste obtained as new scrap can partially be recycled by using additional inputs in order to cut back the purchase of virgin material. Waste not completely recyclable will leave the firm as disposal which also entails cost to the firm. We use the dual cost function approach to develop a theory of the firm under solid residual management.

Since the producer does not bear the full cost of disposal, there will be a bias toward virgin materials and away from recycling. The goal of the government is to stimulate the firms to recycle with respect to the preservation of exhaustible resources. An incentive to recycle is a tax on resources or on waste. In order to determine the tax levels the government maximizes welfare subject to the dynamic constraint for decumulation of land fill for waste deposits. This gives the user cost and its time profile for taxing waste disposal or virgin material.

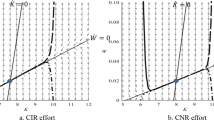

In a comparative statics analysis we compare the effect of taxes on waste vs. virgin material on effort to produce in a resource saving manner, on the quantity of recycled material, on output, and on the reduction of waste. Since the impact of environmental regulation on employment is important, our model detects seven effects on labor demand as part of resource conservation policy. We finally carry out a comparative statics analysis of waste intensive firms operating in different market structures. Of interest is the impact of a resource or waste taxation on market volume, on the number of firms, on resource saving effort, and on profit.

Similar content being viewed by others

References

Anderson, C. L. (1987), ‘The Production Process: Inputs and Wastes’, Journal of Environmental Economics and Management 14, 1–12.

Anderson, R. and R. Spiegelman (1977), ‘Tax Policy and Secondary Material Use’, Journal of Environmental Economics and Management 4, 66–82.

D'Arge, D. C. and K. C. Kogiku (1973), ‘Economic Growth and the Environment’, Review of Economic Studies 40, 61–76.

Ayres, R. U. and A. Kneese (1969), ‘Production, Consumption, and Externalities’, American Economic Review LIX, 282–297.

Ayres, R. U. (1996), ‘Industrial Metabolism: Work in Progress’, in J. van den Bergh and M.W. Hofkes, eds., Economic Modeling of Sustainable Development, Kluwer, forthcoming.

Baumol, W. J. (1977), ‘On Recycling as a Moot Environmental Issue’, Journal of Environmental Economics and Management 4, 83–87.

Conrad, K. and J. Wang (1993), ‘The Effect of Emission Taxes and Abatement Subsidies on Market Structure’, International Journal of Industrial Organization 11, 499–518.

Dinan, T. M. (1993), ‘Economic Efficiency Effects of Alternative Policies for Reducing Waste Disposal’, Journal of Environmental Economics and Management 25, 242–256.

Dobbs, J. M. (1991), ‘Litter and Waste Management: Disposal Taxes Versus User Charges’, Canadian Journal of Economics 24, 221–227.

Faber, M. and P. Michaelis (1989), ‘Änderungen der Produktions-und Verbrauchsweise durch Umweltabgaben am Beispiel der Abfallwirtschaft’, in H. G. Nutzinger and A. Zahrnt, eds., Umweltabgaben in der Diskussion, Verlag C. F. Mueller, Karlsruhe.

Faber, M., Stephan, G. and P. Michaelis (1989), Umdenken in der Abfallwirtschaft: Verwerten, Vermeiden, Beseitigen, 2. ed., Heidelberg: Springer Verlag.

Fullerton, D. and T. C. Kinnaman (1995), ‘Garbage, Recycling and Illicit Burning or Dumping’, Journal of Environmental Economics and Management 29, 78–91.

Fullerton, D. and W. Wu (1996), ‘Policies for Green Design’, NBER Working Paper Series, No. 5594, Cambridge, MA.

Hoel, M. (1978), ‘Resource Extraction and Recycling with Environmental Costs’, Journal of Environmental Economics and Management 5, 220–235.

Hughes, J. P. (1978), ‘Factor Demand in the Multi-product Firm’, Southern Economic Journal 45, 494–501.

Huhtala, A. (1997), ‘A Post-consumer Waste Management Model for Determining Optimal Levels of Recycling and Landfilling’, Environmental and Resource Economics 10, 301–314.

Jaeger, K. (1980), ‘Ansätze zu einer ökonomischen Theorie des Recycling’, in M. Siebert, ed., Erschöpfbare Ressourcen, Berlin: Duncker & Humblot, pp. 149–174.

Keeler, E., M. Spence and R. Zeckhauser (1971), ‘The Optimal Control of Pollution’, Journal of Economic Theory 4, 19–34.

Kirchgässner, G. (1977), ‘Eine ökonomische Theorie des Recycling: Kommentar’, Kyklos 30, 699–703.

Lusky, R. (1976), ‘A Model of Recycling and Pollution Control’, Canadian Journal of Economics 9, 91–101.

Mc Niel, D. and A. Foshee (1992), ‘Hazardous Waste Disposal: A Comparative Analysis of Regulation, Taxes and Subsidies’, Journal of Economics and Finance 16(2), 91–101.

Morris, G. E. and D. M. Holthausen (1994), ‘The Economics of Household Solid Waste Generation and Disposal’, Journal of Environmental Economics and Management 26, 215–234.

Pearce, D. W. and I. Walter (ed.) (1977), Resource Conservation; Social and Economic Dimensions of Recycling, New York.

Plourde, C. G. (1972), ‘A Model of Waste Accumulation and Disposal’, Canadian Journal of Economics 5, 119–125.

Porteous, A. (1977), Recycling Resource Refuse, London, New York.

Porter, M. E. and C. van der Linde (1995), ‘Towards a New Conception of the Environment-competitiveness Relationship’, Journal of Economic Perspectives 9(4), 97–118.

Ready, M. J. and R. C. Ready (1995), ‘Optimal Pricing of Depletable, Replaceable Resources: The Case of Landfill Tipping Fees’, Journal of Environmental Economics and Management 28, 307–323.

Rousso, A. D. and S. P. Sha (1994), ‘Packaging Taxes and Recycling Incentives: the German Green Dot Program’, National Tax Journal 47, 689–701.

Schlottmann, A. (1977), ‘New Life for Old Garbage: Resource and Energy Recovery from Solid Wastes’, Journal of Environmental Economics and Management 4, 57–67.

Sigman, H. A. (1995), ‘A Comparison of Public Policies for Lead Recycling’, RAND Journal of Economics 26, 452–478.

Smith, V. L. (1972), ‘Dynamics of Waste Accumulation: Disposal Versus Recycling’, Quarterly Journal of Economics 86, 600–616.

Spofford Jr., W. O. (1971), ‘Solid Residual Management. Some Economic Considerations’, Natural Resource Journal 11, 561–589.

Tietenberg, T. (1994), Environmental Economics and Policy, New York; Harper Collins.

Uimonen, S. (1994), ‘Emission Taxes vs. Financial Subsidies in Pollution Control’, Journal of Economics 3, 281–297.

Weinstein, M. C. and R. J. Zeckhauser (1974), ‘Use Patterns for Depletable and Recycleable Resources’, Review of Economic Studies, Vol. 41, Symposium on the Economics of Exhaustible Resources, pp. 67–88.

Wertz, K. L. (1976), ‘Economic Factors Influencing Households' Production of Refuse’, Journal of Environmental Economics and Management 2, 263–272.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Conrad, K. Resource and Waste Taxation in the Theory of the Firm with Recycling Activities. Environmental and Resource Economics 14, 217–242 (1999). https://doi.org/10.1023/A:1008301626219

Issue Date:

DOI: https://doi.org/10.1023/A:1008301626219