Abstract

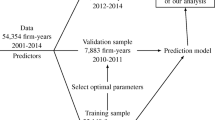

On-site examinations are regulators' primary tool for monitoring the financial condition of federally insured depository institutions. In this paper, we assess the speed with which the information content of the supervisory rating assigned during bank exams—the CAMEL rating—decays. This is an important issue because cost and regulatory burden considerations often cause CAMEL ratings to be assigned relatively infrequently. As a benchmark for information content, we use econometric forecasts of bank failures generated by applying a probit model to publicly available accounting data. When compared with all CAMEL ratings available at a given point in time, the econometric forecasts provide a more accurate indication of failure. Further analysis reveals that this overall finding reflects the tendency for a CAMEL rating's information content to deteriorate noticeably beginning in the second or third quarter after the rating initially was assigned.

Similar content being viewed by others

References

Berger, Allen N., and Sally M. Davies, “The Information Content of Bank Examinations,” Finance and Economics Discussion Series No. 94-20, Board of Governors of the Federal Reserve System, 1994.

Berger, Allen N., Kathleen Kuester King, and James M. O'Brien, “The Limitations of Market Value Accounting and a More Realistic Alternative,” Journal of Banking and Finance 15 (September 1991), 753–783.

Bovenzi, John F., James A. Marino, and Frank E. McFadden, “Commercial Bank Failure Prediction Models,” Economic Review, Federal Reserve Bank of Atlanta (November 1983), 14–26.

Cargill, Thomas F., “CAMEL Ratings and the CD Market,” Journal of Financial Services Research 3 (December 1989), 347–358.

Cole, Rebel A., “When Are Thrift Institutions Closed? An Agency-Theoretic Model,” Journal of Financial Services Research 7 (December 1993), 283–307.

Cole, Rebel A., Barbara G. Cornyn, and Jeffery W. Gunther, “FIMS: A New Monitoring System for Banking Institutions,” Federal Reserve Bulletin 81 (January 1995), 1–15.

Cole, Rebel A., and Jeffery W. Gunther, “Separating the Likelihood and Timing of Bank Failure,” Journal of Banking and Finance 19 (September 1995), 1073–1089.

Demirguc-Kunt, Asli, “Modeling Large Commercial-Bank Failures: A Simultaneous-Equations Approach,” Working Paper 8905, Federal Reserve Bank of Cleveland, 1989.

Federal Deposit Insurance Corporation, History of the Eighties—;Lessons for the Future (December 1997).

Flannery, Mark J., and Joel F. Houston, “Market Responses to Federal Examinations of U.S. Bank Holding Companies,” mimeo, University of Florida, 1994.

Gajewski, Gregory R., “Assessing the Risk of Bank Failure,” Proceedings of a Conference on Bank Structure and Competition, Federal Reserve Bank of Chicago (May 1989), pp. 432–456.

Gilbert, R. Alton, and Sangkyun Park, “The Value of Early Warning Models in Bank Supervision,” mimeo, Federal Reserve Bank of St. Louis, 1994.

Hirschhorn, Eric, “The Information Content of Bank Examination Ratings,” Federal Deposit Insurance Corporation Banking and Economic Review (July-August 1987), 6–11.

Jones, David S., and Kathleen Kuester King, “The Implementation of Prompt Corrective Action: An Assessment,” Journal of Banking and Finance 19 (June 1995), 491–510.

Korobow, Leon, and David P. Stuhr, “The Relevance of Peer Groups in Early Warning Analysis,” Economic Review, Federal Reserve Bank of Atlanta (November 1983), 27–34.

Sinkey, Joseph F., Jr., “A Multivariate Statistical Analysis of the Characteristics of Problem Banks, Journal of Finance 30 (March 1975), 21–36.

Thomson, James B., “Modeling the Regulator's Closure Option: A Two-Step Logit Regression Approach,” Journal of Financial Services Research 6 (May 1992), 5–23.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Cole, R.A., Gunther, J.W. Predicting Bank Failures: A Comparison of On- and Off-Site Monitoring Systems. Journal of Financial Services Research 13, 103–117 (1998). https://doi.org/10.1023/A:1007954718966

Issue Date:

DOI: https://doi.org/10.1023/A:1007954718966