Abstract

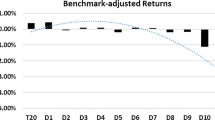

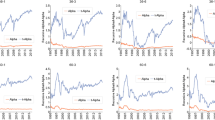

We explore the validity of different benchmark specifications used to evaluate U.K. fund performance, and we examine the sensitivity of U.K. unit trust performance to the factor benchmark specification and two performance measures. Our findings suggest that the different benchmark specifications create some bias when we evaluate U.K. fund performance with either performance measure. We find that the performance of the trusts is sensitive to the factor benchmark specification used, but not to the performance measure. We also find significant time-series variations in the abnormal performance of the trusts.

Similar content being viewed by others

References

Blake, David, and Allan Timmermann. “Mutual Fund Performance: Evidence from the UK.” European Finance Review 2 (1998), 57–77.

Cai, Jun, Kalok C. Chan, and Takeshi Yamada. “The Performance of Japanese Mutual Funds.” Review of Financial Studies 10 (April 1997), 237–273.

Carhart, Mark M. “Persistence in Mutual Fund Performance.” Journal of Finance 52 (March 1997), 57–82.

Carhart, Mark M., Jennifer N. Carpenter, Anthony W. Lynch, A. W., and David K. Musto. “Mutual Fund Survivorship.” New York University, working paper, 2001.

Chalmers, John M. R., Roger M. Edelen, and Gregory B. Kadlec. “Mutual Fund Trading Costs.” Wharton School, University of Pennsylvania, working paper, 1999.

Chan, Louis K. C., Hsiu-Lang Chen, and Josef Lakonishok. “On Mutual Fund Investment Styles.” National Bureau of Economic Research, working paper, 1999.

Chen, Nai-Fu, Richard Roll, and Stephen A. Ross. “Economic Forces and the Stock Market.” Journal of Business 59 (July 1986), 383–403.

Chen, Zhiwu, and Peter J. Knez. “Portfolio Performance Measurement: Theory and Applications.” Review of Financial Studies 9 (April 1996), 511–555.

Christopherson, Jon A., Wayne E. Ferson, and Debra A. Glassman. “Conditioning Manager Alphas on Economic Information: Another Look at the Persistence of Performance.” Review of Financial Studies 11 (April 1998), 111–142.

Christopherson, Jon A., Wayne E. Ferson, and Andrew L. Turner. “Performance Evaluation using Conditional Alphas and Betas.” Journal of Portfolio Management 26 (Fall 1999), 59–72.

Connor, Gregory, and Robert A. Korajcyzk. “Performance Measurement with the Arbitrage Pricing Theory: A New Framework for Analysis.” Journal of Financial Economics 15 (March 1986), 373–394.

Connor, Gregory, and Robert A. Korajcyzk. “The Attributes, Behavior and Performance of US Mutual Funds.” Review of Quantitative Finance and Accounting 1 (January 1991), 5–26.

Daniel, Kent, Mark Grinblatt, Sheridan Titman, and Russ Wermers. “Measuring Mutual Fund Performance with Characteristic-based Benchmarks.” Journal of Finance 52 (July 1997), 1035–1058.

Elton, Edwin J., Martin J. Gruber, Sanjiv Das, and Matthew Hlavka. “Efficiency with Costly Information: A Reinterpretation of the Evidence.” Review of Financial Studies 6 (January 1993), 1–22.

Elton, Edwin J., Martin J. Gruber, and Christopher R. Blake. “The Persistence of Risk-adjusted Mutual Fund Performance.” Journal of Business 69 (April 1996), 133–157.

Fama, Eugene F., and Kenneth R. French. “Dividend Yields and Expected Stock Returns.” Journal of Financial Economics 22 (October 1988), 3–25.

Fama, Eugene F., and Kenneth R. French. “The Cross-section of Expected Returns.” Journal of Finance 47 (June 1992), 427–465.

Fama, Eugene F., and Kenneth R. French. “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics 33 (February 1993), 3–56.

Fama, Eugene F., and Kenneth R. French. “Value versus Growth: The International Evidence.” Journal of Finance 53 (December 1998), 1975–1999.

Ferson, Wayne E., and Rudi W. Schadt. “Measuring Fund Strategy and Performance in Changing Economic Conditions.” Journal of Finance 51 (June 1996), 425–461.

Ferson, Wayne E., and Vincent A. Warther. “Evaluating Fund Performance in a Dynamic Market.” Financial Analysts Journal 52 (November–December 1996), 20–28.

Ferson, Wayne E., and Campbell R. Harvey. “Conditioning Variables and the Cross-section of Stock Returns.” Journal of Finance 54 (August 1999), 1325–1360.

Fletcher, Jonathan. “An Examination of UK Unit Trust Performance within the Arbitrage Pricing Theory Framework.” Review of Quantitative Finance and Accounting 8 (March 1997), 91–107.

Gibbons, Michael R., Stephen A. Ross, and Jay Shanken, “A Test of the Efficiency of a Given Portfolio.” Econometrica 57 (September 1989), 1121–1152.

Grinblatt, Mark, and Sheridan Titman. “Portfolio Performance Evaluation: Old Issues and New Insights.” Review of Financial Studies 2 (April 1989), 393–422.

Grinblatt, Mark, and Sheridan Titman. “A Study of Monthly Mutual Fund Returns and Performance Evaluation Techniques.” Journal of Financial and Quantitative Analysis 29 (September 1994), 419–444.

Gruber, Martin J. “Another Puzzle: The Growth in Actively Managed Mutual Funds.” Journal of Finance 51 (July 1996), 783–810.

Heston, Steven L., K. Geert Rouwenhorst, and Roberto E. Wessels. “The Structure of International Stock Markets and the Integration of Capital Markets.” Journal of Empirical Finance 2 (September 1995), 173–199.

Jegadeesh, Narasimhan, and Sheridan Titman. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” Journal of Finance 48 (March 1993), 65–91.

Jensen, Michael C. “The Performance of Mutual Funds in the Period 1945–1964.” Journal of Finance 23 (May 1968), 389–416.

Keim, Donald B., and Robert F. Stambaugh. “Predicting Return in the Bond and Stock Market.” Journal of Financial Economics 17 (December 1986), 357–390.

Lehmann, Bruce, and David Modest. “Mutual Fund Performance Evaluation: A Comparison of Benchmarks and Benchmark Comparisons.” Journal of Finance 42 (June 1987), 233–265.

Liew, Jimmy, and Maria Vassalou. “Can Book-to-Market, Size and Momentum be Risk Factors that Predict Economic Growth.” Journal of Financial Economics 57 (August 2000), 221–245.

Liu, Weimin, Norman Strong, and Xinzhong Xu. “The Profitability of Momentum Investing.” Journal of Business Finance and Accounting 26 (November–December 1999), 1043–1091.

Otten, Roger, and Dennis Bams. “European Mutual Fund Performance.” Maastricht University, working paper, 2000.

Pastor, Lubos and Robert F. Stambaugh. “Mutual Fund Performance and Seemingly Unrelated Assets.” Journal of Financial Economics (2001), forthcoming.

Roll, Richard. “Ambiguity When Performance is Measured by the Securities Market Line.” Journal of Finance, 33 (September 1978), 1051–1069.

Shanken, Jay. “On the Estimation of Beta-pricing Models.” Review of Financial Studies 5 (January 1992), 1–55.

Strong, Norman, and Gary X. Xu. “Explaining the Cross-section of UK Expected Stock Returns.” British Accounting Review 29 (March 1997), 1–24.

Wermers, Russ. “Mutual Fund Performance: An Empirical Decomposition into Stock-picking Talent, Style, Transactions Costs, and Expenses.” Journal of Finance 55 (August 2000), 1655–1695.

White, Halbert. “A Heteroskedasticity-consistent Covariance Matrix and a Direct Test for Heteroskedasticity.” Economterica 48 (May 1980), 817–883.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Fletcher, J., Forbes, D. U.K. Unit Trust Performance: Does it Matter Which Benchmark or Measure is Used?. Journal of Financial Services Research 21, 195–218 (2002). https://doi.org/10.1023/A:1015029410199

Issue Date:

DOI: https://doi.org/10.1023/A:1015029410199