Abstract

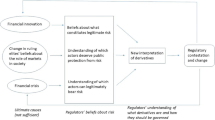

The paper focuses on financial transactions, addressing over-the-counter (OTC) trading of derivatives, which many analyses of the recent financial crisis argue produced significant problems. This area of financial activity grew massively from the 1990s, facilitated by legal developments in both the US and the UK that ruled out any state regulation of the market whilst at the same time affirming that the contracts made in the area were fully legally enforceable in US and UK law. At the same time, the private association, the International Swaps and Derivatives Association (ISDA), developed the Model Contract and international private soft law agreements that were generally respected by national legal systems and provided an agreed framework for OTC contracts. The paper explores how this lack of public regulation was legitimated, and the interests which lay behind this legitimation process. It then considers how the financial crisis and the role of OTC derivatives forced a re-opening of the issue of how these markets should be regulated. The paper explores the interplay between what may be described as technical fixes to regulatory problems, on the one hand, and the efforts of private and public actors to defend their interests by shaping the new markets in particular ways, on the other.

Similar content being viewed by others

References

E. Engelen, I. Erturk, J. Froud, A. Leaver and K. Williams, ‘Reconceptualizing Financial Innovation: Frame, Conjuncture and Bricolage’, 39 Economy and Society (2010) p. 33.

R. La Porta, F. Lopez-de-Silanes, A. Shleifer and R. Vishny, ‘Law and Finance’, 106 Journal of Political Economy (1998) p. 1113.

G.A. Krippner, Capitalizing on Crisis: The Political Origins of the Rise of Finance (Cambridge, Mass., Harvard University Press 2011).

Bank for International Settlements, BIS Quarterly Review June 2009 (Basel, BIS 2009a).

Bank for International Settlements, OTC Derivatives Market Activity in the Second Half of 2008 (Basel, BIS 2009b).

G. Morgan, ‘Market Formation and Governance in International Financial Markets: The Case of OTC Derivatives’, 61 Human Relations (2008) p. 637.

D. MacKenzie and Y. Millo, ‘Constructing a Market, Performing Theory: The Historical Sociology of a Financial Derivatives Exchange’, 109 American Journal of Sociology (2003) p. 107.

L.A. Stout, ‘Why the Law Hates Speculators: Regulation and Private Ordering in the Market for OTC Derivatives’, 48 Duke Law Journal (1999) p. 701.

L.A. Stout, ‘Why We Need Derivatives Regulation’, New York Times, 7 October 2009.

Stout, supra n. 8, at p. 779.

P.S. Goodman, ‘The Reckoning: Taking a Hard New Look at a Greenspan Legacy’, New York Times, 9 October 2008.

Over-the-Counter Derivatives Markets and the Commodity Exchange Act, Report of the President’s Working Group on Financial Markets (Washington, DC. 1999).

Stout, supra n. 9.

A.W. Glass, ‘The Regulatory Drive Towards Central Counterparty Clearing of OTC Derivatives and the Necessary Limits on This’, 4 Capital Markets Law Journal (2009) p. S79.

G. Tett, Fool’s Gold (London, Little, Brown 2009), at p. 87.

MacKenzie and Millo, supra n. 7.

B. Born, ‘International Regulatory Responses to Derivatives Crises: The Role of the U.S. Commodity Futures Trading Commission’, 21 Northwestern Journal of International Law & Business (2001) p. 607.

M. Lewis, The Big Short: Inside the Doomsday Machine (London, Allen Lane 2010).

Tett, supra n. 15, ch. 1.

M. Phillips, ‘The Monster That Ate Wall Street: How “Credit Default Swaps” — An Insurance Against Bad Loans — Turned from a Smart Bet into a Killer’, Newsweek, 27 September 2008.

Bank for International Settlements, New Developments in Clearing and Settlement Arrangements for OTC Derivatives (Basel, BIS 2007).

R. Zabel, ‘Credit Default Swaps: From Protection to Speculation’ (2008), available at: <http://www.rkmc.com/Credit-Default-Swaps-From-Protection-To-Speculation.htm>.

Stout, supra n. 9.

Lewis, supra n. 18.

N. Bullock, M. Mackenzie and G. Tett, ‘CDS Market’s Big Bang Arrives’, Financial Times (London), 7 April 2009.

I. Huault and H. Rainelli-Le Montagner, ‘Market Shaping as an Answer to Ambiguities: The Case of Credit Derivatives’, 30 Organization Studies (2009) p. 549.

Morgan, supra n. 6.

Glass, supra n. 14, at p. S88.

ISDA, ISDA Margin Survey 2009 (2009), at p. 2.

Bank for International Settlements (2009b), supra n. 5, at p. 7.

ISDA, ISDA Margin Survey 2009 (2009).

Bank for International Settlements (2009b), supra n. 5.

AIG, ‘AIG Discloses Counterparties to CDS, GIA and Securities Lending Transactions’ (15 March 2009), available at: <http://www.aigcorporate.com/index.html>; R. Boyle, Fatal Risk: A Cautionary Tale of AIG’s Corporate Suicide (New Jersey, Wiley 2009).

E. Helleiner, S. Pagliari and H. Zimmermann, Global Finance in Crisis: The Politics of International Regulatory Change (London, New York, Routledge 2010).

G20, London Summit Communiqué, 2 April 2009, available at: <http://www.londonsummit.gov.uk/resources/en/news/15766232/communique-020409.

G20 Leaders’ Statement, Pittsburgh Summit (25 September 2009).

T. Smith, ‘The Facts Belie the Diagnosis on Credit Derivatives’, Financial Times, 5 July 2009.

Glass, supra n. 14, at p. S95. See also L. Jones, Current Issues Affecting the OTC Derivatives Market and Its Importance to London (London, City of London 2009).

ISDA, ISDA’s Comments on Clearing Agency Standards for Operation and Governance (29 April 2011), available at: <http://www2.isda.org/functional-areas/public-policy/united-states/page/3>.

Financial Stability Board, OTC Derivatives Market Reforms Progress Report on Implementation (April 2011), at p. 1, available at: <http://www.financialstabilityboard.org/publications/r_110415b.pdf>.

Ibid., at p. 2.

European Commission, Regulation on Over-the-Counter Derivatives and Market Infrastructures — Frequently Asked Questions (Brussels).

G. Morgan, ‘Supporting the City: Economic Patriotism in Financial Markets’, 19 Journal of European Public Policy (2012) p. 373.

G. Morgan, ‘Legitimacy in Financial Markets: Credit Default Swaps in the Current Crisis’, 8 Socio-Economic Review (2010) p. 17.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Morgan, G. Reforming OTC Markets: The Politics and Economics of Technical Fixes. Eur Bus Org Law Rev 13, 391–412 (2012). https://doi.org/10.1017/S1566752912000286

Published:

Issue Date:

DOI: https://doi.org/10.1017/S1566752912000286