Abstract

This study aims to examine the effects of exchange rate misalignment on tax revenue mobilisation on a global scale. The results from the IV-2SLS for a sample of 105 countries between the 2002–2019 periods are as follows: (i) exchange rate misalignment enhances revenue mobilisation on a global scale, a result that varies by income group, level of development, and geographical groupings. (ii) The effect of exchange rate misalignment on revenue mobilisation is rather negative in Africa, America, and Europe. (iii) REER misalignment interacts with trade openness to produce positive net effects in upper-middle-income and high-income countries. The trade openness thresholds required to nullify this positive effect are 71.395881 (%GDP) and 17.0984456 (%GDP), respectively. (iv) REER misalignment interacts with trade openness to produce positive net effects in the global sample, the developed and developing economies. The trade openness thresholds required to nullify these effects are 52.335329 (%GDP), 38.818181 (%GDP), and 63.5359116 (%GDP), respectively. The interaction rather yields negative net effects for America up to a trade openness threshold of 84.641638 (%GDP) when the effect is nullified. Practical policy implications are discussed.

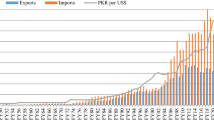

Source: Authors’ computation. Mis-REER is exchange rate misalignment; the continents are classified using the World Atlas

Source: Authors’ computation

Source: Authors’ computation. The continents are classified using the World Atlas

Similar content being viewed by others

Notes

The income groups follow the 2022 World Bank classification of income groups.

References

Achuo, E., Asongu, S., & Tchamyou, V. (2022). Women empowerment and environmental sustainability in Africa. Association for Promoting Women in Research and Development in Africa, ASPROWORDA WP 22/003. https://ideas.repec.org/p/aak/wpaper/22-003.html

Achuo, E. D. (2023). Resource wealth and the development dilemma in Africa: The role of policy syndromes. Resources Policy, 83, 103644. https://doi.org/10.1016/j.resourpol.2023.103644

Achuo, E. D., Nchofoung, T. N., Asongu, A. S. & Dinga, G. D. (2021). Unravelling the mysteries of underdevelopment in Africa. African Governance and Development Institute WP/21/073. http://www.afridev.org/RePEc/agd/agd-wpaper/Unravelling-the-Mysteries-of-Underdevelopment-in-Africa.pdf

Adam, C. S., Bevan, D. L., & Chambas, G. (2001). Exchange rate regimes and revenue performance in Sub-Saharan Africa. Journal of Development Economics, 64(1), 173–213.

Agbeyegbe, T. D., Stotsky, J., & WoldeMariam, A. (2006). Trade liberalization, exchange rate changes, and tax revenue in Sub-Saharan Africa. Journal of Asian Economics, 17(2), 261–284.

Bahmani-Oskooee, M. (1985). Devaluation and the J-curve: Some evidence from LDCs. The Review of Economics and Statistics, 67, 500–504.

Bahmani-Oskooee, M., & Gelan, A. (2012). Is there J-curve effect in Africa? International Review of Applied Economics, 26(1), 73–81.

Bahmani-Oskooee, M., & Kutan, A. M. (2009). The J-curve in the emerging economies of Eastern Europe. Applied Economics, 41(20), 2523–2532.

Bikai, J. L., & Owoundi, F. (2016). Does the choice of an exchange rate regime limits exchange rate misalignments? University Library of Munich.

Botlhole, T., Asafu-Adjaye, J. O. H. N., & Carmignani, F. (2012). Natural resource abundance, institutions and tax revenue mobilisation in Sub-Sahara Africa. South African Journal of Economics, 80(2), 135–156.

Calvo, G. A., Izquierdo, A., & Talvi, E. (2003). Sudden stops, the real exchange rate, and fiscal sustainability: Argentina's lessons. NBER Working Paper No. 9828.

Choudhry, T., & Hassan, S. S. (2015). Exchange rate volatility and UK imports from developing countries: The effect of the global financial crisis. Journal of International Financial Markets, Institutions and Money, 39, 89–101.

Clark, P. B., & MacDonald, R. (1999). Exchange rates and economic fundamentals: A methodological comparison of BEERs and FEERs. In R. MacDonald & J. L. Stein (Eds.), Equilibrium exchange rates (pp. 285–322). Springer.

Cottani, J. A., Cavallo, D. F., & Khan, M. S. (1990). Real exchange rate behavior and economic performance in LDCs. Economic Development and Cultural Change, 39(1), 61–76.

Coudert, V., & Couharde, C. (2009). Currency misalignments and exchange rate regimes in emerging and developing countries. Review of International Economics, 17(1), 121–136.

Couharde, C., Delatte, A. L., Grekou, C., Mignon, V., & Morvillier, F. (2018). Eqchange: A world database on actual and equilibrium effective exchange rates. International Economics, 156, 206–230.

Dada, E. A., & Oyeranti, O. A. (2012). Exchange rate and macroeconomic aggregates in Nigeria. Journal of Economics and Sustainable Development, 3(2), 93–101.

Edwards, S. (1988). Real and monetary determinants of real exchange rate behavior: Theory and evidence from developing countries. Journal of Development Economics, 29(3), 311–341.

Edwards, S. (1998). Openness, productivity and growth: What do we really know?. The economic journal, 108(447), 383–398.

Ehigiamusoe, K. U., & Lean, H. H. (2019). Influence of real exchange rate on the finance-growth nexus in the West African Region. Economies, 7(1), 23–43. https://doi.org/10.3390/economies7010023

Elbadawi, I. A., Kaltani, L., & Soto, R. (2012). Aid, real exchange rate misalignment, and economic growth in Sub-Saharan Africa. World Development, 40(4), 681–700.

Fiaz, A., Khurshid, N., Satti, A., & Malik, M. S. (2021). Real exchange rate misalignment in Pakistan: An application of regime switching model. The Journal of Asian Finance, Economics and Business, 8(12), 63–73.

Fišera, B., & Horváth, R. (2021). Are exchange rates less important for trade in a more globalized world? Evidence for the new EU members. Economic Systems, 45(4), 100868. https://doi.org/10.1016/j.ecosys.2021.100868

Fornaro, L. (2015). Financial crises and exchange rate policy. Journal of International Economics, 95(2), 202–215.

Fratzscher, M. (2009). What explains global exchange rate movements during the financial crisis? Journal of International Money and Finance, 28(8), 1390–1407.

Ghura, D., & Grennes, T. J. (1993). The real exchange rate and macroeconomic performance in Sub-Saharan Africa. Journal of Development Economics, 42(1), 155–174.

Gnangnon, S. K. (2022). Financial development and tax revenue in developing countries: Investigating the international trade channel. SN Business & Economics, 2(1), 1–26.

Gnangnon, S. K., & Brun, J. F. (2018). Impact of bridging the Internet gap on public revenue mobilisation. Information Economics and Policy, 43, 23–33.

Gnangnon, S. K., & Brun, J. F. (2019). Trade openness, tax reform and tax revenue in developing countries. The World Economy, 42(12), 3515–3536.

Gnimassoun, B. (2017). Exchange rate misalignments and the external balance under a pegged currency system. Review of International Economics, 25(5), 949–974.

Gnimassoun, B., & Coulibaly, I. (2014). Current account sustainability in Sub-Saharan Africa: Does the exchange rate regime matter? Economic Modelling, 40, 208–226.

Gupta, K. (2021). The importance of financial liberalisation for economic growth: The case of Indonesia. Bulletin of Indonesian Economic Studies, 57(2), 175–201.

Gwaindepi, A. (2021). Domestic revenue mobilisation in developing countries: An exploratory analysis of sub-Saharan Africa and Latin America. Journal of International Development, 33(2), 396–421.

Ismaila, M. (2016). Exchange rate depreciation and Nigeria economic performance after structural adjustment programmes (SAPs). NG-Journal of Social Development, 5(2), 122–132.

Kalogiannidis, S. (2021). Role of revenue mobilisation in the growth and development of economy: A case analysis of Greece. Research in World Economy, 12(2), 63–76.

Keefe, H. G., & Saha, S. (2021). Threshold effects of openness on real and nominal effective exchange rates in emerging and developing economies. The World Economy, 44(11), 1386–1408. https://doi.org/10.1111/twec.13212

Khattab, A., & Salmi, Y. (2021). Economic optimality of the exchange rate regime applied in Morocco. Journal of Economics Library, 8(2), 78–88.

Khattry, B., & Rao, J. M. (2002). Fiscal faux pas? An analysis of the revenue implications of trade liberalization. World Development, 30(8), 1431–1444.

Kiviet, J. F. (2020). Microeconometric dynamic panel data methods: Model specification and selection issues. Econometrics and Statistics, 13, 16–45.

Kiviet, J. F. (2023). Instrument-free inference under confined regressor endogeneity and mild regularity. Econometrics and Statistics, 25, 1–22.

Krugman, P. R. (1993). The narrow and broad arguments for free trade. The American Economic Review, 83(2), 362–366.

Laffer, A. B. (1981). Government exactions and revenue deficiencies. Cato Journal, 1(1), 1–21.

Laffer, A. B. (2004). The Laffer curve: Past, present, and future. Backgrounder, 1765(1), 1–16.

Li, X. (2004). Trade liberalization and real exchange rate movement. IMF Staff Papers, 51(3), 553–584.

MacDonald, R. (1999). What determines real exchange rates? The long and the short of it. In R. MacDonald & J. L. Stein (Eds.), Equilibrium exchange rates (pp. 241–284). Springer.

Magee, S. P. (1973). Currency contracts, pass-through, and devaluation. Brookings Papers on Economic Activity, 1973(1), 303–325.

Mallick, H. (2021). Do governance quality and ICT infrastructure influence the tax revenue mobilisation? An empirical analysis for India. Economic Change and Restructuring, 54(2), 371–415.

Mawejje, J. (2019). Natural resources governance and tax revenue mobilisation in sub saharan Africa: The role of EITI. Resources Policy, 62, 176–183.

Maziriri, E. T., Mutodi, K., & Chuchu, T. (2021). Real exchange rate misalignment and economic growth NEXUS: Evidence from Southern African Countries. KINERJA, 25(2), 217–233. https://doi.org/10.24002/kinerja.v25i2.4401

Mazorodze, B. T. (2021). Exchange rate misalignment, state fragility, and economic growth in sub-Saharan Africa. Cogent Economics & Finance, 9(1), 1898113.

Morrissey, O., Von Haldenwang, C., Von Schiller, A., Ivanyna, M., & Bordon, I. (2016). Tax revenue performance and vulnerability in developing countries. The Journal of Development Studies, 52(12), 1689–1703.

Mugano, G., & Brookes, M. (2021). Trade liberalisation and economic development in Africa. Routledge. https://doi.org/10.4324/9781003160199

Nasir, M. A., & Jackson, K. (2019). An inquiry into exchange rate misalignments as a cause of major global trade imbalances. Journal of Economic Studies, 46(4), 902–924.

Nchofoung, T. N. (2022). Trade shocks and labour market Resilience in Sub-Saharan Africa: Does the franc zone response differently? International Economics, 169, 161–174. https://doi.org/10.1016/j.inteco.2022.01.001

Nchofoung, T. N., Achuo, E. D., & Asongu, S. A. (2021). Resource rents and inclusive human development in developing countries. Resources Policy, 74, 102382.

Nchofoung, T. N., & Asongu, S. A. (2022a). ICT for sustainable development: Global comparative evidence of globalisation thresholds. Telecommunications Policy, 46(5), 102296.

Nchofoung, T. N., & Asongu, S. A. (2022b). Effects of infrastructures on environmental quality contingent on trade openness and governance dynamics in Africa. Renewable Energy, 189, 152–163. https://doi.org/10.1016/j.renene.2022.02.114

Ndikumana, L., & Abderrahim, K. (2010). Revenue mobilisation in African countries: Does natural resource endowment matter? African Development Review, 22(3), 351–365.

Ngouhouo, I., Nchofoung, T., & Njamen Kengdo, A. A. (2021). Determinants of trade openness in sub-Saharan Africa: Do institutions matter?. International Economic Journal, 35(1), 96–119.

Nkalu, N., Urama, N., & Asogwa, F. (2016). Trade openness and exchange rate fluctuations nexus in Nigeria. European Journal of Scientific Research, 138, 139–144.

Nutahara, K. (2015). Laffer curves in Japan. Journal of the Japanese and International Economies, 36, 56–72.

Ofori, K. I., Obeng, C. K., & Armah, M. K. (2018). Exchange rate volatility and tax revenue: Evidence from Ghana. Cogent Economics & Finance, 6(1), 1537822. https://doi.org/10.1080/23322039.2018.1537822

Okey, M. K. N. (2013). Tax revenue effect of foreign direct investment in West Africa. African Journal of Economic and Sustainable Development, 2(1), 1–22.

Pesaran, M. H. (2015). Testing weak cross-sectional dependence in large panels. Econometric reviews, 34(6–10), 1089–1117.

Pesaran, M. H., & Yamagata, T. (2008). Testing slope homogeneity in large panels. Journal of econometrics, 142(1), 50–93.

Raghutla, C. (2020). The effect of trade openness on economic growth: Some empirical evidence from emerging market economies. Journal of Public Affairs, 20(3), e2081. https://doi.org/10.1002/pa.2081

Razin, O., & Collins, S. M. (1997). Real exchange rate misalignments and growth. NBER Working Paper No. 6174.

Romelli, D., Terra, C., & Vasconcelos, E. (2018). Current account and real exchange rate changes: The impact of trade openness. European Economic Review, 105, 135–158.

Sallenave, A. (2010). Real exchange rate misalignments and economic performance for the G20 countries. International Economics, 121, 59–80.

Sekkat, K. (2016). Exchange rate misalignment and export diversification in developing countries. The Quarterly Review of Economics and Finance, 59, 1–14.

Sekkat, K., & Varoudakis, A. (2002). The impact of trade and exchange-rate policy reforms on North African manufactured exports. Development Policy Review, 20(2), 177–189.

Senghaas, D. (1991). Friedrich List and the basic problems of modern development. Review, 14(3), 451–467.

Shafaeddin, M. (2000). What did Frederick List actually say? Some clarifications on the infant industry argument (No. 149). United Nations Conference on Trade and Development (UNCTAD).

Tanzi, V. (1989). The impact of macroeconomic policies on the level of taxation and the fiscal balance in developing countries. Staff Papers, 36(3), 633–656.

Tarawalie, A. B. (2021). Equilibrium real exchange rate and misalignment: The Sierra Leone perspective. Applied Economics and Finance, 8(3), 41–49.

Tosun, M. S., & Abizadeh, S. (2005). Economic growth and tax components: An analysis of tax changes in OECD. Applied Economics, 37(19), 2251–2263.

Toulaboe, D. (2011). Real exchange rate misalignment and economic growth in developing countries. Southwestern Economic Review, 33, 57–74.

United Nations. (2015). Transforming our world: the 2030 agenda for sustainable development. https://sustainabledevelopment.un.org/post2015/transformingourworld/publication.

Wanniski, J. (1978). Taxes, revenues, and the Laffer curve. The Public Interest, 50, 3–16.

Williamson, J. (1985). The exchange rate system. Institute for International Economics.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. MIT press.

Yakub, M. U., Sani, Z., Obiezue, T. O., & Aliyu, V. O. (2019). Empirical investigation on exchange rate volatility and trade flows in Nigeria. Economic and Financial Review, 57(1), 23–46.

Yang, H. C., Syarifuddin, F., Chang, C. P., & Wang, H. J. (2021). The impact of exchange rate futures fluctuations on macroeconomy: Evidence from ten trading market. Emerging Markets Finance and Trade, 57, 1–14. https://doi.org/10.1080/1540496X.2021.1976636

Funding

No funding was received by authors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors report no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

A1. List of countries

Albania, Algeria, Armenia, Australia, Austria, Bahrain, Bangladesh, Belgium, Benin, Bolivia, Brazil, Bulgaria, Burkina Faso, Cambodia, Cameroon, Canada, Chad, Chile, China, Colombia, Congo, Costa Rica, Côte d’Ivoire, Cyprus, Czechia, Denmark, Dominican Republic, Ecuador, Egypt, Estonia, Ethiopia, Finland, France, Gabon, Germany, Ghana, Greece, Guatemala, Haiti, Honduras, Hungary, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Kenya, Kuwait, Kyrgyzstan, Latvia, Lesotho, Lithuania, Madagascar, Malaysia, Mali, Mauritius, Mexico, Moldova Republic, Mongolia, Morocco, Namibia, Nepal, Netherlands, New Zealand, Niger, Nigeria, Norway, Oman, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Romania, Russian Federation, Rwanda, Saudi Arabia, Senegal, Serbia, Sierra Leone, Singapore, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Thailand, Togo, Trinidad and Tobago, Tunisia, Turkey, Uganda, Ukraine, United Arab Emirates, United Kingdom, Uruguay, USA, and Vietnam

A2. Further graphs

The continents are classified using the World Atlas

The continents are classified using the World Atlas

A3. Test of cross-sectional dependence of Pesaran (2015)

Variable | CD-P value |

|---|---|

Taxes including social contributions | 0.000 |

Direct taxes with social contributions | 0.008 |

Direct taxes (No social contributions) | 0.000 |

Taxes on trade | 0.000 |

Total taxes | 0.001 |

REER misalignment | 0.000 |

Internet penetration rate | 0.000 |

GDP per capita | 0.000 |

Financial development | 0.000 |

Resources rents | 0.000 |

Foreign direct investments | 0.000 |

Trade openness | 0.000 |

A4. Slope homogeneity test of Pesaran and Yamagata (2008)

Model | P value of test statistics |

|---|---|

Effect of exchange rate misalignment on tax revenue | 0.000 |

Taxes on trade | 0.000 |

Direct taxes | 0.000 |

Direct taxes with social contributions | 0.000 |

Taxes including social contributions | 0.000 |

A5. Sources and definition of variables

Variable | Source | Definition |

|---|---|---|

Taxes including social contributions | UN-WIDER | Tax revenue mobilisation excluding social contribution (%GDP) |

Direct taxes with social contributions | UN-WIDER | Direct taxes, including all social contributions(%GDP) |

Direct taxes (no social contributions) | UN-WIDER | Direct taxes excluding social contributions(%GDP) |

Taxes on trade | UN-WIDER | Taxes on international trade (%GDP) |

Total taxes | UN-WIDER | Total taxes including social contributions (%GDP) |

REER misalignment | CEPII | The deviation of the real effective exchange rate from its equilibrium |

Internet penetration rate | World Bank | Number of people using the internet in every 1000 |

GDP per capita | World Bank | The natural logarithm of the Per capita growth domestic product |

Financial development | World Bank | Domestic credit provided to the private sector (%GDP) |

Resources rents | World Bank | Total natural resource rents (%GDP) |

Foreign direct investments | World Bank | Foreign Direct Investment inflows (%GDP) |

Trade openness | World Bank | Trade share (sum of exports and imports) as a percentage of GDP |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Nchofoung, T.N., Achuo, E.D. & Zanfack, L.J.T. Exchange rate misalignment and revenue mobilisation: a global comparative evidence of trade openness thresholds. Ind. Econ. Rev. 58, 281–310 (2023). https://doi.org/10.1007/s41775-023-00201-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41775-023-00201-z