Abstract

In this paper, we investigate if negative effect of geopolitical risk on economic growth reduces with the financial structure of emerging economies. Although previous studies do not find market-based structure to boost economic growth, we cast a light upon why countries still opt for shifting to that structure. We mainly utilize panel autoregressive distributed lag (ARDL) for the period between 1985 and 2021 and employ country-based geopolitical risk (GPR) indices for 15 emerging markets. Findings depict that market-based structure reduces negative impact of geopolitical risk on economic growth, which might be attributed to increasing transparency and hence investors feeling less hesitant in investing market-based economies. On the other hand, we also show that market-based system reduces the adverse effects of GPR on consumption, whereas bank-based system has the same effect on investment growth in the long-run. Therefore, our paper asserts that the financial system is not irrelevant in terms of growth perspective, if the geopolitical risk is a key factor for an emerging country.

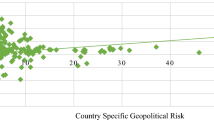

Source: Caldara et al. (2017), author calculations

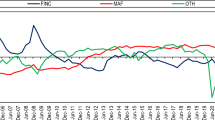

Source: Caldara et al. (2017), author calculations

Source: World Bank databank, author calculations

Source: Author calculation

Similar content being viewed by others

References

Abadie, A., & Gardeazabal, J. (2003). The economic costs of conflict: A case study of the Basque country. American Economic Review., 93, 113–132.

Allen, F., & Gale, D. (1999). Comparing Financial Systems. MIT Press.

Alesina, A., & Tabellini, G. (1990). A positive theory of fiscal deficits and debt. The Review of Economic Studies., 57, 403–414.

Arize, A., Kalu, E. U., & Nkwor, N. N. (2018). Banks versus markets: Do they compete, complement or co-evolve in the Nigerian financial system? An ARDL approach. Research in International Business and Finance., 45, 427–434.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics., 131, 1593–1636.

Bats, J. V., & Houben, C. F. J. (2020). Bank-based versus market-based financing: Implications for systemic risk. Journal of Banking and Finance., 114, 1–13.

Beck, T., & Levine, R. (2002). Industry growth and capital allocation: Does having a market-or bank-based system matter? Journal of Financial Economics., 64, 147–180.

Beck, T., Levine, R., & Loazya, N. (2000). Finance and the sources of growth. Journal of Financial Economics., 58, 261–300.

Becketti, S., & Morris, C. (1992). Does money still forecasts economic activities? Economic Review., 77, 56–78.

Bekaert, G., Harvey, C. R., & Lundblad, C. (2005). Does financial liberalization spur growth? Journal of Financial Economics., 77, 3–55.

Berkman, H., Jacobsen, B., & Lee, J. B. (2011). Time-varying rare disaster risk and stock returns. Journal of Financial Economics., 101, 313–332.

Bilgin, A. H., Gozgor, G., & Karabulut, G. (2020). How do geopolitical risk affect government investment? An empirical investigation. Defense and Peace Economics., 31, 550–564.

Bloom, N., Bond, S., & Van Reenen, J. (2007). Uncertainty and investment dynamics. The Review of Economic Studies., 74, 391–415.

Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77, 623–685.

Boyd, J. H., & Smith, B. D. (1998). The evolution of debt and equity markets in economic development. Economic Theory., 12, 519–560.

Breitung, J. (2000). The local power of some unit root tests for panel data. Advances in Econometrics., 15, 161–178.

Bui, D. T. (2018). Fiscal policy and national saving in emerging Asia: Challenge or opportunity? Eurasian Economic Review., 8, 305–322.

Caldara, D., Iacoviello, M., & Markiewitz, A. (2017). Country-specific geopolitical risk. Mimeo, Federal Reserve Board.

Caldara, D., & Iacoviello, M. (2018). Measuring geopolitical risk. FRB International Finance Discussion Paper 1222.

Calderon, C., & Liu, L. (2003). The direction of causality between financial development and economic growth. Journal of Development Economics., 72, 321–334.

Chakraborty, S., & Ray, T. (2006). Bank-based versus market-based financial systems: A growth-theoretic analysis. Journal of Monetary Economics., 53, 329–250.

Cheng, C. H. J., & Chiu, C. W. (2018). How important are global geopolitical risks to emerging countries? International Economics., 156, 305–325.

Cukierman, A., Edwards, S., & Tabellini, G. (1992). Seignorage and political instability. American Economic Review., 82, 537–555.

Demirgüç-Kunt, A., Feyen, E., & Levine, R. (2013). The evolving importance of banks and securities markets. The World Bank Economic Review, 27(3), 476–490.

Demirgüç-Kunt, A., & Levine, R. (Eds.). (2004). Financial structure and economic growth: A cross-country comparison of banks, markets, and development. MIT press.

Diacon, P. E., & Maha, L. G. (2015). The Relationship between income, consumption and GDP: A Time series, cross country analysis. Procedia Economics and Finance., 23, 1535–1543.

Dissanayake, R., Mehrotra, V., & Wu, Y. (2018) Geopolitical risk and corporate investment (July 29, 2018). Available at SSRN: https://ssrn.com/abstract=3222198.

Drakos, K., & Kallandranis, C. (2015). A note on the effect of terrorism on economic sentiment. Defence and Peace Economics., 26, 1–9.

Eckstein, Z., & Tsiddon, D. (2004). Macroeconomic consequences of terror: Theory and the case of Israel. Journal of Monetary Economics., 51, 971–1002.

Gambacorta, L., Yang, J., & Tsatsaronis, K. (2014). Financial structure and growth. BIS Quarterly Review. 21–35.

Goldsmith, R. W. (1969). Financial structure and development. New Haven, CT: Yale University Press.

Hadri, K. (2000). Testing for stationarity in heterogeneous panel data. Econometrics Journal, Royal Economic Society., 3, 148–161.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics., 115, 53–74.

Kim, H. (2017). The effect of consumption on economic growth in Asia. Journal of Global Economics., 5, 1–8.

Kunreuther, H., Michel-Kerjan, E., & Porter, B. (2003). Assessing, managing, and financing extreme events: Dealing with terrorism. National Bureau of Economic Research. No: w10179.

Levine, R. (2002). Bank-based or market-based financial systems: Which is better? Journal of Financial Intermediation., 11, 398–428.

Levine, R., & Zervos, S. (1998). Stock markets, banks, and economic growth. American Economic Review., 88, 537–558.

Mishra, P. K. (2011). Dynamics of the relationship between real consumption expenditure and economic growth in India. Indian Journal of Economics and Business., 4, 553–563.

Moradi, Z. S., Mirzaeenejad, M., & Geraeenejad, G. (2016). Effect of bank-based or market-based financial systems on income distribution in selected countries. Procedia Economics and Finance., 36, 510–521.

Nasreen, S., Mahalik, M. K., Shahbaz, M., & Abbas, Q. (2020). How do financial globalization, institutions and economic growth impact financial sector development in European countries? Research in International Business and Finance., 54, 101–247.

Omar, A. M., Wisniewski, T. P., & Nolte, S. (2017). Diversifying away the risk of war and cross-border political crisis. Energy Economics., 64, 494–510.

Pagano, M., Langfield, S., Acharya, V., Boot, A., Brunnermeier, M., Buch, C., Hell- wig, M., Sapir, A., van denBurg, I. (2014). Is Europe overbanked? The European Systemic Risk Board’s Advisory Scientific Committee report No 4.

Pesaran, M. H., & Smith, R. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics., 68, 79–113.

Pesaran, M. H., Shin, Y., & Smith, R. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association., 94, 621–634.

Saint Akadiri, S., Eluwole, K. K., Akadiri, A. C., & Avci, T. (2020). Does causality between geopolitical risk, tourism and economic growth matter? Evidence from Turkey. Journal of Hospitality and Tourism Management., 43, 273–277.

Sevastianova, D. (2009). Impact of war on country per capita GDP: A descriptive analysis. Peace Economics, Peace Science and Public Policy., 15, 7.

Sonje, A. A., Casni, A. C., & Vize, M. (2014). The effect of housing and stock market wealth on consumption in emerging and developed countries. Economic System., 38, 433–450.

Stulz, R. M. (2000). Financial structure, corporate finance and economic growth. International Review of Finance., 1, 11–38.

Toda, H. Y., & Yamamato, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics., 66, 225–250.

Uzunkaya, M. (2012). Economic performance in bank-based and market-based financial systems: Do non-financial institutions matter? Journal of Applied Finance and Banking., 2, 159–176.

Funding

The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by EU-Y and BMO-A. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

There is no conflicts of interest to disclose.

Research involving human participants and animal rights

This article does not contain any studies involving animals performed by any of the authors. This article does not contain any studies involving human participants performed by any of the authors.

Ethical approval

There is no ethical approval to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ugurlu-Yildirim, E., Ordu-Akkaya, B.M. Does the impact of geopolitical risk reduce with the financial structure of an economy? A perspective from market vs. bank-based emerging economies. Eurasian Econ Rev 12, 681–703 (2022). https://doi.org/10.1007/s40822-022-00219-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-022-00219-3