Abstract

How does trade affect the making and implementation of environmental policies? I extend our understanding about this broad research question with an understudied case: government support for environmental innovation. As the foremost channel wherein cross-border technology transfer occurs, trade materializes the positive externality of technology investment. With this in mind, countries may tend to strategically underfund environmental technologies—particularly when their trade partners enlarge that spending—to have more money to use otherwise and to avoid politically awkward innovation failures. To substantiate this crowding-out argument, I perform spatial regression with data from 32 OECD countries, 1982–2017, and find that government spending on environmental R&D in one country is negatively correlated with that of the country’s trade partners in environmental goods. My research contributes to the literature by adding new to our understanding about the international trade-environmental policy nexus, depicting a new scenario wherein states underprovide global public goods, and showing the strategic calculus underlying the use of technology-push strategy in addressing climate change.

Similar content being viewed by others

Introduction

With the ever growing globalization, international trade increasingly affects the making and implementation of each country’s environmental policies. The race-to-the-bottom theory, for example, suggests that countries leverage lax environmental regulations one after another to increase their export competitiveness (Cao and Prakash 2010, 2012; Porter 1999; Woods 2006). By contrast, a growing body of literature lends support to the “California effect” (Vogel 1995, 1997), with higher regulatory standards diffusing from a few first movers to the rest of the world through trade networks (Prakash and Potoski 2006; Saikawa 2013). Meanwhile, some studies within this vein of research particularly underscore the role of trade agreements in the aforesaid green policy diffusion (Bastiaens and Postnikov 2017; Brandi et al. 2020; Jinnah and Lindsay 2016; Lechner and Spilker 2022; Prakash and Potoski 2017).

In this article, I extend our understanding about trade’s implications on environmental policies by focusing on the relationship between trade network and the differing extents of government support for environmental innovation in different countries. Despite being fundamental in addressing climate change, the development and deployment of environmental innovation is lagging behind that growing threat. For instance, the renewable share in the world’s total primary energy consumption only increased from 6 to 11% in the past 5 decades (BP p.l.c. 2020), whereas the annual carbon dioxide emission rocketed from 11 to 37 billion tonnes during the same period (Friedlingstein et al. 2022). It was estimated that until 2050 ensuring a global green transition needs an additional $27-trillion investment—a 30% increase compared to the current trajectory—in low-carbon technologies (IRENA 2018).Footnote 1 Nevertheless, the private sector cannot fill such funding gap due to market failure. For example, “low-emission infrastructures investment (remained) less than 1% of the total portfolios of institutional investors” (OECD 2018, p. 23). In the meantime, government support has proven irreplaceable to environmental innovation (Acemoglu et al. 2012, 2016; Fischer et al. 2017). To deliver the Paris Agreement target, government research funding for environmental technologies worldwide has to grow at least twofold (Dechezleprêtre et al. 2019).

However, in this article, I argue that trade could undermine the willingness of governments to fund environmental innovation. As the foremost channel wherein cross-border technology transfer occurs (e.g., Keller 2004), trade materializes the positive externality of technology investment: one country invests, all others benefit. With that in mind, countries may tend to strategically underfund environmental technologies—particularly when their trading partners enlarge that spending—to have more money to use otherwise and to avoid politically awkward innovation failures happening on their own territory.

To substantiate that argument, I use data on government environmental R&D spending and bilateral trade in environmental goods from 32 OECD countries, 1982–2017. Spatial regression analysis—a typical empirical approach to test policy interdependence (Franzese and Hays 2007, 2008)—corroborates my theoretical expectation: government spending on environmental R&D in one country is negatively correlated to that elsewhere, with this relationship being more pronounced between the countries with more environmental trade flows to each other. Such crowding-out effect still holds even if the trade data are inclusive of all goods, but it then becomes absent when trade partnership is replaced by geographic distance in regression. The contrast of these two additional results shows robust and generalized evidence in support of my argument, while ruling out the alternative, confounding mechanisms that might underpin my finding.

This article contributes to the scholarship in environmental politics and beyond in various frontiers. First of all, I add new to the inconclusive, ongoing debate about international trade’s implications on environmental policies with an understudied case: government support for environmental innovation. On the one hand, the trade-driven underinvestment in environmental technologies I find is opposite to what the “California effect” implies. On the other hand, in spite of my finding demonstrating that trade undermines policy independence in a negative way, the underlying mechanism—free riding—is different from that seen in the race-to-the-bottom theory either. Additionally, the “California effect” is particularly relevant to the North–South trade, whereas the race-to-the-bottom theory is established upon the trade competition between the global South countries (Cao and Prakash 2010, 2012; Porter 1999; Woods 2006; Vogel 1995, 1997); yet by drawing conclusion based on the trade within the global North, my research echoes Lechner and Spilker (2022), among others, who reminded scholars of having more focus on the trade relationships that would otherwise draw less attention. Simply put, I show a new dynamic that enriches our understanding of the nexus between international trade and environmental policies and broaden the scope of the said literature.

When it comes to the transnationally contagious climate inaction, most previous studies emphasize on how some toothless international institutions, such as the United Nations Framework Convention on Climate Change (UNFCCC), fails to keep countries fully committed to climate mitigation (Aklin and Mildenberger 2020; Bättig and Bernauer 2009; Urpelainen 2013). In contrast, I show in this article that trade could also exacerbate the underprovision of global public goods, with the trade-driven technology transfer materializing the positive externality of government spending on environmental innovation. Research in the future may further explores the cross-national connections that affect each country’s willingness to address the growing threat of climate change.

Last, most of the research to date shows how governments employ regulatory instruments, such as renewable portfolio standards or feed-in tariff, to speed up the deployment of environmental technologies (e.g., Baldwin et al. 2019; Bayer and Urpelainen 2016; Stokes 2020). But beyond these demand-pull policy interventions, little is known about the equally important technology-push strategies in addressing environmental problems, i.e., how governments support the development of environmental technologies in the first place. This article fills this gap by showing the strategic calculus behind the government underfunding of environmental innovation. With that, I also shed light on the politics of innovation in general, which the existing literature primarily addresses through the lens of domestic dynamics such as institution and the relationship between government and business (e.g., Bayer and Urpelainen 2016; McLean and Plaksina 2019; Meckling and Nahm 2018; Taylor 2007, 2016). Focusing on the interplay between different countries instead, the present article expands the analytical scope of the relevant research.

Trade and underspending on environmental innovation

Before developing my argument that international trade undermines the willingness of governments to spend on environmental innovation, it is necessary to discuss why governments are reluctant to fully fund that business at all. First, government support for environmental innovation faces great technological and market uncertainties. In their investigation into the carbon capture and storage technologies in the USA, for instance, Abdulla et al. (2020) found that more than 80% investments ended up with failure in spite of generous funding from the federal government. A similar study concludes that these projects oftentimes overrun their budgets and are not cost-competitive without taxpayer bailouts, which leads the government to the sunk cost fallacy (Food & Water Watch 2020; Stokes 2020).

Second, funding environmental technologies enthusiastically could even bring political troubles for governments. For example, after the massive power outage in Texas, early 2021, the Republicans heavily criticized the incumbent’s renewable energy subsidies to direct the public outrage over the unreliable power supply to the Democrats’ support for environmental innovation (The New York Times 2021). Among others, the collapse of Solyndra LLC might constitute one of the most high-profile cases that illustrates the potential political cost of funding environmental technologies. This famous energy start-up company received a $535-million federal grant from the Obama administration but then soon went into bankruptcy at the end of 2011, just a year ahead of the presidential election. Seeing Solyndra’s failure as an electoral opportunity, Obama’s opponents launched an 18-month investigation in Congress and spent $6 million on advertisements against the president’s mishandling of the issue (Reuters 2012; The Wall Street Journal 2012).

However, the trade-driven technology transfer enables national governments to take advantage of the environmental innovation funding made by others and, thus, to prevent politically awkward innovation failures and to have more money to spend elsewhere. New technologies travel across borders with or without the notice of innovators themselves, because one can access the technological information embodied in the directly traded items by imitating or revere-engineering. Coe and Helpman (1995), Coe et al. (1997), among others, found that a nation’s domestic R&D input significantly increases others’ total factor productivity, an oft-used indicator for technology-empowered economic output. This relationship evidently shows the considerable impact that technology transfer has on innovation. A consensus among scholars, policymakers, and practitioners is that international trade in goods and services is the foremost channel wherein technology transfer occurs (Maskus 2004). Wacziarg (2001) provided strong evidence in support of this claim by discovering a positive relationship between trade liberalization and technology transfer across different countries.Footnote 2

From the late 1970s to the early 2000s, the global export rate of green inventions climbed from 10 to 30% with an accelerating trend (Dechezleprêtre et al. 2011). Drawing from the case studies on pollution mitigation measures and photovoltaics, de la Tour et al. (2011), Lanjouw and Mody (1996) concluded that it is trading on related products rather than domestic R&D that propels a nation’s technological catch-up. Perkins and Neumayer (2009) showed that a country’s carbon efficiency increases as a result of the deepening trade relationships with the carbon-efficient economies. This finding implies that through trade, environmental technologies elsewhere could serve as an alternative to a country’s own innovation. Using the gravity model, Garsous and Worack (2021) directly demonstrated that international trade allows countries to acquire advanced renewable technologies that are otherwise challenging for them to develop.

Because of the trade-driven transfer of environmental technologies, the government funding of environmental R&D is providing a global public good, up to a point. In other words, it entails a positive externality, with all others benefiting from a single country’s investment without bearing the fiscal cost and facing the technological and political risks (Gersbach et al. 2018; Jaakkola and van der Ploeg 2019). Although state-funded environmental R&D is not completely non-excludable—so it is an impure public good, the impact of intellectual property rights on environmental-technology transfer in particular is in fact limited. As the UN Agenda 21 posited, many environmental technologies are in the public domain and off-patented, allowing them to travel across borders more easily at lower costs (Less and McMillan 2005). Dechezleprêtre and Sato (2017) found the spillover of low-carbon technologies indeed faster than others. In addition, the trade-driven environmental-technology transfer is advocated by the international trade regime. For instance, the WTO’s 2001 Doha declaration explicitly asked countries to reduce and even eliminate any tariff and non-tariff barriers on environmental goods and services (WTO 2001). In their evaluations on the impact of the Eco-Patent Commons, a royalty-free patent pool of environmental technologies initiated by a dozen of giant multinationals, Contreras et al. (2018), Hall and Helmers (2013) ended up with null findings, implying that intellectual property’s chilling effect on environmental-technology transfer is not as large as many may expect.

The positive externality of government spending on environmental innovation, and its materialization through international trade, incentivizes the cost-minimizing governments to strategically underfund environmental technologies. That is to say, the government spending on environmental innovation elsewhere crowd out one’s very own spending, with trade bringing environmental technologies from overseas to home and thus weakening the government’s justification for the R&D expense. We would therefore expect that countries reduce their government environmental R&D spending as a response to the increasing spending from their trade partners. Or put differently, government spending on environmental R&D in one country is negatively correlated with that in the country’s trade partners.

Having said that, any budgetary decision—which is usually made on a yearly basis—takes time to materialize. So should a country wants to free ride off the environmental R&D investments made elsewhere, the reduction of its environmental R&D spending is unlikely to become effective instantly. Due to the concurrence of budgetary making across many different countries, in addition, it is more likely that policy makers do their strategic calculation according to each other’s previous spending records. Thus, it is more reasonable to expect that the current government spending on environmental innovation in a country is, if any, influenced by that overseas in the preceding year. Also, since larger bilateral trade flows in general spread more environmental technologies, countries are more responsive, i.e., making more funding cuts, to the increasing environmental innovation spending of their larger trade partners, while remaining relatively insensitive to the expanding funding from the smaller trade partners.

Data and variables

Dependent variable

My sample is restricted to OECD countries, 1982–2017, because only the OECD provides high-quality, sector-specific, and cross-nationally comparable government research funding data with sufficient temporal coverage. Since developed countries are major investors and contributors in environmental innovation worldwide, the limited sample here only asserts a minimal impact on my research’s substantive significance.Footnote 3 By focusing on OECD countries, I avoid introducing excessive cross-sectional heterogeneities by pooling categorically different countries together, which may confound my statistical results. I access the data for my dependent variable—government spending on environmental R&D—from the OECD’s official statistics.Footnote 4 Among the 34 high-income OECD members as of 2017, I drop Chile and Switzerland from my sample since their data have a large number of missing values for undocumented reasons.Footnote 5 The raw distribution of my dependent variable is right-skewed, so I use the natural logarithm to transform it.

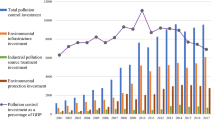

Figure 1 shows my dependent variable’s considerable spatiotemporal variation. From the 1980s to 2010s, Germany and the USA always outspent the others in funding environmental R&D, notwithstanding their irresolute spending trajectory, while Japan soon joined the leading camp in the 2000s. By contrast, the expenditures made by the Nordic countries, which are generally viewed as green campaigners, actually almost stagnated in the past decades. The eastern European and Benelux countries also experienced a similar spending stagnation. Although the large economies expanded their environmental R&D expenditures over time, the trend of their funding expansions was wavering, indicating the probable hesitating and strategic spending decisions. My argument and the descriptive evidence shown in Fig. 1 implies that the countries in my sample would spend more on environmental R&D if there was no crowding-out effect in a counterfactual world. Therefore, I contend that my involuntary sample selection does not introduce a ceiling effect into the following empirical analysis.

Spatial lag

To substantiate my argument, I employ spatial regression model, wherein the explanatory variable is commonly known as spatial lag. For a single country, it is a weighted average of the government spending on environmental R&D elsewhere, and it thus can quantify how this country’s spending is influenced by that of others. Taken together, spatial lag captures how different countries mutually influence each other. Dictated by my argument that the extent of such mutual influence is materialized by the international trade through which environmental technologies diffuse, I use the bilateral trade flows of environmental goods as the weights here. The colloquial term environmental goods, according to the OECD (1999), encompass three broad categories, namely pollution management, cleaner technologies and products, and resource management (including renewable energy). For the required data, I first access the fine-grained dyadic trade flows disaggregated by the Harmonized Commodity Description and Coding System (HS).Footnote 6 After that, the data filtering is done based upon the OECD’s Combined List of Environmental Goods (see Sauvage 2014). Some exemplary environmental goods in my data include filtering or purifying machinery, wind turbines, and photosensitive semiconductor devices.

Following the common practice in the policy interdependence literature, I temporally lag my explanatory variable, Spatial lag by environmental trade flows, by 1 year (Drolc et al. 2019; Wimpy et al. 2021; Beck et al. 2006). Noting my argument that the crowding-out effect of environmental R&D spending elsewhere is more likely to occur after some delay, this lagging exercise is foremost theoretically informed. Having said that, it also has something to do with the endogenous spatial weights, which may blur the causal direction in this research (Pinkse and Slade 2010; Qu et al. 2021). Trade network influences a country’s environmental R&D by technology transfer but, at the same time, environmental R&D also changes how a country trades with others. Yet a temporally lagged spatial lag is not subject to this simultaneity bias.

It is also worth noting that I do not row-standardize the spatial weights; otherwise, I would make the homogeneous exposure assumption, which assumes all of my observations having identical overall trade volumes to all others (Neumayer and Plümper 2016). This assumption not only discards the contemporaneous variation of trade volumes between different countries but also ignores the fact that most countries trade more over time as globalization deepens.

My regression equation takes the following form:

in which \({y}_{i,t}\) is country \(i\)’s environmental R&D spending in year \(t\), with \({w}_{i,j,t-1}\) denoting the environmental trade flows between this country \(i\) and its trade partner \(j\) in the preceding year (\(t-1\)) and \({y}_{j,t-1}\) being the environmental R&D spending in country \(i\)’s trade partner \(j\) in year \(t-1\). In other words, \({\sum }_{i\ne j}^{n}{w}_{i,j,t-1}\times {y}_{j,t-1}\) is the time-lagged spatial lag presented in a scalar fashion and \(\rho\) is the coefficient of interest. \({X}_{i,t-1}^{\mathrm{^{\prime}}}\) is a vector of control variables discussed below.

Control variables

Joining the spatial lag on the right-hand side of my regression equation is selected covariates that are correlated to my dependent variable according to some previous studies. The extent to which a country relies on fossil fuels reveals the degree of carbon lock-in and the political power that environment-unfriendly industries may have (e.g., Aklin and Urpelainen 2013), which are likely to weaken the government’s ability and willingness to fund environmental innovation. Conversely, a country’s high reliance on fossil fuels could encourage the environmentally progressive government to expand its financial support for environmental innovation even faster. Fossil fuel rents/GDP in percentage is therefore included in light of these two possibilities. How do national governments spend on environmental R&D is naturally influenced by their very own ideological position on environmental issues. I thus use data from the Comparative Manifesto Project to control the government’s environmental progressiveness (Volkens et al. 2020). Following Ward and Cao (2012)’s exercise, specifically, I aggregate the seat share-weighted environmental protection progressiveness of each party in every election and then use the aggregate value from one election until the next to proxy the government’s environmental position during a certain period.

Compared to other countries, EU members have to meet their supernational, environmentally ambitious targets collectively, so their spending on environmental R&D are likely to converge. With that in mind, I control the binary EU membership, which equals 1 if a country in a given year is a member state of the EU. Next, I add the KOF political globalization index (Gygli et al. 2019), which measures to extent is a country engaged in multilateral institutions where norm cascade and policy learning usually take place (Cao 2009; Finnemore and Sikkink 1998; Holzinger and Knill 2005). That is to say, I take the possibility that countries may follow one another to spend even more on environmental R&D—the competing theoretical expectation against my argument—into account directly.

A country’s stage of development arguably determines its ability and willingness to innovate for the environment, and I therefore add GDP per capita on the right-hand side. Next, I also include GDP growth since governments are found to be less motivated to address environmental issues during economic downturns (Abou-Chadi and Kayser 2017). I then take Total population into account to make countries of differing sizes, which are influential to the scale of R&D spending, more comparable to each other. The final control variable is Total government R&D spending, which quantifies the overall budget constraint that the government funding of environmental R&D faces. Since it is hard for data collectors to locate environmental R&D precisely and exclusively in all times, including this variable also alleviates the concern about measurement error in my dependent variable.Footnote 7 In consistency with the spatial lag, I temporally lag all of the aforementioned control variables too (Drolc et al. 2019).

Empirical analysis

Regression results

I include two-way fixed effects throughout the empirical analysis. The inclusion of country-fixed effects absorbs time-invariant or sluggish heterogeneities between different countries, such as political institutions or geography. The inclusion of year-fixed effects takes the common time trend or exogenous shocks, such as energy crises or international environmental movements, into account. Considering the incrementalism in the budget-making process, my estimation is made to allow autoregressive random errors. Last, the standard errors are “panel-corrected” such that they are robust to unobserved spatial interdependence (Beck and Katz 1995).

Table 1 reports my main regression results. I regress my dependent variable to the stand alone spatial lag to present a baseline result in column (1). The purpose of doing so is to show that my subsequent results are not just the artifact of some particular covariates (Lenz and Sahn 2020). Next, column (2) shows the full specification which incorporates all of the variables discussed so far. Across these two columns, the coefficient estimates of my explanatory variable, Spatial lag by environmental trade flows—are all negatively signed and is consistent with my theoretical expectation. The negative sign, specifically, indicates that a country reduces its own government environmental R&D spending following the increasing funding made by its trade partners in the preceding year. This “strategic-substitute” spending suggests that national governments indeed take advantage of one another when it comes to funding environmental innovation (Franzese and Hays 2008). The statistical significance levels of these two spatial lag coefficients are both below the conventional 0.05 threshold, indicating there is sufficient statistical evidence in support of my argument.

Substantive effects

The spatial lag coefficients shown in Table 1 quantify the negative correlation between a country’s very own government funding of environmental R&D and that elsewhere in (weighted) sum. Yet it would be more substantively interesting to see how the increased government environmental R&D spending in a single country asserts a global impact. To this end I adopt the method advocated by LeSage and Pace (2009), Ward and Gleditsch (2008), Whitten et al. (2021), among others, to recover country-specific spillover effects.

At the first step, 1000 simulated coefficients of Spatial lag by environmental trade flows are drawn parametrically from a multivariate normal distribution based upon the estimates from column (2), Table 1. I then use these simulated values with the spatial weights, bilateral trade on environmental goods, to calculate 1000 “effect matrices,” of which the off-diagonal entries correspond spillover effects from column countries to row countries.Footnote 8 So the sum of a column represents the global spillover effect a single country asserts. With simulation, there are 1000 different global spillover effects from any single country, enabling the intuitive calculation of uncertainty estimates (King et al. 2000).Footnote 9

Figure 2 visualizes these spillover effects by each country in descending order of magnitude. Across all cases the upper bounds of the 95% confidence interval fall below zero, indicating the estimated effects are all statistically significant here. The negative signs, again, suggest that the increased funding in environmental R&D in a country crowds out that in the country’s trading partners. Unsurprisingly, such leading innovators in environmental technologies as Germany and the USA come with significantly more sizable crowding-out effects than others. For instance, a 10% increase in environmental R&D spending made by the German government would actually suppress the spending made by other governments by about 1.1%. This unintended crowding-out effect sharply contradicts the growing threat of climate change, which begs governments worldwide to generously invest in green technologies sooner rather than later.

Importantly, the spillover effect from, say, Germany includes a part that crowds out some environmental R&D expenditures in, for example, the USA, and vice versa. Hence, my finding implies that not only latecomers or small countries take advantage of the environmental innovation made by first-movers and large countries—as expected by conventional wisdom, but also the crowding-out effect undermines the “willingness to innovate” of the leading countries in environmental technologies as well. In other words, these countries would contribute more to the development of environmental technologies without their strategic calculus on environmental R&D spending.

Robustness checks

Defining what goods are environment-related accurately and exclusively amid international trade is not easy. And beyond the narrowly defined environmental goods, environmental technologies may diffuse internationally through the trade on general commodities as well, since environmental innovation itself is an intersectoral process (Nemet 2012). For these two reasons, I replicate Table 1 while using Spatial lag by aggregate trade flows instead. The updated spatial lag coefficients are both negative and statistically significant, providing robust and generalized evidence in support of my argument (see Appendix Table B1).

Bilateral trade is necessarily correlated with various dyadic attributes. Considering that, some may ask to what extent my empirical finding really involves the trade-driven technology transfer—the mechanism I argue—rather than some other cross-national connections. To address this concern, I use geographic distance between countries to replace trade as the placebo spatial weights to replicate my main regression model. The first law of geography claims that “everything is related to everything else, but near things are more related than distant things” (Tobler 1970, p. 236). If my finding was an artifact of some confounding factors that are interrelated to trade, rerunning regression with Spatial lag by geographic distance would return a statistically significant spatial lag coefficient, whereas a statistical insignificance result from the said placebo replication could rule out alternative mechanisms. Appendix Table B2 lends support to the latter, as the placebo spatial lag’s effect is not statistically distinguishable from 0 once control variables are taken into account.

Government spending in environmental R&D has some “memory.” Compared to just allowing autoregressive errors in model estimation, I directly add the time-lagged dependent variable on the right-hand side in Appendix Table B3. While adding this term along with two-way fixed effects (as in my case) causes the Nickell bias by construction (Nickell 1981) and may also render posttreatment bias (Morgan and Winship 2014), ignoring this temporal dynamic when it is actually present is likely to give rise to spurious spatial interdependence (Drolc et al. 2019; Plümper and Neumayer 2010), which would nullify the crowding-out effect I argue. In the absence of a solely “correct” answer, regression results when the time-lagged dependent variable is added anyway show that my finding is not model-dependent.

Finally, I demonstrate that my finding is insensitive to different functional forms with regards to the nexus between the stage of development and government spending on environmental R&D. Following the well-known environmental Kuznets curve, there might exist a U-shaped relationship between, say, GDP per capita and my dependent variable (Grossman and Krueger 1995), not to mention the possible N-shaped relationship as discovered by Allard et al. (2018). I take these two possibilities into account by putting GDP per capita in quadratic polynomial and cubic polynomial, respectively, and replicate my main regression model. As shown in Appendix Table B4, there is empirical evidence in support of the N-shaped relationship, but importantly the conclusion regarding my central argument remains unchanged in either case. The triangular relationship involving innovation, economic development, and environmental quality (including climate mitigation) is of course more complicated. Though beyond my article’s scope, future research could explore this research question that is of both strong theoretical potential and impactful policy relevance.

Concluding remarks

In its ambitious infrastructure proposal, the American Jobs Plan, the Biden-Harris administration called on Congress to make a $35-billion investment in environmental technologies, the largest ever federal funding increase on R&D outside defense.Footnote 10 According to the theories on the transnational diffusion of norms and policies, it would “rally the rest of the world to meet the threat of climate change,”Footnote 11 a key component of the Biden-Harris campaign. Specifically, the international socialization theory suggests that the USA’s strong demonstration effect and leadership in international organizations would persuade other countries to conform to the norm that governments should fund environmental R&D generously (Finnemore and Sikkink 1998). The policy learning theory and the “California effect” contend that countries with some similarities or close economic relationships with the USA would also follow its massive environmental innovation spending plan (Bennett 1991; Rose 1991; Vogel 1995, 1997).

In this article, nonetheless, I argue that such progressive diffusion might not happen as the trade-driven technology transfer incentivizes national governments to underfund environmental innovation. Using data on government environmental R&D expenditures and bilateral trade flows from 32 OECD countries, 1982–2017, spatial econometric analysis corroborates the said crowding-out argument.

My finding presents a specific yet important case where the diffusion of progressive norm and policy ceases to exist and even goes to the opposite side. By drawing a different conclusion from the influential “California effect,” I add new to the inconclusive and ongoing debate about international trade’s implications on environmental policies. I also show a new context—international trade—under which countries take advantage of each other’s climate action. Joining the conventional, institution-centric studies, my research adds new to the dynamics underlying the transnationally contagious climate inaction. Last, by focusing on government funding for environmental R&D, the present article contributes to our understanding of the use of technology-push policies, compared to demand-pull policies which are the focus of most of the research to date, in addressing the growing threat of climate change.

Data Availability

The data that support this study are available upon request.

Notes

See OECD, World Bank, and UN Environment (2018) for an overview on the financing gap in environmental innovation.

See Keller (2004) for a review of the economics research on the trade-driven technology transfer.

Because China’s environmental innovation is largely driven by its techno-nationalism and bid for global leadership (e.g., Kennedy 2013), the country’s government environmental R&D spending is theoretically irrelevant to the crowding-out argument made in this article. Thus, the exclusion of China from my empirical analysis should not bias my conclusion.

This is done by using the R package OECD: Search and Extract Data from the OECD (Persson 2019) with the query GBARD_NABS2007. But readers can also view and manually download the data from https://bit.ly/42upTw1 (last accessed October 26, 2021). By spending, the said data only capture direct budgetary allocations without considering implicit expenditures due to tax incentives.

See Appendix Fig. A1 for missing values of other countries.

For the spatial weights I use the cross-section of 2017, the latest time point in my sample.

https://bit.ly/3pBhs3u (last accessed May 18, 2021).

https://bit.ly/456SEAL (last accessed May 18, 2021).

References

Abdulla A, Hanna R, Schell KR, Babacan O, Victor DG (2020) Explaining successful and failed investments in U.S. carbon capture and storage using empirical and expert assessments. Environ Res Lett 16(1):014036. https://doi.org/10.1088/1748-9326/abd19e

Abou-Chadi T, Kayser MA (2017) It’s not easy being green: why voters punish parties for environmental policies during economic downturns. Elect Stud 45:201–207. https://doi.org/10.1016/j.electstud.2016.10.009

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166. https://doi.org/10.1257/aer.102.1.131

Acemoglu D, Akcigit U, Hanley D, Kerr W (2016) Transition to clean technology. J Polit Econ 124(1):52–104. https://doi.org/10.1086/684511

Aklin M, Mildenberger M (2020) Prisoners of the wrong dilemma: why distributive conflict, not collective action, characterizes the politics of climate change. Glob Environ Polit 20(4):4–27. https://doi.org/10.1162/glepa00578

Aklin M, Urpelainen J (2013) Political competition, path dependence, and the strategy of sustainable energy transitions. Am J Polit Sci 57(3):643–658. https://doi.org/10.1111/ajps.12002

Allard A, Takman J, Uddin GS, Ahmed A (2018) The N-shaped environmental kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25:5848–5861. https://doi.org/10.1007/s11356-017-0907-0

Baldwin E, Carley S, Nicholson-Crotty S (2019) Why do countries emulate each others’ policies? a global study of renewable energy policy diffusion. World Dev 120:29–45. https://doi.org/10.1016/j.worlddev.2019.03.012

Bastiaens I, Postnikov E (2017) Greening up: the effects of environmental standards in EU and US trade agreements. Environ Polit 26(5):847–869. https://doi.org/10.1080/09644016.2017.1338213

Bättig MB, Bernauer T (2009) National institutions and global public goods: are democracies more cooperative in climate change policy? Int Org 63(2):281–308. https://doi.org/10.1017/S0020818309090092

Bayer P, Urpelainen J (2016) It is all about political incentives: democracy and the renewable feed-in tariff. J Polit 78(2):603–619. https://doi.org/10.1086/684791

Beck N, Gleditsch KS, Beardsley K (2006) Space is more than geography: using spatial econometrics in the study of political economy. Int Stud Quart 50(1):27–44. https://doi.org/10.1111/j.1468-2478.2006.00391.x

Beck N, Katz JN (1995) What to do (and not to do) with time-series cross-section data. Am Polit Sci Rev 89(3):634–647. https://doi.org/10.2307/2082979

Bennett CJ (1991) What is policy convergence and what causes it? Br J Polit Sci 21(2):215–233. https://doi.org/10.1017/S0007123400006116

BP p.l.c. (2020) Statistical review of world energy. https://bit.ly/42L4DSo. Accessed 22 Jan 2021

Brandi C, Schwab J, Berger A, Morin JF (2020) Do environmental provisions in trade agreements make exports from developing countries greener? World Dev 129:104899. https://doi.org/10.1016/j.worlddev.2020.104899

Cao X (2009) Networks of intergovernmental organizations and convergence in domestic economic policies. Int Stud Quart 53(4):1095–1130. https://doi.org/10.1111/j.1468-2478.2009.00570.x

Cao X, Prakash A (2010) Trade competition and domestic pollution: a panel study, 1980–2003. Int Organ 64(3):481–503. https://doi.org/10.1017/S0020818310000123

Cao X, Prakash A (2012) Trade competition and environmental regulations: domestic political constraints and issue visibility. J Polit 74(1):66–82. https://doi.org/10.1017/S0022381611001228

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39(5):859–887. https://doi.org/10.1016/0014-2921(94)00100-E

Coe DT, Helpman E, Hoffmaister AW (1997) North-South R&D spillovers. Econ J 107(440):134–149. https://doi.org/10.1111/1468-0297.00146

Contreras J, Hall B, Helmers C (2018) Green technology diffusion: a post-mortem analysis of the Eco-Patent Commons. National Bureau of Economic Research Working Paper Series 25271. https://doi.org/10.3386/w25271

Dechezleprêtre A, Glachant M, Haščič I, Johnstone N, Ménière Y (2011) Invention and transfer of climate change–mitigation technologies: a global analysis. Rev Environ Econ Policy 5(1):109–130. https://doi.org/10.1093/reep/req023

Dechezleprêtre A, Martin R, Bassi S (2019) Climate change policy, innovation and growth. In: Roger Fouquet (ed) Handbook on Green Growth. Edward Elgar Publishing, Cheltenham, England, p 217–239. https://doi.org/10.4337/9781788110686.00018

Dechezleprêtre A, Sato M (2017) The impacts of environmental regulations on competitiveness. Rev Environ Econ Policy 11(2):183–206. https://doi.org/10.1093/reep/rex013

de la Tour A, Glachant M, Ménière Y (2011) Innovation and international technology transfer: the case of the Chinese photovoltaic industry. Energy Policy 39(2):761–770. https://doi.org/10.1016/j.enpol.2010.10.050

Drolc CA, Gandrud C, Williams LK (2019) Taking time (and space) seriously: how scholars falsely infer policy diffusion from model misspecification. Policy Stud J. https://doi.org/10.1111/psj.12374

Elhorst JP (2014) Spatial econometrics: from cross-sectional data to spatial panels. Springer, Heidelberg, Germany

Finnemore M, Sikkink K (1998) International norm dynamics and political change. Int Org 887–917. https://doi.org/10.1162/002081898550789

Fischer C, Preonas L, Newell RG (2017) Environmental and technology policy options in the electricity sector: are we deploying too many? J Assoc Environ Resour Econ 4(4):959–984. https://doi.org/10.1086/692507

Food & Water Watch (2020) The case against carbon capture: false claims and new pollution. https://foodandwaterwatch.org/wp-content/uploads/2021/04/ib_2003_carboncapture-web.pdf. Accessed 27 Sep 2021

Franzese RJ, Hays JC (2007) Spatial econometric models of cross-sectional interdependence in political science panel and time-series-cross-section data. Polit Anal 140–164. https://doi.org/10.1093/pan/mpm005

Franzese RJ, Hays JC (2008) Interdependence in comparative politics: substance, theory, empirics, substance. Comp Pol Stud 41(4–5):742–780. https://doi.org/10.1177/0010414007313122

Friedlingstein P, O’Sullivan M, Jones MW, Andrew RM, Gregor L, Hauck J, Le Quéré C, Luijkx IT, Olsen A, Peters GP, Peters W, Pongratz J, Schwingshackl C, Sitch S, Canadell JG, Ciais P, Jackson RB, Alin SR, Alkama R, Arneth A, Arora VK, Bates NR, Becker M, Bellouin N, Bittig HC, Bopp L, Chevallier F, Chini LP, Cronin M, Evans W, Falk S, Feely RA, Gasser T, Gehlen M, Gkritzalis T, Gloege L, Grassi G, Gruber N, Gürses O, Harris I, Hefner M, Houghton RA, Hurtt GC, Iida Y, Ilyina T, Jain AK, Jersild A, Kadono K, Kato E, Kennedy D, Klein Goldewijk K, Knauer J, Korsbakken JI, Landschützer P, Lefèvre N, Lindsay K, Liu J, Liu Z, Marland G, Mayot N, McGrath MJ, Metzl N, Monacci NM, Munro DR, Nakaoka SI, Niwa Y, O’Brien K, Ono T, Palmer PI, Pan N, Pierrot D, Pocock K, Poulter B, Resplandy L, Robertson E, Rödenbeck C, Rodriguez C, Rosan TM, Schwinger J, Séférian R, Shutler JD, Skjelvan I, Steinhoff T, Sun Q, Sutton AJ, Sweeney C, Takao S, Tanhua T, Tans PP, Tian X, Tian H, Tilbrook B, Tsujino H, Tubiello F, van derWerf GR, Walker AP, Wanninkhof R, Whitehead C, Wranne AW, Wright R, Yuan W, Yue C, Yue X, Zaehle S, Zeng J, Zheng, B (2022) Global carbon budget 2022. Earth Syst Sci Data 14(11):4811–4900. https://doi.org/10.5194/essd-14-4811-2022

Garsous G, Worack S (2021) Trade as a channel for environmental technologies diffusion: the case of the wind turbine manufacturing industry. OECD Trade and Environment Working Papers 2021/01. https://doi.org/10.1787/ce70f9c6-en

Gersbach H, Oberpriller Q, Scheffel M (2018) Double free-riding in innovation and abatement: a rules treaty solution. Environ Resource Econ 73(2):449–483. https://doi.org/10.1007/s10640-018-0270-8

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377. https://doi.org/10.2307/2118443

Gygli S, Haelg F, Potrafke N, Sturm JE (2019) The KOF globalisation index – revisited. Rev Int Organ 14(3):543–574. https://doi.org/10.1007/s11558-019-09344-2

Hall BH, Helmers C (2013) Innovation and diffusion of clean/green technology: can patent commons help? J Environ Econ Manag 66(1):33–51. https://doi.org/10.1016/j.jeem.2012.12.008

Holzinger K, Knill C (2005) Causes and conditions of cross-national policy convergence. J Eur Publ Policy 12(5):775–796. https://doi.org/10.1080/13501760500161357

IRENA (2018) Global energy transformation: a roadmap to 2050. https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Apr/IRENA_Report_GET_2018.pdf. Accessed 22 Jan 2021

Jaakkola N, van der Ploeg F (2019) Non-cooperative and cooperative climate policies with anticipated breakthrough technology. J Environ Econ Manag 97:42–66. https://doi.org/10.1016/j.jeem.2018.04.001

Jinnah S, Lindsay A (2016) Diffusion through issue linkage: environmental norms in US trade agreements. Glob Environ Polit 16(3):41–61. https://doi.org/10.1162/GLEPa00365

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782. https://doi.org/10.1257/0022051042177685

Kennedy AB (2013) China’s search for renewable energy: pragmatic technonationalism. Asian Surv 53(5):909–930. https://doi.org/10.1525/as.2013.53.5.909

King G, Tomz M, Wittenberg J (2000) Making the most of statistical analyses: improving interpretation and presentation. Am J Polit Sci 44(2):347–361. https://doi.org/10.2307/2669316

Lanjouw JO, Mody A (1996) Innovation and the international diffusion of environmentally responsive technology. Res Policy 25(4):549–571. https://doi.org/10.1016/0048-7333(95)00853-5

Lechner L, Spilker G (2022) Taking it seriously: commitments to the environment in South-South preferential trade agreements. Environ Polit 31(6):1058–1080. https://doi.org/10.1080/09644016.2021.1975399

Lenz G, Sahn A (2020) Achieving statistical significance with control variables and without transparency. Polit Anal 29(3):356–369. https://doi.org/10.1017/pan.2020.31

LeSage J, Pace RK (2009) Introduction to Spatial Econometrics. Chapman & Hall/CRC, Boca Raton, FL

Less CT, McMillan S (2005) Achieving the successful transfer of environmentally sound technologies: trade-related aspects. OECD Trade and Environment Working Paper No. 2005–02. https://doi.org/10.1787/308662648512

Maskus KE (2004) Encouraging international technology transfer. UNCTAD-ICTSD Project on IPRs and Sustainable Development Issue Paper No. 7. https://bit.ly/3Otvixs. Accessed 7 Aug 2023

McLean EV, Plaksina T (2019) The political economy of carbon capture and storage technology adoption. Glob Environ Polit 19(2):127–148. https://doi.org/10.1162/glepa00502

Meckling J, Nahm J (2018) When do states disrupt industries? Electric cars and the politics of innovation. Rev Int Polit Econ 25(4):505–529. https://doi.org/10.1080/09692290.2018.1434810

Morgan SL, Winship C (2014) Counterfactuals and causal inference: methods and principles for social research. Cambridge University Press, second edition

Nemet GF (2012) Inter-technology knowledge spillovers for energy technologies. Energy Econ 34(5):1259–1270. https://doi.org/10.1016/j.eneco.2012.06.002

Neumayer E, Plümper T (2016) Polit Sci Res Methods 4(1):175–193. https://doi.org/10.1017/psrm.2014.40

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426. https://doi.org/10.2307/1911408

OECD (1999) The environmental goods & services industry: manual for data collection and analysis. OECD Publishing. https://doi.org/10.1787/9789264173651-en

OECD (2018) Mobilising bond markets for a low-carbon transition. OECD Publishing, Green Finance and Investment Series. https://doi.org/10.1787/9789264308114-en

OECD, World Bank, and UN Environment (2018) Financing climate futures: rethinking infrastructure. OECD Publishing. https://doi.org/10.1787/9789264308114-en

Perkins R, Neumayer E (2009) Transnational linkages and the spillover of environment-efficiency into developing countries. Glob Environ Chang 19(3):375–383. https://doi.org/10.1016/j.gloenvcha.2009.05.003

Persson E (2019) OECD: Search and extract data from the OECD. R Package, version 0.2.4. The Comprehensive R Archive Network (CRAN). https://CRAN.R-project.org/package=OECD. Accessed 9 May 2023

Pinkse J, Slade ME (2010) The future of spatial econometrics. J Reg Sci 50(1):103–117. https://doi.org/10.1111/j.1467-9787.2009.00645.x

Plümper T, Neumayer E (2010) Model specification in the analysis of spatial dependence. Eur J Polit Res 49(3):418–442. https://doi.org/10.1111/j.1475-6765.2009.01900.x

Porter G (1999) Trade competition and pollution standards: “race to the bottom” or “stuck at the bottom.” J Environ Dev 8(2):133–151. https://doi.org/10.1177/107049659900800203

Prakash A, Potoski M (2006) Racing to the bottom? Trade, environmental governance, and ISO 14001. Am J Polit Sci 50(2):350–364. https://doi.org/10.1111/j.1540-5907.2006.00188.x

Prakash A, Potoski M (2017) The EU effect: does trade with the EU reduce CO2 emissions in the developing world? Environ Polit 26(1):27–48. https://doi.org/10.1080/09644016.2016.1218630

Qu X, Lee LF, Yang C (2021) Estimation of a SAR model with endogenous spatial weights constructed by bilateral variables. J Econ 221(1):180–197. https://doi.org/10.1016/j.jeconom.2020.05.011

Reuters (2012) Solyndra backers could reap big tax breaks; U.S. wants details. https://reut.rs/3vvaSJP. Accessed 19 May 2021

Rose R (1991) What is lesson-drawing? J Publ Policy 11(1):3–30. https://doi.org/10.1017/S0143814X00004918

Saikawa E (2013) Policy diffusion of emission standards: is there a race to the top. World Politics 65(1):1–33. https://doi.org/10.1017/S0043887112000238

Sauvage J (2014) The stringency of environmental regulations and trade in environmental goods. The OECD Trade and Environment Working Paper Series Issue 2014/03. https://doi.org/10.1787/5jxrjn7xsnmq-en

Stokes LC (2020) Short circuiting policy: interest groups and the battle over clean energy and climate policy in the American states. Oxford University Press

Taylor MZ (2007) Political decentralization and technological innovation: testing the innovative advantages of decentralized states. Rev Policy Res 24(3):231–257. https://doi.org/10.1111/j.1541-1338.2007.00279.x

Taylor MZ (2016) The politics of innovation: why some countries are better than others at science and technology. Oxford University Press

The New York Times (2021) The lessons of the Texas power disaster. https://www.nytimes.com/2021/02/19/opinion/texas-power-energy.html. Accessed 27 Sep 2021

The Wall Street Journal (2012) Americans for prosperity to air ads slamming Obama’s ties to Solyndra. https://www.wsj.com/articles/BL-WB-33080.Accessed 19 May 2021

Tobler WR (1970) A computer movie simulating urban growth in the Detroit region. Econ Geogr 46(sup1):234–240. https://doi.org/10.2307/143141

Urpelainen J (2013) Promoting international environmental cooperation through unilateral action: when can trade sanctions help? Glob Environ Polit 13(2):26–45. https://doi.org/10.1162/GLEPa00165

Vargas M (2019) tradestatistics. R Package, version 0.2.5. GitHub. https://github.com/ropensci/tradestatistics. Accessed 24 Oct 2021

Vogel D (1995) Trading up: consumer and environmental regulation in a global economy. Harvard University Press, Cambridge, MA

Vogel D (1997) Trading up and governing across: transnational governance and environmental protection. J Eur Publ Policy 4(4):556–571. https://doi.org/10.1080/135017697344064

Volkens A, Burst T, Krause W, Lehmann P, Matthieß T, Merz N, Regel S, Weßels B, Zehnter L (2020) The manifesto data collection. Manifesto Project (MRG/CMP/MARPOR), Version 2020b. Berlin: Wissenschaftszentrum Berlin für Sozialforschung (WZB). https://doi.org/10.25522/manifesto.mpds.2020b

Wacziarg R (2001) Measuring the dynamic gains from trade. World Bank Econ Rev 15(3):393–429. https://doi.org/10.1093/wber/15.3.393

Ward H, Cao X (2012) Domestic and international influences on green taxation. Comp Pol Stud 45(9):1075–1103. https://doi.org/10.1177/0010414011434007

Ward MD, Gleditsch KS (2008) Spatial regression models. Sage Publications, Thousand Oaks, CA

Whitten GD, Williams LK, Wimpy C (2021) Interpretation: the final spatial frontier. Polit Sci Res Methods 9(1):140–156. https://doi.org/10.1017/psrm.2019.9

Wimpy C, Williams LK, Whitten GD (2021) X marks the spot: unlocking the treasure of spatial-X models. J Polit 81(2). https://doi.org/10.1086/710089

Woods ND (2006) Interstate competition and environmental regulation: a test of the race-to-the-bottom thesis. Soc Sci Q 87(1):174–189. https://doi.org/10.1111/j.0038-4941.2006.00375.x

WTO (2021) Doha WTO Ministerial 2001. https://www.wto.org/english/thewto_e/minist_e/min01_e/mindecl_e.htm. Accessed 27 Sep 2021

Acknowledgements

I am grateful to Zorzeta Bakaki, Tobias Böhmelt, Martin Elff, Ana Carolina Garriga, Federica Genovese, Howard Liu, and participants at the Essex PhD IR Workshop, EPG Online, and GSIPE for valuable comments. I also thank the anonymous reviewers for helping to improve the manuscript a lot. All errors are my own.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhang, M. Trade and the government underfunding of environmental innovation. J Environ Stud Sci 13, 575–586 (2023). https://doi.org/10.1007/s13412-023-00847-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13412-023-00847-4