Abstract

A retention strategy based on an enlightened lapse model is a powerful profitability lever for a life insurer. Some machine learning models are excellent at predicting lapse, but from the insurer’s perspective, predicting which policyholder is likely to lapse is not enough to design a retention strategy. In our paper, we define a lapse management framework with an appropriate validation metric based on Customer Lifetime Value and profitability. We include the risk of death in the study through competing risks considerations in parametric and tree-based models and show that further individualization of the existing approaches leads to increased performance. We show that survival tree-based models outperform parametric approaches and that the actuarial literature can significantly benefit from them. Then, we compare, on real data, how this framework leads to increased predicted gains for a life insurer and discuss the benefits of our model in terms of commercial and strategic decision-making.

Similar content being viewed by others

Data availability

For privacy reasons, all the data, statistics, product names and perimeters presented in this paper have been either anonymized or modified. All analyses, discussions and conclusions remain unchanged.

Notes

Using XGBoost.

We suppose that T has a continuous distribution.

Because derived from the CIF, an improper cumulative distribution function.

unlike to the function \(1-\exp \left( -\int _{0}^{t} \lambda _{T, j}(u) d u\right)\).

as it does not tend to 1 as t goes to \(+\infty\)

References

Akaike H (1973) Information theory and an extension of the maximum likelihood principle. In: Second international symposium on information theory, pp 267–281

Ascarza E, Neslin SA, Netzer O, Anderson Z, Fader PS, Gupta S, Hardie B, Lemmens A, Libai B, Neal DT, Provost F, Schrift R (2018) In pursuit of enhanced customer retention management: review, key issues, and future directions. In: Special issue on 2016 choice symposium. Customer needs and solutions, p 5

Azzone M, Barucci E, Moncayo GG, Marazzina D (2022) A machine learning model for lapse prediction in life insurance contracts. Expert Syst Appl 191:116261. https://doi.org/10.1016/j.eswa.2021.116261. (ISSN 0957-4174)

Blum V, Thérond P-E (2019) Discount rates in IFRS: how practitioners depart the IFRS maze. PhD thesis, Autorité des Normes Comptables

Bou-Hamad I, Larocque D, Ben-Ameur H (2011) A review of survival trees. Stat Surv 5:44–71. https://doi.org/10.1214/09-SS047

Breiman L (2001) Random forests. Mach Learn 45(1):5–32. https://doi.org/10.1023/A:1010933404324

Breiman L, Friedman J, Stone CJ, Olshen RA (1984) Classification and regression trees. Taylor & Francis, UK (ISBN 9780412048418)

Brier GW (1950) Verification of forecasts expressed in terms of probability. Mon Weather Rev 78(1):1–3

Buchardt K (2014) Dependent interest and transition rates in life insurance. Insur Math Econ. https://doi.org/10.1016/j.insmatheco.2014.01.004

Buchardt K, Moller T, Bjerre SK (2015) Cash flows and policyholder behaviour in the semi-Markov life insurance setup. Scand Actuar J 8:660–688. https://doi.org/10.1080/03461238.2013.879919

Burrows R, Lang J (1997) Risk discount rates for actuarial appraisal values of life insurance companies. In: Proceedings of the 7th international AFIR colloquium, pp 283–307

Chen T, Guestrin C (2016) XGBoost: a scalable tree boosting system. In: Proceedings of the 22nd ACM SIGKDD international conference on knowledge discovery and data mining, KDD ’16. ACM, New York, NY, USA, pp 785–794. https://doi.org/10.1145/2939672.2939785. (ISBN 978-1-4503-4232-2)

Chinchor N (1992) Muc-4 evaluation metrics. In: Proceedings of the 4th conference on message understanding, MUC4 ’92. Association for Computational Linguistics, USA, pp 22–29. https://doi.org/10.3115/1072064.1072067. (ISBN 1558602739)

Cox DR (1972) Regression models and life-tables. J Roy Stat Soc Ser B (Methodol) 34(2):187–220. http://www.medicine.mcgill.ca/epidemiology/hanley/c626/cox_jrssB_1972_hi_res.pdf

Cox SH, Lin Y (2006) Annuity lapse modeling: tobit or not tobit ? Society of Actuaries. https://www.soa.org/globalassets/assets/files/research/projects/cox-linn-paper-11-15-06.pdf

Ćurak M, Podrug D, Poposki K (2015) Policyholder and insurance policy features as determinants of life insurance lapse-evidence from Croatia. Econ Bus Rev 1(15), 58–77. https://doi.org/10.18559/ebr.2015.3.5

Dar AA, Dodds C (1989) Interest rates, the emergency fund hypothesis and saving through endowment policies: some empirical evidence for the UK. J Risk Insur 56:415

Davidson-Pilon C (2019) Lifelines: survival analysis in python. J Open Source Softw 4(40):1317. https://doi.org/10.21105/joss.01317

Donkers B, Verhoef P, Jong M (2007) Modeling clv: a test of competing models in the insurance industry. Quant Market Econ (QME) 5(2):163–190

Duchemin R, Matheus R (2021) Forecasting customer churn: comparing the performance of statistical methods on more than just accuracy. J Supply Chain Manage Sci JSCMS 2(3/4):115–137

Eling M, Kiesenbauer D (2014) What policy features determine life insurance lapse? an analysis of the German market. J Risk Insur 81(2):241–269 (ISSN 00224367)

Eling M, Kochanski M (2013) Research on lapse in life insurance: what has been done and what needs to be done? J Risk Fin 14(4):392–413

Freund Y, Schapire RE (1996) Experiments with a new boosting algorithm. In: International conference on machine learning, pp 148–156. http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.51.6252

Gatzert N, Schmeiser H (2008) Assessing the risk potential of premium payment options in participating life insurance contracts. J Risk Insur 75(3):691–712 (ISSN 00224367)

Gemmo I, Götz M (2016) Life insurance and demographic change: an empirical analysis of surrender decisions based on panel data. ICIR working paper series 24/16, Goethe University Frankfurt, International Center for Insurance Regulation (ICIR). https://ideas.repec.org/p/zbw/icirwp/2416.html

Grinsztajn L, Oyallon E, Varoquaux G (2022) Why do tree-based models still outperform deep learning on tabular data?. Thirty-sixth conference on neural information processing systems datasets and benchmarks track. https://openreview.net/forum?id=Fp7__phQszn

Gupta S (2009) Customer-based valuation. J Interact Market 23(2):169–178. https://doi.org/10.1016/j.intmar.2009.02.006. (ISSN 1094-9968)

Gupta S, Lehmann DR (2006) Customer lifetime value and firm valuation. J Relationship Market 5(2–3):87–110. https://doi.org/10.1300/J366v05n02_06

Gupta S, Hanssens D, Hardie B, Kahn W, Kumar V, Lin N, Ravishanker N, Sriram S (2006) Modeling customer lifetime value. J Serv Res 9(139–155):11. https://doi.org/10.1177/1094670506293810

Hanley JA, McNeil BJ (1982) The meaning and use of the area under a receiver operating characteristic (roc) curve. Radiology 143(1):29–36. https://doi.org/10.1148/radiology.143.1.7063747. (PMID: 7063747)

Harrell FE, Califf RM, Pryor DB, Lee KL, Rosati RA (1982) Evaluating the yield of medical tests. JAMA 247(18):2543–2546

He H, Garcia EA (2009) Learning from imbalanced data. IEEE Trans Knowl Data Eng 21(9):1263–1284. https://doi.org/10.1109/TKDE.2008.239

Hu S, O’Hagan A, Sweeney J, Ghahramani M (2021) A spatial machine learning model for analysing customers’ lapse behaviour in life insurance. Ann Actuar Sci 15(2):367–393. https://doi.org/10.1017/S1748499520000329

Hwang Y, Chan LF-S, Tsai J (2022) On voluntary terminations of life insurance: differentiating surrender propensity from lapse propensity across product types. North Am Actuar J 26(2):252–282. https://doi.org/10.1080/10920277.2021.1973507

Ishwaran H, Kogalur UB (2007) Random survival forests for r. R News 7(2):25–31

Ishwaran H, Kogalur UB, Blackstone EH, Lauer MS (2008) Random survival forests. Ann Appl Stat 2(3):841–860. https://doi.org/10.1214/08-AOAS169

Ishwaran H, Gerds TA, Kogalur UB, Moore RD, Gange SJ, Lau BM (2014) Random survival forests for competing risks. Biostatistics 15(4):757–73. https://doi.org/10.1093/biostatistics/kxu010. (Epub 2014 Apr 11. PMID: 24728979 ; PMCID: PMC4173102)

Kagraoka Y (2005) Modeling insurance surrenders by the negative binomial model. In: JAFEE international conference, 01. https://www.researchgate.net/publication/228481596_Modeling_Insurance_Surrenders_by_the_Negative_Binomial_Model

Kiesenbauer D (2012) Main determinants of lapse in the German life insurance industry. North Am Actuar J 16(1):52–73. https://doi.org/10.1080/10920277.2012.10590632

Kim C (2005) Modeling surrender and lapse rates with economic variables. North Am Actuar J 9(4):56–70. https://doi.org/10.1080/10920277.2005.10596225

KPMG (2020) First impressions: Ifrs 17 insurance contracts (2020 edition), Jul 2020. https://assets.kpmg/content/dam/kpmg/ie/pdf/2020/09/ie-ifrs-17-first-impressions.pdf

Kuo W, Tsai C, Chen W-K (2003) An empirical study on the lapse rate: the cointegration approach. J Risk Insur 70(3):489–508 (ISSN 00224367)

Laurent J-P, Norberg R, Planchet F (eds) (2016) Modelling in life insurance—a management perspective (1st edn). European Actuarial Academy (EAA) series. Springer International Publishing, Cham, Switzerland

Leblanc M, Crowley J (1993) Survival trees by goodness of split. J Am Stat Assoc 88(422):457. https://doi.org/10.2307/2290325. (ISSN 0162-1459)

Lemmens A, Gupta S (2020) Managing churn to maximize profits. Mark Sci 39(5):956–973

Loisel S, Piette P, Jason Tsai C-H (2021) Applying economic measures to lapse risk management with machine learning approaches. ASTIN Bull 51(3):839–871. https://doi.org/10.1017/asb.2021.10

Mantel N (1966) Evaluation of survival data and two new rank order statistics arising in its consideration. Cancer Chemother Rep 1(50):163–170

Milhaud X, Dutang C (2018) Lapse tables for lapse risk management in insurance: a competing risk approach. Eur Actuar J 8(1):97–126

Milhaud X, Loisel S, Maume-Deschamps V (2011) Surrender triggers in life insurance: what main features affect the surrender behavior in a classical economic context ? Bull Fran d’Actuar 11(22):5–48

Nolte S, Schneider JC (2017) Don’t lapse into temptation: a behavioral explanation for policy surrender. J Bank Fin 79:12–27

Oh S, Ouh C, Park S, Siyeol C, Park K (2018) A study on the estimation of the discount rate for the insurance liability under ifrs 17. J Insur Fin 29(3):45–75 (ISSN 2384-3209)

Pedregosa F, Varoquaux G, Gramfort A, Michel V, Thirion B, Grisel O, Blondel M, Prettenhofer P, Weiss R, Dubourg V et al (2011) Scikit-learn: machine learning in python. J Mach Learn Res 12:2825–2830

Pölsterl S (2020) scikit-survival: a library for time-to-event analysis built on top of scikit-learn. J Mach Learn Res 21(212):1–6

Poufinas T, Michaelide G (2018) Determinants of life insurance policy surrenders. Mod Econ 9:1400–1422. https://doi.org/10.4236/me.2018.98089

Putter H, Schumacher M, van Houwelingen HC (2020) On the relation between the cause-specific hazard and the subdistribution rate for competing risks data: the fine-gray model revisited. Biom J. https://doi.org/10.1002/bimj.201800274

Renshaw AE, Haberman S (1986) Statistical analysis of life assurance lapses. J Inst Actuar 113:459–497. http://www.jstor.org/stable/41140822

Routh P, Roy A, Meyer J (2021) Estimating customer churn under competing risks. J Oper Res Soc 72(5):1138–1155. https://doi.org/10.1080/01605682.2020.1776166

Russell DT, Fier SG, Carson JM, Dumm RE (2013) An empirical analysis of life insurance policy surrender activity. J Insur Issues 36(1):35–57 (ISSN 15316076)

Shamsuddin S, Noriszura I, Roslan N (2022) What we know about research on life insurance lapse: a bibliometric analysis. Risks 10(97):5. https://doi.org/10.3390/risks10050097

Sirak AS (2015) Income and unemployment effects on life insurance lapse. https://www.wiwi.uni-frankfurt.de/fileadmin/user_upload/dateien_abteilungen/abt_fin/Dokumente/PDFs/Allgemeine_Dokumente/Inderst_Downloads/Neuere_Arbeiten_seit2015/SIRAK_-_Income_and_Unemployment_Effects_on_Life_Insurance_Lapse.pdf

Vasudev M, Bajaj R, Escolano AA (2016) On the drivers of lapse rates in life insurance. Sarjana thesis, University of Barcelona, Barcelona, Spain. https://diposit.ub.edu/dspace/handle/2445/115586

von Mutius B, Huchzermeier A (2021) Customized targeting strategies for category coupons to maximize clv and minimize cost. J Retail 97(4):764–779. https://doi.org/10.1016/j.jretai.2021.01.004. (ISSN 0022-4359)

Yu L, Cheng J, Lin T (2019) Life insurance lapse behaviour: evidence from China. Geneva Pap Risk Insur Issues Pract 44(4):653–678

Acknowledgements

Work(s) conducted within the Research Chair DIALog under the aegis of the Risk Foundation, an initiative by CNP Assurances. The authors would like to express their very great gratitude to Marie Hyvernaud and Stéphanie Dosseh for their valuable and constructive suggestions while developing this research work. Special thanks should be given to Marie Hyvernaud for her contribution to code writing.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

A Appendix

A Appendix

1.1 A.1 Competing risk framework

There are several regression models to estimate the global hazard and the hazard of one risk in settings where competing risks are present: modeling the cause-specific hazard and the subdistribution hazard function. They account for competing risks differently, obtaining different hazard functions and thus distinct advantages, drawbacks, and interpretations. Here, we will introduce those approaches’ theoretical and practical implications and justify which one we will use in our modeling approaches.

In cause-specific regression, each cause-specific hazard is estimated separately, in our case, the cause-specific hazards of lapse and death, by considering all subjects that experienced the competing event as censored. Here, t is the traditional time variable of a survival model, with \(t=0\) being the beginning of a policy. It is not to be confused with the use of t in Sects. 3 and 4. We remind that \(J_{T}=0\) corresponds to an active subject that did not experience lapse \(J_{T}=1\) or death \(J_{T}=2\). The cause-specific hazard rates regarding the jth risk (\(j \in [1, \ldots J]\)) are defined as

We can recover the global hazard rate as \(\lambda _{T, 1}(t)+\cdots +\lambda _{T, J}(t)=\lambda _{T}(t)\), and derive the global survival distribution of T as

This approach aims at analysing the cause-specific “distribution” function: \(F_{T, j}(t)=P\left( T \le t, J_{T}=j\right)\). In practice, it is called the Cumulative Incidence Function (CIF) for cause j and not a distribution function since \(F_{T, j}(t) \rightarrow P\left( J_{T}=j\right) \ne 1\) as \(t \rightarrow +\infty\). By analogy with the classical survival framework, the CIF can be characterised as \(F_{T, j}(t)=\int _{0}^{t} f_{T, j}(s) d s\),Footnote 2 where \(f_{T, j}\) is the improperFootnote 3 density function for cause j. It follows that

The equation above is self-explanatory: the probability of experiencing cause j at time t is simply the product of surviving the previous time periods by the cause-specific hazard at time t. We finally obtain the CIF for cause j as

There are several advantages to that approach. First of all, cause-specific hazard models can be easily fit with any classical implementation of CPH by simply considering as censored any subject that experienced the competing event. Then the CIF is clearly interpretable and summable \(P(T \le t)=F_{T, 1}(s)+\cdots +F_{T, J}(s)\)Footnote 4. On the other hand, the CIF estimation of one given cause depends on all other causes: it implies that the study of a specific cause requires estimating the global hazard rate, and interpreting the effects of covariates on this cause is difficult. Indeed, part of the effects on a specific cause comes from the competing causes, but in our setting, we are only interested in the prediction of the survival probabilities, not their interpretation as such.

We have introduced it at the beginning of this section; another approach is often considered to analyze competing risks and derive a cause-specific CIF. This other approach called the subdistribution hazard function of Fine and Gray regression, works by considering a new competing risk process \(\tau\). Without loss of generality, let’s consider death as our cause of interest,

It has the same as T regarding the risk of death, \(P(\tau \le t)=F_{T, 2}(t)\) and a mass point at infinity \(1-F_{T, 2}(\infty )\), probability to observe other causes \(\left( J_{T} \ne 2\right)\) or not to observe any failure. In other words, if the previous approach considered every subject that experienced competing events as censored, this approach considers a new and artificial at-risk population. This last consideration is made clear when deriving the hazard rate of \(\tau\),

Finally, we obtain the CIF for the risk of death as

This subdistribution approach resolves the most important drawback to cause-specific regression, as the coefficients resulting from it do have a direct relationship with the cumulative incidence: estimating the CIF for a specific cause does not depend on the other causes, which makes the interpretation of CIF easier. The subdistribution hazard models can be fit in R by using the crr function in the cmprsk package or using the timereg package. Still, to our knowledge, there is no implementation of a Fine and Gray model in Lifelines or, more generally, Python. We can also note that these two approaches are linked, [55] and the link between \(\lambda _{\tau }(t)\) and \(\lambda _{T, j}(t)\) is given by

In other words, if the probability of any competing risk is low, the two approaches give very close results.

1.2 A. 2 Survival analysis results

The quantity \(r^{lapser}_{i,t}\) represents the probability that the policy of subject i is still active at time t, given that it was active at its last observed time. Predicting the overall conditional survival with the competing risks, in that case, can be achieved by creating a combined outcome. The policy ends with death or lapse, whichever comes first, and to compute \(r^{lapser}\), we recode the competing events as a combined event. In terms of statistical guarantees, this approach is compatible with any survival analysis method.

In the following sections of this appendix, \(r^{acceptant}_{i,t}\) indicates the probability of survival for subject i at time t given that it will not lapse. In other words, it is the survival probability regarding only the risk of death. As detailed in Sect. 4.1.1, this corresponds to the cause-specific survival probability for death. It is to be noted that the density from which we derive our survival probabilities is improper as it derives itself from the CIF, which is not a proper distribution function.Footnote 5 Therefore, any conclusion about those probabilities should be drawn with care. Similarly to \(r^{lapser}\), covariates selection and tuning are performed by minimizing AIC.

All graphs representing survival curves below are plotted with the same axis. The x-axes are the time in years, the y-axes represent the survival probability.

1.2.1 A.2.1 Cox-model

We first decide to estimate survival with a Cox Proportional hazard model with a spline baseline hazard from the Python library Lifelines. Covariate selection and tuning are performed by minimizing AIC.

Here is what \(r^{acceptant}\), the vector of cause-specific probabilities, looks like, and we can compare it to \(r^{lapser}\) on some subjects (Figs. 9, 10).

The effect of various covariates on the survival outcome can be found below (Figs. 11, 12, 13, 14, 15, 16, 17, 18, 19).

1.2.2 A.2.2 RSF

We obtain better results than Cox in terms of concordance index at the cost of very high computation time for one training with one set of parameters—5 days without parallelisation, 4 h with—compared to a few seconds for cox model (Tables 4, 5).

Some of the results we obtain are displayed below (Figs. 20, 21).

1.2.3 A.2.3 XGSB

We obtain better results than Cox and slightly better results than RSF in terms of concordance index at the cost of even higher computation time for one training with one set of parameters—10 h with great parallelisation—compared to a few seconds for Cox model (Tables 6, 7).

Some of the results we obtain are displayed below (Figs. 22, 23).

1.2.4 A.2.4 Final survival model

The final concordance index scores are displayed below (Table 8):

1.3 A.3 Other results

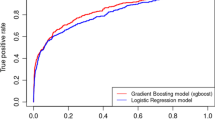

1.4 A.4 Considering various statistical metrics

The table below contains the results of the ”LMS listed in Table 3, evaluated on accuracy, recall, F1-score and AUC. For every metric, it displays the results of a classification over \(y_i\) tuned and cross-validated with each of the metrics—respectively \({\mathop {y_i}\limits ^{accuracy}}\), \({\mathop {y_i}\limits ^{recall}}\), \({\mathop {y_i}\limits ^{F1-score}}\) and \({\mathop {y_i}\limits ^{AUC}}\)—or over \(\tilde{y}_i\) which is always tuned and cross-validated with RG (Table 9, Fig. 24).

It is to be noted that regardless of the evaluation metric used for tuning and validation purposes, the objective function used with XGB to generate those results is always the log-loss function. Using the area under the ROC curve or the area under the Precision-Recall curve as an objective function in this boosting algorithm would surely yield better results when trained on \(y_i\) and even better on the more unbalanced \(\tilde{y}_i\). As stated in Sect. 4.2, this analysis is not within the scope of our article.

1.5 A.5 Complete LMS numerical results

See Table 10.

No | Time (s) | Model | % Target diff | Accuracy | Retention gain | RG/target | Improvement\(^{\text{a}}\) | |||

|---|---|---|---|---|---|---|---|---|---|---|

\(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | |||||

A-1 | 4949 | CART | 62.58% | 92.3% | 85.3% | 114,661 | 219,655 | 4.48 | 38.20 | 91.57% |

RF | 92.9% | 85.4% | 232,314 | 287,884 | 9.82 | 56.65 | 23.92% | |||

XGB | 93.4% | 85.8% | 243,365 | 324,952 | 9.61 | 54.64 | 33.52% | |||

A-2 | 6111 | CART | 26.66% | 92.3% | 89.8% | 7,092,097 | 6,142,119 | 277.00 | 353.83 | \(-\)13.39% |

RF | 92.9% | 90.2% | 6,596,374 | 5,696,455 | 278.47 | 351.02 | \(-\)13.64% | |||

XGB | 93.4% | 90.9% | 7,308,721 | 7,432,688 | 288.92 | 404.84 | 1.70% | |||

A-3 | 4603 | CART | 93.50% | 92.3% | 83.3% | \(-\)2,187,622 | \(-\)8224 | \(-\)85.52 | \(-\)31.09 | 99.62% |

RF | 92.9% | 83.4% | \(-\)1,900,265 | 45,483 | \(-\)80.18 | 194.35 | 102.39% | |||

XGB | 93.4% | 83.5% | \(-\)2,032,650 | 77,481 | \(-\)80.39 | 174.44 | 103.81% | |||

A-4 | 5555 | CART | 55.37% | 92.3% | 86.5% | 4,789,814 | 5,117,844 | 187.00 | 577.74 | 6.85% |

RF | 92.9% | 86.4% | 4,463,796 | 4,255,175 | 188.47 | 566.05 | \(-\)4.67% | |||

XGB | 93.4% | 86.8% | 5,032,706 | 5,433,366 | 198.92 | 610.26 | 7.96% | |||

A-5 | 4753 | CART | 86.72% | 92.3% | 83.6% | \(-\) 514,477 | \(-\)112,372 | \(-\)20.08 | \(-\)86.48 | 78.16% |

RF | 92.9% | 83.4% | \(-\)323,544 | \(-\)3937 | \(-\)13.65 | \(-\)28.28 | 98.78% | |||

XGB | 93.4% | 83.3% | \(-\)383,004 | 0 | \(-\)15.14 | 0 | 100.00% | |||

A-6 | 5803 | CART | 44.27% | 92.3% | 87.9% | 335,810 | 517,224 | 13.17 | 39.91 | 54.02% |

RF | 92.9% | 87.9% | 655,350 | 661,021 | 27.68 | 61.13 | 0.87% | |||

XGB | 93.4% | 88.6% | 654,219 | 729,493 | 25.86 | 58.22 | 11.51% | |||

A-7 | 4241 | CART | 99.09% | 92.3% | 83.3% | \(-\)2,816,759 | \(-\)10,205 | \(-\)110.08 | \(-\)384.04 | 99.64% |

RF | 92.9% | 83.3% | \(-\)2,456,122 | 1013 | \(-\)103.65 | 66.30 | 100.04% | |||

XGB | 93.4% | 83.3% | \(-\)2,659,020 | 243 | \(-\)105.14 | 15.92 | 100.01% | |||

A-8 | 5164 | CART | 82.78% | 92.3% | 84.0% | \(-\)1,966,473 | \(-\)46,323 | \(-\)76.83 | \(-\)22.31 | 97.64% |

RF | 92.9% | 84.0% | \(-\)1,477,229 | 253,885 | \(-\)62.32 | 149.67 | 117.19% | |||

XGB | 93.4% | 84.1% | \(-\)1,621,796 | 273,243 | \(-\)64.14 | 117.83 | 116.85% | |||

A-9 | 4781 | CART | 77.60% | 92.3% | 83.7% | \(-\)825 372 | \(-\)161 100 | \(-\)32.19 | \(-\) 127.87 | 80.48% |

RF | 92.9% | 83.4% | \(-\)384,736 | 8 596 | \(-\)16.22 | 32.12 | 102.23% | |||

XGB | 93.4% | 83.6% | \(-\)498,263 | 22,337 | \(-\)19.70 | 35.47 | 104.48% | |||

A-10 | 6075 | CART | 29.10% | 92.3% | 89.7% | 4,614,513 | 4,483,831 | 180.36 | 266.33 | \(-\)2.83% |

RF | 92.9% | 89.9% | 4,973,929 | 4,328,724 | 210.01 | 280.90 | \(-\)12.97% | |||

XGB | 93.4% | 90.7% | 5,354,770 | 5,368,917 | 211.69 | 301.57 | 0.26% | |||

A-11 | 4506 | CART | 96.56% | 92.3% | 83.2% | \(-\)3,127,655 | \(-\)118,886 | \(-\)122.19 | \(-\)2230.39 | 96.20% |

RF | 92.9% | 83.3% | \(-\)2,517,315 | 1340 | \(-\)106.22 | 87.71 | 100.05% | |||

XGB | 93.4% | 83.3% | \(-\)2,774,278 | 736 | \(-\)109.70 | 52.00 | 100.03% | |||

A-12 | 5534 | CART | 57.93% | 92.3% | 86.2% | 2,312,231 | 3,310,314 | 90.36 | 412.71 | 43.17% |

RF | 92.9% | 86.1% | 2,841,351 | 3,129,652 | 120.01 | 465.74 | 10.15% | |||

XGB | 93.4% | 86.6% | 3,078,755 | 3825920 | 121.69 | 475.53 | 24.27% | |||

A-13 | 4640 | CART | 92.91% | 92.3% | 83.3% | \(-\)1,201,626 | \(-\)163,056 | \(-\)46.87 | \(-\)1838.44 | 86.43% |

RF | 92.9% | 83.3% | \(-\)717,620 | \(-\) 5339 | \(-\)30.28 | \(-\)354.24 | 99.26% | |||

XGB | 93.4% | 83.3% | \(-\)875,378 | 508 | \(-\)34.60 | 16.26 | 100.06% | |||

A-14 | 5739 | CART | 47.12% | 92.3% | 87.3% | \(-\)1,476,651 | \(-\) 831,019 | \(-\)57.49 | \(-\)77.99 | 43.72% |

RF | 92.9% | 86.0% | \(-\)380,683 | 126,532 | \(-\)16.03 | 21.14 | 133.24% | |||

XGB | 93.4% | 85.5% | \(-\)644,389 | 29,382 | \(-\)25.47 | 7.10 | 104.56% | |||

A-15 | 4216 | CART | 99.61% | 92.3% | 83.3% | \(-\)3,503,908 | \(-\) 97,263 | \(-\) 136.87 | \(-\)2354.34 | 97.22% |

RF | 92.9% | 83.3% | \(-\)2,850,198 | 0 | \(-\)120.28 | 0 | 100.00% | |||

XGB | 93.4% | 83.3% | \(-\)3,151,393 | 0 | \(-\)124.60 | 0 | 100.00% | |||

A-16 | 5096 | CART | 84.46% | 92.3% | 83.8% | \(-\)3,778,933 | \(-\)734,773 | \(-\)147.49 | \(-\)418.58 | 80.56% |

RF | 92.9% | 83.5% | \(-\)2 ,513,261 | 8914 | \(-\)106.03 | 20.13 | 100.35% | |||

XGB | 93.4% | 83.6% | \(-\)2,920,405 | 34,492 | \(-\)115.47 | 45.75 | 101.18% | |||

No | Time (s) | Model | % Target diff | Accuracy | Retention gain | RG/target | Improvement\(^{\text{a}}\) | |||

|---|---|---|---|---|---|---|---|---|---|---|

\(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | |||||

A-17 | 5390 | CART | 28.74% | 92.3% | 89.5% | 5,100,456 | 4,899,479 | 199.11 | 279.88 | \(-\)3.94% |

RF | 92.9% | 89.8% | 4,635,482 | 4,226,648 | 195.69 | 276.06 | \(-\)8.82% | |||

XGB | 93.4% | 90.2% | 5,196,736 | 5,138,253 | 205.40 | 299.27 | \(-\)1.13% | |||

A-18 | 6452 | CART | 12.12% | 92.3% | 91.3% | 52,090,240 | 47,706,070 | 2034.15 | 2170.64 | \(-\)8.42% |

RF | 92.9% | 91.9% | 46,171,160 | 42,049,900 | 1949.05 | 2082.36 | \(-\)8.93% | |||

XGB | 93.4% | 92.5% | 51,629,950 | 52,606,740 | 2040.95 | 2339.70 | 1.89% | |||

A-19 | 4913 | CART | 64.89% | 92.3% | 85.2% | 2,798,173 | 3,182,143 | 109.11 | 481.60 | 13.72% |

RF | 92.9% | 85.2% | 2,502,903 | 2,743,070 | 105.69 | 554.76 | 9.60% | |||

XGB | 93.4% | 85.6% | 2,920,720 | 3,438,303 | 115.40 | 576.64 | 17.72% | |||

A-20 | 6160 | CART | 29.03% | 92.3% | 89.6% | 49,787,960 | 45,366,730 | 1944.15 | 2616.32 | \(-\)8.88% |

RF | 92.9% | 90.0% | 44,038,580 | 39,947,830 | 1859.05 | 2547.89 | \(-\)9.29% | |||

XGB | 93.4% | 90.6% | 49,353,940 | 49,789,670 | 1950.95 | 2796.17 | 0.88% | |||

A-21 | 5079 | CART | 51.69% | 92.3% | 86.8% | 482,682 | 544,887 | 18.85 | 53.99 | 12.89% |

RF | 92.9% | 86.8% | 557,090 | 554,195 | 23.52 | 65.17 | \(-\)0.52% | |||

XGB | 93.4% | 87.1% | 607,670 | 624,556 | 24.01 | 64.79 | 2.78% | |||

A-22 | 6199 | CART | 23.94% | 92.3% | 90.2% | 9,335,438 | 8,527,444 | 364.60 | 454.78 | \(-\)8.66% |

RF | 92.9% | 90.6% | 8,570,307 | 7,931,029 | 361.80 | 460.42 | \(-\)7.46% | |||

XGB | 93.4% | 91.2% | 9,518,466 | 9,581,934 | 376.27 | 501.56 | 0.67% | |||

A-23 | 4601 | CART | 89.51% | 92.3% | 83.6% | \(-\)1,819,600 | 135,305 | \(-\) 71.15 | 121.80 | 107.44% |

RF | 92.9% | 83.5% | \(-\)1,575,489 | 159,620 | \(-\) 66.48 | 215.65 | 110.13% | |||

XGB | 93.4% | 83.7% | \(-\)1,668,346 | 228,226 | \(-\) 65.99 | 208.69 | 113.68% | |||

A-24 | 5650 | CART | 50.83% | 92.3% | 87.0% | 7,033,156 | 7,124,100 | 274.60 | 680.08 | 1.29% |

RF | 92.9% | 87.0% | 6,437,729 | 6,364,477 | 271.80 | 711.89 | \(-\)1.14% | |||

XGB | 93.4% | 87.4% | 7,242,450 | 7,840,770 | 286.27 | 771.71 | 8.26% | |||

A-25 | 5379 | CART | 30.97% | 92.3% | 89.2% | 4,160,423 | 3,882,623 | 162.44 | 241.06 | \(-\)6.68% |

RF | 92.9% | 89.5% | 4,018,432 | 3,666,219 | 169.65 | 249.54 | \(-\)8.76% | |||

XGB | 93.4% | 90.0% | 4,455,108 | 4,410,629 | 176.09 | 267.87 | \(-\)1.00% | |||

A-26 | 6410 | CART | 12.52% | 92.3% | 91.3% | 49,612,660 | 45,948,690 | 1937.51 | 2 083.30 | \(-\)7.39% |

RF | 92.9% | 91.9% | 44,548,720 | 40,814,960 | 1880.59 | 2029.68 | \(-\)8.38% | |||

XGB | 93.4% | 92.5% | 49,676,000 | 50,549,740 | 1963.72 | 2260.20 | 1.76% | |||

A-27 | 4887 | CART | 66.67% | 92.3% | 85.1% | 1,858,140 | 2,575,538 | 72.44 | 442.86 | 38.61% |

RF | 92.9% | 85.0% | 1,885,853 | 2,387,018 | 79.65 | 531.25 | 26.57% | |||

XGB | 93.4% | 85.4% | 2,179,093 | 2,879,880 | 86.09 | 544.35 | 32.16% | |||

A-28 | 6047 | CART | 29.42% | 92.3% | 89.4% | 47,310,370 | 43,168,880 | 1847.51 | 2519.41 | \(-\)8.75% |

RF | 92.9% | 89.9% | 42,416,140 | 38,573,620 | 1790.59 | 2504.61 | \(-\)9.06% | |||

XGB | 93.4% | 90.5% | 47,399,990 | 47,812,830 | 1873.72 | 2721.63 | 0.87% | |||

A-29 | 5070 | CART | 53.79% | 92.3% | 86.5% | \(-\) 204 467 | \(-\) 5098 | \(-\) 7.95 | \(-\) 1.66 | 97.51% |

RF | 92.9% | 86.1% | 163,014 | 273,435 | 6.90 | 40.30 | 67.74% | |||

XGB | 93.4% | 86.8% | 115,297 | 248,982 | 4.55 | 28.64 | 115.95% | |||

A-30 | 6179 | CART | 24.36% | 92.3% | 90.3% | 7,522,978 | 7,058,487 | 293.94 | 382.06 | \(-\)6.17% |

RF | 92.9% | 90.6% | 7,534,275 | 7,068,293 | 318.08 | 411.80 | \(-\)6.18% | |||

XGB | 93.4% | 91.2% | 8,219,857 | 8,265,167 | 324.94 | 442.88 | 0.55% | |||

A-31 | 4627 | CART | 90.18% | 92.3% | 83.6% | \(-\) 2 506 749 | \(-\) 139 983 | \(-\) 97.95 | \(-\) 121.44 | 94.42% |

RF | 92.9% | 83.5% | \(-\)1,969,564 | 73,101 | \(-\) 83.10 | 111.49 | 103.71% | |||

XGB | 93.4% | 83.6% | \(-\)2,160,719 | 76,641 | \(-\) 85.45 | 93.28 | 103.55% | |||

A-32 | 5679 | CART | 51.25% | 92.3% | 86.8% | 5, 220,695 | 5,811,833 | 203.94 | 583.55 | 11.32% |

RF | 92.9% | 86.9% | 5,401,696 | 5,269,505 | 228.08 | 605.69 | \(-\)2.45% | |||

XGB | 93.4% | 87.4% | 5,943,841 | 6,682,230 | 234.94 | 670.03 | 12.42% | |||

No | Time (s) | Model | % Target diff | Accuracy | Retention gain | RG/target | Improvement\(^{\text{a}}\) | |||

|---|---|---|---|---|---|---|---|---|---|---|

\(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | |||||

B-1 | 4778 | CART | 75.89% | 92.3% | 84.0% | \(-\) 627,165 | \(-\)148,913 | \(-\)24.46 | \(-\)65.19 | 76.26% |

RF | 92.9% | 83.7% | \(-\)280,855 | 11,973 | \(-\)11.84 | 9.57 | 104.26% | |||

XGB | 93.4% | 84.1% | \(-\)366,103 | 25,099 | \(-\)14.47 | 12.30 | 106.86% | |||

B-2 | 6074 | CART | 29.70% | 92.3% | 89.7% | 3,862,156 | 3,397,247 | 150.95 | 203.11 | \(-\)12.04% |

RF | 92.9% | 89.9% | 4,127,224 | 3,550,730 | 174.26 | 230.67 | \(-\)13.97% | |||

XGB | 93.4% | 90.6% | 4,451,686 | 4,408,819 | 175.99 | 250.17 | \(-\)0.96% | |||

B-3 | 4528 | CART | 96.60% | 92.3% | 83.2% | \(-\)2,929,448 | \(-\)85,465 | \(-\)114.46 | \(-\)1482.06 | 97.08% |

RF | 92.9% | 83.3% | \(-\)2,413,433 | 3724 | \(-\)101.84 | \(-\)108.33 | 100.15% | |||

XGB | 93.4% | 83.3% | \(-\)2,642,119 | 9092 | \(-\)104.47 | 93.79 | 100.34% | |||

B-4 | 5476 | CART | 60.93% | 92.3% | 85.9% | 1,559,874 | 2,471,262 | 60.95 | 329.63 | 58.43% |

RF | 92.9% | 85.8% | 1,994,645 | 2,517,111 | 84.26 | 422.45 | 26.19% | |||

XGB | 93.4% | 86.3% | 2,175,670 | 3,089,897 | 85.99 | 422.77 | 42.02% | |||

B-5 | 4708 | CART | 84.33% | 92.3% | 83.4% | \(-\)857,439 | \(-\)159,856 | \(-\)33.45 | \(-\)218.16 | 81.36% |

RF | 92.9% | 83.3% | \(-\)484,459 | 40 | \(-\)20.44 | 7.23 | 100.01% | |||

XGB | 93.4% | 83.3% | \(-\)596,203 | 897 | \(-\)23.57 | 46.96 | 100.15% | |||

B-6 | 5906 | CART | 36.63% | 92.3% | 88.8% | 705,721 | 922,490 | 27.69 | 60.21 | 30.72% |

RF | 92.9% | 88.9% | 1,352,182 | 1,269,349 | 57.11 | 97.63 | \(-6.13\)% | |||

XGB | 93.4% | 89.6% | 1,342,882 | 1,428,722 | 53.09 | 96.76 | 6.39% | |||

B-7 | 4400 | CART | 98.49% | 92.3% | 83.2% | \(-\)3,159,722 | \(-\)39,633 | \(-\)123.45 | \(-\)1230.61 | 98.75% |

RF | 92.9% | 83.3% | \(-\)2,617,037 | 1024 | \(-\)110.44 | 0.56 | 100.04% | |||

XGB | 93.4% | 83.3% | \(-\)2,872,219 | 295 | \(-\)113.57 | 19.31 | 100.01% | |||

B-8 | 5278 | CART | 73.18% | 92.3% | 84.6% | \(-\)1,596,562 | 169,852 | \(-\)62.31 | 41.78 | 110.64% |

RF | 92.9% | 84.6% | \(-\)780,396 | 637,625 | \(-\)32.89 | 194.52 | 181.71% | |||

XGB | 93.4% | 85.0% | \(-\)933,133 | 780,845 | \(-\)36.91 | 188.79 | 183.68% | |||

B-9 | 4601 | CART | 94.12% | 92.3% | 83.3% | \(-\)2,380,789 | \(-\)113,444 | \(-\)92.86 | \(-\)840.25 | 95.24% |

RF | 92.9% | 83.3% | \(-\)1,403,468 | 317 | \(-\)59.21 | 7.96 | 100.02% | |||

XGB | 93.4% | 83.3% | \(-\)1,724,731 | 3980 | \(-\)68.17 | 149.44 | 100.23% | |||

B-10 | 5947 | CART | 35.98% | 92.3% | 89.0% | \(-\)760,449 | 429,196 | \(-\)29.35 | 29.80 | 156.44% |

RF | 92.9% | 88.5% | 1,175,540 | 1,354,131 | 49.71 | 118.11 | 15.19% | |||

XGB | 93.4% | 89.8% | 871,455 | 1,456,080 | 34.48 | 96.25 | 67.09% | |||

B-11 | 4229 | CART | 99.16% | 92.3% | 83.3% | \(-\)4,683,072 | \(-\)48,985 | \(-\)182.86 | \(-\)1186.22 | 98.95% |

RF | 92.9% | 83.3% | \(-\)3,536,046 | 0 | \(-\)149.21 | 0 | 100.00% | |||

XGB | 93.4% | 83.3% | \(-\)4,000,747 | 0 | \(-\)158.17 | 0 | 100.00% | |||

B-12 | 5391 | CART | 66.76% | 92.3% | 85.0% | \(-\)3,062,732 | \(-\)388,289 | \(-\)119.35 | \(-\)80.44 | 87.32% |

RF | 92.9% | 84.7% | \(-\)957,039 | 710,688 | \(-\)40.29 | 220.55 | 174.26% | |||

XGB | 93.4% | 85.3% | \(-\)1,404,561 | 834,198 | \(-\)55.52 | 163.88 | 159.39% | |||

B-13 | 4493 | CART | 96.30% | 92.3% | 83.3% | \(-\)2,358,179 | \(-\)159,922 | \(-\)91.98 | \(-\)2793.13 | 93.22% |

RF | 92.9% | 83.3% | \(-\)1,384,098 | 0 | \(-\)58.40 | 0 | 100.00% | |||

XGB | 93.4% | 83.3% | \(-\)1,705,577 | 0 | \(-\)67.42 | 0 | 100.00% | |||

B-14 | 5851 | CART | 42.98% | 92.3% | 87.8% | \(-\)3,251,762 | \(-\)1,761,821 | \(-\)126.63 | \(-\)143.20 | 45.82% |

RF | 92.9% | 86.4% | \(-\)1,013,089 | 79,273 | \(-\)42.69 | 11.90 | 107.82% | |||

XGB | 93.4% | 83.3% | \(-\)1,582,006 | 4396 | \(-\)62.52 | 287.68 | 100.28% | |||

B-15 | 4040 | CART | 99.67% | 92.3% | 83.3% | \(-\)4,660,462 | \(-\)38,969 | \(-\)181.98 | \(-\)2075.03 | 99.16% |

RF | 92.9% | 83.3% | \(-\)3,516,676 | 0 | \(-\)148.40 | 0 | 100.00% | |||

XGB | 93.4% | 83.3% | \(-\)3,981,592 | 161 | \(-\)157.42 | 10.53 | 100.00% | |||

B-16 | 5182 | CART | 77.97% | 92.3% | 84.2% | \(-\)5,554,044 | \(-\)1,491,522 | \(-\)216.63 | \(-\)549.23 | 73.15% |

RF | 92.9% | 83.6% | \(-\)3,145,668 | 52,475 | \(-\)132.69 | 84.54 | 101.67% | |||

XGB | 93.4% | 83.3% | \(-\)3,858,022 | 0 | \(-\)152.52 | 0 | 100.00% | |||

No | Time (s) | Model | % Target diff | Accuracy | Retention gain | RG/target | Improvement\(^{\text{a}}\) | |||

|---|---|---|---|---|---|---|---|---|---|---|

\(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | \(y_i\) | \(\tilde{y}_i\) | |||||

B-17 | 5324 | CART | 32.66% | 92.3% | 88.9% | 3,361,471 | 3,037,200 | 131.25 | 191.31 | \(-\)9.65% |

RF | 92.9% | 89.3% | 3,241,680 | 2,911,023 | 136.86 | 204.43 | \(-\)10.20% | |||

XGB | 93.4% | 89.6% | 3,596,593 | 3,546,671 | 142.15 | 222.04 | \(-\)1.39% | |||

B-18 | 6411 | CART | 13.83% | 92.3% | 91.1% | 39,860,670 | 37,695,680 | 1556.66 | 1778.71 | \(-\)5.43% |

RF | 92.9% | 91.7% | 35,787,050 | 32,345,100 | 1510.72 | 1654.32 | \(-\)9.62% | |||

XGB | 93.4% | 92.0% | 39,908,670 | 40,886,810 | 1577.61 | 1848.71 | 2.45% | |||

B-19 | 4853 | CART | 70.34% | 92.3% | 84.7% | 1,059,189 | 1,813,631 | 41.25 | 392.14 | 71.23% |

RF | 92.9% | 84.8% | 1,109,101 | 1,808,616 | 46.86 | 474.33 | 63.07% | |||

XGB | 93.4% | 85.0% | 1,320,578 | 2,141,271 | 52.15 | 482.34 | 62.15% | |||

B-20 | 5973 | CART | 31.76% | 92.3% | 89.2% | 37,558,390 | 34,068,550 | 1466.66 | 2125.97 | \(-\)9.29% |

RF | 92.9% | 89.4% | 33,654,470 | 30,032,580 | 1420.72 | 2072.47 | \(-\)10.76% | |||

XGB | 93.4% | 90.1% | 37,632,650 | 38,008,480 | 1487.61 | 2277.17 | 1.00% | |||

B-21 | 5228 | CART | 41.79% | 92.3% | 87.7% | 1,136,879 | 1,179,837 | 44.40 | 92.50 | 3.78% |

RF | 92.9% | 88.1% | 1,276,808 | 1,188,256 | 53.91 | 104.81 | \(-\)6.94% | |||

XGB | 93.4% | 88.7% | 1,385,145 | 1,356,864 | 54.74 | 104.76 | \(-\)2.04% | |||

B-22 | 6296 | CART | 19.52% | 92.3% | 90.7% | 18,704,980 | 17,177,190 | 730.55 | 852.81 | \(-\)8.17% |

RF | 92.9% | 91.1% | 17,182,100 | 15,732,340 | 725.34 | 859.29 | \(-\)8.44% | |||

XGB | 93.4% | 91.5% | 19,071,370 | 19,050,020 | 753.90 | 939.00 | \(-\)0.11% | |||

B-23 | 4746 | CART | 81.36% | 92.3% | 84.1% | \(-\) 1,165,404 | 458,223 | \(-\) 45.60 | 172.83 | 139.32% |

RF | 92.9% | 84.0% | \(-\) 855,770 | 525,335 | \(-\) 36.09 | 288.55 | 161.39% | |||

XGB | 93.4% | 84.1% | \(-\) 890,871 | 645,445 | \(-\) 35.26 | 310.86 | 172.45% | |||

B-24 | 5845 | CART | 40.47% | 92.3% | 88.2% | 16,402,700 | 15,013,310 | 640.55 | 1093.43 | \(-\)8.47% |

RF | 92.9% | 88.4% | 15,049,520 | 13,423,040 | 635.34 | 1122.81 | \(-\)10.81% | |||

XGB | 93.4% | 88.9% | 16,795,360 | 17,144,260 | 663.90 | 1247.50 | 2.08% | |||

B-25 | 5274 | CART | 37.42% | 92.3% | 88.6% | 1,607,847 | 1,839,864 | 62.84 | 126.33 | 14.43% |

RF | 92.9% | 88.7% | 2,119,067 | 1,923,982 | 89.49 | 152.71 | \(-\)9.21% | |||

XGB | 93.4% | 89.2% | 2,237,965 | 2,194,469 | 88.45 | 155.54 | \(-\)1.94% | |||

B-26 | 6425 | CART | 14.83% | 92.3% | 91.1% | 35,238,060 | 32,690,970 | 1376.37 | 1558.26 | \(-\)7.23% |

RF | 92.9% | 91.6% | 32,835,370 | 29,986,540 | 1386.17 | 1543.12 | \(-\)8.68% | |||

XGB | 93.4% | 92.0% | 36,328,440 | 36,803,630 | 1436.10 | 1688.53 | 1.31% | |||

B-27 | 4811 | CART | 73.92% | 92.3% | 84.3% | \(-\) 694,436 | 751,404 | \(-\) 27.16 | 226.99 | 208.20% |

RF | 92.9% | 84.4% | \(-\)13,512 | 1,018,369 | \(-\)0.51 | 356.48 | 7636.98% | |||

XGB | 93.4% | 84.7% | \(-\)38,050 | 1,253,252 | \(-\)1.55 | 345.94 | 3393.68% | |||

B-28 | 5995 | CART | 32.61% | 92.3% | 89.1% | 32,935,780 | 29,342,930 | 1286.37 | 1847.71 | \(-\)10.91% |

RF | 92.9% | 89.4% | 30,702,790 | 27,725,620 | 1296.17 | 1933.38 | \(-\)9.70% | |||

XGB | 93.4% | 90.0% | 34,052,420 | 34,390,060 | 1346.10 | 2094.90 | 0.99% | |||

B-29 | 5143 | CART | 47.03% | 92.3% | 87.3% | \(-\)363,861 | 55,985 | \(-\)14.12 | 3.38 | 115.39% |

RF | 92.9% | 87.4% | 377,170 | 488,284 | 15.95 | 49.62 | 29.46% | |||

XGB | 93.4% | 88.0% | 275,772 | 491,567 | 10.89 | 44.89 | 78.25% | |||

B-30 | 6243 | CART | 20.47% | 92.3% | 90.7% | 14,747,500 | 13,838,380 | 576.23 | 690.22 | \(-\)6.16% |

RF | 92.9% | 91.1% | 14,816,830 | 13,378,460 | 625.54 | 743.34 | \(-\)9.71% | |||

XGB | 93.4% | 91.5% | 16,146,490 | 16,169,440 | 638.30 | 814.80 | 0.14% | |||

B-31 | 4730 | CART | 83.83% | 92.3% | 83.7% | \(-\)2,666,144 | \(-\)487,716 | \(-\) 104.12 | \(-\) 267.75 | 81.71% |

RF | 92.9% | 83.7% | \(-\) 1,755,409 | 139,545 | \(-\) 74.05 | 102.66 | 107.95% | |||

XGB | 93.4% | 83.7% | \(-\) 2,000,244 | 134,199 | \(-\) 79.11 | 130.13 | 106.71% | |||

B-32 | 5865 | CART | 41.41% | 92.3% | 88.0% | 12,445,210 | 11,693,070 | 486.23 | 884.49 | \(-\)6.04% |

RF | 92.9% | 88.3% | 12,684,250 | 11,381,260 | 535.54 | 971.28 | \(-\)10.27% | |||

XGB | 93.4% | 88.8% | 13,870,470 | 14,101,470 | 548.30 | 1048.38 | 1.67% | |||

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Valla, M., Milhaud, X. & Olympio, A. Including individual customer lifetime value and competing risks in tree-based lapse management strategies. Eur. Actuar. J. 14, 99–144 (2024). https://doi.org/10.1007/s13385-023-00358-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-023-00358-0