Abstract

This research aims to explore the role of social media as aids for accounting education and how people use social media to share accounting knowledge. We use the 5E Learning Model and the Knowledge Management (KM) Processes Model to investigate this issue using qualitative research methods and interviews. Our findings indicate that accounting practitioners and learners discovered knowledge through previous classrooms and exchanges between colleagues in knowledge discovery. In sharing knowledge, they shared their experiences by freely publishing posts, testing cognition, and interacting and communicating. In knowledge capture, learners capture knowledge by viewing online courses, using social media to contact accounting practitioners, learning from others’ experiences, and posting questions. In knowledge application, learners apply knowledge in examinations, internships, work guidance, error avoidance, and daily fund management. We also discovered that accounting practitioners and learners have different attitudes toward the issue of knowledge payment. We put forward suggestions for establishing accounting forums and groups on social media. Accounting practitioners should be willing to share knowledge, and accounting learners should gain knowledge through interaction. The public should use social media to know more about the profession and gain basic accounting knowledge to facilitate daily living.

Similar content being viewed by others

Introduction

With the development of science and technology, social media has established an open and collaborative communication channel for people, playing an increasingly important role in people’s work, study, and life (Dong et al., 2021; Wang et al., 2021a, 2021b; Yang et al., 2022). Social media helps people share information anytime, anywhere, and quickly and thus helps learning (Cepeda-Carrion et al., 2022; Lei et al., 2021; Leung et al., 2021; Ma et al., 2016; Sungkur et al., 2020).

To disseminate financial and business information, the active use of social media can increase communication with stakeholders (Blankespoor, 2018; Cheung et al., 2022a, 2022b; Kebede, 2020). In the accounting sector, some prior research has suggested that people increasingly need social media to learn accounting through popularizing accounting news, sharing learning experiences, and promoting collaboration and innovation (Khan et al., 2016). However, other research (Lin & Hwang, 2021) reveals that some accounting practitioners do not know or are unwilling to use social media to share accounting knowledge due to personality and age factors.

Knowledge management (KM) frameworks can systematically describe the process of discovery, capture, sharing, and application of knowledge on social media (Attour & Barbaroux, 2021; de Castro Peixoto et al., 2022; Khatun et al., 2022; Riad Shams & Belyaeva, 2019). Therefore, this research investigates these problems and guides practitioners and learners to use social media correctly to share and acquire accounting knowledge by critically analyzing the role of social media in accounting knowledge management processes. Our findings of good practice provide practical and theoretical guidelines for accounting practitioners and learners in different fields to use social media, reveal the perceived pros and cons of social media learning, and propose new insights on knowledge sharing and acquisition. In particular, the following four research questions (RQs) guide this study:

-

RQ1. How do accounting practitioners and learners discover knowledge?

-

RQ2. How do accounting practitioners and learners share accounting knowledge on social media?

-

RQ3. How do accounting learners get the information that has been shared?

-

RQ4. How do accounting learners apply such knowledge?

Literature Review

Social Media

Social media refers to a platform based on user content and interactions (Yoo et al., 2019). It is a medium through which people use social media to exchange experiences, opinions, and speeches, characterized by comprehensive coverage, fast transmission speed, spontaneity, and interaction (Dong et al., 2021; Lei et al., 2021). Social media relies on Web 2.0, and the central meaning is to empower the Internet to be democratic, which is its mass and technical foundation (Lin et al., 2016).

Social media’s advantages are promoting information disclosure, providing real-time communications, free access to knowledge, live content, and user interaction (Chan et al., 2020; Cheng et al., 2020; Lam et al., 2022; Süar, 2017). Compared with traditional media, social media has a different form of communication, entry barriers, and speed, and it has occupied an important position in people’s work and lives today (Lei et al., 2021; Nijssen & Ordanini, 2020). In addition, for some specialized organizations, corporate social media can make it easier to contact the company and customers, impacting customers’ investment decisions (Cade, 2018).

Knowledge Sharing on Social Media

Knowledge sharing refers to social dissemination activities in a particular social environment. With the help of specific means and media, some social groups disseminate specific knowledge and information to other social groups and hope to achieve the expected results (Mehrizi, 2016), forming a community of practice (Lei et al., 2021; Yang et al., 2022). For practitioners, social media makes the dissemination of online knowledge among practitioners more frequent and faster (Xiong et al., 2018). For learners, social media expands the objects and scope of their learning and exposure to knowledge, creates a dedicated learning environment, and changes how they use and process knowledge and information (Dron & Anderson, 2014).

Knowledge sharing on social media is convenient and fast, saving time and money without being restricted by geographical areas (Gunasagaran et al., 2019). However, knowledge accumulated and shared on social media is not as systematic and linguistical as knowledge from books. Therefore, it is necessary for those who accept knowledge to treat knowledge dialectically (Gibbs et al., 2013). Appropriate and effective use of social media is conducive to disseminating knowledge, improving knowledge acquisition efficiency, and creating a healthy and progressive network environment.

Social Media in Accounting Education

Social media also plays a vital role in the accounting field. Social media allows accountants to learn about the updated company system, the latest tax rates, and bookkeeping methods (Fineberg, 2012). In addition, accountants can use international social media to communicate and cooperate, which is very useful for understanding the accounting policies of multinational companies. They can also use it to learn international accounting standards and accounting methods in different countries. When multinational companies need to cooperate with other countries, social media can help accountants obtain accounting materials across the globe (Radhakrishnan et al., 2018).

Furthermore, accounting learners can find information about accounting professional exams, download exam questions and books, communicate with teachers and mentors, and ask questions on social media (Khan et al., 2016). Thus, social media provides an intermediary for students and experienced people, facilitating students to seek help and advice from accounting practitioners of different backgrounds and obtain accounting internship information.

For listed companies and public organizations, people can use relevant financial information on social media to monitor whether accountants have faithfully reflected the organizations’ finances, making the information more transparent (Thankachan & George, 2012). Moreover, social media is also conducive to accounting professional ethics and has an excellent supervisory effect on the entire industry. For example, certain social media platforms such as Glassdoor.com can provide insider information, and practitioners can freely share experiences, opinions, and analyses of the company’s prospects, which is beneficial for organizations to gather opinions from all parties and monitor the company’s senior personnel (Hales et al., 2018).

Theoretical Framework

This research provides new perspectives on how accounting practitioners use social media to disseminate their knowledge to the next generation. Compared with some prior research (for example, Naeem, 2019), more studies currently expound on the role of social media in knowledge sharing. However, few of them focus on knowledge sharing in the domain of accounting knowledge. Therefore, this research can fill this research gap.

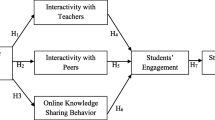

Two research models guide this study, providing the basis for the qualitative interview questions and follow-up analyses. The first is the 5E learning model, which emphasizes taking participants as the center and solving problems through investigations and experiments (Keeley, 2017). The 5E in their models are Engage, Explore, Explain, Elaborate, and Evaluate. Engage introduces some interesting questions as knowledge exploration to increase the participants’ interest and facilitate concentration in further learning. Explore means to guide participants to investigate the topic independently so they can be inserted naturally. Explain refers to verifying whether the topic is logical and factual through verifying facts, opinions, and knowledge. Elaborate is to arouse in-depth thinking and create new knowledge. Evaluate is to comment on things to reflect on and adjust. The 5E learning model has been used in investigating reading habits (Cheung et al., 2022a, 2022b) and student learning (Lam et al., 2022). In this research, we use it to guide the interview analysis and systematically explore the effectiveness of social media as aids for accounting education and knowledge sharing.

The second research model applied in the research is the knowledge management (KM) process model, comprising knowledge discovery, capture, sharing, and application (Amber et al., 2018). Knowledge discovery refers to developing new knowledge from available data and information or synthesizing prior knowledge (Anthony, 2021). Knowledge capture refers to retrieving knowledge that resides within people, artifacts, or organizational entities (Cepeda-Carrion et al., 2022). Knowledge sharing refers to how knowledge is communicated to other individuals across individuals, groups, departments, or organizations (Sungkur & Santally, 2019; Oliveira et al., 2022; Lepore et al., 2022). Knowledge application refers to applying knowledge to carry out useful tasks (Caliari & Chiarini, 2021; Attour Barboaroux, 2021; Zhan & Xie, 2022). The KM process model guides the formulation of our research questions and discussions on what and how accounting knowledge is shared and disseminated on social media sustainably.

Methodology

This study uses qualitative research to examine the attributes of participants through dialogs and analysis to help determine this study’s essential attributes (Priya, 2021). The semi-structured interview is developed based on the 5E Model (Keeley, 2017) and the KM process model (Amber et al., 2018). We invited 11 accounting practitioners and learners from China to participate in our interview. They had diversified backgrounds, including company accounting personnel, accounting information publishers, graduate students majoring in accounting, and learners who would take professional accounting exams.

The interviews were conducted through a combination of online and face-to-face methods. Online interview was the first choice because it is convenient and saves time and money (Davies et al., 2020). In addition, as this research was conducted during the COVID-19 pandemic period, online interviews were a natural choice to kick off the interviews and build up the trust between the interviewers and interviewees (Huang et al., 2021; 2022) ahead of face-to-face interviews when needed. The interview was based on the 5E model, starting with the background of the participants and then gradually increasing the more in-depth questions according to the KM process model. Since participants were from Mainland China, the interview questions were set in English and Mandarin (See Appendix for the English version of the interview scripts). There were 20 interview questions in total, and each respondent took about 15 min to respond.

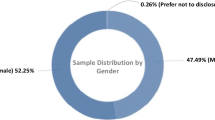

Table 1 shows the demographic information of our respondents. Our respondents had diversified academic backgrounds, ranging from undergraduate to doctoral students. Some were college or graduate students who would like to pursue the accounting profession as their career. Their academic disciplines ranged from accounting, software engineering, economics, and library and information management. For those working, their capacities ranged from newly recruited frontline staff to senior management. They came from different industries, including banking, accounting, and construction. Our information summarized from the interviews became saturated after around ten rounds of interviews. Thus, we stopped after the 11th one.

Interview Analysis

Engaging Accounting Practitioners and Learners with Social Media

The engagement stage summarizes the respondents’ use of social media as outlined in Table 2. They used social media platforms such as WeChat, Bilibili, Weibo, and QQ to share accounting knowledge almost daily. The knowledge they shared was mainly conceptual and communicative accounting knowledge. There was also little practical knowledge sharing on social media. Therefore, accounting practitioners and learners may use social media to enrich their knowledge, and social media provides these participants with various interactive ways to learn accounting knowledge (Eschenbrenner et al., 2015).

Exploring Accounting Practitioners and Learners with Social Media

The exploration stage summarizes the characteristics of social media as outlined in Table 3. For example, it was highly interactive, professional, and convenient for participants to publish their ideas timely, and it helped students repeatedly watch the course. Through the communication feature of social media, learners could connect and learn from outstanding accounting practitioners and experienced people, forming a community of practice (Lei et al., 2021). In this way, social media is like a bridge in accounting learning, and it can provide feedback and learning materials, simplify complex problems, and facilitate knowledge reuse.

Explaining Accounting Practitioners and Learners with Social Media

The explanation stage summarizes the reasons for using social media as outlined in Tables 4. For instance, it provided participants with communication channels and accounting practice and allowed them to learn more specific accounting knowledge. Through social media, participants learned the latest policies, asset inventory, subject definitions, and other conceptual and practical knowledge. In this way, social media can help the community of practitioners and learners avoid mistakes, strengthen memory, learn from others, and make daily fund management (Yang & Berger, 2017).

Elaborating Accounting Practitioners and Learners with Social Media

The elaboration phase summarizes the role of social media in accounting learning. Regarding sharing knowledge, people could publish news in time, trigger multiple people to participate, and harvest fans interested in the accounting field (See Table 5). In acquiring knowledge, people can express their opinions anytime and anywhere and obtain comprehensive and high-quality knowledge. Social media allowed participants to freely combine knowledge and choose who to share with to avoid embarrassment and communicate with each other. To combine old and new knowledge, interviewees completed it by notetaking, discussions, and self-reflection.

Evaluation of Social Media by Accounting Practitioners and Learners

The evaluation stage is the comment of the interviewees on social media learning as outlined in Table 6. When it comes to sharing and acquiring accounting knowledge, social media has two sides. According to the interviewees, although it was timely, the information might be imperfect, lacked realism, and exposed the sharer to cyber violence.

Discussion

In this section, we discuss the four research questions which have been formulated under the conceptual lens of the KM process model: discovery, capture, sharing, and application of accounting knowledge, with a focus on the practical implications.

Accounting Knowledge Discovery (RQ1)

Table 7 summarizes how accounting practitioners and learners discovered knowledge for learning accounting. Interviewees new to the field often attempt to discover knowledge through accounting classes and website searches. For example, class knowledge included basic accounting concepts and subject processing in books, problems prone to errors in preparing financial statements taught by instructors, and reporting processes that the interviewees simulated in accounting practice classes. The interviewees used two main ways to search web pages: browser searches (such as Baidu, Sogou, and Google) and professional accounting app searches (such as Dongao, Chinaacc, and Kuaijitong).

Interviewees new to the field used social media to search for information to help them because they had just joined the practice. They were afraid that their knowledge inadequacy might be exposed and avoided disturbing the work of other colleagues (Oliveira et al., 2022). Hence, they used technologies to discover knowledge to avoid embarrassment and accusations since this is quite a general phenomenon for the new generation (Schroth, 2019). In contrast, experienced interviewees tended to get real knowledge from practice and communication with colleagues. For example, they could choose the style and method of pasting bills according to their work needs and audit verification requirements to avoid errors and administrative problems (Jiang & Zhou, 2017).

Besides, similar to other professions (Lei et al., 2021; Khatun et al., 2022), accounting learners discovered accounting knowledge through the recommendation of instructors and classmates and WeChat official accounts, which some practitioners also found useful. For example, they could learn about the functions of particular accounting software through the vendor’s official WeChat account to better use them for their work, increasing their work efficiency.

Different from the findings of Burdon & Munro, (2017) that the primary source of accounting knowledge is from life situations, our interviewees of different backgrounds use different methods of discovering accounting knowledge. Regardless of the method used, interviewees of different backgrounds generally used methods that suited them to solve problems that arise in work or learning, improve their efficiency, transform the findings into their knowledge, and continue to enrich themselves.

Sharing Accounting Knowledge on Social Media (RQ2)

There are many ways to share accounting knowledge on social media (Majchrzak et al., 2013). Usually, accounting instructors post courses, assignments, tests, and feedback through online course management systems, including massive open online courses (MOOC) platforms (Cheng et al., 2022a, 2022b; Gardner & Brooks, 2018; Khatun et al., 2022). Such platforms integrate various social network tools and digital resources to form diversified learning tools and rich curriculum resources. Accounting instructors can share conceptual knowledge and promptly answer questions raised by the students on such platforms, which are highly interactive. It can overcome time, space, and other general restrictions of traditional courses and meet the needs of large-scale course learners (Veletsianos et al., 2015).

Many excellent accounting practitioners share their accounting experience in Zhihu, a high-quality Chinese Internet question-and-answer community and original content platform where creators gather (Chen et al., 2022). It allows accounting practitioners to share their knowledge and experience with people in need by writing posts, and they can further share knowledge with those in need through private chats or comments. Experienced practitioners also use WeChat private chat or group chat to discuss knowledge points and share problems encountered at work with colleagues. WeChat can provide instant messaging timelier than various social media platforms (Dong et al., 2021; Yin et al., 2021). As experienced practitioners have enough conceptual and practical knowledge reserves, they need more to handle details and meet their superiors’ requirements. Using WeChat enables them to quickly get specific instructions and share the problems that need to be dealt with by multiple people at once through group chats, making their sharing faster (Lam et al., 2022).

In addition, the interviewees mainly focused on the following in terms of shared content. The first was the practitioners’ experience explaining what knowledge should be used in accounting practice to solve practical problems. For example, changes in accounting practices brought about by tax policy changes, how to conduct asset inspections, specific treatment of subjects in accounting practices, and areas requiring special treatment in preparing financial statements. They shared their insights by posting these experiences on social media (Imran et al., 2019).

In line with Moghavvemi et al. (2017), people sharing knowledge on social media can be recognized and respected by others to achieve a realm of mutual benefit. Due to the spontaneity of social media, people could anonymously share and publish accounting knowledge that they believed to be high-quality and verified by peers (Lei et al., 2021; Yang et al., 2022). Notably, they freely shared the knowledge they thought was correct. Such freedom enables them to gain a lot of attention and becomes well-known knowledge bloggers, thereby gaining many fans and a sense of recognition (Au et al., 2021; Schmidt et al., 2016). Therefore, social media can help practitioners freely share, interact, communicate, trigger multi-person participation, verify ideas, and gain a sense of identity (Wang et al., 2017).

Social Media Knowledge Capture by Accounting Learners (RQ3)

Interviewees revealed many ways to obtain accounting knowledge on social media. Accounting learners obtained many latest accounting policy updates through the information push of WeChat official accounts of various entities. According to individual needs and recently browsed content, modern social media can analyze user preferences through big data and artificial intelligence (Iandolo et al., 2021; Leung et al., 2021; Wong et al., 2022). Thus, learners can obtain articles recommended by social media and acquire useful accounting knowledge automatically. In addition, other major platforms, such as Bilibili, Weibo, QQ, Douban, Xiaohongshu, and Zhihu, provide similar features using similar technologies. As long as users watch accounting-related content, these platforms can automatically push other related knowledge (Wu et al., 2020).

TikTok is a short video social app that lets interviewees learn a lot of accounting knowledge, especially procedural knowledge, through short videos (Cervi, 2021). In addition, learners can directly contact the author in the comment area to ask related questions. TikTok significantly increases learning interest, and learners can also improve efficiency and obtain direct knowledge (Zhang, 2021).

Furthermore, social media is like a bridge that provides direct communication channels between learners and practitioners (Peake & Reynolds, 2020). Learners can seek help from experienced accounting practitioners to obtain explanations through direct inquiry. Besides, they can ask questions on MOOC to get professional answers from instructors. In addition to using the interactivity of social media, learners could also search for knowledge on social media directly, look for similar case studies, learn from previous theories to solve practice, and view the accounting notes of peers.

After the interviewees captured the knowledge, they adopted some transformation methods (Cheng et al., 2022a, 2022b; Rêgo et al., 2021; Rehman et al., 2022). The most common way was to complete the internalization of knowledge by taking notes and self-thinking. In the process of writing and thinking, they could strengthen their memory and gain a deeper understanding. They deepened their memory by discovering the relationship between the new and the old knowledge, using what they have learned. In addition, learners and classmates discussed and exchanged the accounting theories and exercises they learned to expand the scope of exploration, a common practice among new-generation learners (Wang et al., 2021b).

Therefore, learners capture accounting knowledge through multiple types of social media. They get in touch with experienced practitioners, instructors, and peers to learn from their experience to complete the internalization and externalization of knowledge. It will be more convenient to sustainably guide their work and life for lifelong learning (Asongu & Tchamyou, 2019).

Accounting Knowledge Application (RQ4)

After interviewees learned accounting knowledge on social media, they applied it to practice (Caliari & Chiarini, 2021; Giovannoni et al., 2011; Khatun et al., 2022). Table 8 summarizes their uses.

For accounting learners, knowledge was applied to examinations. Since Mainland China pays more attention to examination-oriented education, students may exchange their knowledge on test papers or in-class presentations to improve their exam results. Besides, they applied their knowledge to accounting internships. Interns who initially entered the workforce might find the operation process different from textbook-style conceptual knowledge (Perusso & Baaken, 2020). For example, as handling bad debts in practice (especially in Mainland China) might not be the same as mentioned in the instructional materials, they would use social media to ask how to handle bad debts according to the company’s needs and the industrial environment (Abdel-Kader & Luther, 2008; de Castro Peixoto et al., 2022; Zhan & Xie, 2022).

In addition, accounting learners use social media to explore their knowledge gap with others. For example, they might see many accounting videos on TikTok created by outstanding students, automatically matching up with those higher standards. Thus, they were motivated to raise their requirements and learn more in the community of practice (Dong et al., 2021; Lei et al., 2021; Yang et al., 2022).

From a macro level, accounting practitioners and learners mutually improve one another in the community of practice (Dong et al., 2021; Lei et al., 2021). When practitioners learn more advanced knowledge on social media, they are accounting learners to a certain extent. They used social media accounting knowledge to improve their practice. As accounting work is often repetitive, a key purpose of learning knowledge is to avoid making mistakes again in similar situations. Experienced practitioners use knowledge to guide others’ actions. Furthermore, learning knowledge on social media is convenient, timely, and knowledge-rich for learners, who can use the fragmented time to learn (Dong et al., 2021; Vlegels & Huisman, 2021; Yu et al., 2021). They usually apply knowledge in real-life management work that guides their practice, which can result in effective and sustainable knowledge management and learning that improves the whole profession in the long run, especially by eliminating the barriers to knowledge exchange (Moghavvemi et al., 2017; 2018; Oliveira et al., 2022).

Other Insights and Observations

Our findings indicated an interesting issue regarding payment for accounting knowledge learning aids in Mainland China. Even if student interviewees spent much time, they tended to find free accounting knowledge on social media and were less concerned about time and opportunity costs (Chen et al., 2022). For example, one interviewee preferred posting questions on social media and chatting privately with experienced practitioners than spending money to gain accounting knowledge. Notably, he was more concerned about the number of fans and posted views to estimate the quality. Besides, learners may not have sufficient financial resources to pay for knowledge.

On the contrary, practitioner interviewees could afford and were more willing to spend money to acquire knowledge. For example, according to Daily, (2021), although some professional accounting apps charge subscription fees or membership fees, many accounting practitioners are willing to spend part of their income to purchase professional knowledge. Particularly, they believe this can allow them to use the functions of accounting software better. They also prefer to be paid when they share their accounting work experience and knowledge on social media.

This situation may be due to knowledge, expertise, time, experience, and consuming ability. Accounting learners mainly want to acquire examination-related conceptual knowledge, which is relatively simple, less specialized, and easy to find. Yet, practitioners usually want to find professional knowledge of specific sectors and solve specific problems (Consoli & Elche, 2013), which is often tricky and hard to find. Besides, the knowledge shared by practitioners is the experience they have personally internalized, compiled, and refined. As practitioners are more stressed at work and have less spare time than learners, they are more willing to spend money to save time. In contrast, accounting learners are usually in college and have free time to search for the knowledge they need, and they usually share knowledge learned in the classroom, which is relatively easy to find.

Personal experience also has a certain impact on this issue (Oliveira et al., 2022; Sungkur & Santally, 2019). Learners with less experience, less exposure, and less access to accounting knowledge will first ask for help from the Internet and social media. In contrast, because practitioners have more experience than learners and think the knowledge readily available on the Internet rarely fulfills their needs, they are more eager for deeper knowledge.

Suggestions

We recommend establishing special accounting topics, forums, or groups on social media for the learners and practitioners to facilitate knowledge sharing and exchange (Cepeda-Carrion et al., 2022; Sungkur et al., 2020). The same type of content can be gathered for easy search and viewing by posting topics in groups with appropriate tags (Cheng et al., 2020; Lei et al., 2021). These posts can become more engaging to learners if the posts include more pictures and videos (Chan et al., 2020; Cheng et al., 2020; Lam et al., 2022). People subscribed to accounting topics can freely publish and discuss to spread accounting knowledge.

Currently, many accounting practitioners are unwilling to publish opinions on social media (Lin & Hwang, 2021). They should voluntarily post accounting information on social media and cross-check to ensure the correctness of the knowledge. Reputation and rating systems can be set up to encourage such activities (Ji et al., 2020).

Accounting learners are suggested to contact practitioners on social media platforms to learn about internships and future jobs, while practitioners are suggested to respond actively. Particularly, social media has shown impacts on the origin and dissemination of information for student job searches (Mowbray & Hall, 2021). Accounting learners may show their strengths, while practitioners may recruit more high-calibrate candidates for internships.

When accounting learners learn accounting knowledge on social media, they should remember the basic principle of “for my use,” as social media is a complementary learning tool (Moghavvemi et al., 2018). Both practitioners and learners should learn to distinguish between true and false accounting information on social media platforms. As network information is of varying quality, knowledge acquirers should pay attention to the identity of information publishers, information authenticity, and the release time to distinguish them (Au et al., 2021).

Even if people are neither accounting learners nor practitioners, they still often need some accounting knowledge through social media for daily use. Besides, sharing knowledge and information about a profession is essential to attract future generations to join the profession sustainably and lifelong learning (Asongu & Tchamyou, 2019; Yew et al., 2022).

Conclusion

Our findings indicated that social media serves effectively as aids for accounting education and knowledge sharing according to the 5E learning model. Further from knowledge management perspectives under the lens of the KM process model, manifested in the stages of discovery, capture, sharing, and application, our findings showed the mechanisms involved and how such knowledge help accounting learners and practitioners in lifelong learning. Through the push mechanism of social media, people can discover relevant accounting knowledge other than proactive searching. People can learn and apply knowledge through access and instant sharing without geographical or time restrictions in life and work. As reflected by our interviewees, social media provides a new way to solve practical problems by sharing accounting knowledge and practices in an interactive environment, combining old and new knowledge.

There are pros and cons to acquiring and sharing accounting knowledge on social media as learning aids. Key advantages include timely, extensive, rich in knowledge, and relevant information push, but its disadvantages are unsystematic, risk of misinformation, and difficulties in deep learning. Therefore, people should take the initiative to identify the authenticity of accounting information and knowledge so that social media can play a positive role in sustainably sharing and learning accounting knowledge.

In the future, more and more people should be guided and educated to understand accounting knowledge through social media. Accounting practitioners, accounting learners, and the public should also be able to sustainably obtain relevant knowledge through social media for their daily business and living.

Limitations and Future Work

This research has certain limitations to overcome in the future. For example, there were few interview samples, and the interviews might be subjective and not represent the complete views of all accounting practitioners and learners. As interviewees answered questions from their viewpoints, the interviews might be subjective. In the future, the number of interviewees will be expanded to enlarge the sample size, and other research methods will be used for research, such as focus groups and surveys.

On the other hand, we would like to research interviewees from different countries to compare the differences in behaviors and social media’s role in disseminating global accounting knowledge due to different cultures and accounting regulations. We are also interested in researching other social media platforms, such as LinkedIn, Facebook, Twitter, and Instagram, available globally, especially focusing on the sustainability of lifelong professional education (Chan et al., 2020; Lam et al., 2022; Lei et al., 2021).

Data Availability

Data are available upon request to the corresponding author.

References

Abdel-Kader, M., & Luther, R. (2008). The impact of firm characteristics on management accounting practices: A UK-based empirical analysis. The British Accounting Review, 40(1), 2–27.

Amber, Q., Khan, I. A., & Ahmad, M. (2018). Assessment of KM processes in a public sector organisation in Pakistan: Bridging the gap. Knowledge Management Research & Practice, 16(1), 13–20.

Anthony, B. (2021). Information flow analysis of a knowledge mapping-based system for university alumni collaboration: A practical approach. Journal of the Knowledge Economy, 12(2), 756–787.

Asongu, S. A., & Tchamyou, V. S. (2019). Foreign aid, education and lifelong learning in Africa. Journal of the Knowledge Economy, 10(1), 126–146.

Attour, A., & Barbaroux, P. (2021). The role of knowledge processes in a business ecosystem’s lifecycle. Journal of the Knowledge Economy, 12(1), 238–255.

Au, C. H., Ho, K. K. W., & Chiu, D. K. W. (2021). The role of online misinformation and fake news in ideological polarization: Barriers, catalysts, and implication. Information Systems Frontiers, in Press. https://doi.org/10.1007/s10796-021-10133-9

Blankespoor, E. (2018). Firm communication and investor response: A framework and discussion integrating social media. Accounting, Organizations and Society, 68–69, 80–87.

Burdon, W. M., & Munro, K. (2017). Simulation – is it all worth it? The impact of simulation from the perspective of accounting students. The International Journal of Management Education, 15(3), 429–448.

Cade, N. L. (2018). Corporate social media: How two-way disclosure channels influence investors. Accounting, Organizations and Society, 68–69, 63–79.

Caliari, T., & Chiarini, T. (2021). Knowledge production and economic development: Empirical evidences. Journal of the Knowledge Economy, 12(2), 1–22.

Cepeda-Carrion, I., Ortega-Gutierrez, J., Garrido-Moreno, A., & Cegarra-Navarro, J. G. (2022). The mediating role of knowledge creation processes in the relationship between social media and open innovation. Journal of the Knowledge Economy, in Press. https://doi.org/10.1007/s13132-022-00949-4

Cervi, L. (2021). Tik Tok and generation Z. Theatre, Dance and Performance Training, 12(2), 198–204.

Chan, T. T. W., Lam, A. H. C., & Chiu, D. K. W. (2020). From Facebook to Instagram: Exploring user engagement in an academic library. The Journal of Academic Librarianship, 46(6), 102229.

Chen, X., Chua, A. Y., & Pee, L. G. (2022). Who sells knowledge online? An exploratory study of knowledge celebrities in China. Internet Research, 32(3), 916–942.

Cheng, W. W. H., Lam, E. T. H., & Chiu, D. K. W. (2020). Social media as a platform in academic library marketing: A comparative study. The Journal of Academic Librarianship, 46(5), 102188.

Cheng, H., Huang, S., Yu, Y., Zhang, Z., & Jiang, M. (2022). The 2011 collaborative innovation plan, university-industry collaboration and achievement transformation of universities: Evidence from China. Journal of the Knowledge Economy, in Press. https://doi.org/10.1007/s13132-022-00907-0

Cheng, J., Yuen, A. H., & Chiu, D. K. (2022). Systematic review of MOOC research in mainland China. Library Hi Tech, Ahead-of-Print. https://doi.org/10.1108/LHT-02-2022-0099

Cheung, L. S. N., Chiu, D. K. W., & Ho, K. K. W. (2022). A quantitative study on utilizing electronic resources to engage children’s reading and learning: Parents’ perspectives through the 5E instructional model. The Electronic Library, Ahead of Print. https://doi.org/10.1108/EL-09-2021-0179

Cheung, V. S. Y., Lo, J. C. Y., Chiu, D. K. W., & Ho, K. K. W. (2022). Predicting Facebook’s influence on travel products marketing based on the AIDA model. Information Discovery and Delivery, in Press. https://doi.org/10.1108/IDD-10-2021-0117

Chung, C.-h, Chiu, D. K. W., Ho, K. K. W., & Au, C. H. (2020). Applying social media to environmental education: Is it more impactful than traditional media? Information Discovery and Delivery, 48(4), 255–266.

Consoli, D., & Elche, D. (2013). The evolving knowledge base of professional service sectors. Journal of Evolutionary Economics, 23(2), 477–501.

Daily, L. (2021). Don’t let forgotten online subscriptions rack up monthly charges. Here’s how to take control. The Washington Post. Retrieved from: https://www.washingtonpost.com/lifestyle/home/recurring-subscription-fees-how-to-end/2021/05/24/e083b70c-b71f-11eb-96b9-e949d5397de9_story.html. Accessed 6 March 2023

Davies, L., LeClair, K. L., Bagley, P., Blunt, H., Hinton, L., Ryan, S., & Ziebland, S. (2020). Face-to-face compared with online collected accounts of health and illness experiences: A scoping review. Qualitative Health Research, 30(13), 2092–2102.

de Castro Peixoto, L., Barbosa, R. R., & de Faria, A. F. (2022). Management of regional knowledge: Knowledge flows among university, industry, and government. Journal of the Knowledge Economy, 13(1), 92–110.

Dong, G., Chiu, D. K. W., Huang, P.-S., Lung, M.-M.-w, Ho, K. K. W., & Geng, Y. (2021). Relationships between research supervisors and students from coursework-based master’s degrees: Information usage under social media. Information Discovery and Delivery, 49(4), 319–327.

Dron, J., & Anderson, T. (2014). Teaching crowds: Learning and social media. Athabasca University Press.

Eschenbrenner, B., Nah, F.F.-H., & Telaprolu, V. R. (2015). Efficacy of social media utilization by public accounting firms: Findings and directions for future research. The Journal of Information Systems, 29(2), 5–21.

Fineberg, S. (2012). Social media: Accountants share their success with Facebook, Twitter and more. Accounting Today, 26(2), 24–25.

Gardner, J., & Brooks, C. (2018). Student success prediction in MOOCs. User Modeling and User-Adapted Interaction, 28(2), 127–203.

Gibbs, J. L., Rozaidi, N. A., & Eisenberg, J. (2013). Overcoming the “ideology of openness”: Probing the affordances of social media for organizational knowledge sharing. Journal of Computer-Mediated Communication, 19(1), 102–120.

Giovannoni, E., Maraghini, M. P., & Riccaboni, A. (2011). Transmitting knowledge across generations: The role of management accounting practices. Family Business Review, 24(2), 126–150.

Gunasagaran, S., Mari, M. T., Srirangam, S., & Kuppusamy, S. (2019). Adoption of social media by architecture students in fostering community service initiative using technology acceptance model. IOP Conference Series Materials Science and Engineering, 636, 12015.

Hales, J., Moon, J. R., & Swenson, L. A. (2018). A new era of voluntary disclosure? Empirical evidence on how employee postings on social media relate to future corporate disclosures. Accounting, Organizations and Society, 68–69, 88–108.

Huang, P. S., Paulino, Y., So, S., Chiu, D. K. W., & Ho, K. K. W. (2021). Special issue editorial - COVID-19 pandemic and health informatics (part 1). Library Hi Tech, 39(3), 693–695.

Huang, P.-S., Paulino, Y. C., So, S., Chiu, D. K. W., & Ho, K. K. W. (2022). Guest editorial: COVID-19 pandemic and health informatics part 2. Library Hi Tech, 40(2), 281–285.

Iandolo, F., Loia, F., Fulco, I., Nespoli, C., & Caputo, F. (2021). Combining big data and artificial intelligence for managing collective knowledge in unpredictable environment—insights from the Chinese case in facing COVID-19. Journal of the Knowledge Economy, 12(4), 1982–1996.

Imran, M. K., Iqbal, S. M. J., Aslam, U., & Fatima, T. (2019). Does social media promote knowledge exchange? A qualitative insight. Management Decision, 57(3), 688–702.

Ji, S., Yang, W., Guo, S., Chiu, D. K. W., Zhang, C., & Yuan, X. (2020). Asymmetric response aggregation heuristics for rating prediction and recommendation. Applied Intelligence, 50, 1416–1436.

Jiang, X., Chiu, D. K. W., Chan, C. T. (2022). Application of the AIDA model in social media promotion and community engagement for small cultural organizations: A case study of the Choi Chang Sau Qin Society. In M. Dennis & J. Halbert (Eds) Community Engagement in the Online Space, The Digital Folklore of Cyberculture and Digital Humanities, Hershey, PA: IGI Global. pp.171–185

Jiang, L., & Zhou, H. (2017). The role of audit verification in debt contracting: Evidence from covenant violations. Review of Accounting Studies, 22(1), 469–501.

Kebede, G. F. (2020). Network locations or embedded resources? The effects of entrepreneurs’ social networks on informal enterprise performance in Ethiopia. Journal of the Knowledge Economy, 11(2), 630–659.

Keeley, P. (2017). Embedding formative assessment into the 5E instructional model. Science and Children, 55(4), 28–31.

Khan, T., Kend, M., & Robertson, S. (2016). Use of social media by university accounting students and its impact on learning outcomes. Accounting Education, 25(6), 534–567.

Khatun, A., Sarmah, R., & Dar, S. N. (2022). Knowledge management practices in India: A case study of a premier B-school. Journal of the Knowledge Economy, in Press. https://doi.org/10.1007/s13132-022-00923-0

Lam, A. H. C., Ho, K. K. W., & Chiu, D. K. W. (2022). Instagram for student learning and library promotions: A quantitative study using the 5E Instructional Model. Aslib Journal of Information Management, Ahead-of-Print. https://doi.org/10.1108/AJIM-12-2021-0389

Lei, S. Y., Chiu, D. K. W., Lung, M.M.-W., & Chan, C. T. (2021). Exploring the aids of social media for musical instrument education. International Journal of Music Education, 39(2), 187–201.

Lepore, D., Dubbini, S., Micozzi, A., & Spigarelli, F. (2022). Knowledge sharing opportunities for Industry 4.0 firms. Journal of the Knowledge Economy, 13(1), 501–520.

Leung, T. N., Hui, Y. M., Luk, C. K. L., Chiu, D. K. W., & Kevin, K. K. W. (2021). Evaluating Facebook as aids for learning Japanese: Learners’ perspectives. Library Hi Tech, Ahead-of-Print. https://doi.org/10.1108/LHT-11-2021-0400

Lin, H., & Hwang, Y. (2021). The effects of personal information management capabilities and social-psychological factors on accounting professionals’ knowledge-sharing intentions: Pre and post COVID-19. International Journal of Accounting Information Systems, 42, 100522.

Lin, W.-Y., Zhang, X., Song, H., & Omori, K. (2016). Health information seeking in the Web 2.0 age: Trust in social media, uncertainty reduction, and self-disclosure. Computers in Human Behavior, 56, 289–294.

Lin, J., Chen, S., & Huang, F. (2018). Bank interest margin, multiple shadow banking activities, and capital regulation. International Journal of Financial Studies, 6(3), 63.

Ma, J., Chiu, D. K. W., & Tang, J. K. (2016). Exploring the use of social media to advance K12 science education. International Journal of Systems and Service-Oriented Engineering (IJSSOE), 6(4), 47–59.

Majchrzak, A., Faraj, S., Kane, G. C., & Azad, B. (2013). The contradictory influence of social media affordances on online communal knowledge sharing. Journal of Computer-Mediated Communication, 19(1), 38–55.

Mak, M. Y. C., Poon, A. Y. M., Chiu, D. K. W. (2022). Using social media as learning aids and preservation: Chinese martial arts in Hong Kong. In: S. Papadakis & A. Kapaniaris (Eds), The Digital Folklore of Cyberculture and Digital Humanities. Chapter 10, Hershey, PA: IGI Global. pp.171–185.

Mehrizi, F. Z. (2016). Investigating the relationship between job security and knowledge sharing behavior with the mediator of organizational culture in Ayandeh Bank. Mediterranean Journal of Social Sciences, 7(3 S2), 161–166.

Moghavvemi, S., Sharabati, M., Paramanathan, T., & Rahin, N. (2017). The impact of perceived enjoyment, perceived reciprocal benefits and knowledge power on students’ knowledge sharing through Facebook. The International Journal of Management Education, 15(1), 1–12.

Moghavvemi, S., Sulaiman, A., Jaafar, N. I., & Kasem, N. (2018). Social media as a complementary learning tool for teaching and learning: The case of Youtube. The International Journal of Management Education, 16(1), 37–42.

Mowbray, J. A., & Hall, H. (2021). Using social media during job search: The case of 16–24 year olds in Scotland. Journal of Information Science, 47(5), 535–550.

Naeem, M. (2019). Uncovering the role of social media and cross-platform applications as tools for knowledge sharing. VINE Journal of Information and Knowledge Management Systems, 49(3), 257–276.

Nijssen, E., & Ordanini, A. (2020). How important is alignment of social media use and R&D–Marketing cooperation for innovation success? Journal of Business Research, 116, 1–12.

Oliveira, M., Pinheiro, P., Lopes, J. M., & Oliveira, J. (2022). How to overcome barriers to sharing tacit knowledge in non-profit organizations? Journal of the Knowledge Economy, 13(3), 1843–1874.

Palmer, L., Bliss, D. L., Goetz, J. W., & Moorman, D. (2010). Improving financial awareness among college students: Assessment of a financial management project. College Student Journal, 44(3), 659–676.

Peake, J., & Reynolds, A. (2020). Implementing social media bridges for student-teacher chasms created during the COVID-19 pandemic. CEA Critic, 82(3), 274–284.

Perusso, A., & Baaken, T. (2020). Assessing the authenticity of cases, internships and problem-based learning as managerial learning experiences: Concepts, methods and lessons for practice. The International Journal of Management Education, 18(3), 100425.

Priya, A. (2021). Case study methodology of qualitative research: Key attributes and navigating the conundrums in its application. Sociological Bulletin, 70(1), 94–110.

Radhakrishnan, G. S., Basit, A., & Hassan, Z. (2018). The impact of social media usage on employee and organization performance: A study on social media tools used by an IT multinational in Malaysia. Journal of Marketing and Consumer Behaviour in Emerging Markets, 1(7), 48–65.

Rêgo, B. S., Jayantilal, S., Ferreira, J. J., & Carayannis, E. G. (2021). Digital transformation and strategic management: A systematic review of the literature. Journal of the Knowledge Economy, in Press. https://doi.org/10.1007/s13132-021-00853-3

Rehman, J., Hawryszkiewycz, I., Sohaib, O., Namisango, F., & Dahri, A. S. (2022). Towards the knowledge-smart professional service firms: How high-performance work systems support the transformation. Journal of the Knowledge Economy, in press. https://doi.org/10.1007/s13132-022-00903-4

Riad Shams, S. M., & Belyaeva, Z. (2019). Quality assurance driving factors as antecedents of knowledge management: A stakeholder-focussed perspective in higher education. Journal of the Knowledge Economy, 10(2), 423–436.

Schmidt, G. B., Lelchook, A. M., & Martin, J. E. (2016). The relationship between social media co-practitioner connections and work-related attitudes. Computers in Human Behavior, 55, 439–445.

Schroth, H. (2019). Are you ready for Gen Z in the workplace? California Management Review, 61(3), 5–18.

Süar, A. (2017). The advantages of social media marketing against traditional media channels. Online Academic Journal of Information Technology, 8(28), 21–44.

Sungkur, R. K., & Santally, M. I. (2019). Knowledge sharing for capacity building in open and distance learning (ODL): Reflections from the African experience. Journal of the Knowledge Economy, 10(1), 380–396.

Sungkur, R. K., Sebastien, O., & Singh, U. G. (2020). Social media as a catalyst for distant collaborative learning: Trends and concerns for small island states. Journal of the Knowledge Economy, 11(4), 1454–1469.

Thankachan, A., & George, J. (2012). The cyber sieve: Social media monitoring for financial institutions. Global Finance, 26(11), 16–19.

Veletsianos, G., Collier, A., & Schneider, E. (2015). Digging deeper into learners’ experiences in MOOCs: Participation in social networks outside of MOOCs, notetaking and contexts surrounding content consumption. British Journal of Educational Technology, 46(3), 570–587.

Vlegels, J., & Huisman, J. (2021). The emergence of the higher education research field (1976–2018): Preferential attachment, smallworldness and fragmentation in its collaboration networks. Higher Education, 81(5), 1079–1095.

Wang, R., Yang, F., & Haigh, M. M. (2017). Let me take a selfie: Exploring the psychological effects of posting and viewing selfies and groupies on social media. Telematics and Informatics, 34(4), 274–283.

Wang, W., Lam, E. T. H., Chiu, D. K. W., Lung, M.M.-W., & Ho, K. K. W. (2021). Supporting higher education with social networks: Trust and privacy vs. perceived effectiveness. Online Information Review, 45(1), 207–219.

Wong, J., Chiu, D. K. W., Leung, T. N., & Kevin, K. K. W. (2022). Exploring the associations of addiction as a motive for using Facebook with social capital perceptions. Online Information Review, in Press. https://doi.org/10.1108/OIR-06-2021-0300

Wu, Y., Wang, F., Zou, Y., & Li, M. (2020). Push management platform based on WeChat small program and cloud development. International Journal of Education and Management Engineering, 10(1), 20–26.

Xiong, F., Chapple, L., & Yin, H. (2018). The use of social media to detect corporate fraud: A case study approach. Business Horizons, 61(4), 623–633.

Yang, S., & Berger, R. (2017). Relation between start-ups’ online social media presence and fundraising. Journal of Science and Technology Policy Management, 8(2), 161–180.

Yang, Z., Zhou, Q., Chiu, D. K. W., & Wang, Y. (2022). Exploring the factors influencing continuance usage intention of academic social network sites. Online Information Review, 46(7), 1225–1241.

Yew, A., Chiu, D. K. W., Nakamura, Y., & Li, K. K. (2022). Quantitative comparison of LIS programs accredited by ALA and CILIP. Library Hi Tech, Ahead-of Print. https://doi.org/10.1108/LHT-12-2021-0442

Yin, C., Zhou, Y., He, P., & Tu, M. (2021). Research on the influencing factors of the switching behavior of Chinese social media users: QQ transfer to WeChat. Library Hi Tech, Ahead-of-Print. https://doi.org/10.1108/LHT-09-2020-0234

Yip, K. H. T., Chiu, D. K. W., Ho, K. K. W., & Lo, P. (2021). Adoption of mobile library apps as learning tools in higher education: A tale between Hong Kong and Japan. Online Information Review, 45(2), 389–405.

Yoo, E., Gu, B., & Rabinovich, E. (2019). Diffusion on social media platforms: A point process model for interaction among similar content. Journal of Management Information Systems, 36(4), 1105–1141.

Yu, H. Y., Tsoi, Y. Y., Rhim, A. H. R., Chiu, D. K., & Lung, M. M. W. (2021). Changes in habits of electronic news usage on mobile devices in university students: A comparative survey. Library Hi Tech, in Press. https://doi.org/10.1108/LHT-03-2021-0085

Zhan, X., & Xie, F. (2022). Knowledge activities of external knowledge network and technological capability: Evidence from China. Journal of the Knowledge Economy, in Press. https://doi.org/10.1007/s13132-022-00894-2

Zhang, Z. (2021). Infrastructuralization of Tik Tok: Transformation, power relationships, and platformization of video entertainment in China. Media, Culture & Society, 43(2), 219–236.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical Approval

The first author has received ethical approval of this project from the hosting institute.

Conflict of Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. Questionaire used for data collection

Appendix. Questionaire used for data collection

Background

-

1. How old are you?

-

2. Are you an accounting practitioner or an accounting learner?

-

3. What is your educational background (major/minor/study level)?

-

4. What kind of industry are you working in and your position? (if practitioner).

Engage

-

5. Do you use social media to help your general learning and knowledge acquisition? If so, which ones and how often do you use them?

-

6. How do you discover accounting knowledge and learning materials? Mainly which kind of accounting knowledge? For example, is it on social media, web, or library? In the accounting class? Or is it in practice? Or from co-practitioners/classmates?

Explore

-

7.Which social media do you usually use to acquire and share accounting knowledge? Why?

-

8.How can social media help you interact with accounting practitioners or students?

-

9.Can such interactions help you explore your ideas for learning accounting knowledge and practices? Can you give some examples?

Explain

-

10. Can social media provide with the accounting knowledge and practices to solve your problems in learning or work? Can you give some examples?

-

11. Can social media interactions with teachers, students, and/or fellow practitioners provide you with the accounting knowledge to solve your problems in learning or work? Can you give some examples?

-

12. What is the most useful accounting knowledge you have learned from social media? why?

Elaborate

-

13. What aspects of social media are useful for you to gain accounting knowledge? Do you think that is better or worse than tradition classroom or face-to-face interactions? How and why?

-

14. What aspects of social media are useful for you to share accounting knowledge? Why do you want to share, to whom, and what do you usually share and under what circumstances?

-

15. After discovering accounting knowledge, how do you usually combine it with your existing knowledge?

Evaluate

-

16. What do you think are the advantages and disadvantages of social media in sharing accounting knowledge?

-

17. In your opinion, what are the advantages and disadvantages of social media in acquiring accounting knowledge?

-

18. After learning accounting knowledge on social media, what will you use it for?

-

19. In summary, how do you think learning accounting knowledge on social media help you to improve your study or work result?

-

20. Any other comments or suggestions?

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Xie, Z., Chiu, D.K.W. & Ho, K.K.W. The Role of Social Media as Aids for Accounting Education and Knowledge Sharing: Learning Effectiveness and Knowledge Management Perspectives in Mainland China. J Knowl Econ (2023). https://doi.org/10.1007/s13132-023-01262-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-023-01262-4