Abstract

This paper examines the dynamic relationship between fintech investments and financial performance, and it explores whether the bank size could influence the performance in the context of the digital transformation (digitization). The fully modified ordinary least squares (FMOLS) model is estimated for 23 European banks throughout the whole period ranging from 2010 to 2019 and for the two sub-periods spanning from 2010 to 2014 and from 2015 to 2019. The econometric results evince that fintech are positively and significantly related to the bank profitability, inferring that the greater the digital engagement of banks is, the higher the profitability is. Our findings provide evidence that the bank size is a moderator factor in affecting the relationship between digital investments and the profitability. Hence, larger banks benefit more from investments in the financial technology so as to improve their performance. Our study has substantial policy implications as we suggest that the increased investment in the fintech is a possible channel through which banks improve their performance, particularly when the bank size is considered large.

Similar content being viewed by others

Introduction

In the twenty first century, financial markets and economies have been experiencing an explosion of innovation and technologies having modified financial services and products, especially banking services. The financial technology (fintech) aims to provide automated and improved financial services. It has initially designated the computer technology applied to the back office of banks or trading firms, but now, it bases its business model on new efficient information technologies such as the blockchain, artificial intelligence (AI), big data, and the Internet of Things (Song et al., 2021). The fintech can simplify the information transfer, improve the processing speed, reduce costs, and promote a continuous improvement in the transactional lending (Cenni et al., 2015; Liberti & Peterson, 2019).

Apart from the emergence of new innovators in the sector and the accelerating pace of growth in online commerce platforms, tech giants have been a main motive to digitize banks through using these new technologies with the intention of creating new revenues and ameliorating the interact process between customers and banks. As a matter of fact, digital banking is the perfect example of how financial innovative technologies can influence the future of banking. Today, the activities of almost every bank and financial institutions are based on financial technologies, providing online banking services (Asongu, 2018), high levels of automation, and facilitation of decision-making (artificial intelligence).

Investing in the financial technology refers to the action of spending on costly new technologies in order to implement new software and hardware being able to enhance the quality of banking services and thus provoking a digital transformation of traditional activities.

Existing research has different views on the effect of investing in the financial technology on the bank profitability. Indeed, Solow (1987) suggests that the increase in the information technology adoption does not increase the productivity. Sathye (2005) also finds that the adoption of the Internet banking in credit unions in Australia does not improve the bank performance.

However, recent studies (Kou et al., 2021; Cho & Chen, 2021; Wang et al., 2021; Tunay et al., 2019; Zhang & Yang, 2019; Saidi, 2018; Scott et al., 2017) have pointed out a positive effect of investing in the financial technology on profitability. In fact, Le and Ngo (2020) give proof that involving innovative technologies significantly contributes to enhancing the financial performance. The positive impact may be explained by the fact that the adoption of new software and online banking improves the management of credit risk (Campanella et al., 2017) and reduces the information cost access (Liberti & Peterson, 2019) and the operating cost (Dong et al., 2020). What is more, Zhang and Yang (2019) demonstrate that the fintech system has a prominent contribution for companies to decrease their costs and therefore to increase their profitability. In addition, Wang et al. (2021) reveal that the fintech improves the risk control and profitability of banks and decreases the cost of the financial intermediation. Cho and Chen (2021) also state that the fintech innovation ameliorates the Chinese bank performance. Similarly, focusing on Chinese banks, Sheng (2021) indicates that the fintech facilitates banking credit services, especially for large size banks. In the same vein, several studies argue that the bank size represents a significant moderator factor affecting the bank profitability (Abul Hasan et al., 2020; Shevrin, 2019). Due to the difference between large and small size banks in their activities and in their investments in financial technology, it is possible to find different results on the relation between fintech and profitability. Indeed, Distinguin et al. (2013) denote that larger banks are more diversified than small ones focusing more on intermediation activities. Moreover, Sapci and Miles (2019) and Wang et al. (2021) suggest that large banks achieve more economies of scale than small ones. Furthermore, Filip et al. (2017) and Shevrin (2019) report that large banks are spending more on technology. However, Dos Santos and Peffers (1995) note that small firms can adapt to fintech faster than large ones.

In this article, we examine the dynamic relationship between the financial technologies and profitability in 23 European banks over the period spanning from 2010 to 2019. We also investigate the moderator effect of the bank size on the links between the financial technologies and profitability. Our empirical procedure is based on the econometric tests of stationarity, Chow, and cointegration in order to identify the appropriate model providing better estimation results. The Chow test identifies the structural break of 2014, and Pedroni tests evince the cointegration between variables. Consequently, the cointegrated panel model (FMOLS) is estimated for all the period ranging from 2010 to 2019 and for the two sub-periods of 2010–2014 and 2015–2019.

Accordingly, this work aims to make two contributions. Firstly, by relying on the digitization lexicon frequency in the annual report, this paper explores the effect of the technology investment on European banks before and after 2014. As a matter of fact, 2014 is considered as a year after which European banks have intensively integrated technology in their activities. Secondly, the work looks into how the bank size ranging from big to small size could become a source of enhancing the impact of technology on profitability.

The remainder of this study is organized as follows: the second section presents the literature review related to the financial technology investment, bank size, and financial performance. The third section details the descriptions of the sample and variables. The fourth section sets forth the empirical model. The fifth section deals with the research findings. Eventually, the sixth section concludes.

Literature Review

Definition and Measures of the Financial Technology

Fintech, digitization, and digital transformation are terms having been developed with the revolution of technology. Darolles (2016) defines financial technology or fintech as the application of different types of advanced technologies in the financial industry. Digitization refers to transforming the way companies interact with customers and conduct business through using new technologies. Indeed, digitization promotes the use of new technologies so as to generate new revenues and opportunities. In this context, a set of actions known as digital transformation must be applied by organizations to adopt new innovative models such as big data, artificial intelligence, and blockchain (Sadigh et al., 2021). Thus, the digitization or digital transformation is complex and costly, and it requires a focus on features and functionality. Therefore, digitization necessitates investments known as digital investments defined as technology projects, which need enabling expenditures to implement or use the new technology. On that account, it is essential that companies actively plan and monitor their digital investments so that they can achieve the goal of digital transformation and assess its return.

Research on the financial technology focuses attention on using the most reliable measure of the financial technology investment as this information is not available. Limited measures such as dummy variables, self-reported data, and survey data have been adopted in empirical studies.

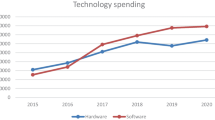

Among the measures of the digital investment, we find that research, like that of Brynjolfsson (1993), has measured the degree of digitization by the presence of IT (information technology) expenditures related to hardware assets and software reported on corporate balance sheets.

The investment in financial technology is also measured by a survey methodology (Tippins & Sohi, 2003). However, Baker (2003) criticizes this method as a subjective data collection technique since differences in understanding and interpretation of the questions may arise. In addition, the rate of missing data is generally high when using questionnaires as the rates of unanswered questions are relatively high.

Dong et al. (2020) test the relationship between the online channel adoption in banks and profit and cost efficiency. They consider a dummy variable in order to measure the investment in digitization. The dummy variable takes 1 if the bank adopts the online channel in banks and 0 otherwise. Yet, using the dummy variable method to measure the technology investment has been criticized because the dummy variable itself does not distinguish between a bank intensively adopting digitization and a bank minimally adopting digitization as all banks today certainly have some form of digitization (The annual report of the Council of Economic Advisers, 2001).

Recently, Barnewold and Lottermoser (2020) and Kriebel and Debener (2019) have developed new analysis measures based on text mining methods. Barnewold and Lottermoser (2020) have used the large textual database of the insight report of 13 global consulting firms. The authors have developed a measure of digitization for identifying emerging technology trends in the mining industry. They reveal that automation, robotics, the Internet of Things, big data, and artificial intelligence are the most used technologies in the mining industry. They also consider the digital adoption information as not only related to spending on hardware and software, but also encompassing information about using technology to develop new services, enable people to take advantage of digital financial services, and maintain a competitive ecosystem. Nevertheless, such information encompassing many aspects and a large volume of diverse information can be extracted by the text mining method as the best solution (Fan et al., 2006).

The Effect of the Financial Technology Adoption on the Bank Profitability

The research examining the effect of the financial technology adoption on the profitability reports mixed results. Solow (1987) suggests that despite the significant increase in the information technology adoption in the USA since 1970, productivity has not increased accordingly. This phenomenon is referred to as the productivity paradox, raising new research questions in an effort to better understand this paradox. Clemons (1986) argues that digital innovators could only benefit from their innovation if they are capable of establishing a considerable market share before second-tier competitors’ act. In line with Hitt and Brynjolfsson (1996), Clemons (1986) indicates that profitability cannot be extended, in the case of abundant digital technologies, to all other competitors.

Other theories assert that the information technology reduces costs and promotes the bank performance.

According to the transaction cost theory, the maximization of profit requires efforts on economizing the transaction cost. In order to reduce the latter, any organization should apply an optimum organizational structure by, for example, carrying out forward integration or acquiring valued skills (Williamson, 1985).Owing to the development of new technologies and especially with the emergence of the Internet, corporations become in connection with low-cost suppliers all over the world, removing the need for forward integration. That being so, the IT favors the improvement of profit without increasing or even by shrinking the size of the organization (Kenneth & Jane, 2009).

The information technology can also reduce the agency cost. According to the agency theory, the firm is defined as “a nexus for a set of contracting relationships among individuals” (Jensen & Meckling, 1976). The agency cost arises due to any contractual relations such as with employees, with suppliers, and with customers. In this context, keystroke, logging, and Internet monitoring are new technologies that help to monitor employees, reduce the agency cost, and make supervision easier. Moreover, the IT helps firms acquire and analyze information at a lower cost, in favor of reducing management cost and facilitating coordination activities, mainly for complex organizations (Kenneth & Jane, 2009).

In this context, several studies have been conducted with the objective of exploring the impact of financial technologies on profitability. As a matter of fact, Hernando and Nieto (2007) study the influence of the Internet channel adoption on a sample of 72 commercial banks operating in Spain over the period of 1994–2002. The empirical results substantiate that adopting the Internet channel leads to an improvement in the return on assets (ROA) and return on equity (ROE) of banks. Moreover, Campanella et al. (2017) examine the impact of three types of information technology – which are retail Internet, home banking, and business Internet – on the bank profitability for 3692 banks across 28 European countries over the year 2013. They find out a positive relationship between all types of IT investments and the profitability of European banks. Furthermore, Tunay et al. (2015) look into the relationship between the Internet banking and financial performance of banks, using ROA and ROE measures for 30 European countries during the period of 2005–2013. The authors prove a significant relationship between Internet banking and performance. Rega (2017) investigates the influence of digital investments as well as the effect of the number of physical branches on the bank profitability in a sample of 38 European banks throughout the period of 2013–2015. The author gives proof of a positive relationship between the digital investment and profitability. What is more, Wang et al. (2021) denote that fintech can boost the productivity factors of commercial banks. This is because fintech promoted the adoption of more attractive business models, reduced operating costs, and improved service efficiency, thereby boosting competitiveness. Furthermore, Dong et al. (2020) provide evidence that Chinese commercial banks have benefited from the development of Internet finance, promoting diversification, profitability, and security of commercial banks but decreasing the bank liquidity. In addition, Cho and Chen (2021) argue that fintech in China is regarded as a strategy for improving the banking performance. Kou et al. (2021) evince that fintech improves the financial performance of European banks through its ability to enhance the bank’s competitive advantage.

Dadoukis et al. (2021) analyze the effect of the information technology adoption in the course of the COVID-19 pandemic on the bank performance. They draw the inference that the IT adoption improves the bank soundness in times of this crisis.

Thus, we posit the first hypothesis as follows:

H1: Investing in technology positively affects the profitability of European banks

The Financial Technology Investment, Bank Size, and Financial Performance

The previous literature has highlighted the role of the bank size as a determinant of the bank profitability and its interaction with the information technology. In this context, Hannan and McDowell (1984) indicate that large banks are more likely to adopt the financial technology than small ones. Moreover, large banks are safer, more established, and more profitable than small ones primarily due to the economies of scale. The impacts above are more likely to improve the financial technology of large banks. However, Dos Santos and Peffers (1995) show that the effect of the technological innovation on profitability is higher on small firms than on large ones because the former can adapt to it more quickly than the latter that may be slow to respond as a result of their stable market position and legacy systems necessitating substantial changes.

The development of fintech might provide additional evidence regarding the differences between large and small banks. Distinguin et al. (2013) suggest that large and small banks may exhibit a different business model. Indeed, large banks could be more diversified than small ones, and they have economies of scale in supervising borrowers, but small banks focus more on intermediation activities. Leong and Dollery (2004) study the effect of the bank asset size on the bank profitability. Using data from banks in Singapore, they find evidence that large banks tend to be less efficient, resulting in a lower ROA and ROE than small banks. Scott et al. (2017) outline that the Society for Worldwide Interbank Financial Telecommunication (SWIFT) suggested that digital innovation adoption has a significant impact on long-run profitability and that this influence is larger for small banks than for large ones.

Filip et al. (2017) point out that large banks accept and implement fintech faster than small regional banks. Sapci and Miles (2019) show that in the US banking industry, the bank size significantly affects the cost efficiency and returns to scale. What is more, Shevrin (2019) reports that large banks spend more on technology than small ones. Wang et al. (2021) also states that the larger the assets are, the higher the effect of total productive factors is. Indeed, he explains this impact via the ability of these banks to invest in fintech, leading to a higher efficiency. In addition, AlKulaib and AlAli (2020) evince a statistically significant direct relationship between the number of bank branches as a proxy for the bank size and profitability.

Based on the analysis above, we postulate the following hypothesis:

H2: Bank size is a moderating factor in the relationship between bank profitability and financial technology.

Sampling, Data, and Variable Description

Sampling

In this study, we sought to analyze the effect of investment in technologies on the financial performance of banks listed in STOXX Europe 600 Index. Data on the 40 banks included in the STOXX Europe 600 Index were collected. Due to the missing data, we reduced our sample to include only 23 banks covering the 2010–2019 period. The panel was noticed to be balanced since there were no missing values. The included European countries in the study are Ireland, Spain, Great Britain, Switzerland, Denmark, Germany, Norway, Belgium, France, Austria, and Sweden. The choice of the region was motivated by the limited empirical data available on the study of the effect of the latest technologies at the global level on European banks. It also seems interesting to study the banking sector in Europe because of the huge amounts that are being invested in the digitalization of this sector (Network Readiness Index Report, 2020).

The underlying reason for the choice of the 2010–2019 period is that it is a recent period and allows us to investigate the effect of investing in the most recent information technologies. It is also a period characterized by the emergence and development of such new technologies as blockchain, artificial intelligence, and big data (Thakor, 2019). The data were collected from 3 sources: annual reports, Datastream, and the World Bank. The financial data related to capital adequacy ratio (CAR), liquidity (LIQ), solvency, credit risk (NPL), size (SIZE), and profitability variables (ROA) were gathered from Datastream. The digitalization (DIG) variable was elaborated manually from information extracted from annual reports which were downloaded from their respective bank website. As for inflation (INF) and GDP growth variables, they were obtained from the World Bank website.

Data

The financial profitability is the dependent variable in this study. Profitability was measured by the return on asset (ROA) which was calculated by net income divided by total assets. The main independent variable is the measure of a bank investment in financial technology. We followed the method of Kriebel and Diebner (2019) to calculate the digitalization engagement labeled DIG score. This score measures the digitalization engagement through the frequency of occurrence of digitalization lexicon in annual reports. The keywords selected for the search are “digital,” “mobile,” “Internet,” “cyber,” “fintech,” “crowdfunding,” “blockchain,” “big data,” “hack,” “social media,” “artificial intelligence,” “robotic,” “online,” “information technology,” “information system,” “computing,” “programming,” and “computer science”:

Specifically, DIG \(({annual\ report }_{t,i})=\mathrm{ln}({\sum\nolimits_{m=1}^{M}}^{tf}/_{nt})\) where \(tf\) is the term frequency of m is the keyword in the investigated report, \(nt\) is the number of total words in the investigated report, and \(M\) is the total number of keywords tested in the investigated report (M = 18).

The control variables are bank size (Size) measured as a logarithmic transformation of the total assets, liquidity ratio (LIQ) was measured by cash to deposit ratio, solvency ratio (SOLV) was measured as total shareholders’ equity to total assets, credit risk ratio (NPL) was measured by non-performing loans to total loans, and capital adequacy ratio (CAR) was measured as follows:\(\frac{Tier1+Tier2}{risk\ weighted\ assets}\). In addition, we used the inflation ratio (INF) as well as the gross domestic product (GDP) growth ratio.

Descriptive Statistics

The descriptive statistics for the analyzed variables are summarized in Table 1.

The results in Table 1 indicate that the ROA mean and median are, respectively, of 0.84% and 0.745%. The ROA expands over the span [−0.86%; 4.08%]. The ROA ratio that is close to 1% is considered pretty good in banks (Lukosiunas, 2017). We also noticed that most of return on assets observations is positive except for few isolated observations.

As shown in Table 1, the DIG variable displays a median variable of 0.043 with a spread of [0–0.42]. The value “0” occurred mostly in the early years of the study (2010–2012 periods) since the sampled bank commitment was relatively low. Their engagement in digitalization reached considerable values during the 2015–2019 period.

The analysis of the bank performance financial determinants like capital adequacy ratio indicates that all the banks of our sample conform to the requirements of Basel 2. Indeed, it is clearly shown that the minimum value is 9.59%, which means that all the values exceed 8%. Therefore, the banks in our sample are highly capitalized. They can absorb a reasonable amount of loss with a statutory capital. Moreover, the mean value of liquidity ratio was found to be 102.8%, and the median was of 70.005%. Thus, on average, the banks in our sample have enough liquidity to satisfy their financial obligations.

The Dynamic Evolution of the Digital Score Variable

In order to assess the temporal evolution of the digitalization score, we first divided the DIG according to its components. Such division discards a certain undesirable effect that prevents the visualization of the digitalization score evolution. Figure 1 shows the total frequency of each term across all the studied banks during the study period.

Figure 2 displays the evolution of the first frequent 10 keywords from 2010 to 2019. The keyword “digital” is the most frequent. Such a frequency is explained with the generalized characteristic of the keywords. The keyword “digital” is found in combination with many other specific keywords that are closely related to the digitalization lexicon such as “digital banking,” “digital application,” “digital payment,” “digital finance,” and “digital solutions.” Keywords like online, mobile, and the Internet are also general keywords that coexist with specific keywords to build new keywords like “online banking,” “online brokerage,” “online trading,” “mobile banking,” “mobile payment,” “mobile app,” “Internet banking,” and “Internet advisory.”

Moreover, an important frequency degree was noticed with the keyword “cyber.” This importance may be explained by the very rising concern relative to system security and the rising awareness related to a new form of bank risk (Bahri & Hamza, 2020). Other keywords such as information technology, fintech, artificial intelligence, and big data are less frequent.

Surprisingly, we found that most of the used digital terms exhibit two different frequency levels. Most keywords such as information technology, information system, social media, and artificial intelligence display a low level (low frequency) during the 2010–2012 period. However, the frequency of these keywords showed a rising trend after 2014 (high level). Such evolution is explained by the fact that the associated keywords reflect the new current financial technologies and may display the different investment levels before and after 2014.

In order to better visualize the digital commitment or digital expense degree, we have plotted the dynamic evolution of the digitalization commitment for 10 important banks in the world from 2010 to 2019 in Fig. 3.

The above figure allows us to notice a change in the trend of the series from 2014 onwards for all the studied banks. It is therefore justifiable to test the existence of a structural change in 2014 on the digital variable and to test the effect of the different levels of digital investment (low and high levels) on bank profitability.

Preliminary Tests and Empirical Model

Preliminary Tests

In order to decide on the panel model, we should firstly study the stationarity of the variables. The stationarity test consists in verifying the temporal structure of variables.

The three tests we have run are Levin and Lin (1992), Im et al. (1997), and Dickey and Fuller (1981), and our three used models are cited in Dickey and Fuller’s (1981) study. The three above-indicated models are intercept and trend, intercept, and none. The null hypothesis of non-stationary series is accepted if the p value > 0.05 for most of the models in the three tests. The differentiated variable is preceded by the letter D, for example, DROA, which implies that the variable ROA is differentiated once.

The analysis of Table 2 indicates that most of the studied variables had a sum of p value that exceeds 0.05 in most of the models. Thus, all the series of this study are non-stationary. Since all variables are non-stationary, we applied a first differentiation (D) on all the series and tested their stationarity to identify the order of integration. The results of Table 2 indicate that all the series become stationary after one difference; they are integrated in order 1:I (1). Because all the estimated series are non-stationary in the same order, we performed the cointegration test of Pedroni. It consists of seven cointegration tests which results are displayed in Table 3.

As shown in this Table 3, most of Pedroni (2004) tests results reject the null hypothesis of non-co-integration, meaning that the variables are cointegrated and there exists a cointegration relationship between the variables. Thus, the model should be estimated with the (FMLOS) method.

Chow Test

Since the DIG variable was found to show high and low levels during the studied period, we referred to Chow test proposed by Gregory Chow in 1960 to test the hypothesis of structural break.

The results of this test are displayed Table 4 and show that a structural change hypothesis is accepted in 2014 as the probability is below the significance level for most banks. Thus, based on Chow test results, we should divide the studied period into two sub-periods: 2010–2014 and 2015–2019.

Empirical Model

In this study, the estimation was performed using fully modified ordinary least squares. We used this estimation because all the estimated series are non-stationary following the same order of stationarity and because all the estimation variables are cointegrated.

It is worth reminding that this study investigated the relation between financial performance measured by return on assets and financial technology investment by estimating two models. The first tested the effect of DIG on profitability. In the second model, however, we added the interaction term DIG*SIZE to study whether the effect of technology investment on performance depends on the bank size. The control variables LIQ, SIZE, CAR, SOLV, NPL, INF, and GDP growth were added in the two models. Then, our estimations were performed over three periods which are the full period, the first sub-period, and the second sub-period. Opposite the second sub-period, the first sub-period identifies the low level of digitalization adoption.

The FMOLS method is based on the following panel regression model:

where i = 1,2,…23, t = 2010,…,2019, and e and \(\varepsilon\) are error terms and are accepted as stationary.

\({Y}_{it}\) is the dependent variable (ROAit), \({X}_{it}\) is the vector of exogenous variables (DIGit, SIZEit, SOLVit, LIQit, CARit, NPLit, INFit, GDPit). Next, we introduced the interaction term variable (DIGit*SIZEit) into the equation to obtain model 2.

\({\alpha }_{i}\) is a parameter that captures the specificity of banks.

\(\beta\) estimator can be calculated as follows:

Here, \({\Omega }_{i}={\Omega }_{i}^{0}+{\Gamma }_{i}+{{\Gamma }^{^{\prime}}}_{i}\) shows the long-run covariance matrix where \({\Omega }_{i}^{0}\) is the contemporaneous covariance and \({\Gamma }_{i}\) is a weighted sum of covariances. \({L}_{i}\) is the lower triangular matrix in the decomposition of \({\Omega }_{i}\).

Before running the estimated model, we performed the correlation test in order to verify whether there was a correlation between the variables that might possibly bias the estimation.

From the correlation matrix (Table 5), we can notice that all the correlation coefficients are below 0.5, which indicates an absence of strong correlation between the variables. Thus, our estimation model is accepted.

Empirical Results and Discussion

Main Results

In this study, we tested the effect of financial technology investment on ROA. Moreover, we studied the effect of bank size and technology adoption level on the relation between technology investment and ROA. To this end, we estimated the models over the full period of 2010–2019 and during the sub-periods of 2010–2014 and 2015–2019. The estimated model results are reported in Table 6.

From Table 6, we notice that the R-squared in all the estimated models exhibit values that exceed 85%. Since R-squared is close to the value 1, we considered that all the estimations of these models are of good quality. According to the p value, we remarked that most variables are significant at 1%, 5%, and 10% levels. The only insignificant variable is the capital adequacy ratio in most of the models except for the low level investment period.

In fact, the coefficient estimate of the DIG is statistically significant and positively related to bank performance. Moreover, we found that the effect of financial technology investment is higher during the high level. In the first model, the high level investment coefficient (8.874) is higher than the level low investment coefficient (3.098). Similarly, in the second model, the DIG coefficient during the high level was 7.235, whereas that of the low investment period was 2.123. We also noticed that the DIG coefficients are more significant during the high investment period compared to their significance during the low investment period. The level of significance is 10% during the low investment period but only 1% in the high investment period.

The results of the estimation of interaction term during 2010–2019, 2010–2014, and 2015–2019 indicate that the bank size affects the relation between financial technology investment and financial performance positively and significantly. Moreover, the inclusion of the interaction term improves the estimation quality as R-squared increases in all periods. Analyzing the control variables, we found that the liquidity ratio coefficient is always statistically significant and negatively related to the bank performance. Solvency is positively and significantly related to the bank financial performance. The capital adequacy ratio is not significant except for the low investment period during which it affects negatively and significantly the bank’s financial performance at 10%. The NPL ratio affects negatively the bank profitability. The coefficient of size positively and significantly affects the bank financial performance. When analyzing the macroeconomic conditions, we found that inflation negatively and significantly affects the bank profitability. For the GDP growth variable, we found that the variable positively and significantly affects the bank performance.

Discussions

In this section, we will discuss the empirical results and compare our findings with the existing literature. The findings reveal that the more banks are engaged in the digital investment, the more financial performance of banks increases. This outcome supports hypothesis 1 stating that investing in the financial technology positively affects the profitability of European banks. In line with Kou et al. (2021), Cho and Chen (2021), Tunay et al. (2019), and Scott et al. (2017), our result illustrates that fintech improves the financial performance of banks. The positive effect of the fintech investment on the financial performance can be explained by the cost reduction impact of fintech. According to the transaction and agency theories, the digital technology reduces a variety of costs such as monitoring costs, information reporting costs, transaction costs, and agency costs. These findings are consistent with those of many studies. As a matter of fact, Campanella et al. (2017) point out that the adoption of software to manage credit risk improves the profit margin of banks. Liberti and Peterson (2019) shows that fintech reduces the cost of obtaining information remotely. Dong et al. (2020) indicate that the adoption of online banking will reduce operating costs and thus improve the bank’s profitability. Villar and Khan (2021) find that adopting the robotic process software by Deushe Bank has changed the banking industry by exponentially improving efficiency and enhancing safety and security. Furthermore, the positive influence of financial technology investments on the financial performance of European banks could be explained by the fact that the productivity of bank clerks increases as a result of these investments since a lot of operations are automated. Eventually, the digital adoption can improve the revenues of banks because it creates more attractive business models for customers.

In accordance with Table 1, the size can promote the performance of banks. It creates important cost advantages as fixed costs are spread over a greater amount of production. Moreover, the results – indicating a strong positive relationship between the interaction term (DIG X SIZE) and bank performance – provide empirical evidence that the effect of digitization on profitability increases with the bank size. Investing in the financial technology is more accessible to large banks for improving their performance. Consistent with Shevrin (2019), this may suggest that large banks have the skills and capacity to invest in and manage an innovative digital project better than small banks. Large banks are known for having larger IT teams and more expertise in the IT field. Unlike small banks, large banks are able to raise the big capital needed to invest in a digital project. In addition, the size makes it easier to manage the risky fintech projects as large banks can spread business risk via launching a variety of innovative projects. What is more, large banks are more likely to have specialized assets necessary for the commercial success of digital projects. One of these assets is marketing which is explained by AlKulaib and AlAli (2020). Furthermore, in line with Wang et al. (2021), the larger a bank is, the more economies of scale are able to generate, which enhances its ability to adopt fintech, and thus improve its operational efficiency. This result could also be explained by the greater importance of the cost-saving effect of fintech in larger banks since the number of managers, employees, and branches is greater.

The impact of control variables shows that the liquidity negatively affects the financial performance. This result can be accounted for by the fact that the high ratio of liquidity to deposits indicates that banks keep so much cash that there are fewer opportunities to invest customer deposits and generate profits according to the findings of Nimer et al. (2015) and Dahiyat (2016). The outcomes also show that the credit risk measured by non-performing loans negatively affects the performance of banks. This result is explained by the negative effect of the customer default on the balance sheet and income statement. The bank profitability is reduced due to the increase in the credit risk. Our results are consistent with those of Cetin (2019).

Not surprisingly, a higher level of inflation is negatively related to the bank performance. This is owing to the phenomenon that interest rates rise because of inflation rates and bank costs since inflation increases more than bank revenues. These results are similar to Demirguc-Kunt and Huizinga (1998) and Egbunike and Okerekeoti (2018).

The positive relationship between GDP and ROA can be accounted for by the overall increase in the demand for loans and deposits when the economy grows. This is because the banking activity increases as a result of the expanding economy, allowing banks to generate more profits. The results of this study confirm those of Fadzlan and Habibullah (2009) and Petriaa et al. (2015).

Based on the results and discussion above, we summarize that hypotheses 1 and 2 are confirmed. Indeed, the investment in financial technology boosts the financial performance of banks. Moreover, this effect is greater for large banks. Furthermore, we note that the factors of liquidity, solvency, credit risk, inflation, and GDP significantly affect the financial performance of European banks.

Conclusion

This study discusses the impact of financial technologies on the performance of banks, with a focus on the bank size. We also investigate the effect of the size factor on the relation between DIG and financial performance based on cointegrated panel data from European countries for the period spanning from 2010 to 2019. Furthermore, we develop two models. The first one accounts for the dependent variable of performance measured by return on equity, and the independent variable DIG measured by the digital score, and other control variables such as liquidity, size, solvency, capital adequacy, credit risk, inflation, and economic growth. This model aims to test the effect of financial technology investments on performance. The second one consists exactly of the same dependent and independent variables of the first model, except that it adds an interaction term (DIG*SIZE) with a view to test the impact of the interactive factor on the relation between financial technology investments and the financial performance. We perform an econometric test so as to specify the estimation we use on these models. Accordingly, we carry out stationarity, cointegration, a graphic test of the structural change in the DIG variable, Chow test, and a correlation test. In accordance with the tests, we infer that the total period of 2010–2019 ought to be divided into two sub-periods: 2010–2014 and 2015–2019. We also come to the conclusion that the fully modified ordinary least squares estimation is the best model of estimation.

The results of the model estimated prove that financial technology investments are positively and significantly related to the bank performance in all the three periods studied. What is more, we denote that the positive effect is stronger in the second period of 2015–2019 than in the first period of 2010–2014. Moreover, the size constitutes a moderator factor affecting the relation between digital investments and profitability in all the periods studied. Thus, hypotheses 1 and 2 are consequently confirmed.

The findings of this study provide additional insights to the literature. We find out that the European region has made significant progress in the financial technology. This paper also asserts that the fintech improves the bank performance. Furthermore, we come to the conclusion that the bank size boosts the relation between the investment in financial technologies and financial performance.

Our study has substantial policy implications as we suggest that the increased investment in fintech is a possible channel through which banks involved in digitization improve their performance, especially when the bank size is considered large.

Thus, these results are relevant to the Basle Committee and regulators, helping them perceive how fintech can positively affect the bank profitability.

Financial technologies might have the potential to lower costs by maximizing economies of scale and to increase the rapidity and security of transactions. In the same vein, the current crisis of the COVID-19 pandemic has brought to the fore the benefits for operational financial systems, keeping people safe during this period of social distancing, falling demand, and reduced input supply. Therefore, the Basel Committee, authorities, and policymakers need to set new regulations in order to enhance the integration of fintech by banks and consequently improving the stability and the prosperity of the financial sector. However, they should similarly reinforce the law to supervise banks in the environmental technology and to guarantee the security of new developed services and products to consumers.

Thus, giving the importance of such an area of research, we encourage future research to explore the effect of financial technology and the level of country innovation on the relationship between the bank diversification and profitability. Moreover, the connectedness between banks or between bank and firm can also be investigated. Comparing the profitability of banks by controlling the impact of fintech during the COVID period across developed and emerging countries constitutes a substantial research question to look into. Future research may also investigate the effect of the technology disclosure on the bank price dynamic through using the machine learning applications.

References

Abul Hasan, M. S., Adler H. M., & Bahtiar U. (2020). Determinants of bank profitability with size as moderating variable. Journal of applied Finance & Banking, 10, 1–7. http://www.scienpress.com/Upload/JAFB%2fVol%2010_3_7.pdf

Alkulaib, Y. A., & AlAli, M. S. (2020). The estimation of banking industry staffing level benchmark: A case study on Kuwaiti banks. Accounting, 7(1), 95–98. https://doi.org/10.5267/j.ac.2020.10.009

Asongu, S. A. (2018). Conditional determinants of mobile phones penetration and mobile banking in sub-Saharan Africa. The Journal of the Knowledge Economy, 9(1) 81–135. https://doi.org/10.1007/s13132-015-0322-z

Bahri, F., & Hamza, T. (2020). the impact of market power on bank risk-taking: An empirical investigation. The Journal of the Knowledge Economy, 11(3), 1198–1233. https://doi.org/10.1007/s13132-019-0584-y

Baker, M. (2003). Data collection–questionnaire design. The Marketing Review, 3, 343–370. https://doi.org/10.1362/146934703322383507

Barnewold, L., & Lottermoser, B. (2020). Identification of digital technologies and digitalisation trends in the mining industry. International Journal of Mining Science and Technology., 30(6), 747–757. https://doi.org/10.1016/j.ijmst.2020.07.003

Brynjolfsson, E. (1993). The productivity paradox of information technology. Communications of the ACM, 36, 66–77. https://doi.org/10.1145/163298.163309

Campanella, F., Della Peruta, M. R., & Del Giudice, M. (2017). The effects of technological innovation on the banking sector. Journal of the Knowledge Economy, 8, 356–368. https://doi.org/10.1007/s13132-015-0326-8

Cenni, S., Monferrà, S., Salottic, V., Sangiorgid, M., & Torluccio, G. (2015). Credit rationing and relationship lending. Does firm size matter? Journal of Banking & Finance, 53, 249–265. https://doi.org/10.1016/j.jbankfin.2014.12.010

Cetin, H. (2019). The relationship between non-performing loans and selected EU members banks profitabilities. International Journal of Trade, Economics and Finance, 10, 52–55. https://doi.org/10.18178/ijtef.2018.10.2.637http://www.ijtef.org/vol10/637-FM015.pdf

Cho, T. -Y., & Chen, Y. -S. (2021). The impact of financial technology on China’s banking industry: An application of the metafrontier cost Malmquist productivity index. The North American Journal of Economics and Finance, 57(C). https://doi.org/10.1016/j.najef.2021.101414

Clemons, E. (1986). Information systems for sustainable competitive advantage. Information & Management., 11, 131–136. https://doi.org/10.1007/s13132-015-0326-8

Dadoukis, A., Fiaschetti, M., & Fussi, G. (2021). IT adoption and bank performance during the Covid-19 pandemic. Economics Letters, 204, 109904. https://doi.org/10.1016/j.econlet.2021.109904

Dahiyat, A. (2016). Does liquidity and solvency affect banks profitability? Evidence from listed banks in Jordan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 6, 35–40. https://doi.org/10.6007/IJARAFMS/v6-i1/1954

Darolles, S. (2016). The rise of fintechs and their regulation. Financial Stability Review, Banque De France, 20, 85–92.

Demirguc-Kunt, A., & Huizinga, H. (1998). Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review, 13(2). https://doi.org/10.1093/wber/13.2.379

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072.

Distinguin, I., Roulet, C., & Tarazi, A. (2013). Bank regulatory capital and liquidity: Evidence from U.S. and European publicly traded banks. Journal of Banking & Finance, 37, 3295–3317. https://doi.org/10.1016/j.jbankfin.2013.04.027

Dong, J., Yin, L., Liu, X., Hu, M., Li, X., & Liu, L. (2020). Impact of Internet finance on the performance of commercial banks in China. International Review of Financial Analysis, 72, 1–12. https://doi.org/10.1016/j.irfa.2020.101579

Dos Santos, B., & Peffers, K. (1995). Rewards to investors in innovative information technology applications: First movers and early followers in ATMs. Organization Science, 6, 241–259. https://doi.org/10.1287/orsc.6.3.241

Egbunike, C. F., & Okerekeoti, C. U. (2018). Macroeconomic factors, firm characteristics and financial performance: A study of selected quoted manufacturing firms in Nigeria. Asian Journal of Accounting Research, 3, 142–168. https://doi.org/10.1108/AJAR-09-2018-0029

Fadzlan, S., & Habibullah, M. S. (2009). Determinants of bank profitability in a developing Economy: Empirical evidence from Bangladesh. Journal of Business Economics and Management, 10(3), 207–217. https://doi.org/10.3846/1611-1699.2009.10.207-217

Fan, W., Wallace, L., Rich, S., & Zhang, Z. (2006). Tapping the power of text mining. Communications of the ACM, 49, 76–82. https://doi.org/10.1145/1151030.1151032

Filip, D., Jackowicz, K., & Kozłowski, L. (2017). Influence of Internet and social media presence on small, local banks’ market power. Baltic Journal of Economics, 17(2), 190–214. https://doi.org/10.1080/1406099X.2017.1376856

Hannan, T., & McDowell, M. (1984). The determinants of technology adoption: The case of the banking firm. The Rand Journal of Economics, 15, 328–335. http://links.jstor.org/sici?sici=0741-6261%2819842...O%3B2–6&origin=repec

Hernando, I., & Nieto, M. (2007). Is the Internet delivery channel changing banks performance? The case of Spanish banks. Journal of Banking & Finance, 31, 1083–1099. https://doi.org/10.1016/j.jbankfin.2006.10.011

Hitt, L. M., & Brynjolfsson, E. (1996). Productivity, business profitability, and consumer surplus: Three different measures of information technology value. Economics Computer Science, 20, 121–142. https://doi.org/10.2307/249475

Im, K. S., Pesaran, M. H., & Shin, Y. (1997). Testing for unit roots in hetero-genous panels. Cambridge: University of Cambridge (DAE, Working Paper 9526).

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of FinaNcial Economics, 3, 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Kenneth, L., & Jane, L. (2009). Management information system managing the digital firm. Pearson Education Inc.

Kou, G., Olgu Akdeniz, Ö., & Dinçer, H. (2021). Fintech investments in European banks: A hybrid IT2 fuzzy multidimensional decision-making approach. Financial Innovation, 7, 39. https://doi.org/10.1186/s40854-021-00256-y

Kriebel, J., & Debener, J. (2019). Measuring the effect of digitalization efforts on bank performance. Proceedings Academy of Management. https://doi.org/10.2139/ssrn.3461594

Le, T., & Ngo, T. (2020). The determinants of bank profitability: A cross-country analysis. Central Bank Review, 20, 65–73. https://doi.org/10.1016/j.cbrev.2020.04.001

Leong, W. H., & Dollery, B. (2004). The productive efficiency of Singapore banks: An application and extension of the Barr et al. The Singapore Economic Review, 49(2), 273–290. https://doi.org/10.1142/S0217590804000925

Levin, A., & Lin, C. F. (1992). Unit root tests in panel data Asymptotic and finite-sample properties. University of California (UC San Diego, Working Paper 92–23).

Liberti, J. M., & Peterson, M. (2019). Information: Hard and soft. The Review of Corporate Finance Studies, 8(1), 1–41. https://doi.org/10.1093/rcfs/cfy009

Lukosiunas, R. (2017). ROA, ROE, and what these key measures mean for your bank. Weiss Rating. https://greyhouse.weissratings.com/ROA-ROE-and-What-These-Key-Measures-Mean-for-YOUR-Bank. Accessed 26 February 2019.

Nimer, M., Warrad, L., & Al Omari, R. (2015). The impact of liquidity on Jordanian banks profitability through return on assets. European Journal of Business and Management, 7(7), 229–232. ISSN (Paper)2222–1905 ISSN (Online)2222–2839.

Pedroni, P. (2004). Panel cointegration: Asymptotic and limite sample properties of pooled time series tests with an application to the PPP hypothesis Cambridge University. Econometric Theory, 3, 579–625.

Petriaa, N., Capraru, B., & Ihnato, I. (2015). Determinants of banks’ profitability: Evidence from EU 27 banking systems. Procedia Economics and Finance, 20, 518–524. https://doi.org/10.1016/S2212-5671(15)00104-5

Rega, F. (2017). The bank of the future: The future of banking - An empirical analysis of European banks. Available at SSRN. https://doi.org/10.2139/ssrn.3071742

Report of index of network readiness. (2020). Network readiness of countries worldwide: Research Policy, 533–544. https://networkreadinessindex.org/wp-content/uploads/2020/10/NRI-2020-Final-Report-October2020.pdf. Accessed 6 January 2021.

Sadigh, N., Asgari, T., & Rabiei, M. (2021). Digital transformation in the value chain disruption of banking services. Journal of Knowledge Economy. https://doi.org/10.1007/s13132-021-00759-0

Saidi, A. M. (2018). E-Payment technology effect on bank performance in emerging economies–evidence from Nigeria. Journal of Open Innovation: Technology, Market and Complexity, 4(4), 43. https://doi.org/10.3390/joitmc4040043

Sapci, A., & Miles, B. (2019). Bank size, returns to scale, and cost efficiency, Journal of Economics and Business, 105(C), 105842. https://doi.org/10.1016/j.jeconbus.2019.04.003

Sathye, M. (2005). The impact of Internet banking on performance and risk profile: Evidence from Australian credit unions. Journal of Banking Regulation, 6(2), 163–174. https://doi.org/10.1057/palgrave.jbr.2340189

Scott, S. V., Reenen, J. V., & Zachariadis, M. (2017). The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Research Policy, 46, 984–1004. https://doi.org/10.1016/j.respol.2017.03.010

Sheng, T. (2021). The effect of fintech on banks’ credit provision to SMEs: Evidence from China. Finance Research Letters, 39(C). https://doi.org/10.1016/j.frl.2020.101558

Shevrin, R. (2019). How much do banks spend on technology? (Hint: It would weigh 670 tons in $100 bills). Observations from the fintech snark tank. https://www.forbes.com/sites/ronshevlin/2019/04/01/how-much-do-banks-spend-on-technology-hint-chase-spendsmore-than-all-credit-unions-combined/?sh=1fe43deb683a. Accessed 6 January 2021.

Solow, R. M. (1987). We’d better watch out (p. 36). New York: New York Times (Book Review).

Song, T., Cai J., & Le, L. (2021). Towards smart cities by Internet of Things (IoT)-A silent revolution in China. The Journal of the Knowledge Economy, 12(2), 1–17. https://doi.org/10.1007/s13132-017-0493-x

Thakor, A. (2019). Fintech and banking: What do we know? Journal of Financial Intermediation, 41, 100–858. https://doi.org/10.1016/j.jfi.2019.100833

The annual report of the Council of Economic Advisers. (2001, January). Washington, DC 20402-0001. ISBN 0-16-050616-6.

Tippins, M., & Sohi, R. (2003). IT competency and firm performance: Is organizational learning a missing link? Strategic Management Journal, 24, 745–761. https://doi.org/10.1002/smj.337

Tunay, K. B., Tunay, N., & Akhisar, İ. (2015). Interaction between Internet banking and bank performance: The case of Europe. Procedia - Social and Behavioral Sciences, 195, 363–368.

Tunay, K. B., Tunay, N., & Akhisar, İ. (2019). The effects of technology on bank performance in advanced and emerging economies: An empirical analysis. Handbook of Research on Managerial Thinking in Global Business Economics. https://doi.org/10.4018/978-1-5225-7180-3.ch015

Villar, A. S., & Khan, N. (2021). Robotic process automation in banking industry: A case study on Deutsche bank. Journal of Banking and Financial Technology, 5, 71–86. https://doi.org/10.1007/s42786-021-00030-9

Wang, Y., Xiuping, S., & Zhang, Q. (2021). Can fintech improve the efficiency of commercial banks? –An analysis based on big data. Research in International Business and Finance. https://doi.org/10.1016/j.ribaf.2020.101338

Williamson, O. E. (1985). The economic institutions of capitalism. New York: Free Press, 21, 528–530.

Zhang, M., & Yang, J. (2019). Research on financial technology and inclusive finance development. In 2018 6th international conference on economics, social science, arts, education and management engineering. Atlantis Press. https://doi.org/10.2991/ieesasm-18.2019.14

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chhaidar, A., Abdelhedi, M. & Abdelkafi, I. The Effect of Financial Technology Investment Level on European Banks’ Profitability. J Knowl Econ 14, 2959–2981 (2023). https://doi.org/10.1007/s13132-022-00992-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-022-00992-1