Abstract

Residential demand response is poised to emerge as an increasingly important aspect of power market operations. A major challenge in the proliferation of residential demand response relates to the development of scalable aggregator business models. This has motivated quality differentiation in the form of priority service. Priority service consists of a priority charge, which is payable regardless of the usage of electricity, and a service charge, which is payable only when electricity is actually consumed. In this paper, we analyze the role of service charges in priority service pricing. From a theoretical standpoint, we characterize service charges that maintain the equivalence between priority service and real-time pricing in terms of consumer expenditures. We also revisit the results of the traditional theory regarding a finite number of priority service classes for the general case of non-zero service charges. The experimental side of the paper is focused on the comparison of different priority service settings in terms of their impact on consumer comfort and electricity bills. The analysis is performed on a realistic case study of a Texas household using the Pecan Street database and on a Belgian household using the LINEAR database. The results reveal that service charges are crucial for the viable practical implementation of priority service pricing. We use our case study to further analyze the incentives of households in a priority service pricing regime.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Due to the expansion of renewable resources in electric power systems, residential demand response schemes have recently received increasing consideration in the scientific literature. The aggregated flexibility of residential and commercial consumption can be exploited in order to address operational and market clearing challenges linked to the growing reliance of power systems on unpredictable and highly variable renewable energy.

Whereas sophisticated industrial consumers can participate directly to the wholesale market by virtue of size and significant economic opportunities, residential consumer engagement requires respecting the premium that small consumers place on privacy, simplicity, and control. Various demand response paradigms have been proposed, which aim at responding to these requirements. The literature can be clustered into two groups. Price-based methods, such as real-time pricing [32], consider consumers as sophisticated agents that react instantaneously to prices. Quantity-based methods, such as direct load control [22], assume that an aggregator can override residential consumers and control appliances directly.

1.1 Priority service pricing

The present contribution aims at investigating the viability of priority service as a paradigm for mobilizing residential demand response at a massive scale. Priority service [8] aims at combining the strengths of both real-time pricing and direct load control [28]. The idea of the approach is to define a simple offering of electricity service, while allowing consumers to maintain privacy on their usage of electricity and control over the use of specific household devices. Quality of service refers particularly to the reliability of electricity supply. Aggregators thus offer a priority service menu to consumers in the form of price-reliability pairs. Residential consumers can subscribe to a certain capacity under each option for the entire horizon of service. Options with higher reliability correspond to higher prices. Multilevel demand subscription, which generalizes priority service, has been proposed by Chao et al. [7]. Multilevel demand subscription additionally differentiates electricity service by the duration of time over which the option can be used during the service horizon.

Priority service refers to an array of contingent forward delivery contracts offered by a seller [8]. The selection of one option from the menu by each consumer determines the service order or priority of the consumer. Under each contingency, the seller rations supplies by serving customers in order of their selected priorities. Priority service has received renewed interest in both the scientific literature [5, 6, 15, 23, 25,26,27], as well as in industry applications [1, 29, 37]. The practical deployment of priority service that is described by Papalexopoulos et al. [29] relies on a color-tagging system, which includes three options: (1) green indicates cheap power that can be interrupted frequently; (2) orange indicates power that can only be interrupted under emergency conditions; (3) red represents expensive power that cannot be interrupted. In practice, this form of demand response can be implemented in households by means of fuse limits and color tags for plugs, whereby the consumer can attribute a color to a specific appliance either manually or by means of a home energy management system. We will use this color-tagging system as the basis for our analysis in the present work.

The pricing of priority service contracts is characterized by a menu of options \(M = \{(p,s,r)\}\). For each option, p is the priority charge (payable in advance), s is the service charge (payable as service is provided), and r is the service reliability which is the probability of receiving the product or service. Although the theory of priority service has been developed extensively, the practical performance of the approach hinges crucially on the service charge s. However, the literature is relatively terse in analyzing the role of service charges in priority service [28]. In our work, we demonstrate that service charges can be instrumental in decreasing the cost of priority service contracts to consumers. The goal is to preserve the simplicity of the approach relative to more complex contract offerings based on energy and capacity, such as multilevel demand subscription, while keeping consumer expenditures acceptable.

1.2 Household modeling

Our analysis is focused on the impact of demand response on consumers. This impact is quantified by means of a mixed integer linear program (MILP) that schedules appliances in the house efficiently, thereby replicating the behavior of a home energy management system. An extensive review of home energy management systems is provided in [36].

Most of the work in the field of home energy management systems is focused on real-time pricing [2, 9, 10, 17, 20, 34, 35]. Notably, a limited amount of recent literature analyzes the impact of alternatives to real-time pricing. For example, Hayn et al. [19] compares the impact of a flat tariff, a variable energy tariff, a variable capacity tariff and a combination of energy and capacity tariffs. A predecessor of the present analysis is presented in [15].

Whereas the majority of the demand response literature is devoted to real-time pricing, the range of modeling approaches that are used for solving the appliance scheduling problem is wide. Reinforcement learning has been considered as a viable approach for adaptive real-time home energy systems [17, 35]. Jin et al. [21] employ model predictive control. Mathematical programming formulations based on MILP are widespread in the literature [2, 9, 15, 19, 20]. Due to computational considerations, certain papers adopt a relaxed formulation of MILP programs [34]. For a broad review on modeling approaches applied to home energy management systems, we refer the reader to Beaudin and Zareipour [3]. To a large extent, the aforementioned research assesses the impact of different tariffs on the operation of the system [19]. By contrast, the impact of demand response schemes on consumer comfort and monthly electricity bills often receives less consideration. Instead, our paper is focused on the impact of demand response on consumers, rather than the system.

The notable growth of the literature on home energy management systems has been possible due to large demand response pilot programs that have been deployed recently. Such demand response programs increase the amount of available data that is accessible to the research community. This data reaches down to the level of individual appliances. For instance, the LINEAR demand response pilot provides insights about the flexibility of wet appliances in Belgium [12]. The availability of appliance-level consumption data and consumer features allows the research community to generate synthetic load profiles for residential consumers [31]. This is expected to proliferate further analysis for understanding the impact of demand response on consumers.

1.3 Contributions

Our paper is concerned with developing practically viable offerings of priority service contracts. Accordingly, our work aims at providing a realistic end-to-end analysis of several priority service pricing settings. We thus aim at matching the level of rigor that has been devoted by the literature on real-time pricing. Our analysis is consumer-centric and focuses specifically on consumer comfort and expenditures. It is developed along the following four axes:

-

1.

Designing priority service menus and contracts.

-

2.

Modeling the choice of an optimal contract by the household.

-

3.

Simulating the dispatch of devices given a chosen contract.

-

4.

Compare several priority service schemes on a realistic case study.

We aim at integrating all of these axes in a single framework in the present paper. By contrast, past literature on priority service [5, 6, 8, 23, 28, 29] is often limited to a subset of these dimensions, for example contract design [6, 8, 28], contract choice [6, 8, 23], or device dispatch [23, 29].

Our analysis demonstrates that service charges become a crucial element for the successful practical application of priority service in households that are characterized by peaky seasonal demand (e.g., as related to air conditioning loads in summer months). A specific definition of this service charge based on the marginal cost of supply is provided by Chao and Wilson [8]. In order to assess the importance of service charges in a practical deployment of priority service in an existing market, we generalize the theorems and proofs described by Chao and Wilson [8] for any service charge function. Our development follows closely the original priority service theory presented in [8].

We use our simulation framework to conduct a detailed analysis regarding the effect of demand response on residential consumers and system operations. This framework is also employed in order to provide insights on the interplay between priority service contracts and the incentive to invest in home energy storage.

1.4 Structure

The paper is organized as follows. Section 2 generalizes priority service pricing theory in order to include nonzero service charges. Subsequently, Sect. 3 is dedicated to the formulation of mathematical programs for scheduling appliances in a household that is enrolled to priority service. In Sect. 4 we present the data sources that we rely on for our case study. We also explain the procedure that we use for generating counterfactual real-time prices, and for designing a priority service menu that is comparable to real-time pricing. In Sect. 5 we present our results on a case study of a typical household in Texas and compare these results to a typical household in Belgium. Furthermore, we develop the main policy messages that emerge from the analysis of these results. Section 6 concludes our study. Notation is summarized in the Appendix.

2 Priority service pricing theory

As discussed in Sect. 1, priority service refers to an array of contingent forward delivery contracts offered by an electricity supplier [8]. The selection of one option from the menu by each consumer determines the service order or priority of the consumer. Under each contingency, the seller rations supplies by serving customers in the order of their selected priorities. In the basic priority service model, v represents the valuation of a consumer for power. This valuation can equivalently be interpreted as a ranking of consumers. This means that under conditions of scarcity, consumers with higher valuation v should be entitled to higher-priority access to power. The function D(v) corresponds to the demand function of the system. Information asymmetry implies that the menu designer has access to aggregate system information (i.e., D(v)), but does not know which individual consumer corresponds to which type v a priori (i.e. when the contract is designed). This information is revealed ex post (i.e. after contracts are selected), following the revelation principle of mechanism design.

The key element of priority service pricing is the priority service menu \(M = \{(p,s,r)\}\). The menu consists of (1) a priority charge p, which is payable regardless of the usage of electricity, (2) a service charge s, which is payable only when electricity is actually consumed, and (3) a service reliability level r, which corresponds to the probability of receiving the product or service [8]. Interestingly, the role of the service charge s has not been emphasized in the original priority service literature. Therefore, in this section, we revisit the original priority service theory presented in [8] in order to include service charges in a generalized form. The section is structured as follows. Section 2.1 restates theorems 1 and 2 of [8] which characterize how consumers choose priority classes. Afterwards, Sect. 2.2 presents an alternative to the priority service pricing menu in [8] that includes a general functional expression for service charges. Subsequently, in Sect. 2.3, we prove the equivalence between priority service and spot pricing for the case of any service charge function. Then, we discuss in Sect. 2.4 the effects of a cutoff valuation on the priority service menu and on the equivalence between priority service and spot pricing. Finally, Sect. 2.5 proposes a formula for service charges in the case of a menu with a finite number of classes. This final point is required for the practical implementation of priority service contracts in the case study of Sect. 4.

2.1 Choice of priority classes by consumers

As we mention in the previous paragraph, a priority service menu is composed of a set of options. The consumer chooses a priority option from the menu, and assigns it to an increment of consumption. Concretely, we consider a continuum of consumers, with privately known types v. Each consumer engages in a forward agreement with an aggregator, according to which it pays a reservation charge p, in order to gain access to electricity service with reliability r. Additionally, the consumer pays a service charge s whenever it actually consumes power. As in the case of [8], without loss of generality, we characterize each consumer as a single unit of demand with an associated willingness-to-pay v (\(\in [0,V]\)). Consequently, the objective of the consumer is to choose a priority option from the menu that maximizes its expected surplus. Therefore, for each v, the consumer solves the following problem:

The function Surplus(v) represents the surplus of a consumer with privately known type v when this consumer optimizes over the set of options offered in menu M. We denote the optimal choice of a consumer of type v for the above problem as \(\{p(v), s(v), r(v)\}\). Based on this consumer objective, two theorems are stated and proven in [8].

Theorem 1

The optimal consumer choices satisfy the following conditions: (A) r(v) is nondecreasing in v; (B) \(p(v)+s(v) \cdot r(v)\) is nondecreasing in v; and (C) \(p(v)+r(v) \cdot s(v) = \int _{0}^{v} [r(v) - r(u)] du,\) for every v.

Theorem 2

If \(p(\cdot ),\) \(s(\cdot ),\) and \(r(\cdot )\) satisfy conditions (A) and (C) stated in Theorem 1, and \(M=\{(p(v),s(v),r(v))\; | \; 0 \le v \le V\},\) then for each v, (p(v), s(v), r(v)) is an optimal solution to Problem 1.

2.2 Priority service menu

Throughout this section, the representation of uncertainty used in [8] is adopted. Therefore, all random variables are represented as a function of \(\omega \in \Omega \), an abstract sample space associated with a \(\sigma \) field, and a probability measure. Following the standard theory [8], we denote by \(\hat{p}(\omega )\) the instantaneous equilibrium price (or spot price) for electricity associated with a given random outcome \(\omega \). Then, the service reliability of a consumer of type v who faces real-time pricing is:

Equation (2) indicates that the consumer is served in the events for which the spot price is less than its willingness to pay. Given this definition, we propose the following price menu \(M^*\), and then show that it is equivalent to real-time pricing in Sect. 2.3:

In our proposed menu, S(v) can be any function of v, and represents the mapping from consumer valuation to service charges. Note that this priority service menu is different from the one presented in [8]. Indeed, this priority service menu does not consider any specific form of service charge and does not account for a cutoff valuation. Instead, [8] defines a menu by specifying a service charge linked with the marginal cost of the supply side and a cutoff valuation.

Using Theorem 2, we can show that our priority service menu \(M^*\) induces optimal consumer choices.

Proof

In order to prove that \(M^*\) induces optimal consumer choices, from Theorem 2, only conditions (A) and (C) must hold for \(M^*\) to be optimal.

Condition (A): By definition of R(v), \(r^*(v)\) is nondecreasing in v.

Condition (C): By definition of \(p^*(v)\), it follows that:

Since conditions (A) and (C) hold, the price menu \(M^*\) induces optimal consumer choices for Problem 1.

Note that this result implies that any form of service charge can be used (positive, negative, increasing, constant, decreasing, etc.) while preserving the optimality of the menu.

2.3 Equivalence between priority service and spot pricing

An important practical attribute of priority service is that it should not overburden consumers. The natural benchmark of comparison is the consumer bill that would be incurred under real-time pricing. The practically relevant question is whether consumers pay a premium for the added simplicity of priority service pricing. Chao and Wilson [8] proves that there is no such premium. Therefore, having proposed a priority service menu \(M^*\) with a general service charge, and having proven its optimality, we are interested in exploring next to what extent the newly proposed menu retains the equivalence to real-time pricing.

As emphasized by [8], the key difference between real-time pricing and priority service pricing is in the time frame. Indeed, any consumer experiencing real-time pricing is subject to a price that is revised instantaneously as the status of supply and demand changes. However, in the case of priority service, the consumer subscribes to a forward contract over a longer period of time. These two pricing schemes are closely related, and indeed spot pricing can be viewed as a limiting case of priority service, when the contracting horizon tends to zero [8]. Proposition 1 in [8] establishes a close relation between the two pricing schemes. We now show that the proof holds for the case of a more general service charge function \(s^*(v) = S(v)\) (see Eq. (4) above).

Proposition 1

Under the assumption of risk neutrality, priority service pricing and spot pricing are equivalent from the perspective of individual consumers. The expected expenditures and the expected surplus of each consumer under the two pricing schemes are identical. That is,

and

where \(I_{\{\hat{p}(\omega ) \le v\}}(\omega )\) is an indicator function, which takes on value 1 or 0 depending on whether \(\omega \) belongs to the set \(\{\omega :\hat{p}(\omega ) \le v\}\) or not.

Proof

The expected expenditure of a consumer of type v under spot pricing can be written as followsFootnote 1:

The crucial observation in the above proof is that it does not depend on any particular service charge. Thus, the general service charge that we propose in Eq. (4) above is valid for this proof. Therefore, the equivalence between real-time pricing and priority service that is expressed in proposition 2 of [8] still holds. Note that the choice of the service charge is a choice left to the menu designer.

2.4 Role of cutoff valuation

In this section we analyze the interplay of the non-zero service charge with the cutoff valuation \(v_0\). We are specifically interested in analyzing whether the equivalence between real-time pricing and priority service remains valid. We propose the following priority service pricing menu, \(M^{**}\), that uses a cutoff valuation \(v_0\) and a general form of service charge:

Similarly to the menu presented in Sect. 2.2, \(M^{**}\) can be shown to induce optimal consumer choices. Indeed, priority service menu \(M^{**}\) verifies conditions (A) and (C).

Having established the optimality of the priority service menu \(M^{**}\), we discuss the influence of the presence of a cutoff valuation on the equivalence between real-time pricing and priority service. We show that the equivalence holds only for \(v_0 \in [0,V]\) such that:

Since \(R(x) \ge 0\), this condition is equivalent to:

Proof

For the priority menu \(M^{**}\), we can keep the equivalence proof until the step where the function R(x) is introduced in the equation. We have:

Therefore, the equivalence is only verified when the integral part of the sum is equal to 0.

2.5 Priority service pricing for a finite number of classes

In order to implement priority service in a practical setting, it is necessary to consider a finite number of priority classes instead of a continuum of options. This section proposes a way to compute the service charge of each class. In this setting, consumers are divided into n priority classes based on their willingness to pay, say \([0,v_1]\), \([v_1,v_2],\ldots ,[v_{n-1},V]\), where \(0=v_0< v_1<\cdots< v_{n-1} < v_n = V\). Service is provided to consumers such that consumers in a higher value class enjoy a higher priority (and pay more). However, within each class, all consumers are treated equally, and are therefore served in a random order. Then, the probability that a consumer with valuation v between \(v_i\) and \(v_{i+1}\) is served is:

In this section, we propose a formula that can be used in order to create a unique service charge per class:

The total payment of a consumer in priority class i is computed as:

Given the proposed transformation of a continuum of priority classes to a finite number, we can revisit the result presented in [8] regarding the surplus obtained with a finite number of priority classes. Indeed, the authors in [8] prove the following proposition, which considers a priority service menu with no service charge and additional assumptions.

Proposition 2

The surplus that is unrealized due to a finite number n of priority classes is of order \(\frac{1}{n^2}.\) That is, \(S_n \ge S_{\infty } - O(\frac{1}{n^2}).\)

Our analysis allows us to conclude that this proposition can be extended to the case where the service charge is represented by any function. Indeed, the proof linked with this proposition does not depend on the form of the service charge. Therefore, this result can be used in order to demonstrate that, even with a non-zero service charge, nearly 90% of the potential benefit of priority service pricing can be captured by offering just three priority classes. The ColorPower approach that we describe in the introduction and specifically analyze in this paper indeed relies on three options.

3 Household model

In order to infer the impact of priority service on consumers, we describe a mathematical programming formulation for scheduling appliances under priority service pricing. This scheduling problem proxies the behavior of a home energy management system.

We consider a household that contains a battery, solar panels, an electric vehicle, and several appliances that can be considered as being flexible or inflexible loads. Flexible loads correspond to “jobs” with specific execution deadlines and power consumption profiles, which are assumed to be known in advance. These include wet appliances (dishwashers, washing machines and tumble dryers). The LINEAR pilot project [12] contains information about the amount of delay that users are willing to tolerate in terms of the usage of individual wet appliances (washing machine, dishwasher and dryer). The availability of this data allows us to populate our model of consumer discomfort with values based on the pilot data, that are used in the case study presented in this paper. This has driven the choice of considering wet appliances in the house. Moreover, it is standard to assume an electric vehicle and a battery in the demand response literature as potential sources of consumer flexibility. Finally, no uncertainty regarding arrival times, deadlines, consumption profiles, etc. is considered in the present model.

Several assumptions are used in our analysis, following [15]:

- (A1):

-

An appliance can change color (i.e. move to a different reliability tier) while in the middle of executing a power consumption profile in the priority service setting.

- (A2):

-

An appliance can be interrupted at any stage of its operation and be started on again at the stage that it was interrupted.

- (A3):

-

An appliance arrives with a deadline by which the task of the appliance must be completed, in order for the consumer to avoid any frustration.

- (A4):

-

The power consumption footprint of each appliance is known.

- (A5):

-

Any unused solar power is wasted. No payment is made by the grid to buy that extra solar power.

The footprint of an appliance is defined as the usual consumption pattern of the appliance. The estimation of these consumption patterns is the focus of an extensive body of literature on non-intrusive load monitoring [18].

We now proceed with the mathematical programming formulation of the device scheduling problem. The formulation is inspired from [19]. Nevertheless, we modify Hayn’s formulation in order to include features that are particular to priority service. We divide the description of the mathematical program into different elements that are present in the household. First, Sect. 3.1 presents constraints that are related to particular features of priority service. Section 3.2 presents constraints that are related to inflexible electricity consumption and solar panels. In Sect. 3.3 we present the constraints that are required for representing the dynamics of the electric vehicle. Section 3.4 describes the use of flexible appliances in the household, while Sect. 3.5 is devoted to constraints that are related to the use of a battery by the household. Finally, Sect. 3.6 introduces the objective function used for the household scheduling optimization program.

3.1 Priority service pricing features

As pointed out in Sects. 1 and 2, we consider a priority service menu that contains three options corresponding to colors [29]. Each color corresponds to a different level of reliability for serving electricity. The consumer subscribes to a certain amount of capacity to each option of the menu at the beginning of the horizon. This amount of capacity is denoted as \(P_i^{max}\). After subscribing, the consumer is entitled to the requested capacity for each color and faces the reliability of the corresponding option. The total consumption under each option i, denoted by the variable \(y_{t,i}\), is therefore bounded by the amount of power procured in the beginning of the horizon. This is represented by Eq. (14):

Here, \(profile_{t,i}\) is a binary parameter that records if color i is interrupted or not at time period t.

3.2 Solar panels and inflexible load

Solar production at time step t is represented by \(S_{t}\), while \(s_{t,i}\) corresponds to the solar supply that is actually used by option i. Inflexible load consumption in period t is denoted by \(B_t\), and corresponds to inflexible appliances. The consumer may decide to serve only a portion \(b_{t,i}\) of its inflexible load through a particular option i, and incurs a cost of \(\phi \) per unit of discarded energy. This is expressed as follows:

3.3 Electric vehicle

The state of charge of the home electric vehicle is denoted by \(soc_t^{EV}\) and its maximum capacity is \(EV^{max}\). The charge efficiency is denoted by \(\eta ^{EV}\). The charge and discharge decisions are represented respectively by \(ch_{t,i}^{EV}\) and \(dis_{t,i}^{EV}\), and are limited by the maximum rates, which are expressed respectively by \(Ch_{EV}^{max}\) and \(Dis_{EV}^{max}\). Since the electric vehicle is either charging or discharging at any given moment, we use a binary indicator variable \(u_t^{EV}\) in order to represent the charge/discharge state of the vehicle. Finally, charging or discharging requires the vehicle to be plugged in. The parameters \(T_A\) and \(T_D\) represent, respectively, the time of arrival and departure of the vehicle. The parameters \(EV_A\) and \(EV_D\) express, respectively, the state of charge at arrival and departure. The operation of the electric vehicle can therefore be represented by the following constraints, following [14]:

Here, \(\Delta t\) corresponds to the number of time periods present in an hour, i.e. four periods in the case of the 15-min intervals considered in this paper.

3.4 Flexible appliances

As explained previously, flexible appliances are modeled as power demand arrivals with specific deadlines and interruptible power consumption profiles. A consumption profile is divided into one power level/part per time period. The binary variable \(x_{t,j,\beta ,\tau ^, i}\) is 1 if part \(\tau \) of appliance j that arrives at time \(\beta \) is scheduled to run at time t and served by option i. The flexible appliances are modeled by the following set of constraints:

Equation (29) expresses the fact that only one part of the profile of an appliance j can be served during a certain time period. The fact that a part of an appliance can only be served once in the entire horizon is represented by Eq. (30). Furthermore, the order of service of the parts of the consumption profile of each appliance must be respected. For example, the first step of the washing machine has to be served before the second one. This is described in Eq. (31). Finally, an appliance must finish before the next arrival of that appliance, as indicated in Eq. (32).

3.5 Battery

Equations (34)–(40) correspond to the constraints that represent the operation of the household battery . The notation follows the exposition of the electric vehicle model.

3.6 Power balance and objective function

The goal of the household is to minimize the sum of expenditures and consumer discomfort. In the case of priority service, the objective function is therefore expressed by Eq. (41):

The first term in the sum represents the expenditure of the consumer for subscribing to an amount of power \(P_i^{max}\) with a priority charge \(\lambda _i^P\) for each option i at the beginning of the horizon. The second term corresponds to the cost due to the actual consumption of electricity. Here, \(\lambda _i^S\) is the service charge for option i. The third term is linked with the extra cost due to shortage in serving load. Finally, the last term represents the frustration of the consumer for any delay in serving a flexible appliance beyond its deadline \(D_j\), where \(F_j\) is a marginal measure for this frustration. Note that any inflexible load shortage incurred by the household due to unreliable service is not planned, and its cost is captured by Eq. (41).

The device scheduling model under priority service pricing can then be expressed as follows:

The total consumption of the household is the sum of the consumption of each flexible appliance, inflexible load, battery charge/discharge, and electric vehicle charge/discharge at every time period. The parameter \(\rho _{j,\tau }\) represents the consumption pattern of part \(\tau \) of appliance j.

4 Case study

We apply our model of priority service to realistic household models. We rely on three categories of data, which we now present. In Sect. 4.1 we describe the data used for populating the household models. Section 4.2 is devoted to the construction of a series of real-time prices in a forward-looking scenario of widespread demand response adoption. This is needed in order to create a priority service menu on the basis of meaningful real-time prices in a system that undergoes a large penetration of demand response. Finally, in Sect. 4.3 we describe how we design a priority service menu on the basis of real-time prices.

4.1 Household data

We use the Texas household with identity number 661 from the Pecan Street data set [30]. The total electricity consumption of the household, along with several appliance consumption profiles, is available at 15-min resolution. The electricity production of the solar panels of this household for 2018 is also part of the data set.

4.1.1 Solar and inflexible load

We obtain the inflexible load of the household by subtracting the consumption of flexible appliances from the total load. The appliances defined in this work as being flexible are the washing machine, the dishwasher, and the tumble dryer. The inflexible load of our chosen household for the year 2018 is presented in Fig. 1. The total energy corresponding to inflexible demand amounts to 10,777 kWh over the year. The total solar energy produced throughout the year corresponds to approximately 70% of the inflexible load (7762 kWh). However, the lack of synchronization between solar production and inflexible consumption implies that solar power can only serve 30% of the inflexible demand. The annual energy consumption for the electric vehicle and the flexible appliances is equal to 3284 kWh and 380 kWh, respectively.

4.1.2 Flexible appliances

The 15-min data series for each flexible appliance for 2018 are used in order to create a consumption footprint by averaging the consumption of each appliance. We present the consumption footprints in Fig. 2. The arrival times are recorded from the electricity consumption time series of each flexible appliance. The two parameters linked with the annoyance of the consumer, appliance deadline and disutility values, are tuned based on results provided by the LINEAR demand response pilot project [12]. The deadline is computed as the average flexibility window observed for each wet appliance in [12]. Following [12], disutility values are assumed to be constant over time. This assumption cannot capture the growing frustration of a consumer who is subject to several consecutive delays, as this level of detail is out of scope for the present paper.

4.1.3 Electric vehicle

We consider a Chevy Volt with a battery capacity of 16 kWh [14]. The maximum charging and discharging power amounts to 3.3 kW. We assume a charging efficiency of 95%. The data concerning the use of the electric vehicle are based on a German study [24]. The results of the study show that electric vehicles are mostly used during weekdays, in order to drive to work, which is our assumption in the paper. Based on [24], we assume a typical departure and arrival time of 8 a.m. and 5:30 p.m. respectively. Concerning the arrival and departure state of charge, the electric vehicle is ensured to be fully charged during departure, and returns from work after traveling a distance of 60 km per day with an assumed consumption of 0.2 kWh/km [24].

4.1.4 Battery

The battery specifications are based on the Tesla Powerwall 2 [33]. The total capacity of the battery is equal to 13.5 kWh. The maximum charging and discharging power is considered to be 5 kW and the charging efficiency is 90%. The annual battery investment cost is sourced from [25] and ranges from 84.6 to 496.32 $/year. This cost range accounts for potential future improvements in battery manufacturing costs (1110–3330 $), varying lifespan of the battery (15–20 years), and varying annual discount rates (3–10%).

4.2 Real-time prices

We consider households that are exposed to the wholesale market of the Electric Reliability Council of Texas (ERCOT) [13]. Note that the real-time prices that have transpired in ERCOT in the past are based on a relatively inelastic demand function. The goal of this section is to use these observed real-time prices in order to estimate a new price series that accounts for the flexibility of residential consumers. This process is realized in order to create input for Eqs. (3)–(6), which are required for determining an optimal priority service menu which allocates system resources optimally to consumers.

The generation of this new time series of real-time prices uses as input the historically realized real-time prices, the historically realized demand, and the wind and solar production of each 15-min period of 2018. The process of obtaining counterfactual real-time prices is described as follows:

-

1.

Form groups of 15-min periods with similar solar and wind production, by means of clustering.

-

2.

For each group, create a piecewise linear supply function. Assume zero cost for wind and solar production, and use a linear regression over the set of historically observed market clearing prices and quantities. We assume that the system has a maximum production capacity of 110 GW.

-

3.

For each 15-min period, estimate an isoelastic demand function with an elasticity of \(-0.5\) based on the observed price-quantity data point. The curve is shifted by the amount of industrial demand, which is assumed to be inflexible.

-

4.

For each 15-min period, compute a new real-time price by using the intersection of the estimated demand function and the respective supply function of the group to which the period belongs.

Summary statistics of the new real-time prices, compared to the old ones, are presented in Fig. 3.

4.3 Priority service menu

As we note in Eqs. (3)–(6), the design of an optimal priority service menu requires the time series of equilibrium real-time prices as input. In this paper, we generalize the theory of [8] in order to account for optimal menus with service charges. The procedure can be summarized as follows:

-

1.

Create an optimal reliability curve R(v) using Eq. (2), which indicates the proportion of time that a consumer with a certain valuation should be served under efficient real-time dispatch.

-

2.

Decide on a service charge function S(v). In this work, the service charge is considered to be a constant function of consumer valuation. Four values of service charges are analyzed: 0, 10, 20 and 25 $/MWh. Our goal is to assess the impact of the level of the service charge on the electricity bill of households. Thus, we create 4 priority service menus, one for each service charge.

-

3.

Use Eqs. (11)–(12) to transform the continuum of options into only 3 options. Concretely, we use the reliability levels that are indicated in Table 1 in order to compute the valuation breakpoints from Eqs. (11)–(12).

-

4.

Compute the priority charge of each option for each service charge, using Eq. (13).

The priority charge of each menu is presented in Table 1. Each column corresponds to a different service charge.

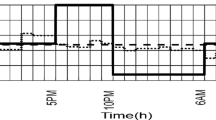

The interruption profile of each option is created as follows. For each option, each 15-min period belonging to the x% lowest real-time prices is considered to be a period when that option has access to electricity service. Here, x corresponds to the reliability of the option. For example, the 60% lowest real-time prices are the periods when the green color is ON.

5 Results and discussion

Numerical experiments are performed using the JuMP package [11] in the Julia programming language [4]. The optimization program presented in Sect. 3 is solved for every week of an entire year. Therefore, the analysis is dynamic, as it accounts for inter-daily and inter-seasonal variations. Breaking the device scheduling into weekly sub-problems lowers computation time and permits efficient use of parallel computing. The mathematical programs are solved using the Gurobi optimization solver [16]. We run our programs on the Lemaitre3 cluster hosted at UCLouvain. We present the results of these simulations in Table 2.

Two types of simulations are performed for each priority service menu:

-

1.

One simulation for which the consumer subscribes to a single contract for the entire year.

-

2.

One simulation where the consumer can change its subscription from one week to the next. Allowing the consumer to update its choice on a weekly basis reduces the amount of power that is procured without being used by taking into account the impacts of varying weekly consumption profiles.

The first simulation is motivated by simplicity considerations: we do not require consumers to update their contracts too often. The results for the first simulation are presented in the lines of Table 2 that corresponding to “yearly” for the subscription type. The results of the second simulation are presented in the other lines of the table. Note that the best contract for the first simulation is chosen among the set of best weekly contracts generated by the second simulation.

From the results that are presented in Table 2, we can provide the following observations, which are discussed in the following sections:

-

Service charges are essential in keeping costs manageable for priority service pricing.

-

If consumers are constrained to choose among priority service contracts, then a battery is a worthwhile investment.

-

There is significant value added for households in updating subscriptions relatively frequently.

In order to clarify if these observations can be generalized, we consider a household that faces different weather and consumer behavior. We therefore rerun our analysis for a Belgian household, which is populated based on the LINEAR dataset [12]. We specifically assume that the Belgian household is subject to the same priority service menu as the Texas household. The results of these two simulations are presented in Table 2.

5.1 Significance of service charge

Table 2 highlights the fact that service charges are essential for a viable implementation of priority service pricing in a practical setting. This is due to the fact that, under priority service pricing, consumers pay for reserving capacity that may not be used entirely at any given time interval. We present an example of this difference in Fig. 4 for the Texas household. The blue surface in the figure corresponds to the electric power that is consumed by the household. By contrast, the red and orange surfaces represent the amount of power that is reserved by the consumer for week 21 of year 2018 when the household does not include a battery and when the contract is updated on a weekly basis. The energy which is booked but not actually used amounts to 325.24 kWh over the whole week. This corresponds to a significant cost when the service charge is low compared to the priority charge in the priority service pricing menu. Concretely, higher service charges allow a reduction in “wasted expenditures” for booking capacity that is not actually used, and thus decrease the cost of priority service pricing for residential consumers. When a consumer procures a priority service contract, it has to pay a priority charge for the reserved capacity of each priority tier and a service charge for each unit of energy that is actually consumed. We can observe from Table 1 that the priority charge is decreasing when the service charge is increasing. Therefore, if we increase the service charge, the bill is decreasing because we pay less for unused energy, as indicated in Fig. 4. However, this service charge cannot be increased arbitrarily, since we require the priority charge to be non-negative.

As discussed in Sect. 2.3, priority service and real-time pricing are equivalent in terms of consumer expenditure. The essential difference between our realistic setting and the more simplified setting considered by Chao and Wilson in [8] is that devices can only consume power if they have access to a level of capacity which at least covers their power rating. This results in total benefit functions (which map the fuse limit of the household to a total benefit over the subscription horizon) which are non-concave, and thus violate the necessary assumptions for the equivalence result of [8] to hold. In intuitive terms, the fact that a device needs a minimum amount of power to operate creates “holes” of unused capacity. This effect is explained in a stylized example in [15]. It is reaffirmed in the realistic simulations in the present paper, and motivates the need for employing service charges effectively in order to keep consumer costs for priority service contracts as low as possible.

5.2 Interaction between priority service and storage

If residential consumers are limited to priority service contracts, then an investment in home energy storage becomes interesting for the Texas household. Observe that, for example, in the case of weekly subscription and a service charge of 25 $/MWh, the bill decreases by 69.58% (net decrease of 513.92 $/year). Insofar as the Belgian household is concerned, the difference between the results obtained with and without a battery is not sufficient for deducing that it can cover the investment cost of the battery. Note, however, that the battery that we consider in our analysis is large. As we can observe from the total cost in Table 2, the Texas household consumes a significantly larger amount of energy compared to the Belgian household. Therefore, this particular battery may not be the best choice for the Belgian household.

5.3 Yearly versus weekly contract

Another notable observation that can be drawn from Table 2 is the significant difference between consumer costs for weekly versus annual priority service contracts. This can be explained by observing the large variations in the load in Fig. 1. Indeed, renewing subscription on a weekly basis allows consumers to better adapt their contract to the weekly fluctuations of load. As we observe in Fig. 4, when too much capacity is booked, the consumer incurs an unnecessary cost for power that is not used. We can observe that this significant difference is reduced for the Belgian household, but remains high. Indeed, without a battery, the mean of this difference passes from 38% for the Texas household to 33% for the Belgian household. With a battery, it reduces from 51 to 43%.

The reduction of the difference between costs linked with weekly and yearly contracts for the Belgian household compared to the Texas one can be explained by observing Fig. 5, where we present the inflexible load of the Belgian household. Compared to the Texas household, the Belgian consumer has a relatively flat inflexible load profile, with fewer seasonal variations. This allows the Belgian household to choose a yearly subscription that better represents its needs throughout the entire year. Instead, the Texas household buys a higher yearly subscription, in order to satisfy its inflexible load during summer. This leads to a large amount of unused energy credits during winter.

This observation is further validated by Fig. 6. This figure presents a boxplot of the weekly total cost incurred by each household when the consumers are able to update subscriptions weekly, with no service charges considered. We can detect larger fluctuations for the Texas household due to seasonal variations in its inflexible load.

6 Conclusion

We develop a methodology for analyzing the impact of quality differentiation for mobilizing residential demand response. Our analysis is consumer-centric, and focuses on quantifying the impact of demand response on consumer comfort and bills. We apply the methodology to the simplest instance of quality differentiation, namely priority service. We design a priority service menu which is consistent with real-time prices and extend existing theoretical results on priority service to include a general form of service charges. Simulations are conducted on households from Texas and Belgium.

Our case study quantifies the significant influence of service charges on the performance of priority service in terms of consumer payments and comfort. Indeed, our work highlights the potential of service charges to reduce “wasted payments” in priority service, by shifting charges from the capacity to the energy component of the service. We analyze the dependency between the load profile and the benefit that households gain from batteries under priority service pricing. Finally, we note that there is significant added value for households in changing their priority service contract frequently, in order to target their weekly needs more accurately.

In future research, we are interested in applying our methodology to generalizations of priority service that include energy components in addition to capacity components, in particular multilevel demand subscription. We are also interested in expanding our model in order to account more accurately for uncertainty. This is particularly relevant, since the interruption patterns of colors and the arrival patterns of appliances are random.

Change history

12 November 2021

A Correction to this paper has been published: https://doi.org/10.1007/s12667-021-00493-1

Notes

We refer here to integration by parts on x and \(\Pr [\hat{p}(\omega ) I_{\{\hat{p}(\omega ) \le v\}}(\omega ) = x]\). The indefinite integral of the second term is \(\Pr [\hat{p}(\omega ) I_{\{\hat{p}(\omega ) \le v\}}(\omega ) \le x]\) by definition of the cumulative distribution and probability density function.

References

Aravena, I., Papavasiliou, A., Papalexopoulos, A.: A distributed computing architecture for the large-scale integration of renewable energy and distributed resources in smart grids. In: Hwang, W.J. (ed.) Recent Progress in Parallel and Distributed Computing. InTech (2017). https://doi.org/10.5772/67791

Arun, S.L., Selvan, M.P.: Intelligent residential energy management system for dynamic demand response in smart buildings. IEEE Syst. J. 12(2), 1329–1340 (2018)

Beaudin, M., Zareipour, H.: Home energy management systems: a review of modelling and complexity. Renew. Sustain. Energy Rev. 45, 318–335 (2015)

Bezanson, J., Edelman, A., Karpinski, S., Shah, V.B.: Julia: a fresh approach to numerical computing. SIAM Rev. 59(1), 65–98 (2017). https://doi.org/10.1137/141000671

Campaigne, C., Oren, S.: Firming renewable power with demand response: an end-to-end aggregator business model. J. Regul. Econ. 50(1), 1–37 (2016)

Chao, H.P.: Competitive electricity markets with consumer subscription service in a smart grid. J. Regul. Econ. 41(1), 155–180 (2012). https://doi.org/10.1007/s11149-011-9179-7

Chao, H., Oren, S.S., Smith, S.A., Wilson, R.B.: Multilevel demand subscription pricing for electric power. Energy Econ. 8(4), 199–217 (1986)

Chao, H., Wilson, R.: Priority service: pricing, investment, and market organization. Am. Econ. Rev. 77(5), 899–916 (1987)

Chen, Z., Wu, L., Fu, Y.: Real-time price-based demand response management for residential appliances via stochastic optimization and robust optimization. IEEE Trans. Smart Grid 3(4), 1822–1831 (2012)

Du, P., Lu, N.: Appliance commitment for household load scheduling. IEEE Trans. Smart Grid 2(2), 411–419 (2011)

Dunning, I., Huchette, J., Lubin, M.: Jump: a modeling language for mathematical optimization. SIAM Rev. 59(2), 295–320 (2017). https://doi.org/10.1137/15M1020575

Dhulst, R., Labeeuw, W., Beusen, B., Claessens, S., Deconinck, G., Vanthournout, K.: Demand response flexibility and flexibility potential of residential smart appliances: experiences from large pilot test in Belgium. Appl. Energy 155, 79–90 (2015)

Electricity Reliability Council of Texas (ERCOT). http://www.ercot.com. Accessed Oct 2019

Erdinc, O., Paterakis, N.G., Mendes, T.D.P., Bakirtzis, A.G., Catalao, J.: Smart household operation considering bi-directional EV and ESS utilization by real-time pricing-based DR. IEEE Trans. Smart Grid 6(3), 1281–1291 (2015)

Gérard, C., Papavasiliou, A.: A comparison of priority service versus real-time pricing for enabling residential demand response. In: 2019 IEEE Power Energy Society General Meeting (PESGM), pp. 1–5 (2019). https://doi.org/10.1109/PESGM40551.2019.8973823

Gurobi Optimization, LLC.: Gurobi optimizer reference manual (2020). http://www.gurobi.com

Hansen, T.M., Chong, E.K.P., Suryanarayanan, S., Maciejewski, A.A., Siegel, H.J.: A partially observable Markov decision process approach to residential home energy management. IEEE Trans. Smart Grid 9(2), 1271–1281 (2018)

Hart, G.W.: Nonintrusive appliance load monitoring. Proc. IEEE 80(12), 1870–1891 (1992)

Hayn, M., Zander, A., Fichtner, W., Nickel, S., Bertsch, V.: The impact of electricity tariffs on residential demand side flexibility: results of bottom-up load profile modeling. Energy Syst. 9(3), 759–792 (2018)

Hubert, T., Grijalva, S.: Modeling for residential electricity optimization in dynamic pricing environments. IEEE Trans. Smart Grid 3(4), 2224–2231 (2012)

Jin, X., Baker, K., Christensen, D., Isley, S.: Foresee: a user-centric home energy management system for energy efficiency and demand response. Appl. Energy 205, 1583–1595 (2017)

Kirby, B.J.: Spinning Reserve From Responsive Loads. Citeseer (2003)

Margellos, K., Oren, S.: Capacity controlled demand side management: a stochastic pricing analysis. IEEE Trans. Power Syst. 31(1), 706–717 (2015)

Metz, M., Doetsch, C.: Electric vehicles as flexible loads—a simulation approach using empirical mobility data. Energy 48(1), 369–374 (2012). https://doi.org/10.1016/j.energy.2012.04.014

Mou, Y.: Nonlinear pricing schemes for mobilizing residential flexibility in power systems. Ph.D. thesis, UCLouvain (2020)

Mou, Y., Papavasiliou, A., Chevalier, P.: Application of priority service pricing for mobilizing residential demand response in Belgium. In: 2017 14th International Conference on the European Energy Market (EEM), pp. 1–5. IEEE, Dresden (2017)

Mou, Y., Papavasiliou, A., Chevalier, P.: A bi-level optimization formulation of priority service pricing. IEEE Trans. Power Syst. (2019). https://doi.org/10.1109/TPWRS.2019.2961173

Oren, S.: A historical perspective and business model for load response aggregation based on priority service. In: 2013 46th Hawaii International Conference on System Sciences, pp. 2206–2214. IEEE, Wailea (2013)

Papalexopoulos, A., Beal, J., Florek, S.: Precise mass-market energy demand management through stochastic distributed computing. IEEE Trans. Smart Grid 4(4), 2017–2027 (2013)

Pecan Street Inc., Dataport. https://www.pecanstreet.org/dataport/. Accessed 16 July 2019

Richardson, I., Thomson, M., Infield, D., Clifford, C.: Domestic electricity use: a high-resolution energy demand model. Energy Build. 42(10), 1878–1887 (2010)

Schweppe, F.C., Caramanis, M.C., Tabors, R.D., Bohn, R.E.: Spot Pricing of Electricity. Springer Science & Business Media, Berlin (2013)

Tesla Powerwall. https://www.tesla.com/powerwall

Tsui, K.M., Chan, S.C.: Demand response optimization for smart home scheduling under real-time pricing. IEEE Trans. Smart Grid 3(4), 1812–1821 (2012)

Wen, Z., O’Neill, D., Maei, H.: Optimal demand response using device-based reinforcement learning. IEEE Trans. Smart Grid 6(5), 2312–2324 (2015)

Zhou, B., Li, W., Chan, K.W., Cao, Y., Kuang, Y., Liu, X., Wang, X.: Smart home energy management systems: concept, configurations, and scheduling strategies. Renew. Sustain. Energy Rev. 61, 30–40 (2016)

ZOME Energy Networks. https://zomepower.com/. Accessed Sept 2020

Acknowledgements

Céline Gérard is a Research Fellow (Aspirant) of the Fonds de la Recherche Scientifique-FNRS in Belgium. This research has been supported by the EPOC 2030-2050 project (Belgian energy transition funds). The authors would also like to thank the Consortium des Equipements de Calcul Intensif (CECI) for granting access and computing time at the high performance computing cluster Lemaitre3, which was used extensively to conduct numerical experiments throughout this work. CECI is funded by the Fonds de la Recherche Scientifique de Belgique (F.R.S.-FNRS) under Grant no. 2.5020.11 and by the Walloon Region.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised due to a retrospective Open Access order.

Appendix: Nomenclature

Appendix: Nomenclature

This section clarifies the notation that is used in the paper.

1.1 Sets and indices

- \({\mathcal {I}}, i\) :

-

Set of colors/priority service options and its corresponding index.

- \({\mathcal {T}}, t\) :

-

Set of time periods and its corresponding index.

- \({\mathcal {J}}, j\) :

-

Set of flexible appliances present in the household and its corresponding index.

- \({\mathcal {B}}_j, \beta \) :

-

Set of starting times of flexible appliance j and its corresponding index.

- \({\mathcal {T}}_j, \tau \) :

-

Set of part of flexible appliance j and its corresponding index.

1.2 Parameters

- M :

-

Priority service pricing menu of options.

- p, p(v), \(p_i\):

-

Priority charge of an option in the priority service pricing menu ($/MWh).

- s, s(v), \(s_i\):

-

Service charge of an option in the priority service pricing menu ($/MWh).

- r, r(v), \(r_i\):

-

Reliability of an option in the priority service pricing menu.

- v :

-

Consumer valuation for power.

- \(\hat{p}(\omega )\) :

-

Real-time price in the original priority service theory.

- \(\Delta t\) :

-

Number of time periods present in an hour.

- \(S_t\) :

-

Total solar production of the household at time period t (kW).

- \(B_t\) :

-

Total inflexible load of the household needed to be served at time period t (kW).

- \(Ch_{EV}^{max}\) :

-

Maximum charging power for the electric vehicle (kW).

- \(Dis_{EV}^{max}\) :

-

Maximum discharging power for the electric vehicle (kW).

- \(EV^{max}\) :

-

Maximum capacity of the electric vehicle (kWh).

- \(\eta ^{EV}\) :

-

Electric vehicle charging efficiency (\(\in [0,1]\)).

- \(T_A, EV_A\) :

-

Arrival time period of the electric vehicle and its respective state of charge.

- \(T_D, EV_D\) :

-

Departure time period of the electric vehicle and its respective state of charge.

- \(Ch_{B}^{max}\) :

-

Maximum charging power for the battery (kW).

- \(Dis_{B}^{max}\) :

-

Maximum discharging power for the battery (kW).

- \(B^{max}\) :

-

Maximum capacity of the battery (kWh).

- \(\eta ^{B}\) :

-

Battery charging efficiency (\(\in [0,1]\)).

- \(\phi \) :

-

Unflexible load shedding cost ($/kWh).

- \(F_j\) :

-

Marginal frustration cost for delaying the end of flexible appliance j of one time period after its deadline ($/time period).

- \(D_j\) :

-

Deadline of flexible appliance j.

- \(\rho _{j,\tau }\) :

-

Part \(\tau \) of the Power consumption footprint of flexible appliance j to be served (kW).

- \(\lambda _{i}^P\) :

-

Priority charge of option i in the priority service menu ($/kWh).

- \(\lambda _i^S\) :

-

Service charge of option i in the priority service menu ($/kWh).

- \(profile_{t,i}\) :

-

Binary indicator if option i is available or not at time period t.

1.3 Variables

- \(s_{t,i}\) :

-

Used solar production at time period t by option i (kW).

- \(b_{t,i}\) :

-

Served inflexible load at time period t by option i (kW).

- \(u_{t}^{EV}\) :

-

Binary variable indicating if the household electric vehicle is charging or not at time period t.

- \(ch_{t,i}^{EV}\) :

-

Electric vehicle charging power at time period t from option i (kW).

- \(dis_{t,i}^{EV}\) :

-

Electric vehicle discharging power at time period t into option i (kW).

- \(soc_{t}^{EV}\) :

-

State of charge of the electric vehicle at time period t (kWh).

- \(u_t^B\) :

-

Binary variable indicating if the household battery is charging or not at time period t.

- \(ch_{t,i}^B\) :

-

Power from color i used to charge the battery at time period t (kW).

- \(dis_{t,i}^B\) :

-

Power discharged from the battery into option i at time period t (kW).

- \(soc_t^B\) :

-

State of charge of the battery at time period t (kWh).

- \(y_{t,i}\) :

-

Total household power consumption at time period t for option i in the priority service pricing setting (kW).

- \(x_{t,j,\beta ,\tau ,i}\) :

-

Binary decision for part \(\tau \) of flexible appliance j arrived at time period \(\beta \) to be turned ON at time period t with option i.

- \(P_i^{max}\) :

-

Amount of power subscribed by consumer to option i in the priority service menu (kW).

1.4 Functions

- Surplus(v):

-

Surplus of a consumer with privately known type v.

- R(v):

-

Function exploited to represent the reliability for a consumer with valuation v.

- S(v):

-

Function used to represent the service charge for a consumer with valuation v.

- D(v):

-

System demand function for a certain valuation v.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gérard, C., Papavasiliou, A. The role of service charges in the application of priority service pricing. Energy Syst 13, 1099–1128 (2022). https://doi.org/10.1007/s12667-021-00471-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-021-00471-7