Abstract

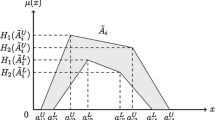

Recently, a model for project portfolio selection have been proposed. Here, to modify the proposed model, we consider the parameters of model as fuzzy numbers and we call it fuzzy project portfolio selection problem (FPPSP). Since our proposed model is NP-hard problem, then an efficient fuzzy variable neighborhood search (FVNS) algorithm for solving this model is proposed. In several methods, a FPPS is converted to a crisp problem, but in our proposed algorithm, using modified Kerre’s inequality, the fuzzy optimization problem is solved directly, without changing it to a crisp problem. Finally, in order to demonstrate the efficiency of proposed algorithm, the numerical results of FVNS algorithm are compared with the numerical results of recently proposed method.

Similar content being viewed by others

References

Abyazi-Sani, R., Ghanbari, R.: An efficient tabu search for solving the uncapacitated single allocation hub location problem. Comput. Ind. Eng. 93, 99–109 (2016). https://doi.org/10.1016/j.cie.2015.12.028

Abbasi, D., Ashrafi, M., Ghodsypour, S.H.: A multi objective-BSC model for new product development project portfolio selection. Expert Syst. Appl. 162, 1–14 (2020). https://doi.org/10.1016/j.eswa.2020.113757

Bai, L., Han, X., Wang, H., Zhang, K., Sun, Y.: A method of network robustness under strategic goals for project portfolio selection. Comput. Ind. Eng. 161, 1–14 (2021). https://doi.org/10.1016/j.cie.2021.107658

Carazo, A. F.: Multi-Criteria project portfolio selection. In Handbook on Project management and scheduling, Springer 709-728 (2015). https://doi.org/10.1007/978-3-319-05915-0

Carlsson, C., Fullér, R., Heikkil, M., Majlender, P.: A fuzzy approach to R &D project portfolio selection. Int. J. Approximate Reasoning 44, 93–105 (2007). https://doi.org/10.1016/j.ijar.2006.07.003

Deng, X., Li, W., and Liu, Y.: Hesitant fuzzy portfolio selection model with score and novel hesitant semi-variance. Computers and Industrial Engineering, 164 (2021). https://doi.org/10.1016/j.cie.2021.107879

Dolan, E.D., More, J.J.: Benchmarking optimization software with performance profiles. Springer-Verlag 91, 201–213 (2002). https://doi.org/10.1007/s101070100263

Gendreau, M., Potvin, J.Y.: Handbook of metaheuristics. Springer, New York (2010)

Ghasemzadeh, F., Archer, N.P.: Project portfolio selection through decision support. Decis. Support Syst. 29, 73–88 (2000). https://doi.org/10.1016/S0167-9236(00)00065-8

Ghanbari, R., Ghorbani-Moghadam, Kh., and Mahdavi-Amiri, N.: A variable neighborhood search algorithm for solving fuzzy number linear programming problems using modified Kerre’s method. IEEE Transaction on Fuzzy Systems 27, 1286–1294 (2019) https://doi.org/10.1109/TFUZZ.2018.2876690

Ghanbari, R., Ghorbani-Moghadam, K., Mahdavi-Amiri, N.: VNS algorithm for solving fuzzy number quadratic programming problems using modified Kerre’s method. Soft. Comput. 23, 12305–12315 (2019). https://doi.org/10.1007/s00500-019-03771-4

Ghanbari, R., Ghorbani-Moghadam, K., Mahdavi-Amiri, N., De Baets, B.: Fuzzy linear programming problems: models and solutions. Soft. Comput. 24, 10043–10073 (2020). https://doi.org/10.1007/s00500-019-04519-w

Gong, X., Yu, C., Min, L., and Ge, Z.: Regret theory-based fuzzy multi-objective portfolio selection model involving dea cross-efficiency and higher moments, Applied Soft Computing 100, 106958 (2021) https://doi.org/10.1016/j.asoc.2020.106958

Hill, R. A.: Portfolio Theory and Financial Analyses. Economics (2010)

Hult, H., Lindskog, F., Hammarlid, O., and Rehn, C. J.: Risk and portfolio analysis: Principles and methods. Springer Science and Business Media (2012)

Hansen, P., and Mladenović, N.: First vs. best improvement: An empirical study. Discrete Applied Mathematics 154, 802-817 (2006) https://doi.org/10.1016/j.asoc.2020.106958

Hendry Purba, J., Sony Tjahyani, D.T., Widodo, S., Tjahjono, H.: \(\alpha \)-Cut method based importance measure for criticality analysis in fuzzy probability - Based fault tree analysis. Ann. Nucl. Energy 110, 234–243 (2017). https://doi.org/10.1016/j.anucene.2017.06.023

Khalili-Damghani, K., Sadi-Nezhad, S., Hosseinzadeh Lotfi, F., Tavana, M.: A hybrid fuzzy rule-based multi-criteria framework for sustainable project portfolio selection. Inf. Sci. 220, 442–462 (2017). https://doi.org/10.1016/j.ins.2012.07.024

Senthil Kumar, P.: Intuitionistic fuzzy solid assignment problems: a software-based approach. International Journal of System Assurance Engineering and Management 10, 661–675 (2019). https://doi.org/10.1007/s13198-019-00794-w

Senthil Kumar, P.: Intuitionistic fuzzy zero point method for solving type-2 intuitionistic fuzzy transportation problem. International Journal of Operational Research 37, 418–451 (2020). https://doi.org/10.1504/ijor.2020.105446

Senthil Kumar, P.: Algorithms for solving the optimization problems using fuzzy and intuitionistic fuzzy set. International Journal of System Assurance Engineering and Management 11, 189–222 (2020). https://doi.org/10.1007/s13198-019-00941-3

Senthil Kumar, P.: A note on ‘a new approach for solving intuitionistic fuzzy transportation problem of type-2’. International Journal of Logistics Systems and Management 29, 102–129 (2018). https://doi.org/10.1504/IJLSM.2018.088586

Senthil Kumar, P.: Developing a New Approach to Solve Solid Assignment Problems Under Intuitionistic Fuzzy Environment. International journal of fuzzy system applications 9, 1–34 (2020). https://doi.org/10.4018/ijfsa.2020010101

Senthil Kumar, P.: Search for an optimal solution to vague traffic problems using the PSK method. IGI global publisher of timely knowledge (2018). https://doi.org/10.4018/978-1-5225-5396-0.ch011

Senthil Kumar, P.: Finding the Solution of Balanced and Unbalanced Intuitionistic Fuzzy Transportation Problems by Using Different Methods With Some Software Packages. IGI global publisher of timely knowledge (2021). https://doi.org/10.4018/978-1-5225-5396-0.ch011

Senthil Kumar, P.: Computationally Simple and Efficient Method for Solving Real-Life Mixed Intuitionistic Fuzzy 3D Assignment Problems. International Journal of Software Science and Computational Intelligence 14 (2022) https://doi.org/10.4018/ijssci.291715

López-Ibáñez, M., Dubois-Lacoste, J., Pérez Cáceres, L., Birattari, M., Stützle, T.: The irace package: Iterated racing for automatic algorithm configuration. Operations Research Perspectives 3, 43–58 (2016). https://doi.org/10.1016/j.orp.2016.09.002

Liu, Y., and Liu, Y. K.: Distributionally robust fuzzy project portfolio optimization problem with interactive returns. Applied Soft Computing 56, 655-668 (2017) https://doi.org/10.1016/j.asoc.2016.09.022

Liu, Y. J., and Zhang, W. G.: A multi-period fuzzy portfolio optimization model with minimum transaction lots. European Journal of Operational Research 242, 933-941 (2015) https://doi.org/10.1016/j.ejor.2014.10.061

Lu, X.L., He, G.: QPSO algorithm based on l‘evy flight and its application in fuzzy portfolio. Appl. Soft Comput. 99, 106894 (2020). https://doi.org/10.1007/s00500-021-05688-3

Mladenović, N., Hansen, P.: Variable neighborhood search. Comput. Oper. Res. 24, 1097–1100 (1997). https://doi.org/10.1016/S0305-0548(97)00031-2

Mahdavi-Amiri, N., Nasseri, S.H.: Duality results and a dual simplex method for linear programming problems with trapezoidal fuzzy variables. Fuzzy Sets Syst. 158, 1961–1978 (2007). https://doi.org/10.1016/j.fss.2007.05.005

Maleki, H.R., Tata, M., Mashinchi, M.: Linear programming with fuzzy variables. Fuzzy Sets Syst. 109, 21–33 (2000). https://doi.org/10.1016/S0165-0114(98)00066-9

Mahdavi-Amiri, N., Nasseri, S.H.: Duality in fuzzy number linear programming by use of certain linear ranking function. Appl. Math. Comput. 180, 206–216 (2006). https://doi.org/10.1016/j.amc.2005.11.161

Mahdavi-Amiri, N., Nasseri, S. H., and Yazdani, A.: Fuzzy primal simplex algorithm for solving fuzzy linear programming problems. Iranian Journal of Operations Research 1, 68-84 (2009) https://iors.ir/journal/article-1-66-en.pdf

Nassif, L.N., Filho, J.C.S., Nogueira, J.M.: Project Portfolio Selection in Public Administration Using Fuzzy Logic. Procedia. Soc. Behav. Sci. 74, 41–50 (2013)

Péreza, F., Gómez, T., Caballero, R., Liern, V.: Project portfolio selection and planning with fuzzy constraints. Technological Forecasting & Social Change 131, 117–129 (2018). https://doi.org/10.1016/j.techfore.2017.07.012

Relich, M., Pawlewski, P.: A fuzzy weighted average approach for selecting portfolio of new product development projects. Neurocomputing 231, 19–27 (2017). https://doi.org/10.1016/j.neucom.2016.05.104

Ross, T. J.: Fuzzy Logic with Engineering Applications, second ed., John Wiley & Sons Ltd., The Atrium, Southern Gate, Chichester, West Sussex PO19 8SQ, England (2004)

Songa, S., Yang, F., Xia, Q.: Multi-criteria project portfolio selection and scheduling problem based on acceptability analysis. Comput. Ind. Eng. 135, 793–799 (2019). https://doi.org/10.1016/j.cie.2019.06.056

Tavana, M., Keramatpour, M., Santos-Arteaga. F. J., and Ghorbaniane, E.: A fuzzy hybrid project portfolio selection method using Data Envelopment Analysis, TOPSIS and Integer Programming. Annals of Operations Research 197, 71-86 (2012) https://doi.org/10.1016/j.eswa.2015.06.057

Tsaur, R.C.: Fuzzy portfolio model with different investor risk attitudes. Eur. J. Oper. Res. 227, 385–390 (2013). https://doi.org/10.1016/j.ejor.2012.10.036

Wang, X., Kerre, E.E.: Reasonable properties for the ordering of fuzzy quantities (I). Fuzzy Sets Syst. 118, 375–385 (2001). https://doi.org/10.1016/S0165-0114(99)00063-9

Yu, L., Wang, S., Wen, F., Lai, K.K.: Genetic algorithm-based multi-criteria project portfolio selection. Ann. Oper. Res. 197, 71–86 (2012). https://doi.org/10.1007/s10479-010-0819-6

Zhang, Y., Liu, W., Yang, X.: An automatic trading system for fuzzy portfolio optimization problem with sell orders. Expert Syst. Appl. 187, 1–36 (2022). https://doi.org/10.1016/j.eswa.2021.115822

Zolfaghari, S., Mousavi, S.M.: A novel mathematical programming model for multi-mode project portfolio selection and scheduling with flexible resources and due dates under interval valued fuzzy random uncertainty. Expert Syst. Appl. 182, 1–44 (2022). https://doi.org/10.1016/j.eswa.2021.115207

Zhang, X., Fang, L., Hipel, K.W., Ding, S., Tan, Y.: A hybrid project portfolio selection procedure with historical performance consideration. Expert Syst. Appl. 142, 113003 (2022). https://doi.org/10.1016/j.eswa.2019.113003

Zhang, W.G., Mei, Q., Lu, Q., Xiao, W.L.: Evaluating methods of investment project and optimizing models of portfolio selection in fuzzy uncertainty. Comput. Ind. Eng. 61, 721–728 (2011)

Zimmermann, H. J.: Fuzzy set theory and its applications, Springer Science & Business Media (2001)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

Authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sohrabi, A.A., Ghanbari, R., Ghorbani-Moghadam, K. et al. A new fuzzy model for multi-criteria project portfolio selection based on modified Kerre’s inequality. OPSEARCH 61, 33–50 (2024). https://doi.org/10.1007/s12597-023-00685-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-023-00685-6