Abstract

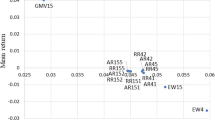

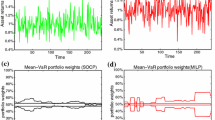

The out-of-sample performance of relative robust portfolio optimization methodologies is still little explored in portfolio literature. In this paper, a new minimax regret portfolio optimization model is presented, where regret is defined as the utility loss for the investor. The real benefits of the proposed methodology were analyzed by comparing in-sample and out-of-sample performances of robust and non-robust portfolios. The results suggest that the proposed relative robust model has more value for risk-taking investors. Furthermore, the proposed relative-robust portfolio outperforms the non-robust portfolios, in many of the time windows under analysis, with the exception of the global minimum variance portfolio. Comparatively to the minimax regret model presented by Xidonas et al. (Eur J Oper Res 262:299–305,2017) and the absolute robust approach developed by Kim et al. (Econ Lett 122:154–158, 2014a), the proposed methodology presents itself as a more consistent approach since it generates portfolios that reveal greater stability concerning in-sample and out-of-sample performances. The developed relative robustness approach stands out as a valuable contribution for the assertion of robust optimization, in particular of relative robust methodologies, within the field of portfolio selection under uncertainty.

Similar content being viewed by others

Notes

In the in-sample analysis, the overall in-sample period was used in order to compute estimators for the models.

A portfolio is a dominated solution when it shows, simultaneously, lower return and higher risk than another portfolio.

Notice that the out-of-sample periods of the windows 1993–2008 and 1996–2011 overlapped the subprime mortgage crisis and the European debt crisis, respectively.

References

Ben-Tal A, Nemirovski A (1998) Robust convex optimization. Math Oper Res 23:769–805. https://doi.org/10.1287/moor.23.4.769

Ben-Tal A, Nemirovski A (2000) Robust solutions of linear programming problems contaminated with uncertain data. Math Progr 88:411–424

Ben-Tal A, Margalit T, Nemirovski A (2000) Robust modeling of multi-stage portfolio problems. In: Frenk H, Roos K, Terlaky T, Zhang S (eds) High performance optimization. Springer, Boston, pp 303–328

Ben-Tal A, El Ghaoui L, Nemirovski A (2009) Robust optimization. Princeton University Press, Princeton

Bertsimas D, Brown DB (2009) Constructing uncertainty sets for robust linear optimization. Oper Res 57:1483–1495

Bertsimas D, Sim M (2004) The price of robustness. Oper Res 52:35–53

Bertsimas D, Thiele A (2006) Robust and data-driven optimization: modern decision-making under uncertainty. In: INFORMS tutorials in operations research: models, methods, and applications for innovative decision making, p 137

Bertsimas D, Brown D, Caramanis C (2011) Theory and applications of robust optimization. SIAM Rev 53:464–501

Best MJ, Grauer RR (1991) On the sensitivity of mean–variance-efficient portfolios to changes in asset means: some analytical and computational results. Rev Financ Stud 4:315

Beyer H-G, Sendhoff B (2007) Robust optimization—a comprehensive survey. Comput Methods Appl Mech Eng 196:3190–3218

Carhart MM (1997) On persistence in mutual fund performance. J Financ 52:57–82

Chan LKC, Karceski J, Lakonishok J (1999) On portfolio optimization: forecasting covariances and choosing the risk model. Rev Financ Stud 12:937–974

Chang T-J, Yang S-C, Chang K-J (2009) Portfolio optimization problems in different risk measures using genetic algorithm. Expert Syst Appl 36:10529–10537

Chen X, Sim M, Sun P (2007) A robust optimization perspective on stochastic programming. Oper Res 55:1058–1071

Chopra VK, Ziemba WT (1993) The effect of errors in means, variances, and covariances on optimal portfolio choice. J Portf Manag 19:6–11

Constantinides GM, Malliaris AG (1995) Portfolio theory. In: Jarrow RA, Maksimovic V, Ziemba WT (eds) Handbooks in operations research and management science, vol 9. Elsevier, Amsterdam, pp 1–30

Cornuejols G, Tütüncü R (2006) Optimization methods in finance. Cambridge University Press, Cambridge

DeMiguel V, Garlappi L, Uppal R (2009) Optimal versus naive diversification: how inefficient is the 1/N portfolio strategy? Rev Financ Stud 22:1915–1953

Deng G, Dulaney T, McCann C, Wang O (2013) Robust portfolio optimization with value-at-risk-adjusted Sharpe ratios. J Asset Manag 14:293–305

El Ghaoui L, Lebret H (1997) Robust solutions to least-squares problems with uncertain data. SIAM J Matrix Anal Appl 18:1035–1064

El Ghaoui L, Oustry F, Lebret H (1998) Robust solutions to uncertain semidefinite programs. SIAM J Optim 9:33–52

El Ghaoui L, Oks M, Oustry F (2003) Worst-case value-at-risk and robust portfolio optimization: a conic programming approach. Oper Res 51:543–556

Fabozzi FJ, Kolm PN, Pachamanova D, Focardi SM (2007) Robust portfolio optimization and management. Wiley, Hoboken

Fama EF, French KR (1996) Multifactor explanations of asset pricing anomalies. J Financ 51:55–84

Fliege J, Werner R (2014) Robust multiobjective optimization & applications in portfolio optimization. Eur J Oper Res 234:422–433

Gabrel V, Murat C, Thiele A (2014) Recent advances in robust optimization: an overview. Eur J Oper Res 235:471–483

Goldfarb D, Iyengar G (2003) Robust portfolio selection problems. Math Oper Res 28:1–38

Gregory C, Darby-Dowman K, Mitra G (2011) Robust optimization and portfolio selection: the cost of robustness. Eur J Oper Res 212:417–428

Halldórsson BV, Tütüncü RH (2003) An interior-point method for a class of saddle-point problems. J Optim Theory Appl 116:559–590

Hauser R, Krishnamurthy V, Tütüncü R (2013) Relative robust portfolio optimization. arXiv:1305.0144

Israelsen CL (2005) A refinement to the Sharpe ratio and information ratio. J Asset Manag 5:423–427

Jagannathan R, Ma T (2003) Risk reduction in large portfolios: why imposing the wrong constraints helps. J Financ 58:1651–1684

Kaläı R, Lamboray C, Vanderpooten D (2012) Lexicographic α-robustness: an alternative to min–max criteria. Eur J Oper Res 220:722–728

Kalayci CB, Ertenlice O, Akyer H, Aygoren H (2017) A review on the current applications of genetic algorithms in mean–variance portfolio optimization. Pamukkale Univ J Eng Sci 23:470–476

Kapsos M, Christofides N, Rustem B (2014) Worst-case robust Omega ratio. Eur J Oper Res 234:499–507

Kim JH, Kim WC, Fabozzi FJ (2013a) Composition of robust equity portfolios. Financ Res Lett 10:72–81

Kim WC, Kim JH, Ahn SH, Fabozzi FJ (2013b) What do robust equity portfolio models really do? Ann Oper Res 205:141–168

Kim JH, Kim WC, Fabozzi FJ (2014a) Recent developments in robust portfolios with a worst-case approach. J Optim Theory Appl 161:103–121

Kim WC, Fabozzi FJ, Cheridito P, Fox C (2014b) Controlling portfolio skewness and kurtosis without directly optimizing third and fourth moments. Econ Lett 122:154–158

Kim WC, Kim MJ, Kim JH, Fabozzi FJ (2014c) Robust portfolios that do not tilt factor exposure. Eur J Oper Res 234:411–421

Kouvelis P, Yu G (1997) Robust discrete optimization: past successes and future challenges. In: Kouvelis P, Yu G (eds) Robust discrete optimization and its applications. Springer, Boston, pp 333–356

Lu Z (2006) A new cone programming approach for robust portfolio selection. Optim Methods Softw 26:89–104

Lu Z (2011) Robust portfolio selection based on a joint ellipsoidal uncertainty set. Optim Methods Softw 26:89–104

Markowitz H (1952) Portfolio selection. J Financ 7:77–91

Markowitz H (1959) Portfolio selection: efficient diversification of investments. Wiley, New York

Natarajan K, Pachamanova D, Sim M (2009) Constructing risk measures from uncertainty sets. Oper Res 57:1129–1141

Pınar MÇ, Paç AB (2014) Mean semi-deviation from a target and robust portfolio choice under distribution and mean return ambiguity. J Comput Appl Math 259:394–405

Roy B (2010) Robustness in operational research and decision aiding: a multi-faceted issue. Eur J Oper Res 200:629–638

Ruszczyński A, Shapiro ABT (2003) Stochastic programming models. In: Ruszczyński A, Shapiro A (eds) Stochastic programming. Handbooks in operations research and management science. Elsevier, Amsterdam, pp 1–64

Scutellà M, Recchia R (2013) Robust portfolio asset allocation and risk measures. Ann Oper Res 204:145–169

Sharma A, Utz S, Mehra A (2017) Omega-CVaR portfolio optimization and its worst case analysis. OR Spectr 39:505–539

Sharpe WF (1992) Asset allocation: management style and performance measurement. J Portf Manag 18:7–19

Soleimani H, Golmakani HR, Salimi MH (2009) Markowitz-based portfolio selection with minimum transaction lots, cardinality constraints and regarding sector capitalization using genetic algorithm. Expert Syst Appl 36:5058–5063

Soyster AL (1973) Technical note—convex programming with set-inclusive constraints and applications to inexact linear programming. Oper Res 21:1154–1157

Streichert F, Ulmer H, Zell A (2004) Evolutionary algorithms and the cardinality constrained portfolio optimization problem. In: Ahr D, Fahrion R, Oswald M, Reinelt G (eds) Operations research proceedings 2003, vol 2003. Operations research proceedings [Gesellschaft für Operations Research e.V. (GOR)]. Springer, Berlin, pp 253–260

ter Horst JR, Nijman TE, de Roon FA (2004) Evaluating style analysis. J Empir Financ 11:29–53

Tütüncü RH, Koenig M (2004) Robust asset allocation. Ann Oper Res 132:157–187

Xidonas P, Mavrotas G, Hassapis C, Zopounidis C (2017) Robust multiobjective portfolio optimization: a minimax regret approach. Eur J Oper Res 262:299–305

Zhu S, Fukushima M (2009) Worst-case conditional value-at-risk with application to robust portfolio management. Oper Res 57:1155–1168

Zhu H, Wang Y, Wang K, Chen Y (2011) Particle swarm optimization (PSO) for the constrained portfolio optimization problem. Expert Syst Appl 38:10161–10169

Acknowledgements

This study has been funded by national funds, through the Portuguese Science Foundation (FCT), under project UID/Multi/00308/2019.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Caçador, S.C., Godinho, P.M.C. & Dias, J.M.P.C.M. A minimax regret portfolio model based on the investor’s utility loss. Oper Res Int J 22, 449–484 (2022). https://doi.org/10.1007/s12351-020-00550-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-020-00550-0