Abstract

This paper examines long-range dependence in the inflation rates of the G7 countries by estimating their (fractional) order of integration d over the sample period January 1973—March 2020. The results indicate that the series are very persistent, the estimated value of d being equal to or higher than 1 in all cases. Possible non-linearities in the form of Chebyshev polynomials in time are ruled out. Endogenous break tests are then carried out, and the degree of integration is estimated for each of the subsamples corresponding to the detected break dates. Significant differences are found between subsamples and countries in terms of the estimated degree of integration of the series, which is likely to be related to the reputation and credibility of the monetary authorities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Measuring inflation persistence is of interest to both academics (to establish the empirical relevance of different theoretical models, such as the Phillips curve or DSGE models) and monetary authorities (to anchor expectations in order to lower persistence and reduce the output costs of disinflation). High persistence might result, for instance, from price and wage rigidities (Galí and Gertler, 1999), or from the lack of transparency of monetary policy (Walsh, 2007).

There is plenty of evidence suggesting that inflation has been highly persistent in most developed countries since WWII (Miles et al., 2017). However, an equally important issue is whether or not its degree of persistence has changed over time, possibly as a result of the adoption of different monetary policy frameworks such inflation targeting. Pivetta and Reis (2007) and Stock and Watson (2007, 2010) do not find any significant changes in the US in the post-WWII period when accounting for uncertainty around point estimates or distinguishing between persistent and transitory changes in inflation. Similarly, Caporale et al. (2018) conclude that inflation persistence has been lower in the UK in the twentieth century compared to earlier ones but has not changed significantly since WWI.

The present paper aims to provide more extensive evidence on this issue by analysing the stochastic behaviour of inflation in all G7 countries in the last five decades and testing for possible breaks. The motivation for the analysis is therefore to investigate more thoroughly inflation persistence in the most developed countries by allowing for long memory, nonlinearities and breaks, as well as interpreting the empirical evidence to draw policy implications. More specifically, our study uses a fractional integration framework that is much more general and flexible than the AutoRegressive-(Integrated)-Moving Average (AR(I)MA) models most commonly adopted in the literature since it is not based on the classical I(0) versus I(1) dichotomy and allows instead the order of integration d to take fractional as well as integer values. Having ruled out non-linearities in the series of interest, it then carries out endogenous break tests and re-estimates d over the corresponding sub-samples, thereby obtaining evidence of significant changes in persistence across countries and subsamples, which is an important piece of information for policy makers. Therefore the contribution of this study to the literature is fourfold: (i) it improves upon earlier works by following a modelling approach that encapsulates a much wider range of dynamic behaviours and therefore is better suited to capturing the properties of inflation; (ii) it explores the issues of possible nonlinearities, which is typically overlooked by studies on inflation; (iii) it addresses the issue of changing persistence, which again is normally not addressed in this area of the literature, virtually all papers on the topic of inflation only considering average persistence over the entire sample; (iv) it draws some policy implications by interpreting the results in terms of the reputation and credibility of monetary authorities.

The layout of the paper is as follows. Section 2 briefly reviews the relevant literature. Section 3 outlines the methodology and describes the data. Section 4 presents the empirical results. Section 5 offers some concluding remarks.

2 Literature Review

There exists an extensive literature on inflation persistence, mostly based on the estimation of AR(I)MA models. For instance, Cogley and Sargent (2002) reported that US inflation persistence had declined after the 1980s, whilst Pivetta and Reis (2007) concluded that it had remained stable. Stock and Watson (2007, 2010, 2016) revisited this issue using a model that distinguishes between transitory and permanent components of inflation. Benati (2008) examined inflation persistence in the UK (from 1750 to 2003) and in other countries and concluded that inflation persistence cannot be considered structural in the sense of Lucas (1976). Caporale et al. (2018) applied fractional integration methods to UK inflation data spanning more than three centuries and also found that persistence was higher in the most recent century but not significantly affected by monetary policy changes. Caporale and Gil-Alana (2020) considered an even longer period going back to 1210 and concluded that monetary and exchange rate regime changes do not appear a significant impact on the stochastic behaviour of inflation if one takes a long-run, historical perspective. This is in contrast to Osborn and Sensier (2009), who had argued that both seasonal patterns and persistence in (monthly) UK inflation had changed with the introduction of inflation targeting in 1992, but their analysis focuses on a relatively short period and is based on a rather restrictive ARMA modelling framework.

More recently, Kurozumi and Van Zandweghe (2019) have proposed a novel theory of intrinsic inflation persistence by introducing trend inflation and variable elasticity of demand in a DSGE model with staggered price and wage setting. With non-zero trend inflation, variable elasticity generates intrinsic persistence in inflation through price dispersion stemming from staggered price setting. It also introduces intrinsic persistence in wage inflation under staggered wage setting, which affects price inflation. Their theoretical model implies a persistent, hump-shaped response of inflation to a monetary policy shock. Further, in their framework a credible disinflation leads to a gradual decline in inflation and a fall in output, and lower trend inflation reduces inflation persistence.

Correa-López et al. (2019) study the inflation process in twelve Euro Area countries over the period 1984 – 2017 and find cross-country heterogeneity, in terms of mean, volatility and persistence. Having estimated a wide array of unobserved components models, they isolate trend inflation rates in a framework that allows for time-varying inflation gap persistence and stochastic volatility in both the trend and transitory components. A sizeable share of inflation dynamics is accounted for by movements in the trend reflecting short-term inflation expectations, economic slack, and openness variables. Banerjee (2017) analysed monthly consumer price inflation over the period from January 1958 to February 2016 for 41 countries. The estimation of GARCH (1, 1) models for the individual countries does not indicate any significant differences between developing and developed countries in the behaviour of the conditional volatility of inflation; however, GMM panel estimation suggests that inflation is nearly three and half times more volatile in developing countries compared to developed countries.

Concerning the emerging economies, in a recent study García and Poon (2019) apply a Beveridge-Nelson decomposition to observed inflation rates in Asia, and estimate a trend, or permanent component, and a transitory, or (cyclical) inflation gap. In this context, trend inflation represents the most likely inflation rate once transitory effects have died away and can therefore be interpreted as the optimal conditional long-term inflation forecast. The disinflationary shocks that have hit Asia since 2014 were to some extent transitory, and they have had asymmetric effects depending on the behaviour of trend inflation in each country. Countries with relatively high inflation (India, Philippines, Indonesia) benefited, and some were affected very mildly (China, Taiwan, Hong Kong SAR, Malaysia). Among countries with inflation below target, in those with low and constant trend inflation (Australia, New Zealand) a low inflation rate may be long-lasting but is temporary, while in those where trend inflation has declined (South Korea, Thailand) low inflation risks to become entrenched.

D'Amato et al. (2007) and D'Amato and Garegnani (2013) estimated high inflation persistence in Argentina. A wider study by Capistrán and Ramos-Francia (2006) reached similar conclusion for a wide range of Latin American countries. Finally, Isoardi and Gil-Alana (2019) found evidence of long-memory in the inflation rate in Argentina by applying fractionally integration methods to both monthly and annual data (especially in the case of the former).

As for the African continent, Nyoni (2018) modelled the volatility of the monthly inflation rate in Zimbabwe over the period from July 2009 to July 2018 and found that an AR(1)–IGARCH(1,1) specification is the most appropriate; they argued that this evidence of persistence should be taken into account by monetary authorities to design appropriate policies. High inflation persistence was also found by Tule et al. (2020) in the case of Nigeria by estimating a fractional cointegration VAR model (FCVAR—see Johansen and Nielsen, 2012) in addition to carrying out univariate fractional integration analysis; their findings are similar for headline, core and food inflation rates.

Moroke and Luthuli (2015) focused instead on South Africa and found evidence of volatility clustering, leptokurtosis, asymmetric effects and non-stationarity of the inflation series. An AR(1)-IGARCH(1,1) model appears to be the most appropriate to capture the high degree of persistence in the conditional volatility of the series, although it is outperformed by an AR(1)-EGARCH(2,1) specification in terms of forecasting accuracy.

Most recently, Oloko et al. (2021) investigated the impact of oil price shocks on the inflation persistence of the top ten oil-exporting and oil-importing economies by estimating a fractional cointegration vector autoregressive (FCVAR) model; they concluded that such shocks have no effect on inflation persistence owing to monetary policy responses. Finally, Devpura et al. (2021) found time-varying inflation persistence in 36 Asian countries in the context of a model allowing for two endogenous structural breaks coinciding with monetary policy changes.

As can be gathered from the above discussion, there exists already a vast number of studies on inflation persistence. However, none of them provides cross-country evidence obtained from a long-memory approach which might be more appropriate to capture the properties of inflation. allowing at the same time for possible nonlinearities and changes in the degree of persistence, and suggesting a policy interpretation of the empirical findings based on the reputation and credibility of monetary authorities. The current study makes a contribution to the existing literature in all these respects.

3 Methodology and Data

We use fractional integration or I(d) models which generalise the classical ARMA-ARIMA specifications. Allowing d to take fractional as well as integer values enables us to consider a wider range of processes including those that are mean-reverting despite exhibiting long memory; in this case the differencing parameter is positive but smaller than 1 and shocks have transitory but long-lasting effects.

Fractional integration and long memory processes have been related to non-linearities by many authors (Deo et al., 2006; Caporale and Gil-Alana, 2007; Kuswanto, and Sibbertsen, 2008; Raggi, and Bordignon, 2012; Belmor et al., 2020); for that reason, the possibility of non-linear deterministic trends, based on Chebyshev polynomials in time, will also be examined, still in the context of fractional integration. Finally, given the importance of taking into account possible breaks in the series when carrying out fractional integration analysis (Diebold and Inoue, 2001; Granger and Hyung, 2004), we also perform endogenous break tests and re-estimate the models over the corresponding subsamples.

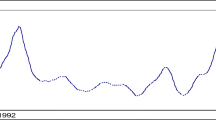

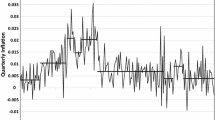

We use monthly data on the Consumer Price Index to measure annual inflation in the G7 countries (Canada, Japan, United States, Germany, France, Italy and UK) from January 1973 to March 2020. The number of observations is 567, and the data have been obtained from Refinitiv Datastream, the primary sources being the following for each country: Canada (CANSIM – Statistics Canada), Japan (Statistics Bureau, Ministry of Internal Affairs & Communication), USA (Bureau of Labor Statistics, U.S. Department of Labor), Germany (Thomson Reuters), France (INSEE – National Institute for Statistics and Economic), Italy (Istat – National Institute of Statistics) and UK (ONS – Office for National Statistics). The series are not seasonally adjusted.

4 Empirical Results

The first estimated model is the following:

where yt is the series of interest, and ut is assumed to be a white noise and an autocorrelated process in turn; in the latter case we use the (non-parametric) spectral model of Bloomfield (1973) to approximate the AR structures. Following standard practice, we consider three possible specifications, namely without deterministic terms, with an intercept only, and with an intercept as well as a linear time trend.

Table 1 displays the estimates of d along with their corresponding 95% confidence bands for the two cases of white noise (in the upper half) and autocorrelated errors (in the lower half). In both cases the selected specification on the basis of the statistical significance of the regressors includes an intercept only. The estimated values of d under the assumption of white noise errors imply that the unit root null hypothesis cannot be rejected for Germany (d = 0.95) and Canada (1.03); for the remaining countries, they are significantly higher than 1, especially in the case of the US (1.28) and the UK (1.38). When autocorrelated disturbances are assumed, the unit root null cannot be rejected for the same two countries as before (Germany and Canada) as well as for the US (1.05), whilst d is significantly higher than 1 in the other cases. Therefore, mean reversion (d < 1) is not found in any case, which implies that shocks have permanent effects.

The possibility of non-linear trends is investigated next by estimating the following model:

where T is the sample size, and m indicates the order of the Chebyshev polynomials, which are defined as:

This model was proposed in Cuestas and Gil-Alana (2016) to jointly examine non-linearities and persistence. Note that if m = 0 the model contains only an intercept; if m =1, it contains an intercept and a linear trend, and if m > 1 non-linearities are present, a higher m indicating a higher degree of non-linearity. We set m = 3, θ2 and θ3 being the coefficients capturing possible non-linearities.

The results are presented in Table 2. It can be seen that the estimates of d are very similar to those reported in Table 1; mean reversion is not found in any single case, and the estimated values of d are equal to or higher than 1 in all cases. However, given the lack of significance of the corresponding coefficients, there is no evidence of non-linearities in the series (at least of the form specified above).

Therefore, next we examine the possible presence of structural breaks by performing the tests of both Bai and Perron (2003) and Gil-Alana (2008) for multiple breaks, the latter specifically designed for the case of fractional integration. The results are essentially the same in both cases, which is not surprising given the previous finding that the series exhibit unit roots, therefore we report only those for the first test in Table 3, which shows the number of breaks and their dates for each country. Three breaks are found in the case of Italy and the UK, four in all other cases. Some of them correspond to policy changes, for instance to the introduction of inflation targeting (IT) in the UK in 1992 as well as in Canada, where IT had been announced in 1991, and the launch of the Single Market Programme in Europe in 1985, which might be behind the breaks detected around that time in France and Italy. In Germany, the dominant player in the European Monetary System according to the German Leadership Hypothesis, a break occurred earlier, in 1983, shortly after a new coalition government including the CDU/CSU and FDP parties was formed under the leadership of Helmut Kohl. In Japan the 1990s were characterised by deflation after the economic bubble burst and the 1992 break might reflect that change in economic conditions. For the US, the first break occurred around the time of the start of the Volcker monetary regime that used interest rates to create a nominal anchor in the form of an expected low, stable trend inflation.

Table 4 displays the estimates of d for each corresponding subsample and each country under the assumption of white noise errors. For Canada, the estimated values of d range from 0.73 in the last subsample to 1.16 in the third subsample, but the unit root null hypothesis cannot be rejected in any single case. For France, the unit root null is rejected in favour of d > 1 in the case of the first and fourth subsample but cannot be rejected in the case of the others. For Germany, the unit root null cannot be rejected in the case of the first and fourth subsamples, but it is rejected in favour of d > 1 in the second, and mean reversion (d < 1) occurs in the third and fifth subsamples. For Italy, d > 1 is found for the first three subsamples whilst the unit root null cannot be rejected in the case of the fourth one. For Japan, d > 1 is found for the first and the last subsamples, whist the unit root null cannot be rejected for the others. For the UK, d is statistically higher than 1 in all four subsamples. Finally, for the US, d is higher than 1 in the first, second and fourth subsamples, while the unit root null cannot be rejected for the third and fifth subsamples.

Table 5 reports the corresponding estimates of d under the assumption of autocorrelated disturbances. The estimated values of d are now slightly smaller. For example, mean reversion occurs in the case of Canada during the last two subsamples, and also for France in the second subsample, and for Japan during the fourth subsample. For the UK, the unit root null cannot be rejected in the case of the second and third subsamples. Finally, for the US, the unit root null is rejected in favour of d > 1 in the first subsample, the unit root hypothesis cannot be rejected for the second and fourth subsamples, and evidence of mean reversion (d < 1) is found for the third and fifth subsamples.

It might seem surprising at first that the estimated degree of persistence is very high, in some cases even higher than 1, in a set of highly developed countries such as the G7. However, one should note that during the period being investigated there were times when food and energy prices deviated explosively from other prices in the economy which led consumers to revise upwards their inflation expectations and thus also increased inflation persistence, which implies that in the case of explosive deviations in headline prices from core prices it is essential to design appropriate policies to anchor inflation expectations.

On the whole, the above results suggest that inflation persistence has changed over time in the case of the countries being considered. In order to draw some unequivocal policy implications one would need to analyse the causes of persistence (which is beyond the scope of the present paper). This can result, for instance, from backward-looking price setting mechanisms or from the mark-up over costs. However, it could also reflect inflation expectations based on the credibility of the monetary policy regime in place. Therefore, a plausible interpretation of our findings is that the observed dynamics are driven by the reputation and the credibility of the monetary policy authorities. When these commit themselves to follow well-articulated, publicly announced, transparent rules and policy goals agents do not expect actual inflation to deviate from the stated objective and thus the inflation cycle is broken and persistence is reduced. This is a convincing argument in favour of monetary frameworks such as inflation targeting which normally result in higher credibility and thus lower persistence.

5 Conclusions

This paper examines long-range dependence in the inflation rates of the G7 countries by estimating their (fractional) order of integration d over the sample period January 1973—March 2020. Its key contribution is to provide extensive evidence on the issue of whether or not inflation persistence has changed over time in the countries under investigation.

The results indicate that the series are very persistent, the estimated value of d being equal to or higher than 1 in all cases, which might reflect explosive deviations of headline prices from core prices during the period examined. Possible non-linearities in the form of Chebyshev polynomials in time are ruled out. Endogenous break tests are then carried out, and the degree of integration is estimated for each of the subsamples corresponding to the detected break dates. Significant differences are found between subsamples and countries in terms of the estimated degree of integration of the series, which implies that the degree of persistence has not remained stable over time. This is an important finding for both academics aiming to discriminate between different theoretical models of inflation and for monetary authorities responsible for the design of appropriate stabilization policies. In particular, it suggests that the latter should adopt policy frameworks resulting in higher credibility since this leads to lower persistence.

The analysis carried out in this paper could be extended in several ways. In particular, future work should explore time variation in inflation persistence further by explicitly modelling regime shifts in the context of a Markov-switching model and also by allowing for gradually evolving parameters through rolling and recursive estimation methods. Also, other non-linear modelling approaches, such as those based on Fourier transforms (Gil-Alana and Yaya, 2021) and neural networks (Yaya et al., 2021, should be considered in addition to the framework used here which is based on Chebyshev polynomials. Finally, a FCVAR model (Johansen and Nielsen, 2010, 2012) including appropriate macroeconomic variables in addition to inflation should be estimated to shed light on the possible determinants of persistence.

References

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Economet 18:1–22

Banerjee S (2017) Empirical Regularities of Inflation Volatility: Evidence from Advanced and Developing Countries. South Asian J Macroecon Pub Finance 6(1):133–156

Belmor S, Ravichandran C, Jarad F (2020) Nonlinear generalized fractional differential equations with generalized fractional integral conditions. J Taibat University of Science 14:1

Benati L (2008) Investigating Inflation Persistence Across Monetary Regimes. Q J Econ 123(3):1005–1060

Bloomfield P (1973) An exponential model in the spectrum of a scalar time series. Biometrika 60:217–226

Capistrán C, Ramos-Francia M (2006) Inflation Dynamics in Latin America. Working Paper 2006–11, Banco de Mexico, forthcoming in Contemporary Economic Policy

Caporale GM, Gil-Alana LA (2007) Nonlinearities and Fractional Integration in the US Unemployment Rate. Oxford Bull Econ Stat 69(4):521–544

Caporale GM, Gil-Alana LA (2020) Fractional integration and the persistence of UK inflation, 1210–2016. Forthcoming, Economic Papers

Caporale GM, Gil-Alana LA, Trani T (2018) On the persistence of UK inflation: a long-range dependence approach. WP no. 18–03, Department of Economics and Finance, Brunel University London

Cogley T, Sargent TJ (2002) Evolving post-World War II U.S. inflation dynamics. NBER Macroeconomics Annual 2001, Volume 16, 331–388, National Bureau of Economic Research

Correa-López M, Pacce M, Schlepper K (2019) Exploring trend inflation dynamics in Euro Area countries”. Documentos de Trabajo Nº 1909. Bank of Spain

Cuestas JC, Gil-Alana LA (2016) A nonlinear approach with long range dependence based on Chebyshev polynomials. Stud Nonlinear Dyn Econom 20:57–94

D’Amato L, Garegnani L, Sotes Paladino J (2007) Inflation persistence and changes in the monetary regime: The Argentine case. Working Paper 2007/23, Banco Central de la República Argentina

D'Amato LY, Garegnani L (2013) ¿Cuán persistente es la inflación en Argentina?: regímenes inflacionarios y dinámica de precios en los últimos 50 años, en Dinámica inflacionaria, persistencia y formación de precios y salarios, 2013, 91–115. Centro de Estudios Monetarios Latinoamericanos, CEMLA

Devpura N, Sharma SS, Harischandra PKG, Pathberiya LRC (2021) Is inflation persistent? Evidence from a time-varying unit root model. Pac Basin Financ J 68. https://doi.org/10.1016/j.pacfin.2021.101577

Deo R, Hsieh M, Hurvich CM, Soulier P (2006) Long Memory in Nonlinear Processes. In: Bertail P., Soulier P., Doukhan P. (eds) Dependence in Probability and Statistics. Lecture Notes in Statistics, vol 187. Springer, New York, NY. https://doi.org/10.1007/0-387-36062-X_10

Diebold FX, Inoue A (2001) Long memory and regime switching. J Econo 105:131–159

Galí J, Gertler M (1999) Inflation dynamics: a structural econometric analysis. J Monet Econ 44(2):195–222

García JA, Poon A (2019) Inflation trends in Asia: implications for central banks. Working Paper Series, No 2338 / December 2019. European Central Bank

Gil-Alana LA (2008) Fractional integration and structural breaks at unknown periods of time. J Time Ser Anal 29(1):163–185

Gil-Alana LA, Yaya O (2021) Testing fractional unit roots with non-linear smooth break approximations using Fourier functions. J Appl Stat 48:13–15

Granger CWJ, Hyung N (2004) Occasional structural breaks and long memory with an application to the S&P 500 absolute stock returns. J Empir Financ 11:399–421

Isoardi M, Gil-Alana LA (2019) Inflation in Argentina: Analysis of Persistence Using Fractional Integration. East Econ J 45:204–223

Johansen S, Nielsen MO (2010) Likelihood inference for a nonstationary fractional autoregressive model. Journal of Econometrics 158:51–66

Johansen S, Nielsen MØ (2012) Likelihood Inference for a Fractionally Cointegrated Vector Autoregressive Model. Econometrica 80(6):2667–2732

Kurozumi T, Van Zandweghe W (2019) A Theory of Intrinsic Inflation Persistence. Working Paper 19–16. August 2019. The Federal Reserve Bank of Cleveland, USA

Kuswanto H, Sibbertsen P (2008) A study on spurious long memory in nonlinear time series models, Diskussionsbeitrag No. 410,Leibniz Universität Hannover, Wirtschaftswissenschaftliche Fakultät, Hannover

Lucas R Jr (1976) Econometric policy evaluation: A critique. Carn-Roch Conf Ser Public Policy 1(1):19–46

Miles DK, Panizza U, Reis R, Ubide AJ (2017) And yet it moves: Inflation and the Great Recession. Geneva Reports on the World Economy 19, International Center for Monetary and Banking Studies, CEPR Press

Moroke N, Luthuli A (2015) An Optimal Generalized Autoregressive Conditional Heteroskedasticity Model for Forecasting the South African inflation volatility. J Econ Behav Stud 7(4):134–149

Nyoni Th (2018) Modeling and Forecasting Inflation in Zimbabwe: A Generalized Autoregressive Conditionally Heteroskedastic (GARCH) approach. MPRA Paper No. 88132, Jul 2018

Oloko TF, Ogbonna AE, Adedeji AA, Lakhani N (2021) Oil price shocks and inflation rate persistence: A Fractional Cointegration VAR approach. Econ Anal Policy 70:259–275. https://doi.org/10.1016/j.eap.2021.02.014

Osborn DR, Sensier M (2009) UK inflation: persistence, seasonality and monetary policy. Scottish J Political Economy 56(1):24–44

Pivetta F, Reis R (2007) The persistence of inflation in the United States. J Econ Dyn Control 31(4):1326–1358

Raggi D, Bordignon S (2012) Long memory and nonlinearities in realized volatility: A Markov switching approach. Comput Stat Data Anal 56(11):3730–3742

Stock JH, Watson MW (2007) Why has U.S. inflation become harder to forecast? Journal of Money, Credit and Banking, 39(s1), 3–33

Stock JH, Watson MW (2010) Modeling inflation after the crisis. NBER Working Papers No. 16488, National Bureau of Economic Research

Stock JH, Watson MW (2016) Core Inflation and Trend Inflation. Rev Econ Stat 98(4):770–784

Tule MK, Salisu AA, Godday UE (2020) A test for inflation persistence in Nigeria using fractional integration & fractional cointegration techniques. Economic Modelling, Elsevier, vol. 87(C), pages 225–237

Walsh CE (2007) Optimal economic transparency. Int J Cent Bank 3(1):5–36

Yaya O, Ogbonna AE, Furuoka F, Gil-Alana LA (2021) A New Unit Root Test for Unemployment Hysteresis Based on the Autoregressive Neural Network. Oxford Bulletin of Economics and Statistics 83(4):960–981

Acknowledgements

We are grateful to an anonymous referee for useful comments. Prof. Luis A. Gil-Alana also gratefully acknowledges financial support from the MINEIC-AEI-FEDER PID2020-113691RB-I00 project from ‘Ministerio de Economía, Industria y Competitividad’ (MINEIC), `Agencia Estatal de Investigación' (AEI) Spain and `Fondo Europeo de Desarrollo Regional' (FEDER), and also from Internal Projects of the Universidad Francisco de Vitoria.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest with the publication of the present manuscript.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caporale, G.M., Gil-Alana, L.A. & Poza, C. Inflation in the G7 countries: persistence and structural breaks. J Econ Finan 46, 493–506 (2022). https://doi.org/10.1007/s12197-022-09576-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-022-09576-w