Abstract

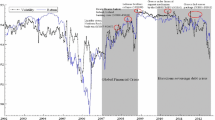

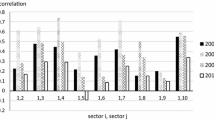

This paper adopts the robust cross-correlation function methodology developed by Hong (J Econom 103:183–224, 2001) in order to test for volatility and mean spillovers between Greek long-term government bond yields and the banking sector stock returns of four Southern European countries, namely Greece, Portugal, Italy, and Spain. Its primary focus is on investigating the potential impacts of the recent European sovereign debt crisis. While most previous studies have focused on within-country causalities, we rather assess cross-country transmission effects. The presented results provide evidence of bidirectional volatility spillovers between Greek long-term interest rates and the banking sector equities of Portugal, Italy, and Spain that emerged during the European sovereign debt crisis. We also find significant unidirectional causality-in-mean from bank stock returns in Greece to Greek long-term bond yields during the crisis period as well as significant causality at the mean level from the bank equity returns in Portugal, Italy, and Spain to Greek bond yields.

Similar content being viewed by others

Notes

See Nelson (1991) for details of the EGARCH model.

Hong’s (2001) approach is typically used in a bivariate framework, because it allows for dealing with only two variables at once. Some previous studies have conducted Granger causality tests with multiple variables as a system. For instance, Lee (1992), using a VAR system, investigates the relationships among stock returns, interest rates, inflation rates, and growth in industrial production. Our study focuses specifically on the bivariate relationship between bank stock returns and bond yields.

In terms of the weighting function k(z) above, we selected the truncated kernel, which provides compact support. By performing Monte Carlo experiments, Hong (2001) contends that for a smaller M (i.e., M = 10), the truncated kernel gives approximately similar power to non-uniform kernels such as the Bartlett, Daniell, and QS kernels. For the application of the Hong test, refer to, for example, Xu and Hamori (2012) and Tamakoshi and Hamori (2013).

One possible choice for the Greek government bond data is to use the risk premium on bond prices, because we use stock price-level data to represent the banking sector. Nevertheless, we employ bond yields data to ensure that the results of our analysis are comparable with those of similar studies such as Alaganar and Bhar (2003).

We selected this date based on the key event that signified the onset of the crisis, as is common in the related literature. Nonetheless, we also need to mention that the break date in the time series could be earlier or later than this announcement by the Greek government. Indeed, some methodologies detect structural breakpoints endogenously, although these statistical procedures do have their own limitations. For instance, Bai and Perron (1998, 2003) describe how to estimate the location of multiple endogenous structural breaks in mean and variance parameters.

However, it must be noted that even though the variance equation in the pre-crisis period displays a very good fit to the EGARCH specification, the fit of the equation in the crisis period is relatively poor. An alternative approach that may be useful for considering the effect of the crisis in the EGARCH framework, although not used in this paper, is to include a dummy variable in the conditional variance equation.

References

Alaganar V, Bhar R (2003) An international study of causality-in-variance: interest rate and financial sector returns. J Econ Financ 27:39–54

Bae SC (1990) Interest rate changes and common stock returns of financial institutions: revisited. J Financial Res 13:71–79

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J of Appl Econom 18:1–22

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 52:5–59

Chance DM, Lane WR (1980) A re-examination of interest rate sensitivity in the common stocks of financial institutions. J Financial Res 3:49–55

Cheung Y, Ng L (1996) A causality-in-variance test and its applications to financial market prices. J Econom 72:33–48

Elyasiani E, Mansur I (1998) Sensitivity of the bank distribution to changes in the level and volatility of interest rate: a GARCH-M model. J Bank Financ 22:535–563

Elyasiani E, Mansur I (2004) Bank stock return sensitivities to the long-term and short-term interest rates: a multivariate GARCH approach. Manage Financ 30(9):32–55

Engle RF (1982) Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50:987–1007

Engle RF, Ito T, Lin KL (1990) Meteor showers or heat waves? Heteroskedastic intra-daily volatility in the foreign exchange market. Econometrica 58:525–542

Flannery MJ, James CM (1984) The effect of interest rate changes on the common stock returns of financial institutions. J Finance 39:1141–1153

Hong Y (2001) A test for volatility spillover with application to exchange rates. J Econom 103:183–224

Lee BS (1992) Causal relations among stock returns, interest rates, real activity, and inflation. J Finance 47(4):1591–1603

Lloyd WP, Shick RA (1977) A test of Stone’s two-index model of returns. J Financial Quantitative Anal 12:363–376

Nelson D (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59:347–370

Ross SA (1989) Information and volatility: no-arbitrage Martingale approach to timing and resolution irrelevancy. J Financ 44:1–17

Shiller RJ, Beltratti AE (1992) Can their co-movements be explained in terms of present value models? J Monetary Econ 30:25–46

Song F (1994) A two-factor ARCH model for deposit-institution stock returns. J Money, Credit, Bank 26:323–340

Tai CS (2000) Time-varying market, interest rate, and exchange rate risk premia in the US commercial bank stock returns. J Multinatl Financ Manag 10:397–420

Tamakoshi G, Hamori S (2013) Volatility and mean spillovers between sovereign and banking sector CDS markets: a note on the European sovereign debt crisis. Appl Econ Lett 20:262–266

Verma P, Jackson OD (2008) Interest rate and bank stock returns asymmetry: evidence from U.S. banks. J Econ Financ 32:105–118

Xu H, Hamori S (2012) Dynamic linkages of stock prices between the BRICs and the United States: effects of the 2008–09 financial crisis. J Asian Econ 23:344–352

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tamakoshi, G., Hamori, S. Causality-in-variance and causality-in-mean between the Greek sovereign bond yields and Southern European banking sector equity returns. J Econ Finan 38, 627–642 (2014). https://doi.org/10.1007/s12197-012-9242-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-012-9242-y

Keywords

- Bank Stock Returns

- Bond Yields

- Causality-In-Variance Test

- International Volatility Spillover

- Greek Sovereign Debt Crisis