Abstract

Empirical research in the economic literature is increasingly addressing the implications of social comparison on incentive contracts by using analytical principal-agent models. Contrary to the existing investigations, which are primarily based on the assumption that individuals exclusively compare monetary income, theories of behavioral science suggest that monetary income and effort represent different dimensions of social comparison, which are weighted individually. Using a LEN framework, the present study focuses on this aspect of social comparisons and discusses how these dimensions and their individual weights affect optimal contract design and contract efficiency. I consider status-seeking agents who compare themselves to each other and differ with regard to their intensity of social preferences and the specific relevance of dimensions. Finally, I draw conclusions for the drafting of contracts with respect to (1) the choice of performance measures and (2) an optimal team composition.

Similar content being viewed by others

1 Introduction

In recent decades, economic research on agency theory and the investigation of optimal contract design has gained in importance, deviating increasingly from the traditional assumption of purely self-interested individuals. Empirical studies and experiments have shown that human behavior is particularly determined by social comparison processes (Festinger 1954; Adams 1963; Rabin 1993; Fehr and Schmidt 1999, 2003; Camerer 2003; Sobel 2005). Due to these observations, analytical agency research has investigated the effects of social comparisons on principal-agent relationships (Itoh 2004; Mayer and Pfeiffer 2004; Demougin et al. 2006; Sandner 2008; Bartling 2011). The existing body of literature assumes that individuals primarily compare their monetary incomes. However, theories of behavioral science suggest that social comparison processes generally occur in different dimensions, which are weighted according to individual preferences (Adams 1963; Harris 1980; Kruglanski and Mayseless 1990, p. 203; Wagner 1999, pp. 129–131 and 213–214; Gächter et al. 2012b). The individual structure of social comparison, namely, the dimensions’ relative importance, plays a decisive role. Thus, the question arises of which essential effects of multidimensional social comparison need to be considered for contract design. This study’s objective is to analyze these effects and to draw implications for (1) the choice of performance measures for incentive contracting and (2) optimal team composition. As a simple, but practically relevant case of multidimensional social comparison, the analysis assumes that a decision maker does not exclusively account for monetary income, but also considers the corresponding personal effort. The analysis is related to the recent series of papers that has included social preferences into principal-agent models. A lateral comparison between multiple agents is addressed in the context of a moral hazard problem.

Some papers have already offered elaborate insights into the contractual relationship between a risk-neutral principal and a single risk-averse agent. In this context, Mayer and Pfeiffer (2004) investigate the use of performance measures, assuming that the status-seeking agent compares his monetary income with a certain share of the principal’s payoff. A status-seeking individual suffers from being worse off and enjoys being ahead. Based on LEN assumptions, they focus on relevant characteristics of performance measures.

In a general principal-agent model, Englmaier and Wambach (2010) consider a risk-averse agent who compares his compensation to the principal’s expected net payoff. The authors restrict their analysis to inequity-averse agents who not only suffer from receiving a lower income, but also from receiving a higher income. They point out that optimal contract design approximates a linear sharing rule as the intensity of social preferences increases. The model is extended to a situation with two identical agents who compare themselves to each other as well as to the principal. The analysis shows that a team contract is optimal, i.e., each agent is rewarded for a high team output.

Itoh (2004) examines the influence of social preferences in one- and two-agent settings using a discrete principal-agent model. He considers status-seeking as well as inequity-averse agents. The analysis is restricted to risk-neutral and—with respect to their social preferences—identical agents with limited liability and addresses how far the results would change if agents compare their compensation net of effort costs instead of their compensation. As this extension might be interpreted as a multidimensional social comparison, the analysis shows some similarity to the present investigation. However, due to the assumptions of identical reservations utilities, identical social preferences and risk neutrality, none of the effects occur, which are discussed in this study. Itoh’s focus is the comparison of typical contract designs rather than the effects of social comparison on contract efficiency.

Bartling and von Siemens (2010) extend this setting to the case of risk-averse and status-seeking agents that have either limited or unlimited liability. They identify an incentive and a cost effect of social preferences, which are opposed to the principal’s payoff. While Bartling and von Siemens restrict their analysis to agents who are identical except for the intensity of their social preferences, Dierkes and Harreiter (2010) consider agents who differ in productivity and risk aversion under LEN assumptions. In this model, agents compare their compensation with a share of the other agent’s compensation and, alternatively, with a share of the total payoff. Assuming status-seeking preferences, a team contract is optimal, although with purely self-interested individuals, optimal contracts are independent.

Sandner (2008) extends this model by additionally assuming technological and stochastic interdependencies. His analysis covers status-seeking and altruistic agents. Under LEN assumptions, he observes that a diverse team structure is beneficial to the principal, i.e., one agent is altruistic while the other one is status-seeking. The intuition behind this result corresponds to the structural effect of social preferences, which is identified in this study: If agents differ in the structure of their preferences, a reallocation of efforts might increase contract efficiency. As Sandner assumes that agents have identical reservation utilities and exclusively compare compensation, the remaining effects discussed in this study do not occur in his analysis.

While the abovementioned papers do not address the effects of different dimensions of social comparison, Bartling (2011) assumes that risk-averse agents compare their effort costs to a certain degree. Therefore, his analysis shows the greatest similarity to this investigation. Bartling assumes that agents ex ante compare their expected compensations. Thus, the social comparison does not influence their risk premia. Although this assumption enables the analysis of status-seeking as well as inequity-averse agents in a LEN setting, the present analysis proves that the risk associated with social comparison might be decisive for optimal contract design. Furthermore, Bartling assumes that agents show the same structure of social comparison and reservation utilities are normalized to zero. Thus, the central effects of social comparison, which are observed in this study, do not occur either. Instead, Bartling’s investigation allows for status-seeking and inequity-averse agents and discusses the effects of team contracts and relative performance contracts on contract efficiency.

The present analysis focuses on the individual weighting of the different dimensions of social comparison, restricting to the dimensions of compensation and effort costs. Using LEN assumptions, three effects of social preferences on optimal contract design are identified.Footnote 1 The investigation shows that the inclusion of effort comparison has a decisive influence on all identified effects. The reservation utility of the agent who rather compares effort instead of compensation gains in importance (reservation utility effect). According to the structural effect, a reallocation of effort is optimal, especially if agents differ in their weighting of the dimensions. In the second-best solution, an additional risk effect occurs, i.e., the principal is able to reduce the agents’ risk premia if they tend to compare compensation instead of effort. These effects are useful to draw conclusions for important aspects of performance measurement and team composition. Considering social preferences, performance measures might be valuable, even if they are uninformative about the effort choice, as long as they correlate with the dimensions of comparison. Furthermore, the study confirms recent investigations, which show that a diverse team structure might be beneficial for the firm. In the context of this paper diversity relates to the weighting of the dimensions of comparison.

In Sect. 2, the theory of social comparison processes is presented. An overview of key findings is given and their behavioral implications are critically examined. Section 3 considers the social comparison between two status-seeking agents who differ in the intensity and in the structure of their preferences. The essential effects of a multidimensional social comparison on contract design are analyzed and illustrated. Conclusions with respect to important questions of performance measurement and team composition are discussed in Sect. 4.

2 Theory of social comparison processes

Behavioral science theory has considered social comparison processes since the mid-20th century. To avoid arbitrary ad hoc modeling, the behavioral assumptions presented in this analysis are closely aligned with previous theoretical and empirical results.

According to findings from psychological studies, social comparison processes are based on the human drive to evaluate individual ability and performance (Festinger 1954, p. 117; Wagner 1999, p. 48). Referring to social relationships, Festinger states that individuals might experience cognitive dissonance if their comparison reveals inequity. In his terminology, inequity occurs if the perceived inputs into a social relationship or the outcomes that are received psychologically stand in an obverse relation to those of others (Festinger 1957). Equity theory developed by Adams in the 1960 s formalizes this definition to outline the concept of fair exchange in social relationships (Adams 1963, 1965). His analysis is limited to situations in which two individuals (i = 1, 2) are in a direct exchange relationship or in an exchange relationship with a third party.Footnote 2 Let O (j) i and I (j) i represent the outcome and input of individual i perceived by individual j (i, j = 1, 2).Footnote 3 According to equity theory, social exchange is assessed as being fair by individual i if the proportion of his perceived outcome and input corresponds to a normative expectation, which is obtained by reference to person j:

Therefore, inequity occurs if an inequality of the left- and right-hand side is given:

In the first case, individual i is behind and thereby suffers from a feeling of relative deprivation and dissatisfaction; in the second case, he is ahead, which might cause a feeling of guilt.Footnote 4 The outcomes and inputs of social relationships represent highly aggregated constructs that, in general, relate to a variety of attributes. Depending on the exchange situation and individuals involved, inputs might be education, experience, seniority, ethnic background, or effort expended. Possible outcomes could be any kind of reward, such as monetary compensation, commendation, or a higher social status (Adams 1965, pp. 277–279). Not only is the valuation of these attributes a matter of perception, but so is their selection and functional aggregation. Adams emphasizes two characteristics of attributes that make them potential inputs: individuals have to (1) recognize their existence and (2) consider them to be relevant in the given situation. In accordance with the terminology used in the literature, the attributes chosen will be referred to as dimensions of comparison (Carrell and Dittrich 1978, p. 207).

According to equity theory, people react to perceived inequity in different ways. Aside from distorting their perceptions of inputs and outcomes, leaving the social relationship, or changing their reference person, individuals tend to alter their own inputs and outcomes to restore equity. If possible, they might even attempt to alter their reference person’s inputs and outcomes (Adams 1965, pp. 283–296). The selected alternative ultimately depends on the adequacy and costs in the given situation (Adams 1965, p. 277; Walster et al. 1973, p. 158).

The implications of perceived inequity have been empirically confirmed in situations when individuals are behind (Thibaut 1950; Jaques 1961; Leventhal et al. 1969; Pritchard 1969). In this case, individuals in general feel deprived, i.e., they intend to restore equity. This type of preferences is typically described as envy. However, the findings about advantageous comparisons are less clear. While some investigations have succeeded in supporting the theoretical expectations, that people feel guilty and try to restore equity (Jaques 1961; Adams 1963; Leventhal et al. 1969), other experiments have concluded that beneficiaries do not show a feeling of guilt (Lawler 1968; Carrell and Dittrich 1978; Walster et al. 1978; Mowday 1987).Footnote 5 Some experiments have even suggested that individuals experience a feeling of satisfaction and self-affirmation in being ahead and, therefore, try to extend their leads (Frank 1985; Falk et al. 2003, 2005; Fehr et al. 2008). This is usually simplistic described as spite.

The combination of being envious in case of a disadvantageous comparison and feeling guilty in case of an advantageous comparison is known as inequity aversion, i.e., individuals try to accomplish equity, independent of their own relative status. The present analysis is limited to status-seeking individuals that are characterized by a combination of envy and spite.Footnote 6

Based on the main assertions of equity theory, several experimental investigations have addressed the proportionality measure of perceived inequity proposed by Adams and have discussed alternative ways of defining equity (Walster et al. 1973; Romer 1977; Samuel 1978; Harris 1980).Footnote 7 It turns out that a linear formula fits empirical results better than Adams’ proportionality approach. Therefore, Harris (1980) proposes defining perceived equity from person i’s point of view using the following linear equation:

The preference parameter α i ≥ 0 of individual i might depend on (the perception of) the specific context and reference person. It represents the relevance of input attributes in the social comparison of individual i. For α i = 0, an equal distribution of outcomes is perceived to be fair, independent of the individuals’ inputs. The higher the value of α i , the more the given inputs determine a fair allocation of outcomes. Because this linear representation of the equity formula has been empirically confirmed and is analytically tractable, it is used to model social preferences in the present analysis.

Although equity theory and related theories of social exchange have been the predominant approaches to analyzing social comparison for a long time, they have been criticized in several areas. For example, the theoretical expositions assume that individuals compare primarily with those who have similar performance-related attributes, which is an imprecise definition. The choice of reference persons and dimensions as well as their valuation are also insufficiently specified by equity theory (Farkas and Anderson 1979; Deutsch 1985). Furthermore, limiting the analysis to interindividual comparison has been criticized for failing to consider a connection to higher level justice and social norms (Martin and Murray 1983).Footnote 8 Nevertheless, equity theory is still one of the most important theoretical approaches to analyzing social comparison. Thus, it provides a suitable basis for further investigations.

3 Social comparison in a two-agent model

3.1 The general model

In this section, I investigate a situation in which a risk-neutral principal hires two risk-averse agents, each controlling an activity. According to the related attributes hypothesis, social comparison takes place among individuals that are similar with respect to performance-related attributes (Wheeler et al. 1982; Festinger 1954, pp. 120–121). It is assumed that the agents work in close proximity and that their activities are similar enough to meet this requirement, while the principal’s task and status are too different to allow for social comparison.Footnote 9 Agent i provides effort a i ≥ 0. The principal’s ex ante random payoff \( \tilde{x}_{i} \) is given by:

The marginal productivity of agent i’s effort is denoted as b i > 0, and the random variable \( \tilde{\varepsilon }_{i} \) is normally distributed with mean 0 and variance σ 2 i . It is assumed that neither technological nor stochastic interdependencies exist. In particular, \( \tilde{\varepsilon }_{1} \) and \( \tilde{\varepsilon }_{2} \) are uncorrelated.Footnote 10 Agents are effort-averse, so the provision of effort induces costs k i = 0.5·a 2 i for agent i.

Under symmetric information, the principal offers contracts to both agents. After the agents accept these offers, but before the realization of \( \tilde{\varepsilon }_{1} \) and \( \tilde{\varepsilon }_{2} \), they simultaneously choose effort levels, which cannot be observed by the principal. Because the realization of the payoff levels does not reveal the agents’ efforts, the principal has to evaluate their performance using the available information about x 1 and x 2. The investigation is limited to incentive contracts, which are linear in these performance measures (Holmström and Milgrom 1987; Hemmer 2004). The compensation c i of agent i comprises a share v ii in his own payoff x i and v ij in the payoff x j . Additionally, a fixed wage f i is granted:

The economic literature distinguishes team contracts from relative performance contracts. While a team contract is characterized by a positive share in the other agent’s payoff (v ij > 0), a relative performance contract reduces an agent’s compensation if the other agent’s payoff increases (v ij < 0). Agents decide on contract acceptance and effort levels under symmetric information with regard to their preferences and contractual parameters.Footnote 11 Figure 1 illustrates the timeline of the principal-agent relationship.

In the framework described thus far, social comparison between the agents is considered. The theory suggests that the comparison relates to attributes, which measure the inputs and outcomes of each agent in the given principal-agent relationship. A large body of work has analyzed the attributes that apply to business relationships because they represent a classical example of social exchange processes and can easily be reproduced in laboratory experiments (Adams 1965; Lawler 1968; Pritchard 1969). While the relevance of monetary compensation as the main attribute of outcome is well established, several attributes of input, such as personal effort, tenure, job status, and responsibility, have frequently been shown to significantly influence equity judgments (Cowherd and Levine 1992; Sell and Griffith 1993). As indicated by various investigations, the effort exerted on the job is of great importance to explaining job input (Deutsch 1985; Overlaet and Schokkaert 1991; Gächter et al. 2012b). For this reason, the present analysis assumes that compensation and effort costs are the relevant attributes for outcome and input. As preferences are common knowledge, equilibrium efforts are known. Therefore, the dimensions do not need to be interpreted. Although some bias in perception might remain, the analysis assumes that it is small enough to be neglected.

For modeling social comparison of the agents, two preference parameters are introduced.Footnote 12 The parameter γ i ∈[0, 1] represents the relative weight of the dimensions, i.e., the structure of social comparison. A high value of γ i indicates that agent i primarily compares monetary income. For γ i = 1, effort costs are neglected in social comparison, which is predominantly assumed in the economic literature. Lower values of γ i characterize agents who especially compare effort costs. If the expression

is positive, agent i feels deprived, otherwise he experiences advantageous inequity. The model considers agents whose utility depends not only on their own net compensation c i − k i , but also on the measure of inequity (1), deduced from equity theory.

Aside from the structure of fair exchange, the social comparison of agent i is characterized by an individually distinct intensity of social comparison, which is represented by the parameter ω i ∈ [0, 1]. Furthermore, the disutility due to social preferences measured in monetary units is assumed to take the following linear form:Footnote 13

As indicated before, different types of social preferences seem to influence human behavior.Footnote 14 Although most theoretical approaches, such as equity theory, emphasize inequity aversion, experimental investigations have shown that, depending on the reference person, on the exchange situation as well as on the individual socialization and cultural environment, other types of social preferences such as status-seeking preferences might occur (Frank 1985; Levine 1998; Falk et al. 2003, 2005; Fehr et al. 2008). The present analysis contributes to the investigation of optimal incentive contracting with status-seeking agents (Itoh 2004; Mayer and Pfeiffer 2004; Sandner 2008; Dierkes and Harreiter 2010; Bartling 2011).

In case of a disadvantageous comparison, the preference function N i becomes positive. Negative values of N i indicate an advantageous comparison. The assumption ω i ≤ 1 ensures that the direct monetary effect on utility due to a variation in the agent’s effort always exceeds the implicit effect due to social preferences. A social disutility that can be interpreted as envy occurs if an agent experiences higher effort costs or receives a lower compensation compared with the other. An advantageous comparison creates satisfaction due to self-enhancement or spite. The parameters ω i and γ i represent individual preferences, which are exogenous and uncontrollable by the principal.Footnote 15

By choosing optimal contract parameters, the risk-neutral principal aims to maximize his expected net payoff:Footnote 16

It is assumed that the agents’ preferences are given by negative exponential utility functions, which implies constant measures of absolute risk aversion r i > 0. The utility of agent i, depending on compensation c i , effort costs k i , and disutility of comparison N i , is given by:

Due to the linear specification of the compensation contract and the social preference function, the agent’s objective c i − k i − N i is normally distributed. Thus, his certainty equivalent is given by (Spremann 1987):

To optimize his objective function, the principal has to consider participation as well as incentive constraints. By granting a sufficiently high compensation, the principal ensures that the agents’ expected utility is at least as high as their reservation utility, which can be understood as the utility of alternative employment. It is assumed that the reservation utility of agent i corresponds to the monetary value U i .Footnote 17 Agents have the incentive to accept the contract offer if the following participation constraints are met:

The principal cannot contractually specify the agents’ effort levels, which might result in opportunistic behavior. By choosing effort, each agent maximizes his certainty equivalent (incentive constraint):

3.2 Derivation and interpretation of optimal contract design

3.2.1 Analysis of the first-best solution

As a benchmark solution, the first-best setting is analyzed in which no incentive problem occurs. The principal can contractually specify effort levels by imposing sufficiently large penalties. All decisions are made by the principal under the relevant participation constraints. The incentive rates serve the purpose of enabling efficient risk sharing.Footnote 18

Lemma 1

In the first-best setting, an optimal contract always satisfies the condition CE i = U i , i.e., the participation constraints are binding.

To design an optimal incentive contract, the principal has to consider only those contractual parameters that make the participation constraints binding. Using this lemma, the unique optimal contract is characterized by Lemma 2.

Lemma 2

In the first-best setting, agents are offered a fixed wage contract (v FB ij = 0 for i, j = 1, 2). The optimal effort levels and the expected utility of the principal are given by:

The parameter λ i represents the marginal cost of effort due to social comparison.Footnote 19 The agents’ first-best compensation is not performance-related. Fixed wage contracts ensure that each agent’s own compensation as well as the difference to the other agent’s compensation are deterministic. This implies efficient risk sharing. A risk premium can be avoided.

The first effect of social preferences that can be identified is the influence of the agents’ reservation utilities on contract efficiency. With purely self-interested agents, the principal’s expected net payoff is reduced by the sum of the reservation utilities U 1 + U 2. Obviously, the social comparison of compensation (γ1, γ2 > 0) implies that reservation utilities U 1 and U 2 are weighted according to the agents’ preference parameters.

Proposition 1 (Reservation utility effect)

Assume that agent i shows the higher absolute weighting of compensation, ω i ·γ i > ω j ·γ j . Then, his reservation utility becomes less important to the principal, whereas the other agent’s reservation utility gains in importance. Therefore, contract efficiency increases if agent i’s reservation utility is higher, U i > U j .

The reason for this reservation utility effect is intuitive. Given the binding participation constraints, the principal is interested in increasing the agents’ utility due to their social comparison because this allows him to reduce overall compensation. Therefore, the reservation utility U i of agent i influences the principal’s net payoff in two ways. First, as agent i needs to be compensated for his reservation utility, it directly affects the compensation cost, which is the only effect with purely self-interested individuals. Second, by influencing compensation payments, the reservation utility implicitly influences the social comparison of both agents. A higher reservation utility U i is accompanied by a higher fixed wage f i , which causes an additional utility for agent i and disutility for agent j because of their social comparison of compensation. An indirect cost effect occurs, because the principal has to readjust both agents’ compensations to make participation constraints binding. This effect is detrimental for the principal if the resulting disutility of agent j is higher than the positive effect with respect to agent i’s social comparison, ω i ·γ i > ω j ·γ j . Altogether, the reservation utility of the agent with the lower absolute weighting ω i ·γ i gains in importance.

As this reservation utility effect influences fixed compensation payments and is of minor importance to the incentive problem, it is neglected in the further analysis by assuming U 1 = U 2. Thus, the weighting of reservation utilities has no influence on contract efficiency. To analyze the remaining effects of social comparison, it is useful to define the following types of agents.

Definition 1

For given preference parameters, the following classification is introduced:

-

(a)

Agent i is effort-focused if the condition 1–2·γ i + (γ j − γ i )·ω j > 0 holds. Otherwise he is compensation-focused.

-

(b)

A team structure is diverse, if agents differ in types. Obviously, this is the case if they show a divergent structure of preferences (γ1 ≠ γ2) and their intensity of social comparison is sufficiently high:

In particular, these conditions hold if γ1 < 0.5 < γ2 or γ2 < 0.5 < γ1.

Effort-focused agents are characterized by low values of γ i compared with γ j , i.e., they particularly compare effort instead of compensation. Compensation-focused agents have relatively high values of γ i , i.e., their social comparison particularly relates to compensation. Note that the classification of an agent not only depends on his own preference parameters, but also on those of the other agent. Therefore, the classification of one agent is relative to the other: High values of γ i indicate that agent i is compensation-focused if γ j is sufficiently low.

If agents differ sufficiently in the structure of comparison, i.e., for high absolute values of γ1 − γ2, or if their intensity parameters are high enough, a diverse team structure is given. The following analysis will show that this constellation is of particular interest, as it allows for a clear prediction of contract efficiency.

In the first-best setting, a structural effect with regard to the social preferences of agent i can be observed. Proposition 2 considers changes in the preferences of a single agent to facilitate the interpretation, before the simultaneous influence of both agents’ comparison is analyzed.

Proposition 2 (Structural effect)

The effect of the comparison depends on the agent’s type.

-

(a)

For an effort-focused agent i the principal reacts to the agent’s social preferences by reducing his effort and increasing the other agent’s effort:

$$ {{\partial a_{i}^{FB} } \mathord{\left/ {\vphantom {{\partial a_{i}^{FB} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }} < 0,\quad {{\partial a_{j}^{FB} } \mathord{\left/ {\vphantom {{\partial a_{j}^{FB} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }} > 0 $$The overall effect is beneficial if agent i is sufficiently less productive than is the other:

$$ {{\partial EU^{P,FB} } \mathord{\left/ {\vphantom {{\partial EU^{P,FB} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }}\begin{array}{*{20}c} { > 0} & \Leftrightarrow & {{{b_{i}^{2} } \mathord{\left/ {\vphantom {{b_{i}^{2} } {b_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {b_{j}^{2} }} < {{\lambda_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda_{i}^{2} } {\lambda_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j}^{2} }}} \\ \end{array} $$(2) -

(b)

For compensation-focused agents, the effects are reversed:

$$ {{\partial a_{i}^{FB} } \mathord{\left/ {\vphantom {{\partial a_{i}^{FB} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }} > 0,\quad {{\partial a_{j}^{FB} } \mathord{\left/ {\vphantom {{\partial a_{j}^{FB} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }} < 0\quad {and}\quad {{\partial EU^{P,FB} } \mathord{\left/ {\vphantom {{\partial EU^{P,FB} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }}\begin{array}{*{20}c} { > 0} & \Leftrightarrow & {{{b_{i}^{2} } \mathord{\left/ {\vphantom {{b_{i}^{2} } {b_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {b_{j}^{2} }} > {{\lambda_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda_{i}^{2} } {\lambda_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j}^{2} }}} \\ \end{array} $$(3)

First, assume that agent i is effort-focused. If the intensity of the social preferences of agent i increases, his optimal effort level is reduced, while the principal requests a higher effort level of agent j. This effect of social preferences of agent i is beneficial if the agent is less productive, i.e., the value of \( {{b_{i}^{2} } \mathord{\left/ {\vphantom {{b_{i}^{2} } {b_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {b_{j}^{2} }} \) is low, and if it is more costly to induce his effort instead of the other agent’s effort, i.e., \( {{\lambda_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda_{i}^{2} } {\lambda_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j}^{2} }} \) is high. This condition is intuitive: With purely self-interested individuals, the principal assigns the higher effort level to the agent with the higher marginal productivity and the lower marginal effort costs. If this agent particularly compares his effort costs, the optimal effort allocation causes social disutility. This is unfavorable to the principal because the additional social disutility requires a higher compensation payment due to binding participation constraints. Therefore, the desirable high effort level is reduced to mitigate social disutility. Conversely, the principal tends to assign the lower effort level to the less productive agent. If this agent particularly compares effort costs, he receives an additional utility due to his preferences. This reduces the total compensation the principal has to pay.

The reversed effects arise if agent i is compensation-focused. In this case, the principal tries to avoid social disutility by increasing agent i’s effort level and reducing that of the other agent. Therefore, the principal benefits from agent i’s social preferences if his effort is sufficiently profitable, i.e., for high values of \( {{b_{i}^{2} } \mathord{\left/ {\vphantom {{b_{i}^{2} } {b_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {b_{j}^{2} }} \), and his marginal effort cost is rather low, i.e., for low values of \( {{\lambda_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda_{i}^{2} } {\lambda_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j}^{2} }} \).

In general, with higher intensity ω i the principal increases the effort of the agent who particularly compares compensation and reduces the effort of the other agent. This turns out to be beneficial if the agent whose effort is increased is sufficiently productive. Proposition 2 characterizes the requirements for a beneficial effect of social comparison of one agent. The following observations regarding the combined effect of both agents’ preferences are possible:

Corollary 1

With regard to the comparison of both agents, the following effects arise:

-

(a)

A diverse team structure is a necessary condition for an equally directed beneficial effect due to both agents’ social comparison, i.e., one agent needs to be effort-focused and the other one compensation-focused.

-

(b)

Assume a diverse team structure with agent i being effort-focused and agent j compensation-focused. Then the sufficient condition for an equally directed beneficial effect is:

$$ {{b_{i}^{2} } \mathord{\left/ {\vphantom {{b_{i}^{2} } {b_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {b_{j}^{2} }} < {{\lambda_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda_{i}^{2} } {\lambda_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j}^{2} }} $$ -

(c)

Consider a diverse team structure with effort-focused agent i and compensation-focused agent j who both show some minimum intensity level. Footnote 20 For higher structural difference γ j − γ i among agents and increasing intensity ω 1 and ω 1 of any agent, \( {{\lambda_{i} } \mathord{\left/ {\vphantom {{\lambda_{i} } {\lambda_{j} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j} }} \) increases and the sufficient condition (b) for a beneficial effect is more likely to be met.

To understand the joint effect of both agents’ social preferences on the principal’s expected utility, a closer look at (2) and (3) is useful. The symmetry of the conditions shows that an equally directed effect as a result of both agents’ social preferences is only possible if a diverse team structure is given. Otherwise, a beneficial effect due to one agent’s comparison is always accompanied by a detrimental effect because of the other agent’s comparison.

According to (b), conditions (2) and (3) for beneficial effects of both agents’ preferences are identical if a diverse team structure is given. It turns out that with increasing divergence of structure, a beneficial effect of social preferences is more likely to occur, i.e., the threshold of relative marginal effort costs \( {{\lambda_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda_{i}^{2} } {\lambda_{j}^{2} }}} \right. \kern-\nulldelimiterspace} {\lambda_{j}^{2} }} \) in (b) increases.

If the agents considerably differ in their weighting of the dimensions, the principal reduces the effort level of the effort-focused agent and increases the effort level of the compensation-focused agent. Thus, he can generate additional utility, which enables him to reduce the total compensation.Footnote 21 This is not possible for similar structure of social preferences because reducing social disutility for one agent implies a higher disutility for the other.

If, for a given structure of comparison, the parameter values ω1 and ω2 are sufficiently high, an increasing intensity of comparison is generally beneficial to the principal. The intuition behind this observation is that the productivity of efforts and the corresponding payoffs become less important for the principal. Instead, he succeeds in generating additional utility due to social comparison and minimizing total compensation payment.

Figure 2 illustrate the structural effect of social preferences.Footnote 22 In the first example agent 1 particularly compares compensation, while the comparison of agent 2 is exclusively based on effort costs, γ1 = 0.9, γ2 = 0. Because agent 1 is less productive (b 1 = 8, b 2 = 14), social preferences produce a detrimental effect as long as the intensity parameters are small. Given a sufficiently high intensity of both agents’ preferences, social comparison affects the principal’s expected utility EU P,FB in a positive manner. By reallocating effort, the principal induced an advantageous comparison and generates additional utility for both agents that allows him to reduce compensation. In the second example, both agents exclusively compare compensation (γ1 = γ2 = 1) and agent 1 is more productive (b 1 = 14, b 2 = 10). Therefore, the principal’s expected utility EU P,FB increases in ω1 and decreases in ω2. In contrast to the case of a divergent structure of comparison, the principal does not benefit from a high intensity of both agents’ comparison because the effects due to each agent’s social comparison neutralize each other. If both agents are exactly equal with respect to the intensity of social preferences, the results correspond to the solution of the model with self-interested individuals.

3.2.2 Analysis of the second-best solution

In the second-best setting, an additional incentive problem occurs, i.e., the principal has to employ performance-related compensation to provide adequate incentives. For simplicity, assume that both agents show the same structure of comparison, \( \gamma = \gamma_{1} = \gamma_{2} \).Footnote 23 According to the incentive constraints, the agents choose the following effort levels:

As in the first-best setting, it turns out that for optimal contract design the participation constraints are necessarily binding. Lemma 3 summarizes the analytical results.

Lemma 3

The solution in the second-best setting is given by the following incentive rates:

The resulting effort levels and the principal’s expected net payoff are given by:

As expected, performance-related compensation is used to provide incentives in the second-best setting. Similar to the case of purely self-interested agents, the optimal incentive rates are determined by the trade-off between risk and incentive. Obviously, the principal benefits from granting each agent a positive share in his own payoff as well as in the payoff of the other agent. A team contract turns out to be optimal, except for γ = 0. If agent i exclusively compares effort costs, his compensation is independent of the other agent’s payoff, v ij = 0.

For γ ≠ 0, the optimal contract design violates against the controllability principle because agent i is granted a share in the payoff \( \tilde{x}_{j} \), although he cannot control it (e.g., Solomons 1965, p. 83). This is hardly surprising as recent studies have shown that signals might be valuable for incentive contracting, even if they are not controllable (e.g., Arya et al. 2007; Dierkes and Harreiter 2010). In the corresponding model with purely self-interested individuals, a performance measure should be used if it is informative about an agent’s effort.Footnote 24 However, according to Lemma 3, even uninformative performance measures might be useful for incentive contracting if social preferences are considered.Footnote 25

The reason for this result is that with social preferences agents care about signals they are not compensated for. In contrast to the first-best setting, the principal has to grant a share in each agent’s own payoff to induce effort. Thus, the compensation payments c i are risky as well as the disutility due to social comparison N i . The variance of agent i’s objective is given by:

The slope of one agent’s objective function is negative in the other agent’s compensation because of his status-seeking preferences. Therefore, a risk reduction can be obtained through a positive share in each other’s payoffs, v ij , v ji > 0. Obviously, even uninformative performance measures are valuable if they are correlated with outcome variables of social comparison. If social comparison is exclusively based on deterministic effort costs (γ = 0), no advantage can be obtained by risk diversification, v ij = 0.

Aside from the reservation utility effect, which carries over to the second-best case, the influence of social comparison on the second-best effort can be separated into two interactive effects, a SB i = a FB i · m i : the structural effect with regard to a FB i , which is identified in the first-best setting, and a risk effect m i . The value of m i corresponds to the relative reduction of effort due to the second-best incentive problem.Footnote 26 The multiplier m i depends on the agents’ social preferences. This risk effect corresponds to an adjusted measure of risk aversion r i .Footnote 27

While the structural effect is discussed in detail in Proposition 2 and Corollary 1, the risk effect requires further investigation. Proposition 3 characterizes those structural parameters that imply high values of m i and, hence, a less detrimental risk effect.

Proposition 3 (Risk effect)

In contrast to the structural effect, which might increase the principal’s expected net payoff, the risk effect of social preferences in terms of m i is never beneficial, i.e., the trade-off between risk and incentive is tightened by social comparison, \( m_{i} \le \left. {m_{i} } \right|_{{\omega_{1} = \omega_{2} = 0}} \). The loss of efficiency due to the risk effect is reduced if agents increasingly compare compensation rather than effort, \( {{\partial m_{i} } \mathord{\left/ {\vphantom {{\partial m_{i} } {\partial \gamma }}} \right. \kern-\nulldelimiterspace} {\partial \gamma }} \ge 0 \) . It finally vanishes if γ1 = γ2 = 1.

Proposition 3 shows that the risk effect generally makes the principal’s incentive problem more severe. The structure of social comparison influences his ability to reduce the agents’ risk premia. If agents tend to compare risky compensation payments, a diversification is possible that reduces the loss of efficiency. If agents exclusively compare compensation, the risk effect vanishes completely. In this extreme case, the second-best reduction of effort \( {{a_{i}^{FB} } \mathord{\left/ {\vphantom {{a_{i}^{FB} } {a_{i}^{SB} }}} \right. \kern-\nulldelimiterspace} {a_{i}^{SB} }} \) corresponds to the model with purely self-interested individuals.

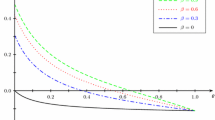

The risk effect is illustrated in Fig. 3. In the first example (b 1 = 8, b 2 = 12, σ 21 = σ 22 = 16, r 1 = r 2 = 1) both agents compare their net compensation, i.e., the dimensions of compensation and effort costs are weighted equally, γ = 0.5.Footnote 28 In this setting, the structural effect of social comparison vanishes completely and changes in the expected net payoff unambiguously reflect the risk effect. Because agents compare effort costs to a certain degree, social comparison implies higher risk premia. Obviously, the incentive problem becomes more severe as agents are more status-seeking.Footnote 29 In the second example (b 1 = 14, b 2 = 10, σ 21 = σ 22 = 16, r 1 = r 2 = 1), agents exclusively compare compensation, γ = 1. A comparison with the corresponding first-best solution in Fig. 2 (the second example) shows that the relative reduction of efficiency due to the second-best incentive problem is independent of the intensity parameters. The expected net payoff is reduced uniformly. As both agents exclusively compare compensation, a diversification of the risk associated with social comparison is possible.

The results of Sect. 3.2 show the importance of considering multiple dimensions of social comparison. Assuming that agents exclusively compare compensation, as has been done in the analytical literature, the risk effect identified in Proposition 3 vanishes. However, under the given assumptions, the risk effect is the only direct effect of social comparison on incentive contracting because all other effects are first-best effects and are only implicitly a matter of incentive provision, as they change the underlying first-best allocation of efforts.

4 Conclusion

The present analysis shows that the individual weighting of the dimensions of comparison is important to optimal contract design and contract efficiency. Under LEN assumptions, a comparison of compensation and effort costs as simple, but practically relevant example of multidimensional social comparison is analyzed to draw conclusions with respect to (1) the choice of performance measures and (2) an optimal team composition.

The effects of social preferences give insight into the optimal choice of performance measures. With status-seeking agents, a team contract turns out to be optimal if the social comparison of an agent is at least partly related to compensation. This observation is in line with recent studies, which consider social comparison in analytical agency models. Therefore, the criticism regarding the controllability principle, which is increasingly expressed in the economic literature, can be confirmed. It is well known that with purely self-interested individuals performance measures should be used for contracting purposes if they are informative about an agent’s effort, even if they are not controllable (Holmström 1979; Antle and Demski 1988). This study confirms the result that under consideration of social preferences even those performance measures might be useful for incentive contracting, which are not informative about an agent’s effort, as long as they affect his social comparison (Dierkes and Harreiter 2010, p. 537). Considering multiple dimensions of social comparison gives further insights into the usefulness of additional performance measures. Uninformative performance measures should be used for risk reduction if they are correlated with outcome variables of social comparison. However, the extent to which they are used critically depends on the structure of social comparison. If firms additionally use incentive schemes, which are not based upon the given performance measures, e.g., subjective performance evaluations, the relevance of compensation as a variable of measuring outcome is reduced and team compensation becomes less important. If individuals tend to compare deterministic job input (e.g., effort, tenure, job status), the usefulness of team compensation is mitigated as well. Considering a company as a social network characterized by a multilayered and complex structure of social relationships and comparison processes, the derived results emphasize the importance of aggregated performance measures—even if the weighting of the available metrics is associated with considerable problems in corporate practice.

From a team composition perspective the structure of social comparison affects the extent to which the agents’ outside options affect contract efficiency. A beneficial team structure is given if the reservation utilities of the team members who show the higher absolute weighting of compensation exceed the reservation utilities of the team members who tend to compare their inputs. In this case granting each individual his reservation utility is less expensive. This observation might be useful in matching team members with different outside options. Furthermore, detrimental effects of social preferences can be avoided if team members working in close proximity differ in their structures of social comparison, i.e., the agents’ preferences complement one another.Footnote 30 These results might help in obtaining testable behavioral predictions. In particular, because individuals tend to compare those attributes that are unequivocal, a disclosure of compensation rules and payments should intensify a comparison of compensation and, for given contractual parameters, increase individual effort. For the same reason, organizing teams in which individuals work together in close relationships and have sufficient information about each other’s efforts might enforce a comparison of effort (Bartling 2011, p. 190; Gächter et al. 2012b). If the model predictions can be confirmed, the disclosure of compensation and effort information might be used to influence the structure of comparison.Footnote 31 Furthermore, a variety of other contextual aspects might be considered, which influence the intensity and structure of social comparison (MacLeod 2007, Luft and Shields 2009, p. 60).

Previous economic research, which has focused on the comparison of monetary compensation, has identified and discussed implications of social preferences in business relationships. The conclusions drawn from these analytical agency models should be interpreted with caution. The present analysis, which additionally includes a comparison of effort costs as a simple, but practically relevant example, shows that the results and practical implications of a multidimensional social comparison might change considerably. Psychological and experimental findings largely indicate that social comparisons take place in multiple dimensions—with effort as an important dimension in business relationships (Deutsch 1985; Harris 1993).Footnote 32 However, a closer empirical analysis of equity judgments and the weighting of attributes in working environments could help in obtaining more specific conclusions.

Some restrictions with respect to the model results arise from the notion of social comparison that is used. While the analysis relates to individual comparison with the purpose of evaluating own ability and performance, the notion of fairness in groups and societies might also relate to high-order norms of equity (Lazear 1989; Luft and Shields 2009, p. 60; Gächter et al. 2012a) that additionally have an influence on the incentive mechanisms that firms apply. For example, the optimal contracts derived in this analysis systematically violate the principle “equal pay for equal work”. The additional consideration of social norms might mitigate differences in compensation due to individual preferences.

Finally, various assumptions, which restrict the findings of the analysis, should be addressed. In particular, in order to make use of the conclusions, companies must have knowledge of the intensity and structure of their employees’ social preferences. Furthermore, the present analysis restricts to the dimensions of compensation and effort costs. Although these dimensions are clearly important in business relationships, many other attributes might be used, especially in a dynamic context. A comparison to the principal is neglected, which is a realistic assumption if he sufficiently differs in his performance-related attributes. However, this might not fit to all business relationships.Footnote 33 In addition, the LEN assumptions make it impossible to extend the investigation to other types of social preferences. However, although the optimal contract design is derived under restrictive assumptions, the implications drawn from the model results might be useful for practical application. Although economic research is increasingly considering the results of behavioral science, many questions remain unanswered. Based on the results of the present analysis, an investigation into different dimensions of social comparison that additionally considers other types of social preferences would be interesting.

Notes

Using LEN assumptions makes it necessary to restrict the investigation to status-seeking individuals. The extension to reciprocity and inequity aversion is not possible within this framework because a linear social preference function is required; see Mayer and Pfeiffer (2004). Altruism is not taken into consideration, although the model could be extended to this type of preferences; see Sandner (2008).

This third-party allocation situation can be demonstrated in real working environments if employees compare themselves to each other as they actually exchange goods with their employer.

In his early work on distributive justice, Homans used the quasi-economic terms “profits” and “investments” instead of “outcomes” and “inputs”; see Homans (1961).

Equity theory presumes that individuals are naturally selfish and that social preferences can be attributed to socialization in groups, which generally reward equitable and punish inequitable behavior. According to this argumentation, differences in socialization might be one explanation for the ambiguous empirical results reported on individual reactions to advantageous comparisons.

Furthermore, altruistic preferences describe the case in which individuals generally enjoy if others receive a higher outcome or have to provide lower input, even if they are behind. For an overview of types of social preferences with further references, see Sandner (2008), pp. 7–11.

Typically, quantitatively measured inputs of a number of people involved in a social relationship are presented to the study participants and different allocations of outcomes are suggested. In each case, the subjects have to judge whether the allocation is perceived to be fair. Afterwards, it is analyzed to what degree alternative equity formulas can explain the assessments of fairness. An overview of equity formulas that are discussed in literature is provided by Harris (1980).

For further criticism, see Dornstein (1991), pp. 30–32.

These assumptions seem to cover a variety of real working situations. However, there are settings that do not fit this stereotype and thus have to be excluded from the present analysis.

For optimal contract design in a model with multiple agents in which technological and stochastic interdependencies are considered, see Sandner (2008). Although especially technological interdependencies in the form of a team production setting might give additional reason for social comparison in corporate practice, they are neglected in the present analysis in order to keep the model tractable. Further analysis shows that including interdependencies would complicate the calculations without changing the main results.

Note that it is not assumed that agents can observe each other’s efforts. If agents work together closely, they have beliefs about the other’s effort, which is sufficient to generate social comparison. Mutual observability of effort generally enforces these effects (Bartling 2011, p. 190), but this is not a prerequisite for the social comparison of effort or for solving the analytical model. The standard assumption of knowing each other’s preferences is accepted in the analytical agency literature.

For a derivation of the social preference function from psychological results of Sect. 2, see the appendix.

A linear preference function is typical for modeling status-seeking agents in LEN models; see Mayer and Pfeiffer (2004), Sandner (2008), and Dierkes and Harreiter (2010). As a consequence of a linear preference function, the degree to which utility from compensation and from social comparison are substitutes is independent of the absolute income level. This contradicts the intuitive expectation that a large decrease in compensation, which challenges the material existence of an individual, cannot be balanced by social comparison. However, a linear preference function is required under LEN assumptions. It might be understood as an approximation of a more complex preference function in a given range of compensation.

The choice of agents is not part of the analytical model. Nevertheless, conclusions can be drawn with respect to the principal’s hiring decision, which are separated from the analytical model and discussed subsequently.

In the following investigation, E[·] denotes the mean and V[·] denotes the variance of random variables.

Although agents perform similar tasks and work together closely, they might differ in productivity b i and reservation utilities U i due to individual qualification, educational background and seniority.

The proof of the following propositions is straightforward algebra. For Lemma 1, additional argumentation is presented in the appendix.

To ensure a reasonable incentive problem, preference parameters are restricted to the conditions λi > 0. Otherwise, the solution to the first-best problem would be unbounded.

The thresholds with respect to the minimum intensity levels are given by:

\( \begin{array}{*{20}c} \Leftrightarrow & \begin{gathered} {{\partial \lambda_{i} } \mathord{\left/ {\vphantom {{\partial \lambda_{i} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }},{{\partial \lambda_{i} } \mathord{\left/ {\vphantom {{\partial \lambda_{i} } {\partial \omega_{j} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{j} }} > 0 \quad\quad \wedge \quad\quad{{\partial \lambda_{j} } \mathord{\left/ {\vphantom {{\partial \lambda_{j} } {\partial \omega_{i} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{i} }},{{\partial \lambda_{j} } \mathord{\left/ {\vphantom {{\partial \lambda_{j} } {\partial \omega_{j} }}} \right. \kern-\nulldelimiterspace} {\partial \omega_{j} }} < 0 \hfill \\ \omega_{1} > \max \left\{ {\frac{{1 - \gamma_{2} }}{{2 \cdot (\gamma_{2} - \gamma_{1} )}},\frac{{1 - 3 \cdot \gamma_{2} }}{{2 \cdot (\gamma_{2} - \gamma_{1} )}}} \right\} \quad\quad \wedge \quad\quad\omega_{2} > \max \left\{ {\frac{{1 - \gamma_{1} }}{{2 \cdot (\gamma_{1} - \gamma_{2} )}},\frac{{1 - 3 \cdot \gamma_{1} }}{{2 \cdot (\gamma_{1} - \gamma_{2} )}}} \right\} \hfill \\ \end{gathered} \\ \end{array} \).

A similar result is obtained if, in addition to status-seeking preferences, altruistic behavior is considered. Assuming that agents compare compensation, Sandner (2008) shows that social comparison is beneficial if different types of preferences are given, i.e., if one agent is status-seeking and the other one is altruistic.

For simplicity, both agents’ reservation utilities are normalized to zero, no reservation utility effect occurs.

This assumption enables a clearer presentation without changing the results.

The payoff \( \tilde{x}_{j} \) is not controllable by agent i and not correlated with \( \tilde{x}_{i} \). Thus, it is not informative about a i. With purely self-interested individuals, there would be no use of including \( \tilde{x}_{j} \) in agent i’s compensation.

The inefficiency increases with higher performance measure risk σ 2 i and risk aversion r i and decreases with higher productivity b i. In LEN models with quadratic effort costs this reduction can be factorized typically.

Structural and a risk effect are not a consequence of the LEN assumptions, but might arise in any hidden action model with social preferences, although possibly with deviating directions and relevance. An important advantage of the LEN model is the possibility to analyze them separately.

This observation is in contrast to Sandner’s result, which states that for identical agents social preferences do not have an influence on the principal’s expected utility; see Sandner (2008), pp. 76, 150. Because his analysis assumes that agents exclusively compare compensation, the detrimental risk effect does not occur.

A similar conclusion can be drawn if aside from status-seeking preferences altruistic agents are taken into consideration; see Sandner (2008), p. 166. The results of this study confirm Sandner’s conclusion that diversity in team composition might be beneficial. Gächter et al. (2012b) come to a similar result by experimentally analyzing the reciprocity of workers who compare compensation as well as effort information.

Of course, the disclosure of information might cause additional effects that are not part of the previous model, but that might be important in corporate practice. Furthermore, empirical investigations should consider that the model predictions critically depend on the assumption of status-seeking preferences.

Some experiments even indicate that a comparison of compensation does not occur if no sufficient information about the other’s effort is available; see Gächter et al. (2012b).

A comparison with the principal might occur if he is member of the same team and similar in the sense of the related attributes hypothesis; see Wheeler et al. (1982).

Early contributions to equity theory assume that individuals tend to compare controllable aspects that relate to performance. This would imply that agents compare their expected performance-related pay instead of total compensation; see Bartling (2011). Nevertheless, this analysis includes uncontrollable effects in social comparison. In real working environments, there might be insufficient information to separate random effects from controllable measures or separating controllable and uncontrollable effects is possible, but requires considerable time, effort and cognitive ability (Luft and Shields 2009, pp. 94–113). This assumption is consistent with various analytical agency models; see Mayer and Pfeiffer (2004); Englmaier and Wambach (2010).

For simplicity, Harris (1980) chooses to normalize δ i = 1. Nevertheless, any other definition would have led to the same results with respect to the suitability of a linear equity formula.

References

Adams JS (1963) Toward an understanding of inequity. J Abnorm Soc Psychol 67:422–436. doi:10.1037/h0040968

Adams JS (1965) Inequity in social exchange. In: Berkowitz L (ed) Advances in experimental social psychology 2. Academic Press, New York, pp 267–299

Antle R, Demski JS (1988) The controllability principle in responsibility accounting. Acc Rev 63:700–718

Arya A, Glover J, Radhakrishnan S (2007) The controllability principle in responsibility accounting. In: Antle R, Gjesdal F, Liang PJ (eds) Essays in accounting theory in honour of Joel S. Demski. Springer, New York, pp 183–198

Bartling B (2011) Relative performance or team evaluation? Optimal contracts for other-regarding agents. J Econ Behav Organ 79:183–193. doi:10.1016/j.jebo.2011.01.029

Bartling B, von Siemens F (2010) The intensity of incentives in firms and markets: moral hazard with envious agents. Labour Econ 17:598–607. doi:10.1016/j.labeco.2009.10.002

Camerer CF (2003) Behavioral game theory: experiments in strategic interaction. Princeton University Press, Princeton

Carrell MR, Dittrich JE (1978) Equity theory: the recent literature, methodological considerations, and new directions. Acad Manag Rev 3:202–210

Clark AE, Oswald AJ (1996) Satisfaction and comparison income. J Public Econ 61:359–381. doi:10.1016/0047-2727(95)01564-7

Cowherd DM, Levine DI (1992) Product quality and pay equity between lower-level employees and top management: an investigation of distributive justice theory. Adm Sci Q 37:302–320

Demougin D, Fluet C, Helm C (2006) Output and wages with inequality averse agents. Can J Econ 39:399–413. doi:10.1111/j.0008-4085.2006.00352.x

Deutsch M (1985) Distributive justice: a social-psychological perspective. Yale University Press, New Haven

Dierkes S, Harreiter B (2010) Profit-Center-Steuerung unter Berücksichtigung von sozialen Präferenzen. Betriebswirtschaftliche Forschung und Praxis 62:534–557

Dornstein M (1991) Conceptions of fair pay: theoretical perspectives and empirical research. Praeger, New York

Englmaier F, Wambach A (2010) Optimal incentive contracts under inequity aversion. Games Econ Behav 69:312–328. doi:10.1016/j.geb.2009.12.007

Falk A, Fehr E, Fischbacher U (2003) Reasons for conflict: lessons from bargaining experiments. J Inst Theor Econ 159:171–187. doi:10.1628/0932456032974925

Falk A, Fehr E, Fischbacher U (2005) Driving forces behind informal sanctions. Econometrica 73:2017–2030. doi:10.1111/j.1468-0262.2005.00644.x

Farkas AJ, Anderson NH (1979) Multidimensional input in equity theory. J Pers Soc Psychol 37:879–896. doi:10.1037/0022-3514.37.6.879

Fehr E, Schmidt KM (1999) A theory of fairness, competition, and cooperation. Q J Econ 114:817–868. doi:10.1162/003355399556151

Fehr E, Schmidt KM (2003) Theories of fairness and reciprocity—evidence and economic applications. In: von Dewatripont M, Hansen LP, Turnovsky SJ (eds) Advances in economics and econometrics—eighth world congress 1. Cambridge University Press, Cambridge, pp 208–257

Fehr E, Hoff K, Kshetramade M (2008) Spite and development. Am Econ Rev 98:494–499. doi:10.1257/aer.98.2.494

Festinger L (1954) A theory of social comparison processes. Hum Relat 7:117–140. doi:10.1177/001872675400700202

Festinger L (1957) A theory of cognitive dissonance. Stanford University Press, Stanford

Frank RH (1985) Choosing the right pond: human behavior and the quest for status. Oxford University Press, New York

Gächter S, Nosenzo D, Sefton M (2012a) Peer effects in pro-social behavior: social norms or social preferences? J Europ Econ Assoc, (forthcoming)

Gächter S, Nosenzo D, Sefton M (2012b) The impact of social comparisons on reciprocity. Scand J Econ. doi:10.1111/j.1467-9442.2012.01730.x

Harris RJ (1980) Equity judgements in hypothetical, four-person partnerships. J Exp Soc Psychol 16:96–115. doi:10.1016/0022-1031(80)90002-5

Harris RJ (1993) Two insights occasioned by attempts to pin down the equity formula. In: Mellers BA, Baron J (eds) Psychological perspectives on justice. Cambridge University Press, Cambridge, pp 32–54

Hemmer T (2004) Lessons lost in linearity: a critical assessment of the general usefulness of LEN models in compensation research. J Manag Acc Res 16:149–162. doi:10.2308/jmar.2004.16.1.149

Holmström B (1979) Moral hazard and observability. Bell J Econ 10:74–91

Holmström B, Milgrom PR (1987) Aggregation and linearity in the provision of intertemporal incentives. Econometrica 55:303–328

Homans GC (1961) Social behavior: its elementary forms. Harcourt Brace, New York

Itoh H (2004) Moral hazard and other-regarding preferences. Jpn Econ Rev 55:18–45. doi:10.1111/j.1468-5876.2004.00273.x

Jaques E (1961) Equitable payment. Wiley, New York

Kruglanski AW, Mayseless O (1990) Classic and current social comparison research: expanding the perspective. Psychol Bull 108:195–208. doi:10.1037/0033-2909.108.2.195

Lawler EE (1968) Equity theory as a predictor of productivity and work quality. Psychol Bull 70:596–610. doi:10.1037/h0026848

Lazear EP (1989) Pay equality and industrial politics. J Politi Econ 97:561–580

Leventhal GS, Allen J, Kemelgor B (1969) Reducing inequity by reallocating rewards. Psychon Sci 14:295–296

Levine DK (1998) Modelling altruism and spitefulness in experiments. Rev Econ Dyn 1:593–622. doi:10.1006/redy.1998.0023

Luft J, Shields MD (2009) Psychology models of management accounting. Found Trends Acc 4:199–345

MacLeod WB (2007) Can contract theory explain social preferences? Am Econ Rev 97:187–192

Martin J, Murray A (1983) Distributive injustice and unfair exchange. In: Messick DM, Cook KS (eds) Equity theory: psychological and sociological perspectives. Praeger, New York, pp 169–205

Mayer B, Pfeiffer T (2004) Prinzipien der Anreizgestaltung bei Risikoaversion und sozialen Präferenzen. Zeitschrift für Betriebswirtschaft 74:1047–1075

Mowday RT (1987) Equity theory predictions of behavior in organizations. In: Steers RM, Porter LW (eds) Motivation and work behavior, 3rd edn. McGraw-Hill, New York, pp 91–113

Overlaet B, Schokkaert E (1991) Criteria for distributive justice in a productive context. In: Steensma H, Vermunt R (eds) Social justice in human relations volume 2—societal and psychological consequences of justice and injustice. Plenum Press, New York, pp 197–208

Pritchard RD (1969) Equity theory: a review and critique. Organ Behav Hum Perform 4:176–211. doi:10.1016/0030-5073(69)90005-1

Rabin M (1993) Incorporating fairness into game theory and economics. Am Econ Rev 83:1281–1302

Romer D (1977) Limitations in the equity-theory approach: toward a resolution of the “negative-inputs” controversy. Pers Soc Psychol Bull 3:228–231

Samuel W (1978) Toward a simple but useful equity theory: a comment on the Romer article. Pers Soc Psychol Bull 4:135–138. doi:10.1177/014616727800400129

Sandner KJ (2008) Behavioral contract theory: Einfluss sozialer Präferenzen auf die Steuerung dezentraler Organisationseinheiten. Duncker & Humblot, Berlin

Sell J, Griffith WI (1993) Are inputs sometimes outcomes? Some thoughts on definition in distributive justice. Soc Justice Res 6:383–398. doi:10.1007/BF01050338

Sobel J (2005) Interdependent preferences and reciprocity. J Econ Lit 43:392–436

Solomons D (1965) Divisional performance measurement and control. Richard D. Irwin, Inc., Homewood

Spremann K (1987) Agent und Principal. In: Bamberg G, Spremann K (eds) Agency theory, information, and incentives. Springer, Berlin, pp 3–37

Thibaut J (1950) An experimental study of the cohesiveness of underprivileged groups. Hum Relat 3:251–278. doi:10.1037/10646-005

Wagner JWL (1999) Soziale Vergleiche und Selbsteinschätzungen—Theorien, Befunde und schulische Anwendungsmöglichkeiten. Waxmann, Münster

Walster E, Berscheid E, Walster GW (1973) New directions in equity research. J Pers Soc Psychol 25:151–176. doi:10.1037/h0033967

Walster E, Walster GW, Berscheid E (1978) Equity: theory and research. Allyn and Bacon, Boston

Wheeler L, Koestner R, Driver RE (1982) Related attributes in the choice of comparison others: it’s there, but it isn’t all there is. J Exp Soc Psychol 18:489–500. doi:10.1016/0022-1031(82)90068-3

Zizzo DJ, Oswald AJ (2001) Are people willing to pay to reduce others’ incomes? Ann Écon Stat 63–64:39–65

Open Access

This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Derivation of the social preference function:

With compensation as outcome and effort costs as input of comparison, agent i perceives the compensation payment to be fair if the following equation holds:Footnote 34

This definition of fair exchange is invariant to identical relative changes in the weighting of both dimensions, i.e., rescaling the weights of compensation and effort costs with a positive constant δ i > 0 defines the same preferences:

Therefore, an individual’s preferences are characterized by the proportion 1/α i of these weights instead of the absolute weights δ i of outcome and δ i ·α i of input.Footnote 35 The equity formula above specifies combinations of compensation and effort costs that are perceived to be fair (structure of social comparison), but it includes no information about the extent to which this equity judgment influences an individual’s decision making (intensity of social comparison). To separate these two concepts, the parameter α i derived from Harris (1980) should not have any impact on the intensity of comparison. Increasing values of α i must not imply that social comparison of effort costs becomes more important relative to other sources of utility (e.g., income), but that it becomes more important relative to a comparison of compensation. This can be accomplished by normalizing the weight of outcome and input, δ i = 1/(1 + α i ).

In this case the weights of compensation and effort costs sum up to one. An increasing value of α i shifts the focus of social comparison from compensation to effort costs, without changing the sum of the marginal effects. Using this definition of fair exchange, the normalized measure of inequity is defined as the difference between the left- and the right-hand sides:

The parameter \( \gamma_{i} = {1 \mathord{\left/ {\vphantom {1 {(1 + \alpha_{i} )}}} \right. \kern-\nulldelimiterspace} {(1 + \alpha_{i} )}} \in [0,1] \) represents the relative weight of the dimensions, i.e., the structure of social comparison. Aside from the structure of fair exchange, the social comparison of agent i is characterized by an individually distinct intensity of social comparison, which is represented by the parameter ω i ∈ [0, 1]. The following social preference function quantifies the disutility due to social comparison in monetary units:

Proof of Lemma 1

It is assumed that the parameters \( (\vec{v}^{FB} ,\vec{a}^{FB} ,f_{1}^{FB} ,f_{2}^{FB} ) \) represent an optimal incentive contract in the first-best setting. The real valued vectors \( \vec{v}^{FB} \in {\mathbb{R}}^{4} \) and \( \vec{a}^{FB} \in {\mathbb{R}}_{ + }^{2} \) denote the optimal incentive rates and effort levels. The participation constraint of agent i can be reformulated in the following way:

with \( g_{ii} = 1 + \omega_{i} \cdot \gamma_{i} \), \( g_{ij} = \omega_{i} \cdot \gamma_{i} > 0 \) and \( F_{i} (\vec{v},\vec{a}) \) independent of f 1 and f 2. Without loss of generality, it is assumed that, given the optimal contract, the first agent’s participation constraint is not binding:

Consider the following definition of \( \hat{f}_{1}^{FB} \):

The contract \( (\vec{v}^{FB} ,\,\vec{a}^{FB} ,\,\hat{f}_{1}^{FB} ,\,f_{2}^{FB} ) \) implies a higher expected utility than had the original one. The participation constraint of the first agent is binding, whereas that of the second agent is still met because CE 2 decreases in the fixed wage f 1. Obviously, this contradicts the optimality of \( (\vec{v}^{FB} ,\,\vec{a}^{FB} ,\,f_{1}^{FB},\,f_{2}^{FB} ) \). Therefore, given an optimal contract, both participation constraints are necessarily binding.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Schäfer, U. The influence of different dimensions of social comparison on performance measure choice and team composition. Rev Manag Sci 7, 475–498 (2013). https://doi.org/10.1007/s11846-012-0092-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-012-0092-y

Keywords

- Social preferences

- Social comparison theory

- Performance measurement

- Principal-agent

- Moral hazard

- Team composition