Abstract

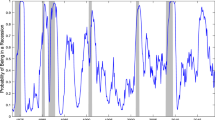

This paper aims to explain crude oil price volatility and its relationship respect to some macroeconomic and financial variables. Finding the main drivers of oil price dynamics is a crucial element for the definition of adequate monetary policies and risk management purposes. The role of macroeconomic and financial variables is analyzed in a Vector Error Correction Model framework, in order to test the existence of a long run equilibrium in the oil price dynamics. We use monthly data for crude oil prices, the Dollar/Euro exchange rate, the US interest rate, the crude oil Futures open interest, the US oil imports and the gold price over the period 1993–2009. One cointegrating relationship is found which allows to identify a long run equilibrium between the variables.

Similar content being viewed by others

Notes

According to the International Energy Agency (EIA) the OECD countries still represent 60 % of the world energy consumption.

WTI is the benchmark for crude oil spot prices and the underlying commodity of the NYMEX’s oil future contracts (Geman 2005).

The GAUSS code is available at: http://qed.econ.queensu.ca/jae/2003-v18.1/bai-perron/.

In the following, for the VAR(p) model we exclude the presence of exogenous variables.

\(-\Upgamma\) is the matrix of adjustment coefficients which has dimension n × r and the coefficients, γ i , describe the speed of adjustment of the particular series Y t to deviation from the cointegration relationship, i.e., the equilibrium errors.

In an Engle–Granger framework (Engle and Granger 1987) given two price series Y 1,t and Y 2,t , both I(1), the “cointegration regression”, Y 1,t = α + β Y 2,t + z t , is estimated to fit equilibrium relationship. The Ordinary Least Squares (OLS) residuals z t from the cointegrating regression are estimates of the equilibrium errors.

References

Amano RA, Norden S (1998) Exchange rates and oil prices. Rev Int Econ 6(4):683–694

Amano RA, Norden S (1998) Oil prices and the rise and fall of the US real exchange rate. J Int Money Finance 17(2):299–316

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66(1):47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econ 18(1):1–22

Bencivenga C, Sargenti G, D’Ecclesia RL (2011) Integration of energy commodity markets: the case of Europe and US. J Risk Manag Financ Inst 4:301–313

Chen SS, Chen HC (2007) Oil prices and real exchange rates. Energy Econ 29(3):390–404

Chen Y, Rogoff K, Rossi B (2008) Can exchange rates forecast commodity prices? Working paper, Hardward University

Chevillon G, Rifflart C (2007) Physical market determinants of the price of crude oil and the market premium. ESSEC, Paris

Cuaresma JC, Breitenfellner A (2008) Crude oil and the Euro-Dollar exchange rate: a forecasting exercise. Monet Policy Econ 4:102–121

Diba B, Grossman H (1984) Rational bubbles in the price of gold. National Bureau of Economic Research working paper series, vol w1300

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Geman H (2005) Commodity and commodity derivatives. Wiley Finance, New York

Hamilton JD (2009a) Understanding crude oil prices. Energy J 30(2):179–206

Hamilton JD (2009b) Causes and consequences of the oil shock of 2007-2008. Brookings papers on Economic Activity, Spring, pp 215–259

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S (1994) The role of constant and linear terms in cointegration of nonstationary variables. Econ Rev 13:205–209

Johansen S (1995) Likelihood-based Inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Johansen S (2005) Interpretation of cointegrating coefficients in the cointegrated vector autoregressive model. Oxford Bull Econ Stat 67(1)

Kaufmann RK, Ullman B (2009) Oil prices, speculation and fundamentals: interpreting causal relationship among spot and futures prices. Energy Econ 31(4):550–558

Krugman P (2008) The oil nonbubble. The New York Times Opinion

Malliaris AG, Malliaris M (2009) Time series and neural networks comparison on gold, oil and the euro. International joint conference on neural networks (IJCNN), 1961–1967

Mu X, Ye H (2011) Understanding the crude oil price: how important is the China factor? Energy J 32(4):69–92

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69(6):1519–1554

Roubini N (2009) Big crash coming. http://finance.yahoo.com/news

Rubin J (2009) Oil prices caused the current recession. http://www.oil-price.net

Schulmeister S (2000) Globalization without global money: the double role of the dollar as national corrency and as world currency and its consequences. J Post Keneysian Econ 22:365–395

Soros G (2008) Rocketing oil price is a bubble. http://www.telegraph.co.uk/finance

Stevans LK, Sessions DN (2008) Speculation, futures prices and the US real price of crude oil. Economics working paper. Christian-Albrechts-University, Kiel

Stock JH, Watson MW (1988) Testing for common trends. J Am Stat Assoc 83:1097–1107

Wang ML, Wang CP, Huang TY (2010) Relationships among oil price, gold price, exchange rate and international stock market. Int Res J Finance Econ 47:80–89

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bencivenga, C., D’Ecclesia, R.L. & Triulzi, U. Oil prices and the financial crisis. Rev Manag Sci 6, 227–238 (2012). https://doi.org/10.1007/s11846-012-0083-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-012-0083-z