Abstract

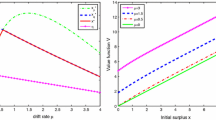

This paper investigates the dividend problem with non-exponential discounting in a dual model. We assume that the dividends can only be paid at a bounded rate and that the surplus process is killed by an exponential random variable. Since the non-exponential discount function leads to a time inconsistent control problem, we study the equilibrium HJB-equation and give the associated verification theorem. For the case of a mixture of exponential discount functions and exponential gains, we obtain the explicit equilibrium dividend strategy and the corresponding equilibrium value function. Besides, numerical examples are shown to illustrate our results.

Similar content being viewed by others

References

H Albrecher, S Thonhauser. On optimal dividend strategies in insurance with a random time horizon, Stochastic Processes, Finance and Control: A Festschrift in Honor of Robert J Elliott, 2012, 157–179.

B Avanzi, H U Gerber, E S Shiu. Optimal dividends in the dual model, Insurance Math Econom, 2007, 41(1): 111–123.

B Avanzi, J Shen, B Wong. Optimal dividends and capital injections in the dual model with diffusion, Astin Bull, 2011, 41(2): 611–644.

T Björk, A Murgoci. A general theory of Markovian time inconsistent stochastic control problems, Working paper, Stockholm School of Economics, 2010.

T Björk, A Murgoci, X Y Zhou. Mean-Variance Portfolio Optimization with State-Dependent Risk Aversion, Math Finance, 2014, 24(1): 1–24.

S Chen, Z Li, Y Zeng. Optimal dividend strategies with time-inconsistent preferences, J Econom Dynam Control, 2014, 46: 150–172.

S Chen, X Wang, Y Deng, Y Zeng. Optimal dividend-financing strategies in a dual risk model with time-inconsistent preferences, Insurance Math Econom, 2016, 67: 27–37.

B de Finetti. Su una impostazione alternativa della teoria collettiva del rischio, Transaction XVth International Congress of actuaries, 1957, 2: 433–443.

I Ekeland, A Lazrak. Being serious about non-commitment: subgame perfect equilibrium in continuous time, 2006, arXiv preprint math/0604264.

I Ekeland, O Mbodji, T A Pirvu. Time-consistent portfolio management, SIAM J Financial Math, 2012, 3(1): 1–32.

H U Gerber, E S Shiu. On optimal dividend strategies in the compound Poisson model, N Am Actuar J, 2006, 10(2): 76–93.

Y Li, Z Li, Y Zeng. Equilibrium Dividend Strategy with Non-exponential Discounting in a Dual Model, J Optim Theory Appl, 2016, 168(2): 699–722.

R H Strotz. Myopia and inconsistency in dynamic utility maximization, Rev Econom Stud, 1955, 23(3): 165–180.

S Thonhauser, H Albrecher. Dividend maximization under consideration of the time value of ruin, Insurance Math Econom, 2007, 41(1): 163–184.

J Yong. Time-inconsistent optimal control problems and the equilibrium HJB-equation, Math Control Relat F, 2012, 2(3): 271–329.

Y Zeng, Z Li. Optimal time-consistent investment and reinsurance policies for mean-variance insurers, Insurance Math Econom, 2011, 49(1): 145–154.

Q Zhao, J Wei, R Wang. On dividend strategies with non-exponential discounting, Insurance Math Econom, 2014, 58: 1–13.

Y Zhao, H Dong, W Zhong. Equilibrium dividend strategies for spectrally negative Lvy processes with time value of ruin and random time horizon, Communications in Statistics-Theory and Methods, 2020, 1–24.

Y Zhao, P Chen, H Yang. Optimal periodic dividend and capital injection problem for spectrally positive Lvy processes, Insurance Math Econom, 2017, 74: 135–146.

Y Zhao, R Wang, D Yao, P Chen. Optimal dividends and capital injections in the dual model with a random time horizon, J Optim Theory Appl, 2015, 167(1): 272–295.

Y Zhao, D Yao. Optimal dividend and capital injection problem with a random time horizon and a ruin penalty in the dual model, Appl Math J Chinese Univ, 2015, 30(3): 325–339.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest The authors declare no conflict of interest.

Additional information

Supported by the Shandong Provincial Natural Science Foundation of China(ZR2020MA035 and ZR2023MA093).

Rights and permissions

About this article

Cite this article

Zhao, Yx., Ye, Cx. & Cheng, Gp. Equilibrium dividend strategies in the dual model with a random time horizon. Appl. Math. J. Chin. Univ. 38, 510–522 (2023). https://doi.org/10.1007/s11766-023-3751-7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11766-023-3751-7

Keywords

- equilibrium dividend strategies

- non-exponential discounting

- time inconsistence

- dual model

- equilibrium HJB-equation