Abstract

Generation companies with controllable units put considerable analysis into the process of bidding into the day-ahead markets for electricity. This article investigates the gain of coordinating price-taking bids to the day-ahead electricity market (DA) and sequentially cleared energy-only markets, such as the Nordic balancing market (BM). A technically detailed case study from the Nordic market is presented. We find that coordinated bidding is hardly worthwhile under current market conditions, but that only a modest increase in the demand for balancing energy will make coordination profitable. If the supply curve for balancing energy is convex, so that the cost of balancing energy is asymmetric, the gains will be even higher. Finally, we find that day-ahead market bid curves that result from coordinated instances provide extra supply at low prices, and lower supply at high prices, compared to sequential bids. This is rational given the anticipated opportunities that the balancing market offers; however, it makes day-ahead bidding appear to exploit market power.

Similar content being viewed by others

1 Introduction

In the last decade, wind and photovoltaic (PV) technology have by far had the largest share of new investments in power capacity in the European Union. According to Ember (2022), 38% of the global electricity generated came from renewable sources in 2021. The increasing share of non-dispatchable new renewables has brought attention to how these sources could be handled within a restructured market framework. Most regions have a day-ahead and a real-time market for energy, and several authors show how optimal day-ahead bidding for a wind power generator is a function of real-time market prices, i.e. the price of deviating from the contracted day-ahead volume (Bitar et al 2012; Matevosyan and Söder 2006; Dent et al 2011; Vilim and Botterud 2014). In contrast, the effect of real-time market prices on the bidding behaviour of conventional generators is a less explored topic, although conventional generators need to provide balancing services to cover inflexible generators’ deviations. For flexible generators, a real time market can increase profit if the producer sells additional power at a higher price than marginal cost or buys back generation at a lower price than own marginal generation cost.

The turnover in real-time markets is often a result of forecasting errors—for demand, renewable generation, or availability. Thus, the traded amounts and resulting prices are stochastic variables. Does it pay for flexible generators to assess opportunities in markets succeeding the day-ahead market when placing bids in the day-ahead market? We will refer to such behaviour as coordinated bidding, whereas the term myopic bidding will be used for a strategy that considers only one market at a time. Myopic bidding does not anticipate how commitments in the day-ahead market will influence profit opportunities in subsequent markets. A priori, coordinated bidding will always be better, since it is a less restricted optimization problem than myopic bidding. However, the coordinated bidding problem will inevitably be more complex than the myopic bidding problem. The question is if the extra effort is worth it.

Our analysis distils three novel insights:

-

1.

The extra efforts associated with coordinated bidding cannot be defended considering the near-zero coordination gains that can be estimated using a detailed case study from a price-taking hydropower producer operating in the Nordic day-ahead and balancing markets. The administrative restrictions on the use of balancing markets are explicitly heeded.

-

2.

However, looking forward, there will be a need for increased balancing services. Taking the case above as a starting point, and then doubling the frequency and volume of the need for ramping in the balancing market, the gain of coordinated bidding is in the order of 4%, which could very well defend moving to a more sophisticated day-ahead bidding tool. If, in addition, the supply curve for balancing is convex, causing ramp-up prices to increase more than proportional to the increase in volume, then coordination gains are even higher, in the order of 6%.

-

3.

We observe and discuss that there is an apparent abuse of market power inherent in qualitative properties of day-ahead bid curves that are generated from coordinated bidding instances.

Further overview of the current literature on the coordinated bidding problem is found in Sect. 3. The market framework is discussed in Sect. 2, while the empirical scenario modelling for our Nordic case is described in Sect. 5. The mathematical model of bidding and hydropower generation is found in Sect. 4, the empirical case is briefly described at the end of Sect. 5 and the gains of coordinated bidding are quantified and analysed in Sect. 6.

2 Market framework

The details of market designs and market rules in deregulated electricity markets differ considerably from region to region, however, the fundamental needs of the market participants are strikingly similar. Conventional generators have time-coupling constraints, such as start-up costs, ramp constraints, storage, or emissions constraints, which necessitates planning commitment and generation over several time steps. This explains the need for a day-ahead market designed to clear the market in chunks of 24 h at a time, like in day-ahead forward markets of the US power pools (Helman et al 2008), or European power exchanges. In the US, these markets are cleared with distinct volumes and prices for each node in the electrical grid, while in Europe day-ahead (spot), markets have one or just a few price areas per nation state, with forced equal prices within each area.

For non-dispatchable power generation, like wind and PV, forecast accuracy typically improves as forecast horizon decreases. For these generators, short lead time from the time of trading to the time of generation is an advantage. In order for the market participants to be able to trade into balance, multilateral markets have emerged. These markets typically have gate closure 30 min–2 h before real time. In the US, they are referred to as real-time markets (Helman et al 2008), and in Europe, they are called intraday markets. Here, producers and consumers can adjust the area- and bid hour-specific commitments from the day-ahead market through a combination of batch and continuous double-sided auctions.

Due to the need for instantaneous balance between supply and demand, all electricity markets have a period from intraday gate closure to actual dispatch where a system operator (SO) manages the market. The balance is secured through utilization of a series of reserves with various degree of automatization and response time. The procurement procedures and remuneration schemes vary a lot from region to region—for an overview of procedures in the US and European markets, respectively, see Helman et al (2008), van der Veen et al (2012) and Rivero et al (2011). The reserves vary from spinning capacity with negligible amounts of energy activated, to start-up types of reserves with longer activation time and energy remuneration only. In this article, we will focus on the latter, and refer to it as the balancing market.Footnote 1

In this general market framework, two main characteristics are important to address in the modelling of the markets:

-

Volumes traded in the post-spot markets are limited. By design, the volumes traded follow the adjustment needs of variable renewable generation and other uncertain load and supply factors. The higher the penetration of variable renewable sources, the higher these volumes will be.

-

Balancing prices are higher than day-ahead prices at time of deficits of power and vice versa at times of surplus.

In the Nordic balancing market, the up-regulation price is by design higher than the day-ahead price, and vice versa for the down-regulation price. The balancing market price is set by uniform marginal pricing, determined by the price of the last activated bid in the merit order.

3 Coordinated bidding in the literature

This article contributes to the literature on bidding in electricity markets by combining qualitative insight on how post-day-ahead markets influence the conventional generator’s day-ahead market bids with empirical quantifications of gains under a changing generation mix.

Optimal bidding for conventional hydro- or thermal power generators in sequentially cleared markets has been studied by, for example, Plazas et al (2005), Ugedo et al (2006), Triki et al (2005), Corchero et al (2011), Corchero et al (2013), Wozabal and Rameseder (2019), Kongelf et al (2019), Löhndorf and Wozabal (2022), and for flexible consumers by Zhang et al (2016) and Ottesen et al (2018). Reviews are provided by Li et al (2011) and Aasgård et al (2019). The earliest studies are case oriented and focus on the formulation and solution of the (multistage) stochastic problem.

The following articles are the most relevant to ours, since they focus on coordination gains: Faria and Fleten (2011), Boomsma et al (2014), Kongelf et al (2019), Wozabal and Rameseder (2019), Aasgård (2022) and Löhndorf and Wozabal (2022).

Faria and Fleten (2011) and Boomsma et al (2014) do not require that day-ahead bids be “in balance”, that is, that the volume expected to be dispatched in the day-ahead is the same as expected generation, at the time of day-ahead bidding. Boomsma et al (2014) is a more analytic study of the coordination gains between the balancing and the day-ahead market, deriving bounds on the gains on coordinated bidding in a single and dual pricing balancing market. Their case study showed a quite substantial gain in for coordinated bidding between the Nordic day-ahead and balancing market. We believe that the main cause of this substantial potential gain is the absence of the “in balance” requirement. Furthermore, Boomsma et al (2014) use a price response approach to the balancing market, which we argue below is less realistic for the Swedish-Norwegian case.

Wozabal and Rameseder (2019) study the problem of coordinated bidding in sequential markets for a renewable electricity producer without storage in the Spanish intraday market and find gains of up to 20%. Similarly, Löhndorf and Wozabal (2022) focus on the multistage aspect of the problem, and use data from the German electricity market. Aasgård (2022) uses an approach that is very similar to ours regarding scenario generation as well as regarding the modelling of the balancing market in Sect. 4 (building on Klæboe et al (2015) and Klæboe (2015)).

Our contributions compared to previous literature can be summarized as follows. In the context of analysis of coordination gains, our study of consequences of future developments in the generation mix is novel. We are also the first to observe and discuss that day-ahead bidding curves that result from coordinated bidding have a qualitative shape that may lead observing regulators to conclude, erroneously, that market power is being abused.

Quantifying the gains of coordinated bidding can be an instructive exercise to inform short-term operations for producers. In order to contribute to the general insight in the problem, careful attention and discussion of appropriate modelling choices are needed. There are especially two recurring problematic issues in these types of studies, (i) how to ensure a realistic distribution of volumes between markets, and (ii) how to build a scenario tree that reflects the price uncertainty in all markets.

As discussed in Sect. 2, the volumes traded in the intraday and balancing market are lower than the volumes in the day-ahead market. How can a model be formulated to reflect such a behaviour? There are at least two ways to handle this properly:

-

Model price response

-

Model the volumes and prices in subsequent markets as bounded and event-driven

The first approach is suited for a liquid intraday market, where volumes can always be sold if the price just get low enough. At least the intercept of the inverse demand function should be modelled as a stochastic variable, to account for unpredictable over- or under supply from the day-ahead market as more accurate predictions on load and renewable generation are available. The second approach is better for balancing markets and illiquid intraday markets where finding a counterpart can be a challenge, or the SO intervenes in the balancing market in the opposite direction of which the producer needs to trade. However, previous authors have rarely chosen either of these two approaches, but settled for one of two simplistic solutions, (i) no implicit or explicit limits to how much can be traded in the intraday or balancing market, (ii) a fixed, arbitrary limit to how much can be traded in the intraday market. The approach using a fixed limit was done by Faria and Fleten (2011), whereas Boomsma et al (2014) opted for no limits at all, and price response has been used by Plazas et al (2005), Ugedo et al (2006), Boomsma et al (2014) and Löhndorf and Wozabal (2022).

A declining demand for balancing services, that is, a price response, seems like an elegant way to restrict the trade in the balancing market, but those modelling practices fail to recognize that the demand for balancing reserves are absolute and limited to the amount that is needed to bring supply and demand of electricity back into balance. This partially justifies our choice of the second approach. Furthermore, the balancing market is event-driven. This means that there will be occasions without activity in the balancing market, and a proper model should account for the risk of not being dispatched. Finally, a SO will want a balancing market to remain a market for balancing as opposed to being a de facto spot market. Consequently, it is natural to require that day-ahead bidders do not plan to deviate from their expected day-ahead volume commitments. We enforce this requirement as a constraint, and this effectively bounds (but does not rule out) balancing market participation.

With regards to scenario generation, time series modelling has been the typical way of representing a balancing or an intraday market. A GARCH model is used for modelling the intraday prices in Faria and Fleten (2011), while Boomsma et al (2014) uses an ARMA model with the day-ahead price as an exogenous input, and so does Plazas et al (2005). In illiquid intraday or balancing markets, the time series model approach fails, because the market is event-driven. This means that there will be times without activity in the balancing market. In the Nordic market, almost 50% of the hours have no activation of balancing reserves. A proper model should include the producer’s risk of not being dispatched in the balancing market.

4 Case description and model

In this article, we study the bidding behaviour of a hydropower generator with storage across two markets—the Nordic day-ahead market and the balancing market. The Nordic market situation reflects the general market framework discussed above. The day-ahead market is very liquid, with a turnover of around 80% of the consumption. The balancing market is still larger than the intraday market, with around 1% of the consumed energy.

The Norwegian balancing market price is by regulation more favourable to the provider of balancing services than the day-ahead market. See Table 1 for an overview of balancing states and prices.

The Nordic countries have had a dual price system for imbalances (until 1 November 2021), implying that only explicit suppliers of balancing services benefits from the balancing market price. This is in contrast to single pricing schemes where anyone whose imbalance is in opposite direction of the system balancing need is remunerated by the balancing market price (see van der Veen et al (2012) for a discussion of the efficiency of dual vs single imbalance scheme). The economic implications of imbalances are summarized in Table 2.

Both the Nordic balancing market and day-ahead market are centrally cleared with marginal pricing. The bidding is done on bidding zone level in both markets.

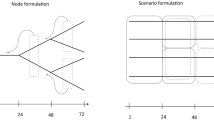

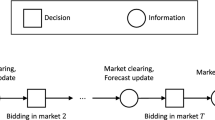

4.1 Stage definition

The bidding problem is inherently multistage. Each day-ahead market bid constitutes one stage, followed by the clearing of 24-hourly balancing market auctions. A full model would require 25 stages for each day in the planning period. Since the purpose of the model is to investigate the effect on the day-ahead bid of the balancing market, the problem is simplified and the considerable number of stages is collapsed into three: In the first stage, the producer submits its bids to the day-ahead market. In the second stage, the day-ahead market price for the next day is revealed, and the day-ahead commitments are determined through simple recourse given by the bidding rules. In the third stage, the producer observes balancing market states, volumes, and prices, as well as the day-ahead market prices for the rest of the horizon. Important decisions made in the third stage include balancing market commitments, generation, and imbalances. Note that bidding in the day-ahead market is only modelled for the first day. For the rest of the horizon, we abstract from bidding aspects, and We let generation be set to the levels that maximize revenue within the production constraints, using the prevailing scenario prices. Thus, for the remaining time steps, the producer decides upon his day-ahead market commitments directly without going through the bidding procedure. The balancing market and the opportunity for imbalances are also only modelled for the first day.

Note that we let the producer determine the balancing market commitments after the balancing prices are known. We argue that this does not lead to any significant bias. In a competitive market, the a priori knowledge of prices in one hour will not alter the bidding in that hour, since the producer has no incentive to bid anything else than his marginal cost. The marginal cost of generation may be interlinked across hours, however, so the clairvoyance should lead to a modest overestimation of profit.

4.2 Bidding, market clearing and imbalance rules

The framework for bidding in the day-ahead market is similar to that in Fleten and Kristoffersen (2007), building on Fleten and Pettersen (2005). The price-taking generator uses hourly bids; block bids are left out from this analysis. In the market clearing process, committed volumes are found by interpolating (in the volume dimension) between the two most adjacent (in the price dimension) bid price-volume pairs. We use the following indices, parameters, and decision variables.

For \(t \in {\mathcal {T\,}}^B\), \(s \in {\mathcal {S}}\), and i such that \(P_{it}\le \rho _{1ts} \le P_{(i+1)t}\), the commitment in the day-ahead market (\(m=1\)) becomes:

Furthermore, bids must be non-decreasing. For all \(t \in {\mathcal {T\,}}^B\), \(i \in \{1,\ldots ,I-1\}\) (I is the index of the highest price/volume):

To rule out speculative behaviour, the generator should not bid more than the installed capacity:

In the balancing market, either the whole bid is accepted or rejected. So the bid and commitment process is modelled in a simpler way. First, obtained obligations in the balancing market cannot exceed the total marketFootnote 2:

The offering of upward balancing power is limited by excess capacity after the day-ahead market is cleared:

The bidding of downward regulation depends on the obligations in the spot market. The producer cannot turn off more generation than the amount that is committed in the day-ahead market:

All commitments in the day-ahead market and balancing market should be matched with generation. Any deviations will be settled as imbalance. For all \(t \in {\mathcal {T\,}}^B, s \in {\mathcal {S}}\) the following must hold:

For time steps after the bidding period (\(t \in {\mathcal {T\,}}^N\)), the balancing market is not modelled, and the possibility of imbalances removed, so (7) collapses to \(y_{1ts}=\sum _{g \in {\mathcal {G}}}{w_{gts}}.\)

In the Nordic countries, each producer is obliged, by law or by mandatory agreement with the system operator, to design day-ahead bids in such a way that for each future bid-hour, there is planned balance between all internal demand and supply, including own production. Failing to do so can lead to loss of licence to operate. To mimic this rule, we impose a restriction saying that the expected imbalance should be zero:

4.3 Hydropower generation

Good descriptions of the costs of hydropower generation depend on sufficient technical detail and modelling of the hydraulic couplings in the water course. For our case study, we have chosen a system with a large reservoir upstream and a small reservoir downstream. This system has a level of flexibility that is representative for Nordic hydropower producers. The cascade is illustrated in Fig. 1. The availability of water to the downstream plant depends on the inflow and the operation of the upstream plant. An important technical feature is to model the diminishing return on water as the plant is loaded from the best point of efficiency to maximum. Generation in this area has an increasing marginal cost, modelled by a concave discharge-generation curve. Start-up costs are important time-couplers. Variations in head water level influence this system less than the other technical issues and is left for future work.

Water balance restrictions for each reservoir must of course hold. There are no time delays in the system, which simplifies modelling.

Like in Fleten and Kristoffersen (2008), the generation-discharge relationship is described by a set of enveloping restrictions. For all \(g \in {\mathcal {G}}\), \(f \in {\mathcal {F}}\), \(s \in {\mathcal {S}}\), and \(t \in {\mathcal {T\,}}\) generation is restricted by the linear restrictions:

For simplicity, each unit is modelled independently of the others, so the effect of increased head loss when more than one turbine is running is not included.

To capture the cost of the start-up of units, a binary status variable per unit is added. Every time a unit goes from a non-committed to a committed state, a start-up cost is induced. For all \(g \in {\mathcal {G}}\), \(s \in {\mathcal {S}}\), and \(t \in \{2,..,T\}\) we define:

Start-up cost for the first time step is added for each generator if the unit changes from an initial state of standing to running.

Since we already have introduced a status variable, the minimum discharge level can easily be modelled. For all \(g \in {\mathcal {G}}\), \(s \in {\mathcal {S}}\), and \(t \in {\mathcal {T\,}}\):

Trivial upper and lower bounds on reservoir level and discharge are added as well.

The water in the reservoirs at the end of the planning horizon is valued by a set of linear cuts that are supplied from a seasonal planning model (Gjelsvik et al 2010). The cuts consist of a future income, reference reservoir levels and a marginal cost of deviating from this level. Together the linear cuts form an outer approximation on the future value of water. For all \(s \in {\mathcal {S}}\), \(k \in {\mathcal {K}}\):

Failure to include such a relationship would give the model an incentive to deplete the water levels towards the end of the planning horizon.

4.4 Optimization model

The generator seeks to maximize revenue from all markets and the value of stored water, minus start-up costs and costs for imbalance.

subject to market rules constraints (1)–(8) and hydropower generation constraints (9)–(13).

Nonanticipativity constraints are only necessary if there are copies of variables at a stage that should not be different but that the optimization would adapt to each scenario unless forced equal by nonanticipativity constraints. Here, nonanticipativity in bidding is ensured by not letting the first stage variable, bid volumes, \(x_{it}\) depend on scenario. The second stage variable, day-ahead commitment, \(y_{1ts}\) is determined by simple recourse (cf. Eq. 1).

5 Scenario generation and data

The problem contains three stochastic parameters: The day-ahead market price, the balancing market volume, and the balancing market price premium. The day-ahead market price is seen as an independent random process. Balancing market volumes are a random process conditioned on the balancing market state. Balancing market premiums are assumed to depend on both balancing market volumes and day-ahead market prices.

The scenarios for the day-ahead market prices are generated by adding a stochastic error to the deterministic day-ahead forecast. The stochastic error is cast as a linear time series model in the form of an autoregressive moving average process, with parameters and variance estimated from the time series of forecast errors made by the hydropower generator the last eight weeks. A similar approach is found in Conejo et al (2005).

Three different sets for balancing market scenarios (price and volume) are generated:

-

In scenario set A, the balancing volume and prices are modelled as close to the current Norwegian balancing market as possible.

-

In scenario set B, the frequency of balancing events is increased so that balancing occur in every time step, and the balancing volumes are increased. Balancing market prices are higher than in scenario set A, but the relationship between balancing volumes and prices is the same as in A.

-

In scenario set C, balancing volumes are equal to those in scenario set B, but the prices are increased disproportionately. The response to up-regulation volumes is increased compared to scenario set A, in order to emulate a convex market supply curve. This gives the asymmetric balancing cost discussed by Dent et al (2011).

Due to the event-driven nature of the balancing market, it is necessary to build a balancing market model that reflect the intermittency of balancing events (Olsson and Söder 2008). More precisely, it is important to distinguish the probability of the arrival of an event from the probability of the magnitude of the event. This point was first made by Croston (1972) for inventory control problems, and validated for electricity balancing markets by Klæboe et al (2015). In markets where balancing does not occur in every time step, models without balancing state information tend to overestimate variance, and produces too wide probabilistic forecast intervals. Empirically, many time steps does not have a defined balancing state, thus autocorrelation in balancing volume must be modelled with care, utilizing methods for unevenly spaced time series (see Erdogan et al (2005) and Jones (1986)).

The probability of arrival of a balancing event is modelled as a (slow) moving average process. A balancing event is defined as an instance of either upward or downward balancing. In time steps with balancing, the direction of the regulation is determined by the sign of the balancing volume. The balancing market volume is modelled as an unevenly spaced autoregressive time series of order 1, using the methodology for stationary time series presented in Erdogan et al (2005). Inspired by Jaehnert et al (2009) the balancing market price premium is explained by the balancing market volume, as well as the day-ahead market price and the overall generation level in the bidding zone. The balancing market specification is equal to the EXO model described in Klæboe et al (2015).

The balancing scenarios are generated as follows. First, the balancing state is sampled. Based on the time since last arrival of a balancing event, the probability for balancing is updated. Then, the balancing volume is forecasted as an unevenly spaced autoregressive process of order 1 (AR(1)). If the balancing volume is nonzero, balancing market premium is calculated, using the day-ahead market price and balancing volume as input.

As in Boomsma et al (2014), scenarios are constructed in a two-step procedure. First day-ahead prices are simulated and reduced, using the fast-forward algorithm SCENRED (Gröwe-Kuska et al 2003). The reduced day-ahead market prices are used as input for simulating balancing market scenarios, which then in turn are simulated and reduced separately. The day-ahead market prices for day 2..t are matched randomly to balancing market scenarios, assuming there is no systematic correlation between today’s balancing market prices and tomorrow’s day-ahead prices. Thirty day-ahead scenarios were used, with ten balancing market scenarios per day-ahead market scenario—300 scenarios in total.

The simulated scenarios for the balancing market and day-ahead market price in scenario set A are illustrated in Fig. 2. The expected price in the day-ahead and the balancing market are approximately equal, whereas the variability in the balancing market is much larger than in the day ahead market. Table 3 displays summary statistics of the simulated balancing market premiums.

The data for current and historical price forecasts as well as hydrological data for week 40 of 2012 were kindly provided by the hydropower producer Hydro. Data for production levels, balancing market prices and day-ahead market prices were collected from Nord Pool Spot, for the area NO2.

The problem was formulated in GAMS 23.6.5 and solved using CPLEX 12.2 on an 8-core 2.6 GHz HP CPU with 64Gb RAM. Average computing time to reach optimality was 8700 s for the coordinated bidding problem, and 23,000 s + 3270 s for the myopic bidding problem (solution time for the day-ahead market bidding + balancing market problem, respectively).

6 Results

The upper reservoir is large (178 Mm\(^{3}\)), whereas the lower reservoir is small (1.6 Mm\(^{3}\)). There is one 45 MW generator in the upper station, and the lower station contains two generators with a total production capacity of 150 MW. The number of water value cuts is seven. The period has high reservoir levels, and one should hence anticipate high production rates. The model is run with a planning horizon of four days, with hourly resolution.

6.1 Comparison of coordinated and myopic bidding

Participating in the balancing market can increase profit in two ways: by selling upward balancing power at higher prices than marginal cost, or by buying downward balancing power at lower prices than marginal cost. Often, these operations can be performed without interfering with the schedule for the day-ahead market. However, sometimes it may give expected higher profit to hold back (through pricing) some generation from the day-ahead market and reserve for bidding upward balancing power in the balancing market. Or it may pay to bid a little more into the day-ahead market than otherwise perceived profitable, hoping to make additional profit from providing downward balancing power. These two potential cases are the source of the gain from coordinated bidding.

It is hard to do coordinated bidding by rules of thumb. The producer assesses both if and how she should alter the day-ahead market bid in anticipation of balancing market opportunities. The assessment relies on both probability of different balancing states, as well as the size of balancing market volumes and price premiums. All these variables are difficult to predict (see Klæboe et al (2015)).

The numbers in Table 4 indicate that participation in the balancing market is worthwhile. Compared to a problem without the possibility to sell upward and downward balancing services, profit increased by 3.1%, 12.2% and 14.4% in scenario sets A, B and C, respectively,Footnote 3 by taking part in the balancing market. In the current market (scenario set A), the gain of coordinated bidding is negligible. In scenario set B, where balancing occurs more frequently and prices are higher, but balancing premiums still are symmetrical, there is a substantial gain from coordinated bidding. In scenario set C, where volumes and downward balancing prices are equal to scenario B, the value of participating in the balancing market increases due to higher upward balancing prices. The gain from coordinated bidding increases comparatively more than the increase in gain from solely participating in the balancing market. When balancing market premiums for upward and downward balancing are asymmetric, the producer may take a biased position in the day-ahead market, favouring flexibility for upward balancing.

The reported gains from coordinated bidding in the current Nordic market situation (scenario set A) are very modest compared to Boomsma et al (2014), who reported a gain of in the range from 8 to 25% for a price taking Nordic generator. Our reported gains are lower because we model a limited market liquidity and require that the generator closes her positions as the main rule (cf. Equation (8)). When restriction (8) is removed, a lesser amount is sold in the day-ahead market, and quite a large amount of energy is sold as imbalance (excess generation). If imbalance has no cost, which it effectively has not in hours with no balancing, the generator may hold back generation in anticipation of upward balancing. Should the opportunity for selling energy in the balancing market not occur, the dual pricing Nordic imbalance system allows the power to be delivered to the market, and the generator will receive the day-ahead market price if there is no downward balancing. This does not reflect a profit opportunity, but a modelling flaw, because any generator who neglects her obligation to plan in balance will lose her licence to operate from the SO.

Interestingly, the calculated gains from coordinated bidding do approach the levels reported by Boomsma et al (2014) in scenario sets B and C. The market is still modelled properly, and the increase in balancing volume is within a conceivable range. An approximate doubling in average volume and doubling in frequency of regulation means a quadrupling of overall balancing volumes, but in the Norwegian power system it does not imply extreme imbalance energy volumes, only about 4% of annual consumption. With a higher penetration of wind generation and more transmission capacity to areas with a high share of wind power and PV electricity generation, a balancing demand of this magnitude is not unrealistic. Thus, flexible generators should position themselves for coordinated bidding across multiple subsequent energy markets as a means to maximize their profit over the next decades.

Even in scenario set A, where the profit gain is negligible compared to myopic bidding, the coordinated and myopic bidding method give bid curves for the day-ahead market with somewhat distinct characteristics. Bid curves from two selected hours are presented in Fig. 3. The bid curves from coordinated bidding in scenario set A offer higher volumes at the lower end of the supply curve, and lower volumes at higher prices. The increase in volume at low prices is especially pronounced in night hours and reflect the anticipated possibility for down regulation. But already at bid prices reflecting the expected price, the bid volumes from the coordinated bidding strategy are generally lower, and the lower volumes persist throughout the highest prices. Thus, the coordinated bidding strategy gives bids that increases flexibility for participating in the balancing market by committing units at lower prices levels, but also hesitating to bid maximum capacity. As the bid volumes in the balancing market increases (scenario set B and C), the bids become more biased towards pricing capacity in the day-ahead market higher, and the effect is more pronounced in the case of asymmetric balancing prices (scenario set C).

Bid curves for selected hours. Bids from myopic bidding are black (unlabelled), bids from coordinated bidding, scenario set A are labelled with dots, scenario set B with triangles, and scenario set C with diamonds. The Y-axis is capped at the highest day-ahead prices in the scenario sample, and all methods give maximum generation at maximum bid price

The qualitative difference between the shape of the bid curves from myopic bidding and the shape of the bid curve from coordinated bidding is noteworthy also because it resembles the difference between bid curves coming from a strategic, price-setting producer, versus bid curves coming from a price taking producer. A price making hydropower producer would hold back supply in scarcity (i.e. high price) situations, and, because the water should not be spilt, provide extra supply in situations of low prices (Bushnell 2003). This implies that if a producer implements a coordinated approach to bidding over markets beyond the day-ahead, they may come under scrutiny from monitoring market regulators that scan the markets for possible abusive practices. Such scrutiny would be unwarranted in this case; the bid curves that hold back day-ahead supply at high prices are simply a result of rational adaption to the market design that involves a sequence of physical electricity markets. If such scrutiny, warranted or not, is undesirable, it is a factor in favour of keeping the simpler systems and tools that support bidding one market at a time.

Out-of-sample-simulation of profit from the day-ahead market bids for the two bidding strategies from scenario set A resulted in the same quantified gain of coordinated bidding as the in-sample results. Thus, the results seem robust to sampling error.

The standard deviation of the normalized objective function can be found in Table 5. We observe that there is no significant difference in profit variability between coordinated and myopic bidding, except when the costs are asymmetric. Thus, in the case of asymmetric cost, coordinated bidding introduces more profit variability.

7 Discussion and conclusion

The case study presented in this article suggests that coordinated bidding for a reservoir hydropower generator is not worthwhile in the current Nordic market situation. This result is consistent with recent results of Aasgård (2022) and Löhndorf and Wozabal (2022), who also consider hydropower plants. However, we show that with an increase in the demand for post-day-ahead market adjustment, from the current level of 1% of total demand, to about 4% of total demand, the gain can become significant.

An increase in the balancing demand will increase the value of participating in the balancing market, but it will especially reward those who anticipate opportunities in the balancing market before the closing of the day-ahead market (i.e. coordinated bidding). Anticipating the energy trading opportunities that are available after the closing of the day-ahead market leads to a more flexible bidding strategy. Our analysis indicates that coordinated bidding leads to higher pricing in the upper end of the bid curve, as the opportunity cost of bidding in subsequent energy market is calculated as part of the marginal cost. In some cases, it also profitable to commit large supply volumes, aiming to keep the option to provide ramp-down open.

This interesting qualitative difference between more rational (coordinated) day-ahead bid curves and myopic (sequential, uncoordinated) bid curves corresponds well with the difference we would expect from observing bids from a price-taking versus a price-setting producer. A producer heeding our suggestions and starting to take the adjustment and balancing markets into account when submitting day-ahead bids, may thus come under unwarranted scrutiny from observant regulators. However, as our results are for a price-taking producer, we conclude that the regulator cannot expect to gather sufficient evidence of abuse of market power simply by inspecting changes in the shape of the day-ahead bid curves. We leave the analysis of the extent of this problem to future work.

Coordinated bidding is cumbersome 2022]and calculation intensive. However, flexible generators should monitor the gain of coordinated bidding closely, as even moderate post-day-ahead volumes and price increases can make the effort of coordinated bidding quite profitable.

Notes

Jaehnert et al (2009) refers to this as the regulating power market, and it is sometimes also called the market for tertiary reserves.

Note that the commitments in the balancing market are defined with a positive sign regardless of whether there is up- or down-regulation.

Recall that the objective function contains the expected future value of stored water, as well as the revenue from production beyond the first day. Since the magnitude of this part of the objective is dominant, we choose to compare the differences in the objective functions with the corresponding revenue from the day-ahead market.

Abbreviations

- \(\mathcal {T}\) :

-

Time steps t

- \(\mathcal {T\,}^B \subset \mathcal {T}\) :

-

Time steps with bidding and balancing

- \(\mathcal {T\,}^N \subset \mathcal {T}\) :

-

Time steps without bidding or balancing

- \(\mathcal {S}\) :

-

Scenarios s

- \(\mathcal {M}\) :

-

Markets m, \(\mathcal {M}= \{1, 2, 3\}\), where 1 is day-ahead, 2 is up-regulation and 3 is down-regulation

- \(\mathcal {I}\) :

-

Day-ahead market bid points i, i.e. set of bid price-volume pairs.

- \(\mathcal {J}\) :

-

Reservoirs/plants j

- \(\mathcal {J}_{j}\subset \mathcal {J}\) :

-

Immediate upstream elements to plant j

- \(\mathcal {F}\) :

-

Production-discharge segments f

- \(\mathcal {G}\) :

-

Generation units g

- \(\mathcal {G}_j \subset \mathcal {G}\) :

-

Units belonging to plant j

- \(\mathcal {K}\) :

-

Water value segments k

- \(x_{it}\) :

-

Bid volume

- \(y_{mts}\) :

-

Committed volume

- \(q_{gts}\) :

-

Turbine discharge

- \(w_{gts}\) :

-

Production

- \(r_{jts}\) :

-

Spill

- \(l_{jts}\) :

-

Reservoir filling (volume)

- \(o_{gts}\) :

-

Induced start-up cost

- \(v_s\) :

-

Value of stored water in all reservoirs at the end of the horizon

- \(\Delta w_{ts}^+\) :

-

Excess production according to commitments

- \(\Delta w_{ts}^-\) :

-

Deficit production according to commitments

- \(u_{gts}\) :

-

Commitment status (=1 means unit g is running in scenario s at time t)

- \(\rho _{mts}\) :

-

Market price

- \(\nu _{mts}\) :

-

Volume in balancing market, \(m \in \left\{ 2, 3\right\}\)

- \(\delta _{ts}\) :

-

Balancing market premium

- \(\sigma _{ts}\) :

-

Risk adjusted cost of imbalance

- \(\bar{W}_g\) :

-

Maximum unit production

- \(\underline{W}_g\) :

-

Minimum running unit production

- \(\pi _s\) :

-

Scenario probability

- \(P_{it}\) :

-

Bidprice, sorted ascending along i for each t

- \(C_g\) :

-

Start-up cost

- \(F_k\) :

-

Future value

- \(V_{jk}\) :

-

Marginal water value

- \(L_{jk}\) :

-

Reference reservoir level

- \(\hat{E}_{gf}\) :

-

Intercept of production-discharge relation

- \(E_{gf}\) :

-

Slope of production-discharge relation

- \(\kappa _{jt}\) :

-

Inflow

References

Aasgård EK (2022) The value of coordinated hydropower bidding in the Nordic day-ahead and balancing market. Energy Syst 13:53–77

Aasgård EK, Fleten SE, Kaut M et al (2019) Hydropower bidding in a multi-market setting. Energy Syst 10(3):543–565

Bitar EY, Rajagopal R, Khargonekar PP et al (2012) Bringing wind energy to market. IEEE Trans Power Syst 27(3):1225–1235

Boomsma TK, Juul N, Fleten SE (2014) Bidding in sequential electricity markets: the Nordic case. Eur J Oper Res 238(3):797–809

Bushnell J (2003) A mixed complementarity model of hydrothermal electricity competition in the western United States. Oper Res 51(1):80–93

Conejo AJ, Contreras J, Espínola R et al (2005) Forecasting electricity prices for a day-ahead pool-based electric energy market. Int J Forecast 21:435–462

Corchero C, Mijangos E, Heredia FJ (2013) A new optimal electricity market bid model solved through perspective cuts. TOP 21(1):84–108

Corchero C, Heredia FJ, Mijangos E (2011) Efficient solution of optimal multimarket electricity bid models. In: 2011 8th International Conference on the European Energy Market (EEM), pp 244–249

Croston J (1972) Forecasting and stock control for intermittent demands. Oper Res Q 23(3):289–303

Dent CJ, Bialek JW, Hobbs BF (2011) Opportunity cost bidding by wind generators in forward markets: analytical results. IEEE Trans Power Syst 26(3):1600–1608

Ember (2022) Global electricity review 2022. https://ember-climate.org/insights/research/global-electricity-review-2022/, Last accessed on 2022-05-03

Erdogan E, Ma S, Beygelzimer A, et al (2005) Statistical models for unequally spaced time series. In: Proceedings of the 2005 SIAM International Conference on Data Mining, pp 626–630

Faria E, Fleten SE (2011) Day-ahead market bidding for a Nordic hydropower producer: taking the Elbas market into account. CMS 8(1–2):75–101

Fleten SE, Kristoffersen TK (2007) Stochastic programming for optimizing bidding strategies of a Nordic hydropower producer. Eur J Oper Res 191(2):916–928

Fleten SE, Kristoffersen TK (2008) Short-term hydropower production planning by stochastic programming. Comput Oper Res 35(8):2656–2671

Fleten SE, Pettersen E (2005) Constructing bidding curves for a price-taking retailer in the Norwegian electricity market. IEEE Trans Power Syst 20(2):701–708

Gjelsvik A, Mo B, Haugstad A (2010) Long- and medium-term operations planning and stochastic modelling in hydro-dominated power systems based on stochastic dual dynamic programming. In: Pardalos PM, Rebennack S, Pereira MVF et al (eds) Handbook of Power System I. Springer, pp 33–55

Gröwe-Kuska N, Heitsch H, Römisch W (2003) Scenario reduction and scenario tree construction for power management problems. Proc IEEE Power Tech Conf Bologna Italy 3:1–7

Helman U, Hobbs BF, O’Neill RP (2008) The design of US wholesale energy and ancillary service auction markets: theory and practice. In: Sioshansi FP (ed) Competitive electricity markets. Elsevier global energy policy and economics series. Elsevier, pp 179–243

Jaehnert S, Farahmand H, Doorman GL (2009) Modelling of prices using the volume in the Norwegian regulating power market. In: IEEE PowerTech Bucharest, pp 1–7

Jones RH (1986) Time series regression with unequally spaced data. J Appl Probab 23:89–98

Klæboe G (2015) Stochastic short-term bidding optimisation for hydro power producers. PhD thesis, Norwegian University of Science and Technology

Klæboe G, Eriksrud AL, Fleten SE (2015) Benchmarking time series based forecasting models for electricity balancing market prices. Energy Syst 6(1):43–61

Kongelf H, Overrein K, Klæboe G et al (2019) Portfolio size’s effects on gains from coordinated bidding in electricity markets. Energy Syst 10(3):567–591

Li G, Shi J, Qu X (2011) Modeling methods for GenCo bidding strategy optimization in the liberalized electricity spot market—a state-of-the-art review. Energy 36(8):4686–4700

Löhndorf N, Wozabal D (2022) The value of coordination in multimarket bidding of grid energy storage. Oper Res (Published Online 31 January 2022). https://doi.org/10.1287/opre.2021.2247

Matevosyan J, Söder L (2006) Minimization of imbalance cost trading wind power on the short-term power market. IEEE Trans Power Syst 21(3):1396–1404

Olsson M, Söder L (2008) Modeling real-time balancing power market prices using combined SARIMA and Markov processes. IEEE Trans Power Syst 23(2):43–61

Ottesen SØ, Tomasgard A, Fleten SE (2018) Multi market bidding strategies for demand side flexibility aggregators in electricity markets. Energy 149:120–134

Plazas MA, Conejo A, Prieto FJ (2005) Multimarket optimal bidding for a power producer. IEEE Trans Power Syst 20(4):2041–2050

Rivero E, Barquìn J, Rouco L (2011) European balancing markets. In: 8th International Conference on the European Energy Market (EEM), pp 333–338

Triki C, Beraldi P, Gross G (2005) Multimarket optimal bidding for a power producer. Comput Oper Res 32(2):201–217

Ugedo A, Lobato E, Franco A et al (2006) Strategic bidding in sequential electricity markets. IEEE Proc Gener Transmiss Distribut 153:431–442

van der Veen RAC, Abbasy A, Hakvoort RA (2012) Agent-based analysis of the impact of the imbalance pricing mechanism on market behavior in electricity balancing markets. Energy Econ 34(4):874–881

Vilim M, Botterud A (2014) Wind power bidding in electricity markets with high wind penetration. Appl Energy 118:141–155

Wozabal D, Rameseder G (2019) Optimal bidding of a virtual power plant on the Spanish day-ahead and intraday market for electricity. Eur J Oper Res 280(2):639–655

Zhang C, Wang Q, Wang J et al (2016) Trading strategies for distribution company with stochastic distributed energy resources. Appl Energy 177:625–635

Funding

Open access funding provided by NTNU Norwegian University of Science and Technology (incl St. Olavs Hospital - Trondheim University Hospital).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Klæboe, G., Braathen, J., Eriksrud, A.L. et al. Day-ahead market bidding taking the balancing power market into account. TOP 30, 683–703 (2022). https://doi.org/10.1007/s11750-022-00645-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11750-022-00645-1