Abstract

Accounting for scope 3 emissions from investments remains a challenge due to a lack of adequate data and guidelines that do not accommodate the systemic role of firms in the financial chain. Here, we use network analysis to estimate investment-associated scope 3 carbon emissions of public firms. Using shareholder data from publicly traded firms listed on the Tokyo Stock Exchange, we identified the most influential firms by their ownership share values. Environmental responsibility can then be assigned by distributing the carbon footprint in the network to each of these influential firms. The industrial services, including trading and manufacturing, and financial services industries were found to be the largest source of scope 3 emissions in the investment network. In particular, the influential role of financial firms is reflected by having the largest increase in carbon allocation after the adjustment. This research contributes to ongoing efforts to improve carbon disclosure through methods that accommodate complex interactions among firms and to quantitatively reveal the overlooked responsibility of investors in carbon emissions.

Similar content being viewed by others

Introduction

Achieving a carbon–neutral society is now a widely recognized and accepted global agenda. For that purpose, we need system transformation and institution-accelerating transformation. Firms are now expected to reduce greenhouse gas (GHG) emissions not only from their activities but also from supply chains where they are involved. However, compared to the emissions by their production activities and extended responsibility along the supply chain, there is less attention to responsibilities by investments. Publicly listed firms invest in other firms for a variety of reasons, such as to diversify their portfolio, increase their financial returns, share risks, or gain access to new markets or technologies (Shinkle and Suchard 2019). Such investments distribute the environmental impact of operations. A firm investing in another with a carbon footprint indirectly contributes to ensuring the emissions of that firm (Lenzen and Murray 2010; GHG Protocol 2013). Firms are suggested to include in their environmental reports the carbon emissions derived from investments that are regarded as part of scope 3 emissions.

The Greenhouse Gas Protocol Corporate Accounting and Reporting Standard (GHG Protocol 2015) has become the global standard for assessing carbon footprint. The protocol was developed by the World Resources Institute (WRI) and World Business Council on Sustainable Development (WBCSD) in collaboration with major corporations, government agencies, and other NGOs and is regarded as an exemplary instance of private regulation given its wide adoption in a time that no international organization could take the lead (Green 2010). The protocol categorizes carbon emissions into three different scopes. Scope 1 emissions are those direct emissions from owned or controlled sources of an organization. Scope 2 emissions are indirect emissions from the generation of purchased energy (e.g., electricity, heat, steam, or cooling) consumed by the reporting organization. Scope 3 emissions are all other indirect emissions that occur in a company’s value chain. This includes both upstream and downstream emissions that are not owned or directly controlled by the reporting organization but are associated with its activities. The Carbon Disclosure Project estimates that more than 75% of a firm's carbon profile is due to its scope 3 emissions on average and larger for firms in the service and financial sectors (CDP 2023).

NGOs and governments have campaigned for firms to disclose their emissions, with relative success on scope 1 and 2 disclosures given their mostly straightforward nature of accounting. On the other hand, the measure of scope 3 emissions remains a challenge. The protocol divides scope 3 emissions into 15 categories which, ideally, should be measured across the full value chain. The complexity of modern, often multinational, supply chains adds a layer of intricacy to the task, making the tracing of all associated emissions a particularly arduous endeavor (Wilhelm et al. 2016a). Moreover, the issues related to data availability and methodological consistency further compound the difficulty, as different suppliers may employ disparate methodologies and lack standardized data (Shrimali 2022).

The challenge is exacerbated by economic considerations, particularly for smaller companies for whom the necessary investment in tools, personnel, and potentially third-party audits may be prohibitive. Additionally, the responsibility and control of scope 3 emissions often lie outside the reporting company’s domain, leading to difficulties in influencing or even accessing the requisite data. Finally, the engagement of stakeholders, including the building of necessary relationships and securing cooperation throughout the supply chain, might present significant hurdles, especially if the stakeholders do not perceive direct benefits from the emissions measurement process (Patchell 2018).

The measurement of the carbon footprint originated by investments is indicated in the protocol as the scope 3’s fifteenth category, covering equity investments, debt investments, project finance, managed investments, and client services (GHG Protocol 2013). These are among the less-reported scope 3 emissions across most of the economic sectors (CDP 2023). Even in the financial sector around 45% of firms did not report their investment-derived emissions (CDP 2023, p. 29). The lack of data in this category may be due to the few incentives for comprehensive reporting of scope 3 emissions in general. In particular, the protocol suggests that it is at the discretion of the reporting firm to select thresholds for which it considers an investment to be relevant to reporting or not. Therefore, firms may choose larger reporting thresholds hindering the impact of smaller investments.

Even though the protocol encourages the measure of emissions along the complete value chain, it is worth noting that most of the provided guidelines refer only to the first tiers (Patchell 2018). In the case of investment-derived emissions, the accounting is based on the emissions of the investee. There is no explicit mention of considering or collecting data downstream, that is, the investments of the investee and so on. Such an approach would add a burden to the reporting firms. The complexity of this task has been the subject of research where multitier methods are developed to properly account for emissions down the supply chain (Mena et al. 2013; Hearnshaw and Wilson 2013; Grimm et al. 2016) although none of them seem to apply to the case of complex investment networks. In any case, the extent of oversight of GHG emissions derived from investments is largely unknown and the need for empirical methods that accommodate such complexity is recognized (Hettler and Graf-Vlachy 2023).

This study aims to close that gap by proposing the application of network analysis (Girvan and Newman 2002) to estimate investment-associated scope 3 (i-scope 3) emissions of publicly traded firms. Visualization of the networks of investments enables a more holistic understanding of GHG flow across multiple interconnected firms and industries. The largest emitting firms and industries and influencers can be identified from the network for a clearer focus on the transformation to a low-carbon society.

The selection of the case of Japan offers a number of merits for this study. Japan, currently the third largest global economy and home to large multi-sector multinationals has a significant carbon footprint with estimated GHG emissions of 1.15 billion metric tons of CO2 in 2020 (The Ministry of Environment of Japan 2022). Towards its efforts to achieve net-zero GHG emissions, the Japanese government requires private and public firms to report their scope 1 and scope 2 emissions to the Ministry of Environment for public consumption, making it easier to source such data. The complexity in cross-holdings and interlocking directorates between various Japanese firms though generally stable (Hu and Izumida 2008; Li et al. 2018; Kobori 2020) offers a robustness test to the method utilized in this study that can be replicated in other countries.

Previous literature

Greenhouse Gas emissions data is reported by firms following two schemes: mandatory and voluntary (Busch et al. 2022b). Mandatory approaches are often legislated by governments or regulatory bodies ensuring accountability and standardization in reporting. On the other hand, voluntary approaches are driven by corporate sustainability goals, investor pressure, or public relations benefits. These schemes vary in terms of comprehensiveness and rigor. The similarity between them lies in the goal of quantifying emissions, but they differ in their enforcement mechanisms and often in the level of detail and verification required (Perrault Crawford and Clark Williams 2010). For example, in Japan, the reporting of scope 1 and 2 emissions is mandatory and regulated by the Ministry of Environment. However, large conglomerates like Mitsui Corporation voluntarily disclose sustainability reports covering multiple categories from the GHG protocol, including scope 3 emissions on a best-effort basis (Mitsui & Co 2022).

In practice, firms quantify their emissions through methodologies like Process Analysis, which is a systematic and thorough approach particularly used in industrial and manufacturing settings to measure direct emissions at product, process, or firm levels (Block et al. 2011; Busch et al. 2022b). Another methodology is Input–Output Analysis, which uses economic data to understand the relationship between industries and their emissions. Emission values are allocated across firms in relation to a firmographic indicator (e.g., relative sales, market capitalization). This method captures a broader range of emissions across the value chain but may lack precision for specific company activities (Minx et al. 2009). Other methods account for the firm’s own data and external data generating hybrid approaches. Goldhammer et al. (2017) applied a regression model to infer corporate carbon footprint with publicly available data. In their model, firm size, capital intensity, and centrality of production were found to have significant explanatory power. Similarly, Assael et al. (2023) applied a regression model to estimate non-reported scope 1 and 2 emissions finding, albeit expectedly, that energy consumption has the larger impact in the estimations, followed by number of employees and sector, among others.

The above-mentioned methodologies are mostly focused on scope 1 and 2 estimations and are used by reporting firms to comply with the requirements of the schemes they subscribe to. To access emissions data, other stakeholders, like investors, academics, or policymakers must wait for the firms or regulatory bodies to release their sustainability reports, as few of these stakeholders are resourceful enough to gather insider data and compute the emissions on their own. Alternatively, they may resort to third-party data providers. Several third-party providers like Moody’s, Refinitiv, or Sustainalytics offer GHG emission data. These providers use various methodologies to estimate emissions and there is a growing consistency between their estimates and the self-reports of firms for scope 1 and 2 emissions (Busch et al. 2022b). However, for scope 3 emissions, the data is often less reliable, more inconsistent, and sometimes entirely missing (Swinkels and Markwat 2023; Ducoulombier 2021)

This inconsistency underscores the need for new methods that can handle the intricacies and interconnections inherent in scope 3 emissions, potentially leading to more accurate and comprehensive assessments. Supply chain management research has recognized the need to understand the dynamics between suppliers beyond the first tiers for compliance with standards and the management of GHG emissions. Thus, the study of multi-tier suppliers in the supply chain emerged as a pivotal area of focus with an emphasis on sustainability (Patchell 2018). This research stream not only focuses on the estimation of emission values but also on the power dynamics that motivate GHG-emitting firms in the supply chain to be compliant with mandatory or voluntary schemes. Research suggests that firms can improve sub-suppliers compliance by actively assessing and collaborating with them, with factors such as public attention, perceived risks, and channel power influencing sub-supplier management (Mena et al. 2013; Grimm et al. 2016). Kumar and Rahman (2015) note that companies are motivated to adopt sustainability practices due to external pressures from entities like governments and NGOs, as well as the inherent benefits it offers, including enhanced reputation and the potential for premium pricing. Thus, the relationship between buyers and suppliers plays a crucial role in fostering a sustainable supply chain as these may exert pressure for sustainable change. Their research suggests that when forming these relationships, firms should prioritize sustainability standards in supplier selection. Wilhelm et al. (2016a) identified how buying firms may extend their sustainability strategies to sub-suppliers, these being controlling supply chain complexity, traceability and transparency in relation to environmental sustainability, and the management capabilities of the first-tier supplier. They further stress the role of the first-tier supplier as an information broker and manager of resources for increased transparency in sustainability across the supply chain (Wilhelm et al. 2016b).

The intricate dynamics of multi-tier supply chain management have also been linked to the study of complex network analysis. Just as complex network theory seeks to understand the interdependencies and structures within vast networks, multi-tier supply chain management delves into the multifaceted relationships, power balances, and interdependencies among suppliers at various tiers. Both fields recognize the importance of resilience, adaptability, and the potential vulnerabilities that can arise from overlooked nodes or tiers. For instance, Hearnshaw and Wilson (2013) apply complex network theory to supply chain networks, proposing that efficient supply chains follow a scale-free network structure. The authors review interdisciplinary literature to develop propositions around supply chain complexity and adaptive phenomena. Their findings suggest that supply chain resilience can be enhanced by incorporating hub firms and implementing redundancy strategies.

Extant literature has focused on assigning the responsibility to firms across the supply chain from industries associated with a large carbon footprint, like those from the resources and material extraction and manufacturing industries. However, these are not the only players that should be considered accountable for emissions across the supply chain. Relatively newer initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) have stressed the need for the active participation of financial institutions given their overarching involvement in the supply chains (TCFD 2021). In this direction, researchers have also tried to understand the impact of finance on climate change (Calvet et al. 2022), and the evaluation of sustainability aspects of investment portfolios (Popescu et al. 2021, 2023). Despite the analogies that can be drawn from the study of sustainability in multi-tier supply chains we did not find instances of research addressing concrete cases on how sustainability efforts or carbon footprint can be traced through complex investment networks. In particular, the sustainability aspects of shareholder networks seem to be understudied. In the context of scope 3 emissions and investments, research has focused on investors’ pressure of disclosing environmental data, and how such disclosing affects financial performance.

Investor pressure is a significant factor driving corporate scope 3 carbon emission reporting. Research indicates that as investors increasingly seek information on scope 3 emissions, companies are expected to enhance their reporting (Busch et al. 2022a). Studies have found that corporate representatives acknowledge the growing demand from investors for data on scope 3 carbon emissions and ways to reduce them (Tang and Demeritt 2018). This trend is supported by the fact that investors are using scope 3 emission data to assess firms’ supply chains and potential regulatory risks related to climate change (Linares-Rodríguez et al. 2022). Blanco (2021) further highlighted that, besides carbon footprint data, other risks like physical, regulatory, and market impact can also be identified through such disclosures.

Research has found a significant positive correlation between carbon performance and financial performance, emphasizing a clear incentive for firms to engage in carbon mitigation efforts. This relationship’s strength varies depending on the measurement method as relative emission reductions show a positive financial impact (Busch and Lewandowski 2018). However, there’s no research directly linking scope 3 emission reporting to profitability, Patchell (2018) theorizes that such reporting is financially advantageous only if it aligns with customer environmental preferences, potentially leading to a green premium. However, empirical evidence supporting this claim is lacking with varying results across industries and demographics (Lewandowski 2017; Ferrat 2021).

In this article, we focus on the shareholder network of firms traded in the stock market for insights into scope 3 accounting. Shareholder networks help capture the ownership structure of publicly traded firms (Tekušová and Kohlhammer 2008). By revealing investment patterns, we expect to find investors most exposed to carbon-intensive industries, highlight firms and investors that are lagging in terms of carbon footprint disclosure, and identify which shareholders might be able to influence multiple firms toward more sustainable practices.

Data and methods

Data

Shareholding data of public firms listed in the Tokyo Stock Exchange was sourced from Toyo Keizai (Toyo Keizai Major Shareholders Database 2023), one of the largest publishers specializing in Japanese politics, economics, and business. This data consists of a snapshot of September 2021 of the ownership of each public firm. It includes the top 35 shareholders by holdings of each firm being institutional investors, individuals, and other public firms. In this study, we only considered shares between public firms. It also included the ticker, Japanese firm name, English firm name, outstanding shares, the value of shares in JPY, and percentage of shares (ownership). Additionally, we sourced corporate data that included capital, revenue, value of assets, number of employees, and address, among others. The Tokyo Stock Exchange classifies each firm into any of seven industries: Finance, Healthcare and Daily Necessities, Transportation and Public infrastructure, IT and Electronics, Retail and Consumer Goods, Industrial Services, Automobile and Housing, and Materials and Resources.

The government of Japan through the Ministry of Environment, tracks firms’ emissions of the following greenhouse gases (GHG): CO2 carbon dioxide, CH4 methane, N2O nitrous oxide, HFC hydrofluorocarbons, PFC perfluorocarbons, SF6 sulfur hexafluoride, NF3 nitrogen trifluoride. Their equivalent in metric tons of CO2 (tCO2) is aggregated and reported on their website (The Ministry of Environment of Japan 2023). The Japanese regulatory system set the rules for reporting emissions independent of the GHG Protocol and a direct mapping between the two systems is not always possible. The Japanese reporting system is based on the Global Warming Countermeasures Act and the Energy Savings Act. Although the reporting categories may differ, it is acknowledged that scope 1 and 2 emissions are part of the mandatory disclosure (The Ministry of Environment of Japan 2015). Some designated companies also include category 4 (transportation and distribution) and 8 (leased assets) of scope 3 as part of this report. In this article, we refer to the total emissions of Japanese firms as “scope 1 & 2”.

Methods

We applied network analysis to assign the carbon responsibility of each firm based on their influence in the investment network. Figure 1 summarizes our approach which includes creating the network of shareholders from the stock market data and assignation of carbon emissions based on the data from the Ministry of Environment. Details are explained as follows.

Overview of the methodology. a A shareholder network of publicly traded firms is created; the weight of the edges represents the % of ownership. b Each firm in the network is weighed based on its reported emissions. c The carbon flow network is created by flipping the direction of the edges and adjusting weights. d Total emissions in the network are reassigned to each firm based on centrality measures from the carbon flow network

The stock market data was used to create the shareholder network. In the network, each publicly traded firm is treated like a node and is connected to any other public firm from which has shares. This is a directed network where the direction of the connection is the direction of the investment, and the weight of the connection is the percentage of ownership. Two firms can have shares of each other, in such cases two arrows in opposite directions are used to describe their relationship.

We then assigned to each firm in the network the carbon emission they reported to the Ministry of Environment. We mapped GHG emissions by matching the firm’s name across datasets programmatically. We also conducted a manual assignation for those firms where the name did not exactly match due to differences in the writing system (e.g., part of the name is written in Hiragana in the Tokyo Stock Exchange while in Kanji in the Ministry report, these being two valid Japanese spellings). This match covered all major firms by capital. A subset of smaller firms by capital, or recently listed firms were not immediately found in the report of the Ministry. For these, a regression model that accounted for the firm size and industry was used to estimate the remaining emissions. Therefore, 85% of emissions of publicly traded firms are directly sourced from the Ministry report and the remaining is estimated.

At this point, the network can be understood as a representation of capital flow in the sense that each arrow represents the direction of investments, however, we are interested in a network of carbon responsibility. Therefore, we switched the directions of the arrows to represent the flow of carbon due to investments (e.g., if firm A invests in firm B (A → B) a part of the emissions of B should be allocated to A (A ← B). This change of direction in the network is in line with how current guidelines suggest carbon estimation due to investments (GHG Protocol 2013). With this network representation, we can compute investment-derived scope 3 emissions, and adjust weights accordingly, by following the current guidelines of the protocol which asks for the firms to calculate the aggregated carbon emissions flowing from directly connected neighbors (i.e., first-tier investments) based on the proportion of ownership. The technical guidance of the GHG protocol refers to this calculation as an “investment-specific method for calculating emission from equity investments” and is computed by the following equation (GHG Protocol 2013, p. 142):

where \(firm x\) is the reporting firm, and \(firm i\) are all the firms in which \(firm x\) invested in. Henceforth, called the direct investment method.

This direct investment method fails to capture the impact of investments downstream of the network. Therefore, we propose the use of network centrality measures to assign each firm a value that better captures their influence in the whole system, and thus assign the carbon responsibility accordingly. Since this influence goes beyond the first-tier investments, we call it expanded i-scope 3 and is calculated as follows:

where \(firm x\) is the reporting firm, \(centrality\) is a normalized network centrality score, and \(Total tCO2\) is the total tons of CO2 reported by firms in the network that can be distributed to other public firms. The distribution of carbon footprint across the firms in the network has the additional benefit of avoiding double counting, a common issue of traditional carbon footprint measure approaches (Caro et al. 2013), because all the actors are considered as part of the chain simultaneously. Shares of publicly traded firms are also bought by individuals, institutional investors, and other entities that ideally should be accounted for by their carbon footprint responsibility from those investments. Therefore, \(Total tCO2\) concretely refers to the proportion of tCO2 of all listed firms after subtracting the CO2 that should be allocated to those other entities not included in the network.

The expanded i-scope 3 varies depending on the chosen centrality measure. In network theory, there are several centrality measures with different purposes and interpretations (Newman 2018). We assessed the following measures of centralities in terms of their effect on carbon distribution, impact on the network structure, and firm capabilities: degree, betweenness, closeness, eigen, PageRank, Kleinberg, and harmonic centralities. PageRank was estimated to be the metric that better represents firms’ responsibility in the network. Details of the assessment are included in the appendix.

PageRank is a measure of centrality that is used to capture the influence of actors in complex social networks (Kloumann et al. 2017; Smith et al. 2021). The idea behind PageRank centrality is that a node’s importance is determined not only by the number of connections it has (its degree) but also by the quality or importance of those connections. In other words, a node is considered more central if it is connected to other high-ranking nodes (Page et al. 1999). In the context of the carbon responsibility network, a firm is more central if it invests in firms with a larger carbon footprint, who in turn also invest in other firms with a larger carbon footprint.

The most influential firms in the network are those found with a larger expanded i-scope 3. These firms have a large cumulated carbon footprint given their centrality as investors. We study the top influential firms and discuss the impact of the expanded i-scope 3 at the industry levels.

Results

There are 3904 publicly traded firms listed in the Tokyo Stock Exchange as of September 2021, out of which 3225 (82.6%) appear in the shareholder network and 1562 (40%) own shares of other public firms. The firms with the largest carbon footprint were Nippon Steel with 80 M tCO2 contributing 26% of all emissions in the network, followed by Kobe Steel (16 M tCO2), and Idemitsu Kosan (7 M tCO2) a petroleum company.

Beyond the required reporting of scope 1 & 2 emissions, firms may opt to voluntarily disclose scope 3 emissions which may include emissions attributed to investments. When following guidance from the GHG protocol these are calculated based on the first-tier investments, here referred to as direct i-scope 3 (Eq. 1). The relationship between scope 1 & 2 and i-scope 3 is shown in Fig. 2.

The scatterplot visualizes 1562 publicly traded Japanese firms, with the x-axis representing scope 1 & 2 emissions and the y-axis representing scope 3 emissions from first-tier investments, both in tons of CO2 in log scale. While there’s a general lack of strong correlation between the two axes, a noticeable trend emerges toward the upper-right quadrant, housing firms from the steel, chemicals, and materials industries. Nippon Steel, Kobe Steel, and Idemitsu Kosan are the most extreme points in this quadrant, not only due to the previously reported large scope 1 & 2 emissions, but they also present large direct i-scope 3 emissions. Nippon Steel is one of the world’s largest steel producers, and it is expected for them to have high scope 1 & 2 emissions due to the energy-intensive nature of steel production. Their position also suggests they have significant first-tier investments in other high-emitting firms. The same can be said for Kobe Steel. Idemitsu Kosan is an energy company involved in oil refining and production. The energy sector is typically a high emitter, so their position on the chart aligns with industry expectations.

Conversely, the upper-left quadrant is dominated by trading firms, holding corporations, and finance-related firms, with Sumitomo Corporation, Mitsui Corporation, Aeon Co., Japan Securities Finance, and Oji Holdings being particularly prominent. Sumitomo Corporation & Mitsui Corporation are diversified conglomerates involved in various sectors, from metals to energy to finance. Their direct operations might not be highly polluting, but their diverse investments point towards high i-scope 3 emissions. Aeon Co. is primarily a retail company, and its direct emissions would be relatively lower. However, its investments or supply chain might be linked to high-emitting sectors. Japan Securities Finance being in the finance sector, expected for its direct emissions to be low. However, its investments in various industries lead to high i-scope 3 emissions. In our data, it is the firm with the most first-tier investments having shares of more than 436 firms where the average is 2. Oji Holdings is a firm in the pulp and paper sector, a sector known for its large carbon footprint. As a holding company, Oji Holdings reports relatively lower scope 1 & 2 emissions because most of its emissions are reported to the Ministry of Environment specifically through its subsidiaries or other firms in the same group as Oji Materials Co. Ltd. and Oji Paper Company. Mitsubishi Corporation shares a similar condition, where higher scope 1 & 2 emissions are found in multiple subsidiaries that are not publicly traded.

Along the identity line, we see Toyota Motors, Toyota Industries, and Hokuetsu Corporation. Being firms where the first-tier investments scope 3 emissions are comparable to their own scope 1 & 2 emissions.

The majority of firms, however, are agglomerated primarily on the left side of the chart. The distribution suggests that most Japanese firms have relatively lower direct emissions, but their investment-related emissions vary widely. This distinction underscores the importance of addressing both direct and indirect emissions in sustainability efforts. We also highlight the importance of finance, trading companies, and holding firms of manufacturing companies when it comes to assessing investment-derived emissions.

Investment decisions may have far-reaching effects in the network (Shahzad et al. 2018), so that, estimating the influence of certain firms is of higher significance. We measured the relative influence of firms using the PageRank centrality score (Kloumann et al. 2017; Smith et al. 2021) and accordingly assigned their expanded GHG contribution to the network, which we call expanded i-scope 3. Figure 3 presents a subset of the network comparing the direct i-scope 3 and by factoring their influential role in the network, i.e., the expanded i-scope 3.

Subset of the investment network focusing on the six firms with the largest expanded i-scope 3. The size of the node represents a the direct i-scope 3 when factoring direct investments only, and b the expanded i-scope 3. Colors indicate industries and arrows the flow of emissions (i.e., the inverse direction of investments)

The six firms with the largest expanded i-scope 3 are Toyota Motors (TM), Japan Securities Finance (JSF), Toyota Industries, The Bank of Kyoto (BK), Kyocera Corporation, and Denso Corporation. JSF and BK are the firms with the largest delta increase in the network. On the other hand, TM presents a large i-scope 3 in both cases (direct and expanded). The relationship between scope 1 & 2 and the expanded i-scope 3 is shown in Fig. 4.

When considering the expanded influence of firms’ investments, we see a difference over the y-axis in relation to Fig. 2. Notably, the adjustment reveals some firms scoring a higher i-scope 3 than Nippon Steel which was the highest value using the direct method. The distributional effect after the adjustment caused Nippon Steel to drop and, for example, JSF and Toyota Industries to increase their i-scope 3. This difference can be used to point to firms with the largest expanded influence. Table 1 shows 30 firms with the largest expanded i-scope 3.

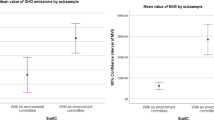

The impact of the systemic measure of i-scope 3 emissions at the industry level is shown in Table 2 and Fig. 5. The materials and resources industry alone, which includes steel and refineries, produces 63.7% of total scope 1 & 2 emissions. It is also the largest when estimating the scope 3 emissions derived from direct investments. However, when i-scope 3 emissions derived from investments are redistributed based on firms’ influence (expanded i-scope 3) the private infrastructure services and financial services industries are the largest. In particular, the largest delta in the increase of tCO2 when considering the network effect surfaces the influencing role of the financial service industry, which has been otherwise overlooked. Figure 5 shows how reporting i-scope 3 emissions with the direct method hinders the expanded impact of some firms across industries. For illustration purposes, we focus on the firms where the i-scope 3 emissions are larger than their scope 1 & 2 emissions which are marked in red. It can be seen in the upper panel that some of these firms appear with a relatively lower i-scope 3 using the direct method, thus, calculating i-scope 3 from direct investments hides the true influence of these firms.

Discussion

The relevance of financial firms in an investment network is expected given their role in the redistribution of capital. It is also recognized that scope 3 emissions may account for nearly 99% of the total emissions of financial firms (CDP 2023). In addition to that, this research suggests that financial services firms also play a central role in how carbon emissions are distributed through investment networks, being the second largest contributor of i-scope 3 emissions. Out of 3904 public firms listed on the Tokyo Stock Exchange, only 217 firms, or 7% are classified under the financial services industry. This makes financial services the second smallest industry by number of firms and the smallest by scope 1 & 2 carbon emissions. However, their i-scope 3 emissions went from an estimated 1.58 to 4.04 million tCO2 when considering their systemic impact instead of direct investments only, being the largest increase among industries. Small direct i-scope 3 calculations can be attributed to investments going from financial firms to public corporations and holdings having relatively low scope 1 & 2 emissions. Therefore, not accounting for impacts farther in the network of investments (e.g., trading and manufacturing firms under those corporations) where the actual scope 1 & 2 emissions are generated. Despite scope 3 being the largest of the carbon profiles of financial firms, their emissions may still be underestimated.

Network dynamics also revealed the industrial services industry as the largest contributor to i-scope 3 emissions. This includes trading firms, real estate, and industrial manufacturing among other heavy industries. In third place, we found the automobile and housing industry. Therefore, in these sectors, emissions in the financial network cannot be neglected in addition to those along the supply chain. This is a change of focus from the conventional resource and material industries suggesting wider policy efforts over those less regulated. In this regard, this article adds to the increasing calls for climate regulation (Busch et al. 2022a) by signaling specific industries in need of tailored policies.

We also note the distributional effect and group dynamics offered by network measures. The assignation of carbon responsibility based on network centrality implies that investing in publicly traded firms can be considered a signal of participating in the dynamics of the value chain, and even a small responsibility will be borne just by engaging in the network. Concretely, in the shareholder network, each firm investing in any other firm will be assigned a minimum carbon footprint (which, for the Japanese case, corresponds to 2247 tCO2, observed as a lower threshold in the lower panel of Fig. 5).

Measuring investment-derived scope 3 emissions through a shareholder network presents some limitations. It is focused on a specific subset of investments typified in category fifteen of the GHG protocol. Other types of investments aiming to finance subsidiaries, associate companies, and joint ventures that are not publicly traded are not captured in the network. Two notable examples are JFE Steel and JERA. The former is the second largest carbon footprint firm after Nippon Steel, according to data from the Ministry, with 53.3 million tons of CO2 (The Ministry of Environment of Japan 2023). JFE Steel is owned by JFE Holdings, which is publicly traded, but this relationship is not captured in the network. JERA is the largest power generation company in Japan reporting scope 1 & 2 emissions of 131.7 million tons of CO2 (JERA 2023) which is higher than those of Nippon Steel. JERA is a joint venture between Chubu Electric Power and TEPCO Fuel & Power, of which only Chubu Electric Power is publicly traded. These relationships are out of the scope of shareholder networks, so that, research on subsidiary networks can be a promising avenue of future research. In a related direction, it may be worth considering the financial structure of investee firms, as these may not only be financed by other actors not visible in the network, but also through debt. Considering this connection would add to the role of financial institutions or shed light on the role of governments and other entities that may have indirect responsibility for the emissions of firms along the financial chain.

Companies may sell and buy shares due to market pressure and other factors. Hence, shareholder networks are dynamic. The greenhouse gas protocol recognizes this situation and suggests that “companies should identify investments by choosing a fixed point in time, such as December 31 of the reporting year, or by using a representative average over the course of the reporting year.” (GHG Protocol 2013, p. 137). Therefore, although the results of a shareholder network as presented in this research are a snapshot of investments at the time, they are in line with the protocol. Further research can investigate how these dynamics can be integrated for more accurate accounting.

The need to factor sustainability and carbon reduction into investment decisions is well recognized (Millar et al. 2018). Initiatives like the Taskforce on Climate-related Financial Disclosure and others are developing frameworks to guide firms with up-to-date practices in evaluating and disclosing their carbon footprint and nature-positive indicators (TCFD 2021). These frameworks continue to be bottom-up methodologies, where firms gather emissions data from their individual invested firms and calculate the total emissions associated with their value chain (Hoepner and Rogelj 2021; Ding et al. 2023) While these approaches can be effective, they can also be time-consuming and resource intensive, or even misleading in the case of financial firms (Janssen et al. 2022).

This study, though limited to Japanese public firms, contributes to introducing a methodology that relies on public data, offering a comprehensive picture of the emissions associated with investment activity that is easier to compute and reproduce. This method will support the exploration of hidden contributions to GHG emissions by equity investments and responsibilities for climate change mitigation as shareholders. This can help promote greater transparency and accountability, encouraging companies to model their influence in the network and make informed decisions. We suggest policymakers, NGOs, or other stakeholders implement and keep up-to-date emission data based on system-level methodologies, like the one proposed in this article, readily available for public consumption. In addition, we suggest the necessity of a data platform with a common data scheme and identifiers and sufficient coverage of companies. Related data for analysis is scattered and neither reported nor registered in a machine-readable and exchangeable manner. We analyzed only public companies but not private ones. This situation causes a huge manual task for data gathering and editing, which hampers efficient analysis. In so doing, firms would have a lesser burden on estimating certain i-scope 3 emissions, it would promote comprehensive reporting, and increase public awareness. From an academic standpoint, we contribute by incorporating network analysis into the study of the estimation of GHG emissions at the system level. This helps in identifying firms whose investments have influence in the financial chain, and in identifying industries commonly overlooked in GHG emissions research.

Conclusion

A shareholder network approach for the estimation of investment-derived scope 3 emissions can be used for policymakers to highlight the dichotomy between a firm’s operational emissions and those arising from its investments. While some firms may operate with a smaller carbon footprint, their investment choices can significantly impact their overall environmental impact. This insight emphasizes the need for comprehensive strategies that consider both operational and investment-related emissions when aiming for a sustainable transition in the business landscape.

This study elucidated the role of investment-derived scope 3 emissions within the Japanese economy using network analysis. The research revealed that traditional methods, which focus on direct investments, may not capture the full carbon footprint of firms, particularly in the financial sector. The difference between direct i-scope 3 and expanded i-scope 3 emissions highlighted the broader influence of firms in the investment network. The financial sector, despite its low direct emissions, has a significant impact on the carbon responsibility network. Additionally, the industrial services and automobile and housing industries play central roles in the distribution of i-scope 3 emissions. The methodology introduced offers a comprehensive approach to estimating investment-derived emissions, promoting transparency and accountability. As global efforts intensify to transition to a low-carbon economy, understanding the complete carbon footprint of firms, encompassing both direct and indirect emissions, becomes paramount.

Notes

Degree means the in-degree centrality of the carbon flow network, or the out-degree of the investments network.

References

Albert R, Jeong H, Barabási A-L (2000) Error and attack tolerance of complex networks. Nature 406:378–382. https://doi.org/10.1038/35019019

Assael J, Heurtebize T, Carlier L, Soupé F (2023) Greenhouse gases emissions: estimating corporate non-reported emissions using interpretable machine learning. Sustainability 15:3391. https://doi.org/10.3390/su15043391

Blanco CC (2021) Supply chain carbon footprinting and climate change disclosures of global firms. Prod Oper Manag 30:3143–3160. https://doi.org/10.1111/poms.13421

Block C, Van Praet B, Windels T et al (2011) Toward a carbon dioxide neutral industrial park. J Ind Ecol 15:584–596. https://doi.org/10.1111/j.1530-9290.2011.00355.x

Brin S, Page L (1998) The anatomy of a large-scale hypertextual Web search engine. Comput Netw ISDN Syst 30:107–117. https://doi.org/10.1016/S0169-7552(98)00110-X

Brouthers LE, Gao Y, Napshin S (2014) Keiretsu centrality—profits and profit stability: a power dependence perspective. J Bus Res 67:2603–2610. https://doi.org/10.1016/j.jbusres.2014.03.019

Busch T, Lewandowski S (2018) Corporate carbon and financial performance: a meta-analysis. J Ind Ecol 22:745–759. https://doi.org/10.1111/jiec.12591

Busch T, Bassen A, Lewandowski S, Sump F (2022a) Corporate carbon and financial performance revisited. Organ Environ 35:154–171. https://doi.org/10.1177/1086026620935638

Busch T, Johnson M, Pioch T (2022b) Corporate carbon performance data: Quo vadis? J Ind Ecol 26:350–363. https://doi.org/10.1111/jiec.13008

Calvet L, Gianfrate G, Uppal R (2022) The finance of climate change. J Corp Finan 73:102162. https://doi.org/10.1016/j.jcorpfin.2022.102162

Caro F, Corbett CJ, Tan T, Zuidwijk R (2013) Double counting in supply chain carbon footprinting. M&SOM 15:545–558. https://doi.org/10.1287/msom.2013.0443

CDP (2023) CDP Technical Note: Relevance of Scope 3 Categories by Sector. Carbon Disclosure Project

Ding D, Liu B, Chang M (2023) Carbon emissions and TCFD aligned climate-related information disclosures. J Bus Ethics 182:967–1001. https://doi.org/10.1007/s10551-022-05292-x

Ducoulombier F (2021) Understanding the importance of Scope 3 emissions and the implications of data limitations. J Impact ESG Invest 1:63–71. https://doi.org/10.3905/jesg.2021.1.018

Ferrat Y (2021) Carbon emissions and firm performance: a matter of horizon, materiality and regional specificities. J Clean Prod 329:129743. https://doi.org/10.1016/j.jclepro.2021.129743

Girvan M, Newman MEJ (2002) Community structure in social and biological networks. Proc Natl Acad Sci 99:7821–7826. https://doi.org/10.1073/pnas.122653799

Goldhammer B, Busse C, Busch T (2017) Estimating corporate carbon footprints with externally available data. J Ind Ecol 21:1165–1179. https://doi.org/10.1111/jiec.12522

Green JF (2010) Private standards in the climate regime: the greenhouse gas protocol. Bus Polit 12:1–37. https://doi.org/10.2202/1469-3569.1318

Grimm JH, Hofstetter JS, Sarkis J (2016) Exploring sub-suppliers’ compliance with corporate sustainability standards. J Clean Prod 112:1971–1984. https://doi.org/10.1016/j.jclepro.2014.11.036

Hearnshaw EJS, Wilson MMJ (2013) A complex network approach to supply chain network theory. Int J Oper Prod Manag 33:442–469. https://doi.org/10.1108/01443571311307343

Hettler M, Graf-Vlachy L (2023) Corporate scope 3 carbon emission reporting as an enabler of supply chain decarbonization: a systematic review and comprehensive research agenda. Bus Strat Environ. https://doi.org/10.1002/bse.3486

Hoepner AGF, Rogelj J (2021) Emissions estimations should embed a precautionary principle. Nat Clim Chang 11:638–640. https://doi.org/10.1038/s41558-021-01109-3

Hofstetter JS (2018) Extending management upstream in supply chains beyond direct suppliers. IEEE Eng Manag Rev 46:106–116. https://doi.org/10.1109/EMR.2018.2810078

Hu Y, Izumida S (2008) Ownership concentration and corporate performance: a causal analysis with Japanese panel data. Corporate Govern Int Rev 16:342–358. https://doi.org/10.1111/j.1467-8683.2008.00690.x

Janssen A, Botzen W, Dijk J, Duijm P (2022) Overcoming misleading carbon footprints in the financial sector. Clim Policy 22:817–822. https://doi.org/10.1080/14693062.2022.2083548

JERA (2023) Environmental data. In: ESG information. https://www.jera.co.jp/en/sustainability/data/e. Accessed 8 Aug 2023

Kleinberg JM (1999) Authoritative sources in a hyperlinked environment. J ACM 46:604–632. https://doi.org/10.1145/324133.324140

Kloumann IM, Ugander J, Kleinberg J (2017) Block models and personalized PageRank. Proc Natl Acad Sci 114:33–38. https://doi.org/10.1073/pnas.1611275114

Kobori K (2020) Effects of corporate profitability and growth on the shareholding strategies of banks: evidence from Japan. Int J Econ Financ 12:p83. https://doi.org/10.5539/ijef.v12n9p83

Kumar D, Rahman Z (2015) Sustainability adoption through buyer supplier relationship across supply chain: a literature review and conceptual framework. Int Strat Manag Rev 3:110–127. https://doi.org/10.1016/j.ism.2015.04.002

Lenzen M, Murray J (2010) Conceptualising environmental responsibility. Ecol Econ 70:261–270. https://doi.org/10.1016/j.ecolecon.2010.04.005

Lewandowski S (2017) Corporate carbon and financial performance: the role of emission reductions. Bus Strateg Environ 26:1196–1211. https://doi.org/10.1002/bse.1978

Li B, Li C, Wu Z (2018) Ownership structure in Japanese banking industry: evolution and effects. Financ Res Lett 25:154–159. https://doi.org/10.1016/j.frl.2017.10.020

Linares-Rodríguez MC, Gambetta N, García-Benau MA (2022) Carbon management strategy effects on the disclosure and efficiency of carbon emissions: a study of Colombian companies’ context and inherent characteristics. J Clean Prod 365:132850. https://doi.org/10.1016/j.jclepro.2022.132850

Lo F-Y, Liao P-C (2021) Rethinking financial performance and corporate sustainability: perspectives on resources and strategies. Technol Forecast Soc Chang 162:120346. https://doi.org/10.1016/j.techfore.2020.120346

Mena C, Humphries A, Choi TY (2013) Toward a theory of multi-tier supply chain management. J Supply Chain Manag 49:58–77. https://doi.org/10.1111/jscm.12003

Millar RJ, Hepburn C, Beddington J, Allen MR (2018) Principles to guide investment towards a stable climate. Nat Clim Change 8:2–4. https://doi.org/10.1038/s41558-017-0042-4

Minx JC, Wiedmann T, Wood R et al (2009) Input–output analysis and carbon footprinting: an overview of applications. Econ Syst Res 21:187–216. https://doi.org/10.1080/09535310903541298

Mitsui & Co (2022) Sustainability Report 2023—MITSUI & CO., LTD. In: Sustainability Report 2023 - MITSUI & CO., LTD. https://www.mitsui.com/jp/en/sustainability/sustainabilityreport/2023/index.html. Accessed 13 Dec 2023

Newman M (2018) Networks. Oxford University Press

Page L, Brin S, Motwani R, Winograd T (1999) The PageRank citation ranking: bringing order to the web

Patchell J (2018) Can the implications of the GHG Protocol’s scope 3 standard be realized? J Clean Prod 185:941–958. https://doi.org/10.1016/j.jclepro.2018.03.003

Perrault Crawford E, Clark Williams C (2010) Should corporate social reporting be voluntary or mandatory? Evidence from the banking sector in France and the United States. Corporate Governa Int J Bus Soc 10:512–526. https://doi.org/10.1108/14720701011069722

Popescu I-S, Hitaj C, Benetto E (2021) Measuring the sustainability of investment funds: a critical review of methods and frameworks in sustainable finance. J Clean Prod 314:128016. https://doi.org/10.1016/j.jclepro.2021.128016

Popescu I-S, Gibon T, Hitaj C et al (2023) Are SRI funds financing carbon emissions? An input-output life cycle assessment of investment funds. Ecol Econ 212:107918. https://doi.org/10.1016/j.ecolecon.2023.107918

GHG Protocol (2013) Technical guidance for calculating scope 3 Emissions. Greenhouse Gas Protocol

GHG Protocol (2015) A corporate accounting and reporting standard, revised edition. Greenhouse gas protocol

Shahzad SJH, Hernandez JA, Rehman MU et al (2018) A global network topology of stock markets: transmitters and receivers of spillover effects. Physica A 492:2136–2153. https://doi.org/10.1016/j.physa.2017.11.132

Shinkle GA, Suchard J-A (2019) Innovation in newly public firms: the influence of government grants, venture capital, and private equity. Aust J Manag 44:248–281. https://doi.org/10.1177/0312896218802611

Shrimali G (2022) Scope 3 emissions: measurement and management. The Journal of Impact and ESG Investing. pp 31–54

Smith ST, Kao EK, Mackin ED et al (2021) Automatic detection of influential actors in disinformation networks. Proc Natl Acad Sci 118:e2011216118. https://doi.org/10.1073/pnas.2011216118

Swinkels L, Markwat T (2023) Corporate carbon emissions data for equity and bond portfolios. Manag Finance. https://doi.org/10.1108/MF-02-2023-0077. (Ahead-of-Print)

Tang S, Demeritt D (2018) Climate change and mandatory carbon reporting: impacts on business process and performance. Bus Strateg Environ 27:437–455. https://doi.org/10.1002/bse.1985

TCFD (2021) Guidance on metrics, targets, and transition plans. taskforce on climate-related financial disclosures

Tekušová T, Kohlhammer J (2008) Visual analysis and exploration of complex corporate shareholder networks. In: Visualization and Data Analysis 2008. SPIE, pp 152–161

The Ministry of Environment of Japan (2015) Supply Chain Emissions in Japan. Climate Change Policy Division, Global Environment Bureau

The Ministry of Environment of Japan (2022) Japan’s National Greenhouse Gas Emissions in Fiscal Year 2020 (Final Figures). In: Press Release. https://www.env.go.jp/en/headline/2599.html. Accessed 25 Apr 2023

The Ministry of Environment of Japan (2023) Greenhouse Gas Emissions Calculation, Reporting, and Publication System. In: Ministry of the Environment Tally Results. https://ghg-santeikohyo.env.go.jp/result. Accessed 30 Apr 2023

Toyo Keizai Major Shareholders Database (2023) In: Toyo Keizai Data Services. https://biz.toyokeizai.net/en/data/service/detail/id=862&academic=1. Accessed 30 Apr 2023

Watanabel N, Yamauchi S, Sakawa H (2022) The board structure and performance in IPO firms: evidence from stakeholder-oriented corporate governance. Sustainability 14:8078. https://doi.org/10.3390/su14138078

Wilhelm M, Blome C, Wieck E, Xiao CY (2016a) Implementing sustainability in multi-tier supply chains: Strategies and contingencies in managing sub-suppliers. Int J Prod Econ 182:196–212. https://doi.org/10.1016/j.ijpe.2016.08.006

Wilhelm MM, Blome C, Bhakoo V, Paulraj A (2016b) Sustainability in multi-tier supply chains: understanding the double agency role of the first-tier supplier. J Oper Manag 41:42–60. https://doi.org/10.1016/j.jom.2015.11.001

Yoshida K, Iino Y, Managi S (2022) Do Japanese keiretsu promote better CSR activities? Econ Anal Policy 76:452–475. https://doi.org/10.1016/j.eap.2022.08.018

Acknowledgements

This work was supported by JSPS KAKENHI Grant Number JP21H00740. We thank Maria Okumura for her help in data cleansing and Ranjit Gupta for insightful discussions.

Funding

Open Access funding provided by The University of Tokyo. This work was supported by JSPS KAKENHI Grant Number JP21H00740.

Author information

Authors and Affiliations

Contributions

YK and CM designed research. CM and YK performed research. CM contributed analytic tools. CM and YK analyzed data. and CM and YK wrote the paper.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Handled by Xianbing Liu, Institute for Global Environment Strategies, Japan.

Appendices

Appendix

Selection of centrality measure

We assessed seven measures of network centrality to understand how they affect the distribution of carbon emissions across the shareholder network and their ability to detect influential firms. The selected centralities are among the most used metrics in complex network analysis and their definitions and applications are well-developed (Newman 2018).

Degree centrality: refers to the number of connections of a node in a network. In this research, we focus on the in-degree centrality, which is the count of incoming links from the carbon responsibility network.

where \({a}_{ij}=1\) when j points to i and zero otherwise. \({a}_{ij}\) refers to each possible intersection of pair of nodes in the adjacency matrix, \(A\), of the network.

Closeness centrality: focuses on how close a node is to all other nodes in the network, rather than just counting the number of incoming connections. It is measured as the average length of the shortest path between a node and the rest of the nodes.

where \(N\) is the number of nodes in the network, and d is the length of the shortest path between nodes i and j.

Harmonic centrality: is a special case of closeness centrality that better handles disconnected networks by assigning a weight of zero when there is no path between two nodes. Formally defined as the sum of reciprocal of distances between nodes.

Betweenness centrality: measures the number of times a node acts as a bridge along the shortest path between the other pairs of nodes. It is useful to assess the influence of a node in communication networks.

where \(D(s,t)\) is the number of shortest paths between nodes s and t. and \({D}_{i}(s,t)\) is the number of those paths where i appears.

Eigenvector centrality: this centrality measure considers not just how many connections a node has, but also the quality or importance of these connections. For example, being connected to a highly influential firm is more significant than being connected to several less influential firms. In this context, a node (firm) with few connections could still have high eigenvector centrality if those connections are with highly influential nodes. The "eigenvector" part of the name comes from a mathematical method used in its calculation. In essence, each node’s centrality is proportional to the sum of the centralities of the nodes it is connected to. This creates a recursive relationship where the importance of a node depends on the importance of its neighbors (Newman 2018). The Eigen centrality of node I is defined as:

where \(j\to i\) is the set of neighbors of \(i\) and \(\lambda\) is a positive constant, being the largest eigen value for the adjacency matrix of the network, \(A\). The equation is commonly written in its vector form.

where \(x\) is the eigen centralities of the nodes, as a vector.

The centrality scores are determined through an iterative process, eventually converging to the eigenvector \(x\) associated with the largest eigenvalue \(\lambda\) of the network’s adjacency matrix.

PageRank: Is a special case of eigenvector centrality where emphasis is placed on the incoming links.

where \(\alpha\) is a dumping factor set to 0.85 (Brin and Page 1998), and \(L(j)\) is the outbound links of j. As with Eigen centrality, PageRank is computed iteratively, where values at the first iteration are uniformly distributed across nodes and sum 1.

Kleinberg centrality: also known as the HITS algorithm is another variation of the eigen vector centralities appropriate for directed network. HITS stands for Hyperlink-Induced Topic Search; Like PageRank, it was first developed to assess the relevance of pages on the internet. However, Kleinberg centrality seeks to also give a higher relevance score to nodes with outward connections to other relevant nodes in the network, not only to those receiving as PageRank does (Kleinberg 1999). In the vector form it is defined as:

where \(A\) is the Adjacency matrix of the network and \(x\) is the eigenvector corresponding to the largest eigne value λ, as in the Eigen centrality.

All measurements where normalized and the weight of edges set as the proportion of emissions based on the percentage of ownership.

In this paper, we assigned carbon responsibility to each firm based on the normalized centrality score. Each centrality measure ranks and scores firms differently which directly impacts who in the network should bear more responsibility for the emissions of the system. For example, a poor ranking measure could assign a very high score to a single firm while the rest remain low. Conversely, a scoring measure that allocates carbon linearly may end up assigning undeservedly high emissions to smaller firms of little influence. Figure 6 shows the carbon allocation pattern in the shareholder network of publicly traded Japanese firms. In this figure, the x-axis represents the firms sorted from the highest score for that centrality, and the y-axis is the cumulative proportion of emissions assigned to the firms. It can be seen that both Kleinberg and Eigenvector centralities give the highest scores to the very few firms at the top of the ranking, and thus these very few end up bearing most of the responsibility for the emissions. Closeness and betweenness centralities show a smoother pattern where around the top 500 firms would be assigned almost the total emissions in the network. The rest of the centralities have a larger distributional effect across the firms.

We then evaluate the extent that centrality measures can locate influential firms by assigning them a higher score so that top-ranked firms are influential. Research in multi-tier supply chains suggests that firms can exert influence for sustainable transformation to other firms in the value chain (Wilhelm et al. 2016b). The necessary assumption is that the firms are connected through relationships across the supply chain. In the context of complex networks, a firm can only influence other firms in the same component, as there must be a connecting path from firm A to firm B. Here, we use a node deletion approach to test the influence of firms. When non-influential firms are removed from the network, there will still be a path connecting the remaining firms. On the contrary, removing influential firms would destroy paths across firms creating separate components (Albert et al. 2000). Figure 7 shows the results for the targeted deletion of firms one by one from the highest scoring in each centrality. The x-axis represents the top 500 firms for each centrality, and the y-axis is the number of components resulting from deleting those firms. Both DegreeFootnote 1 and PageRank sort firms in a way that their deletion would quickly decompose the network into smaller components and thus the reach of the influence of remaining firms gets shorter. Meaning that those firms at the top play an important role in connecting the whole network.

We then show the correlation between these centralities, scope 1 & 2 emissions, and the market value of the firms in the network in Fig. 8. Degree, PageRank, Harmonic, and Eigen centralities are positively correlated, with PageRank and Eigen being the largest correlated pair. Except for Kleinberg, centralities do not correlate with scope 1 & 2 emissions. Kleinberg, by definition, seeks to give a high score to both sinks and sources in a directed network (Kleinberg 1999). This being a network of carbon emission flow with some firms being large sources of emissions it is expected that Kleinberg centrality would surface these sources as relevant. However, our interest is to detect influential firms whose investments make them great receivers of carbon inflow. Additionally, a high correlation to scope 1 & 2 emissions just keeps signaling firms for which their high levels of emissions are already known. Finally, PageRank and Eigen centralities correlate to the market value.

In conclusion, our assessment points to PageRank as the appropriate indicator to measure firms’ influence in the shareholder network of Japanese firms. PageRank is among the three with better carbon distributional effects, and one of the best-ranking firms based on their structural influence in the network. Finally, PageRank is the second largest correlated to market value. We deem this to be a relevant factor for selection given that, in practice, we can expect that larger firms can exert more influence over their value chain (Hofstetter 2018). Although Eigenvector centrality is the highest in this regard, its poor distributional effect makes it not a suitable metric.

Firms with the largest GHG emissions

Carbon footprint responsibility is usually attributed to firms with the largest footprint in the supply chain. Table 3 lists the publicly traded firms with the largest footprint in the Japanese investment network. Only Kajima Corp. and Nippon Steel also appear as firms with the largest i-scope 3 (Table 1). This signals a qualitative disjoint between the firms known as larger emitters and those whose responsibility arises due to their investments.

Although the distinction between direct emitters and those based on investments is clear at the firm level, the distinction may be more subtle at the corporate level. For example, Mitsubishi Corporation and Mitsubishi Estate are firms among the largest i-scope 3 emissions as indicated in Table 1, while Mitsubishi Materials is so on direct carbon emissions, all firms of the Mitsubishi Group. Similarly, the conglomerates of Mitsui and Sumitomo have firms either identified with large direct or investment-derived emissions. These tightly connected conglomerates, known as keiretsu in the Japanese context, are known to be resilient due to their highly diversified portfolio of firms (Lo and Liao 2021). In particular, the horizontal keiretsu, a structure where a bank is placed at the center orchestrating the relationship among the firms, is associated with sustainable growth (Watanabel et al. 2022) and profit stability (Brouthers et al. 2014). These are positive characteristics in terms of corporate performance but may pose a challenge in terms of sustainability policies, given that keiretsu are resilient to external changes. On the one hand, firms in the keiretsu may be reticent to integrate and report GHG emissions beyond the mandatory schemes given that continued operations are granted within the conglomerate that supports them, on the other hand, adopting greener practices and improved reporting can disseminate quickly across firms in the same group once the orchestrating firms adopt such greener practices. Which of these approaches is currently taken by the keiretsu is a question that remains open. However, initial evidence points to Japanese keiretsu engaging in Corporate Social Responsibility activities in general (Yoshida et al. 2022), but more research is necessary for the case of GHG emission reporting specifically.

Investment networks, as presented in this article, offer the opportunity to identify keiretsu-like structures, not only within the Japanese context but also internationally. Complex networks can be partitioned into clusters of highly connected nodes (Newman 2018). In a network of international crossholdings, clusters of firms from different industries having banks with high centrality scores would be akin to horizontal keiretsu. Direct and investment-derived emissions at the firm and corporate levels can then be computed. We consider these approaches as avenues for future research.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mejia, C., Kajikawa, Y. Estimating scope 3 greenhouse gas emissions through the shareholder network of publicly traded firms. Sustain Sci (2024). https://doi.org/10.1007/s11625-023-01460-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11625-023-01460-8