Abstract

Why do some developing countries obtain more official finance from China vis-a-vis Western sources? This study finds borrower transparency significantly affects which governments borrow more from China. From a supply side perspective, Chinese lending agencies have incentives to lend more to untransparent borrowers. From a demand side perspective, untransparent borrowers have incentives to use Chinese finance to avoid Western pressure to become more transparent. These findings and explanations have three implications. First, they help explain variation in external debt composition across developing countries using official credit. Second, they have implications for the international political economy of developing countries’ financial ties to China. Third, they imply the use of Chinese finance may allow untransparent governments to remain so, an important implication for the political economy of development.

Similar content being viewed by others

1 Introduction

Why do developing countries receive different amounts of official Chinese finance?Footnote 1 Most studies emphasize China’s political and economic interests in explaining credit allocation.Footnote 2 Less clear is the effect of borrower institutions. Some evidence suggests democratic governance does not systematically affect Chinese flows (Broich, 2017; Bunte, 2019). Others find Chinese finance increases local corruption over time (Brazys et al., 2017; Isaksson & Kotsadam, 2018a), but not the extent to which such borrower institutional characteristics determine Chinese flows in the first place.

This study adds borrower transparency to this literature. It finds less-transparent developing countries obtain more Chinese than Western official credit. A correlation between lack of borrower transparency and increased Chinese finance has two plausible explanations. One is a supply side explanation, where China prefers lending to less-transparent countries because this helps its lending practices avoid unwanted scrutiny. The other is a demand side explanation, where less-transparent borrowers use China to avoid Western creditors that condition finance on increased borrower transparency, which would expose elites in untransparent countries to political risk.

A relationship between borrower government transparency and shares of Chinese vis-à-vis Western finance has several implications. Most narrowly, it adds to literature on the structure of developing country sovereign debt. More broadly, insofar as borrower transparency helps explain the relative size of a country’s financial obligations to China, this has wide-ranging implications for understanding how multipolarity and diversity in the global financial system affect both international political economy (IPE) and development.

First, recent studies highlight political reasons that developing country sovereigns obtain credit from different sources (Ballard-Rosa et al., 2021a), including markets and official creditors (Bunte, 2019; Cormier, 2022b; Zeitz, 2021b). In the official credit context, the rise of Chinese lending has been a major source of variation in the creditors used by developing country governments to fund projects and spending (Humphrey & Michaelowa, 2013, 2019; Morris et al., 2020; Prizzon et al., 2017). Some estimations suggest Chinese flows have become larger than Western flows (Horn et al., 2021). But questions remain about why countries obtain more or less Chinese vis-à-vis Western finance. While many focus on China’s strategic foreign policy and economic interests in explaining this variation (Dreher et al., 2018; Kaplan, 2021), this study adds borrower transparency to our understanding of why countries get more or less credit from, and thus come to owe more or less to, China rather than Western creditors.

Second and relatedly, this implies less-transparent developing countries are likely to have closer financial ties to China. Recent studies show Chinese and Western official credit prices are similarly sub-market (Morris et al., 2020) and affect domestic economic groups in similar ways (Isaksson & Kotsadam, 2018b; Kaplan, 2021: Chapter 3) despite differences in fiscal policy conditionality (Kaplan, 2021). Such similarities underpin claims that China’s aid “is not special” compared to the “political, economic and humanitarian interests in aid allocation by the so-called ‘traditional’ Western donors… China differs in the detailed content” of its lending practices (Fuchs & Rudyak, 2019: 394). Western emphasis on, and China’s explicit de-emphasis on, transparency in their own practices as well as in a borrower is one such point of detailed differentiation between Western and Chinese finance. By affecting variation in official financial flows, transparency in turn affects the strength of developing countries’ financial ties to China vis-à-vis the West.

Lastly, this implies less-transparent developing countries are able to avoid Western pressure to become more transparent by relying on Chinese finance. In this sense, the study follows suggestions that what “deserves more attention” are “the effects of China’s development footprint on development outcomes other than economic growth” (Fuchs & Rudyak, 2019: 405). By identifying that (lack of) transparency helps determine when borrowers are likely to obtain more or less Chinese finance, the study is an example of ways in which implications of Chinese aid lie at the local as well as the international level. That untransparent countries can remain so by using Chinese finance has ramifications for transparency in a country, with implications for a borrower’s domestic politics, institutions, and economic development (Boix et al., 2003; Cormier, 2022a; Hollyer et al., 2011, 2014).

In sum, the study finds untransparent borrowers obtain more Chinese than Western credit. It argues this makes theoretical sense from both supply and demand perspectives, helping explain variation in official credit flows and external debt structure in developing countries. This has implications for IPE questions about financial ties between developing countries and China in a multipolar world. This also has implications for the political economy of development, highlighting how sources of credit have varied effects on transparency in borrowers.

The paper is organized as follows. The next section reviews how official Chinese finance compares and contrasts with official Western finance. The third section highlights that despite some broad similarities, an explicit and persistent difference between Western and Chinese finance is the degree to which these official lenders are transparent themselves, as well as the degree to which they pressure borrowers to enhance transparency as part of good governance reforms. The fourth section theorizes how this incentivizes less-transparent borrowers to obtain more Chinese finance, from both creditor and borrower perspectives. The fifth section presents robust empirical evidence in support of the theory. The conclusion discusses implications.

2 The official credit landscape

Official credit flows have been explained by focusing on both lender and borrower preferences. Many studies focus on allocation by lenders, theorizing that variation in flows is determined by their interests. Other studies focus on borrowers, using the proliferation of financing options available to developing countries as reason to ask why they may prioritize use of some creditors over others. This section summarizes these perspectives then characterizes how Chinese finance compares and contrasts to Western finance across these perspectives. This sets up the third section, which discusses how across the different perspectives, a key yet under-analyzed difference between Western and Chinese official creditors is their respective emphasis on transparency. This gives reason to expect that borrower transparency impacts official credit flows regardless of perspective.

2.1 Supply and demand of official credit

A vast literature identifies how official credit allocation reflects the strategic interests of both bilateral (Alesina & Dollar, 2000; Dreher et al., 2011) and multilateral lenders (Clark & Dolan, 2021; Dreher et al., 2015; Fleck & Kilby, 2006; Kilby, 2011; Lim & Vreeland, 2013; Lyne et al., 2009; Stone, 2011). Bilaterals lend to advance national political and economic interests while multilaterals lend within constraints set by powerful principals that ensure the institutions lend according to their interests. Even insofar as Western aid allocation may be determined by concern for socio-economic development outcomes rather than strategic interests, theory remains driven by the supply side as lenders are seen to analyze “recipient country governance when making aid allocation decisions” (Winters & Martinez, 2015: 516).

Meanwhile, the number of official creditors around the world has proliferated over time. While implications of proliferation are debated (for a discussion see Gehring et al., 2017),Footnote 3 one clear consequence is that developing countries can increasingly “shop” among various creditors (Bunte, 2019; Clark, 2022; Cormier, 2022b; Humphrey & Michaelowa, 2013; Zeitz, 2021b). This “age of choice” has increased borrower autonomy, meaning official credit flows are not strictly about top-down allocation decisions by strategic donors (Prizzon et al., 2017). Borrowers have some space to choose preferred creditors based on the implications of each creditor’s lending processes and requirements, such as expected negotiation delays before loan approval, technical expertise, conditionalities, or post-project monitoring, making “the role of demand” central to the IPE of official finance (Humphrey & Michaelowa, 2013: 143).

2.2 Chinese finance

This means both supply and demand determine official financial flows, including Chinese flows. On the lender or supply side, strategic foreign policy and economic interests shape the country’s “allocation of concessional finance” (Dreher et al., 2018: 184). In Latin America, for example, China advances its commercial interests with “patient” finance that does not include fiscal policy conditions in order to be attractive to, and gain influence with, borrowing governments (Kaplan, 2021). This is why as China’s lending volume increases, many observers suspect China uses aid to gain alliances and increase its international political power vis-à-vis the West (see discussion in Drezner, 2009; Halper, 2010).

But recent work suggests that such implications for international relations, where credit is used to create a Chinese “sphere of influence” (Ibrahim, 2020), are not systematically evident. China appears “no more self-interested than their Western counterparts” (Dreher et al., 2018: 2), pushing back on concerns that China’s “rogue aid” undermines development (Naim, 2007): Chinese rates do not undercut Western rates (Morris et al., 2020); Chinese credit to African countries correlates-to rather than crowds-out Western credit (Humphrey & Michaelowa, 2019) and the World Bank emulates Chinese projects in these contexts (Zeitz, 2021a); while China does not include fiscal policy conditions, other conditionalities have constraining effects on borrowers that are similar to the West (Kaplan, 2021: Chapter 3); the content of World Bank loan conditions does not systematically change when China is also lending to the country (Cormier & Manger, 2021), even if the number of conditions may (Hernandez, 2017). Together, empirical studies of Chinese credit allocation do not see Chinese interests as wholly different than Western interests, arriving “at more conditional conclusions” (Dreher et al., 2018: 183). This may be why Western creditors do not claim that their bargaining power has been weakened as Chinese lending increases (Swedlund, 2017a).

On the borrower or demand side, recent work has begun to consider the conditions under which governments prefer Chinese credit. One argument is that borrowers use more Chinese credit when they are governed by industry and labor political coalitions, reasoning that China’s tendency to fund infrastructure projects benefits these groups (Bunte, 2019). Some surveys find that when lending is for infrastructure, borrowers indeed prefer Chinese over Western funds (Swedlund, 2017a). Yet other research finds that Chinese loans are not so agreeable to these domestic groups. In a fashion similar to Western bilaterals (Bunte, 2019: 39), Chinese finance is conditional on market access for its firms (Dreher et al., 2018: 9; Kaplan, 2021: Chapter 3) and, often, on use of Chinese labor (Huang et al., 2018: 33, 243, 251; Mattlin & Nojonen, 2015). Both forms of conditionality make domestic labor and industry worse off in areas receiving Chinese funds (Isaksson & Kotsadam, 2018b) with benefits accruing to elites that support Chinese firm entry (Isaksson & Kotsadam, 2018a). Such “elite kickback” schemes reduce the gains local non-elites obtain from Chinese loans and related projects (Kern & Reinsberg, 2021). This is why “China has [been] met with difficulty in cultivating a positive image among publics — as opposed to among governing elites” in borrowers (Thornton, 2020: 4), explaining why industry and labor-based governments may seek to avoid Western and Chinese official credit altogether (Cormier, 2022b). Yet despite such varied implications for domestic political-economic groups, there is no systematic evidence that democracies (where such labor groups may have more political voice) borrow less from China than autocracies (Broich, 2017; Bunte, 2019).

This leaves muddled the question of why some countries obtain more or less Chinese finance vis-à-vis Western official finance. There is recognition that both supply and demand forces likely underpin variation in these flows. But on the supply side, recent studies emphasize similarities between Western and Chinese credit, pushing back on claims of rogue aid.Footnote 4 On the demand side, there is disagreement on the degree to which, and reasons that, borrowers might prefer Chinese rather than Western finance.

3 Variation in transparency across Chinese and western credit

If motives are not as incompatible as sometimes assumed, differences between Chinese and Western finance do persist “in the detailed content” of lending practices (Fuchs & Rudyak, 2019: 394). One clear, yet understudied, difference between Chinese and Western official creditors is the degree to which they (1) are transparent themselves and (2) seek to enhance transparency in borrowers. This section defines transparency then illustrates the salience of different approaches to transparency across Chinese and Western lenders. This provides context for theorizing why transparency considerations, from both supply and demand perspectives, impact Chinese and Western official credit flows to developing countries.

3.1 Macroeconomic transparency

Government transparency refers to the provision of information to citizens, markets, and other audiences. Of particular interest in the context of financial relationships with external creditors is macroeconomic transparency and dissemination of public financial information (Hollyer et al., 2014: 417). Transparent financial relationships make governments accountable to citizens for their dealings with other states and financial actors, while lack of transparency in this space is associated with corruption, repression, and underdevelopment (Brazys et al., 2017; Isaksson & Kotsadam, 2018a, b). Macroeconomic and public financial transparency varies significantly across developing countries (see International Monetary Fund and World Bank, 2018) and is not simply a matter of regime type (Cormier, 2022a; Hollyer et al., 2014: 417; Hollyer et al., 2019).

Regardless of the roots of variation in government transparency, the political and economic effects of (lack of) transparency are significant. For example, many studies find transparency and corruption are correlated. Corruption is a broader concept, the presence of which may be affected by the transparent provision of data and information by governments (Hollyer et al., 2014: 431; Kolstad & Wiig, 2009). Corrupt practices such as uncompetitive government contract bidding processes, elite rent extraction, or unproductive patrimonial spending is at least partially determined by the degree to which government is transparent. This is why transparency is seen as a possible “medicine” for various forms of corruption (Lindstedt & Naurin, 2010: 302) and transparently providing information about public finances and the macroeconomy is a key component of good governance programs. Other factors also relate to corruption, such as free and fair elections, freedom of the press, corporate social responsibility, and the ability to organize at local levels (Transparency International, 2021: 7–25), but transparency is a key determinant of corruption levels.

3.2 Variation in transparency across official Chinese and western lenders

This means that, insofar as official creditors provide different incentives and pressures for borrowers to increase transparency, the lenders a borrower uses will have implications for the political economy of development. On one hand, Chinese official credit agencies are explicitly and purposely less-transparent about their own lending activities than Western creditors (Grimm, 2011). Chinese bilateral loan contracts contain wide-ranging confidentiality clauses, requiring borrowers to not disclose the conditions, terms, and even existence of loans (Gelpern et al., 2021: Section 3.1). Moreover, China’s bilateral lending is neither “reported to international organizations, nor has Beijing released an official and comprehensive aid database” (Fuchs & Rudyak, 2019: 392), leaving up to 50% of Chinese credit flows hidden (Horn et al., 2021). Extensive “lack of transparency” has led some observers to “assume that the Chinese do not demand proper accounting of funds and worry that the lack of conditions on governance will worsen corruption” in borrowing governments (Brautigam, 2010: 12–13).

Indeed, studies identify ways in which corruption becomes worse in sub-national locations receiving significant Chinese flows (Brazys et al., 2017; Isaksson & Kotsadam, 2018a). Others highlight how untransparent procurement and contracting processes allow China to ensure its official credit is tied to use of Chinese material inputs and labor (Bunte, 2019: 42–43), insulating Chinese firms from competition with local labor as well as national and other foreign firms (Isaksson & Kotsadam, 2018b). Beyond increasing corruption and decreasing competitiveness of local labor and firms, untransparent lending may also provide space for expansion of informal Chinese influence in borrowers, as has been claimed in coverage of untransparent financial agreements between China and African television companies (The Economist, 2018).

This stands in stark contrast to Western creditors, who explicitly emphasize transparency in both their own practices and in their expectations of borrowers. Among themselves, in the same period that untransparent Chinese lending was increasing in volume around the world (see Fig. 1 in Section 5.1.4 below), transparency of lending activities became central to the Western multilateral and bilateral development agenda (OECD, 2011). Numerous initiatives designed to strengthen Western aid transparency subsequently emerged (for example, Moon & Williamson, 2010) and studies find these initiatives often successfully enhance aid coordination and effectiveness (Honig & Weaver, 2019). Transparency has also become a central component of Western aid conditionality, with multilateral and bilateral creditors emphasizing transparency as part of good governance reforms (Best, 2014: 118–25; Clark & Dolan, 2021: 44–45; Cormier & Manger, 2021: Fig. 2; Kentikelenis et al., 2016: 558; World Bank, 2020).

Both China and the West perceive this explicitly different relationship with transparency as a major distinction between one another’s lending activities. China sees lack of transparency as a strategic point of differentiation from Western finance, “arguing that transparency standards regarding financial assistance should be different for South-South cooperation” (Swedlund, 2017b: 161). Indeed, China intentionally “keep[s its] distance from… global partnership[s]” designed to increase aid transparency (Tran, 2012). Meanwhile, Western lenders also use transparency as a key differentiator, but as a value-add proposition rather than something to be avoided. For example, the US-led “Blue Dot” infrastructure lending program is explicitly “aimed at countering China’s Belt and Road Initiative” by “promot[ing] transparency” among other developmental aims (The Economist, 2021).

Moreover, these differences are salient in borrowers and inform perceptions of Western and Chinese financing options. For example, Rwandan president Paul Kagame has criticized the Western development finance regime’s focus on transparency as a tool for “trying to influence [local] decision-making to advance their own interests” and transparency initiatives emphasized by Western creditors are sometimes criticized for negatively affecting aid efficiency and effectiveness (Kimenyi, 2012). In a similar fashion, Tanzanian President John Magufuli prefers Chinese rather than Western finance in large part as a response to the EU and World Bank reconsidering their Tanzanian lending out of concern for Magufuli’s socio-economic policies (BBC, 2018), which includes legislation designed to reduce government transparency and accountability (Harris, 2021). Elsewhere, Cambodian leaders value how Chinese finance is not linked to government “conduct” while China gains military linkages, land claims, and preferred access for its firms in the country, despite negative effects on local labor and resistance from rights groups (The Economist, 2017).

4 Hypothesis: borrower transparency affects Chinese and western credit flows

This makes transparency a key point of differentiation between Chinese and Western official credit, perceived and emphasized by lenders and borrowers alike. On the lender side, China explicitly rejects transparency while Western creditors see transparency as both a strategic and developmental necessity. Both use different relationships to transparency as a distinctive feature of their lending. On the borrower side, developing countries with the autonomy to shop from Chinese and Western options are aware of the transparency implications of using Western or Chinese credit. Using Western credit conditional on becoming more transparent would expose leaders in currently-untransparent countries to political risk, making Chinese credit that is not conditional on increasing transparency beneficial to such governing elites.

For both supply and demand reasons, then, this study hypothesizes that the degree of transparency in a borrower is likely to affect when developing countries obtain relatively more Chinese or Western official credit. This section articulates this hypothesis before testing it empirically.

4.1 Lenders and transparency

China’s lending activities are purposely less transparent than Western creditors: “the Chinese government does not publish any comparable documentation pertaining to its [lending] programs. It is neither surprising nor unprecedented that the organization and management of these programs are less transparent than comparable programs conducted by other countries” (Wolf et al., 2013: 12). Many controversial conditions and effects particular to Chinese official lending practices go beyond economic policy or project conditions and effects associated with Western credit. This makes it plausible that China prefers lending to untransparent governments, insofar as transparent borrowers would increase exposure of such controversial loan conditions and effects (while less-transparent borrowers minimize this risk).

Perhaps primary among these practices is the securing of collateral in case of default. This collateral has included major infrastructure and property assets in a borrower, which are associated with “debt trap diplomacy” critiques among observers and seen as infringing on borrower sovereignty. While negative effects are sometimes over-emphasized (Brautigam, 2019), real-world examples of consequential collateral abound, including Chinese state-owned firms acquiring ports, airports, and resources in the event of default (Behuria, 2018; Brautigam, 2019). In this sense, China would benefit from lending to untransparent countries because “the lack of transparency in China’s lending obscures [the] risks [it presents] to recipient countries, many of which are already vulnerable to or are suffering from financial or fiscal distress” (Green, 2019).

Other effects of Chinese loans are also susceptible to criticism by local and international audiences if and when observed, further incentivizing China’s lending agencies to prioritize untransparent borrowers. In addition to collateral, these include but are not limited to “stealthily expand[ing] China’s military presence” (Thorne & Spevack, 2017: 4; see also Johnson & de Luce, 2018), allowing abusive labor practices in Chinese-run production facilities (Nyathi, 2021), introducing Chinese firms and labor at the expense of local companies and workers (Huang et al., 2018: 33, 243, 251; Mattlin & Nojonen, 2015), increasing corruption (Isaksson & Kotsadam, 2018a), and lending to particularly repressive regimes to which Western creditors suspend aid (The Economist 2017). Lack of transparency, a central feature of Chinese loan contracts (Gelpern et al., 2021), helps China maintain a veneer of “non-interference” despite these conditions and effects (Kalathil, 2018:52).

4.2 Borrowers and transparency

In contrast transparency is central to Western lending, in terms of both coordination efforts among creditors themselves and in the conditions they attach to loans in the name of good governance reforms. This likely changes the calculus among potential borrowers that are untransparent. Because borrowers are subject to a transparency agenda if using Western creditors, untransparent Chinese finance presents a qualitatively different financing option. This is an important point of differentiation for a developing country seeking official credit.

And becoming more transparent, an explicit aim of Western conditionality, is threatening to the public and private elites who benefit from untransparent regimes. Beneficiaries of untransparent regimes will sense that transparency makes them less-well off, as economic rents obtained through opaque or corrupt relationships with the state are likely to become exposed (Williams, 2011). The same idea can be put in terms of clientelist spending, which would become more difficult if and as transparency were to increase (Bobonis et al., 2019). In short, “for those who misuse public office for private gain, transparency increases the risk of exposure and decreases expected returns” (Berliner, 2014: 479). Transparency can bring about economic benefits, for example lower borrowing costs in financial markets (Cormier, 2022a; Kemoe & Zhan, 2018). But such diffuse gains are secondary concerns for political leaders benefitting from an untransparent regime, who will perceive significant risks to their political survival if pressured to become more transparent (see Bueno de Mesquita et al., 2005). This means they are likely to ensure debt managers do not borrow from sources that expose them to such political risk (see Cormier, 2021).

Given significant variation in transparency across developing countries, and the interest untransparent regimes have in resisting external pressure to become more transparent, transparency likely determines borrower preference for Chinese finance. Specifically, less-transparent countries seeking official finance have incentives to use more Chinese credit to meet their borrowing needs. This is because Chinese credit will not expose the borrower to transparent reporting of financial activities by Western creditors, nor will China condition lending on the borrowing government increasing its transparency as part of good governance reforms. Chinese credit will not affect the degree to which a borrower is transparent, a key political benefit for untransparent governments.

This discussion prioritizes two sets of interests to theorize about Chinese vis-à-vis Western flows: China’s interest in untransparent lending, and untransparent borrowers’ interest in avoiding Western transparency conditions. A third explanation could be that Western donors prefer to lend to more-transparent countries. But this is not clear. Much research suggests that Western lenders do not, or only minimally, select borrowers based on institutional characteristics (Clist, 2011; Easterly, 2007). And even if Western conditionality is more lenient for transparent borrowers (Clist et al., 2012; Winters & Martinez, 2015), it does not necessarily follow that Western creditors strategically lend less to untransparent borrowers as this would undermine efforts to improve transparency across potential borrowers. This uncertainty suggests that non-flows from Western lenders are most-likely a function of Chinese interests on the supply side and borrower interests on the demand side, rather than selection by Western lenders.

4.3 Hypothesis

For at least two reasons then, from both supply and demand perspectives, this paper hypothesizes that borrower transparency is likely to determine relative Chinese and Western official financial flows:

-

H1: Less-transparent governments are likely to obtain more Chinese vis-a-vis Western official credit.

5 Empirical analysis

5.1 Data

Do less-transparent borrowers obtain relatively more Chinese finance? A panel of developing countries’ borrowings from official creditors allows a test of this hypothesis. This section describes dependent variables (DVs) used in the main analysis and robustness tests, the explanatory variable for government transparency, and the set of variables used to control for other factors that likely determine Chinese and Western financial flows.

5.1.1 Dependent variables

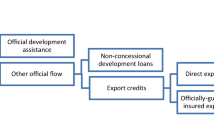

For data on official Chinese lending, we use AidData’s Global Chinese Official Finance Dataset (Dreher et al., 2022). The data is available for 2000–2017 and captures annual financial commitments, the loan amounts agreed-to between a borrower and China’s bilateral financing agencies each year. We are interested in any official bilateral finance from China, what AidData refers to as “all flow classes.” This includes both Official Development Assistance (ODA) and Other Official Flows (OOF) types of flows.

Both categories of Chinese finance are less-transparent than their Western counterparts. So if H1 is correct, all types of official Chinese finance should be subject to our hypothesis. The amount of annual lending commitments from China is the variable ChnFinance. However there are important differences between these types of lows, particularly with respect to finance that meets the criteria of OECD Development Assistance Committee (DAC) ODA flows (Dreher et al., 2018). We accordingly also create a ChnODA variable that includes only finance coded by AidData as “ODA-like.”

For non-Chinese lending, we first draw on the World Bank’s International Debt Statistics (IDS). For the twin international financial institutions we collect the World Bank’s annual IDA and IBRD commitments as well as IMF drawings. For major regional development banks we collect Inter-American Development Bank (IADB), Asian Development Bank (ADB), and African Development Bank (AfDB) annual commitments. The IDS also has data on bilateral flows to developing countries. We first select bilateral flows from all countries except China. The sum of IFI, regional, and all non-Chinese bilateral flows is NonChnFinance. We secondly select only bilateral flows from OECD countries (OECDbilateral). The sum of IFI, regional, and OECD-only bilateral flows is WestFinance.Footnote 5

Four DVs are used in the analysis, capturing in different ways the degree to which a borrower obtains more or less Chinese finance vis-a-vis other official sources, particularly more or less Chinese finance vis-à-vis Western official finance, each year.

The first DV captures all annual official borrowings by countries from China vis-à-vis all other official creditors, testing the hypothesis against all official credit sources:

The second DV is the same but removes IMF drawings from the denominator, ensuring last resort lending is not driving findings:

The third DV includes bilateral flows from only OECD countries. This removes bilateral sources such as the Gulf states or emerging markets whose lending may not require the same transparency conditions as Western multilateral, regional, and bilateral sources. IMF last-resort lending is also removed:

The fourth DV strictly includes bilateral flows from OECD members. This tests the argument in the narrower bilateral-only context:

5.1.2 Explanatory variable

To capture transparency, we use Hollyer, Rosendorff, and Vreeland’s (HRV) government transparency index (Transparency). The HRV index measures a “government’s collection and dissemination of aggregate economic data” (Hollyer et al., 2014:413). HRV’s measure thus reflects this study’s theory and hypothesis more than measures of political rights and freedoms, freedom of the press, freedom of information laws, or vague quality-of-bureaucracy measures. The degree to which a government currently does or does not transparently provide details on public finances and other economic information is the type of transparency that we expect to influence Chinese vis-à-vis Western financial flows. If a government is relatively untransparent by HRV’s definition, we expect them to obtain more Chinese credit to avoid Western creditors that emphasize transparency in their lending.

The HRV index is available up to 2010. In half of the models below, we rely on these raw values. In the other half of the models, we impute post-2010 HRV values to maximize use of AidData’s data coverage (which extends to 2017). We use predictive mean matching for this imputation, estimating 10 predictions using the control variables below then averaging those 10 predictions. See Section 5.3.2 for results and discussion.

In addition to mean-based imputation methods, we also construct alternative transparency measures for robustness. This includes using other transparency-related indexes as well as re-estimating the entire HRV index so it includes post-2010 years. These robustness tests are detailed with their estimation results in Section 5.4 and respective appendices.

To preview results, the relationship between untransparent governments and Chinese finance identified below persists across DVs and regardless of whether using strictly raw HRV values or various imputation methods.

5.1.3 Control variables

A collection of variables control for other factors that might shape use or avoidance of Chinese finance vis-à-vis Western finance. General macroeconomic variables include GDPpcap and GDPgrowth. The size and health of an economy may affect use of official creditors in a variety of ways. SovDebtCrisis controls for the degree to which a government’s borrowings are shaped by the need for last resort lending (Laeven & Valencia, 2012). We also include a dummy for whether the country issued a foreign-denominated long-term sovereign bond that year (BondDummy). Bond market use should decrease the amount of official borrowing a country pursues overall, which may affect the degree to which a country uses Chinese or Western credit. We code this using replication data from Ballard-Rosa, Mosley, and Wellhausen’s study of foreign-denominated government bond issues (2021b).

We control for creditors’ strategic interests and a borrower’s political-economic ties to creditors in a variety of ways. Using the IMF’s Direction of Trade Statistics database, we control for the logged volume of a borrower’s exports to China (ln_ExpsToChn) as well as the logged volume of a borrower’s imports from China (ln_ImpsFromChn). Deeper trade and value chain relationships between a borrower and China may lead the borrower to obtain more Chinese aid. A dummy variable codes whether the borrower is currently or has previously been party to a formal trade agreement with China (PTAwChn), coded using the DESTA database (Dür et al., 2014). Formal trade agreements with China may increase Chinese credit flows through a variety of formal and informal mechanisms. OilDummy captures whether a country is an oil producer, controlling for claims that China lends more to countries with natural resources (same approach and data as Dreher et al., 2018: 187). Another dummy codes whether a borrower recognizes Taiwan (Dreher et al., 2022; Rich, 2011), as this should reduce or even eliminate Chinese aid flows (Dreher et al., 2018). Lastly, we control for the borrower’s political ties to the United States (agreeUS), coded via the borrower’s degree of alignment with the US in United Nations General Assembly voting (Bailey et al., 2017), which has been shown to affect Western-led multilateral lending (Clark & Dolan, 2021; Dreher et al., 2015; Kilby, 2009). To the extent this is the case, this would affect the degree to which borrowers obtain more Western credit and, in turn, more or less Chinese credit.

Another set of controls account for factors that should be partialed out as independent effects on borrowing to ensure the Transparency variable is not picking up the effects of other closely-associated governance characteristics. To this end we include Democracy using the Varieties of Democracy continuous liberal democracy measure (Coppedge et al. 2016). This ensures our explanatory variable of interest is not reflecting more-general regime type effects. We also include the Varieties of Democracy Corruption measure to control for the extent to which political office holders in a country are known to use office for personal gain. As discussed in previous sections, this is important for ensuring our Transparency variable hones-in on macroeconomic and public financial data disclosure, and is not reflecting the broader concept of the degree to which a government is generally corrupt.

A last set of controls account for arguments about borrower preferences. This includes average tariff rates on all products, from the WDI (TariffRate). A prominent argument is that when industry is politically powerful in a country, the country is likely to prefer Chinese credit. To the extent that “the political strength of industry increases as economic actors use more domestic rather than foreign, inputs” (Bunte, 2019: 171), higher values of TariffRate should lead to more Chinese flows. There are extensive gaps in the WDI’s data, so we impute missing values using predictive mean matching. We also include government ideology using the Database of Political Institutions (Beck et al., 2001), coding a government as 1 if Left and 0 otherwise, reflecting other arguments about borrowing preferences (Cormier, 2022b) (Table 1).

5.1.4 AidData’s Chinese lending data over time

Figure 1 plots the general rise in Chinese lending as a share of borrowing countries’ incoming official financial flows over time. That China has in practice been lending more over time is widely acknowledged (Horn et al., 2021), but the nature of data collection does give rise to potential bias in using AidData. Specifically, it is likely that we have less information from less transparent borrowers. For purposes of this study, this bias would bias the estimations below against H1. If more transparent borrowers provided more information to AidData, we would find transparency associated with more Chinese finance, simply as a function of having more data from transparent borrowers. Yet previewing the findings, we still find robust evidence in support of H1 despite this likely bias in the data against H1.

5.2 Models

Complete cases of these variables leave a panel with observations for 55 developing countries. The appendixFootnote 6 lists these countries. With this data, we estimate models that account for (1) fractional DVs, (2) a slowly-moving institutional explanatory variable that would be cannibalized by unitary fixed effects, (3) the possibility that unit effects are nested within and cluster around higher-order units, and (4) joint determination.

First, the DVs are fractions, so we use probit models. Second, bounded DVs preclude use of unit fixed effects due to the incidental parameter problem given a short panel and non-linear DV (Greene, 2004). Moreover, the explanatory variable of interest is an institutional measure that changes only slowly, if at all, within countries over the timeframe of the sample. This means unit fixed effects would both bias the estimations and cannibalize the relationship we are trying to identify.

For both reasons we avoid unit fixed effects in this study. We instead use standard errors robust to unit-clustering and use between-unit Random Effects (REs) (see Plümper & Troeger, 2019). This allows us to recover estimations that account for differences in Transparency between units, the aim of the study, but of course does not eliminate the possibility that Transparency’s effect on borrowing across countries is in truth explained by common omitted factors, a standard limitation to causal inference in quantitative studies of institutional effects (see Manger & Sattler, 2020: 645).

A third concern is that unit effects on borrowing may be nested within or cluster around higher-order unit effects. As doctor effects are nested within and cluster on higher-order hospital effects, Western and Chinese credit flows may cluster around higher-order international political relationships. For example, given extensive research on the topic, it is plausible that US allies, indicated by agreeUS, may most-appropriately be seen as a type of unit rather than simply a control variable. Not accounting for clustering of effects around this unit type may overestimate the effect of Transparency on borrowing outcomes. Nested hierarchical models, also known as mixed effect or multilevel models, account for such multilevel unit clustering (Gelman & Hill, 2007). Hierarchical models below nest country REs within higher-level groups of political alignment with the US.Footnote 7

A lagged DV is included, accounting for habitual borrowing. Year effects are also included. Reverse causality is not a concern here in the sense that we theorize from the supply side that more Chinese aid is likely flowing into untransparent governments. However, simultaneity bias from joint determination may be a concern. It is also possible that some time to negotiate loans must be accounted for, meaning Transparency in year t may have some effect on flows in year t + 1. For both reasons, we lag transparency by one year in the main specifications. This leaves the following probit equation as the primary point of inference:

5.3 Results

We begin with two tables of fractional probit models using the four DVs above. We first estimate models of these four DVs using only HRV’s raw Transparency values (Table 2). We secondly estimate models of these four DVs using imputed HRV Transparency values to extend the dataset to 2017 (Table 3). We plot predicted marginal effects of Transparency, adjusted across observed values of Transparency in the sample (Figs. 2 and 3). We thirdly estimate hierarchical models using all DVs and using both raw and imputed Transparency values (Table 4). We then plot average marginal effects of Transparency across these models (Fig. 4).

All results lend robust support to H1. A less-transparent borrowing country is likely to obtain more Chinese finance, and in turn relatively less Western finance, to meet its official financing needs. Recall that larger values of Transparency, using the HRV index, indicate a government is more transparent. This means evidence in favor of H1 would be a negative relationship between Transparency and the various DVs.

5.3.1 Baseline models

Table 2 probit models use all four DVs and strictly raw values of HRV Transparency. Models 1–3 include all official credit sources in the DV (ChnFinance_PerTotal). Model 1 is a simple correlation. Model 2 includes all controls except a lagged DV. Model 3 estimates the full model. Models 4–6 follow the same pattern (correlation, no lagged DV, full model) but remove IMF flows from the DV (ChnFinance_PerTotalNoIMF). Models 7–9 follow the same pattern but remove non-OECD bilateral flows from the DV (ChnFinance_vsAllWestNoIMF). Models 10–12 follow the pattern but include only OECD bilateral flows in the DV (ChnFinance_vsOECDBilateralOnly).

All models estimate a significant relationship between borrower transparency and Chinese finance in the expected direction. The more transparent a government, the less Chinese finance it receives as a percentage of official borrowings. The full specifications (Models 3, 6, 9, and 12) estimate a one-unit increase in transparency is associated with 12% to 15% less Chinese finance vis-à-vis official alternatives each year. Applied over the standard deviation of Transparency scores in Table 1 descriptive statistics, this is a substantively significant effect on the percentage of official finance a borrower obtains from China. Conservatively using the lower 12% coefficient in Model 12, a one standard deviation increase or decrease in Transparency (1.91) shifts annual borrowings from China vis-à-vis other sources ± 23% of their annual official borrowings.

Figure 2 then plots predicted marginal effects of Transparency for each DV’s full specification in Table 2, adjusted by observed Transparency values. Notably, as DV denominators become more-narrowly defined and thus smaller, the estimated relationship between borrower transparency and % of Chinese finance becomes larger. Compare, for example, the predicted effect of Transparency at scores below 3 in Models 3, 6, and 9 with Model 12. In Models 3, 6, and 9 Transparency < 3 has a predicted effect between 0.3 and 0.1. In Model 12, where only OECD bilateral flows are included, Transparency < 3 is predicted to have an effect between 0.6 and 0.3. This reinforces the strength of the relationship between transparency and Chinese finance across this variety of measurements. As the percentage of Chinese finance being modelled becomes larger due to smaller DV denominators, transparency’s effect on how much Chinese finance a country obtains vis-à-vis alternatives only increases.

Predicted marginal effects of transparency in Table 2 full models

5.3.2 Imputed HRV models

Table 3 probit models also use all four DVs but impute missing values of Transparency with predictive mean matching. This significantly increases the N by allowing use of AidData’s 2011–2017 data. Descriptive statistics of the sample used in these models with imputed Transparency values are in Appendix C and do not vary significantly from Table 1.

Across Table 3, Transparency is estimated to have a significant effect in the manner expected by H1. As borrower transparency decreases, use of Chinese finance increases. As borrower transparency increases, use of Chinese finance decreases.

Table 3 estimates and Fig. 3 predicted marginal effects are not significantly different from Table 2 and Fig. 2. Coefficients in fully-specified Models 15, 18, 21, and 24 range between 0.10 and 0.12. This means that a one-unit increase in Transparency in Table 3’s imputed dataset is associated with a borrower obtaining between 10 and 12% less Chinese finance vis-à-vis official alternatives. Conservatively using the lower 10% coefficients in Models 18 and 24, a one standard deviation (1.8, see Appendix C) increase or decrease in borrower transparency is associated with a ± 18% shift in official borrowings.

Predicted marginal effects of transparency in Table 3 full models

Figure 3 then plots predicted marginal effects adjusted across observed Transparency values in these samples. As in Fig. 2, the greater the size of Chinese finance in the DV, the greater is transparency’s effect on the amount of Chinese finance a country obtains vis-à-vis alternatives each year.

5.3.3 Hierarchical random effect models

Table 4 reports hierarchical random effect model estimations. These models nest country-unit random effects within higher-order effects of the degree to which the unit is a “friend” or “foe” of the US (Clark & Dolan, 2021). Given substantial research on the topic, a borrower’s political relationship with the US, as measured by UN voting alignment, may mean borrowing patterns cluster around borrower relationships with the US. To the extent this is the case, agreeUS should be a hierarchical unit in models rather than a control variable.

Models 25–28 use all four DVs with only raw Transparency values, then Models 29–32 use imputed Transparency values. All estimate relationships in support of H1. Figure 4 plots the average marginal effect of Transparency at the mean of other covariates, visualizing the consistent effect across these models. The estimated effects are smaller than in the probit models reported above, but further evidence in favor of H1.

Average marginal effect of transparency in Table 4 models

5.3.4 Controls discussion

Where consistently significant, control variables across Tables 2, 3, and 4 perform as expected. Taiwan recognition is always associated with less Chinese finance. More exports to China are associated with more official Chinese finance. In all but one of the main text models, issuing a foreign bond is significantly associated with less Chinese finance. This may suggest borrowers avoid Chinese finance when they have market access, but this is not obvious and the relationship is not consistent across appendix models. No other relationships are consistent across Tables 2, 3, and 4. Meanwhile, Transparency is consistently significant in the expected direction across all DVs and model specifications.

5.4 Appendix & robustness tests

The appendix includes additional data information and robustness tests.

Data information

Appendix A includes further variable details. Appendix B lists in-sample countries in Table 2 models. Appendix C presents descriptive statistics for samples with imputed Transparency values.

Data alternatives

Appendix D uses strictly ODA-like Chinese flows as defined by AidData (see codebook for Dreher et al., 2022) and the OECD’s CRS ODA-defined flows rather than IDS data. Appendix E uses IDS Chinese bilateral flow data rather than AidData, showing correlations in the expected direction persist despite the significant drop in N.

Imputation alternatives

Appendix F uses Transparency International’s (TI) Corruption Perception Index to cover post-2010 Transparency values (Transparency International, 2022). We standardize both HRV and TI values on their own scales before combining them to create a transparency index. While imperfect because they measure different behaviors, this allows us to capture major real-world changes in government behaviors that predictive mean matching imputation may miss. This is discussed at length in Appendix F.

Appendix G re-estimates HRV transparency values for the entire timeframe. We identify which original HRV variables remain in the World Development Indicators and download them for 1999-2018 to fit the AidData timeframe. We then calculate, following the HRV premise, the percentage of WDI variables missing each year for each country. We invert this percentage so 1 equals full transparency and 0 equals no transparency. This is discussed at length in Appendix G.

Appendix H simply extends 2010 Transparency values through 2017 rather than impute using predictive mean matching or alternative indexes.

Model alternatives

Appendix I uses the logged amount of annual Chinese flows rather than a percentage DV. Despite not fully reflecting the study’s theory, this ensures a correlation between Chinese finance and transparency in the expected direction is not dependent on a fractional DV. Appendix J estimates models where Transparency is not lagged. Appendix K estimates simple random effect models, a baseline for Table 4’s hierarchical models.

Across all tests, the size and significance of the relationship between transparency and Chinese financial flows vis-à-vis official alternatives is remarkably consistent.

6 Discussion and conclusion

There has been much discussion about the lack of transparency in Chinese lending. But how this affects cross-country variation in Chinese and Western official financial flows has not been considered. This study finds that less-transparent borrowers obtain relatively more Chinese than Western finance and theorizes this is the case for two reasons. On the supply-side, China is likely to prefer untransparent borrowers who will not expose aspects of lending activities that draw strong international and local criticism. On the demand side, untransparent borrowers are likely to prefer Chinese credit that is not conditional on increasing transparency as part of good governance reforms, perceiving benefits in not exposing themselves to political risk by using Western finance that is conditional on increasing transparency.

This has a number of implications for the IPE of development. In the narrowest sense, it helps explain variation in the external debt structure of developing countries that use official credit. As transparency has become a focal point of Western lenders, and Chinese and Western lenders explicitly differentiate themselves by their relative emphasis (the West) and non-emphasis (China) on transparency, it has become a determinant of official financial flows.

This in turn has broader implications for international political economy and international relations, highlighting a condition under which developing countries are likely to have closer financial ties to China vis-à-vis the West. The effects of this in an increasing multipolar international political and economic system will play out over time.

In borrowers, that different official creditors have different effects on government transparency has further implications for the political economy of development. The study implies less-transparent borrowers are able to avoid pressure to become more transparent by using more Chinese finance. If Chinese finance allows untransparent governments to remain so and still obtain sub-market rate finance, this could have far-reaching implications for politics, institutions, and socio-economic development in developing countries. In this sense, the study is an example of how implications of Chinese credit lie at the local as well as the international level. More work can be done to focus not only on the international relations implications of the rise of Chinese finance, but also the developmental implications of the rise of Chinese finance.

Data availability

Data and replication materials available on Harvard Dataverse, https://doi.org/10.7910/DVN/NARGJG.

Notes

This study is interested in any official bilateral flow from China, either Official Development Assistance (ODA) or Other Official Flows (OOF). There are important differences (Dreher et al., 2018) and these are considered in the empirical section of the study, but in the discussion that follows we are interested in how both forms of Chinese credit are less-transparent than counterpart flows from Western creditors.

To avoid repetition we use official finance, official credit, and aid interchangeably in this paper. These terms refer to concessional credit from various bilateral and multilateral sources (rather than non-concessional finance from bond markets or commercial banks).

This may be seen as an microcosm of broader trends in the politics of regime complexes, relevant across a variety of policy areas (see Alter & Raustiala, 2018).

In addition, many empirical studies analyze Chinese credit in absolute terms, rather than in juxtaposition to Western credit options (see for example Dreher et al., 2018: 185). This study takes the latter approach.

In a robustness check, OECD DAC-defined ODA flows from the OECD’s Creditor Reporting System (CRS) are used instead of the IDS bilateral flow data.

Appendix and other supplementary information available at the Review of International Organizations webpage.

While these are linear models of a fractional DV, this is not a problem in this application because we are ultimately interested in average marginal effect of Transparency. If the aim is to make inferences using marginal effects then “the difference between linear and nonlinear models is not important” even if modeling a percentage DV (Papke & Wooldridge, 2008:130). Average marginal effects for these models are presented in Fig. 4.

References

Alesina, A., & Dollar, D. (2000). Who gives foreign aid to whom and why? Journal of Economic Growth, 5(1), 33–63. https://doi.org/10.3386/w6612

Alter, K. J., & Raustiala, K. (2018). The rise of international regime complexity. Annual Review of Law and Social Science, 14(1), 329–349. https://doi.org/10.1146/annurev-lawsocsci-101317-030830

Bailey, M. A., Strezhnev, A., & Voeten, E. (2017). Estimating dynamic state preferences from united nations voting data. Journal of Conflict Resolution, 61(2), 430–456.

Ballard-Rosa, C., Mosley, L., & Wellhausen, R. L. (2021a). Coming to terms: The politics of sovereign bond denomination. International Organization, 1–38. https://doi.org/10.1017/S0020818321000357

Ballard-Rosa, C., Mosley, L., & Wellhausen, R. L. (2021b). Contingent advantage? Sovereign borrowing, democratic institutions and global capital cycles. British Journal of Political Science, 51, 353–373. https://doi.org/10.1017/S0007123418000455

BBC. (2018). John Magufuli: Tanzania prefers “condition-Free” Chinese aid. BBC, November 27.

Beck, T., Clarke, G., Groff, A., Keefer, P., & Walsh, P. (2001). New tools in comparative political economy: The database of political institutions. World Bank Economic Review, 15(1), 165–176.

Behuria, A. K. (2018). How Sri Lanka walked into a debt trap, and the way out. Strategic Analysis, 42(2), 168–178.

Berliner, D. (2014). The political origins of transparency. The Journal of Politics, 76(2), 479–491. https://doi.org/10.1017/S0022381613001412

Best, J. (2014). Governing Failure: Provisional Expertise and the Transformation of Global Development Finance. Cambridge University Press.

Bobonis, G. J., Gertler. P. J., Gonzalez-Navarro, M., & Nichter, S. (2019). Government Transparency and Political Clientelism: Evidence from Randomized Anti-Corruption Audits in Brazil. CAF Working Paper.

Boix, C., Adserà, A., & Payne, M. (2003). Are you being served? Political accountability and quality of government. The Journal of Law, Economics, and Organization, 19(2), 445–490.

Brautigam, D. (2010). The Dragon’s Gift: The Real Story of China in Africa. Oxford University Press.

Brautigam, D. (2019). A Critical look at chinese “debt-trap diplomacy”: The rise of a meme. Area Development and Policy, 5, 1–14. https://doi.org/10.1080/23792949.2019.1689828

Brazys, S., Elkink, J. A., & Kelly, G. (2017). Bad neighbors? How co-located Chinese and World Bank development projects impact local corruption in Tanzania | SpringerLink. Review of International Organizations, 12, 227–253.

Broich, T. (2017). Do Authoritarian regimes receive more chinese development finance than democratic ones? Empirical evidence for Africa. China Economic Review, 46, 180–207. https://doi.org/10.1016/j.chieco.2017.09.006

Bunte, J. B. (2019). Raise the Debt: How Developing Countries Choose Their Creditors. Oxford University Press.

Clark, R. (2022). Bargain down or shop around? Outside options and IMF conditionality. Journal of Politics. https://doi.org/10.1086/719269

Clark, R., & Dolan, L. R. (2021). Pleasing the principal: U.S. influence in world bank policymaking. American Journal of Political Science, 65(1), 36–51. https://doi.org/10.1111/ajps.12531

Clist, P. (2011). 25 years of aid allocation practice: Whither selectivity? World Development, 39(10), 1724–1734.

Clist, P., Isopi, A., & Morrissey, O. (2012). Selectivity on aid modality: Determinants of budget support from multilateral donors. Review of International Organizations, 7(3), 267–284. https://doi.org/10.1007/s11558-011-9137-2

Coppedge, M., Gerring, J., Lindberg, S. I., Skaaning, S.–E., Teorell, J., Altman, D., Bernhard, M., Fish, M. S., Glynn, A., Hicken, A., Knutsen, C. H., Marquardt, K., McMann, K., Miri, F., Paxton, P., Pemstein, D., Staton, J., Tzelgoiv, E., Wang, Y.-t., & Zimmerman, B. (2016). V-Dem Dataset v6.2. Varieties of Democracy (V-Dem) Project.

Cormier, B. (2021). Interests over institutions: Political-economic constraints on public debt management in developing countries. Governance, 34(4):1167–91. https://onlinelibrary.wiley.com/doi/10.1111/gove.12551.

Cormier, B. (2022a). Democracy, public debt transparency, and sovereign creditworthiness. Governance, 1–23. https://doi.org/10.1111/gove.12668

Cormier, B. (2022b). Partisan external borrowing in middle-income countries. British Journal of Political Science, 1–11. https://doi.org/10.1017/S0007123421000697

Cormier, B., & Manger, M. (2021). Power, ideas, and world bank conditionality. Review of International Organizations. https://link.springer.com/article/https://doi.org/10.1007/s11558-021-09427-z.

de Mesquita, B., Bruce, A. S., Siverson, R. M., & Morrow, J. D. (2005). The Logic of Political Survival. MIT Press.

Dreher, A., Fuchs, A., Parks, B., Strange, A. M., & Tierney, M. J. (2018). Apples and dragon fruits: The determinants of aid and other forms of state financing from China to Africa. International Studies Quarterly, 62(1), 182–194. https://doi.org/10.1093/isq/sqx052

Dreher, A., Fuchs, A., Parks, B. C., Strange, A., & Tierney, M. J. (2022). Banking on Beijing. The Aims and Impacts of China’s Ovserseas Development Program. Cambridge University Press.

Dreher, A., Nunnenkamp, P., & Thiele, R. (2011). Are “new” donors different? Comparing the allocation of bilateral aid between NonDAC and DAC donor countries. World Development, 39(11), 1950–1968.

Dreher, A., Sturm, J.-E., & Vreeland, J. R. (2015). Politics and IMF conditionality. Journal of Conflict Resolution, 59(1), 120–148. https://doi.org/10.1177/0022002713499723

Drezner, D. (2009). Bad debts: Assessing China’s finacial influence in great power politics. International Security, 34(2), 7–45.

Dür, A., Baccini, L., & Elsig, M. (2014). The design of international trade agreements: Introducing a new database. Review of International Organizations, 9(3), 353–375.

Easterly, W. (2007). Are aid agencies improving? Economic Policy, 22(52), 634–678.

Fleck, R. K., & Kilby, C. (2006). World bank independence: A model and statistical analysis of US influence. Review of Development Economics, 10(2), 224–240.

Fuchs, A., & Rudyak, M. (2019). The motives of China’s foreign aid. In Handbook on the International Political Economy of China, edited by K. Zeng (pp. 392–410). Cheltenham UK; Northamptom, MA, USA: Edward Elgar.

Gehring, K., Michaelowa, K., Dreher, A., & Spörri, F. (2017). Aid fragmentation and effectiveness: What do we really know? World Development, 99, 320–334. https://doi.org/10.1016/j.worlddev.2017.05.019

Gelman, A., & Hill, J. (2007). Data Analysis Using Regrression and Multilevel/Hierarchical Models. Cambridge University Press.

Gelpern, A., Horn, S., Morris, S., Parks, B, & Trebesch, C. (2021). How China Lends: A Rare Look into 100 Debt Contracts with Foreign Governments. AidData.

Green, M. (2019). China’s Debt Diplomacy. Foreign Policy. Retrieved 13 January 2022 (https://foreignpolicy.com/2019/04/25/chinas-debt-diplomacy/).

Greene, W. (2004). Fixed Effects and bias due to the incidental parameters problem in the tobit model. Econometric Reviews, 23(2), 125–147. https://doi.org/10.1081/ETC-120039606

Grimm, S. (2011). Transparency of Chinese Aid. Publish What You Fund.

Halper, S. (2010). Beijing’s Coalition of the Willing. Foreign Policy, June 15.

Harris, M. (2021). Unfinished Business: Magufuli’s Autocratic Rule in Tanzania. CSIS: Center for Strategic & International Studies. Retrieved 17 May 2021 (https://www.csis.org/analysis/unfinished-business-magufulis-autocratic-rule-tanzania).

Hernandez, D. (2017). Are “new” donors challenging world bank conditionality? World Development, 96, 529–549. https://doi.org/10.1016/j.worlddev.2017.03.035

Hollyer, J. R., Peter Rosendorff, B., & Vreeland, J. R. (2011). Democracy and transparency. The Journal of Politics, 73(4), 1191–1205. https://doi.org/10.1017/S0022381611000880

Hollyer, J. R., Peter Rosendorff, B., & Vreeland, J. R. (2014). Measuring transparency. Political Analysis, 22(4), 413–434.

Hollyer, J. R., Peter Rosendorff, B., & Vreeland, J. R. (2019). Why do autocrats disclose? Economic transparency and inter-elite politics in the shadow of mass unrest. Journal of Conflict Resolution, 63(6), 1488–1516. https://doi.org/10.1177/0022002718792602

Honig, D., & Weaver, C. (2019). A race to the top? The aid transparency index and the social power of global performance indicators. International Organization, 73(3), 579–610. https://doi.org/10.1017/S0020818319000122

Horn, S., Reinhart, C. M., & Trebesch, C. (2021). China’s overseas lending. Journal of International Economics, 133. https://doi.org/10.3386/w26050

Huang, M., Xu, X., & Mao, X. (2018). South-South Cooperation and Chinese Foreign Aid. Springer Singapore Pte. Limited.

Humphrey, C., & Michaelowa, K. (2013). Shopping for development: Multilateral lending, shareholder composition and borrower preferences. World Development, 44, 142–155. https://doi.org/10.1016/j.worlddev.2012.12.007

Humphrey, C., & Michaelowa, K. (2019). China in Africa: Competition for traditional development finance institutions? World Development, 120, 15–28. https://doi.org/10.1016/j.worlddev.2019.03.014

Ibrahim, A. (2020). China’s Debt Diplomacy Will Get a Coronavirus Boost. Foreign Policy. Retrieved 13 May 2021 (https://foreignpolicy.com/2020/03/23/china-coronavirus-belt-and-road-bri-boost-debt-diplomacy/).

International Monetary Fund, and World Bank. (2018). G20 Notes on Strengthening Public Debt Transparency. International Monetary Fund and World Bank Group.

Isaksson, A.-S., & Kotsadam, A. (2018a). Chinese aid and local corruption. Journal of Public Economics, 159, 146–159. https://doi.org/10.1016/j.jpubeco.2018.01.002

Isaksson, A.-S., & Kotsadam, A. (2018b). Racing to the bottom? Chinese development projects and trade union involvement in Africa. World Development, 106, 284–298. https://doi.org/10.1016/j.worlddev.2018.02.003

Johnson, K., & de Luce, D. (2018). One Belt, One Road, One Happy Chinese Navy. Foreign Policy. Retrieved 13 January 2022 (https://foreignpolicy.com/2018/04/17/one-belt-one-road-one-happy-chinese-navy/).

Kalathil, S. (2018). China in Xi’s “new era”: Redefining development. Journal of Democracy, 29(2), 52–58. https://doi.org/10.1353/jod.2018.0024

Kaplan, S. B. (2021). Globalizing Patient Capital: The Political Economy of Chinese Finance in the Americas. Cambridge University Press.

Kemoe, L., & Zhan, Z. (2018). Fiscal Transparency, Borrowing Costs, and Foreign Holdings of Sovereign Debt. IMF Working Paper. WP/18/189. International Monetary Fund.

Kentikelenis, A., Stubbs, T., & King, L. (2016). IMF conditionality and development policy space, 1985–2014. Review of International Political Economy, 23(4), 543–582.

Kern, A., Reinsberg, B. (2021). The Political Economy of Chinese Debt and IMF Conditionality. SSRN Scholarly Paper. ID 3951586. Rochester, NY: Social Science Research Network. https://doi.org/10.2139/ssrn.3951586.

Kilby, C. (2009). The political economy of conditionality: An empirical analysis of world bank loan disbursements. Journal of Development Economics, 89(1), 51–61. https://doi.org/10.1016/j.jdeveco.2008.06.014

Kilby, C. (2011). Informal influence in the asian development bank. The Review of International Organizations, 6(3–4), 223–257. https://doi.org/10.1007/s11558-011-9110-0

Kimenyi, M. S. (2012). Donor Interference and Transparency Remain a Real Concern to African Countries. Brookings. Retrieved 17 May 2021 (https://www.brookings.edu/blog/up-front/2012/11/01/donor-interference-and-transparency-remain-a-real-concern-to-african-countries/).

Kolstad, I., & Wiig, A. (2009). Is transparency the key to reducing corruption in resource-rich countries? World Development, 37(3), 521–532. https://doi.org/10.1016/j.worlddev.2008.07.002

Laeven, L., & Valencia, F. (2012). Systemic Banking Crises Database: An Update. IMF Working Paper. WP/12/163. Washington, DC: International Monetary Fund.

Lim, D. Y. M., & Vreeland, J. R. (2013). Regional organizations and international politics Japanese influence over the asian development bank and the UN Security Council. World Politics, 65(1), 34–72.

Lindstedt, C., & Naurin, D. (2010). Transparency is not enough: Making transparency effective in reducing corruption. International Political Science Review, 31(3), 301–322.

Lyne, M. M., Nielson, D. L., & Tierney, M. J. (2009). Controlling coalitions: Social lending at the multilateral development banks. Review of International Organizations, 4(4), 407–433. https://doi.org/10.1007/s11558-009-9069-2

Manger, M. S., & Sattler, T. (2020). The origins of persistent current account imbalances in the post-bretton woods era. Comparative Political Studies, 3(3–4), 631–664.

Mattlin, M., & Nojonen, M. (2015). Conditionality and path dependence in Chinese lending. Journal of Contemporary China, 24(94), 701–720.

Moon, S., & Williamson, T. (2010). Greater Aid Transparency: Crucial for Aid Effectiveness. Project Briefing. No. 35. Ovserseas Development institute.

Morris, S., Parks, B., & Gardner, A. (2020). Chinese and World Bank Lending Terms: A Systematic Comparison Across 157 Countries and 15 Years. CGD Policy Paper. Center for Global Development.

Naim, M. (2007). Rogue aid. Foreign Policy, 159, 95–96.

Nyathi, K. (2021). Zimbabwe: China Clashes With Zimbabwean Unions Over “Systematic Abuse”. The East African, July 9.

OECD. (2011). Busan Partnership for Effective Development Co-Operation. OECD.

Papke, L. E., & Wooldridge, J. M. (2008). Panel data methods for fractional response variables with an application to test pass rates. Journal of Econometrics, 145(1–2), 121–133. https://doi.org/10.1016/j.jeconom.2008.05.009

Plümper, T., & Troeger, V. E. (2019). Not so harmless after all: The fixed-effects model. Political Analysis, 27(1), 21–45. https://doi.org/10.1017/pan.2018.17

Prizzon, A., Greenhill, R., & Mustapha, S. (2017). An “age of choice” for external development finance? Evidence from country case studies. Development Policy Review, 35(S1), O29-45. https://doi.org/10.1111/dpr.12268

Rich, T. S. (2011). Diplomatic Recognition of Taiwan (the Republic of China) From 1950–2007. Inter-University Consortium for Political and Social Research.

Stone, R. W. (2011). Controlling Institutions: International Organizations and the Global Economy. Cambridge University Press.

Swedlund, H. J. (2017a). Is China eroding the bargaining power of traditional donors in Africa? International Affairs, 93(2), 389–408. https://doi.org/10.1093/ia/iiw059

Swedlund, H. J. (2017b). The Development Dance: How Donors and Recipients Negotiate the Delivery of Foreign Aid. Cornell University Press.

The Economist. (2017). Why Cambodia Has Cosied up to China. The Economist, January 21.

The Economist. (2018). China Is Broadening Its Efforts to Win over African Audiences. The Economist, October 20.

The Economist. (2021). ‘Banyan: Quad Wrangle’. The Economist, June 12, Print, 51.

Thorne, D., & Spevack, B. (2017). Harbored Ambitions: How China’s Port Investments Are Strategically Reshaping the Indo-Pacific. C4ADS Innovation for Peace.

Thornton, S. A. (2020). China in Central Asia: Is China Winning the “New Great Game”? Brookings.

Tran, M. (2012). Nigerian and Indonesian Officials Join Post-Busan Aid Effectiveness Panel. The Guardian, August 7.

Transparency International. (2021). Holding Power to Account. Transparency International.

Transparency International. (2022). Corruption Perceptions Index 2020. Transparency International.

Williams, A. (2011). Shining a light on the resource curse: An empirical analysis of the relationship between natural resources, transparency, and economic growth. World Development, 39(4), 490–505. https://doi.org/10.1016/j.worlddev.2010.08.015

Winters, M. S., & Martinez, G. (2015). The role of governance in determining foreign aid flow composition. World Development, 66, 516–531.

Wolf, C., Wang, X., & Warner, E. (2013). China’s Foreign Aid and Government-Sponsored Investment Activities: Scale, Content, Destinations, and Implications. Rand Corporation.

World Bank. (2020). Enhancing Government Effectiveness and Transparency: The Fight Against Corruption. World Bank.

Zeitz, A. O. (2021a). Emulate or Differentiate? Review of International Organizations, 16, 265–292. https://doi.org/10.1007/s11558-020-09377

Zeitz, A. O. (2021b). Global capital cycles and market discipline: perceptions of developing-country borrowers. British Journal of Political Science, 1–10. https://doi.org/10.1017/S0007123421000405

Acknowledgements

Thank you to Axel Dreher, Chris Humphrey, James Hollyer, Mark Manger, Bernhard Reinsberg, and three anonymous reviewers for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interests

None to disclose.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Responsible Editor: Axel Dreher

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Cormier, B. Chinese or western finance? Transparency, official credit flows, and the international political economy of development. Rev Int Organ 18, 297–328 (2023). https://doi.org/10.1007/s11558-022-09469-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11558-022-09469-x