Abstract

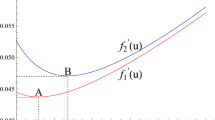

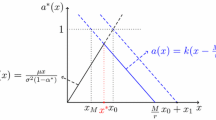

This paper studies the optimal dividend problem in the diffusion model with stochastic return on investments. The insurance company invests its surplus in a financial market. More specially, the authors consider the case of investment in a Black-Scholes market with risky asset such as stock. The classical problem is to find the optimal dividend payment strategy that maximizes the expectation of discounted dividend payment until ruin. Motivated by the idea of Thonhauser and Albrecher (2007), we take the lifetime of the controlled risk process into account, that is, the value function considers both the expectation of discounted dividend payment and the time value of ruin. The authors conclude that the optimal dividend strategy is a barrier strategy for the unbounded dividend payment case and is of threshold type for the bounded dividend payment case.

Similar content being viewed by others

References

B. De Finetti, Su un’impostazione alternativa dell teoria collectiva del rischio, Transaction of the 15th International Congress of Actuaries, New York, 1957, 2: 433–443.

K. Borch, The theory of risk, Journal of the Royal Statistical Society: Series B, 1967, 29: 432–452.

K. Borch, The capital structure of a firm, Swedish Journal of Economics, 1969, 71: 1–13.

H. Bühlmann, Mathematical Methods in Risk Theory, Springer, Berlin, 1970.

H. U. Gerber, Games of economics survival with discrete- and continuous-income processes, Operations Research, 1972, 20: 37–45.

H. U. Gerber, An Introduction to Mathematical Risk Theory, S. S. Huebner Foundation Monographs, University of Pennsylvania, 1979.

S. Asmussen and M. Tsksar, Controlled diffusion models for optimal dividend pay-out, Insurance: Mathematics and Economics, 1997, 20: 1–15.

S. Brown, Optimal investment policies for a firm with random risk process: Exponential utility and minimizing the probability of ruin, Mathematics of Operations Research, 1995, 20(4): 937–958.

J. Cai, H. U. Gerber, and H. L. Yang, Optimal dividends in an Ornstein-Uhlenbeck type model with credit and debit Interest, North American Actuarial Journal, 2006, 10(2): 94–119.

H. U. Gerber and E. S. W Shiu, Optimal dividends: Analysis with Brownian motion, North American Actuarial Journal, 2004, 8(1): 1–20.

H. U. Gerber and E. S. W Shiu, On optimal dividends: From reflecton to refraction, Journal of Computational and Applied Mathematics, 2006, 186(1): 4–22.

H. U. Gerber and E. S. W Shiu, On optimal dividends strategies in the compound Poisson model, North American Actuarial Journal, 2006, 10(2): 76–93.

B. Højgaard and M. Taksar, Controlling risk exposure and dividends payout schemes: Insurance company example, Mathematical Finance, 1999, 9(2): 183–201.

J. Paulsen and H. K. Gjessing, Optimal choice of dividend barrier for a risk process with stochastic return on investments, Insurance: Mathematics and Economics, 1997, 20: 215–223.

S. Thonhauser and H. Albrecher, Dividend maximization under consideration of the time value of ruin, Insurance: Mathematics and Economics, 2007, 41: 163–184.

W. H. Fleming and M. Soner, Controlled Markov Process and Viscosity Solution, Springer, New York, 1993.

V. E. Benes, L. A. Shepp, and H. S. Witsenhausen, Some solvable stochastic control problems, Stochastics, 1980, 4: 39–83.

Author information

Authors and Affiliations

Corresponding author

Additional information

This work is supported by the National Basic Research Program of China (973 Program) under Grant No. 2007CB814905 and the National Natural Science Foundation of China under Grant No. 10871102.

Rights and permissions

About this article

Cite this article

Wang, W., Zhang, C. Optimal dividend strategies in the diffusion model with stochastic return on investments. J Syst Sci Complex 23, 1071–1085 (2010). https://doi.org/10.1007/s11424-010-8077-x

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-010-8077-x