Abstract

This paper studies alternative techniques for identifying stock pairs in a pairs-trading strategy over 1980–2014. We consider two main techniques: the distance approach and the cointegration approach. We also consider a range of parameterizations of the trading system design. Parameterization of the trading system matters for the profitability of pairs trading. We find that the cointegration approach, despite using an optimal in-sample parameterization, yields significant returns only in the 1980s. The distance approach performs better, producing significantly positive risk-adjusted returns in all sub-periods. However, when transaction costs are properly taken into account, the returns largely disappear in recent years.

Similar content being viewed by others

Notes

Specifically, the cointegration approach is often motivated in terms of common stochastic trends that arise from common fundamentals for the two securities. Vidyamurthy (2004) and others relate the cointegration model to the arbitrage pricing theory.

Specifically, we use the algorithm “jcitest” in Matlab, the description of which is: “Johansen tests assess the null hypothesis H(r) of cointegration rank less than or equal to r among the numDims-dimensional time series in Y against alternatives H(numDims) (trace test) or H(r+1) (maxeig test). The tests also produce maximum likelihood estimates of the parameters in a vector error-correction (VEC) model of the cointegrated series”.

Gatev et al. (2006) suggest that data-snooping bias is a reason to avoid exploring alternative parameterizations. Data-snooping bias is a valid argument, of course, but surely institutions that trade pairs, such as hedge funds, have studied alternative parameterizations. However, those studies would be largely proprietary. The present study is not.

This is consistent with anecdotal evidence from the industry. For example, Schmerken (2006) reports that “[p]airs trades usually are meant for investors looking for a short-term profit in the market”. “The average time for a trade to be open is 15 days”, says LCM’s Gaubert. “A position could be held as long as a month”.

Jensen’s alpha is estimated for each sub-period by regressing the monthly pairs-portfolio returns on a constant (Jensen’s alpha) and the market return net of the risk-free rate. The same procedure is used below to estimate the Fama-French four-factor model. Data for the market excess return, as well as the other variables used in the Fama-French four-factor model considered below, are obtained from Kenneth French’s website (https://doi.org/mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html). Reported t-statistics in the market model and Fama-French model are robust to heteroscedasticity and autocorrelation.

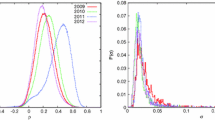

A normal distribution has a skew of 0 and a kurtosis of 3.

References

Baronyan, S., Boduroglu, I.I., Sener, E.: Investigation of Stochastic Pairs Trading Strategies Under Different Volatility Regimes. Manch. School 78(s1), 114–134 (2010)

Bolgun, K.E., Kurun, E., Guven, S.: Dynamic Pairs Trading Strategy for the Companies Listed in the Istanbul Stock Exchange. Int. Rev. Appl. Financ. Issues Econ. 1, 37–57 (2010)

Bookstaber, R.: \(A\) Demon Of Our Own Design. Wiley, New York (2006)

Bramante, R.: An Approach to Ranking the Hedge Fund Industry. In: Giudici, P., Ingrassia, S., Vichi, M. (eds.) Statistical Models for Data Analysis, pp. 63–71. Springer, New York (2013)

Broussard, J.P., Vaihekoski, M.: Profitability of Pairs Trading Strategy in an Illiquid Market with Multiple Share Classes. J. Int. Financ. Mark. Inst. Money 22(5), 1188–1201 (2012)

Caldeira, J.F., Moura, G.V.: Selection of a Portfolio of Pairs Based on Cointegration: A Statistical Arbitrage Strategy. Rev. Braz. Financ. 11(1), 49–80 (2013)

Chen, H., Chen, S., Li, F.: Empirical Investigation of an Equity Pairs Trading Strategy. Mimeo, New York (2012)

Deaves, R., Liu, J., Miu, P.: Pairs Trading in Canadian Markets: Pay Attention to Inattention. Canadian Investment Review, Analysis and Research (2013)

Do, Binh: Faff, Robert: Does Simple Pairs Trading Still Work? Financ. Anal. J. 66(4), 83–95 (2010)

Do, B., Faff, R.: Are Pairs Trading Profits Robust to Trading Costs? J. Financ. Res. 35(2), 261–287 (2012)

Elliott, R., Van Der Hoek, J., Malcolm, W.: Pairs Trading. Quant. Financ. 5(3), 271–276 (2005)

Engelberg, J., Gao, P., Jagannathan, R.: An Anatomy of Pairs Trading: The Role of Idiosyncratic News. Common Information and Liquidity. Mimeo, New York (2009)

Gatev, E., Goetzmann, W., Rouwenhorst, G.: Pairs Trading: Performance of a Relative-Value Arbitrage Rule. Rev. Financ. Stud. 19(3), 797–827 (2006)

Gregory, I., Knox, P., Oliver-Wald, C.: Analytical Pairs Trading Under Different Assumptions on the Spread and Ratio Dynamics. Mimeo, New York (2011)

Herlemont, D.: Pairs Trading, Convergence Trading, Cointegration. Working paper, YATS Finances & Technologies, USA (2004)

Huck, N.: Pairs Selection and Outranking: An Application to the S&P 100 Index. Eur. J. Oper. Res. 196(2), 819–825 (2009)

Huck, N.: Pairs Trading and Outranking: The Multi-Step-Ahead Forecasting Case. Eur. J. Oper. Res. 207(3), 1702–1716 (2010)

Jacobs, H., Weber, M.: Losing Sight of the Trees for the Forest? Attention Allocation and Anomalies. Mimeo, New York (2013)

Kanemura, T., Rachev, S.T., Fabozzi, F.: The Application of Pairs Trading to Energy Futures Markets. mimeo, New York (2008)

Lehmann, B.: Fads, Martingales and Market Efficiency. Q. J. Econ. 105(1), 1–28 (1990)

Lin, Y., McCrae, M., Gulati, C.: Loss Protection in Pairs Trading Through Minimum Profit Bounds: A Cointegration Approach. J. Appl. Math. Decis. Sci. 2006, 1–14 (2006)

Lucey, M., Walshe, D.: European Equity Pairs Trading: The Effect of Data Frequency on Risk and Return. J. Bus. Theory Pract., 329–341 (2013)

Mudchanatongsuk, S., Primbs, J., Wong, W.: Optimal Pairs Trading: A Stochastic Control Approach. In: American Control Conference, pp. 1035–1039 (2008)

Nath, P.: High Frequency Pairs Trading with US Treasury Securities: Risks and Rewards for Hedge Funds. Mimeo, New York (2003)

Papadakis, G., Wysocki, P.: Pairs Trading and Accounting Information. Mimeo, New York (2007)

Peng, L., Xiong, W.: Investor Attention, Overconfidence and Category Learning. J. Financ. Econ. 80, 563–602 (2006)

Perlin, M.S.: Evaluation of Pairs Trading Strategy at the Brazilian Financial Market. J. Deriv. Hedge Funds 15(2), 122–136 (2009)

Schmerken, I.: Finding the Perfect Pair. Wall Street Technol. 24(7), 1 (2006)

Tourin, A., Yan, R.: Dynamic Pairs Trading using the Stochastic Control Approach. J. Econ. Dyn. Control 37, 1972–1981 (2013)

Vidyamurthy, G.: Pairs Trading-Quantitative Methods and Analysis. Wiley, New York (2004)

Acknowledgements

We are grateful to two referees for suggestions. This paper represents the views of the authors and does not represent the views, practices, or policies of Vestcor Investment Management Corporation.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Smith, R.T., Xu, X. A good pair: alternative pairs-trading strategies. Financ Mark Portf Manag 31, 1–26 (2017). https://doi.org/10.1007/s11408-016-0280-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-016-0280-x