Abstract

Under two frameworks of cross-section and time-series factors, we implement asset pricing models to dissect the abnormal returns in the Chinese stock market. Our findings indicate that the model using the earnings-to-price factor outperforms the model using the book-to-market factor in the framework of cross-section factors. Moreover, we further compare the time-varying loadings with constant loadings in the asset pricing models. Existing research has implied the outperformance of time-varying loadings in the US market. However, we consider the effects of backdoor listings in the Chinese stock market. Our evidence documents that the time-varying loading factor model cannot perfectly surpass the constant loading model. Our agent-based simulations indicate that such a finding originates from the static collective behaviors and stable beliefs of the Chinese traders.

Similar content being viewed by others

Notes

Excess returns detect the premium over the risk-free rate, whereas return spreads depict the premium stemming from the mispricing (e.g., Basu and Miffre 2013; Olsen and Troughton 2000). Furthermore, Jegadeesh and Titman (1993)’s momentum profits dissect the anchoring and representativeness biases of traders (e.g., Statman 2019; Ackert and Deaves 2009).

According to Will (2016) and Feng et al. (2012), driven by a rule, the interdependent traders spontaneously act in concert in a crowd without a leader. Such collective behaviors can enable the stock prices to deviate from fundamental information and arouse anomalies (e.g., Baker and Nofsinger 2010; Thaler 2005).

To be specific, the agents engage in mean-reverting activity in the crowd of fundamental traders, whereas those in the crowd of trend-chasing traders engage in trend-extrapolating activity.

We provide more details of heterogeneous agents’ beliefs as well as the determinations of asset prices and returns in Appendix A.

In Sect. 5.2, we specifically discuss these statements and show the simulation results of loadings.

Liu et al. (2019) have used the time-series factors to dissect return spreads.

A time-varying loading is a characteristic of one portfolio according to Fama and French (2020). However, return spreads and momentum profits are the differences in returns between two portfolios. Hence, in the spirit of Fama and French (2020), we extract the loadings from regressions for the models dissecting return spreads and momentum profits.

We employ asset pricing models to dissect abnormal returns. From such dissections, the remaining part of the abnormal returns is the pricing error in compliance with Fama and French (2020).

The return spread is the difference in returns across two portfolios, and so is a momentum profit. However, an excess return is obtained within a portfolio, so the characteristics for each portfolio are calculated following Fama and French (2020). In this vein, we concentrate on the models for excess returns in the horse races between time-varying and constant loadings.

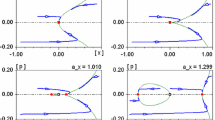

The natural conditions enabling the beliefs regarding expectations and variance–covariance matrices for these two crowds to be constant are m = 0 and h = 1. These conditions enable the beta to remain static over time. On the contrary, if the conditions do not emerge, the beliefs regarding expectations and variance–covariance matrices for these two crowds are time-varying. As a result, the beta is time-varying.

In Chiarella et al. (2013), most participants in the heterogeneous-agent market are trend-chasing traders since \({n}_{f}=0.3\). Differing from Chiarella et al. (2013), this paper focuses on the impacts of constant and time-varying beliefs on the beta. Hence, we implement \({n}_{f}={n}_{c}\) in a heterogeneous-agent market in order to avoid the latent disturbances caused by the fractions of these two crowds.

We have calculated the variances of the betas in the scenario of static collective behaviors. The maximum variance of these betas is just 1.78E-29, again implying that static collective behaviors give rise to constant loadings.

Following Chiarella et al. (2013), we further run rolling-window OLS regressions to obtain the betas. To be specific, in the rolling-window regressions, each window covers 500 periods in accordance with Chiarella et al. (2013). When we estimate a rolling beta, the whole window will shift one unit towards the right. Hence, there will be 499 pieces of overlapping data and only one piece of new data for the estimation of each window. As a result, the variations in the rolling-estimated betas are not dramatic. Consequently, the betas presented throughout this paper are similar to the ex-ante betas from Chiarella et al. (2013).

References

Ackert L, Deaves R (2009) Behavioral finance: psychology, decision-making, and markets. Cengage Learning, Boston

Baker HK, Nofsinger JR (eds) (2010) Behavioral finance: investors, corporations, and markets. Wiley, Hoboken, Vol, p 6

Bargigli L, Riccetti L, Russo A, Gallegati M (2020) Network calibration and metamodeling of a financial accelerator agent-based model. J Econ Interac Coord 15(2):413–440

Basu D, Miffre J (2013) Capturing the risk premium of commodity futures: the role of hedging pressure. J Bank Finance 37(7):2652–2664

Boehmer E, Jones CM, Zhang X (2008) Which shorts are informed? J Financ 63(2):491–527

Brunnermeier MK, Nagel S (2008) Do wealth fluctuations generate time-varying risk aversion? Micro-Evid Individ Am Econ Rev 98(3):713–736

Busse JA, Chordia T, Jiang L, Tang Y (2021) Transaction costs, portfolio characteristics, and mutual fund performance. Manage Sci 67(2):1227–1248

Cakici N, Chan K, Topyan K (2017) Cross-sectional stock return predictability in China. Eur J Finance 23(7–9):581–605

Carhart MM (1997) On persistence in mutual fund performance. J Financ 52(1):57–82

Cheung C, Hoguet G, Ng S (2015) Value, size, momentum, dividend yield, and volatility in China’s A-share market. J Portf Manag 41(5):57–70

Chiarella C, Dieci R, He XZ (2013) Time-varying beta: a boundedly rational equilibrium approach. J Evol Econ 23(3):609–639

Cornelli F, Goldreich D, Ljungqvist A (2006) Investor sentiment and pre-IPO markets. J Financ 61(3):1187–1216

Da Z, Gurun UG, Warachka M (2014) Frog in the pan: continuous information and momentum. Rev Financ Stud 27(7):2171–2218

Eun CS, Huang W (2007) Asset pricing in China’s domestic stock markets: Is there a logic? Pac Basin Financ J 15(5):452–480

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Fama EF, French KR (2012) Size, value, and momentum in international stock returns. J Financ Econ 105(3):457–472

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116(1):1–22

Fama EF, French KR (2020) Comparing cross-section and time-series factor models. Rev Financ Stud 33(5):1891–1926

Fama EF, MacBeth JD (1973) Risk, return, and equilibrium: empirical tests. J Polit Econ 81(3):607–636

Feng L, Li B, Podobnik B, Preis T, Stanley HE (2012) Linking agent-based models and stochastic models of financial markets. Proc Natl Acad Sci 109(22):8388–8393

Ferri P (2013) Income distribution and debts in a fragile economy: market processes and macro constraints. J Econ Interac Coord 8(2):219–230

Garlappi L, Yan H (2011) Financial distress and the cross-section of equity returns. J Financ 66(3):789–822

Goyal A, Wahal S (2015) Is momentum an echo? J Financ Quant Anal 50(6):1237–1267

Gu GF, Chen W, Zhou WX (2008) Empirical regularities of order placement in the Chinese stock market. Physica A 387(13):3173–3182

Hou K, Xue C, Zhang L (2015) Digesting anomalies: An investment approach. Rev Financ Stud 28(3):650–705

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Financ 48(1):65–91

Lamperti F, Roventini A, Sani A (2018) Agent-based model calibration using machine learning surrogates. J Econ Dyn Control 90:366–389

Li G (2007) Time-varying risk aversion and asset prices. J Bank Finance 31(1):243–257

Li X, Becker Y, Rosenfeld D (2012) Asset growth and future stock returns: international evidence. Financ Anal J 68(3):51–62

Li H, Zheng D, Chen J (2014) Effectiveness, cause and impact of price limit—evidence from China’s cross-listed stocks. J Int Finan Markets Inst Money 29:217–241

Liu J, Stambaugh RF, Yuan Y (2019) Size and value in China. J Financ Econ 134(1):48–69

Nartea GV, Kong D, Wu J (2017) Do extreme returns matter in emerging markets? Evidence from the Chinese stock market. J Bank Finance 76:189–197

Olsen RA, Troughton GH (2000) Are risk premium anomalies caused by ambiguity? Financ Anal J 56(2):24–31

Stambaugh RF, Yuan Y (2017) Mispricing factors. Rev Financ Stud 30(4):1270–1315

Statman, M. (2019). Behavioral finance: the second generation. CFA Institute Research Foundation.

Thaler RH (ed) (2005). Advances in Behavioral Finance, Volume II (Vol. 2). Princeton University Press, Princeton .

Will TE (2016) Flock leadership: Understanding and influencing emergent collective behavior. Leadersh Q 27(2):261–279

Yao J, Ma C, He WP (2014) Investor herding behaviour of Chinese stock market. Int Rev Econ Financ 29:12–29

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: More details of the agent-based model

In Sect. 2, we have mentioned that there are two crowds of agents in the agent-based model. Therefore, in this appendix, we present the details of heterogeneous agents’ beliefs, as well as the determinations of asset prices and returns.

1.1 A.1: Heterogeneous agents and their beliefs

Within the crowd of fundamental traders, the agents believe the actual prices of assets vary around the fundamental prices. Hence, the fundamental traders long the underpriced assets and short the overpriced assets. As for the crowd of trend-chasing traders, the agents buy assets when the assets experience price increases in the past and sell assets due to the past decreases in prices. Consequently, the beliefs regarding expectations about returns for these crowds of traders proceed as follows:

where \({E}_{f,t}\left({\mathbf{r}}_{t+1}\right)\) is the beliefs regarding expectations about returns for the crowd of fundamental traders, \({E}_{c,t}\left({\mathbf{r}}_{t+1}\right)\) is the beliefs regarding expectations about returns for the crowd of trend-chasing traders, \({\varvec{\omega}}={\left({\omega }_{1},{\omega }_{2},\cdots ,{\omega }_{N}\right)}^{T}\) denotes the time-series average of the fundamental dividend yields of each asset, \({\mathbf{p}}_{t}^{*}={\left({p}_{1,t}^{*},{p}_{2,t}^{*},\cdots ,{p}_{N,t}^{*}\right)}^{T}\) denotes the fundamental price of each asset, \({\mathbf{P}}_{t}^{*}:=diag\left[{\mathbf{p}}_{t}^{*}\right]\), \({\mathbf{p}}_{t}={\left({p}_{1,t},{p}_{2,t},\cdots ,{p}_{N,t}\right)}^{T}\) denotes the actual price of each asset, \({\mathbf{g}}_{t-1}\) is a vector containing the averages of past returns, and \({\mathbf{g}}_{t-1}=h{\mathbf{g}}_{t-2}+\left(1-h\right){\mathbf{r}}_{t-1}\).

In Chiarella et al. (2013), the fundamental traders stabilize the market, while trend-chasing traders boost the market risks. Therefore, the variance–covariance matrices for the returns of these traders are defined in equations (A3) and (A4):

where \({\Sigma }_{f}\) is the beliefs regarding the variance–covariance matrix for the returns for the crowd of fundamental traders, \({\Sigma }_{c,t}\) is the beliefs regarding the variance–covariance matrix for the returns for the crowd of trend-chasing traders, \({\Sigma }_{0}\) denotes the initial variance–covariance matrix, and \({\mathbf{V}}_{t-1}\) is calculated as follows:

1.2 A.2: The determinations of asset prices and returns

To perform simulations for constant and time-varying betas, we should calculate asset prices and returns in accordance with Chiarella et al. (2013). Equations (A6) and (A7) show the procedures used to obtain the prices and returns.

where \({{\varvec{\rho}}}_{t}={\left({\rho }_{1,t},{\rho }_{2,t},\cdots ,{\rho }_{N,t}\right)}^{T}\) contains the fundamental dividend yield of each asset, \({{\varvec{\rho}}}_{t}\) is randomly drawn from a normal distribution, \({\mathbf{P}}_{t}:=diag\left[{\mathbf{p}}_{t}\right]\), \(\mathbf{S}=diag\left({s}_{1},{s}_{2},\cdots ,{s}_{N}\right)\) is a matrix of average asset supply per trader, and \({\boldsymbol{\vartheta }}_{t}\) denotes a vector of demand shocks for each asset and is randomly drawn from a normal distribution.

Appendix B: Variable definitions

First of all, firm size is measured by market capitalization, which is calculated by the stock price times the number of shares. Four ratios related to accounting metrics are applied in this paper, including earnings-to-price, book-to-market, cash-flow-to-price, and the return on equity. We divide the earnings by firm size to acquire the earnings-to-price ratio. Earnings is net profit in excess of a nonrecurring gain or loss. The ratio of shareholder equity to firm size produces the book-to-market ratio. To obtain the cash-flow-to-price ratio, we divide the changes in cash flow between the two most recent periods by firm size. The return on equity is the ratio of earnings to shareholder equity. Since the accounting information is revealed semi-annually or quarterly in China, the most recent data in month t-1 are used to generate these ratios.

Two volatility measures regarding the 1-month volatility and MAX are used in this paper. We compute the time-series standard deviation of daily returns for the past 20 trading days to acquire the 1-month volatility, while MAX is the maximum daily return for the same horizon. We use the average daily turnover for the past 250 trading days as the 12-month turnover. Besides, we divide the average daily turnover for the past 20 trading days by the 12-month turnover to obtain the 1-month abnormal turnover. The first day of the past T-trading-day period is the last trading day in month t-1.

Appendix C: The construction of the anomaly portfolios and factor portfolios

Following the concepts of Fama and French (2020), the portfolios targeted by model factors and anomaly portfolios as well as related excess returns are created. In each month, the stocks are sorted into 5 groups simultaneously based on firm size, earnings-to-price, and book-to-market for the prior month. The intersections between the sorts based on firm size and earnings-to-price produce 25 value-weighted portfolios besides the intersections between the sorts on firm size and book-to-market. Hence, we obtain 50 value-weighted portfolios targeted by model factors.

The anomaly variables in the Chinese stock market are cash-flow-to-price, the return on equity, 1-month volatility, MAX, 12-month turnover, and 1-month abnormal turnover in accordance with Liu et al. (2019). To be more specific, in each month, the stocks are simultaneously sorted into 5 groups based on firm size, cash-flow-to-price, the return on equity, 12-month turnover, and 1-month abnormal turnover for the last month.

From the intersections between size sorts and the sorts, respectively, on cash-flow-to-price, the return on equity, 12-month turnover, and 1-month abnormal turnover, there are 100 value-weighted portfolios. The above sorts are simultaneous, with two exceptions. It is rare for the stocks with large firm size to have high volatility, and so the portfolios related to 1-month volatility and MAX are obtained by conditional sorts to avoid empty or tiny portfolios (Fama and French 2020). In each month, the stocks are classified one by one based on predetermined firm sizes into 5 groups. Within each size group, the stocks are sorted into 5 groups in accordance with 1-month volatility and MAX for the last month, again resulting in 50 value-weighted portfolios. Consequently, we obtain 150 value-weighted anomaly portfolios.

Appendix D: The construction of the long-short portfolios

Unconditional sorts and size-neutral sorts are executed to generate long-minus-short portfolios following Liu et al. (2019). The unconditional long-minus-short portfolios include those based on firm size, earnings-to-price, book-to-market, cash-flow-to-price, the return on equity, 1-month volatility, MAX, 12-month turnover, and 1-month abnormal turnover. In each month, the stocks are sorted into 10 groups based on firm size for the last month. The group with the lowest firm size is the long leg and the group with the highest firm size is the short leg.

As for the long-minus-short portfolios related to earnings-to-price, book-to-market, cash-flow-to-price, and the return on equity, these variables for the previous month are, respectively, used to classify the stocks into 10 groups in each month. The group with the highest ratio is the long leg and the group with the lowest ratio is the short leg. The long-minus-short portfolios related to 1-month volatility and MAX are engendered as well. The stocks are one by one sorted into 10 groups for each month based on 1-month volatility and MAX for the last month. The group with the highest 1-month volatility or MAX is the short leg, whereas the group with the lowest 1-month volatility or MAX constitutes the long leg.

In each month, the stocks are classified into 10 groups based on the previous 12-month turnover and 1-month abnormal turnover to obtain the long-minus-short portfolios related to 12-month turnover and 1-month abnormal turnover. What forms the long leg is the group with the lowest 12-month turnover or 1-month abnormal turnover. By contrast, the short leg is the group with the highest 12-month turnover or 1-month abnormal turnover.

The size-neutral long-minus-short portfolios are also based on the above variables, but the stocks are sorted based on firm size before selecting the long and short legs. To be specific, the stocks are first sorted into 10 groups based on firm size for the last month for each month. Within every group from the sorts on firm size, the long and short legs are screened out. All long and short legs across size groups are pooled together to construct the total long and short legs. We calculate the value-weighted returns of the long and short legs for each month as well as the long-minus-short return spreads for these long-minus-short portfolios.

Appendix E: Comparing the LSY and FF models through pricing errors

This appendix presents the pricing errors and loadings in dissecting return spreads using the cross-section factors. Table 10 shows the results of the LSY cross-section factors and the outcomes of the FF cross-section factors are presented in Table 11. Since the asset pricing model using the LSY cross-section factors captures more anomalies than the model using the FF cross-section factors, the LSY model is superior in dissecting return spreads.

From Panel A of Table 10, the asset pricing model using the LSY cross-section factors just fails to fully dissect the anomalies based on the return on equity, 1-month volatility, and MAX since the absolute t-statistics of the alphas range from 2.41955 to 23.75747. In addition, the model fully dissects the remaining six anomalies as the absolute t-statistics of the alphas are all lower than 1.96. Hence, the asset pricing model using the LSY cross-section factors fully captures six anomalies out of a total of nine anomalies from unconditional sorts.

When we obtain the return spreads of anomalies from size-neutral sorts, the results just slightly deteriorate in Panel B. The asset pricing model using the LSY cross-section factors fails to fully capture the anomalies related to earnings-to-price, cash-flow-to-price, the return on equity, and 1-month abnormal turnover since the absolute t-statistics of the alphas lie between 2.19063 and 5.00453. The model fully dissects the remaining four anomalies because the absolute t-statistics of the alphas are below 1.96. In short, the asset pricing model using the LSY cross-section factors captures six unconditional anomalies and four size-neutral anomalies.

In Panel A of Table 11, the results of unconditional anomalies show that the asset pricing model using the FF cross-section factors fails to capture the anomalies related to earnings-to-price, the return on equity, 1-month volatility, and MAX because the absolute t-statistics of the alphas range from 4.71424 to 24.53758. The model captures the remaining five unconditional anomalies due to the insignificant absolute t-statistics of the alphas being below 1.96. The results from size-neutral sorts in Panel B indicate that the asset pricing model using the FF cross-section factors is characterized by poor performance. There are eight anomalies from size-neutral sorts, while the asset pricing model using the FF cross-section factors only captures two anomalies based on book-to-market and cash-flow-to-price (the absolute t-statistics of the alphas are below 1.5). Moreover, the model fails when facing the remaining six anomalies as the absolute t-statistics of the alphas exceed 2 or even 7.

Appendix F: The construction of the momentum portfolios

In accordance with Jegadeesh and Titman (1993), the constructions of the momentum portfolios require formation and holding periods. Based on a rolling procedure, for each month, we sort the stocks based on the past returns for the formation period to generate the winner and loser portfolios. The winner portfolio consists of the stocks with the highest past returns, while the loser portfolio contains the stocks with the lowest past returns. In the holding period, we calculate the future returns of the winner and loser portfolios. The momentum profit is the difference in future returns between the winner and loser portfolios (winner minus loser).

Appendix G: The strength of collective behavior

In compliance with Feng et al. (2012), the strength of collective behavior (c) in the context of this paper can be conceptually measured as:

where a is the number of agents in a crowd, \({D}_{i}\) is each agent’s decisions, and P is the probability to be a fundamental trader.

When all agents are fundamental traders or trend-chasing traders, \(\left|\sum_{i=1}^{a}{D}_{i}\right|\) arrives at its maximum value, i.e., \(\left|\sum_{i=1}^{a}{D}_{i}\right|=a\) and \(c=1\), indicating the strongest collective behaviors. In other words, collective behaviors are the strongest once all the crowds of agents have the same strategies. When c is higher, the collective behavior is weaker. Using the agent-based model of this paper as an example, if \({n}_{f}=0.1\), then \(c=1.25\).

Rights and permissions

About this article

Cite this article

Lin, HW., Huang, JB., Lin, KB. et al. The competitions of time-varying and constant loadings in asset pricing models: empirical evidence and agent-based simulations. J Econ Interact Coord 17, 577–612 (2022). https://doi.org/10.1007/s11403-021-00337-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-021-00337-2