Abstract

The study tests the dynamic nexus between climate risk, natural resource exploration strategy in BRICS economies, and climate change mitigation. The study further extended the research aim and presented the recommendations for greening the globe by suggesting green recovery. Climate change protection and climate risk reduction may be efficiently funded using climate risks and natural resources. Still, it is vital to look at the carbon risk in BRICS countries as an example. The researchers used the GMM analysis technique to infer the study findings. According to the study’s findings, environmental mitigation was significant at 17%, and financial strength and carbon risks were significant at 22.0%. In addition, the 20.5% association between climate risks and environmental drift in the BRICS nations highlights climate change concerns. A state’s financial strength is essential to execute green economic recovery strategies, one of the most highly regarded measures to reducing climate change and guaranteeing long-term economic status at the national level. As a result of the study on green economic growth, decision-makers are provided with specific policy recommendations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

There are nine capacities of the planet, including a limit on atmospheric GHG concentrations of 348 parts per million CO2 equivalents or less, a biodiversity loss rate of no more than 11 species per million, a surface water consumer limit of no more than 4000 km3 per year, and a cropland conversion limit of no more than 15 percentage points of the world’s ice-free land (Lamperti et al. 2021). The study emphasizes to investigate it as this is interesting to estimate the boundaries of the process of these data. Studies suggest quantitative limitations for atmospheric concentrations of greenhouse gases (GHGs), aerosol loading, ocean acidification, biodiversity loss, freshwater consumption, nutrient cycling, ozone layer depletion, pollutants, and changes in land systems (Maja and Ayano 2021; Li et al. 2021). For various reasons, it is challenging to keep these limits in mind (Ionescu 2021). Even when evaluated in isolation, government arrangements are far from successfully guiding society within these constraints. When it comes to acidification of the oceans, the carbon dioxide cycles, freshwater resource consumption, and airborne aerosol deposition, non-regimes are prevalent. All of the current authorities suffer from varying degrees of compliance deficiencies (Singh et al. 2021). The Earth’s subsystems are also interconnected, so any change in one will impact the others. Discovered hundreds of critical connections between the environmental limits, some of which are reduced and others aggravated by regulatory changes (Seddon et al. 2021).

Most experts think improved, and more comprehensive climate system governance is required at all geographic scales (Iqbal et al. 2021b). “Effective collaboration, supported by better-designed institutions” is all that is needed. Demand for eco-friendly scholars has long been interested in better governing the Earth system (Zobeidi et al. 2022). On the one hand, scholars have studied how current international environmentalist regimes interact institutionally, while others have looked at organization development to improve the ability. In addition, there has been a focus on the circumstances for learning and knowledge transmission between international organizations and their governmental authorities on the world stage (Zeng et al. 2021). At the national and regional levels, questions of environmental policy integration have been predominantly studied. However, some talks have also been on the international stage. “Nexus approach” has emerged as a new intergovernmental focus on how to control the linkages among land, water, and power sources at the international level (Giglio et al. 2021).

When it comes to studying organizational structure and interaction, there is a significant parallel tendency toward studying governance, including non-state actors and multi-level management in particular, which is not often studied in the literature (Simpson et al. 2021). According to the study of collective action has decided to expand from collective leadership to the design and performance of treaties to the analysis of agency “well beyond state” and “lower side” initiatives for global environmental change. A broader perspective on Earth system governance is emerging among academics, encompassing multiple levels and scales of governance, actors, and accumulative “components” rather than one-off international agreements. Such multi-tiered and comprehensive social-ecological systems leadership has received very little attention for what it does, rather than just its institutional qualities (Maulu et al. 2021). How can geomorphological connections be regulated? This is the central topic of this study. Could a core set of governance functions, significant players, and mechanisms be specified in more detail?

Using EU policy and management as a case study, this article examines how multi-level governance is implemented at the regional scale (Chenet et al. 2021). The EU area serves as an excellent example since it has much power in addressing several Earth system interconnections. It has started an ideology for cooperation and integration that incorporates the dimensions of globalization in its policies. However, the writers only addressed a tiny portion of interactions, and many more can be discussed in a single article (Jhariya et al. 2021). Policymakers may also play a role in connections between the systems. GHG concentrations, freshwater consumption, and biodiversity depletion interact in critical ways. For instance, the loss of meadows and wetlands has detrimental effects on species and environmental issues. In contrast, increased forest cover contributes to environmental protection by sequestering carbon and providing biomass for energy, which may replace fossil fuel–based energy sources (Prichard et al. 2021). Green water and deep percolation may rise in specific locations, while blue water supply may be reduced. According to farming practices and technology, farmland Emissions of greenhouse gases might vary widely (Ozkan et al. 2021). In many regions, agricultural output will be negatively impacted by climate change, which will affect the usage of farm inputs like pesticides and fertilizers, and the land-use patterns (Nalau and Verrall 2021). Longer growing seasons will result from climate change, but so will the utilization of new plant species. This will impact land usage and the introduction of new pollinators. As the temperature warms in Europe, agricultural production is likewise expected to move to the north (El-Naggar et al. 2019).

Changes in the climate have consequences for ecological systems alike. One example is the transfer of alien species into seas, lakes, and land due to rising temperatures. One of the leading causes of biodiversity loss is this. Species that have already suffered degradation can no longer withstand the effects of global warming (such as increasing precipitation variability). Changes in land use have an impact on water usage. Groundwater recharge needs are predicted to rise due to global warming in Northern Europe. Still, water supplies are expected to decline in the Southeast, when severe water restrictions might be anticipated. Climate change or excessive water usage may potentially diminish the total amount of agriculture available and increase the strain on the remaining regions.

The primary objective of this study is to investigate the impact of climate risk on climate change mitigation in BRICS through the household decisions on changing climate comprehensively. The effects of the energy and carbon rebound may be seen across the entire economy. This the first contribution of research too. To balance out the potentially harmful impact of volunteer efforts, we investigate the possibility of relying on a climate charge. Moreover, to compensate for the rebound effects, an estimation of the carbon price is also made for the specific intensity, for which, study also intends to inquire that how climate risk and climate change mitigation effects green recovery of BRICS economies. This is the second contribution of research. On these two theoretical contribution and by using such study objectives, current research also provides practical recommendations for stakeholder that is the third contribution of preceding research.

Literature review

While the green recovery was widely discussed before the Covid-19 outbreak, there is a lot of material today that considers it inadequate. Compared to other financial, ecological, and energy elements, few researchers have focused on environmental money, including venture capital. The role of green speculation on China’s justified development and production-based CO2 emissions was analyzed from 1998 to 2017. Environmentally responsible power use and green investments considerably cut CO2 emissions, but open transactions have the opposite effect. Easily controlled Chinese expansion necessitates the latter two traits listed above (Conway et al. 2019). Even while green business and environmental sustainability go hand-in-hand, Covid-19 tests every industry (Hansen et al. 2019). The importance of green financial markets in the post-Covid-19 era of green money facilitation is studied in this issue. Most squares analysis was performed to sum up the results for the Asia–Pacific area using a combined OLS. It was shown that the greater risk and variability of debt instruments resulted in a greater yield. Furthermore, the financial system accounted for 60% of the green security market. In contrast, the bank-issued green bonds returned less than predicted (Campbell et al. 2019).

In contrast, it is suggested that the finance sector had a worse ability to deal with unforeseen risks (Costa et al. 2019). This feature needs urgent help from the financial institutions and markets of Covid-19. In order to reach simple expression objectives, the evaluation found that there was a need for carbon-free and environmentally beneficial ecological arrangements. In order to achieve ecological sustainability, it is possible that green money, such as green inclines, green securities, and green housing loans, might be a possibility (Mi et al. 2019). Also, the Sustainable Development Goals and the Paris Agreement on Climate Change directly impact environmental resilience. This resulted in emphasizing the Covid-19 pandemic’s ideal SDG portfolio choice. Hypothetically, the most effective income distribution toward the SDGs was devised (Fawzy et al. 2020). Researchers found that the current distribution of SDG’s monetary assistance depends on many consulting organizations, leading to a distorted spectrum of ventures. It is also possible to optimize your portfolio by polluting the planet or disposing of rubbish (Engle et al. 2020).

According to previous research, green manufacturing and sustainability assessment may be effective in environmental protection such as energy reuse, CO2 emissions, and rubbish recycling (Buhr et al. 2018). Research on China’s 2020 energy strategy has shown a significant improvement in energy output while decreasing energy consumption and yearly expenses if current advancements such as heat-and-power storage are used (Markkanen and Anger-Kraavi 2019). Because of this, environmental hazards have lessened, and renewable energy has grown in the total power mix due to increasing interest in environmental policies (Aryal et al. 2020). Everything altered for monetary transactions with the discovery of Covid-19. We assessed how the Covid-19 epidemic might impact current and future approaches to finding efficient ways to use available energy sources through this lens. As per the authors, identifying short-term needs is critical to Covid-19’s impact on renewable electricity development approaches. In order to strike a balance between economic development and environmental protection, it is necessary to take into account the drivers of carbon intensity structural consequences, technological spillover through world commerce, foreign direct investment, and economic deepening. Financial development and energy structure are intimately related to this study. Economic growth and technological progress are now being studied as two important ways to influence energy intensity via financial development. While these routes may seem counter-intuitive, an earlier study has shown contradictory results. To safeguard energy security and the ecosystem, additional research is required to relate financial concerns to energy utilization (Creutzig et al. 2018).

Several studies have examined the relationship between economic growth and CO2 emissions. Scientific data analysis has been placed on the OPEC, Kuwait, Malaysia, middle-income countries, and high-income economies, as well as the financial systems of the Southeast Asian region. Another study found the exact opposite impact to be true. Forty-six countries in sub-Saharan Africa, for example, saw financial development between 2000 and 2015 that increased carbon emissions (Anh et al. 2021). Furthermore, research in Turkey found that financial expansion considerably boosts CO2 emissions, second only to economic growth and urban development. Financial indicators (% of domestic private sector credit measured by real GDP) were not accepted in 24 countries in the Middle East and North Africa (MENA), where a similar situation was identified (Steiger et al. 2019).

Before the Covid-19 epidemic, there was a wealth of information available on green financing; now, in the wake of the outbreak, there is a dearth of such information. Researchers have looked at green financing and investment in the context of other macroeconomic, ecological, and electricity factors in works such as investigating OPEC’s sustainable growth and production-based CO2 emissions to learn more about the effect of green investment (Zhang et al. 2022). CO2 emissions from production and their drivers are shown to be long-term cointegrated using a vector autoregressive lags (ARDL) cointegration technique. Furthermore, the findings show that although trade openness increases CO2 emissions, green investments and the use of renewable power lower them considerably. As a result, the long-term health of OPEC depends on both of these variables. As far as green investments are linked to long-term prosperity, the Covid-19 presents a worldwide challenge to every industry. Accordingly, researched green bond markets to see whether or not they aid in green financing after the implementation of Covid-19 standards. The research employed pooled OLS and random effect generalized least square estimators to examine Asia and the Pacific area. Evidence indicated that financial markets had greater returns, but also more risk and more heterogeneity than conventional bonds (Iqbal and Bilal 2021a). Approximately 60% of the green bond market, according to this research, is dominated by the banking industry. In contrast, the returns on green bonds issued by the banking industry were lower.

The prior research by pointing out that the banking industry has a lesser ability to absorb unanticipated risks. Some financial institutions and marketplaces in Covid-19 have collapsed as a result of this circumstance. Hence, the study recommended that to achieve sustainable environmental goals, there is a need for healthy environmental policies that consider carbon-free and environmentally friendly approaches. However, green finance policies, such as green loans, green bonds, and green mortgages, might be useful in achieving environmental sustainability (Gambhir et al. 2022). SDGs and the Paris Climate Agreement are connected to environmental sustainability as well as environmental sustainability. The best portfolio selection for the SDGs in case of a Covid-19 pandemic was investigated by. Theoretically, the research developed a model for the most efficient distribution of resources toward the Sustainable Development Goals. It has been shown that investment portfolios have been distorted due to the current allocation of SDGs by different consulting businesses. Taxing environmental pollutants and wastes, on the other hand, is the only way to ensure that the correct portfolio allocation is accomplished.

Sustainable production and carbon tax were suggested as effective ways to deal with environmental challenges such as energy recycling, CO2 emission reduction, and trash composting in the research. A study by Ramos et al. (2022) into the energy system of the Organization of the Petroleum Exporting Countries (OPEC) in 2020 found that the use of the most recent technologies such as battery energy storage, heat pump heat and power, and demand response significantly increased energy efficiency and reduced fuel consumption and annual cost. Because of this, putting money into green initiatives helps to minimize environmental risks while also increasing the reliance on intermittent sources of renewable energy. However, with Covid-19’s appearance, the scenario for all economic activities changed (Javaid et al. 2022). According to, the Covid-19 outbreak has posed problems, possibilities, and a potential influence on sustainable energy techniques in both present and future situations. Covid-19 consequences on renewable-energy plans, according to the authors, need short-term policy prioritization (Fahmy 2022). It is also important to design both short- and long-term action plans to meet renewable energy goals in an effective and sustainable manner. According to, a comparison of the OPEC nations’ financial contributions to deal with climate change was made using the difference in differences (DID) approach from 2005 to 2019.

Using renewable sources of energy, population increase, carbon emissions, inflation, foreign direct investment (FDI), technical cooperation grants, R&D, and private partnering investments all contributed to the study’s conclusion that green financing and climate change mitigation are both greatly enhanced as a result of these factors combined (Loehr et al. 2022). After the recent epidemic of Covid-19, research on sustainability and development was conducted. According to the findings, achievement toward SDGs was weak before the pandemic, and financial resources may be scarcer after it. A carbon tax to finance climate solutions, in place of fossil fuel subsidies, might help the SDGs be achieved more quickly in the event of a Covid-19 pandemic, according to the study’s findings (Vicca et al. 2022). To further examine developing nations’ use of green finance mechanisms, Raikes et al. (2022) analyze the best techniques and channels for the green economic recovery and promote environmentally friendly investments.

Furthermore, it is stated that the current infectious pandemic resulted in a rapid fall in energy consumption, which lowers the costs of energy and hence slows down power project deployment. There are several opportunities to promote renewable energy, especially in terms of clean power investment, according to writers (Kim et al. 2022; Bingler et al. 2022). Covid-19’s impact on the global energy market was also examined, as well as plans for reducing greenhouse gas emissions. Evidence from green finance shows that investment in urban development projects like elevated rail adds favorably and considerably to green finance and green productivity. But the favorable impact of these expenditures grows and then declines with time. For example, Dai et al. (2022) analyzed public expenditure and green industrial progress in the BRI area from 2008 to 2018 by just looking at the function of green financing in the region’s economic growth.

GMM estimates reveal that public expenditure on human resources and green energy technology R&D advances a sustainable economy based on renewable resources and clean energy. For nations with a high GDP per capita, however, the outcomes are very different. Environmental and economic development were investigated in relation to the impact of green funding on province statistics for OPEC nations from 2010 to 2017 by. Green financing has a favorable effect on environmental quality, but this effect is dependent on the economic growth of the area, according to the research. As a result, green financing results in a win–win scenario for both the environment and economy (Hussain 2022). According to private investment is needed to align the financial system with sustainable development in G20 nations. Green finance methods should be standardized and marketplaces for green investment should be developed in order to promote investment in the G20 area. Increasing openness is also necessary. In the Covid-19 pandemic era for OPEC, no research has been identified that considers green financing, economic performance or growth, renewable power, and resource investment with private involvement. As a result, this void must be addressed since Covid-19 is a worldwide problem. Table 1 provides an overview of the most current research on this topic.

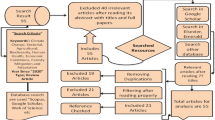

Research methodology

Data sources

From 2005 to 2019, our panel has utilized data from the BRICS countries. Climate change mitigation and climate risks have been combined to reflect two frequent risk categories in the research. It is important to note that the bank’s capacity to service its debts measures its ability to maintain monetary sustainability. To calculate the reimbursements component, the bank’s predicted loan loss as a proportion of total loans was used. Environmental policy insurance has decreased as a result of decreased supply. Over the minimal level of capital needed by authorities, banks have adequate capital (buffer) for environmental mitigation measures. The buffer is the gap between the statutory minimum standards and economic businesses’ capital as a predictor of their capital. Having a larger buffer indicates that a bank’s failure is lessened. If banks retain an “expansionary fiscal buffer” in response to the economy's cycles, the loop might be magnified, and financial instability risks could rise. In the research model, climatic hazards and dealing with climate change are also considered factors of investigation.

Empirical estimation strategy

The researcher used the generalized technique of the moment approach and made predictions about the outcomes. The extended technique of moments substantially aids in assessing and interpreting projections based on the estimated model. Small and medium datasets are among the areas where these advances have been made, and there are slight variations from the expected model. The generalized method of trimmed seconds is the subject of our research since it is more resistant to big model mistakes than other existing techniques and can provide estimations with nearly the same variability as the initial GMM in many cases. A population adjustment may affect arbitrary estimates if we assert that an assessment is robust to minor or significant deviations from the model. GMM estimation methods often have a breakdown down measurement that is zero approximation. For example, a system of sampling criteria may not always provide an accurate answer because of the possibility of sampling error. An estimator’s attributes might differ according to an additional problem presented. We offered two different decreases with updated weight for first-order exponential effectiveness in the category of GMM estimation methods built on the same criterion. When it comes to enhancing the estimator’s minuscule properties, other ways work wonders. The discovery pertains to the traditional thresholding estimation, which is considered a viable two-step generalized linear GMM in this study. There is an equal number of ith statements for every random N sample.

However, for now, in Eq. (1), a restricted variable section is emphasized, and it is assumed that a concurrent solution is possible as in Eq. (2):

This is quantitatively stated in Eq. (3) when the reduction concerns are considered. As a result of the mathematical programming replacing the randomized method, the GMM option for practical inference remains unaffected.

Furthermore, a small set of evaluation metrics controls the consistent variable value, such as Eq. (4). As a result, the threshold regression weighted estimator is elevated in Eq. (4), which measures this.

Equation (5) is further developed in Eqs. (6)–(8) to obtain the minimal amount of weighted estimation technique. An estimation of the two-step GMM approach looks like this:

It is possible to determine the RWE significantly greater approximation biases immediately from RWE based on the results of GMM.

In which

The enlarged nomenclature is linked to the CUE bias.

For computing simulations and calculating the two-step GMM calculated by this research, Eqs. (9) and (10) are expanded.

where BG is close to 0 if the dependent mean requirement is met.

Econometric model

This paper uses a novel technique to reveal the optimally weighted matrix for two-step GMM estimation using fully described threshold regression models. Model-weighted matrices should be optimized using threshold regression variable estimations. This work’s final estimate is a reduced-form weighting estimator (RWE). RWE does not have the higher-order asymptotic bias caused by the choice of the previous weighting matrix, unlike the general two-step GMM, since the autoregressive vector variable is accurately defined. It is indistinguishable between an RWE and an extended estimate in nonlinear numerical methods. A limited amount of information linear regressions are statistically comparable if the moment values are processed about the lowered element.

Climate risks and natural resource utilization in a given nation are essential factors in the study’s evaluation of the influence of climate change risks on reducing greenhouse gas emissions. Using the following equation, researchers were able to identify this connection.

where do the BRICS countries’ climate risks get their official designations? To represent fiscal load, β, λ, and δ may be represented by a sequence with and as its variables at any given point in time. There are country-specific impacts and error terms for each of these three variables.

Results and discussion

The study findings’ result shows that there is a need for required legislation to drive public and private funding toward green goods that are generally seen as providing a supportive environment for domestic financial institutions to increase their adoption of green products. Nevertheless, while prudential regulators in affluent nations vary, strategies for banking services intervention programs are often diverse across developing countries. Examples include rule-based authorities such as the French government, whereas principle-based sources such as Japan’s or Switzerland prefer to pursue more market ways of addressing climate change. Several developing nations have implemented required environmental and social protection policies and reporting requirements, as shown in Table 2, which may be seen here. Central banks establish specific borrowing quotas for environmental industries in developing nations like Thailand and Vietnam. The International Finance Corporation (IFC) and other development aid organizations have helped many developing countries establish green procurement policies. According to the International Finance Corporation (IFC), developing nations are at various levels of global sustainable development, and Nepal, Brasil, Russia, Colombian, Italy, Myanmar, Namibia, and Korea are the most advanced.

In contrast, most industrialized nations have adopted a voluntary approach led by industry, concentrating primarily on the declaration of environmental and financial risks as a tool for facilitating the TCFD. According to the TCFD’s official supporters, as of 2018, the government in Nepal, Brasil, Russia, Colombian, Italy, Myanmar, Namibia, and Korea (UK) have all voiced support for the effort, which is still entirely voluntary (Zhang et al. 2021). Under France’s Energy Transition Law for Green Growth, listed companies, banks, financial institutions, and investors must disclose climate-related accounting reports. The Bank of Japan gives Japanese banks that lend to environmental and energy enterprises particular loans. As a result, even needed programs in place sometimes lack specifics on enforcement and therefore create some doubt about how many responsibilities the government has to ensure compliance (see Table 1).

Empirical parameters of climate risk

A historical review of climate change policy and research reveals that mitigation deterrence does not merely apply to net-zero emissions (NETs). According to Ozkan et al. (2021), climate policy has progressed through five stages, which correlated to advancements in forecasting and the dominance of various technological promises. In each step, the main aim of preventing disastrous climate change is re-conceptualized, and the promises of future technology deployment are shifted. As a result, decarbonization has been delayed due to a combination of these factors working together. Due to increasing computer capacity and expanding scientific and technological research and innovation frontiers, modeling approaches have changed with mission framings. There is no evidence that this has resulted in technical planning and application but instead deferred action on decarbonization. Objective framings have developed from a general stabilization target to “outcome warmth,” a sequence that has shifted from cause to influence on climate following the original broad destabilization frame: “percentage pollution reductions,” “atmospheric percentages,” and “carbon budgets” (understood as globally averaged conditions). There has been an increasing interest in a device that can act on GHGs still in the atmospheric environment to better model GHG concentrations throughout the mid-1990s. CCS and biomass simulation were used to develop BECCS equipment, included in scenario planning. After a while, carbon budgets took over as the preferred goal framework, again depending on advances in modeling and (evolving) technological guarantees.

The concept of “negative pollutants” has come into its own with the advent of carbon accounting, allowing for both the leveling out of stubborn greenhouse gases and the reversal of overshoots. For the first time in recent years, climate policy goals have been expressed in terms of global mean temperature, which has opened up an important market for temperature-related products. To achieve the policy aims without dramatic economic upheaval, we would anticipate SRM (Solar Radiation Management) to be the next promised lined up—with NETs remaining necessary—though incurring from letdown after the early excitement. It is possible to tell a similar story about other more traditional climate change response alternatives, such as nuclear power and coal carbon capture and storage.

GMM estimation results

Technology claims to protect the STF are prevalent in all of them. Levels of investment have resulted in deployment that has been limited and spatially uneven, and in the case of land carbon storage, may even have reversed. The bourgeois system has emphasized words and trade over action regarding environmental policies (see Table 3). SRM, according to Surprise, acts as a pressure valve, reducing the strain on fossil capital.

As our historical review demonstrates, there is already a slew of these valves installed and working on an organ. It is possible that just a few policy ideas are being spoken about at any moment, but these ideas are not going anywhere. There is a cycle of enthusiasm and letdown with each technological promise, leaving behind mostly modeling evidence. The climate models are built on outdated technical fixes (see Table 4). They provide a record and gauge of the controlling a person of the climate problem in circumstances when remedies remain restricted by a strong desire to prevent disturbance and sustain the economic, sociopolitical daily business.

According to our understanding of the cultural case of mitigated political deterrence, the activities involved in permitting dissuasion and delaying from NETs are apparent in other instances of weather patterns technical promises. Defensive STF promises (or, less technically, “technologies of prevarication”) have emerged in tandem with the set’s practices. Since emissions were no longer the aim, technological promises got farther distant first from sectors where pollutants originate—energy, transportation, land use—and therefore from undermining the value of the company’s nitrogen assets and society’s capitalist logic. To understand why each current group of technological promises and deterrents is so appealing, one must first understand the purposeful avoidance of confronting nitrogen capital objectives. It has been possible to delay (or do it very slowly and partly) the decarbonization of the economy by depending on anticipated capabilities that are ever more intrusive in the native surroundings (and even less so in the economy) and which benefit only international bankers and corporate interests. It has been dug for us all to live in, utilizing protective STF vows as shovels under their control.

Furthermore, there seems to be no end to this advancement in technology. SRM deployment might have consequences that need new technology to mitigate. This is true even if strong people decide, plan, and possibly even attempt to “regulate” global temperatures with it. No one can predict precisely what STF will take the place of SRM, but based on the precedence established so far, one may picture a (perhaps nano-)technology capable of mitigating and even reversing environmental issues without the negative consequences associated with SRM.

Regression results

There are reasons to be cautiously optimistic that are not based only on these anticipated technological solutions. As temperatures increase, SRM seems to be the following plausible promise to support carbon pricing and the political order. Nevertheless, this is not a sure thing. Currently, the neoliberal system is in a state of crisis once again. The banking collapse of 2008 rattled the regime, but money printing has helped it survive. Covid-19-related repercussions on economic growth and interactions have increased the pressures on capitalism, even as financial markets have grown. A new political regime might turn talk become action. This is something that has only been spoken about. Low-carbon development may see a rebirth, maybe prompted by Green New Deal-style measures under a more democratic administration. This SRM may reemerge due to the tendency toward nationalistic nationalism, or administrations, such as China’s, may recognize the value of investing in climate catastrophe mitigation technology for their own country.

Defensive STFs may play a role in mitigating deterrence dynamics under various political regimes, but they may act differently and potentially at a different intensity. While NETs are not a panacea, there are not any easy political fixes either. As long as capitalism exists and lengthy waves of structural renewal continue, the financialization of the economy is likely to be met by a fresh round of reinvestment in the “real” economy. Neoliberalism’s reaction to climate science may shift fortunes for defensive STFs, which may get significant investment and become traditional STFs in the next capitalist phase. The mitigated disincentive founder process would become part of a wider founder loop of violent revolution, which would occur slower (see Table 5).

The maturity of the producer is the only house feature that has a quantitatively meaningful and positive relationship with risk and price constraints. As farmers become older, the likelihood of being at risk- and premium rises. Older farmers may be less likely than younger ones to embrace new technology since they are less productive and less likely to do so. As a result, financial institutions are more likely to lend money to young farmers. Raikes et al. (2022) also discovered a positive correlation between the age of the family head and credit limitations, which is consistent with this conclusion.

The amount constraint requirement is inversely associated with the availability of extension services, which is statistically significant. As a result, farmers who interact with extension professionals are more likely to be quantity-constrained. Most studies have shown a clear correlation between farmers’ access to finance and their engagement with extension agents. Farmers with limited access to financing might be hindered from implementing the new ideas that extension workers are constantly disseminating; Africa’s extension–farmer connections and connections for distributing knowledge to farmers are poor and ineffectual. Their results corroborate this conclusion. The likelihood of being probability is positively and scientifically significantly influenced by having instant information. Family farms rice producers may be unable to secure loans if climate change knowledge becomes more widely available. Adaptation strategies in the study region may be inadequate. Thus, this is not unexpected. Farmers may be unable to acquire knowledge on climate change measures because of a lack of extension staff and limited transportation, according to the findings of the FGD report.

A farmer’s reaction to changes in input usage variables such as credit may differ depending on geography. Ekiti State’s rice farmers’ placement is statistically relevant and favorably associated with price restriction circumstances, despite the wide variance in physical location between the two states. Droughts and floods are common in Ekiti State, which considerably influences rice production. Ekiti State is vulnerable to unpredictable rainfall. In developing countries, family farms and rice farmers may be price limited because of high credit management fees and the region’s sensitivity to climate change. On the other hand, rice producers in Osun State have a significantly negative association with quantity constraints. Branches of financial institutions, including the CBN and the BOA, are located in the state. This might be a contributing factor.

Sensitivity analysis

An association between credit limitations and interest rates has been postulated, and the investigation results corroborate this. The chance of just being at risk- and several units are positively influenced by the interest rate, which is statistically significant. As the interest rate increases, the likelihood of being risk and quantity restricted gains. Consequently, the demand for credit decreases as the interest rate on loans rises. As Seddon et al. (2021) discovered in their research, credit rationing and interest rates positively linked Nigerian small-scale farmers’ lending and limitation. It is statically essential that the quantity of credit earned has a negative and significant effect on climate change adaptation strategy. When it comes to farmers strapped for cash, the more credit they obtain, the less likely they are to choose a move forward, according to the qualities of this credit. The development of adaption tactics might be capital-intensive, requiring investments in new, better vegetative propagation and other technology, which may explain this phenomenon.

Consequently, farmers may be unable to implement any climate-resilient plan, even if they are aware of it, since they may not be able to purchase the necessary inputs. Distance from the credit source has a positive and significant effect on the likelihood of being probability in the credit market, suggesting that the greater the distance from the credit source, the greater the possibility of being uncertain. There is a statistically significant negative correlation between the chance of being likelihood and the credit source coefficient. In the informal loan market, peasant farmers are less likely to be probability since finance is easier to get by. According to this, farmers who reside further from established sources have more risk constraints than nearby ones (see Table 6).

Excluding instrumentation, it is strongly predictive of the underlying response variable, which validates the over-identifying limitations in a GMM model by the Sargan test. Higher separation bias in climate change mitigation and adaptation methods were considered for farmers with risk constraints, according to the IMR, which evaluates selection bias in adaptation strategy selection. This indicates that more climate change adaption techniques have not been included in the model’s estimate. As a result, farmers’ views of climate change may vary due to the many factors influencing their reactions to climate change impacts. However, it is still called the internal objective of the ECB, and thus there is room for interpretation. According to one research, 54 of the world’s 135 central banks have a mission to promote sustainable economic development, but their objectives are not expressly related to global warming. Since the financial meltdown, most monetary policies have concentrated on their interventional role in the global economy. They have not made major adjustments to their policies to enable a limited transition. Emerging research supports the notion that climate science problems might harm economic stability. Still, many institutions and financial regulators have begun evaluating the detrimental consequences of climate change on their banking and non-banking financial sectors.

The transition, physical, and liability implications of climate change on the banking industry have previously been studied. For central investors and credit policymakers, the stability of the financial system, prices, and basic economics might be threatened by climate science problems, as indicated in. While migrating to a minimal economy, variations in energy costs may directly impact prices and macroeconomic stability and impede economic and social development in all industries and the financial sector. This may generate a “Sometimes then moment” when a sudden, massive decline in asset prices is projected to endanger economic independence and spark cascading effects across the linked and interdependent financial system. The new IPCC special report suggests that national financial institution supervisors might provide the last recourse for climate finance mechanisms to reduce systemic risk associated with stranded assets.

Additionally, commercial banks and large inspectors are argued to have a greater role in achieving larger public objectives, such as reducing market failure and establishing national plans. Commercial banks and policymakers are gradually being expected to study climate change consequences and react as required to fulfill their responsibilities as public bodies because of the growing danger climate change poses. For this reason, central banks and regulations should impose limitations on the banking system for carbon-intensive and ecologically hazardous borrowers to prevent a credit financial crash. To have a long-term impact on the economy, regional lenders, and investors, there should be a similar approach to climate change issues. Suppose we want to have a long-term impact on global warming. In that case, we need monetary policy and regulations to adopt a long-term environmental policy and give consumers a lengthy market signal. Fewer central banks resist the need to adapt to changing circumstances. To them, temperature hazards were just a part of their job description. While conceding that there are many perspectives and opinions on this issue, one Executive Board member of the European Central Bank (ECB) claimed that the bank must but should help facilitate the decarbonization industry within its mission.

Discussion

BRICS’s limited energy transition can be further developed by focusing on CO2 carbon output to enhance planning and implementation and control carbon pollution severity. Rapid energy transition necessitates efficiency in quality public programs and expansion of healthcare care for the elderly. There is also a need to boost energy performance and conservation and increase metropolitan construction’s use of environmentally friendly materials. A province’s ability to coordinate low-carbon growth with new energy transition depends on the stage of growth and the region’s geography. China has a higher level of coordination in its eastern provinces than in its prairie states when it comes to adaptation efforts (Zhao et al, 2022; Iqbal and Bilal, 2021b). As a result of their lower levels of energy transition, the provinces are more reliant on power consumption for their growth in the economy. Linkage synergy between the east and the western countries is dissimilar, indicating that the two areas of sluggish growth are separated by large energy transition and lower operational gaps in the provinces of China. There should also be greater emphasis on the diverse development stages and geographical regions of countries across the central east and west and the similarities and contrasts in creating low-carbon energy transition in these counties (Yang et al, 2022; Iqbal et al, 2021a).

There can be little doubt that energy transition has played a significant part in modernizing our industry, culture, and culture. In 2007, for maybe the first time, the population overtook the world’s rural areas in terms of total inhabitants. 1.35 billion people now live in cities throughout the globe, and also the energy transition rate has risen from 36.6 to 55.3% since 1970. The United Nations predicts that the global energy transition pattern will start to grow in the future. More than 6 billion people may live in cities throughout the globe by 2050, with an energy transition rate of 68% (Zheng et al, 2022). Concerning Smart Lifestyle, private capital has the highest impact on all three major SUD sources (Tables 5 and 6), as shown by conventional beta coefficients (Table 5). According to the model, advancements in this sector are concentrated on the cultural and recreational, wellness, community safety, home products, and tourist industries. It is an industry run by big private enterprises since they have the scope, capacity, and expertise to conduct R&D operations and establish a substantial product line for these products. Generally, these technological organizations use the classic elements of economies of scale, breadth, and experience to run large operations. Even while the online platform has a lot of operating costs, it has a wide range of goods and services and uses the same technologies, boosting its productivity as it is reused for new products or services. As a result of this approach, firms are encouraged to fund corporate incubation to meet demand and enhance their innovation capacity as conglomerates by reaping the benefits of specialized market possibilities offered by the innovation source (Sun et al, 2022; Huang et al, 2021).

Cost research of complication illustrates how technical innovation grows via progressive answers to industrial technical hurdles that continually accrue, mostly through the recombination and development of existing capabilities. Consequently, important technological businesses may use mechanisms to preserve their technical history as a kind of investment when developing new products and services. People’s quality of life is positively impacted by the proliferation of digitalization (ICTs), especially when it comes to improving life for the elderly and disabled and improving the reporting, collection, and accessibility of patient records by various stakeholders in the healthcare delivery industry. According to this study’s findings, private money significantly impacts the Smart Living component. The Smart Management component is most influenced by finance via academia. The engagement of men in public life is correlated with improved service performance, such as in schools and hospitals, and more openness in governmental actions and choices. It is becoming more common for colleges to serve as a source of innovation policy, achieving strategic, human resource training, and entrepreneurial training. There are a lot of differences between internal and external college incubators in terms of selection processes, management techniques, money sources, kind of backers, and necessary services. Commercial startups have a distinct aim since the taxpayer often provides them. Research shows that the number of initiatives devoted to SCs’ most pressing concerns about administration remains low compared to the explosion of activities on pollution challenges (Sun et al. 2022).

Conclusion and implications

This study used the GMM model to assess the role of climate risks and natural resources’ role in climate risks, climate change mitigation, and implications for green economic recovery for BRICS from 2005 to 2019. Climate change and green economic recovery have now been discovered as a new mechanism for climate risks and natural resource utilization. Some banking institutions and business watchdogs have recently recommended that stockholders and asset managers assess their exposure to financial risks associated with climate change. To find out how a changing climate would affect the economy, banking institutions and central authorities have started preparing models for climate stress testing. Economic institutions have yet to thoroughly assess climate change’s potential influence on climate risks. Climate risk elements are challenging classics associated with financial risk analysis approaches (profound ambiguity, quasi, and indigeneity). New perspectives on climate change must be incorporated into the macro-financial analysis to provide a complete picture of climate warming change’s significance. The link between adaptation and mitigation and climate risks is examined for the first time, emphasizing overcoming analytical limits and illuminating the economic ramifications of climate change and green economic recovery. Network simulation, econometric forecasting, and economics are all used in the book to comprehend climate-related economic problems and the associated financial strategies and tools aiming at a low-carbon transformation. National banks and financial regulators may benefit from the study results of these stakeholders by incorporating global warming concerns and green economic recovery into their policies and financial risk appraisal. According to a new report, competition, expert, and transparent financial market based on fair rules and processes that provide pertinent information and suitable rewards are the most probable means of achieving financial sector uniformity in an interconnected international economy. Macroeconomic policies must be implemented to prevent or at least minimize the emergence of extreme economic imbalance, incorrect price signals, and incentive imbalances. As a result of these findings, the study recommends pursuing a few possible future research avenues that might be followed. Several climate change projects have attempted to reduce pollution by increasing human activity’s influence on greenhouse gas emissions. Emissions of carbon dioxide from hydrocarbon power stations and global energy and transportation consumption boost the green economy, despite efforts to curb climate change. Half of the world’s emissions come from these two areas, while the remaining fifth comes from other places. Power infrastructure and global supply chains have both suffered as a result. This is a matter of worry since it may be advantageous to break mitigation pledges. For the time being, it makes economic and societal sense to focus less on preventing climate change and more on responding to its effects while they are less severe (if any). Individuals (and taxpayers) are understandably economically cautious in opting not to support measures that primarily benefit other nations because of the local political situation.

Data availability

The data that support the findings of this study are openly available on request.

References

Anh TC, Chien F, Hussein MA, Ramli MMY, Psi MM Soelton M, Psi S, Iqbal S, Bilal AR (2021) Estimating role of green financing on energy security, economic and environmental integration of BRI member countries. Singapore Econ Rev

Aryal JP, Sapkota TB, Khurana R, Khatri-Chhetri A, Rahut DB, Jat ML (2020) Climate change and agriculture in South Asia: adaptation options in smallholder production systems. Environ Dev Sustain 22(6):5045–5075

Bingler JA, Kraus M, Leippold M, Webersinke N (2022) Cheap talk and cherry-picking: what climatebert has to say on corporate climate risk disclosures. Financ Res Lett 102776

Buhr B, Volz U, Donovan C, Kling G, Lo YC, Murinde V, Pullin N (2018) Climate change and the cost of capital in developing countries

Campbell I, Macleod A, Sahlmann C, Neves L, Funderud J, Øverland M, ..., Stanley M (2019) The environmental risks associated with the development of seaweed farming in Europe-prioritizing key knowledge gaps. Front Mar Sci 6:107

Chenet H, Ryan-Collins J, van Lerven F (2021) Finance, climate-change and radical uncertainty: towards a precautionary approach to financial policy. Ecol Econ 183:106957

Conway D, Nicholls RJ, Brown S, Tebboth MG, Adger WN, Ahmad B, ..., Wester P (2019) The need for bottom-up assessments of climate risks and adaptation in climate-sensitive regions. Nat Clim Chang 9(7):503-511

Costa MH, Fleck LC, Cohn AS, Abrahão GM, Brando PM, Coe MT, ..., Soares‐Filho BS (2019) Climate risks to Amazon agriculture suggest a rationale to conserve local ecosystems. Front Ecol Environ 17(10):584-590

Creutzig F, Roy J, Lamb WF, Azevedo IM, Bruine de Bruin W, Dalkmann H, ..., Weber EU (2018) Towards demand-side solutions for mitigating climate change. Nat Clim Change 8(4):260-263

Dai H, Mamkhezri J, Arshed N, Javaid A, Salem S, Khan YA (2022) Role of energy mix in determining climate change vulnerability in G7 countries. Sustainability 14(4):2161

El-Naggar A, El-Naggar AH, Shaheen SM, Sarkar B, Chang SX, Tsang DC, ..., Ok YS (2019) Biochar composition-dependent impacts on soil nutrient release, carbon mineralization, and potential environmental risk: a review. J Environ Manag 241:458-467

Engle RF, Giglio S, Kelly B, Lee H, Stroebel J (2020) Hedging climate change news. Rev Financ Stud 33(3):1184–1216

Fahmy H (2022) The rise in investors’ awareness of climate risks after the Paris Agreement and the clean energy-oil-technology prices nexus. Energy Econ 106:105738

Fawzy S, Osman AI, Doran J, Rooney DW (2020) Strategies for mitigation of climate change: a review. Environ Chem Lett 18(6):2069–2094

Gambhir A, George M, McJeon H, Arnell NW, Bernie D, Mittal S, ..., Monteith S (2022) Near-term transition and longer-term physical climate risks of greenhouse gas emissions pathways. Nat Clim Change 12(1):88-96

Giglio S, Kelly B, Stroebel J (2021) Climate finance. Annu Rev Financ Econ 13:15–36

Hansen J, Hellin J, Rosenstock T, Fisher E, Cairns J, Stirling C, ..., Campbell B (2019) Climate risk management and rural poverty reduction. Agric Syst 172:28-46

Huang J, Wang X, Liu H, Iqbal S (2021) Financial consideration of energy and environmental nexus with energy poverty: Promoting financial development in G7 economies. Front Energy Res 666

Hussain Z (2022) Environmental and economic-oriented transport efficiency: the role of climate change mitigation technology. Environ Sci Pollut Res 29(19):29165–29182

Ionescu L (2021) Transitioning to a low-carbon economy. Geopolitics History Int Relations 13(1):86–96

Iqbal S, Bilal AR (2021a) Investment performance: emotional beasts are dragging into the darkness of the castle. Glob Bus Rev 09721509211044309

Iqbal S, Bilal AR (2021b) Energy financing in COVID-19: How public supports can benefit?. China Finance Review International

Iqbal S, Bilal AR, Nurunnabi M, Iqbal W, Alfakhri Y, Iqbal N (2021a) It is time to control the worst: testing COVID-19 outbreak, energy consumption and CO2 emission. Environ Sci Pollut Res 28(15):19008–19020

Iqbal S, Taghizadeh-Hesary F, Mohsin M, Iqbal W (2021b) Assessing the role of the green finance index in environmental pollution reduction. Stud Appl Econ 39(3)

Javaid A, Arshed N, Munir M, Amani Zakaria Z, Alamri FS, Abd El-Wahed KH, Hanif U (2022) Econometric assessment of institutional quality in mitigating global climate-change risk. Sustainability 14(2):669

Jhariya MK, Meena RS, Banerjee A (2021) Ecological intensification of natural resources towards sustainable productive system. In Ecological intensification of natural resources for sustainable agriculture (pp. 1–28). Springer, Singapore

Kim D, Ryu H, Lee J, Kim KK (2022) Balancing risk: generation expansion planning under climate mitigation scenarios. Eur J Oper Res 297(2):665–679

Lamperti F, Bosetti V, Roventini A, Tavoni M, Treibich T (2021) Three green financial policies to address climate risks. J Financ Stab 54:100875

Li W, Chien F, Ngo QT, Nguyen TD, Iqbal S, Bilal AR (2021) Vertical financial disparity, energy prices and emission reduction: empirical insights from Pakistan. J Environ Manage 294:112946

Loehr J, Becken S, Nalau J, Mackey B (2022) Exploring the multiple benefits of ecosystem-based adaptation in tourism for climate risks and destination well-being. J Hosp Tour Res 46(3):518–543

Maja MM, Ayano SF (2021) The impact of population growth on natural resources and farmers’ capacity to adapt to climate change in low-income countries. Earth Syst Environ 5(2):271–283

Markkanen S, Anger-Kraavi A (2019) Social impacts of climate change mitigation policies and their implications for inequality. Climate Policy 19(7):827–844

Maulu S, Hasimuna OJ, Haambiya LH, Monde C, Musuka CG, Makorwa TH, ..., Nsekanabo JD (2021) Climate change effects on aquaculture production: sustainability implications, mitigation, and adaptations. Front Sustain Food Syst 5:609097

Mi Z, Guan D, Liu Z, Liu J, Viguié V, Fromer N, Wang Y (2019) Cities: the core of climate change mitigation. J Clean Prod 207:582–589

Nalau J, Verrall B (2021) Mapping the evolution and current trends in climate change adaptation science. Clim Risk Manag 32:100290

Ozkan A, Ozkan G, Yalaman A, Yildiz Y (2021) Climate risk, culture and the Covid-19 mortality: a cross-country analysis. World Dev 141:105412

Prichard SJ, Hessburg PF, Hagmann RK, Povak NA, Dobrowski SZ, Hurteau MD, ..., Khatri‐Chhetri P (2021) Adapting western North American forests to climate change and wildfires: 10 common questions. Ecol Appl 31(8):e02433

Raikes J, Smith TF, Baldwin C, Henstra D (2022) Disaster risk reduction and climate policy implementation challenges in Canada and Australia. Climate Policy 22(4):534–548

Ramos L, Gallagher KP, Stephenson C, Monasterolo I (2022) Climate risk and IMF surveillance policy: a baseline analysis. Climate Policy 22(3):371–388

Seddon N, Smith A, Smith P, Key I, Chausson A, Girardin C, ..., Turner B (2021) Getting the message right on nature-based solutions to climate change. Global Change Biol 27(8):1518–1546

Simpson NP, Mach KJ, Constable A, Hess J, Hogarth R, Howden M, ..., Trisos CH (2021) A framework for complex climate change risk assessment. One Earth 4(4):489-501

Singh C, Iyer S, New MG, Few R, Kuchimanchi B, Segnon AC, Morchain D (2021) Interrogating ‘effectiveness’ in climate change adaptation: 11 guiding principles for adaptation research and practice. Clim Dev 1–15

Steiger R, Scott D, Abegg B, Pons M, Aall C (2019) A critical review of climate change risk for ski tourism. Curr Issue Tour 22(11):1343–1379

Sun L, Fang S, Iqbal S, Bilal AR (2022) Financial stability role on climate risks, and climate change mitigation: implications for green economic recovery. Environ Sci Pollut Res 29(22):33063–33074

Vicca S, Goll DS, Hagens M, Hartmann J, Janssens IA, Neubeck A, ..., Verbruggen E (2022) Is the climate change mitigation effect of enhanced silicate weathering governed by biological processes? Global Change Biol 28(3):711–726

Yang Y, Liu Z, Saydaliev HB, Iqbal S (2022) Economic impact of crude oil supply disruption on social welfare losses and strategic petroleum reserves. Resources Policy 77:102689

Zeng Y, Friess DA, Sarira TV, Siman K, Koh LP (2021) Global potential and limits of mangrove blue carbon for climate change mitigation. Curr Biol 31(8):1737–1743

Zhang L, Huang F, Lu L, Ni X, Iqbal S (2022) Energy financing for energy retrofit in COVID-19: Recommendations for green bond financing. Environ Sci Pollut Res 29(16):23105–23116

Zhao L, Saydaliev HB, Iqbal S (2022) Energy financing, covid-19 repercussions and climate change: Implications for emerging economies. Clim Change Econ 2240003

Zheng X, Zhou Y, Iqbal S (2022) Working capital management of SMEs in COVID-19: role of managerial personality traits and overconfidence behavior. Econ Anal Policy 76:439–451

Zobeidi T, Yaghoubi J, Yazdanpanah M (2022) Farmers’ incremental adaptation to water scarcity: An application of the model of private proactive adaptation to climate change (MPPACC). Agric Water Manag 264:107528

Author information

Authors and Affiliations

Contributions

Conceptualization, methodology, writing—original draft: JinTong Wei. Data curation, visualization, editing: Shumaila Khan.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

We declare that we have no human participants, human data, or human issues.

Consent for publication.

We do not have any person’s data.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Preprint Service:

Our manuscript is not posted at a preprint server prior to submission.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wei, J., Khan, S. Climate risk, natural resources, and climate change mitigation options in BRICS: implications for green recovery. Environ Sci Pollut Res 30, 29015–29028 (2023). https://doi.org/10.1007/s11356-022-23961-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23961-2