Abstract

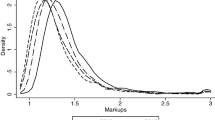

Using the quantile GARCH model estimators to gauge the bidirectional risk magnitude and the Granger causality test in risk distributions to detect the existence of risk spillovers, this paper explores the extreme risk spillovers of China’s regional carbon markets to local listed firm’s stock returns. From the perspectives of macro region level and micro firm level, the findings are outlined as follows. First, among the top three active carbon trading pilots (Hubei, Guangdong, and Shenzhen), Hubei pilot exhibits significant “low risk and high profit” features. Second, the predominant risk spillover effects to local listed firms are heterogeneous across pilots. Specifically, Hubei pilot is dominated by “up-to-down” effect, and Guangdong pilot is dominated by “down-to-down” effect, while Shenzhen pilot has no predominant effect. The heterogeneous risk spillover performance may be caused by the regional divergence in economic development, industry structure, and cap setting concerning each pilot. Third, the risk transmission performance from carbon allowance price to local listed firm’s stock returns depends on the firm’s belonging sector. That is, environment-related firms, either environment-friendly firms or pollution-intensive firms, are more susceptible to carbon markets’ risks compared with environment-unrelated firms. This paper supplies novel information on the risk transmission from carbon markets to local economic entities, which proves valuable not only for firms to improve risk aversion ability but also for policy-makers to perfect carbon markets’ mechanism.

Similar content being viewed by others

Notes

M: Scientific research and technical service

N: Water conservancy, environment, and public facility management

J: Finance

E: Construction

D: Electric power, heat, gas, and water production and supply

F: Wholesale and retail;

S: Diversified industries

K: Real estate

G: Transport, storage and postal service

R: Culture, sport and entertainment

L: Leasing and commercial services

References

Arouri MEH, Jawadi F, Nguyen DK (2012) Nonlinearities in carbon spot-futures price relationships during phase II of the EU ETS. Econ Model 29(3):884–892. https://doi.org/10.1016/j.econmod.2011.11.003

Balcılar M, Demirer R, Hammoudeh S, Nguyen DK (2016) Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energy Econ 54:159–172. https://doi.org/10.1016/j.eneco.2015.11.003

Bredin D, Parsons J (2016) Why is spot carbon so cheap and future carbon so dear? The term structure of carbon prices. Energy J 37(3):83–107. https://doi.org/10.5547/01956574.37.3.dbre

Bushnell JB, Chong H, Mansur ET (2013) Profiting from regulation: evidence from the European carbon market. Am Econ J Econ Pol 5(4):78–106. https://doi.org/10.1257/pol.5.4.78

Candelon B, Tokpavi S (2016) A nonparametric test for granger causality in distribution with application to financial contagion. J Bus Econ Stat 34(2):240–253. https://doi.org/10.1080/07350015.2015.1026774

Chang K, Ge F, Zhang C, Wang W (2018) The dynamic linkage effect between energy and emissions allowances price for regional emissions trading scheme pilots in China. Renew Sust Energ Rev 98:415–425. https://doi.org/10.1016/j.rser.2018.09.023

Chang K, Zhang C, Wang HW (2020) Asymmetric dependence structures between emission allowances and energy markets: new evidence from China’s emissions trading scheme pilots. Environ Sci Pollut Res 27:21140–21158. https://doi.org/10.1007/s11356-020-08237-x

Dhamija AK, Yadav SS, Jain PK (2018) Volatility spillover of energy markets into EUA markets under EU ETS: a multi-phase study. Environ Econ Policy Stud 20(3):561–591. https://doi.org/10.1007/s10018-017-0206-5

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econ 182(1):119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Du L, He Y (2015) Extreme risk spillovers between crude oil and stock markets. Energy Econ 51:455–465. https://doi.org/10.1016/j.eneco.2015.08.007

Fan Y, Zhang YJ, Tsai HT (2008) Estimating ‘value at risk’ of crude oil price and its spillover effect using the GED-GARCH approach. Energy Econ 30(6):3156–3171. https://doi.org/10.1016/j.eneco.2008.04.002

Granger CWJ (1980) Testing for causality: a personal viewpoint. J Econ Dyn Control 2:329–352. https://doi.org/10.1016/0165-1889(80)90069-X

Gronwald M (2016) Explosive oil prices. Energy Econ 60:1–5. https://doi.org/10.1016/j.eneco.2016.09.012

Hong Y, Liu Y, Wang S (2009) Granger causality in risk and detection of extreme risk spillover between financial markets. J Econ 150(2):271–287. https://doi.org/10.1016/j.jeconom.2008.12.013

Ji Q, Zhang D, Geng JB (2018) Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J Clean Prod 198:972–978. https://doi.org/10.1016/j.jclepro.2018.07.126

Jia J, Li H, Zhou J, Jiang M, Dong D (2018) Analysis of the transmission characteristics of China’s carbon market transaction price volatility from the perspective of a complex network. Environ Sci Pollut Res 25(8):7369–7381. https://doi.org/10.1007/s11356-017-1035-6

Jotzo F, Löschel A (2014) Emissions trading in China: emerging experiences and international lessons. Energy Policy 75:3–8. https://doi.org/10.1016/j.enpol.2014.09.019

Kilian L, Park C (2009) The impact of oil price shocks on the US stock market. Int Econ Rev 50(4):1267–1287. https://doi.org/10.1111/j.1468-2354.2009.00568.x

Liu J, Huang Y, Chang CP (2020) Leverage analysis of carbon market price fluctuation in China. J Clean Prod 245:118557. https://doi.org/10.1016/j.jclepro.2019.118557

Lueg K, Krastev B, Lueg R (2019) Bidirectional effects between organizational sustainability disclosure and risk. J Clean Prod 229:268–277. https://doi.org/10.1016/j.jclepro.2019.04.379

Peng C, Zhu H, Guo Y (2018) Risk spillover of international crude oil to China’s firms: evidence from granger causality across quantile. Energy Econ 72:188–199. https://doi.org/10.1016/j.eneco.2018.04.007

Qiao HS, Liu XL (2011) The financial property of carbon emission permits. Theoretical Exploration 3:61–64 CNKI:SUN:LLTS.0.2011-03-019

Reboredo JC, Ugolini A (2016) Quantile dependence of oil price movements and stock returns. Energy Econ 54:33–49. https://doi.org/10.1016/j.eneco.2015.11.015

Shahzad SJH, Mensi W, Hammoudeh S, Rehman MU, Al-Yahyaee KH (2018) Extreme dependence and risk spillovers between oil and Islamic stock markets. Emerg Mark Rev 34:42–63. https://doi.org/10.1016/j.ememar.2017.10.003

Sun C (2018) Spillover effects of price fluctuation on China’s carbon market and EU carbon market. Journal of Industrial Technological Economics 37(3):97–105. https://doi.org/10.3969/j.issn.1004-910X.2018.03.013

Wang GJ, Xie C, He KJ, Stanley HE (2017) Extreme risk spillover network: application to financial institutions. Quantitative Finance 17(9):1417–1433. https://doi.org/10.1080/14697688.2016.1272762

Wang WJ, Zhou WY, Li J, Huang Y (2016) Volatility spillovers among Chinese carbon markets. China Population, Resources and Environment 26(12):63–69. https://doi.org/10.3969/j.issn.1002-2104.2016.12.009

Xiao Z, Koenker R (2009) Conditional quantile estimation for generalized autoregressive conditional heteroscedasticity models. J Am Stat Assoc 104(488):1696–1712. https://doi.org/10.1198/jasa.2009.tm09170

Xia T, Ji Q, Zhang D, Han J (2019) Asymmetric and extreme influence of energy price changes on renewable energy stock performance. J Clean Prod 241:118338. https://doi.org/10.1016/j.jclepro.2019.118338

Yuan N, Yang L (2020) Asymmetric risk spillover between financial market uncertainty and the carbon market: a GAS–DCS–copula approach. J Clean Prod 120750:120750. https://doi.org/10.1016/j.jclepro.2020.120750

Zhang YJ, Ma SJ (2019) How to effectively estimate the time-varying risk spillover between crude oil and stock markets? Evidence from the expectile perspective. Energy Econ 84:104562. https://doi.org/10.1016/j.eneco.2019.104562

Zhu B, Wang P, Chevallier J, Wei YM, Xie R (2018b) Enriching the VaR framework to EEMD with an application to the European carbon market. Int J Financ Econ 23(3):315–328. https://doi.org/10.1002/ijfe.1618

Zhu B, Ye S, He K, Chevallier J, Xie R (2019) Measuring the risk of European carbon market: an empirical mode decomposition-based value at risk approach. Ann Oper Res 281(1–2):373–395. https://doi.org/10.1007/s10479-018-2982-0

Zhu B, Zhou X, Liu X (2020) Exploring the risk spillover effects among China’s pilot carbon markets: a regular vine copula-CoES approach. J Clean Prod 242:118455. https://doi.org/10.1016/j.jclepro.2019.118455

Zhu H, Tang Y, Peng C (2018a) The heterogeneous response of the stock market to emission allowance price: evidence from quantile regression. Carbon Management 9(3):277–289. https://doi.org/10.1080/17583004.2018.1475802

Funding

This study received financial support from the Chinese National Funding of Social Sciences (Grant Nos. 18VSJ055), National Natural Science Foundation of China (Grant Nos. 71573076), and Philosophy and Social Sciences of Guangdong Province Planning Project (Grant Nos. GD19YYJ04).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• This article investigates the extreme risk spillover of China regional carbon markets to local listed firm’s stock returns.

• Bidirectional value at risk (VaR) estimated by quantile linear GARCH model is used to depict the extreme risk magnitude in carbon markets.

• Granger causality test in risk distributions are employed to detect the existence of risk transmission from carbon markets to stock market.

• Heterogeneous risk spillover performance is found in both macro pilot level and micro firm level.

Rights and permissions

About this article

Cite this article

Zhu, S., Tang, Y., Qiao, X. et al. The spillover effects of China’s regional environmental markets to local listed firms: a risk Granger causality approach. Environ Sci Pollut Res 27, 44123–44136 (2020). https://doi.org/10.1007/s11356-020-10320-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10320-2