Abstract

This paper experimentally investigates the potential existence of dynamically inconsistent individuals in a situation of ambiguity. The experiment involves participants making two sequential decisions concerning the allocation of a sum of money, with an ambiguous move by Nature occurring after first decision, and again after the second. We conducted two between-subject sessions: one incentivised and one unincentivised. By analysing the resulting data, we are able to classify participants into four distinct decision-making types: Myopic, Resolute, Sophisticated and Expected Utility (EU). Our results suggest that a significant proportion of the participants do not exhibit dynamic inconsistency being either Resolute, Sophisticated or EU. We discuss how monetary incentives can change the dynamic consistency of decision-makers and the salience of the Ambiguity. Differently from the incentivised treatment, we detect a slight increase of the proportion of Myopic behaviour in the hypothetical case, suspecting that incentives might affect dynamic consistency. A noteworthy observation is that, in the majority of cases, ambiguity tends to simplify to risk in the absence of monetary incentives. These findings have implications for economic decision-making and policymaking. By identifying the different types of decision-makers and understanding how they make choices, we can develop more effective strategies to promote desirable outcomes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper reports on an experiment to test the dynamic consistency of subjects in a dynamic decision problem under ambiguity. We keep things simple, and consider a dynamic decision problem with just two decision nodes (each followed by a random node). A person is dynamically consistent in this context, if sheFootnote 1 implements at the second decision node, the (conditional) decision planned, at the first node, for the second node. Expected Utility (EU) decision-makers are necessarily dynamically consistent (as a consequence of the axioms of EU). SophisticatedFootnote 2 decision-makers (who work by backward induction) are also necessarily dynamically consistent. Resolute decision-makers, who formulate a plan for both decision nodes, and then implement the plan, are, effectively by definition, also dynamically consistent, even though at the second node they might do something that they would prefer at that stage not to do. However, a fourth type, which we call ‘Myopic’, who works through time always choosing the best decision as viewed from the present perspective (even though this may lead to actual choices which differ from planned ones), may not be dynamically consistent. We investigate the frequency of these four types experimentally.

Our experimental context differs from previous experiments in that we consider a dynamic problem under ambiguity. So the subjects are not informed about the probabilities of the various moves by Nature. They are, however, given information about the moves by Nature—in the form of the Ambiguity Box. This is a computerised simulation of a Bingo Blower (this latter used earlier by Hey, Lotito & Maffioletti, 2010). This can be seen here (https://www.york.ac.uk/economics/exec/research/caferraheymoroneandsantorsola/).

Ambiguity, as distinct from risk, adds a layer of complexity to the decision problem. By studying dynamic decision-making in this context enables us to see how whether dynamic inconsistency is exacerbated by the additional layer, or whether subjects simplify the problem in such a way as to guarantee consistency.

2 Literature review, the issue of dynamic inconsistency

Dynamic consistency is a concept in decision theory that refers to the idea that a decision-maker's preferences should remain consistent over time. In economics, dynamic consistency plays a pivotal role and underlies many of the critical outcomes and policy recommendations in areas such as investment, saving and pensions. Despite the importance of dynamic consistency, there is a significant body of evidence suggesting that people often do not exhibit this behaviour. For example, individuals may make decisions that they later regret or change their minds over time. These inconsistencies can lead to suboptimal outcomes and can have significant implications for economic policies.

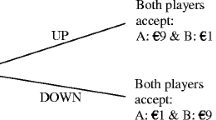

An example of dynamic inconsistency under certainty is provided by Hammond (1976), and is illustrated in Fig. 1. Suppose that an individual is considering whether to start taking an addictive drug. The individual would prefer at most to take the drug without consequences (event a) However, he is certain that, if he starts, he will become an addict, with serious consequences for his health (event b). Of course, he can refuse to take the drug in the first place (event c).

At the initial decision node, the individual has to decide whether to take the drug or not, and his preferences are a ≻ c ≻ b. If he gets to the choice node n1 he has become an addict, and therefore the only relevant preferences are those concerning a and b and addiction itself means that b ≻ a. The individual will choose b inconsistently with his previous preference.

This study delves into the decision-making behaviour of individuals who may be dynamically inconsistent when faced with Ambiguity. As we have noted above, dynamic inconsistency arises when people's preferences change over time, making it difficult to predict their future decisions accurately. Understanding this pattern of inconsistency among such individuals is essential for accurately forecasting both micro and macroeconomic outcomes.

In order to explore the issue of dynamic consistency in decision-making, we employ an experimental design that builds upon the work of Hey and Panaccione (2011), but with an added layer of complexity in the form of ambiguity. While Hey and Panaccione's design focused solely on risk, our approach incorporates ambiguity into the decision-making process. This allowed us to gain a more nuanced understanding of how individuals make decisions in the face of both risk and ambiguity, and to identify any potential discrepancies between their actual choices and their ideal, dynamically consistent choices.

Ambiguity occurs when probabilities are unknown or cannot be determined by the decision-maker. The experimental literature offers different representations of Ambiguity, such as the traditional Ellsberg Urn used by Halevy (2007) and Abdellaoui et al. (2011), where the subject is not informed about the quantities of the objects in the urn. Another representation proposed by Ahn et al. (2010) involves withholding the precise probability of two of the three possible outcomes. Other representations were proposed in Hey et al. (2010), Hey and Lotito (2010), Hey and Pace (2014) and Morone and Ozdemir (2012). In this present paper we use what we call the ‘Ambiguity Box’, which we will describe later.

3 The experimental design

Hey and Panaccione's (2011) experimental design—our reference design—involved presenting participants with a set of 27 risky problems. Each problem had the same structure and amount of money to be allocated (€40), but different probabilities (Fig. 2, Panel A). Each decision problem consisted of two stages.

Hey and Panaccione (2011) experimental design

In the first stage (Fig. 2, Panel B), participants were asked to allocate their initial endowment (€40) between two options with different known probabilities. In the second stage (Fig. 2, Panel C), participants observed the outcome of the first stage (given by Nature’s move) and decided how to allocate the remaining portion of their endowment. At the end of the second stage, the state of the world that determined the particular problem's pay-out was chosen randomly by Nature.

It is important to note that in Hey and Panaccione (2011) all probabilities were known ex ante in both stages, meaning that participants were aware of the probabilities of each outcome before making their decisions. Hey and Panaccione's design aimed to examine how participants make decisions under conditions of risk, where probabilities are known, and how they adjust their decisions in response to new information about the outcomes of their initial choices.

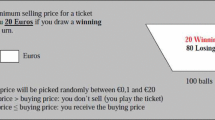

Our experimental design, illustrated below, introduces ambiguity while keeping the same structure. This allows for a more comprehensive examination of decision-making, as it takes into account the ambiguity that individuals may face in real-world situations. The pivotal aspect of our design is the innovative Ambiguity Box. This tool is a visual frame comprising animated squares that interchange randomly between two distinct colours. The result is a visually dynamic and unpredictable environment, demanding subjects to attempt to deduce the underlying probabilities associated with each colour. In every frame, the proportion of squares of each colour remains constant and corresponds to the underlying probability, which is set by the experimenter but remains unknown to the subjects.

The Ambiguity Box introduces a fresh perspective to the economics literature, adding a novel layer of complexity to the decision-making process in our experimental design. As a software-based tool, it addresses the key drawback of the traditional Bingo Blower, eliminating the need for a physical, noisy and cumbersome object. The Ambiguity Box is compatible with any electronic device, thus providing a more practical solution for researchers. The Ambiguity Box offers a high level of flexibility, as the experimenter predetermines the number of squares of each colour. This feature allows for adaptability in experimental design. Furthermore, the tool's application is easily scalable, making it suitable for implementation in various contexts to explore decision-making under ambiguity. Our study, by leveraging the Ambiguity Box, holds the potential to augment our comprehension of decision-making in uncertain situations. It offers previously inaccessible insights into how individuals react in dynamic and unpredictable environments. This is particularly relevant for real-world scenarios where ambiguity is pervasive and can lead to significant outcomes. Thus, our study contributes to a deeper understanding of decision-making behaviour in the face of uncertainty.

Based on Hey and Panaccione's (2011) methodology, participants are initially presented with the full problem description on a screen. In each problem, all the boxes are Ambiguity Boxes, meaning that the participants are not aware of the probability of events but can draw inferences about the possible probability based on the information presented in the coloured boxes.

After reading the problem description (Fig. 3, Panel A), individuals proceed to the first stage of the decision-making process where they are required to allocate (by inserting into the Left/Right boxes) their entire endowment (Fig. 3, Panel B). After this, Nature intervenes and randomly (using the underlying probabilities chosen by the experimenter) chooses to proceed either to the Left or the Right box. In the second stage (Fig. 3, Panel C), the participants must allocate the amount of their endowment that they initially allocated to the choice by Nature between the Left and Right boxes. Finally, Nature randomly randomly (using the underlying probabilities chosen by the experimenter) selects Left or Right, which determines the final pay-out.

In other words, we adopted Hey and Panaccione's (2011) approach and focused on the most basic form of dynamic decision problem that involves two stages, with only two alternatives available at each stage.

3.1 The experimental objective

The primary objective of our study is to gain a deeper understanding of how individuals, who may exhibit dynamic inconsistency, make decisions when faced with ambiguity. By exploring this topic, we aim to shed light on the complexities of decision-making behaviour in uncertain environments, which can have far-reaching implications for both micro and macroeconomic outcomes.

In line with the works of Hey and Panaccione (2011), Hey and Paradiso (2006) and Hey and Lotito (2010), our practical research objective is to classify participants into four distinct groups—Myopic, Sophisticated, Resolute and EU—based on their allocation choices. Our approach differs from the concept of testing choice theories by examining which principles they rely on and how they withstand experimental evidence, as adopted by Cubitt et al. (1998) in their investigation of which principles of dynamic choice contribute to Independence Axiom violations commonly observed of the common ratio type.

Myopic behaviour refers to individuals who have a limited or short-sighted perspective when making decisions. They select options that appear optimal at the current moment, without fully considering the long-term implications. Consequently, their actual choices may deviate from their initial plans. The Myopic individual ignores that his tastes are changing and chooses at each stage the option he considers the best at that moment. A Myopic individual shows dynamic inconsistency.

In contrast, Sophisticated individuals engage in backward induction, anticipating that they may alter their preferences in the future. They take this into account while making decisions.

A Resolute individual commits to a plan based on what they deem to be the best option at the start of a problem. Even if the plan requires them to select an option that may not be their preferred choice at the time, they stick to their resolve and behave in a dynamically consistent manner.

An Expected Utility individual behaves like the Sophisticated, solving the problem by backward induction; additionally, such an individual has an Expected Utility preference functional.

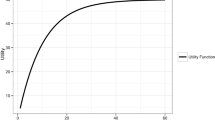

It should be clear by now that we must presume that our subjects may not have an EU preference functional (for otherwise they would necessarily be dynamically consistent). Indeed, we assume that our subjects have an Alpha MaxMin preference functional.Footnote 3

3.2 Mathematical background

From a mathematical perspective, our experimental scenario consists of four distinct states of the world: Left/Left, Left/Right, Right/Left and Right/Right. Because of the ambiguity relating to the true probabilities we assume that the decision-maker has some degree of uncertainty regarding the true probability of each state, and this uncertainty is represented by the parameter δ. Thus, for each true probability pi associated with each of the four outcomes (i = 1,2,3,4), we have corresponding lower (L) and upper (U) bounds on the perceived probability,Footnote 4 denoted by pL = pi(1 − δ) and pU = pi(1 + δ). The parameter δ is an indicator of the individual’s attitude to ambiguity. If it takes the value 0, then the individual is ambiguity-neutral; the larger δ is, the more averse to ambiguity the individual is.

In this 2 × 2 decision problem, there are four possible outcomes (LL, LR, RL and RR) and three allocation decisions to be made. We denote these by x1, x2 and x3:

x1 being the allocation to Left at the first stage (and hence m-x1 being the allocation to Right at the first stage). (0 ≤ x1 \(\le\) m).

x2 being the allocation to Left at the second stage if Nature moved Left at the first stage (and hence x1 -x2 being the allocation to Right at the second stage if Nature moved Left at the first stage). (0 ≤ x2 \(\le\) x1).

x3 being the allocation to Left at the second stage if Nature moved Right at the first stage (and hence m-x1 -x3 being the allocation to Right at the second stage if Nature moved Right at the first stage). (0 ≤ x3 \(\le\) m-x1).

The implications can be represented graphically (Fig. 4):

In order to maximise the Utility Function using the Alpha MaxMin Expected Utility functional we incorporate the maximum and minimum perceived probabilities for each event as described above: if the true probability of an event is p; we assume that the minimum perceived probability for this event is p(1 − δ) and the maximum perceived probability is p(1 + δ). Clearly the parameter δ indicates the individuals degree of ambiguity about the true probability; t is a measure of ambiguity aversion. In our estimation, we shall assume that it is individual specific, and will estimate its value subject-by-subject.

We assume a CRRA utility function (as in Hey & Panaccione, 2011)

and objective probabilities for the outcomes p1 < p2 < p3 < p4, the following objective function has to be maximised:

A Resolute individual chooses the x’s to maximise the above function at the start of each problem, and implements these original choices at the second stage, even though she may not want to at that second stage.

A Myopic individual takes the decision at the first stage (that of choosing x1) ignoring the fact that her payoff depends also upon her second stage decision: that is, a Myopic individual thinks of each stage as being her last. Her optimal decision in a one-stage problem is presented in the Appendix. This solution is invoked (with appropriate changes of notation) at each stage.

A Sophisticated individual works by using backward induction, and instead of making a Resolute decision and implementing it, a Sophisticated individual first solves the maximization problem at the second stage. This is done for allocations m1 and m2, made at the first stage, where m1 + m2 = m. (Here we are introducing new notation). The solution obtained is denoted by (x1∗, x2∗) = (x1(m1), x2(m1)) and (x3∗, x4∗) = (x3(m2), x4(m2)) (where x1∗, x2∗ = m-x1, x3∗, x4∗ = m – x1 – x3, denote the allocations in the second stage (again new notation)—conditional on the decisions m1 and m2, made in the first stage). In the second step of the solution for a Sophisticated individual (which takes us to the first stage of the decision problem), the decision-maker solves for the optimal values of x1 and m – x1, taking into account the optimal choices obtained in the final node and the implied expected utilities.

Our final type of individual is an Expected Utility maximiser. Such an individual cannot be dynamically inconsistent—since finding the solution by either backward induction or by the Strategy method leads to the same solution. We model this individual as a special case of an Alpha MaxMin individual; one with δ = 0 (hence being ambiguity neutral) and, for identification purposes with α = 0.5.Footnote 5

It should be clear from this that different types take different decisions in general, even with the same parameters. This fact is used to identify the different types.

We used MATLAB, subject by subject, to estimate the best-fitting parameters for each type and find the associated maximised log-likelihood, and hence identify the type of each subject through the use of the Akaike Information Criterion (AIC). We assumed that the actual decisions of the subjects (for any given parameter values) of a particular type were centred on the optimal decisions for that type (as described above) with beta distributed noise (as described below in Sect. 3.3).

3.3 The problem set used in the Experiment and our stochastic assumptions

We chose the set of problems (Table 1) presented to our subjects using simulation. Obviously, this simulation necessitated some assumption about the stochastic nature of our data. As we are trying to explain the amounts allocated to Left and Right at each stage, this can equivalently be expressed in terms of the proportions (of the endowment or the residual endowment) allocated to Left and Right. This variable is necessarily between zero and one, and the obvious distributional choice is the Beta distribution. So, we assumed that the actual proportion allocated to Left or Right, which we denote here by P, has a Beta distribution with parameters A and B given by A = P*(s-1) and B = (1-P*)(1-s), where P* is the optimal proportion. Given the properties of the Beta distribution, this guarantees that EP = P* and var(P) = P*(1-P*)/s. So, we are assuming that there is no bias in the actual allocation and that its variance is inversely proportional to s. Hence s is an indicator of the precision of the subjects.

In this p is the underlying true probability of Nature moving Left at the first stage, and q(r) the underlying true probability of Nature moving Left at the second stage given that Nature moved Left (Right) at the first.

Our simulation was aimed at choosing a set of problems from which we could identify the different types with reasonable accuracy (see Table 2). We proceeded as follows: first, we chose a set of problems, then we simulated the decisions of each type of individual (assuming noise as expressed with the Beta distribution) and then we estimated the best-fitting type (on the basis of the highest maximised log-likelihood). Clearly, a good set of problems is one for which the best-fitting type is the assumed type. We repeated this for different sets of problems (with differing numbers of problems) until we found a set for which the best-fitting types were closest to the assumed type. We created a set of 35 problems (these were different from those used by Hey & Panaccione, 2011) and carried out 40 simulations, which produced the results shown below.

Our simulation involved the following parameters: δ for the degree of ambiguity, α for ambiguity aversion, r for risk aversion and s for the precision of the Beta distribution. We chose ‘reasonable’ values for these parameters, obtained from a pilot experiment.

Based on our simulations, we can conclude that the selected problem set is sufficiently large and that it possesses good explanatory power and accuracy. It is also sufficiently small to be completed within a reasonable amount of time. Moreover, upon conducting simulations with larger problem sets, we did not observe any significant improvements.

3.4 The experiment

Our experiment was conducted using the Qualtrics platform with a set of undergraduate economics students from the University of Bari, and consisted of two between-subject sessions: one incentivised and one unincentivised, with 58 participants in the incentivised treatmentFootnote 6 and 58 in the unincentivised treatment.

In the experiment, individuals were required to allocate 40 ECU in each problem. In the incentivised session, subjects were informed that 1 ECU was equivalent to 0.50 euro, and that at the end of the experiment, one decision problem would be randomly chosen and paid out.

It was important to include both an incentivised and unincentivised session in our experiment to investigate the effect of incentives on decision-making behaviour. By comparing the decisions made in the two sessions, we can determine whether the presence of an incentive alters participants' decision-making strategies. Additionally, the unincentivised session serves as a baseline, allowing us to assess participants' decision-making behaviour in the absence of external motivation. By including both sessions, we can obtain a more comprehensive understanding of decision-making behaviour and its underlying factors.

In both treatments, at the end of the experiment the subjects were asked to complete a few socio-demographic questions.

In the incentivised experiment the average completion time was 25 min (min 7’ and max 40’) with a standard deviation of 6.75. Average age was 20; out of the 58 subjects 28 were female. The average pay-off was €7 that is equal to an hourly wage of €16.80.

In the unincentivised experiment the average completion time was 20 min (min 9’, max 42’), with a standard deviation of 5.96. Average age was 23; out of the 58 subjects 33 were female. The average hypothetical pay-off was €7.30; this is equal to an hypothetical hourly wage of €21.

4 Results

Our analysis was conducted on a subject-by-subject basis, as we believe that subjects are different, and we wanted to find the numbers of each type. We assumed that the subjects each had an Alpha MaxMin objective function (with parameters α and δ)—except for the EU type (for which δ takes the value 0Footnote 7), and that their underlying utility function was CRRA (with parameter r). We assumed a beta distribution (with parameter s) for the stochastic component of their decisions (as described in Sect. 3.3). For each subject we proceeded type-by-type, estimating using MATLAB the parameters (α, δ, r and s) for three of the four types (using the mathematics of Sect. 3.2) and hence obtained the associated maximised log-likelihood for that type. For the EU type, we did something necessarily different: seeing as EU is nested within Alpha MaxMin when δ = 0, we carried out the estimation with δ constrained to be zero.Footnote 8 We again calculated the associated maximised log-likelihood. Hence, for each subject and for three of the four types we obtained estimates of δ, α, r and s; for EU we obtained estimates of r and s. For all four types we have the maximised log-likelihood. The results can be found in Tables 3 and 4. From these we calculated the Akaike Information Criterion for each subject and for each type and hence identified the best type for each subject (by the lowest value of the Akaike Information Criterion).

We then ranked the types using the maximised log-likelihoods, obviously corrected for the number of parameters involved in the estimation: three of the types have four parameters, the fourth (EU) has just two parameters. The correction we used was the Akaike correction, so we ranked types by their value of AIC = 2 (k – LL) where k is the number of parameters involved in their estimation and LL the maximised log-likelihood. The lower is AIC the better is the fit.

Tables 5 and 6 provide details on the rankings of the fitted types.

Based on these rankings, we can summarise the overall results as follows:

In the incentivised treatment, we classified 5.17% as Myopic, 36.21% as Resolute, 1.72% as Sophisticated and 56.9% as EU.

In the unincentivised treatment, we classified 8.62% as Myopic, 24.14% as Resolute, none as Sophisticated and 67.24% as EU.

In both the incentivised and unincentivised treatments, we observed some individuals displaying dynamic inconsistency under uncertainty. This was particularly noticeable through the Myopic individuals, who made up 5.17% of the incentivised group and 8.62% of the unincentivised group. When we compared these two groups, we found a statistically significant difference in the likelihood of ranking above the median. In other words, the probability of being classified as either 1st or 2nd (i.e., 15.51% for the incentivised and 32.66% for the unincentivised) was statistically significantly different between the two treatments, as confirmed by a z-test on proportions with a p-value of 0.03. It seems that with incentives— – that is, monetary consequences to actions—subjects slightly engage in more consistent and/or elaborate decision-making. Therefore, monetary incentives can affect both the way people act dynamically and the salience of Ambiguity.

This is confirmed by two observations:

-

The reduction in the number of individuals classified as Myopic. Going from the unincentivised treatment to the incentivised treatment slightly more individuals display a dynamically consistent decision-making process. Although the effect is modest (and not statistically significant), this puts the focus on an important aspect, questioning whether subjects change their dynamic behaviour under different levels of monetary incentives.

-

The reduction in the number of individuals classified as EU, coupled with the increase of Resolute, in the incentivised treatment. While in the unincentivised treatment we observe a high share of EU (67.24%) and a low share of Resolute (24.14), a reversed pattern is observed in the incentivised scenario, where the share of EU decreases to 56.9% and that of Resolute increases to 36.12%. The different size of this switching is statistically significant (z-test on proportions, p-value=0.008). Given that the difference between how an EU and a Resolute takes the decisions relies on the consideration of (and the aversion to) ambiguity, the higher share of Resolute people (paying attention to ambiguity) coupled with the lower number of EU in the incentivised scenario leads to the conclusion that ambiguity is more salient under monetary incentives.

It seems that the use of incentives provides individuals with a tangible motivation to make more consistent decisions. When the potential rewards for making consistent decisions are clear and immediate, individuals may be more likely to engage in careful deliberation and consider all relevant factors before making a decision. In contrast, in the absence of incentives, individuals may be more prone to relying on heuristics or other mental shortcuts that can lead to inconsistent or suboptimal decisions.

Another possible explanation is that the presence of incentives may increase individuals' confidence in their decision-making abilities. When individuals are rewarded for making consistent decisions, they may feel more confident in their ability to identify and mitigate sources of inconsistency. This increased confidence may lead to greater consistency in decision-making across different tasks or situations.

Overall, our results are reassuring to both experimental economists and economic theorists, the former because of their attachment to incentives, and the latter because of their insistence that human beings are dynamically consistent.

5 Conclusions

The experiment was conducted on undergraduate economics students from the University of Bari, aiming to delve deeper into understanding how decisions are made under ambiguity. Using a combined specification of an Alpha MaxMin preference functional and a CRRA utility function, we analysed the data collected from the participants. The model was fitted to each participant's data, which helped identify the best-fitting decision-making type for each individual. The Akaike Information Criterion was used to classify these individuals according to their closest fitting types.

Our findings highlighted the role that incentives play in shaping decision-making behaviour. It was observed that when incentives were introduced, there was a slight decrease in the number of individuals classified as Myopic, suggesting a potential shift in dynamic behaviour and a possible increase in inconsistency under hypothetical scenarios. Additionally, the presence of incentives resulted in a decrease in the number of individuals identified as Expected Utility and an increase in those classified as Resolute.

This suggests that when potential rewards or consequences are presented, ambiguity becomes more prominent and individuals seem to engage in more complex decision-making processes. Our study, therefore, offers a new tool to estimate ambiguity, provides a critical perspective on the influence of incentives in determining human behaviour in decision-making attitudes and investigates the issue of dynamic consistency under ambiguity. Future studies may seek to further explore the mechanisms underlying these processes.

Data availability

The data is available at https://www.york.ac.uk/economics/exec/research/caferraheymoroneandsantorsola/.

Notes

For ‘she’ read ‘he or she'; and the same, mutatis mutandis, for ‘her’.

Those who plan using backward induction.

We have to assume some non-EU preference functional, of which there are many proposed in the literature. Given our experimental context, and given the findings of Hey and Lotito (2010), Alpha MaxMin seems the most appropriate. We note that EU is a special case of Alpha MaxMin when δ = 0 and (for identification purposes) α = 0.5. EU is nested within Alpha MaxMin.

We understand that this is just one way of implementing ambiguity. Others seem to be behaviourally more complex.

Actually any given value of α (between 0 and 1) will guarantee identifiability.

An a priori power analysis was performed in order to determinate the appropriate sample size (effect size = 0.5; alpha = 0.05; power = 0.80) based on a z-test on proportions.

And α takes any value.

And, for identification purposes, α = 0.5.

References

Abdellaoui, M., Bleichrodt, H., & L’Haridon, O. (2011). A tractable method to measure utility and loss aversion under prospect theory. Journal of Risk and Uncertainty, 42(3), 195–210.

Ahn, D. S., Galeotti, F., & Goyal, S. (2010). Regret theory and uncertainty in experimental games. Games and Economic Behavior, 68(2), 496–511.

Cubitt, R. P., Starmer, C., & Sugden, R. (1998). On the validity of the random lottery incentive system. Experimental Economics, 1(2), 115–131.

Halevy, Y. (2007). Ellsberg revisited: An experimental study. Econometrica, 75(2), 503–536.

Hammond, P. J. (1976). Changing tastes and coherent dynamic choice. The Review of Economic Studies, 43(1), 159–173.

Hey, J. D., & Lotito, G. (2010). Decisions under uncertainty: Which theories discriminate? Journal of Economic Behavior & Organization, 74(3), 215–227.

Hey, J. D., & Pace, N. (2014). The explanatory and predictive power of non-two-stage-probability theories of decision making under ambiguity. Journal of Risk and Uncertainty, 49(1), 1–29.

Hey, J. D., & Panaccione, L. (2011). Dynamic decision making: What do people do? Journal of Risk and Uncertainty, 42(2), 85–123.

Hey, J. D., & Paradiso, M. (2006). Preferences over temporal frames in dynamic decision problems: An experimental investigation. The Manchester School, 74(2), 123–137.

Hey J. D., Lotito, G., & Maffioletti, A. (2010). Descriptive and predictive adequacy of theories of decision making under uncertainty/ambiguity. Journal of Risk and Uncertainty, 41(2), 81–111.

Morone, A., & Ozdemir, O. (2012). Displaying uncertain information about probability: Experimental evidence. Bulletin of Economic Research, 64(2), 157–171.

Funding

This study was carried out within the RETURN Extended Partnership and received funding from the European Union Next-GenerationEU (National Recovery and Resilience Plan – NRRP, Mission 4, Component 2, Investment 1.3 – D.D. 1243 2/8/2022, PE0000005).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. The solution to a one-stage problem with a CRRA utility function and an Alpha MaxMin preference functional

Appendix. The solution to a one-stage problem with a CRRA utility function and an Alpha MaxMin preference functional

The CRRA utility function used in Hey and Panaccione (2011) implies that \(u^{\prime}(x) = x^{ - 1/r}\) and hence that u’ is positive for x positive If r = 0 the utility function is linear with a positive slope.

We assume an Alpha MaxMin individual, who wishes to maximise

We suppose for the purpose of this proof that the DM has bounds on Left of p1 and p2 where p1 < p2. So p1 is the lowest probability of Left, and p2 is the highest. The lowest probability of Right is 1-p2, and the highest is 1-p1.

Denote by x and m-x the allocations to Left and Right.

What are the minimum and maximum Expected Utilities? It depends on whether x > m-x or x < m-x; that is, on whether x > ( <) m/2. Let us explore these two possibilities.

-

1.

x > m/2

Here the worst thing that could happen is Left and the best Right. Hence, the maximand is

$$\alpha [p_{1} u(x) + (1 - p_{1} )u(m - x)] + (1 - \alpha )[p_{2} u(x) + (1 - p_{2} )u(m - x)].$$Maximising this with respect to x gives us \(\alpha [p_{1} u^{\prime}(x^*) - (1 - p_{1} )u^{\prime}(m - x^*)] + (1 - \alpha )[p_{2} u^{\prime}(x^*) - (1 - p_{2} )u^{\prime}(m - x^*)] \,\).

and hence

$$u^{\prime}(x^*)[\alpha p_{1} + (1 - \alpha )p_{2} ] = u^{\prime}(m - x^*)[\alpha (1 - p_{1} ) + (1 - \alpha )(1 - p_{2} ].$$Using \(u^{\prime}(x) = x^{ - 1/r}\) and simplifying gives us

$$x^{* - 1/r} [\alpha p_{1} + (1 - \alpha )p_{2} ] = (m - x^*)^{ - 1/r} [\alpha (1 - p_{1} ) + (1 - \alpha )(1 - p_{2} ].$$Denoting A1-1/r = αp1+(1-α)p2 and B1-1/r = α(1-p1)+(1-α)(1-p2) we get

$$x_{1}^{* - 1/r} A_{1}^{ - 1/r} = (m - x_{1}^*)^{ - 1/r} B_{1}^{ - 1/r}.$$From which it follows

$${x}_{1}^*{A}_{1}=\left(m-{x}_{1}^*\right){B}_{1}.$$Hence

$${x}_{1}^*={mB}_{1}/\left({A}_{1}+{B}_{1}\right).$$Now we should check whether the condition x1*>m/2 is satisfied. It is if B1>A1. From our definitions of A1 and B, this requires that

$${ap}_{1}+\left(1-\alpha \right){p}_{2}>\alpha \left(1-{p}_{1}\right)+\left(1-\alpha \right)\left(1-{p}_{2}\right),$$which in turn requires that

$$\left(1-a\right)\left({2p}_{2}-1\right)>\alpha \left({1-2p}_{1}\right).$$The maximised MaxminEU is \(\alpha [p_{1} u(x_{1}^*) + (1 - p_{1} )u(m - x_{1}^*)] + (1 - \alpha )[p_{2} u(x_{1}^*) + (1 - p_{2} )u(m - x_{1}^*)]\).

-

2.

x < m/2

Here the worst thing that could happen is Right and the best Light. Hence, the maximand is

$$\alpha [p_{2} u(x^*) + (1 - p_{2} )u(m - x^*)] + (1 - \alpha )[p_{1} u(x^*) + (1 - p_{2} )u(m - x^*)].$$Maximising this with respect to x gives us \(\alpha [p_{2} u^{\prime}(x^*) - (1 - p_{2} )u^{\prime}(m - x^*)] + (1 - \alpha )[p_{1} u^{\prime}(x^*) - (1 - p_{1} )u^{\prime}(m - x^*)] \,\),

and hence

$$u^{\prime}(x^*)[\alpha p_{2} + (1 - \alpha )p_{1} ] = u^{\prime}(m - x^*)[\alpha (1 - p_{2} ) + (1 - \alpha )(1 - p_{1} ].$$Using \(u^{\prime}(x) = x^{ - 1/r}\) and simplifying gives us

$$x_{2}^{* - 1/r} [\alpha p_{2} + (1 - \alpha )p_{1} ] = (m - x_{2}^*)^{ - 1/r} [\alpha (1 - p_{2} ) + (1 - \alpha )(1 - p_{1} ].$$Denoting A2-1/r = αp2+(1-α)p1 and B2-1/r = α(1-p2)+(1-α)(1-p1) we get

$$x_{2}^{* - 1/r} A_{2}^{ - 1/r} = (m - x_{2}^*)^{ - 1/r} B_{2}^{ - 1/r}.$$From which it follows

x2*A2=(m-x2*)B2.

Hence

x2*= mB2/(A2+B2).

Now we should check whether the condition x2*<m/2 is satisfied. It is if B2<A2. From our definitions of A1 and B, this requires that

αp1+(1-α)p2 < α(1-p1)+(1-α)(1-p2),

which in turn requires that

(1-α)(2p2-1) < α(1-2p1).

The maximised MaxminEU is \(\alpha [p_{1} u(x_{2}^*) + (1 - p_{1} )u(m - x_{2}^*)] + (1 - \alpha )[p_{2} u(x_{2}^*) + (1 - p_{2} )u(m - x_{2}^*)]\).

-

3.

Note that things are OK if the x1* in the x > m/2 case is > m/2 or if the x2* in the x < m/2 case is < m/2.

-

4.

x = m/2

Here both are the same (equally bad or equally good). So, it is either x*= mB1/(A1+B1) or

x*= mB2/(A2+B2). In the first case we need A1=B1 and in the second A2=B2.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caferra, R., Hey, J.D., Morone, A. et al. Dynamic inconsistency under ambiguity: An experiment. J Risk Uncertain 67, 215–238 (2023). https://doi.org/10.1007/s11166-023-09418-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-023-09418-y