Abstract

I collect data on subjects’ risk attitudes using real and hypothetical risky choices. I also measure their cognitive ability using the cognitive reflective test (CRT). On average, measured risk preferences are not significantly different across real and hypothetical settings. However, cognitive ability is inversely related to risk aversion when choices are hypothetical, but it is unrelated when the choices are real. This interaction between cognitive ability and hypothetical setting is consistent with the notion that some individuals, specifically higher-ability individuals, may treat hypothetical choices as “puzzles,” and provides one potential explanation for why some studies find that subjects indicate that they are more tolerant of risk when they make hypothetical choices than when they make real choices.

Similar content being viewed by others

Notes

Charles Sprenger presented preliminary results of his study at the 2011 North American Economic Science Association Conference held in Tucson, Arizona in November 2011.

Camerer (1995) and Camerer and Hogarth (1999) both include reviews of the literature that considers differences in decision making across real and hypothetical settings. Both studies conclude that the effect of incentives on behavior is likely to depend on the task. Incentivizing subjects may result in increased effort in some tasks, but the choice “over money gambles is not likely to be a domain in which effort will improve adherence to rational axioms” (Camerer (1995), pp. 635, emphasis in original).

Murphy and Stevens (2004) discuss the lack of theoretical reasoning for hypothetical bias with respect to willingness-to-pay elicitation, but the same argument applies to risk preference elicitation. Carson and Groves (2007) consider the incentive properties of “inconsequential” survey questions in the context of valuation studies, but their conclusion that “economic theory makes no predictions” about respondent behavior is equally relevant here.

In fact, the ten students who indicated they were economics majors in this study did not have a statistically different cognitive ability score than the rest of the sample.

The text of the script can be found in the Appendix.

The purpose of masking the probability and payoff information was to allow me to observe how subjects acquired information about risky choices. A brief explanation is provided below, but a more detailed description, along with the corresponding results, can be found in the companion paper that examines information acquisition.

Anderson and Mellor (2008) provide a detailed explanation of how the bounds for r, the coefficient of risk aversion, is derived from a subject’s choices.

Mouselab has been used by psychologists as a lower-cost alternative to eye-tracking for more than twodecades (Payne et al. 1988)

The experiment was presented in color. Additional appendix materials are available by request.

The instructions for each subject are designed so that the tutorial material is presented in the same formatas the actual choice scenarios that are later displayed for that subject.

The complete test is included in the Appendix.

See Stanovich and West (2000) for a discussion of System 1 and System 2.

In other words, she made fifteen out of twenty choices in the experiment with no information about the choices she was making.

Taylor (2012) includes additional analysis and discussion of the consistency of subjects’ choices.

See page 903 of Holt and Laury (2005) for a summary of their results.

I conducted an identical analysis using the decision number of the last safe choice before the first risky choice and the results are substantively unchanged.

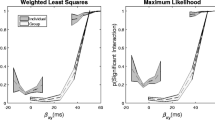

Harrison and Rutström (2008) provide an invaluable overview of maximum likelihood methods to estimate risk preferences as well as guidelines for programming the models.

I also explored a Luce error specification, \(\nabla EU = \frac {EU_S^{\frac {1}{\mu } }} {EU_S^{\frac {1}{\mu }} + EU_R^{\frac {1}{\mu }} }\), but the preferred specification fails to converge. However, for specifications that did converge, the results were not substantively different from the results of comparable specifications using a Fechner error structure. The results reported here are robust to the choice of either normal or logistic cumulative distribution function.

In the study, subjects were asked about their willingness to pay for nets to cover oil ponds to keep migratory birds from drowning in the aftermath of the Exxon Valdez oil spill. The authors used a verbal protocol method to track how subjects arrived at their responses.

References

Andersen, S., Harrison, G.W., Lau, M.I., Rutström, E.E. (2008). Eliciting risk and time preferences. Econometrica, 76(3), 583–618.

Anderson, L.R., & Mellor, J.M. (2008). Predicting health behaviors with an experimental measure of risk preferences. Journal of Health Economics, 27(5), 1260–1274.

Battalio, R.C., Kagel, J.H., Jiranyakul, K. (1990). Testing between alternative models of choice under uncertainty: some initial results. Journal of Risk and Uncertainty, 3, 25–50.

Beattie, J., & Loomes, G. (1997). The impact of incentives upon risky choice experiments. Journal of Risk and Uncertainty, 14(2), 155–168.

Benjamin, D.J., Brown, S.A., Shapiro, J.M. (Forthcoming). Who is “Behavioral”? cognitive ability and anomalous preferences. Journal of European Economics Association.

Branas-Garza, P., Guillen, P., López del Paso, R. (2008). Math skills and risk attitudes. Economics Letters, 99, 332–336.

Callen, M., Isaqzadeh, M., Long, J., Sprenger, C. (forthcoming). Violence and risk preferences: artefactual and experimental evidence from Afghanistan. American Economic Review.

Camerer, C. (1995). Individual decision making. Handbook of Experimental Economics, 587–616.

Camerer, C.F., & Hogarth, R.M. (1999). The effects of financial incentives in experiments: a review and capital-labor-production framework. Journal of Risk and Uncertainty, 19(1–3), 7–42.

Campitelli, G., & Labollita, M. (2010). Correlations of cognitive reflection with judgments and choices. Judgment and Decision Making, 5(3), 182–191.

Carson, R.T., & Groves, T. (2007). Incentive and informational properties of preference questions. Environmental and Resource Economics, 37, 181–210.

Chilton, S.M., & Hutchinson, W.G. (2003). A qualitative examination of how respondents in a contingent valuation study rationalize their WTP responses to an increase in the quantity of the environmental good. Journal of Economic Psychology, 24, 65–75.

Costa-Gomes, M., Crawford, V.P., Broseta, B. (2001). Cognition and behavior in normal-form games: an experimental study. Econometrica, 69(5), 1193–1235.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448–474.

Dave, C., Eckel, C.C., Johnson, C.A., Rojas, C. (2010). Eliciting risk preferences: when is simple better? Journal of Risk and Uncertainty, 41(3), 219–243.

Dohmen, T., Falk, A., Huffman, D., Sunde, U. (2010). Are risk aversion and impatience related to cognitive ability?American Economic Review, 100(3), 1238–1260.

Eckel, C.C., & Wilson, R.K. (2004). Is trust a risky decision?Journal of Economic Behavior & Organization, 55, 447–465.

Eckel, C.C., & Grossman, P.J. (2008). Men, women, and risk aversion: experimental evidence. Handbook of Experimental Economics: Results 1, 1, 1061–1073.

Frederick, S. (2005). Cognitive reflection and decision making. Journal of Economic Perspectives, 25–42.

Gabaix, X., Laibson, D., Moloche, G., Weinberg, S. (2006). Costly information acquisition: experimental analysis of a bounded rational model. American Economic Review, 96(4), 1043–1068.

Green, D., Jacowitz, K.E., Kahneman, D., McFadden, D. (1998). Referendum contingent valuation, anchoring, and willingness to pay for public goods. Resource and Energy Economics, 20, 85–116.

Harrison, G.W. (2006). Hypothetical bias over uncertain outcomes. In J.A. List (Ed.), Chapter 3. Northampton: Edward Elgar.

Harrison, G.W., & Rutström, E. (2008). Risk aversion in the laboratory. In J.C. Cox & G.W. Harrison (Eds.), Research in experimental economics, Chapter 3, (vol. 12, pp. 41–196). JAI Press.

Harrison, G.W., Johnson, E., McInnes, M.M., Rutström, E.E. (2005). Risk aversion and incentive effects: comment. American Economic Review, 95(3), 897–901.

Harrison, G.W., Lau, M.I., Rutström, E.E. (2007). Estimating risk attitudes in Denmark: a field experiment. Scandinavian Journal of Economics, 109(2), 341–368.

Harrison, G.W., Lau, M.I., Rutström, E.E. (2009). Risk attitudes, randomization to treatment, and self-selection into experiments. Journal of Economic Behavior & Organization, 70, 498–507.

Hey, J.D., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica, 62(6), 1291–1326.

Holt, C.A., & Laury, S.K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–55.

Holt, C.A., & Laury, S.K. (2005). Risk aversion and incentive effects: new data without order effects. American Economic Review, 95(3), 902–912.

Johnson, E.J., Schulte-Mecklenbeck, M., Willemsen, M.C. (2008). Process models deserve process data: comment on Brandstatter, Gigerenzer, and Hertwig (2006). Psychological Review, 115(1), 263–272.

Kahneman, D. (2011). Thinking, fast and slow. New York: Farrar, Straus and Giroux.

Kang, M.J., Rangel, A., Camus, M., Camerer, C.F. (2011). Hypothetical and real choice differentially activate common valuation areas. The Journal of Neuroscience, 31(2), 461–468.

Kuhberger, A., Schulte-Mecklenbeck, M., Perner, J. (2002). Framing decisions: hypothetical and real. Organizational Behavior and Human Decision Processes, 89, 1162–1175.

Murphy, J.J., & Stevens, T.H. (2004). Contingent valuation, hypothetical bias, and experimental economics. Agricultural and Resource Economics Review, 33(2), 182–192.

Oechssler, J., Roider, A., Schmitz, P.W. (2009). Cognitive abilities and behavioral biases. Journal of Economic Behavior & Organization, 147–152.

Payne, J.W., Bettman, J.R., Johnson, E.J. (1988). Adaptive strategy selection in decision-making. Journal of Experimental Psychology-Learning Memory and Cognition, 14(3), 534–552.

Schkade, D.A., & Payne, J.W. (1994). How people respond to contingent valuation questions: a verbal protocol analysis of willingness to pay for an environmental regulation. Journal of Environmental Economics and Management, 26, 88–109.

Stanovich, K.E., & West, R.F. (2000). Individual differences in reasoning: implications for the rationality debate?Behavioral and Brain Sciences, 23, 645–726.

Tanaka, T., Camerer, C.F., Nguyen, Q. (2010). Risk and time preferences: linking experimental and household survey data from Vietnam. American Economic Review, 100(1), 557–571.

Taylor, M.P. (2012). Do individuals acquire information differently when making hypothetical risky choices? Working Paper.

Toplak, M.E., West, R.F., Stanovich, K.E. (2011). The cognitive reflection test as a predictor of performance on heuristics-and-biases tasks. Memory & Cognition, 39(7), 1275.

Weller, J.A., Dieckmann, N., Tusler, M., Mertz, C.K., Peters, E. (2013). Development and testing of an abbreviated numeracy scale: a Rasch analysis approach. Journal of Behavioral Decision Making, 26(2), 198–212.

Acknowledgments

This research was supported by a grant from the Mikesell Foundation of the University of Oregon. I thank Trudy Ann Cameron, Bill Harbaugh, and Van Kolpin for valuable insights and comments. I am also grateful for helpful suggestions from Alfredo Burlando, Nicholas Sly, Joe Stone, David Wozniak, and seminar participants at the 2011 North American Economic Science Association Conference and the 1st Annual Association of Environmental and Resource Economists Summer Conference. I also thank Danny O’Neil and Megan Ickler for assisting with the experiment. All remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Script of instructions read aloud

Thank you for participating in this experiment. Your participation will allow us to explore questions economists have about individual decision making.

In this experiment, you will be asked to make some choices. There are no right or wrong choices. Additionally, although there are other people simultaneously completing the experiment, you are not competing against anyone.

After you have made all of your choices, your payoff will be displayed on the computer. Please stop at this page and raise your hand to let us know that you are at your “payoff page” and we will verify your payoff and prepare your payment.

Note that there are some additional questions after the payoff page that we ask that you also complete.

You will be paid in cash today before you leave. You will also be paid a $5 show-up fee. If you decide to leave early, you may do so. If you do leave early, you will be allowed to keep the $5 show-up payment, but you will forfeit any experimental earnings.

We understand that you may have questions, but it is important that we maintain the integrity of the experiment by minimizing talking and other disruptions. If you have a question before you begin making your choices, please write it down on the card next to your computer and raise your hand. We will then check to see if it is a question that we can answer.

Finally, we ask that you do not discuss this experiment with anyone who may also participate in this experiment so that we can maintain the integrity of our results. Thank you.

1.2 Numeracy and cognitive ability test

Please answer the following questions to the best of your ability.

-

1.

Imagine that we roll a fair, six-sided die 1,000 times. (That would mean that we roll one die from a pair of dice.) Out of 1,000 rolls, how many times do you think the die would come up as an even number?

-

2.

In the BIG BUCKS LOTTERY, the chances of winning a $10.00 prize are 1 %. What is your best guess about how many people would win a $10.00 prize if 1,000 people each buy a single ticket from BIG BUCKS?

-

3.

In the ACME PUBLISHING SWEEPSTAKES, the chance of winning a car is 1 in 1,000. What percent of tickets of ACME PUBLISHING SWEEPSTAKES win a car?

-

4.

If the chance of getting a disease is 10%, how many people would be expected to get the disease out of 1000 people:

-

5.

If the chance of getting a disease is 20 out of 100, this would be the same as having a __________% chance of getting the disease.

-

6.

Suppose you have a close friend who has a lump in her breast and must have a mammogram. Of 100 women like her, 10 of them actually have a malignant tumor and 90 of them do not. Of the 10 women who actually have a tumor, the mammogram indicates correctly that 9 of them have a tumor and indicates incorrectly that 1 of them does not have a tumor. Of the 90 women who do not have a tumor, the mammogram indicates correctly that 81 of them do not have a tumor and indicates incorrectly that 9 of them do have a tumor. The table below summarizes all of this information. Imagine that your friend tests positive (as if she had a tumor), what is the likelihood that she actually has a tumor (Fig. 5)?

-

7.

A bat and a ball cost $1.10 in total. The bat costs $1.00 more than the ball. How much does the ball cost? [CRT question]

-

8.

In a lake, there is a patch of lilypads. Every day, the patch doubles in size. If it takes 48 days for the patch to cover the entire lake, how long would it take for the patch to cover half of the lake? [CRT question]

-

9.

If it takes 5 machines 5 min to make 5 widgets, how long would it take 100 machines to make 100 widgets? [CRT question]

Rights and permissions

About this article

Cite this article

Taylor, M.P. Bias and brains: Risk aversion and cognitive ability across real and hypothetical settings. J Risk Uncertain 46, 299–320 (2013). https://doi.org/10.1007/s11166-013-9166-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-013-9166-8