Abstract

This study investigates the impact of both social and news sentiments indices on the dynamic stock–bond correlation across wavelet-based time-scales over the period 1998–2016. Our results show that the news sentiments namely unemployment, tsunami and sanctions exhibit significant effects during expansion at the shortest time-scale of [2–4] days. These predictors remain significant with reverse signs during recession on the long investment horizon. Yet, the predictability of social media sentiments differs from that of news sentiments with the pattern of reversal in sign also presents for some proxies including windstorm and investment flows. Statistically, our further analysis confirmed the predictability of the sentiments out-of-sample. Excluding the news and social media sentiment effects has also resulted in minimizing the value-at-risk of the (40/60) stock/bond portfolios the most at the investment horizon of [32–64] days during recessions. Our results remain the same after performing some robustness checks.

Similar content being viewed by others

Notes

Nardo et al. (2016) reviews the literature exploring social media and its role in stock market predictability.

Down-sampling means reducing the sample size to the half at each time-scale. For example, 1000 observations on first time-scale will be 500 on the second time-sale, 250 on time-scale 3 and so forth.

The decomposition of the daily return series data ensures that the variance at short time-scale is more than that at the long-time scale. That helps in explaining the excess volatility in the short run periods resulting from the high uncertainty and the behaviour of short-term investors in the market.

Aloui et al. (2021) extracted the sentiment proxy from the American association of individual investors (AAII) database and performed their analysis using the continuous wavelet approach.

These sentiment indicators are defined in the Appendix A.1. We describe the process of construction our sentiments in Sect. 3.1.

The data are provided by Thomson Reuters Financial and Risk Team as part of TRMI product. TRMI covers a plethora of securities and markets, including more than 12,000 companies, 36 commodities and energy subjects, 187 countries, 62 sovereign markets, 45 currencies, and, since 2009, more than 150 cryptocurrencies. For more details, see Thomson Reuters MarketPsych Indices 2.2 User Guide, 25 May 2019, Document Version 1.0.

Also aiming at categorising sentiment measures, Ding et al. (2019) decomposed Baker et al. (2006)’s sentiment into short and long term components and examined their impacts on the cross section of stock returns.

We dropped out some news (social media) constructed PCs if they have high correlation with the other constructed news (social media) ones. The correlation coefficient of 70 per cent if considered cut off point to either consider or drop out the variables from the further analysis.

We also perform the log likelihood ratio test by comparing between the performance of the unrestricted (ADCC) and the restricted (DCC) model. The null hypothesis for the superiority of the DCC model is then rejected at the aggregate level and at all time-scales at 5% significance level. The critical value for the test is 3.84. The results from the test are available upon request.

While we also assume the standardised residuals are normally distributed, following Cappiello et al. (2006), we note that the choice of distribution is not statistically important in the estimation of the conditional variance equation.

To estimate our model, we made the order of lagged correlation equals zero.

The diagonal version assumes that equity-bond correlation can differ across different maturity bonds.

However, controlling for only one lag of the daily correlation can be hardly sufficient. To deal with this issue, we controlled for up to 5 lags (a trading week) and our results remain qualitatively and quantitatively similar. Also, based on the information criteria and the log likelihood, our specification is found to be adequate. We thank the reviewer for addressing this point. The results from this additional analysis are available upon request.

Other related studies also ran their regressions with one of the predictors being the lagged correlation (e.g. Christiansen and Ranaldo 2007 among others). However, we also estimated our model without the lagged correlation and the results remain statistically the same, but the adjusted R became low. These findings are available upon request.

Intercepts were included in the regression estimates but not reported to save the space.

Again, the variation in the significance level mirrors those observed in the news sentiments-based regressions, for the full explanation, refer to pages 33 and 34.

We also perform the rolling window exercise. See Appendix C.

The full VaR estimates on time-scales are available upon request. They are omitted to save the space.

References

Aloui C, Shahzad SJH, Hkiri B, Hela BH, Khan MA (2021) On the investors’ sentiments and the Islamic stock-bond interplay across investments’ horizons. Pacific-Basin Finance J 65:101491

Andersson M, Krylova E, Vähämaa S (2008) Why does the correlation between stock and bond returns vary over time? Appl Financial Econ 18(2):139–151

Asgharian H, Christiansen C, Hou AJ (2015) Macro-finance determinants of the long-run stock–bond correlation: The DCC-MIDAS specification. J Financial Econ 14(3):617–642

Aslanidis N, Christiansen C (2014) Quantiles of the realized stock–bond correlation and links to the macroeconomy. J Empirical Finance 28:321–331

Azar PD, Lo AW (2016) The wisdom of Twitter crowds: Predicting stock market reactions to FOMC meetings via Twitter feeds. J Portfolio Manage 42(5):123–134

Baele L, Bekaert G, Inghelbrecht K (2010) The determinants of stock and bond return comovements. Rev Financial Stud 23(6):2374–2428

Baker MP, Wurgler J (2006) Investor sentiment and the cross-section of stock returns. J Finance 61(4):1645–1680

Baker M, Wurgler J (2007) Investor sentiment in the stock market. J Econ Perspect 21(2):129–152

Baker M, Wurgler J (2012) Comovement and predictability relationships between bonds and the cross-section of stocks. Rev Asset Pricing Stud 2(1):57–87

Baker SR, Bloom N, Davis SJ (2016) Measuring Economic Policy Uncertainty. Quarterly J Econ 131(4):1593–1636. https://doi.org/10.1093/qje/qjw024

Bauwens L, Laurent S, Rombouts JV (2006) Multivariate GARCH models: a survey. J Appl Econ 21(1):79–109

Beber A, Brandt MW, Kavajecz KA (2008) Flight-to-quality or flight-to-liquidity? Evidence from the euro-area bond market. Rev Financial Stud 22(3):925–957

Bekaert G, Engstrom E, Xing Y (2009) Risk, uncertainty, and asset prices. J Financ Econ 91(1):59–82

Bollen J, Mao H, Zeng X (2011) Twitter mood predicts the stock market. J Comput Sci 2(1):1–8

Bollerslev T (1990) Modelling the coherence in short-run nominal exchange rates: a multivariate generalized ARCH model. Rev Econ Stat 72(3):498–505

Bukovina J (2016) Social media big data and capital markets—An overview. J Behav Exp Finance 11:18–26

Caballero RJ, Krishnamurthy A (2008) Collective risk management in a flight to quality episode. J Finance 63(5):2195–2230

Campbell JY, Pflueger C, Viceira LM (2014) Monetary policy drivers of bond and equity risks. Harvard University, Cambridge

Cappiello L, Engle RF, Sheppard K (2006) Asymmetric dynamics in the correlations of global equity and bond returns. J Financial Econ 4(4):537–572

Cappiello L, Kadareja A, Manganelli S (2010) The impact of the Euro on equity markets. J Financial Quant Anal 45(2):473–502

Chahine S, Malhotra NK (2018) Impact of social media strategies on stock price: the case of Twitter. Eur J Mark 52(7/8):1526–1549

Chen H, De P, Hu Y, Hwang BH (2014) Wisdom of crowds: the value of stock opinions transmitted through social media. Rev Financial Stud 27(5):1367–1403

Chiang TC, Li J, Yang SY (2015) Dynamic stock–bond return correlations and financial market uncertainty. Rev Quant Financ Acc 45(1):59–88

Christiansen C, Ranaldo A (2007) Realized bond—stock correlation: Macroeconomic announcement effects. J Fut Mark 27:439–469. https://doi.org/10.1002/fut.20258

Christiansen C (2010) Decomposing European bond and equity volatility. Int J Finance Econ 15(2):105–122

Conlon T, Cotter J, Gencay R (2018) Long-run wavelet-based correlation for financial time series. Eur J Oper Res 271(2):676–696

Connolly RA, Stivers C, Sun L (2007) Commonality in the time-variation of stock–stock and stock–bond return comovements. J Financial Markets 10(2):192–218

Connolly R, Stivers C, Sun L (2005) Stock market uncertainty and the stock-bond return relation. J Financial Quant Anal 40(1):161–194

David A, Veronesi P (2013) What ties return volatilities to price valuations and fundamentals? J Political Econ 121(4):682–746

Ding W, Mazouz K, Wang Q (2019) Investor sentiment and the cross-section of stock returns: new theory and evidence. Rev Quant Financ Acc 53(2):493–525

Dunteman G (1994) Factor analysis and related techniques. In: Lewis-Beck M, (eds) Principal components analysis. International Handbooks of Quantitative Applications in the Social Sciences 5. (Sage Publications, London), pp. 157–245

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroscedasticity models. J Bus Econ Stat 20(3):339–350

Fang L, Peress J (2009) Media coverage and the cross-section of stock returns. J Finance 64(5):2023–2052

Fang L, Yu H, Huang Y (2018) The role of investor sentiment in the long-term correlation between US stock and bond markets. Int Rev Econ Finance 58:127–139

Galagedera D, Maharaj EA (2008) Wavelet timescales and conditional relationship between higher-order systematic co-moments and portfolio returns. Quant Finance 8(2):201–221

Gallegati M, Semmler W (2014) Wavelet applications in economics and finance. Springer

Gallegati M, Ramsey JB (2013) Bond vs stock market’s Q: Testing for stability across frequencies and over time. J Empirical Finance 24:138–150

Garcia D (2013) Sentiment during recessions. J Finance 68(3):1267–1300

Gençay R, Selçuk F, Whitcher BJ (2001) An introduction to wavelets and other filtering methods in finance and economics. Elsevier, Amsterdam

Glosten LR, Jagannathan R, Runkle DE (1993) On the relation between the expected value and the volatility of the nominal excess return on stocks. J Finance 48(5):1779–1801

Gotthelf N, Uhl MW (2019) News sentiment: a new yield curve factor. J Behav Finance 20(1):31–41

Gulko L (2002) Decoupling. J Portfolio Manage 28(3):59–66

Gupta R, Kollias C, Papadamou S, Wohar ME (2018) News implied volatility and the stock-bond nexus: Evidence from historical data for the USA and the UK markets. J Multinat Financial Manage 47:76–90

Huang S, An H, Gao X, Hao X (2016) Unveiling heterogeneities of relations between the entire oil–stock interaction and its components across time scales. Energy Econ 59:70–80

Ilmanen A (2003) Stock-bond correlations. J Fixed Income 13(2):55–66

Kaiser H (1960) The application of electronic computers to factor analysis. Educ Psychol Measur 20(1):141–151

Kim SJ, Moshirian F, Wu E (2006) Evolution of international stock and bond market integration: influence of the European monetary union. J Bank Finance 30(5):1507–1534

Kim S, In F (2010) Portfolio allocation and the investment horizon: a multiscaling approach. Quant Finance 10(4):443–453

Kothari S, Lewellen J, Warner JB (2006) Stock returns, aggregate earnings surprises, and behavioral finance. J Financ Econ 79(3):537–568

Lehkonen H, Heimonen K (2014) Timescale-dependent stock market comovement: BRICs vs. developed markets. J Empirical Finance 28:90–103

Li L (2002) Macroeconomic factors and the correlation of stock and bond returns. Working paper, Yale University

Li XM, Zhang B, Gao R (2015) Economic policy uncertainty shocks and stock–bond correlations: Evidence from the US market. Econ Lett 132:91–96

Liew JKS, Wang GZ (2016) Twitter sentiment and IPO performance: a cross-sectional examination. J Portfolio Manage 42(4):129–135

Liew J, Budavari T (2017) The “sixth” factor—a social media factor derived directly from tweet sentiments. J Portfolio Manage 43(3):102–111

Loughran T, Mcdonald B (2011) When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. JFinance 66:35–65. https://doi.org/10.1111/j.1540-6261.2010.01625.x

Ludvigson SC, Ng S (2007) The empirical risk-return relation: a factor analysis approach. J Financ Econ 83(1):171–222

Maghyereh AI, Abdoh H, Awartani B (2019) Connectedness and hedging between gold and Islamic securities: a new evidence from time-frequency domain approaches. Pacific-Basin Finance J 54:13–28

Masset P (2008) Analysis of financial time-series using Fourier and wavelet methods. Available at SSRN 1289420.

Meng X, Huang CH (2019) The time-frequency co-movement of Asian effective exchange rates: a wavelet approach with daily data. North Am J Econ Finance 48:131–148

Mensi W, Hkiri B, Al-Yahyaee KH, Kang SH (2018) Analyzing time–frequency co-movements across gold and oil prices with BRICS stock markets: A VaR based on wavelet approach. Int Rev Econ Finance 54:74–102

Moat HS, Preis T, Olivola C, Liu C, Chater N (2014) Using Big Data to predict collective behavior in the real world. Behav Brain Sci 37(1):92–93

Nardo M, Petracco-Giudici M, Naltsidis M (2016) Walking down wall street with a tablet: a survey of stock market predictions using the web. J Econ Surv 30(2):356–369

Perego ER, Vermeulen WN (2016) Macro-economic determinants of European stock and government bond correlations: a tale of two regions. J Empirical Finance 37:214–232

Percival DB, Walden AT (2000) Wavelet methods for time series analysis (Cambridge Series in Statistical and Probabilistic Mathematics)

Peterson R (2013) Thomson Reuters Marketpsych Indices (TRMI) White Paper. Inside the Mind of the Market

Piñeiro-Chousa J, López-Cabarcos MÁ, Pérez-Pico AM, Ribeiro-Navarrete B (2018) Does social network sentiment influence the relationship between the S&P 500 and gold returns? Int Rev Financial Anal 57:57–64

Renault T (2017) Intraday online investor sentiment and return patterns in the US stock market. J Bank Finance 84:25–40

Sakemoto R (2018) Co-movement between equity and bond markets. Int Rev Econ Finance 53:25–38

Skintzi VD (2019) Determinants of stock-bond market comovement in the Eurozone under model uncertainty. Int Rev Financial Anal 61:20–28

Silvennoinen A, Teräsvirta T (2009) Multivariate GARCH models Handbook of financial time series. Springer, Berlin, pp 201–229

Sprenger TO, Welpe IM (2011) Tweets and peers: defining industry groups and strategic peers based on investor perceptions of stocks on Twitter. Algorithmic Finance 1(1):57–76

Sprenger TO, Tumasjan A, Sandner PG, Welpe IM (2014) Tweets and trades: the information content of stock microblogs. Europ Financial Manage 20(5):926–957

Sun A, Lachanski M, Fabozzi FJ (2016) Trade the tweet: Social media text mining and sparse matrix factorization for stock market prediction. Int Rev Financial Anal 48:272–281

Tetlock PC (2007) Giving content to investor sentiment: the role of media in the stock market. J Finance 62(3):1139–1168

Tetlock PC, Saar-Tsechansky M, Macskassy S (2008) More than words: quantifying language to measure firms’ fundamentals. J Finance 63(3):1437–1467

Viceira LM (2012) Bond risk, bond return volatility, and the term structure of interest rates. Int J Forecast 28(1):97–117

Yang J, Zhou Y, Wang Z (2009) The stock–bond correlation and macroeconomic conditions: One and a half centuries of evidence. J Bank Finance 33(4):670–680

Acknowledgements

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

See Table

11.

Appendix B

See Table

12.

Appendix C

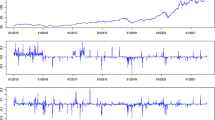

Notes the figure below shows the rolling regression estimates from the equation:

The analysis is performed on the time-scales 1 and 5 with a window size of 1250 days and one step ahead in the future. Panel A (B) shows the estimates from the regression with the news (social media) predictors. The shaded areas indicate the NBER recession periods. For further information about full notation in the model, see Table 6 (Fig. 2).

Rights and permissions

About this article

Cite this article

Alomari, M., Al rababa’a, A., El-Nader, G. et al. Who’s behind the wheel? The role of social and media news in driving the stock–bond correlation. Rev Quant Finan Acc 57, 959–1007 (2021). https://doi.org/10.1007/s11156-021-00967-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-021-00967-4