Abstract

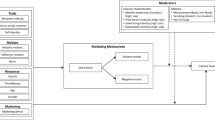

The paper considers how consumers’ cognitive efforts at preference adjustment at the time of decision affect prices in competitive markets with differentiated products. Greater ease of self-persuasion implies higher prices when self-persuasion reinforces first impressions and lower prices when the best opportunities to persuade oneself exist for consumers with weak initial impressions. Exogenous interventions to ease decision-complementing cognition—e.g., advertising—predictably increase or reduce prices, depending upon how they are targeted. While facilitation of consumers’ adjustment always improves welfare in a covered market, firms’ appropriation of surplus may make consumers worse off even as they learn better to love what they get.

Similar content being viewed by others

Notes

Other sorts of internal monologues are also possible. The old saying that “the grass is always greener” captures the sense in which individuals may sometimes find themselves focusing on the positive aspects of what they have foregone—and the inferiority of what they have chosen. While the resulting “buyer’s remorse” may have various resolutions—including returning purchased products—research suggests that in the end individuals quite often resort to dissonance-reducing self-persuasion along the lines of my motivating parable. See, e.g., Ehrlich et al. (1957), Knox and Inkster (1968), and Goetzmann and Peles (1997).

Studies that offer evidence of preference change based solely on subject ratings of chosen alternatives include: Lieberman et al. (2001), Kitayama et al. (2004), Sharot et al. (2010), and Wakslak (2012). Studies that additionally measured changes with the use of functional magnetic resonance imaging (fMRI) of subjects’ brains include: Sharot et al. (2009), Van Veen et al. (2009), Izuma et al. (2010), Jarcho et al. (2011), Qin et al. (2011), Kitayama et al. (2013), and Izuma and Adolphs (2013).

Meanwhile, Stigler and Becker (1977) have argued that all apparent changes (differences) in tastes can be explained by the development (existence) of complementary stocks of human or social capital. They contend that, once these are taken into account, there are in fact no differences in tastes at all.

There are some products - such as a house - for which a prospective buyer might contemplate and plan physical improvements that will increase the utility that he anticipates receiving from the product. Along similar lines, there are products for which the purchase of complementary items—e.g., a trailer hitch for a pickup truck—might result in an increase in the utility that accrues to the principal product. Such physical adjustments do alter final preferences in ways that are to some degree analogous to the process of cognitive adjustment here conceived. In order to focus on the effect of the cognitive type of adjustment, the model here essentially assumes a product for which there is no plausible scope for physical improvement and for which there are no significant complements.

The standard consumer model, of course, assumes that a consumer anticipates future flows of utility: e.g., from a durable good. My model moves beyond this, specifically, to assume that the consumer anticipates future flows of utility that accrue to cognitive effort that increases the utility that is obtained from a good.

One could conceive of these as manifesting, for instance, through a focus-weighted utility function along the lines of Kőszegi and Szeidl (2013).

I specify a marginal adjustment cost function, rather than a total adjustment cost function, so as to maintain the analogy to the marginal transportation cost primitive in the standard Hotelling model.

I consider why each of the two regimes might be observed empirically in Sect. 6.2.

This limitation follows from Assumption 3: since achieving a perfect fit with a product eventually becomes infinitely costly, the individual whose initial preference for a product is sufficiently strong perforce sees his marginal adjustment cost climb quickly. Indeed, one can see that, as a consequence of Assumption 3, there must exist a neighborhood around each product within which increasing initial preference corresponds with increasing marginal adjustment costs.

Note that Assumption 3 guarantees that adjustment grows increasingly costly within the vicinity of the extremes, irrespective of the regime. Consistent with this, the figure depicts the curves near the extremes identically in the two panels.

For evidence that supports the contemporaneousness of decision-making and attitude change, and consumers’ rational anticipation of attitude change, see Section 3.

See footnote 9.

For an extended analysis of the role and effects of advertising under motivated preferences, see Nagler (2020).

This is an artifact of the impression-reinforcing adjustment pattern, according to which adjustment curves flatten as one moves from \(x=\frac {1}{2}\) toward these locations, but then steepen again as one continues toward the extremes. See footnote 9.

Still, consumers at or near \(x=\frac {1}{2}\) do substantially better, because the increase in VoDiPS selectively reduces their cost of adjustment the most.

See Thaler and Sunstein (2009).

Note that pointwise-symmetry of adjustment maps, which requires curve-by-curve symmetry at each location, is not the same as symmetry across products, which requires that the maps be symmetric about \(x=\frac{1}{2}\).

References

Ackerman, P. L., & Heggestad, E. D. (1997). Intelligence, personality, and interests: Evidence for overlapping traits. Psychological Bulletin, 121(2), 219–245.

Bloch, F., & Manceau, D. (1999). Persuasive advertising in Hotelling’s model of product differentiation. International Journal of Industrial Organization, 17(4), 557–574.

Butters, G. R. (1977). Equilibrium distributions of sales and advertising prices. The Review of Economic Studies, 44(3), 465–491.

Caplin, A., & Nalebuff, B. (1991). Aggregation and imperfect competition: On the existence of equilibrium. Econometrica, 59(1), 25–59.

Cox, D. S., & Cox, A. D. (1988). What does familiarity breed? Complexity as a moderator of repetition effects in advertisement evaluation. Journal of Consumer Research, 15(1), 111–116.

Dempsey, M. A., & Mitchell, A. A. (2010). The influence of implicit attitudes on choice when consumers are confronted with conflicting attribute information. Journal of Consumer Research, 37(4), 614–625.

Ehrlich, D., Guttman, I., Schönbach, P., & Mills, J. (1957). Postdecision exposure to relevant information. Journal of Abnormal and Social Psychology, 54(1), 98–102.

Erdem, T., Keane, M. P., & Sun, B. (2008). The impact of advertising on consumer price sensitivity in experience goods markets. Quantitative Marketing and Economics, 6(2), 139–176.

Festinger, L. (1962). A theory of cognitive dissonance (Vol. 2). Stanford, CA: Stanford University Press.

Gignac, G. E., Stough, C., & Loukomitis, S. (2004). Openness, intelligence, and self-report intelligence. Intelligence, 32(2), 133–143.

Goetzmann, W. N., & Peles, N. (1997). Cognitive dissonance and mutual fund investors. Journal of Financial Research, 20(2), 145–158.

Hotelling, H. (1929). Stability in competition. Economic Journal, 39(153), 41–57.

Hutchinson, J. W., & Alba, J. W. (1991). Ignoring irrelevant information: Situational determinants of consumer learning. Journal of Consumer Research, 18(3), 325–345.

Izuma, K., & Adolphs, R. (2013). Social manipulation of preference in the human brain. Neuron, 78(3), 563–573.

Izuma, K., Matsumoto, M., Murayama, K., Samejima, K., Sadato, N., & Matsumoto, K. (2010). Neural correlates of cognitive dissonance and choice-induced preference change. Proceedings of the National Academy of Sciences, 107(51), 22014–22019.

Jarcho, J. M., Berkman, E. T., & Lieberman, M. D. (2011). The neural basis of rationalization: Cognitive dissonance reduction during decision-making. Social Cognitive and Affective Neuroscience, 6(4), 460–467.

Kitayama, S., Chua, H. F., Tompson, S., & Han, S. (2013). Neural mechanisms of dissonance: An fMRI investigation of choice justification. NeuroImage, 69, 206–212.

Kitayama, S., Snibbe, A. C., Markus, H. R., & Suzuki, T. (2004). Is there any ‘free’ choice? Self and dissonance in two cultures. Psychological Science, 15(8), 527–533.

Kitayama, S., & Tompson, S. (2015). A biosocial model of affective decision making: Implications for dissonance, motivation, and culture. In J. M. Olson & M. P. Zanna (Eds.), Advances in Experimental Social Psychology (Vol. 52, pp. 71–137). Burlington: Academic Press.

Knox, R. E., & Inkster, J. A. (1968). Postdecision dissonance at post time. Journal of Personality and Social Psychology, 8(4), 319–323.

Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121(4), 1133–1165.

Kőszegi, B., & Szeidl, A. (2013). A model of focusing in economic choice. The Quarterly Journal of Economics, 128(1), 53–104.

Lieberman, M. D., Ochsner, K. N., Gilbert, D. T., & Schacter, D. L. (2001). Do amnesics exhibit cognitive dissonance reduction? The role of explicit memory and attention in attitude change. Psychological Science, 12(2), 135–140.

Mantel, S. P., & Kardes, F. R. (1999). The role of direction of comparison, attribute-based processing, and attitude-based processing in consumer preference. Journal of Consumer Research, 25(4), 335–352.

Mothersbaugh, D. L., & Hawkins, D. I. (2016). Consumer behavior: Building marketing strategy (13th ed.). New York: McGraw-Hill Education.

Nagler, M. G. (2020). Assisted self-persuasion: A motivated preference theory of advertising. City College of New York working paper.

Popkowski Leszczyc, P. T., & Rao, R. C. (1990). An empirical analysis of national and local advertising effect on price elasticity. Marketing Letters, 1(2), 149–160.

Qin, J., Kimel, S., Kitayama, S., Wang, X., Yang, X., & Han, S. (2011). How choice modifies preference: Neural correlates of choice justification. NeuroImage, 55(1), 240–246.

Reis, H. T., Maniaci, M. R., Caprariello, P. A., Eastwick, P. W., & Finkel, E. J. (2011). Familiarity does indeed promote attraction in live interaction. Journal of Personality and Social Psychology, 101(3), 557–570.

Salop, S., & Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. The Review of Economic Studies, 44(3), 493–510.

Sharot, T., De Martino, B., & Dolan, R. J. (2009). How choice reveals and shapes expected hedonic outcome. Journal of Neuroscience, 29(12), 3760–3765.

Sharot, T., Velasquez, C. M., & Dolan, R. J. (2010). Do decisions shape preference? Evidence from blind choice. Psychological Science, 21(9), 1231–1235.

Simon, D., Krawczyk, D. C., & Holyoak, K. J. (2004). Construction of preferences by constraint satisfaction. Psychological Science, 15(5), 331–336.

Stigler, G. J. (1961). The economics of information. Journal of Political Economy, 69(3), 213–225.

Stigler, G. J., & Becker, G. S. (1977). De gustibus non est disputandum. American Economic Review, 67(2), 76–90.

Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4(3), 199–214.

Thaler, R. H., & Sunstein, C. R. (2009). Nudge: Improving decisions about health, wealth, and happiness. New Haven: Yale Univ. Press.

Tompson, S., Chua, H. F., & Kitayama, S. (2016). Connectivity between mPFC and PCC predicts post-choice attitude change: The self-referential processing hypothesis of choice justification. Human Brain Mapping, 37(11), 3810–3820.

Van Veen, V., Krug, M. K., Schooler, J. W., & Carter, C. S. (2009). Neural activity predicts attitude change in cognitive dissonance. Nature Neuroscience, 12(11), 1469–1474.

Wakslak, C. J. (2012). The experience of cognitive dissonance in important and trivial domains: A construal-level theory approach. Journal of Experimental Social Psychology, 48(6), 1361–1364.

Acknowledgements

I am grateful to Ben Ho, Fahad Khalil, Botond Kőszegi, Jacques Lawarrée, and seminar participants at the University of Toronto, University of Washington, Vassar College, and the ISMS Marketing Science conference for helpful comments. Shay Culpepper provided excellent research assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Applicability of Log Concavity of \(F\left( \cdot \right)\) in \(p_{j}\)

In this section, I show that log concavity of \(F\left( \cdot \right)\) in \(p_{0}\) – a critical condition for the existence of an interior equilibrium in prices—may be met (1) for the general class of pointwise-symmetric adjustment map pairs for any symmetric distribution—f, and (2) for an example of a non-pointwise-symmetric adjustment map pair when f is Beta distributed with shape parameters \(\left( \alpha ,\beta \right) =\left( 3,3\right)\).

The main issue in the case of non-pointwise-symmetric map pairs is that, approaching the extreme locations \(x=0\) and \(x=1\), consumers’ marginal adjustment costs approach infinity for the nearby product. Thus, unless marginal adjustment costs for the distant product similarly grow without limit, sensitivity of demand to price rises precipitously at the extremes, making it potentially profitable for firms to attempt to drop price from any candidate interior maximum to a low enough level to take the whole market.

This situation is avoided if the density of consumers at the extremes is sufficiently low, as with some log-concave distributions such as the Beta. So, to summarize, an interior price equilibrium will result whenever the incentive to de-stabilize such an equilibrium is mitigated by pointwise adjustment symmetry; or when there are not enough consumers with extreme tastes for firms to want to de-stabilize an interior price equilibrium despite non-symmetry.

Let us define the log concavity of \(F\left( \cdot \right)\) in \(p_{0}\) as \(\frac {f\left( x_{E}^{*}\right) \frac{\partial x_{E}^{*}}{\partial p_{0}}}{F\left( x_{E}^{*}\right) }\) being decreasing in \(p_{0}\). This gives rise to the following necessary and sufficient condition:

Using (8),

where \(\frac{d^{2}g^{j}}{dx_{E}^{*2}}\) represents the second derivative of the \(g^{j}\) with respect to x, evaluated at \(x_{E}^{*}\). Hence (11) may be re-written

where \(\frac{\partial x_{E}^{*}}{\partial p_{0}}\), which is not a function of i, has been pulled out of the integrals.

Consider first the set of pairs of pointwise-symmetric adjustment maps, \(\left\{ {\mathscr {G}}^{0},{\mathscr {G}}^{1}:{\mathscr {G}}^{0}=-{\mathscr {G}}^{1}\right\}\). Considering the exemplar pair \({{\bar{\mathscr G}}}^{0}\) and \({{\bar{\mathscr G}}}^{1}\), for each adjustment curve in \({{\bar{\mathscr G}}}^{0}\) corresponding to a given location \(x\in \left( 0,1\right)\), the corresponding curve in \({{\bar{\mathscr G}}}^{1}\) would be its mirror image about x.Footnote 18 A subset of such pairs, for \(j=0,1\) and \(\rho =\left[ -1,1\right]\), is given by

Map pairs corresponding to the values \(\rho =1\) and \(\rho =-1\) are shown in Fig. 6.

Pointwise-Symmetric Adjustment Map Pairs Per (13)

With pointwise-symmetric adjustment map pairs, and symmetric distribution f, the following conditions hold: (i) \(\frac{\partial g^{0}}{\partial x_{E}^{*}}=\frac{\partial g^{1}}{\partial x_{E}^{*}}\), (ii) \(\frac{\partial ^{2}g^{0}}{\partial x_{E}^{*2}}=\frac{\partial ^{2}g^{1}}{\partial x_{E}^{*2}}\), (iii) \(i^{*0}=i^{*1}\), (iv) \(\frac{\partial i^{*0}}{\partial x}=\frac{\partial i^{*1}}{\partial x}\), and (v) \(f'\left( x_{E}^{*}\right) =0\). It may be verified, based on these, that the necessary and sufficient condition (12) above for log concavity is met, whence log concavity of \(F\left( x\left( p_{0}\right) \right)\) holds for any symmetric distribution f.

Consider now an example of a non-pointwise-symmetric adjustment map pair, given by \(g^{0}\left( i,x\right) \equiv \frac{x}{2\left( x-i\right) }\) and \(g^{1}\left( i,x\right) \equiv \frac{1-x}{2\left( 1-x-i\right) }\) for \(x\in \left[ 0,1\right]\). These functions have the property that \(g^{0}\left( 0,x\right) =g^{1}\left( 0,x\right) =\frac{1}{2}\). Observe further that \(i^{*0}\left( x,t\right) =\frac{2t-1}{2t}x\) is defined for \(t\ge \frac{1}{2}\), whence \(i^{*}<x\); similarly \(i^{*1}\left( x,t\right) =\frac{2t-1}{2t}\left( 1-x\right)\), whence \(i^{*}<1-x\). We also have \(\frac{\partial i^{*0}}{\partial x}=\frac{2t-1}{2t}\) and \(\frac{\partial i^{*1}}{\partial x}=-\left( \frac{2t-1}{2t}\right)\). We evaluate the left-hand side of (12) at \(i=0\) (i.e., the position at which the indifferent consumer evaluates his decision between product options) for all \(x\in \left[ 0,1\right]\), using integration by parts:

where \(\frac{\partial g^{0}}{\partial x}=\frac{-i}{2\left( x-i\right) ^{2}}\le 0\), \(\frac{\partial ^{2}g^{0}}{\partial x^{2}}=\frac{i}{\left( x-i\right) ^{3}}\ge 0\), \(\frac{\partial g^{1}}{\partial x}=\frac{i}{2\left( 1-x-i\right) ^{2}}\ge 0\), and \(\frac{\partial ^{2}g^{1}}{\partial x^{2}}=\frac{i}{\left( 1-x-i\right) ^{3}}\ge 0\). Substituting into (8) for our example functions we obtain \(\frac{\partial x_{E}^{*}}{\partial p_{0}}=-\frac{1}{1-\ln \frac{1}{2t}}\), whence we may re-write the left-hand side of (12) as

Now assume f is distributed Beta with shape parameters \(\left( \alpha ,\beta \right) =\left( 3,3\right)\). We have:

whereby

Thus,

One may verify using (15) and (16) that (12) holds for all \(x\in \left( 0,1\right)\), \(t>\frac{1}{2}\).

1.2 Proof of Lemma 1

Beginning with the expression \(g^{j}\left( i^{*j}\left( x,t,\theta \right) ,x,\theta \right) =t\) which implicitly defines \(i^{*j}\), and totally differentiating (here, for \(j=0\)),

Using Cramer’s rule, one obtains, given \(g^{j}\left( i,x,\theta \right) ={\bar{g}}^{j}\left( i,x\right) -\theta\),

Corresponding results can be derived along the same lines for \(j=1\).

1.3 Proof of Lemma 2

The proof is an extension of the proof of Bloch & Manceau’s (1999) Lemma 1. Suppose that the market is not covered, that is, at equilibrium prices \(\left( p_{0}^{*},p_{1}^{*}\right)\) there exists a consumer x for whom

and

One can show these prices do not constitute a Nash equilibrium, in that firm 0 can increase its profit by lowering its price \(p_{0}\) without altering the profit, hence strategy, of firm 1. Begin by noting that, under \(\left( p_{0}^{*},p_{1}^{*}\right)\), because there is a consumer for whom neither good provides nonnegative utility somewhere between the firms, the profit of firm 0 can be written

where \(x_{0}\) is the position of the consumer who, at prices \(\left( p_{0}^{*},p_{1}^{*}\right)\), is just indifferent between buying product 0 and buying nothing. By assumption, \(\frac {\partial \Pi _{0}}{\partial x_{0}}>0\). Now note that

which follows from Assumption 4. Since \(\frac {\partial \Pi _{0}}{\partial x_{0}}=\left( \frac {\partial \Pi _{0}}{\partial p_{0}}\right) \left( \frac {\partial p_{0}}{\partial x_{0}}\right)\), it follows that \(\frac {\partial \Pi _{0}}{\partial p_{0}}<0\). Therefore a small downward deviation in the price \(p_{0}\) from \(p_{0}^{*}\) increases firm 0’s profits while not affecting firm 1’s profits. This contradicts the assertion that \(\left( p_{0}^{*},p_{1}^{*}\right)\) constitutes an equilibrium.

1.4 Proof of Proposition 2

Differentiating (9) with respect to \(\theta\) yields

Inspection of (2) reveals \(\frac{\partial ^{2}g^{0}}{\partial x_{E}^{*}\partial \theta }=\frac{\partial ^{2}g^{1}}{\partial x_{E}^{*}\partial \theta }=0\). Given symmetry, \(\frac{\partial x_{E}^{*}}{\partial \theta }=0\). Therefore, simplifying,

Per Lemma 1, \(\frac{\partial i^{*0}}{\partial \theta }>0\), whence \(\frac{\partial ^{2}D_{0}}{\partial p_{0}\partial \theta }\) takes the sign of \(\frac{\partial g^{0}}{\partial x_{E}^{*}}-\frac{\partial g^{1}}{\partial x_{E}^{*}}\). Given \(\frac{\partial D_{0}}{\partial p_{0}}<0\), the effect of ease of adjustment on price sensitivity of demand takes the sign of \(\frac{\partial g^{1}}{\partial x_{E}^{*}}-\frac{\partial g^{0}}{\partial x_{E}^{*}}\).

1.5 Proof of Corollary 2

Using \(p_{0}^{*}=-\frac{F\left( x_{E}^{*}\right) }{f\left( x_{E}^{*}\right) \frac{\partial x_{E}^{*}}{\partial p_{0}}}\), and noting that symmetry makes \(\frac {F\left( x_{E}^{*}\right) }{f\left( x_{E}^{*}\right) }\) constant in \(\theta\):

which takes the sign of \(-\left( \frac{\partial g^{1}}{\partial x_{E}^{*}}-\frac{\partial g^{0}}{\partial x_{E}^{*}}\right)\).

1.6 Proof of Proposition 3

Begin by deriving adjustment productivity for \({\tilde{g}}^{j}\) for generic x:

and by symmetry,

whence one can obtain the expression \(i^{*1}\left( x,t,\theta \right) -i^{*0}\left( x,t,\theta \right) =\frac{2\sigma \theta }{t}\left( 1-2x\right)\). Using (5) and (10), one may then derive \(x_{E}^{*}\) explicitly. Substitution of our expressions for \(i^{*1}\left( x,t,\theta \right) -i^{*0}\left( x,t,\theta \right)\) and \({\tilde{g}}^{j}\) into (5) yield

Integration, followed by substitution of (18) and (20), leads to

Simplifying, one obtains \(x_{E}^{*}=\frac{1}{2}-\frac{p_{0}-p_{1}}{2\left[ t-2\sigma \theta -2\sigma \left( t-\theta \right) \ln \frac{t-\theta }{t}\right] }\), whence \(\frac{\partial x_{E}^{*}}{\partial p_{0}}=-\frac{1}{2\left[ t-2\sigma \theta -2\sigma \left( t-\theta \right) \ln \frac{t-\theta }{t}\right] }=-\frac{\partial x_{E}^{*}}{\partial p_{1}}\). Now substitution into the expressions provided for equilibrium price levels in Proposition 1 yields

whence \(\frac{\partial p_{0}}{\partial \sigma }=2\left( -2\theta -2\left( t-\theta \right) \ln \frac{t-\theta }{t}\right) \frac {F\left( x_{E}^{*}\right) }{f\left( x_{E}^{*}\right) }\) and \(\frac{\partial p_{1}}{\partial \sigma }=2\left( -2\theta -2\left( t-\theta \right) \ln \frac{t-\theta }{t}\right) \frac {\left[ 1-F\left( x_{E}^{*}\right) \right] }{f\left( x_{E}^{*}\right) }\). Both of these expressions are negative for all \(t>\theta \ge 0\).

1.7 Proof of Proposition 4

Firms incur no costs of production, and based on Corollary 1 we know that there is a common market price. Welfare may therefore be calculated as the integral of utility over the mass of consumers, plus the market price. Given that the market is evenly divided (again, Corollary 1), one may express welfare using (3) and (4) as

which can be re-written again, using symmetry,

Differentiating,

and, recognizing that \(g^{0}\left( i^{*0},x,\theta \right) \equiv t\) and \(\frac{\partial g^{0}}{\partial \theta }=-1\),

which is positive for \(\theta >0\) (whence \(i^{*0}>0\) \(\forall x\in \left( 0,1\right)\), by Lemma 1).

1.8 Proof of Proposition 5

It follows from (10) that, over the range \(x=0\) to \(x=\frac{1}{4}\) (and \(x=\frac{3}{4}\) to \(x=1\)), all the terms in (21) are invariant to \(\sigma\). Differentiation of (21) with respect to \(\sigma\) thus yields

whence \(g^{0}\left( i^{*0},x,\theta \right) =t\) allows us to write

Now using the expression for \({\tilde{g}}^{0}\) in (10), for \(x\in \left[ \frac{1}{4},\frac{1}{2}\right]\),

Using integration by parts and the expression for \(i^{*0}\) in (18) ,

Substituting back into (22),

which is positive for \(\theta >0\).

Rights and permissions

About this article

Cite this article

Nagler, M.G. Loving What You Get: The Price Effects of Consumer Self-Persuasion. Rev Ind Organ 59, 529–560 (2021). https://doi.org/10.1007/s11151-021-09820-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-021-09820-3